- Home

- »

- Renewable Chemicals

- »

-

Green Ammonia Market Size, Share & Growth Report, 2030GVR Report cover

![Green Ammonia Market Size, Share & Trends Report]()

Green Ammonia Market (2023 - 2030) Size, Share & Trends Analysis Report By End-use (Fertilizer, Power Generation), By Technology (Solid Oxide Electrolysis, Proton Exchange Membrane), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-991-7

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Green Ammonia Market Summary

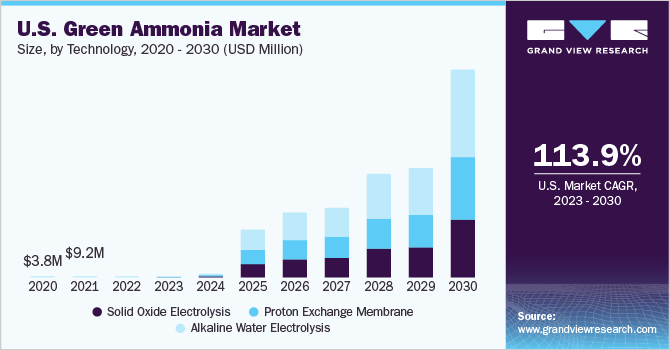

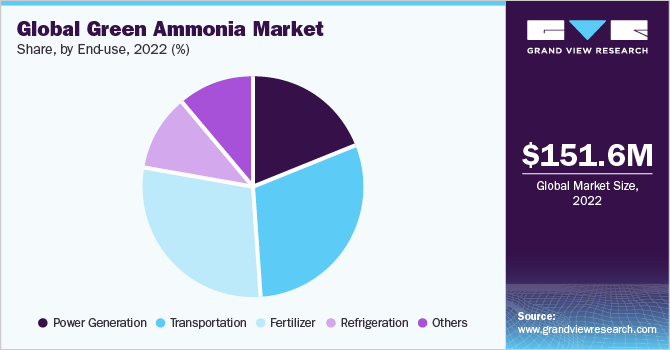

The global green ammonia market size was estimated at USD 151.6 million in 2022 and is projected to reach USD 73.05 billion by 2030, growing at a CAGR of 116.5% from 2023 to 2030. The increasing prevalence of green ammonia due to growing awareness of producing clean energy and reducing carbon footprint is expected to boost the demand in coming years.

Key Market Trends & Insights

- North America dominated the market with the highest revenue share of 28.64% in 2022.

- By technology, the proton exchange membrane technology segment dominated the market with the highest revenue share of 44.4% in 2022.

- By end use, the transportation segment dominated the market with highest revenue share of 30.51% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 151.6 Million

- 2030 Projected Market Size: USD 73.05 Billion

- CAGR (2023-2030): 116.5%

- North America: Largest market in 2022

Increasing popularity of the product as marine fuel and shipping in the transportation industry as it emits zero carbon and leaves no Sulphur traces which leads to improve air quality is further anticipated to drive the market growth in the near future. Green ammonia is produced by hydrogen that comes from water and nitrogen from the air. It is a resourceful fuel for heat and power, especially for marine transport that can be used in gas turbines, internal combustion engines, generator sets, industrial furnaces, and fuel cells. Due to pressure on the shipping sector to reduce the carbon emission, green ammonia is best alternative, as it has less volumetric energy density, which makes storage feasible compared to other fuel. Additionally, the favorable rules and regulations related to low-carbon emissions and the growing fuel application from marine industry are also propelling green ammonia market demand.

Renewable ammonia is expected to become commodity chemical by 2040 as the green ammonia market size is poised to increase exponentially over the forecasted period. This is due to increasing initiatives by several government towards low to zero carbon emission. In the forecast period, the product is likely to become the prime commodity for transporting renewable energy across regions. Further, growing demand for green ammonia in various end-use industries including fertilizer, power generation, refrigeration transportation, and others is expected to propel industry growth. In addition, increasing demand for green ammonia in industrial feedstock products including pharmaceutical products is projected to trigger market growth.

