- Home

- »

- Pharmaceuticals

- »

-

Organ Transplant Immunosuppressant Drugs Market Report, 2030GVR Report cover

![Organ Transplant Immunosuppressant Drugs Market Size, Share & Trends Report]()

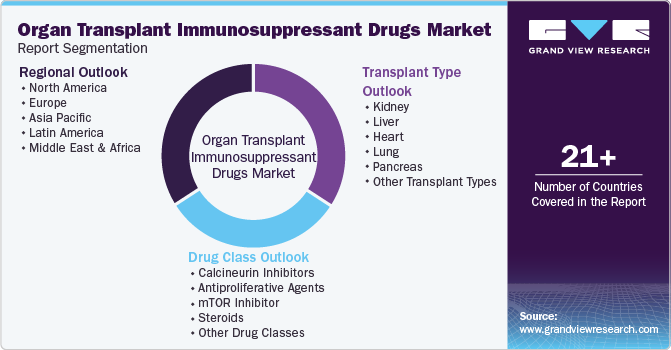

Organ Transplant Immunosuppressant Drugs Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug Class (Calcineurin Inhibitors, Antiproliferative Agents), By Transplant Type, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-786-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Organ Transplant Immunosuppressant Drugs Market Summary

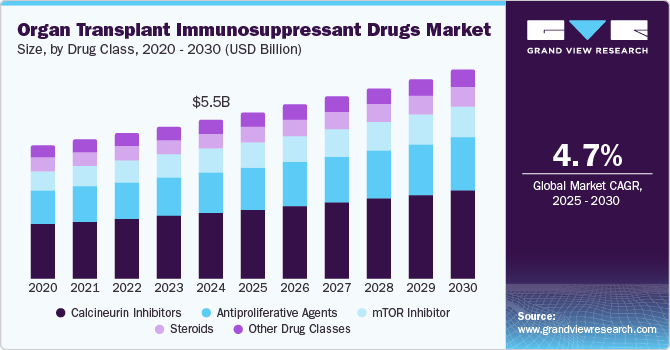

The global organ transplant immunosuppressant drugs market size was estimated at USD 5.51 billion in 2024 and is projected to reach USD 7.24 billion by 2030, growing at a CAGR of 4.7% from 2025 to 2030. The increasing prevalence of chronic diseases that drive the need for organ transplants, the rising proportion of the geriatric population that is more prone to chronic diseases, and the advancements in technologies that enable organ transplants are likely to drive demand in the market.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- The organ transplant immunosuppressant drug market in U.S. accounted for the largest revenue share in 2024.

- Based on drug class, the calcineurin inhibitors segment accounted for the largest share of 41.5% in 2024.

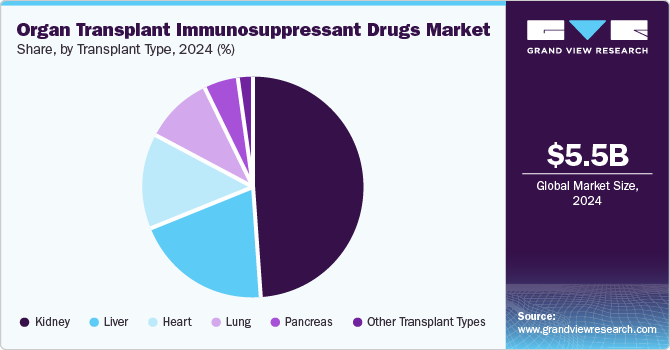

- Based on transplant type, the kidney transplant accounted for the largest market share of 49.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.51 Billion

- 2030 Projected Market Size: USD 7.24 Billion

- CAGR (2025-2030): 4.7%

- North America: Largest market in 2024

According to the information published by the World Health Organization in September 2023, Noncommunicable diseases (NCDs) lead to the death of approximately 41 million people annually, which is equivalent to 74% of all deaths worldwide. These include cardiovascular diseases, kidney diseases, cancers, respiratory diseases, and others. The advancements in organ transplants and the development of immunosuppressant drugs can help in controlling the deaths caused by these diseases and drive market growth.

According to the statistics presented by the United Network for Organ Sharing, there were 46,630 transplants in the U.S. in 2023, and 104,541 people needed a lifesaving organ transplant. This rising demand for organ transplants is likely to drive the demand for organ transplant immunosuppressant drugs over the forecast period.

