- Home

- »

- Medical Devices

- »

-

Orthopedic Contract Manufacturing Market Size Report, 2033GVR Report cover

![Orthopedic Contract Manufacturing Market Size, Share & Trends Report]()

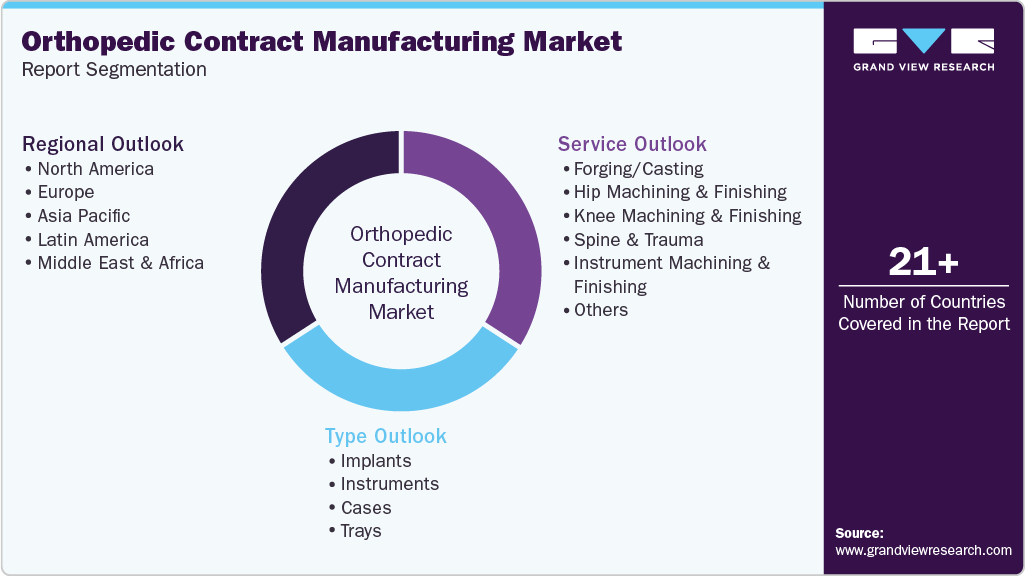

Orthopedic Contract Manufacturing Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Implants, Instruments, Cases, Trays), By Service (Forging/Casting, Hip Machining & Finishing, Knee Machining & Finishing, Spine & Trauma), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-183-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Orthopedic Contract Manufacturing Market Summary

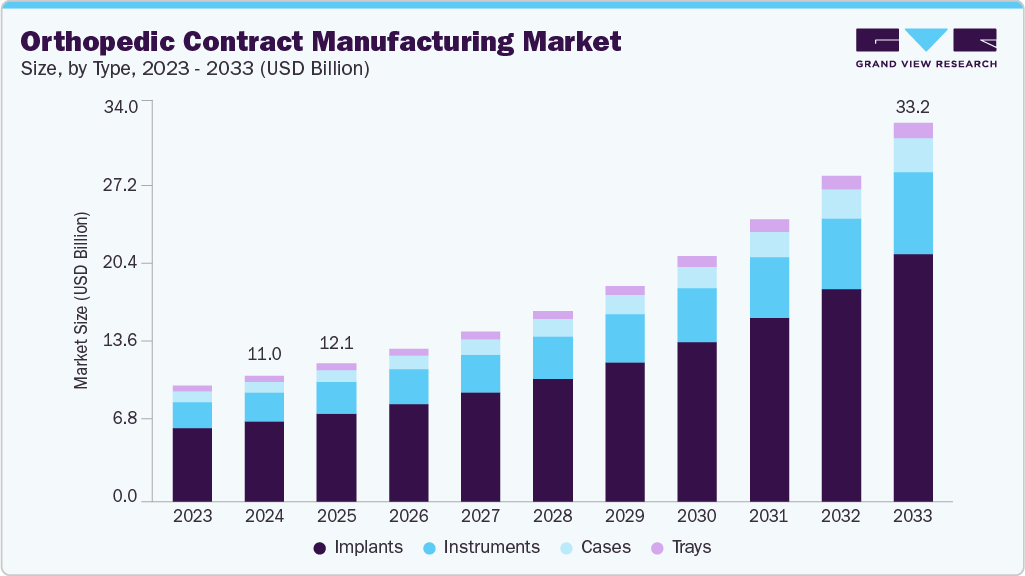

The global orthopedic contract manufacturing market size was estimated at USD 11.01 billion in 2024 and is projected to reach USD 33.20 billion by 2033, growing at a CAGR of 13.49% from 2025 to 2033. The orthopedic contract manufacturing market is gaining momentum owing to increasing prevalence of musculoskeletal disorders, an aging population, and a rising demand for advanced orthopedic implants and instruments.

