- Home

- »

- Medical Devices

- »

-

Oral Solid Dosage Contract Manufacturing Market Report 2030GVR Report cover

![Oral Solid Dosage Contract Manufacturing Market Size, Share & Trends Report]()

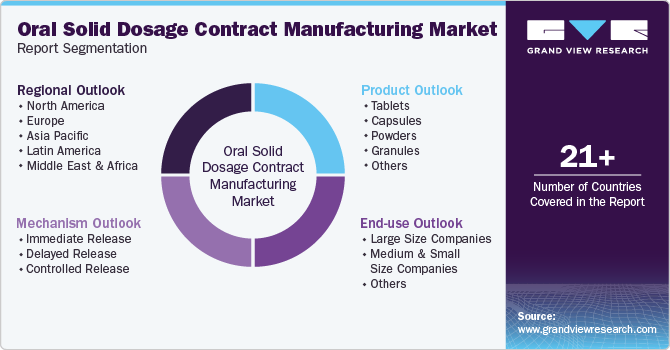

Oral Solid Dosage Contract Manufacturing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Tablets, Capsules, Powders, Granules), By Mechanism (Controlled Release, Immediate Release), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-948-4

- Number of Report Pages: 178

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Oral Solid Dosage Contract Manufacturing Market Summary

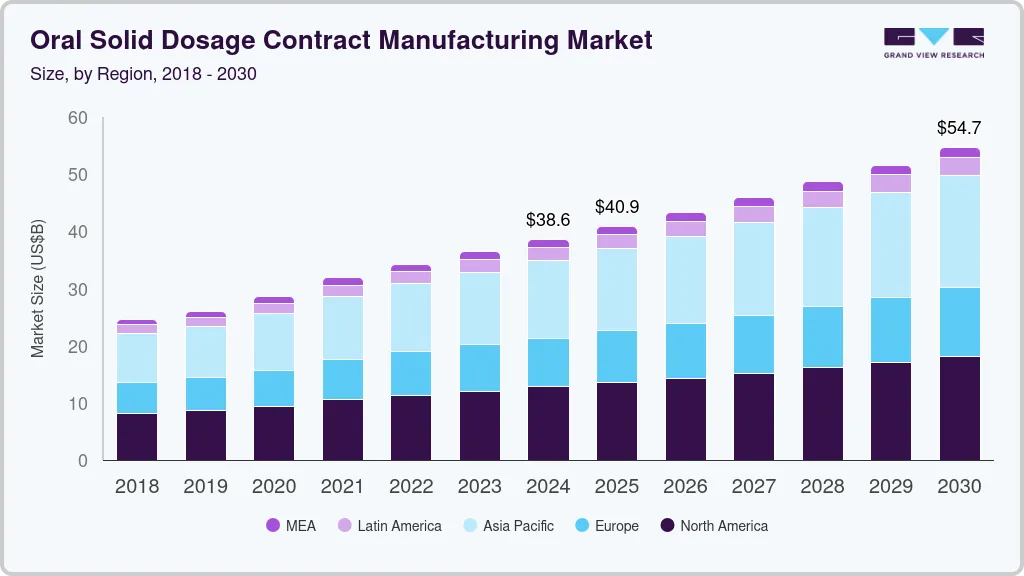

The global oral solid dosage contract manufacturing market size was estimated at USD 38,638.6 million in 2024 and is projected to reach USD 54,718.2 million by 2030, growing at a CAGR of 6% from 2025 to 2030. The growth of the market is due to continuous advancements in drug delivery technologies such as sustained release dosage forms & targeted drug delivery, rising investments from outsourcing firms to enhance OSD development capabilities, and increasing demand for innovative therapeutics.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, tablets accounted for a revenue of USD 12,651.9 million in 2024.

- Capsules is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 38,638.6 Million

- 2030 Projected Market Size: USD 54,718.2 Million

- CAGR (2025-2030): 6%

- Asia Pacific: Largest market in 2024

The growing presence of small and mid-sized pharmaceutical companies is also one of the factors driving demand for contract manufacturing organizations for OSD forms. These companies often lack the infrastructure to support large-scale manufacturing, particularly for complex formulations like modified-release tablets or fixed-dose combinations.

