- Home

- »

- Consumer F&B

- »

-

Organic Chicken Market Size, Share, Industry Report, 2030GVR Report cover

![Organic Chicken Market Size, Share & Trends Report]()

Organic Chicken Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Fresh & Frozen, Processed), By Distribution (Retail, Online), By Region (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68040-493-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Organic Chicken Market Summary

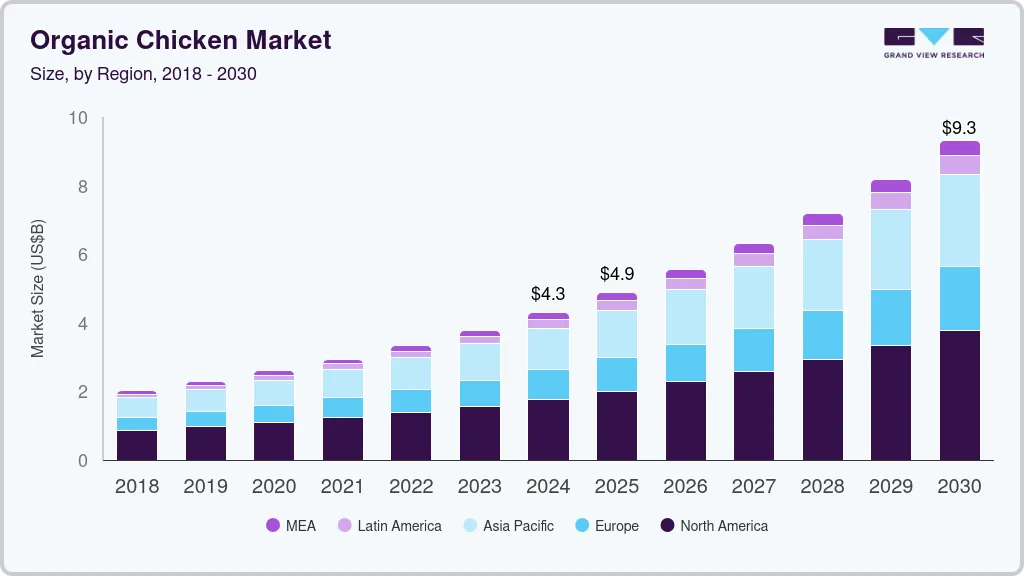

The global organic chicken market was valued at USD 4.29 billion in 2024 and is projected to reach USD 9.31 billion by 2030, growing at a CAGR of 13.8% from 2025 to 2030. The market is experiencing robust growth, primarily driven by the growing consumer awareness of food production practices.

Key Market Trends & Insights

- North America organic chicken market dominated with a revenue share of 41.6% in 2023.

- Asia Pacific organic chicken market is expected to register the fastest growth during the forecast period.

- By product, the fresh and frozen organic chicken segment held an estimated USD 2.26 billion in 2023.

- By end use, the commercial segment is expected to grow significantly with rising adoption in restaurants and hospitality chains.

- By distribution channel, online segment is witnessing the fastest CAGR of 15.6% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4.29 Billion

- 2030 Projected Market Size: USD 9.31 Billion

- CAGR (2025–2030): 13.8%

- North America: Largest market in 2023

As more individuals become informed about the adverse effects of pesticides, antibiotics, and artificial additives in conventional poultry farming, there is a marked shift towards organic options perceived as healthier and safer. The demand for chemical-free food items has surged globally, particularly among meat-eaters who prefer products devoid of synthetic chemicals or antibiotics. This trend aligns with a broader movement towards healthier eating habits, further propelling the organic chicken industry.The health benefits associated with organic chicken are influencing consumer choices. Organic chicken typically contains lower levels of saturated fats and higher levels of omega-3 fatty acids compared to conventionally raised chicken. Studies suggest that organic poultry carries fewer harmful microorganisms due to strict regulations prohibiting antibiotics in healthy chickens, enhancing its safety for consumption. Such nutritional advantages resonate with health-conscious consumers, driving increased sales in this segment.