Key Market Trends & Insights

- Asia Pacific orthopedic contract manufacturing market held the largest share of 44.18% of the global market in 2024.

- The orthopedic contract manufacturing in the U.S. is expected to grow significantly over the forecast period.

- By type, the implants segment held the highest market share of 63.63% in 2024.

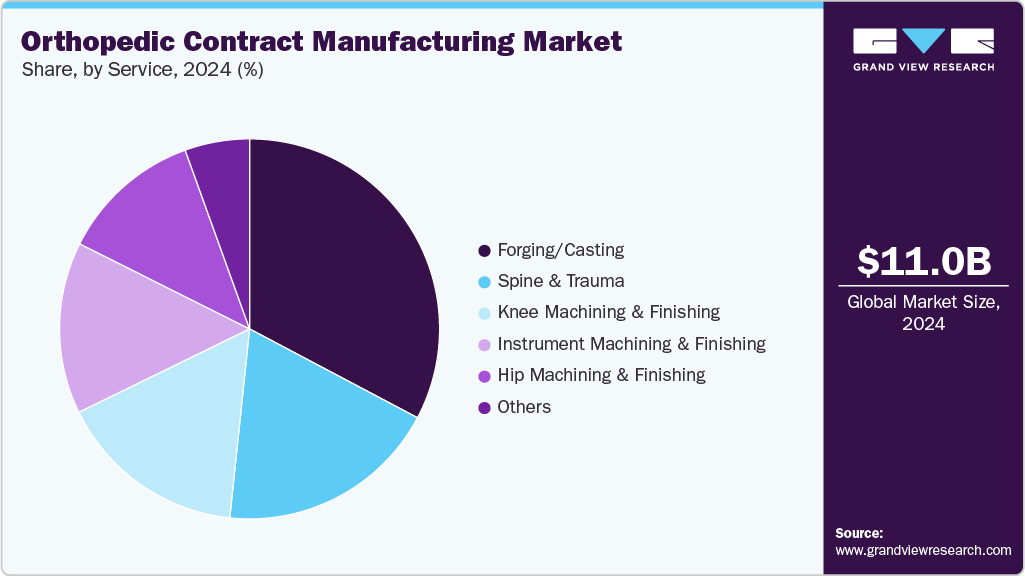

- Based on services, the forging/casting segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.01 Billion

- 2033 Projected Market Size: USD 33.20 Billion

- CAGR (2025-2033): 13.49%

- Asia Pacific: Largest market in 2024

Further, the growing advancements in materials science, additive manufacturing, and precision machining, the production of highly customized and minimally invasive devices is expected to drive the market growth, as it aligns with patient-specific treatments. Additionally, increasing cost pressures on original equipment manufacturers (OEMs) and the need to accelerate their time-to-market have led to greater reliance on external manufacturing partners supporting market growth. Furthermore, the shift toward value-based healthcare models emphasizes the need for high-quality, cost-effective orthopedic solutions.In the orthopedic market, contract manufacturing has become essential for large-scale and specialized production of orthopedic products. Manufacturers increasingly rely on contract manufacturing partners for their technical expertise, advanced production capabilities, and compliance with regulatory standards. This outsourcing approach allows OEMs to focus on their core strengths, such as research and development, clinical validation, and market expansion, while also reducing capital expenditure and streamlining operational complexities.

Furthermore, increasing demand for joint reconstruction, trauma fixation, spinal implants, and sports medicine devices due to a rising orthopedic disease burden and higher accident rates has intensified the need for efficient, high-volume orthopedic manufacturing. Additionally, timely supply, consistent quality, and the ability to scale in response to market changes have driven the trend of outsourcing in the orthopedic industry.