Rather than investing in costly infrastructure and compliance systems, these firms partner with CMOs that have proven expertise in regulatory adherence, cGMP manufacturing, and scalable production capabilities. This trend is particularly strong in therapeutic areas with high volumes, such as generics, chronic disease medications, and over-the-counter products, where oral solid dosage forms remain the preferred choice. The need for rapid time-to-market and cost efficiency further accelerates outsourcing demand for CMOs offering OSD capabilities.

Furthermore, several CROs are becoming one-stop shops (full-service providers), offering an exhaustive list of core and ancillary R&D services. As pharmaceutical and biopharmaceutical companies strive to improve competitiveness, collaboration with a CMO offering end-to-end services is a strategic move. This has led to increasing demand for one-stop-shop services for CMOs and CDMOs.

In addition, the market is highly competitive, characterized by numerous established and emerging players offering a wide array of services. Differentiation based on expertise, technology, regulatory compliance, and service quality is crucial for market positioning. Companies integrating advanced oral solid dosage contract manufacturing technologies and innovative methodologies gain a competitive edge. Besides, increasing research activities, pharmaceutical companies, and government support for drug development contribute to market growth.

Ongoing advancements in formulation technologies create opportunities for contract manufacturers to differentiate themselves by offering innovative OSD forms. Besides, automation & robotics are gaining traction in the OSD contract manufacturing industry. This technology improves the accuracy of the manufacturing process, reduces human error, and increases overall efficiency.

Strong technical expertise in pharmaceutical formulation & regulatory compliance allows companies to offer high-quality services and adapt to evolving industry requirements. Larger CMOs benefit from economies of scale, enabling them to negotiate better deals with suppliers, invest in advanced technologies, and offer competitive pricing. This enhances their market competitiveness and profitability.

Furthermore, increasing demand for generic drugs has created robust demand for contract manufacturing services, particularly in oral solids. Regulatory pathways supporting generic entry, such as the U.S. Hatch-Waxman Act, and EU generic approvals have intensified competition, driving pharma companies to optimize cost structures and seek production partners capable of large-batch production at lower cost. Simultaneously, globalization of supply chains has allowed pharmaceutical companies to outsource to CMOs in developing countries like India, China due to labor and operational cost efficiency. These CMOs often specialize in oral solids and offer competitive advantages in API sourcing, scalability, and regulatory filing support.

Market players like Catalent, Inc., Lonza, Recipharm AB., and Corden Pharma are involved in merger and acquisition activities. Through M&A activity, these entities can expand their geographic reach and strengthen their market position. Understanding the competitive landscape helps businesses position themselves effectively and enhance the development of oral solid formulations and other services.

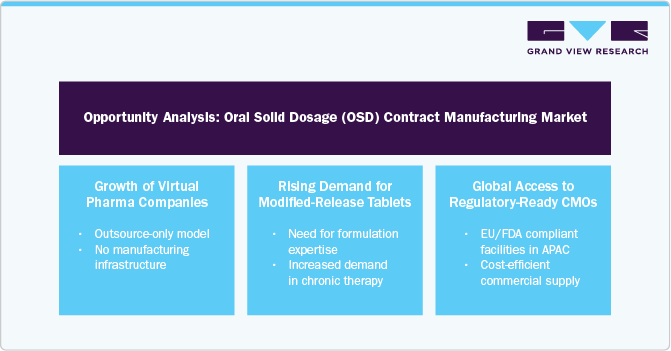

Opportunity Analysis

The market is gaining momentum due to structural shifts in how pharmaceutical products are developed, formulated, and brought to the market. Increasingly outsourcing complex, capital-intensive processes to contract service providers, enabling greater focus on innovation and go-to-market strategies. Moreover, the growing need for advanced formulation technologies and adherence to global regulatory standards is fueling demand for CMOs with specialized capabilities and broad geographic reach.

Growing virtual pharma companies, those operating without internal manufacturing capabilities, will create a strong demand for outsourced production solutions. Moreover, there's a significant rise in demand for modified release tablets, driven by the need for advanced formulation expertise and the increasing prevalence of chronic conditions. Further, global access to regulatory-ready CMOs, particularly in APAC with EU/FDA-compliant facilities, offers a cost-efficient pathway for commercial supply, strengthening the strategic value of contract manufacturing in the evolving pharmaceutical landscape.

