- Home

- »

- Alcohol & Tobacco

- »

-

Organic Tobacco Market Size, Share, Industry Report, 2030GVR Report cover

![Organic Tobacco Market Size, Share & Trends Report]()

Organic Tobacco Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Flue-cured, Sun-cured, Fire-cured), By Application (Smoking, Smokeless), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-876-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Organic Tobacco Market Size & Trends

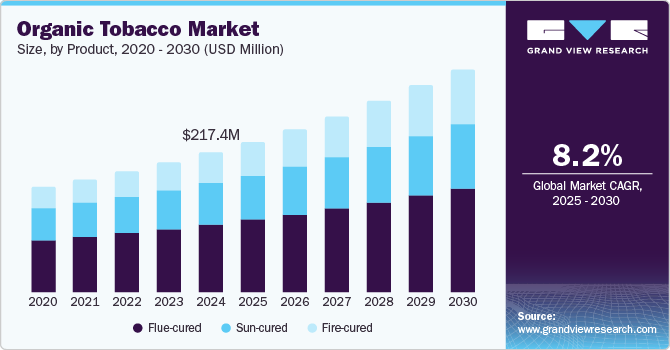

The global organic tobacco market size was valued at USD 217.4 million in 2024 and is projected to grow at a CAGR of 8.2% from 2025 to 2030. With a continued rise in the worldwide smoking population, a healthy number of both occasional and heavy tobacco users are considering moving towards organic tobacco offerings. This tobacco is considered to be a healthier alternative to conventionally grown tobacco due to the absence of chemicals that are extensively utilized in the general farming practices of this crop. Moreover, the broader trend of selecting natural and unprocessed food items has encouraged consumers to demand authentic, natural, and pure tobacco products, enabling steady expansion of the organic tobacco industry.

Organic tobacco is being extensively grown by smaller local producers, which appeals to certain consumer segments who are interested in artisanal, small-batch products. These consumers prioritize quality over quantity and are more willing to pay a premium price for tobacco that is grown with organic techniques. This form of tobacco is especially popular in premium cigars and smokeless tobacco products, where consumers generally seek high-quality and flavorful experiences. Government regulations and policies that promote sustainable farming practices are expected to favor healthy industry growth during the forecast period. Certain regions, such as Western Europe and North America, have placed strict regulations on tobacco farming and pesticide usage, which can drive demand for organic tobacco. In addition, bans on certain chemicals used in conventional tobacco cultivation may make organic tobacco more appealing to growers. The certification of organic tobacco, such as USDA Organic Certification and EU Organic Certification, provides a guarantee of its cultivation methods, which helps boost consumer confidence and increases market demand.

There has been a noticeable shift towards organic tobacco rolled cigarettes, which has positively impacted the global market. Increasing health awareness has forced consumers to shift their preference to organically prepared alternatives, as its consumption is considered less harmful in comparison to conventional tobacco. There has been a steady increase in the number of smokers globally who prefer the consumption of cigars and cigarettes prepared from organic tobacco instead of completely quitting their smoking habit. The demand for organic tobacco is expanding, but it remains a relatively niche segment compared to the broader tobacco market. Factors such as health concerns, sustainability, and an increasing preference for natural products are driving this trend. As the broader awareness and appeal regarding organic and eco-friendly products rises, organic tobacco could see a potential growth in its adoption, particularly among health-conscious and environmentally aware consumers.

Product Insights

The flue-cured segment accounted for a leading revenue share of 48.3% in the global market in 2024. This tobacco is grown using organic farming practices and subjected to flue-curing, which is a specific method of drying tobacco leaves. This type of tobacco is prized for its unique flavor profile, which is typically sweeter and milder compared to other curing methods. Flue curing is a very popular method, with around 90% of tobacco produced in the U.S. annually being of this type. Flue-curing is generally associated with high-quality cigarette tobacco, particularly in the production of Virginia tobacco varieties. Total Leaf Supply, based in Virginia, is a notable seller of flue-cured tobacco, such as Virginia Flue Cured, Organic Virginia Flue Cured Lemon Leaf, and Organic Virginia Flue Cured Orange Leaf.