Furthermore, recent technological advancements in orthopedic contract manufacturing include the integration of additive manufacturing, advanced CNC machining, robotics, and AI-powered quality control systems. These innovations have made it possible to produce highly precise, customized implants and instruments with shorter lead times. Improved biomaterial processing capabilities, such as titanium alloys and bioresorbable polymers, have further enhanced device performance and patient outcomes. Automation and digital manufacturing platforms have increased production efficiency, reduced errors, and strengthened compliance with strict regulatory and quality standards.

Additionally, current strategic initiatives in the orthopedic contract manufacturing market focus on expanding capacity, upgrading technology, and achieving vertical integration to provide comprehensive manufacturing solutions. Companies are actively pursuing partnerships, mergers, and acquisitions to improve their service offerings and broaden their geographic reach. Global players are making substantial investments in advanced manufacturing facilities, automation, and digitalization to boost efficiency and meet the evolving needs of clients. These factors are expected to drive the market. For example, in April 2024, Tyber Medical, Intech, and Resolve Surgical Technologies announced a merger to become a leading provider of surgical devices for MedTech OEMs and patients. The combined company offers advanced implant and instrument platforms along with extensive regulatory and development expertise, enabling faster, smarter solutions and strengthening global OEM partnerships. This merger is supported by a consortium of prominent private investors, led by Montagu, with the goal of setting new standards in innovation, efficiency, and strategic collaboration within the surgical device industry. Such strategic initiatives are likely to support market growth.

Opportunity Analysis

The orthopedic contract manufacturing market is experiencing several new growth opportunities fueled by the increasing demand for customized implants designed to meet patient-specific needs and the rising number of accidents. Besides, orthopedic companies are increasingly forming partnerships with contract manufacturers to leverage the advantage of their advanced manufacturing capabilities and to speed up product development processes, which are expected to drive the market. In addition, growing expansion into emerging markets, attributed to the rising incidence of orthopedic conditions, along with growing improvements in healthcare infrastructure, supports the market growth.

Moreover, integrating advanced technologies such as additive manufacturing and digital design tools facilitates the creation of complex, high-precision implants. Further, contract manufacturers are expanding their service offerings beyond traditional manufacturing to include design support, regulatory consulting, and supply chain management, which adds more value to their clients. Furthermore, the trend toward outsourcing due to growing necessity to cut costs and improve operational efficiency strengthens the market, positioning contract manufacturers as key strategic partners in the orthopedic device market.

Impact of U.S. Tariffs on the Global Orthopedic Contract Manufacturing Market

The imposition of U.S. tariffs has significantly impacted the raw material supply chain for the orthopedic contract manufacturing market. Key materials such as titanium, stainless steel, cobalt-chromium alloys, and specialized polymers critical for producing implants, instruments, and fixation devices have faced increased import costs due to tariffs on metals and industrial inputs. These cost escalations have directly pressured contract manufacturers’ margins, especially in a sector where precision materials account for a substantial share of production expenses. Also, in some cases, manufacturers have been compelled to source alternative materials or suppliers, leading to delays, additional regulatory approvals, and increased operational complexity, slowing output and affecting delivery timelines for OEM clients.

Overall, U.S. tariffs have reshaped market dynamics by speeding up the shift to domestic and nearshore manufacturing to reduce geopolitical and trade risks. While these measures have opened opportunities for U.S.-based contract manufacturers, global players dependent on cross-border material flows have faced increased costs and logistical hurdles. Strategic alliances, long-term contracts, and vertical integration have become key strategies, helping companies secure stable supply channels. The situation has strengthened the industry’s focus on supply chain resilience, cost efficiency, and localized production in the orthopedic manufacturing value chain.

Technological Advancements

Orthopedic contract manufacturing market has seen remarkable changes due to key technological advancements that enhance precision, efficiency, and customization. Besides, additive manufacturing, commonly known as 3D printing, supports the creation of patient-specific implants that feature complex geometries, which traditional methods struggle to produce. In addition, this reduces material waste and speeds up the prototyping process.

Moreover, advanced CNC machining ensures high-precision fabrication of implants and surgical instruments, adhering closely to the tight tolerances necessary in orthopedic applications supports the market growth. In addition, robotic automation further supports development as well as improving manufacturing consistency and throughput by reducing human error and streamlining repetitive tasks.

