- Home

- »

- Medical Devices

- »

-

Orthodontic Consumables Market Size & Share Report, 2030GVR Report cover

![Orthodontic Consumables Market Size, Share & Trends Report]()

Orthodontic Consumables Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Anchorage Appliances, Ligatures, Brackets), By End-use (Hospitals, Dental Clinics), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-109-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Orthodontic Consumables Market Summary

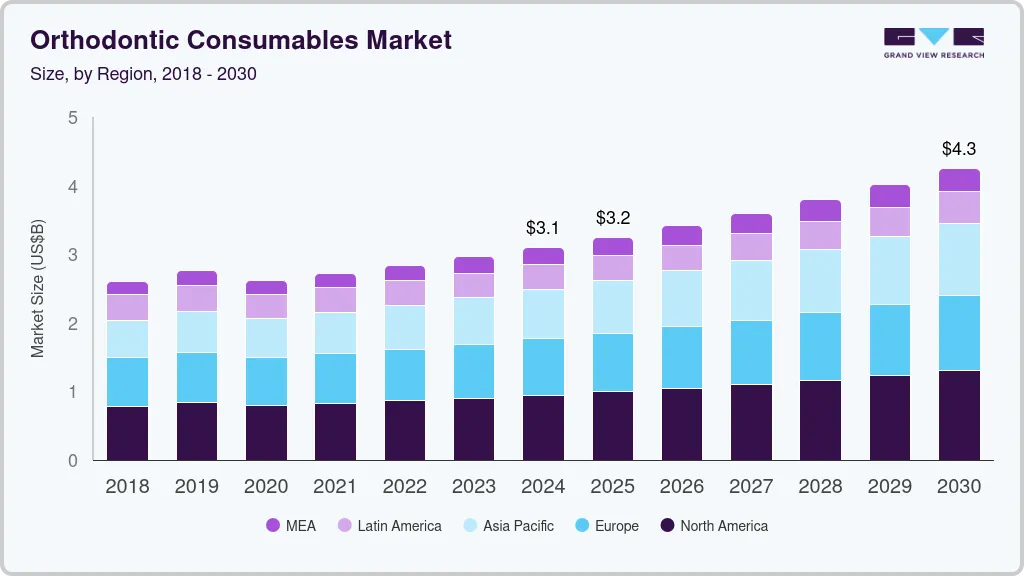

The global orthodontic consumables market size was estimated at USD 3.0 billion in 2024 and is projected to reach USD 4.03 billion by 2030, growing at a CAGR of 5.5% from 2025 to 2030. Orthodontics is an area of dentistry connected to dentofacial augmentation. It deals with adjusting the position of the upper and lower jaws as they close.

Key Market Trends & Insights

- The North America region held the largest revenue share of 30.6% in 2024.

- Based on product type, the brackets segment dominated the global industry in 2024.

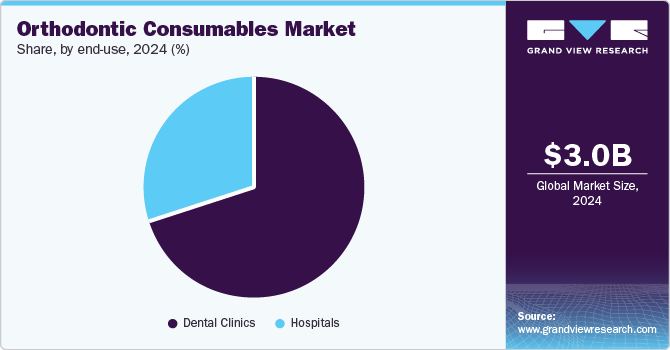

- Based on end-use, the dental clinics end-user segment accounted for the dominant revenue share and is expected to further expand at the fastest CAGR from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 3.0 Billion

- 2030 Projected Market Size: USD 4.03 Billion

- CAGR (2025-2030): 5.5%

- North America: Largest market in 2024

Incorrectly positioned teeth are hard to keep clean and are more likely to face issues such as tooth decay or periodontal disease. Incorrect tooth alignment may also increase the likelihood of contracting other illnesses, such as temporomandibular joint syndrome. Globally, the general public is progressively adopting a lifestyle that emphasizes preserving good dental health and this is likely to boost product demand. The industry growth is also attributed to the rising cases of oral diseases such as gum or periodontal disease and the risk of oral cancer globally. For instance, according to the Global Oral Health Status Report (2022) put forth by the World Health Organization (WHO), oral diseases affect approximately 3.5 billion people globally.