The value chain depicts the vertical integration of key players; whose business operations range from the raw material suppliers to the distribution of finished products. BASF SE, Yara International, ThyssenKrupp AG, and ITM Power PLC are the key players integrated across the value chain. Among these, Haldor Topsoe, Green Fuel, Yara International ASA, Statkraft AS, and Aker Clean Hydrogen are the key players undertaking R&D activities for the development of required green ammonia in respective markets.

Technology Insights

The proton exchange membrane technology segment dominated the market with the highest revenue share of 44.4% in 2022. This can be attributed to growing awareness concerning the advantage of this technology due to its high electric efficiency ranging above 90% with high current densities at low voltages. Additionally, favorable government subsidies towards green and clean energy production and increased R&D on fuel cell plans can trigger the product demand.

The solid oxide electrolysis technology is expected to register highest growth rate over the forecast period. This technology includes the usage of electricity generated from renewable sources to produce green hydrogen, which is further synthesized to produce green ammonia.

Alkaline water electrolysis is a conventional, and robust technology for electrolysis. It is one of the easiest methods to produce hydrogen using renewable energy 0. This method is cost-effective but due to increasing R&D activity on other technologies, the alkaline water electrolysis market will be having constant growth rate during the forecast period. Moreover, alkaline water electrolysis technology is also in high demand due to its low assets expenditure. A technological breakthrough in the industry is considered as one of the prime factors supporting market growth.

The technology providers are constantly increasing their R&D activities in order to achieve enhanced performance and cost reductions on the system, cell, and stack levels. These investments are made by the manufacturers in R&D in order to get efficient results which trigger the market growth.

End-use Insights

The transportation segment dominated the market with highest revenue share of 30.51% in 2022. Its high share is attributable to the increasing fuel energy crisis globally which has stimulated the need for green fuel. Conventional sources are being replaced by renewable sources such as green ammonia and others. These sources produce clean, efficient, and environment-friendly fuel.

The growing concerns such as environmental protection and carbon emissions are gaining attention at the global level. Because of these issues, the product is gaining significant popularity in the transportation industry. As the product requires low storage volumes and is liquid at ambient conditions and it is feasible compared to other fuels.

The market is further witnessing exponential demand due to increasing renewable energy production and the need for storage. Thus, according to the International Renewable Energy Agency (IRENA), solar and wind are highly capable sources of renewable power that will propel the renewable energy sector in the coming years. Thus, increasing renewable power production and consequent advancement in demand for storage will drive the growth of the green ammonia market.

Regional Insights

North America dominated the market with the highest revenue share of 28.64% in 2022.This growth is attributed to the increasing R&D for hydrogen production and the adoption of electric vehicles in the region. Moreover, government support, rising investments from investors, and the feasibility of the technology in the region are driving the market growth.

Asia Pacific market is estimated to expand at a CAGR of 140.6% by 2030. This is attributed to the government policies and initiatives taken towards reducing carbon emission and promoting green energy. For instance, government in India has provided subsidies to increase the use of electric vehicles in the country.

In European region, the product is witnessing high demand from Spain and Germany on account of the rising adoption of technological advancements. Europe is home to many ammonia production plants and has thriving opportunities for manufacturers as the market is consolidated.

Green ammonia utilizes green hydrogen as the key raw material, manufactured from renewable energy and water, instead of using natural gas as the base feedstock.Conventional ammonia is currently more expensive to produce than green ammonia in Europe largely as a result of the Ukrainian geopolitical issues which resulted in a spike in gas prices.

Key Companies & Market Share Insights

The global green ammonia market is oligopolistic in nature and is dominated by key players such as Siemens, ThyssenKrupp AG, and Nel Hydrogen, among others. The manufacturers are focusing on enhancing their production capacity due to estimated high demand for product in the next decade.