The immune system can reject a newly transplanted organ, such as a kidney, liver, heart, or lung, which can often lead to transplant failure and the requirement for immediate removal of the organ from the recipient. Immunosuppressant drugs can help in preventing this rejection, which is likely to drive their market growth with the rising number of organ transplants worldwide.

Drug Class Insights

The calcineurin inhibitors segment accounted for the largest share of 41.5% in 2024 and is projected to grow at the fastest CAGR of 5.0% over the forecast period. This growth can be attributed to using this class of immunosuppressants in effectively managing various autoimmune disorders, such as lupus nephritis, atopic dermatitis, idiopathic inflammatory myositis, interstitial lung disease, and solid organ transplantation. For instance, Cyclosporine is approved by the U.S. Food and Drug Administration (FDA) to prevent allogeneic organ transplant rejection when used with glucocorticoids.

The antiproliferative agents segment is expected to grow at a significant CAGR over the forecast period. Antiproliferative agents include Mycophenolic acid and Azathioprine, which are used as the cornerstone of antirejection maintenance therapy in solid organ transplants. They are also used in autoimmune and cancer research owing to their role in disrupting cellular replication, which is further expected to drive their demand.

Transplant Type Insights

The kidney transplant accounted for the largest market share of 49.1% in 2024. The increasing prevalence and incidence of kidney diseases worldwide and the demand for kidney transplants are major drivers for segment growth. For instance, according to the information published by the National Institutes of Health, approximately one in seven or about 37 million people in the U.S. are affected by Chronic kidney disease (CKD). In addition, about 1 in every three people with diabetes and 1 in 5 people with high blood pressure also suffer from kidney diseases. The rising prevalence of these diseases is expected to drive the segment growth.

Lung diseases are expected to grow at the fastest CAGR over the forecast period. This growth can be attributed to the increasing instances of respiratory diseases, increasing research and development related to lung transplants, and a rising number of transplants. For instance, according to the information published by the Centers for Disease Control and Prevention (CDC), approximately 147,382 deaths were caused by Chronic lower respiratory diseases (including asthma) deaths in the U.S. in 2022.

Regional Insights

North American organ transplant immunosuppressant drug market accounted for the largest market revenue share of 40.0% in 2024 attributed to the increasing number of chronic diseases, increasing proportion of geriatric populations, and advanced treatment options. According to the information published by Statistics Canada in September 2023, approximately 45.1% of Canadians lived with at least one major chronic disease in 2021. The increasing prevalence of chronic diseases is likely to add to the market growth over the forecast period.

U.S. Organ Transplant Immunosuppressant Drugs Market Trends

The organ transplant immunosuppressant drug market in U.S. accounted for the largest revenue share in 2024 in North America organ transplant immunosuppressant drugs market. The availability and access to advanced transplant treatments and the increasing number of transplants are major drivers for the market growth in the country. For instance, according to the information published by the Health Resource and Services Administration, 27,332 patients received kidney transplants in the U.S. in 2023.

Europe Organ Transplant Immunosuppressant Drugs Market Trends

The European organ transplant immunosuppressant drugs market is expected to grow significantly over the forecast period owing to well-established healthcare infrastructure, a rising number of organ transplants, and supportive government policies and initiatives supporting organ donation and transplantation. For instance, the European Day for Organ, Tissue, and Cell Donation initiative works towards increasing awareness of organ, cell, and tissue donation. Such campaigns are likely to create awareness regarding organ transplants and add to the demand for associated immunosuppressant drugs in the region.

The UK organ transplant immunosuppressant drugs market is expected to grow significantly over the forecast period. Rising chronic illnesses, such as kidney, liver, and heart diseases, drive the growing demand for transplants. In addition, the initiatives and supportive policies developed by the government in the country are further expected to drive market growth. For instance, the country has implemented the opt-out system for organ donation, which considers every individual to have agreed to donate their organs post their death unless they opt out of it. This has led to an increase in the availability of organ donations, which is further expected to drive market growth.

The Germany organ transplant immunosuppressant drugs market held the largest market share in 2024. The country's well-established healthcare system and the increasing prevalence of chronic conditions such as kidney disease and liver failure are driving the demand for transplants and immunosuppressive therapies. Treatment advancements are also likely to drive the market over the forecast period.