Technological Advancements

The technological landscape of the market is being reshaped by the integration of digital innovation, automation, and data-driven precision. Manufacturers are increasingly adopting smart technologies to streamline production, improve quality control, and enhance scalability. Automation and robotics are now central to minimizing manual intervention and boosting throughput, while advanced analytics and AI are unlocking new efficiencies in process optimization and predictive maintenance. Integrated platforms for real-time data monitoring and digital twins are enabling greater visibility and control across operations. These advancements, combined with continuous manufacturing and precision coating capabilities, are driving a shift toward more flexible, efficient, and compliant manufacturing environments that can meet the evolving demands of complex drug formulations and personalized medicine.

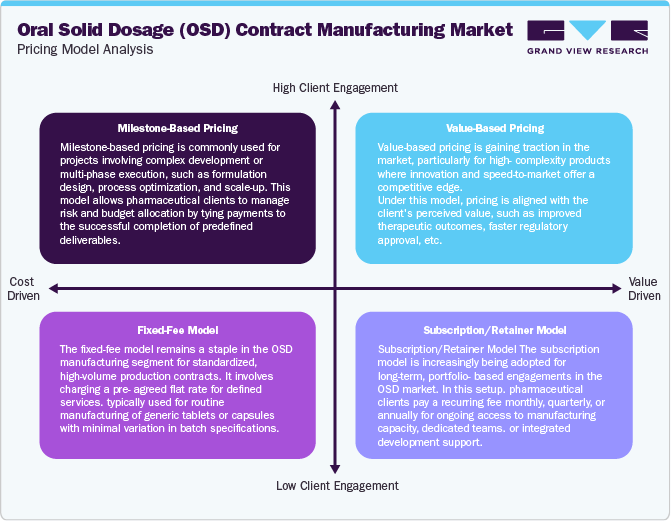

Pricing Analysis

The pricing landscape in the Oral Solid Dosage (OSD) Contract Manufacturing Market is diverse, offering flexibility to both manufacturers and clients. Payments are often tied to key project stages, with clients paying as specific milestones are reached, ensuring progress is met before further investment. Prices can also reflect the value of the service provided, with costs based on the benefits or outcomes delivered, such as higher product efficacy or faster market entry.

Another common structure is a fixed payment for the entire manufacturing process, providing clients with predictable costs but limiting adjustments during production. For clients with ongoing manufacturing needs, regular payment models are also used, ensuring continuous access to services over a longer term. These varied pricing methods allow for tailored solutions depending on the needs and expectations of both companies.

Product Insights

Based on the product type segment, the market is classified into tablets, capsules, powders, granules, and others. the tablets segment held the largest revenue share of 32.74% in 2024. Solid dosage forms, specifically tablets, are recognized as cost-effective pharmaceuticals. The expected rise in demand for these products is anticipated to drive growth within this segment. Furthermore, technological advancements, such as continuous manufacturing and 3D printing, that improve the efficiency of manufacturing processes are expected to enhance segment growth. For instance, The Technology House (TTH) acquired an SLA 750 3D printer from 3D Systems. This acquisition was aimed at strengthening and streamlining the manufacturing processes. By integrating the capabilities of the SLA 750 printer, including its rapid production speed, expansive build area, and diverse material selection, TTH is expected to expand the array of services it offers to its customers.

The capsules segment is expected to grow at the fastest CAGR over the forecast period. The growing advantages of capsules, such as ease of swallowing, faster disintegration, and absorption, are expected to drive the market. These capsules disintegrate more quickly, rapidly releasing and absorbing medication. Moreover, technological advancements and the growing adoption of such technologies for expanding capsule-filling capabilities are expected to drive market growth. For instance, in December 2023, Pace Life Sciences and Division of Pace integrated liquid capsule filling technology into its extensive array of services for oral solid dose development. Incorporating this innovative liquid capsule filling technology allows the company to extend assistance from early-phase to late-phase clinical trials, enhances the capabilities for handling viscous formulations, and protects oxygen-sensitive products through nitrogen overlay.