The industry has limitless growth potential, has shown favorable market dynamics, and is anticipated to expand further in the coming years. Numerous variables contribute to this development, with the primary factor being the prevalence of malocclusion globally. “Evolution” is cited as one of the main causes of malocclusion becoming a global issue. The human jaw size has gradually decreased although the number of teeth has remained constant, as a result of eating cooked food more frequently and eating less raw food overall. Cases of malocclusion have rapidly increased as a result.

Orthodontics, also known as smile aesthetics, is becoming more and more popular and is predicted to expand at a significant growth rate through 2030. In addition, dental care has become more important because of rising disposable income and rising healthcare costs in developed and emerging economies. The use of new technologies, such as 3D printing and dental lasers, has given the dental business a profitable chance for expansion. The increased efficiency & precision offered by these techniques have helped professionals offer high-end dentistry treatments.

In addition, growth in research-related activities and a higher uptake of novel dental treatments due to the growing demand for long-term alternatives to conventional operations are further driving the expansion of the orthodontic consumables market. The coronavirus outbreak massively influenced every business, including the cosmetics industry, as a result of the stringent limits placed by authority bodies globally as a precaution to control its spread.

Aesthetics-related product supply chains were also impacted heavily during this period. The pandemic significantly upset the supply-demand equilibrium across the entire medical device industry. With the continued rise and spread of the coronavirus, the dentistry sector experienced its darkest hours. Dental facilities were closed for months globally. However, by mid-2020 and 2021, clinics resumed operations, and the industry demand again increased in the post-pandemic period.

Product Type Insights

On the basis of product type, the global industry has been further classified into anchorage appliances, ligatures, brackets, archwires, and other products. In 2024, the brackets segment dominated the global industry. The segment is projected to expand further at a significant growth rate in the forecast period. The self-ligating bracket, which holds the archwire in place without the use of an external ligature or elastic, is the most lucrative sub-segment of the bracket segment.

The most popular type of braces are metal or traditional braces as they are the least expensive and allow for simple movement while the teeth are being straightened. Most of these brackets are now thinner and less apparent due to product advancements. A growing number of people are interested in enhancing their aesthetic appearance, as awareness increases. Because they are less noticeable and give the same benefits as metal braces, aesthetic brackets are expected to earn a sizable market share during the projection period.

End-use Insights

Based on the end-use, the global industry has been further segmented into hospitals and dental clinics. The dental clinics end-user segment accounted for the dominant revenue share and is expected to further expand at the fastest CAGR from 2025 to 2030. The increasing number of dental offices worldwide and the widespread usage of cosmetic dentistry by both small- and large-scale dental offices are the primary drivers propelling the growth of this segment.

It is also anticipated that the growing number of dental clinics, particularly in developed nations, will accelerate market expansion. Depending on the area, public healthcare provides dentists in industrialized nations with adequate compensation for their services. In addition, there is still room for dental clinics to expand, given the growing popularity of the dental franchise model. The advantages of this model include enhanced negotiation leverage and cost savings through economies of scale. This lowers the total treatment and service costs, thus increasing the number of patients using dental services.

Regional Insights

The North America region held the largest revenue share of 30.6% in 2024. The dental market in North America, which has the largest share and is seeing rapid expansion, is followed by that in Europe. Due to the population expansion in the U.S., dental technology advancements, and expanding insurance plan coverage, the country is spearheading market growth.

Another contributing aspect is the use of direct sales strategies by American and Canadian businesses. The Invisalign System is one such example. It is predominantly distributed through direct sales in the core countries as well as in Europe & some Asia Pacific nations, including Australia, New Zealand, China, and Japan. The same businesses employ the distributor model to market their goods abroad.