Moreover, digital design and simulation tools allow virtual testing and optimization of implants before their physical production, reducing development risks and speeding up regulatory approval processes. Advances in materials, including the use of high-tech titanium alloys, cobalt-chromium, and bioresorbable polymers, along with improved processing methods like surface coatings and treatments, have further enhanced implant durability, biocompatibility, and patient outcomes. Therefore, these technologies enable contract manufacturers to produce highly customized, reliable orthopedic products while improving operational efficiency and complying with strict quality and regulatory standards in a competitive global market. These factors are likely to drive the market over the forecast period.

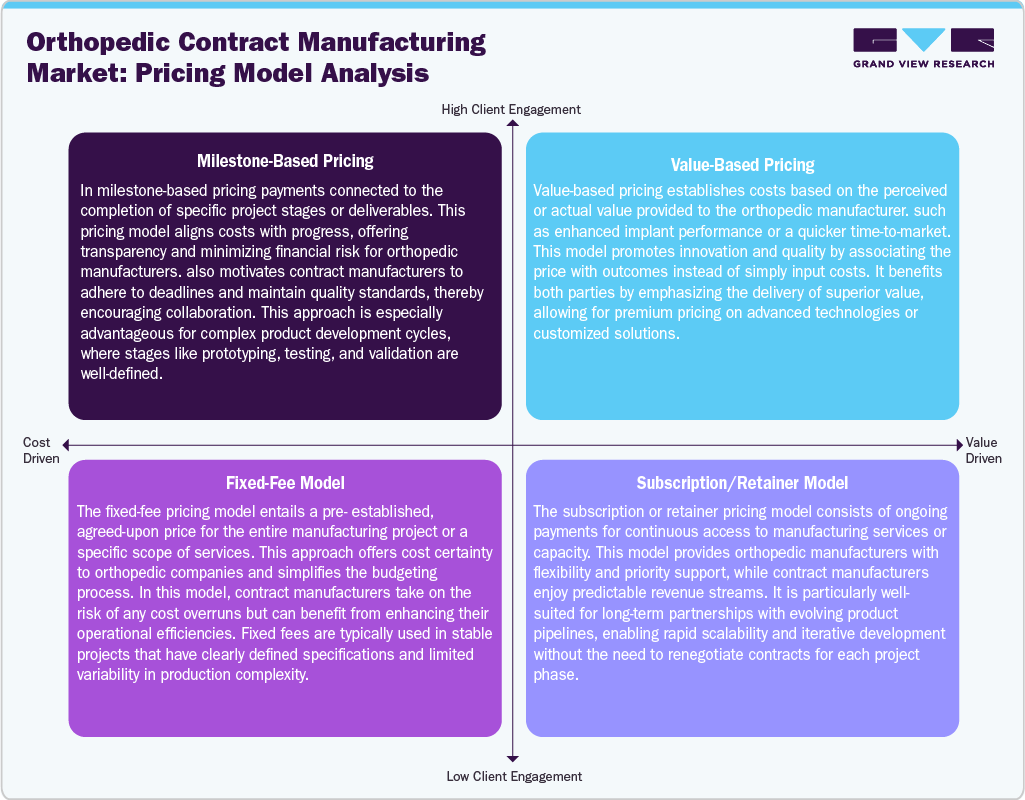

Pricing Model Analysis

The orthopedic contract manufacturing market employs diverse pricing models tailored to project complexity and client needs. Milestone-based pricing links payments to specific project phases or deliverables, aligning costs with progress and incentivizing timely completion & quality adherence. The fixed-fee model offers a predetermined price for defined scopes, providing budget certainty and reducing financial risk for orthopedic manufacturers, especially in projects with clear specifications. Value-based pricing sets costs based on the perceived benefits delivered, such as enhanced implant performance or accelerated time-to-market, promoting innovation and aligning manufacturer incentives with client outcomes. In addition, the subscription or retainer model involves ongoing payments for continuous manufacturing access, fueling the long-term partnerships, ensuring priority service, and enabling scalability. Moreover, each model supports different strategic priorities whether cost control, flexibility, or value maximization allowing orthopedic companies to optimize outsourcing arrangements within a competitive and evolving market landscape. Such factors are expected to drive the market over the forecast period.