Mechanism Insights

The controlled release segment dominated the market in 2024 due to its ability to enhance therapeutic efficacy and improve patient compliance. Controlled release formulations allow for the gradual release of the active pharmaceutical ingredient (API) over an extended period, reducing the frequency of dosing and minimizing side effects. This feature is particularly beneficial for drugs used in the treatment of chronic conditions, such as diabetes, hypertension, and pain management. The increasing demand for medications that provide more consistent and sustained effects, coupled with advancements in drug delivery technologies, has propelled the growth of the controlled release segment in the oral solid dosage contract manufacturing market.

The immediate release (IR) segment is expected to grow at the fastest rate during the forecasted period. The segment's growth is driven due to its widespread application in acute therapies and the need for rapid onset of action. IR formulations are designed to disintegrate and release their active ingredients quickly after oral administration, making them ideal for conditions requiring fast relief, such as pain, infections, and gastrointestinal issues. Their relatively simple manufacturing process and lower production costs also contribute to their growing demand, particularly in emerging markets where cost-efficiency is critical.

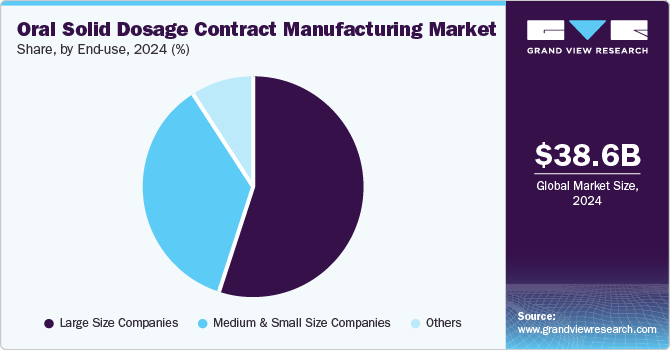

End-use Insights

The large size companies segment dominated the market in 2024 due to their extensive manufacturing capabilities, global presence, and strong client networks. Key factors include the growing need for enhanced operational efficiency, cost optimization, and focus on core competencies such as drug discovery and marketing. In addition, the increasing complexity of regulatory requirements and the growing demand for high-volume production of generics, branded-generics, and specialty medicines are prompting large pharma companies to partner with contract manufacturers. These collaborations allow faster market entry, access to advanced manufacturing technologies, and scalability, specifically for high-demand therapies across chronic diseases.

The medium & small size companies’ segment is estimated to witness the fastest growth during the forecast period. Limited in-house manufacturing capacity and the high capital investment required for advanced production facilities propel these companies to outsource OSD production. In addition, the need for speed-to-market, notably for generics and specialty products, fosters reliance on experienced contract manufacturers. Regulatory complexities, demand for scalable production, and the ability to access specialized technologies such as modified-release formulations further boost outsourcing among small and medium players, allowing them to focus resources on R&D, marketing, and expanding their product pipelines.

Regional Insights

North America oral solid dosage contract manufacturing market is projected to grow at a considerable rate during the forecast. The growth is due to growing investments in R&D of new drugs by pharmaceutical companies, which boosts the demand for oral solid dosage contract manufacturing. The growth of pharmaceutical industry in the U.S. and Canada is a key factor contributing to market growth.

U.S. Oral Solid Dosage Contract Manufacturing Market Trends

The oral solid dosage contract manufacturing market in the U.S. is driven by the rising pharmaceutical and biotechnology companies in this region. Increasing R&D investments, growing drug development costs, expensive raw ingredients, and a rising need for oral solid dosage products are some of the factors driving numerous pharmaceutical entities in the U.S. to outsource OSD manufacturing.

Europe Oral Solid Dosage Contract Manufacturing Market Trends

The Europe oral solid dosage contract manufacturing market is experiencing significant market growth due to rising demand for generic drugs, growing outsourcing trends among pharmaceutical companies, and stringent regulatory requirements that favor specialized manufacturers. Further, technological advancements in formulation and manufacturing processes enhance outsourcing appeal. Countries like Germany, Switzerland, and Ireland, with strong pharmaceutical infrastructures, play pivotal roles in supporting regional market growth.