The Asia Pacific region is estimated to expand at the fastest CAGR of 6.6% during the forecast period. Due to the region’s large population density, the severity of dental disorders, and the progressive introduction of dentistry, the Asia Pacific is predicted to experience substantial growth in the coming years. According to a report by the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP) in July 2022, the Asia Pacific region is the fastest aging region globally.

Approximately 630 million people in the region are aged 60 years or above, representing 60% of the world’s elderly population. This number is expected to rise to 1.3 billion by 2050. As per WHO, 28% of the population in China is expected to be aged 60 or above by 2040. By 2050, 34% of Singapore’s population is predicted to be elderly, according to the 2018 World Population Data Sheet. Also, by 2050, Japan’s elderly population share (36%) is predicted to overtake that of South Korea and Taiwan (35%). All these factors are expected to result in a high demand for orthodontic consumables in the region.

Key Orthodontic Consumables Company Insights

The global industry is extremely competitive. Major players have developed crucial business strategies, including product innovations, new product launches, joint ventures, strategic partnerships & collaborations, advanced service launches, and contracts, to establish their industry position and amass a sizable portion of the market share. For instance, Invisalign, Align Technology’s system, is now commercially available in India.

Businesses are concentrating on generating growth through innovative product developments, partnerships & alliances, regional expansions, and significant R&D expenditures. An upcoming orthodontics sub-segment is Invisalign aligners. The demand for these invisible personalized aligners is increasing as more and more people become conscious of their appearance.

Key Orthodontic Consumables Companies:

The following are the leading companies in the orthodontic consumables market. These companies collectively hold the largest market share and dictate industry trends.

- Dentsply Sirona

- DB Orthodontics Limited

- Align Technology, Inc.

- G&H Orthodontics

- ROCKY MOUNTAIN ORTHODONTICS

- American Orthodontics

- Danaher

Recent Developments

-

In Aug 2022, orthobrain announced the launch of the SimplyClear aligner system. The company aims to revolutionize the way orthodontic treatment is delivered, using SimplyClear’s high quality clear aligners that support successful orthodontic treatments

-

In June 2021, DENTSPLY SIRONA Inc. announced that the company had acquired Propel Orthodontics, an innovator and manufacturer of orthodontic devices. This acquisition has been an important step for DENTSPLY SIRONA to strengthen the company’s position in the rapidly growing clear aligner market

-

In May 2020, American Orthodontics announced the acquisition of Atlanta Orthodontics, and by extension, their Anterior Root Torquing Spring Auxiliary (ART) device. This device has been very effective in the orthodontic industry as an easy-to-use torquing wire

Orthodontic Consumables Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.2 billion

Revenue forecast in 2030

USD 4.03 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Dentsply Sirona; DB Orthodontics Limited; Align Technology, Inc.; G&H Orthodontics; ROCKY MOUNTAIN ORTHODONTICS; American Orthodontics; Danaher

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Orthodontic Consumables Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global orthodontic consumables market report on the basis of product type, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Anchorage Appliances

-

Buccal Tubes & Bands

-

Miniscrews

-

Ligatures

-

Elastomeric Ligatures

-

Wire Ligatures

-

Brackets

- Aesthetic Brackets

-

Metal Brackets

-

Archwires

-

Beta Titanium Archwires

-

Nickel Archwires

-

Stainless Steel Archwires

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Dental Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global orthodontic consumables market size was estimated at USD 3.0 billion in 2024 and is expected to reach USD 3.2 billion in 2025.

b. The global orthodontic consumables market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2030 to reach USD 4.03 billion by 2030..

b. North America dominated the orthodontic consumables market with a share of 30.6% in 2024. This is attributable to rising aging population in the region, technological advancements in dentistry, increasing direct sales by major companies in the region and the increasing coverage by dental insurance plans.

b. Some key players operating in the orthodontic consumables market include MUnitek; DB Orthodontics; Align Technology, Inc.; G&H Orthodontics, Rocky Mountain Orthodontics, Henry Schein, American Orthodontics, Danaher Corporation, and Dentsply International.

b. Key factors that are driving the orthodontic consumables market growth include increasing adoption of dental services by the geriatric population, high prevalence of malocclusion, technological advancements in dentistry, and rising awareness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.