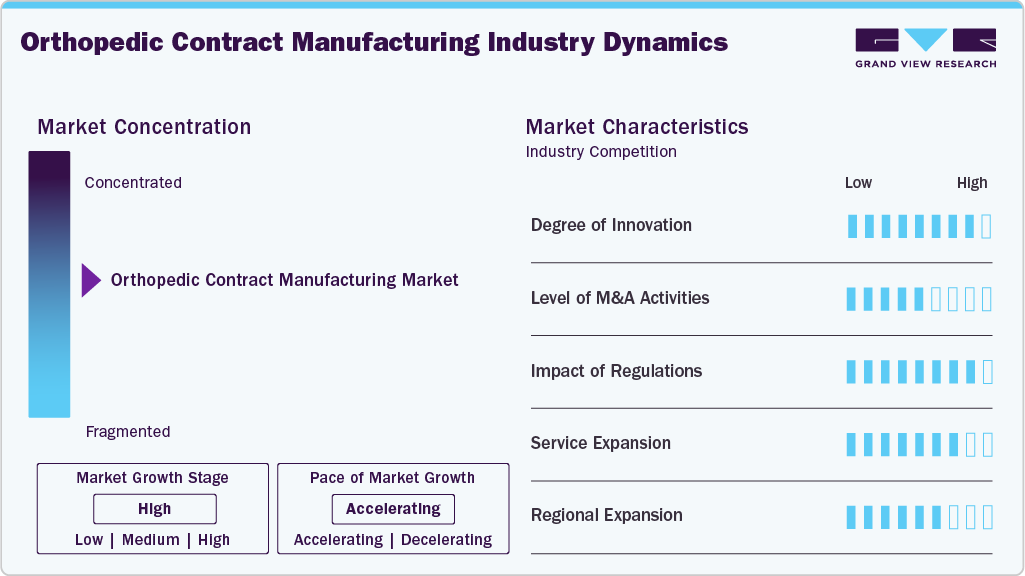

Market Concentration & Characteristics

The orthopedic contract manufacturing market growth stage is moderate, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

The orthopedic contract manufacturing sector is fueled by continuous innovation in materials, design & manufacturing technologies like 3D printing and automation, enabling customized, high-precision implants that improve patient outcomes and reduce production timelines across diverse orthopedic applications.

Mergers and acquisitions are actively shaping the orthopedic contract manufacturing market as companies seek to enhance technological capabilities, expand service portfolios, and strengthen geographic presence to better serve global orthopedic device manufacturers and capitalize on market growth.

Stringent regulatory standards and quality compliance requirements, including FDA and ISO certifications, heavily influenced orthopedic contract manufacturing, necessitating the rigorous process validation and documentation. This further increases the operational complexity, ensuring product safety and market access across the globe.

Contract manufacturers are broadening services beyond fabrication to include design support, regulatory consulting, and supply chain management, creating integrated solutions that support the orthopedic clients to streamline product development, reduce costs, and accelerate time-to-market.

Market growth is driven by expansion into emerging regions such as Asia-Pacific and Latin America, where rising orthopedic disease burden and improving healthcare infrastructure present new outsourcing opportunities for contract manufacturers aiming to capture the untapped market.

Type Insights

Based on the product type, the implants segment led the market in 2024, accounting for 63.63% of the revenue share. The growth of this segment is driven by the rising prevalence of musculoskeletal disorders and increased demand for joint reconstruction, trauma, and spinal implants. Furthermore, contract manufacturers are increasingly supporting the precise production of custom implants using advanced materials and technologies such as additive manufacturing. Additionally, the trend toward minimally invasive and patient-specific solutions, along with strict regulatory compliance and higher investments in R&D, is expected to boost market growth. Therefore, implant manufacturing is becoming more specialized, with contract manufacturers playing a crucial role in meeting challenges related to quality, scalability, and innovation.

The instruments segment is expected to grow significantly during the forecast period. The segment's growth is driven by increasing demand for precise, durable surgical tools used in joint replacement, trauma fixation, and spinal surgeries. Contract manufacturing facilitates the production of complex, high-tolerance instruments through advanced machining and coating technologies. Similarly, outsourcing trends from OEMs focusing on core competencies and cost optimization support market growth. Additionally, the market's expansion is fueled by rising surgical volumes worldwide and innovations in instrument design. Contract manufacturers are enhancing their capabilities to offer integrated solutions, including sterilization and packaging, thereby strengthening their competitive position. These factors are expected to propel market growth.