Asia Pacific Organ Transplant Immunosuppressant Drugs Market Trends

The Asia Pacific organ transplant immunosuppressant drugs market is anticipated to grow at the fastest CAGR over the forecast period. The increasing prevalence of chronic diseases and the rising number of transplants in the region are driving the growth of this market. In addition, increasing initiatives to create awareness regarding organ donations and regional advancements are expected to add to the market's growth over the forecast period. For instance, in August 2024, Mankind Pharma introduced the campaign ‘Spreading Kindness’ in India to increase awareness regarding organ donation in the country.

The China organ transplant immunosuppressant drugs market accounted for a significant market share in 2024 due to the healthcare reforms and significant investments in the country to improve transplant services and accessibility. The increasing incidence of chronic diseases, such as kidney and liver conditions, is further driving demand for organ transplants and, subsequently, immunosuppressive therapies. For instance, according to the National Institute of Health, approximately 8.2% of people above the age of 40, or 43 million people, suffer from COPD in China.

The India organ transplant immunosuppressant drugs market is expected to grow significantly owing to the advancements in the healthcare sector, increasing awareness regarding organ transplants, and increasing number of transplants. For instance, in October 2024, Rela Hospital, Chennai, India, performed a lung transplant on an 18-year-old girl. Such developments increase the availability and accessibility of the treatment option, driving the market growth.

Key Organ Transplant Immunosuppressant Drugs Company Insights

Some of the key companies operating in the organ transplant immunosuppressant drugs market include Astellas Pharma d.o.o., GlaxoSmithKline plc., Hoffmann-La Roche Ltd., Sanofi, Accord Healthcare, Novartis AG, and Viatris Inc. These players are focusing on developing advanced immunosuppressant drugs, expanding, and mergers and acquisition activities to gain a competitive edge in the market.

-

GlaxoSmithKline plc. is a global company engaged in developing, manufacturing, and distributing various pharmaceuticals, vaccines, and consumer health products. The company offers pharmaceutical solutions to address a variety of medical conditions, including HIV, respiratory diseases, cancer, and inflammatory and immune disorders. The company also provides over-the-counter (OTC) solutions for pain management, oral health, skin health, nutrition, and gastrointestinal issues.

-

F. Hoffmann-La Roche Ltd (Roche) is a global biotechnology company that develops pharmaceuticals and diagnostic solutions for various health conditions. The company's drug portfolio includes treatments for cancer, autoimmune disorders, central nervous system diseases, infectious conditions, and respiratory ailments. The company provides the Elecsys Immunosuppressive Drug Assay Panel, which is used for organ transplant patients.

Key Organ Transplant Immunosuppressant Drugs Companies:

The following are the leading companies in the organ transplant immunosuppressant drugs market. These companies collectively hold the largest market share and dictate industry trends.

- Astellas Pharma d.o.o.

- Sanofi

- Accord Healthcare

- Novartis AG

- Viatris Inc.

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline plc.

- Veloxis Pharmaceuticals, Inc.

- Bristol-Myers Squibb Company

Recent Developments

-

In April 2024, United Therapeutics announced the first successful xenothymokidney transplant into a living human using FDA-approved immunosuppressive medicines.

-

In June 2023, Dr. Reddy’s Laboratories Ltd. announced it had successfully completed the Phase I study of its proposed biosimilar of immunosuppressive drugs.

-

In February 2022, Veloxis Pharmaceuticals Inc. announced that VEL-101, which is an investigational maintenance immunosuppressive agent developed by the company for prophylaxis of renal allograft rejection in patients receiving a kidney transplant, received fast-track designation by the U.S. FDA.

Organ Transplant Immunosuppressant Drugs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.76 billion

Revenue forecast in 2030

USD 7.24 billion

Growth rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Drug class, transplant type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Astellas Pharma d.o.o., Sanofi, Accord Healthcare, Novartis AG, Viatris Inc., F. Hoffmann-La Roche Ltd, GlaxoSmithKline plc., Veloxis Pharmaceuticals, Inc., Bristol-Myers Squibb Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organ Transplant Immunosuppressant Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organ transplant immunosuppressant drugs market report based on drug class, transplant type, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Calcineurin Inhibitors

-

Antiproliferative Agents

-

mTOR Inhibitor

-

Steroids

-

Other Drug Classes

-

-

Transplant Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Kidney

-

Liver

-

Heart

-

Lung

-

Pancreas

-

Other Transplant Types

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.