The new entrants have a fair opportunity to stabilize themselves in the next few years and gain a notable market share. In addition, the major players in the market are undertaking initiatives like mergers and acquisition to strengthen their hold on the market and to expand their geographical footprint. For example, in January 2023, AmmPower Corp completed acquisition of 50.05% common shares of Progressus Clean Technologies, Inc. In another example, in March 2023, CF Industries Holdings, Inc. announced agreement to acquire Waggaman Ammonia Production plant from Incitec Pivot Limited. Some of the prominent players in the green ammonia market include:

-

Nel Hydrogen

-

Siemens Energy

-

MAN Energy Solutions

-

ThyssenKrupp AG

-

ITM Power PLC

-

Hydrogenics

-

Green Hydrogen Systems

-

McPhy Energy

-

Electrochaea

-

EXYTRON

-

AquaHydrex

-

Enapter

-

BASF SE

-

Yara International

-

ENGIE

-

Uniper

-

Haldor Topsoe

-

Starfire Energy

-

Queensland Nitrates Pty Ltd

-

Hiringa Energy

Green Ammonia Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 411.35 million

Revenue forecast in 2030

USD 73.05 billion

Growth Rate

CAGR of 116.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Russia; The Netherlands; China; India; Japan; Australia; Brazil; Chile; Argentina; Peru; Saudi Arabia; Zimbabwe; Morocco; South Africa

Key companies profiled

MAN Energy Solutions; Siemens Energy; ITM Power PLC; Nel Hydrogen; Hydrogenics; ThyssenKrupp AG; McPhy Energy; Green Hydrogen Systems; EXYTRON; Electrochaea; Enapter; AquaHydrex; Yara International; BASF SE; Uniper ENGIE; Starfire Energy; Haldor Topsoe; Hiringa Energy; Queensland Nitrates Pty Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

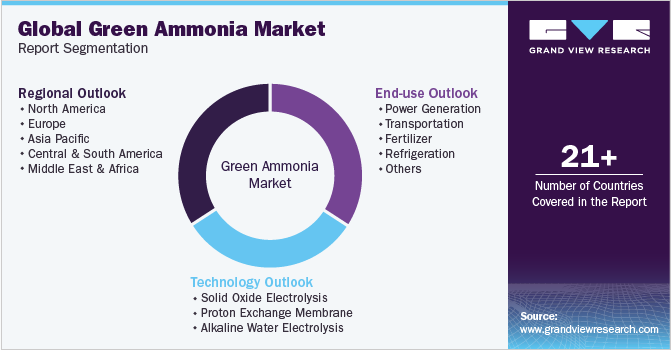

Global Green Ammonia Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global green ammonia market report on the basis of technology, end-use, and region:

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Solid Oxide Electrolysis

-

Proton Exchange Membrane

-

Alkaline Water Electrolysis

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Power Generation

-

Transportation

-

Fertilizer

-

Refrigeration

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Russia

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Chile

-

Argentina

-

Peru

-

-

Middle East & Africa

-

Saudi Arabia

-

Zimbabwe

-

Morocco

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global green ammonia market size was estimated at USD 151.57 million in 2022 and is expected to reach USD 411.35 million in 2023.

b. The global green ammonia market is expected to grow at a compound annual growth rate of 116.5% from 2023 to 2030 to reach USD 73.04 billion by 2030.

b. North America dominated the green ammonia market with a share of 28.64% in 2022. This is attributable to the increasing R&D activities for hydrogen production and the adoption of electric vehicles in the region.

b. Some key players operating in the green ammonia market include MAN Energy Solutions, Siemens Energy, ITM Power PLC, Nel Hydrogen, Hydrogenics, ThyssenKrupp AG, McPhy Energy, Green Hydrogen Systems, EXYTRON, Electrochaea, Enapter, AquaHydrex, Yara International, BASF SE, Uniper ENGIE, Starfire Energy, Haldor Topsoe, Hiringa Energy, Queensland Nitrates Pty Ltd.

b. Key factors that are driving the green ammonia market growth include growing awareness of producing clean energy and reducing carbon footprint, the favorable rules and regulations related to low-carbon emissions, and the growing fuel demand from the marine industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.