Services Insights

Based on the services segment, in 2024, the forging/casting segment held the largest revenue share in the orthopedic contract manufacturing market. The growth of this segment is driven by increasing production of high-strength components for orthopedic implants and instruments. Additionally, contract manufacturers typically use advanced technologies to produce durable titanium and cobalt-chromium parts that meet strict biomechanical standards. Furthermore, the demand is boosted by the need for better implant performance and cost-effective manufacturing methods. Outsourcing these processes enables OEMs to leverage specialized expertise while reducing capital costs. Moreover, improved process controls and material innovations are further advancing the market by allowing the creation of complex implant geometries and high-volume production. Therefore, these factors are likely to propel the market forward.

The spine and trauma segment are expected to grow at the highest CAGR during the forecast period. The segment growth is attributed to growing aging demographic and rising spinal disorders and injury rates. Contract manufacturers play a crucial role in producing intricate, high-precision implants and fixation devices designed for these conditions. Also, the shift towards minimally invasive surgery and the use of advanced biomaterials have heightened quality and customization requirements. Outsourcing offers orthopedic firms access to specialized manufacturing technologies, enhancing supply chain flexibility and expediting time-to-market. In addition, the strategic partnerships and technological advancements continue to develop capabilities in this high-value market segment. Such factors are expected to drive the market over the estimated time period.

Regional Insights

Asia Pacific dominated the global orthopedic contract manufacturing market in 2024, holding a revenue share of 44.18%. The market is driven by rapid economic growth, an expanding healthcare infrastructure, and a large patient base. The region's cost-competitive manufacturing environment, coupled with increasing foreign investments, enhances its attractiveness on the global stage. Besides, urbanization and changing lifestyles are leading to a rise in orthopedic disorders, which, in turn drives the demand for advanced implants. Contract manufacturers are increasingly focusing on enhancing their capabilities in 3D printing, biomaterials, and precision engineering to comply with international standards. In addition, favorable government policies encouraging local production are strengthening the region’s position as a key global manufacturing hub for orthopedic devices and implants.

The orthopedic contract manufacturing market in China is witnessing new growth opportunities due to expanding healthcare services and government incentives aimed at boosting domestic device production. The increasing number of orthopedic cases and the rising demand from the middle class for advanced treatments contribute to higher volumes in the market. Manufacturers are making significant investments in automation and precision machining to cater to both domestic and export markets. In addition, regulatory reforms and partnerships with multinational OEMs are enhancing China’s role in the global supply chain for orthopedic devices.

The orthopedic contract manufacturing market in Japan is driven by its advanced healthcare infrastructure, a strong emphasis on R&D innovation, and expertise in biomaterials. Manufacturers are concentrating on developing miniaturized, high-precision implants to cater to the needs of an aging population. Strict compliance with Pharmaceuticals and Medical Devices Agency (PMDA) regulations, coupled with cutting-edge manufacturing techniques, ensures the reliability of the products. In addition, despite a slow population growth rate, demand remains stable, driven by the long-life expectancy of the population and a growing preference for minimally invasive orthopedic surgeries.

India orthopedic contract manufacturing marketis experiencing rapid expansion attributed to growing healthcare sector and the ‘Make in India’ initiatives. The country’s cost advantages, skilled labor, and technological expertise are attracting global OEMs to outsource manufacturing. The increasing prevalence of orthopedic diseases is driving domestic demand for implants and devices. Manufacturers are actively investing in obtaining certifications, enhancing advanced manufacturing processes, and building export capabilities, further solidifying India’s role in global supply chains for orthopedic products.

North America Orthopedic Contract Manufacturing Market Trends

North America is projected to grow at a significant CAGR during the forecast period. The market expansion is attributed to increasing technological innovation, established healthcare infrastructure, and the presence of mature CMOs in the region. The area benefits from strong investments in R&D and early adoption of advanced manufacturing technologies like additive manufacturing and robotic automation. Additionally, the market is expected to find new growth opportunities due to the rising prevalence of musculoskeletal disorders and an aging population, which further increases the demand for orthopedic implants and instruments. Furthermore, strict regulatory frameworks in countries such as the U.S. and Canada support manufacturers in maintaining high-quality standards, which in turn encourages partnerships with specialized contract manufacturers. Consequently, the shift toward new healthcare models is likely to boost demand for contract manufacturing services over the forecast period.