The impact of the COVID-19 pandemic has also accelerated the demand for organic foods, including chicken. During the pandemic, many consumers shifted their purchasing habits towards products they believed would enhance their immune systems, leading to a sustained interest in organic options post-pandemic. Technological advancements are also playing a crucial role in the market's expansion. Integrating blockchain technology in supply chains enhances transparency and traceability, allowing consumers to trust the origin and quality of the organic chicken they purchase. This technological innovation boosts consumer confidence and aligns with increasing regulatory scrutiny regarding food safety standards. The USDA Organic certification further strengthens consumer trust by ensuring producers adhere to stringent feed quality and animal welfare guidelines.

Finally, innovations in product development and packaging are contributing to market growth. Companies increasingly focus on creating new organic chicken products that cater to evolving consumer preferences while improving convenience through various distribution channels such as online sales and specialty stores. Enhanced packaging highlighting the organic nature of products helps attract more consumers and facilitates more accessible access to organic options, thereby supporting sustained growth in the market.

The organic chicken industry faces several significant challenges that impact its growth and sustainability. One of the primary issues is the high production costs associated with organic farming practices. Organic chickens are raised without antibiotics and are fed organic feed, which often includes vegetable proteins, fruits, and cereals that are more expensive than conventional feed. This increases prices for organic chicken products, making them less accessible to a broader consumer base. Despite the willingness of some consumers to pay a premium for organic options due to perceived health benefits, the overall market penetration remains limited, particularly in price-sensitive demographics. In addition, the regulatory landscape surrounding organic certification can be complex and burdensome for producers, leading to potential inconsistencies in product labeling and consumer trust.

Another challenge is the competition from alternative protein sources, including plant-based proteins and lab-grown meats. As consumer preferences shift towards veganism and plant-based diets for health and environmental reasons, the demand for traditional animal products, including organic chicken, may decline. Furthermore, the market is also impacted by concerns regarding animal welfare and sustainability practices in poultry farming. Consumers increasingly demand transparency in how animals are raised, leading to scrutiny of organic practices that may not fully align with their expectations of humane treatment. Continuous innovation in production methods and marketing strategies is crucial for organic chicken producers to remain competitive and meet evolving consumer demands while addressing these challenges effectively.

Product Insights

The fresh and frozen organic chicken segment held an estimated USD 2264.2 million in 2023. The fresh chicken segment is primarily driven by increasing consumer demand for high-quality, nutritious protein sources. As health consciousness rises globally, consumers are more inclined to choose fresh chicken over processed alternatives due to its perceived health benefits. Fresh chicken is often considered healthier as it typically contains fewer preservatives and additives than frozen or processed meats. This growth is fueled by a shift in consumer preferences towards clean labels and transparency in food sourcing, where consumers are increasingly interested in knowing where their food comes from and how it is produced.

The rise of e-commerce has made it easier for consumers to access fresh poultry products without the need to visit physical stores. In addition, the growing popularity of meal kits and ready-to-cook options that feature fresh chicken as a primary ingredient further supports market growth.

On the other hand, the frozen chicken segment benefits from its long shelf life and convenience, making it an attractive option for consumers looking for flexibility in meal planning. The frozen chicken segment is expected to grow steadily as it caters to busy lifestyles where convenience and meal prep flexibility are paramount. In addition, advancements in freezing technology have improved the quality of frozen chicken products, addressing previous concerns about texture and flavor degradation during freezing. Modern freezing methods, such as flash freezing, help preserve the freshness and nutritional value of chicken while extending its shelf life.

Processed organic chicken, the other major category in the market, is expected to grow at a CAGR of 13.1% from 2024 to 2030. The processed organic chicken segment is primarily driven by the increasing consumer demand for convenient, ready-to-eat food options that align with health and sustainability goals. As busy lifestyles become the norm, consumers seek products that save time without compromising quality. Processed organic chicken products, such as pre-marinated, ready-to-cook, or fully cooked meals, cater to this need for convenience while appealing to health-conscious consumers. Another critical driver is the growing emphasis on sustainability and ethical sourcing within the food industry. Consumers are increasingly concerned about the environmental impact of their food choices and are opting for organic products that adhere to sustainable farming practices. Processed organic chicken is often marketed as being produced without synthetic hormones or antibiotics and from chickens raised in humane conditions.