The oral solid dosage contract manufacturing market in the UK held a significant share in 2024. The growth is driven by increasing demand for generic drugs, a growing elderly population requiring chronic disease management, and pharmaceutical companies’ focus on cost optimization through outsourcing. Additionally, stringent regulatory requirements encourage firms to partner with experienced CMOs for compliance support. Advances in formulation technologies and a surge in small and mid-sized biotech firms lacking in-house manufacturing capabilities further boost the demand for specialized OSD contract manufacturing services across the country.

France oral solid dosage contract manufacturing marketis driven by the strong presence of multinational pharmaceutical companies and increasing government support for local drug production. The country's focus on innovation, particularly in advanced formulations, and rising demand for affordable generics encourage outsourcing to specialized manufacturers.

The oral solid dosage contract manufacturing market in Germany is anticipated to grow during the forecast period. The market growth is primarily fueled by its leadership in pharmaceutical innovation, strong export-oriented production, and a highly developed healthcare infrastructure. The country’s prominence in quality, efficiency, and compliance with international regulatory standards makes it a preferred destination for outsourcing. Growing demand for specialized formulations, including modified-release tablets, and the expansion of biopharmaceutical companies into the OSD segment further drive market growth. Germany’s skilled workforce and advanced manufacturing technologies also strengthen its competitive position in the overall industry.

Asia Pacific Oral Solid Dosage Contract Manufacturing Market Trends

Asia Pacific oral solid dosage contract manufacturing market accounted for the largest revenue share of 34.93% in 2024. This growth can be attributed to cost-effective manufacturing capabilities, a large and skilled workforce, strong availability of raw materials, and strong regulatory support in countries like India and China. Rising demand for generic drugs, increased outsourcing by global pharmaceutical companies to access high-quality, affordable production, and expanding healthcare infrastructure further boost regional market growth. Moreover, government initiatives to boost pharmaceutical exports, favorable intellectual property reforms, and growing domestic consumption of pharmaceuticals are significantly contributing to the regional revenue growth in the OSD contract manufacturing industry.

The oral solid dosage contract manufacturing market in China is expected to grow over the forecast period. China is a cost-effective market for oral solid dosage contract manufacturing. Moreover, Chinese CMOs adhere to cGMP standards and have improved regulatory oversight, which ensures superior quality. Thus, increasing demand for high-quality and ongoing advancements in the pharmaceutical sector is expected to continue driving the growth of China's oral solid dosage contract manufacturing market.

Japan oral solid dosage contract manufacturing market is witnessing significant growth over the forecast period. The country’s revenue growth is primarily attributed to several factors, including the country's rapidly aging population, which is increasing demand for chronic disease therapies commonly formulated as OSDs. Additionally, pharmaceutical companies are increasingly outsourcing manufacturing to focus on R&D and to navigate stringent regulatory requirements more efficiently. The government's initiatives to promote the use of generics, alongside cost-containment measures in healthcare, are further encouraging partnerships with contract manufacturers.

The oral solid dosage contract manufacturing market in Indiais witnessing a considerable market growth. India is emerging as one of the lucrative markets for oral solid dosage contract manufacturing across the globe. This can be attributed to low costs, the availability of industry experts, and the presence of WHO-cGMP-compliant facilities.

Latin America Oral Solid Dosage Contract Manufacturing Market Trends

The Latin America oral solid dosage contract manufacturing market is projected to grow over the forecast period. The regional growth is owing to rising pharmaceutical demand due to a growing middle-class population and expanding healthcare access. Compared to North America and Europe, cost advantages make the region attractive for outsourcing. Governments are increasingly supporting local manufacturing through incentives and regulatory reforms, particularly in countries like Brazil and Argentina.

Multinational pharmaceutical companies are also partnering with regional contract manufacturers to meet local and export demands. The shift toward generic and over-the-counter (OTC) drug consumption, combined with the rising prevalence of chronic diseases, further boosts market opportunities. Investments in upgrading manufacturing facilities to meet international quality standards and the strategic location for export to the U.S. and European markets also support regional growth.