Meanwhile, the fire-cured segment is expected to grow at the highest CAGR from 2025 to 2030. The fire-curing process involves exposing freshly harvested tobacco leaves to smoke and heat from burning wood or other natural materials, creating a unique flavor profile for the tobacco. This type of tobacco is used in smokeless products such as snuff and chewing tobacco, as well as cigars and a few pipe tobacco blends. Fire-cured organic tobacco has a full-bodied, earthy, and savory flavor, with traces of woodsmoke, spices, and sweetness. As synthetic chemicals are not utilized in the farming process, organic fire-cured tobacco generally has a purer flavor when compared to its conventionally grown counterpart.

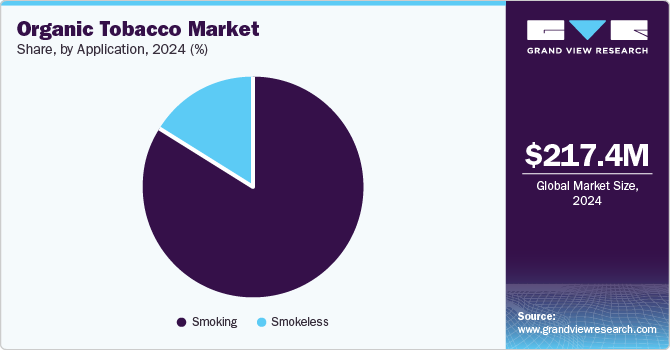

Application Insights

The smoking segment accounted for a dominant revenue share in the organic tobacco industry in 2024. The substantial cigarette smoking population globally has provided a major growth opportunity for organic tobacco companies by enabling them to propagate the advantages of their offerings over traditional tobacco products. Increasing health awareness and concerns about the harmful effects of smoking are prompting consumers to seek alternatives that are perceived to be cleaner or less harmful. Organic tobacco used in cigarettes is grown as per stringent organic farming guidelines. Improved regulatory support for organic tobacco farming and clearer certification standards can potentially help improve market confidence and consumer adoption in this segment.

Meanwhile, the smokeless segment is anticipated to expand at the highest CAGR from 2025 to 2030. Smokeless organic tobacco refers to products made from organic tobacco that do not require combustion and include chewing tobacco, snuff, and nicotine pouches. These products are designed for consumers who prefer alternatives to smoking, offering a way to consume nicotine without inhaling smoke. The organic element signifies that the tobacco used in these products is cultivated without synthetic chemicals, following organic farming standards. In contrast to traditional cigarettes, the absence of combustion in smokeless products means that users are not exposed to harmful chemicals created by burning tobacco, such as tar and carbon monoxide.

Regional Insights

North America accounted for a leading revenue share of 33.7% in the global organic tobacco industry in 2024. The demand for these products is driven by the continued steady growth of a health-conscious and environmentally aware consumer base and increasing premiumization of tobacco products. A growing number of smokers in regional economies are looking for products that are free from additives, preservatives, and chemicals that are commonly used in traditional cigarettes to enhance flavor, shelf-life, or burn rate. Organic tobacco, which is cultivated without synthetic pesticides or fertilizers and processed without chemicals, appeals to consumers who are concerned about what they are inhaling. As a result, the market is expected to expand at a moderate pace in economies such as the U.S. and Canada.

U.S. Organic Tobacco Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024, as the demand for organic tobacco products has witnessed steady growth in recent years. The presence of several major regional and global tobacco companies that have diversified their offerings to include these products has boosted their popularity among consumers, particularly among the younger demographics. Shifting preference among American buyers to consume products that use organically-grown tobacco instead of quitting conventional smoking is projected to remain a major industry driver in the coming years.