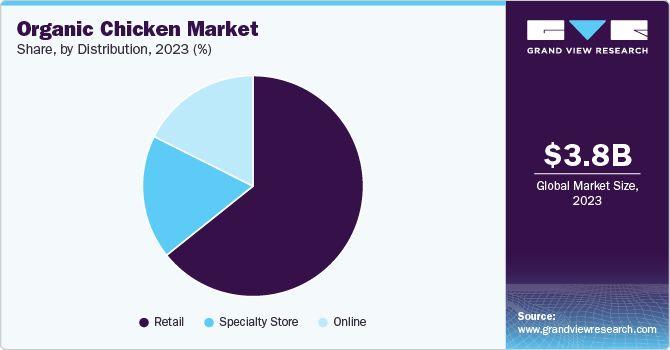

Distribution Channel Insights

Retail sales of organic chicken accounted for a market revenue of USD 2432 million in 2023 and are expected to grow at a CAGR of 13.3% from 2024 to 2030. The increasing consumer preference for convenient and accessible shopping options significantly drives the retail distribution channel for organic chicken. As more consumers seek organic products, the presence of organic chicken in retail outlets has expanded, making it easier for shoppers to find these items. The growth of modern trade, including supermarkets and hypermarkets, has played a crucial role in this expansion. These large retail formats provide a wide variety of organic chicken products and ensure that they meet quality standards, enhancing consumer confidence in purchasing organic options.

Supermarkets and hypermarkets serve as essential hubs for distributing organic chicken due to their extensive reach and ability to offer diverse product ranges. The strategic placement of organic chicken products in high-traffic areas within stores further boosts visibility and encourages impulse purchases.

Online sales of organic chicken are expected to grow at a CAGR of 15.6% from 2024 to 2030. The online distribution channel for organic chicken is rapidly gaining traction due to the increasing consumer preference for convenience and accessibility. This trend has been significantly accelerated by the COVID-19 pandemic, which prompted many consumers to adopt online shopping as a safer and more convenient alternative. Retailers are responding by enhancing their online presence, offering a wide variety of organic chicken options, and providing home delivery services that cater to busy lifestyles.

Moreover, the online channel enables better consumer education and awareness regarding organic products. E-commerce platforms often feature detailed product descriptions, nutritional information, and customer reviews that help consumers make informed purchase choices. As consumers increasingly prioritize health and sustainability in their food choices, the online distribution channel is positioned to play a crucial role in the growth of the market.

Regional Insights

The North America organic chicken market accounted for a revenue share of 41.55% in 2023 . A key driver for regional growth is the increasing emphasis on sustainability and ethical sourcing in food production. North American consumers are increasingly concerned about animal welfare and environmental impacts associated with conventional poultry farming practices. Organic chicken production adheres to strict guidelines that promote the humane treatment of animals and sustainable farming methods, which resonates with ethically minded consumers. The USDA's National Organic Program sets rigorous standards for organic certification, ensuring producers meet high-quality benchmarks in feed, living conditions, and overall animal care. This commitment to sustainability attracts health-conscious consumers and aligns with broader environmental goals, further driving North America's demand for organic chicken.

U.S. Organic Chicken Market Trends

The U.S. organic chicken market is expected to reach USD 2987.9 million by 2030. A significant driver is the rising demand for healthier food options among consumers. As awareness of the health benefits of organic foods increases, many individuals opt for organic chicken as a safer alternative to conventionally raised poultry. Organic chicken is perceived as free from harmful chemicals, antibiotics, and hormones, making it an attractive choice for health-conscious consumers. This trend has been amplified by the COVID-19 pandemic, which led many people to prioritize their health and well-being.