The oral solid dosage contract manufacturing market in Brazil is expected to grow over the forecast period. Regional growth is driven by a large domestic pharmaceutical sector, increasing demand for affordable generics, and supportive government policies enhancing local production. Brazil’s universal healthcare system (SUS) creates consistent demand for cost-effective medications, encouraging pharmaceutical companies to outsource manufacturing to optimize costs and expand capacity. Regulatory alignment with international standards, such as ANVISA’s improvements in GMP inspections, enhances the global competitiveness of Brazilian contract manufacturers.

Key Oral Solid Dosage Contract Manufacturing Company Insights

Some oral solid dosage contract manufacturing companies are Boehringer Ingelheim International GmbH, Lonza, Catalent, Inc., Aenova Group, Jubilant Pharmova Limited, Patheon Pharma Services, Recipharm AB., Corden Pharma International, Piramal Pharma Solutions, Siegfried Holding AG, and AbbVie Contract Manufacturing, Next Pharma AB, among others. These key participants implement various strategic initiatives to strengthen their global market position. The prominent strategies companies adopt are acquisitions, collaborations, expansion, service launches, partnerships, and others to increase market presence & revenue and gain a competitive edge.

Key Oral Solid Dosage Contract Manufacturing Companies:

The following are the leading companies in the oral solid dosage contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Catalent Inc.

- Lonza

- Aenova Group

- Boehringer Ingelheim International GmbH

- Jubilant Pharmova Limited

- Patheon Pharma Services

- Recipharm AB.

- Corden Pharma International

- Siegfried Holding AG

- Piramal Pharma Solutions

- AbbVie Contract Manufacturing

- Next Pharma AB

Recent Developments

-

In December 2024, Novo Holdings completed its acquisition of Catalent. As part of the transaction, Novo Nordisk acquired three of Catalent's manufacturing sites in Italy, Belgium, and the U.S. This strategic move aimed to bolster Novo Nordisk's production capacity for its GLP-1 injectable, Wegovy, addressing supply constraints due to high demand.

-

In July 2023, Aenova Group and Galvita entered a strategic partnership to improve the formulation, production, and development of oral dosage forms. Such a partnership broadened the company’s service offerings in a significant market.

-

In March 2023, Catalent, Inc. collaborated with Grünenthal for an orally dosed small molecule in Grünenthal’s pipeline. Such collaboration strengthened the company’s revenue generation capabilities in the market.

Oral Solid Dosage Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size in 2025

USD 40.91 billion

Revenue forecast in 2030

USD 54.72 billion

Growth rate

CAGR of 5.99% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, mechanism, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Catalent, Inc.; Lonza; Aenova Group; Boehringer Ingelheim International GmbH; Jubilant Pharmova Limited; Patheon Pharma Services; Recipharm AB.; Corden Pharma International; Siegfried Holding AG; Piramal Pharma Solutions; AbbVie Contract Manufacturing; Next Pharma AB.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oral Solid Dosage Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oral solid dosage contract manufacturing market report based on product, mechanism, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Powders

-

Granules

-

Others

-

-

Mechanism Outlook (Revenue, USD Million, 2018 - 2030)

-

Immediate Release

-

Delayed Release

-

Controlled Release

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Size Companies

-

Medium & Small Size Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global oral solid dosage contract manufacturing market size was estimated at USD 38.6 billion in 2024 and is expected to reach USD 40.91 billion in 2025.

b. The global oral solid dosage contract manufacturing market witnessed a moderate growth rate of 5.99% from 2025 to 2030 to reach USD 54.72 billion by 2030.

b. Tablets held the largest market share of 32.7%share in 2024. Solid dosage forms, specifically tablets, are recognized as cost-effective pharmaceuticals. The expected rise in demand for these products is poised to drive growth within this segment.

b. Some key players operating in the oral solid dosage contract manufacturing market include Boehringer Ingelheim International GmbH, Lonza, Catalent, Inc, Aenova Group, Jubilant Pharmova Limited, Patheon Pharma Services, Recipharm AB. and a few others.

b. Increasing advancements of drug delivery technology, including targeted drug delivery & sustained release dosage forms, and investments by contract development manufacturing organizations are a few factors supporting the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.