Europe Organic Tobacco Market Trends

Europe accounted for a substantial revenue share in the global market in 2024 on account of a strong consumer preference for sustainability, health-consciousness, and premium products in the tobacco sector. Furthermore, tobacco regulations in the European Union (EU) are some of the strictest worldwide, with laws that govern every aspect, including packaging, labeling, advertising, and product ingredients. These regulations have compelled both producers and consumers to use products that are cleaner and have fewer additives. This regulatory environment supports the rise of organic and natural tobacco, as it complies with the broader trend of using healthier and more transparent products.

Asia Pacific Organic Tobacco Market Trends

The Asia Pacific region is anticipated to grow at the highest CAGR from 2025 to 2030. Rising awareness regarding the presence of toxic chemicals and other unwanted components in conventional tobacco items has provided an opportunity for manufacturers to market organic tobacco as a healthier and safer alternative for regional consumers. Additionally, countries such as Japan, Australia, and South Korea have seen a growing interest in premium and artisanal tobacco products in the past few years. Organic tobacco, with its emphasis on quality, purity, and natural cultivation methods, aligns with the increasing consumer preference for premium tobacco offerings that provide a distinctive experience.

China accounted for the largest revenue share in the Asia Pacific organic tobacco industry in 2024. The country leads in terms of tobacco consumption globally, with the World Health Organization stating that there are over 300 million smokers in China, which is around 33% of the overall global number. As a result, the country has significantly attracted companies involved in organic tobacco production to promote healthier alternatives to consumers. Major cities such as Beijing, Shanghai, and Guangzhou, where consumers are becoming more conscious of the risks associated with smoking, are expected to witness higher proliferation of these products. While organic tobacco remains a niche product, the Chinese government’s encouragement for sustainable agriculture is anticipated to make it easier for tobacco farmers to transition to organic practices in the near future.

Key Organic Tobacco Company Insights

Some major companies involved in the organic tobacco industry include Reynolds American, Japan Tobacco, and Mother Earth Tobacco, among others.

-

Japan Tobacco Inc. (JT) is known for manufacturing and selling cigarettes, smokeless tobacco, and reduced-risk products. The company’s tobacco business accounts for over 90% of its revenue, with the remaining share coming from its pharmaceutical and processed food business divisions. Some of the notable tobacco brands under the company include MEVIUS, Winston, Camel, and LD, while its smokeless and reduced-risk products, Ploom and Logic, are sold through the Japan Tobacco International (JTI) division.

-

Mother Earth Tobacco markets its products using non-processed tobacco leaves with no additives or artificial ingredients, catering to consumers seeking a rich and pure tobacco experience. Mother Earth Tobacco promotes the use of organic farming methods for growing its tobacco, which results in reduced emissions of greenhouse gases, improved soil productivity, and reduced exposure of farmers to toxic chemicals.

Key Organic Tobacco Companies:

The following are the leading companies in the organic tobacco market. These companies collectively hold the largest market share and dictate industry trends:

- MAC BAREN

- Japan Tobacco Inc.

- HBT Tobacco Industry and Trade LTDA

- Twaksak t/a Quinnington Tobacco

- Leaf Only

- RealOrganicVapors.com

- Mother Earth Tobacco

- Reynolds American Inc.

- SEKESA

- THE TOBACCO COMPANY

Organic Tobacco Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 234.3 million

Revenue forecast in 2030

USD 348.1 million

Growth rate

CAGR of 8.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

MAC BAREN; Japan Tobacco Inc.; HBT Tobacco Industry and Trade LTDA; Twaksak t/a Quinnington Tobacco; Leaf Only; RealOrganicVapors.com; Mother Earth Tobacco; Reynolds American Inc.; SEKESA; THE TOBACCO COMPANY

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Tobacco Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organic tobacco market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flue-cured

-

Sun-cured

-

Fire-cured

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Smokeless

-

Smoking

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.