Asia Pacific Organic Chicken Market Trends

The organic chicken market in Asia Pacific is expected to be the fastest growing at a CAGR of 14.2% from 2024 to 2030. A significant factor contributing to market growth is the increase in disposable incomes among the middle class in Asia Pacific countries. In addition, expanding retail distribution channels, including supermarkets and online platforms, has made organic chicken more accessible to consumers. Retailers are increasingly offering various organic products, catering to the rising demand while ensuring that consumers can conveniently purchase these items in-store and online.

Furthermore, government initiatives promoting organic farming practices are also crucial in supporting the growth of the organic chicken industry in Asia Pacific. Many governments are implementing policies to encourage sustainable agriculture and reduce reliance on chemical inputs, aligning with global trends towards healthier eating habits. These initiatives boost local production and enhance consumer confidence in organic products. As a result, the combination of health awareness, rising incomes, improved accessibility through retail channels, and supportive government policies positions the Asia Pacific market for substantial growth in the coming years.

Key Organic Chicken Company Insights

The market for organic chicken features a diverse landscape of companies that include producers, processors, distributors, and retailers, all focused on meeting the growing consumer demand for organic poultry products. Key players in this sector include both independent farms and larger corporations that have integrated organic practices into their operations.

Key Organic Chicken Companies:

The following are the leading companies in the organic chicken market. These companies collectively hold the largest market share and dictate industry trends.

- Tyson Foods, Inc.

- Perdue Farms, Inc.

- Sanderson Farms

- Foster Farms

- Bell & Evans

- Plainville Farms LLC

- Murray's Organic Chicken

- Eversfield Organic

- Kingbird Farm

- Many Hands Organic Farm

- Nick's Organic Farm

- Greener Pastures Chicken

- Plukon Food Group

- Tecumseh Poultry LLC

- Cargill

Organic Chicken Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.88 billion

Revenue forecast in 2030

USD 9.31 billion

Growth rate (Revenue)

CAGR of 13.8% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, South Africa

Key companies profiled

Tyson Foods, Inc.; Perdue Farms, Inc.; Sanderson Farms; Foster Farms; Bell & Evans; Plainville Farms LLC; Murray's Organic Chicken; Eversfield Organic; Kingbird Farm; Many Hands Organic Farm; Nick's Organic Farm; Greener Pastures Chicken; Plukon Food Group; Tecumseh Poultry LLC; Cargill

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Chicken Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organic chicken market report based on product, distribution, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fresh & Frozen

-

Processed

-

-

Distribution Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Specialty Store

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global organic chicken market was valued at USD 3,785 million in 2023 and is expected to reach USD 4,292.2 million in 2024.

b. The global organic chicken market is expected to expand at a compound annual growth rate (CAGR) of 13.8% from 2024 to 2030 to reach USD 9,314.3 million by 2030.

b. The fresh and frozen organic chicken market was valued at USD 2264.2 million in 2023. The fresh chicken market is primarily driven by increasing consumer demand for high-quality, nutritious protein sources. As health consciousness rises globally, consumers are more inclined to choose fresh chicken over processed alternatives due to its perceived health benefits.

b. Some key players operating in the organic chicken market include Tyson Foods, Inc.; Perdue Farms, Inc.; Sanderson Farms; Foster Farms; Bell & Evans; Plainville Farms LLC; Murray's Organic Chicken; Eversfield Organic; Kingbird Farm; Many Hands Organic Farm; Nick's Organic Farm; Greener Pastures Chicken; Plukon Food Group; Tecumseh Poultry LLC; Cargill

b. The organic chicken market is experiencing robust growth, driven by several key factors that reflect changing consumer preferences and industry dynamics. One significant driver of the organic chicken market is the growing consumer awareness of food production practices. As more individuals become informed about the adverse effects of pesticides, antibiotics, and artificial additives in conventional poultry farming, there is a marked shift towards organic options perceived as healthier and safer. The demand for chemical-free food items has surged globally, particularly among meat-eaters who prefer products devoid of synthetic chemicals or antibiotics. This trend aligns with a broader movement towards healthier eating habits, further propelling the organic chicken market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.