The orthopedic contract manufacturing market in the U.S. accounted for the highest market share in the North America market, owing to the established medical devices industry, increased healthcare spending, and demand for customized, minimally invasive implants. Some other factors contributing to market growth are the rising burden of orthopedics and the rising number of outpatients. Outpatient surgeries are expected to support the market. Moreover, in the country, FDA regulations are increasingly supporting OEMs to opt for CMOs' services, which has led rising number of strategic collaborations with CMOs specializing in quality management. Furthermore, growing reshoring trends fueled by tariffs, geopolitical tensions, and pandemic-related supply chain disruptions are fueling the need for investments in domestic manufacturing and strategic partnerships with advanced capability providers. Thus, such factors are anticipated to support market growth.

The Canada orthopedic contract manufacturing marketis expected to grow at a significant CAGR during the forecast period. The market growth is attributed to growing government healthcare initiatives and rising number of public-private partnerships. Besides, strong emphasis on advanced treatments, innovative manufacturing processes, and sustainable production methods drive the market. In addition, increasing number of elective surgeries and joint replacements presents significant opportunities for market growth. Furthermore, collaborations between OEMs and CMOs are concentrating on quality assurance and the development of specialized implants in compliance with Health Canada regulations, further contributing to market growth.

Europe Orthopedic Contract Manufacturing Market Trends

Europe's orthopedic contract manufacturing market is driven by regulatory harmonization facilitated by the European Medicines Agency, along with a well-established medical device industry. Some other factors contributing to market growth are aging populations and an increase in orthopedic disorders. In addition, growing adoption of digital manufacturing and precision engineering supports market growth. OEMs are increasingly outsourcing work to specialized CMOs to reduce costs and improve supply chain agility while adhering to Medical Device Regulation (MDR) compliance. Key factors involved for the market are implant customization, sustainability, and the integration of advanced production technologies to address changing market and regulatory demands.

The orthopedic contract manufacturing market in Germany held the highest share in 2024. This growth can be attributed to its advanced engineering capabilities, precision machining, and the use of innovative biomaterials. The country is witnessing emerging opportunities with robust CMO network and has been an early adopter of Industry 4.0 technologies, contributing to enhanced efficiency in production. Stringent compliance with Medical Device Regulation (MDR) and ISO standards ensures high-quality outputs. The increasing demand for spinal and trauma implants, along with collaborative efforts with research institutions, further fuels innovation in the industry.

The UK orthopedic contract manufacturing market is expected to grow significantly over the forecast period. The country's growth is fueled by the establishment of advanced manufacturing hubs, the expansion of exports, and the adoption of additive manufacturing for creating personalized implants. In the post-Brexit landscape, manufacturers are ensuring compliance with UKCA and CE standards. The rising demand for digital surgical tools, ongoing healthcare reforms, and government support for medtech innovation are strengthening opportunities in the market, as well as enhancing global trade partnerships.

Latin America Orthopedic Contract Manufacturing Market Trends

The orthopedic contract manufacturing market in the Latin America region is expected to significant growth over the estimated time period. In Latin America, increasing healthcare investments and a rising prevalence of orthopedic disorders are strengthening the market growth. Limited local manufacturing capacity and diverse regulatory environments in the region lead to a reliance on imports and the formation of manufacturing partnerships. Besides, Brazil is at the forefront of this regional growth, backed by government policies aimed at boosting domestic device production. Manufacturers are prioritizing cost efficiency while also adopting advanced technologies to meet the specific needs of the region.

Brazil orthopedic contract manufacturing market is driven by large patient base, improved access to healthcare, and strong government support for domestic production. The rising number of surgeries, especially joint replacements and trauma care procedures, is significantly boosting the market growth. Manufacturers are actively upgrading their technologies and certifications to comply with ANVISA standards. Despite facing economic volatility, partnerships between OEMs and local manufacturers are enhancing market resilience and growth prospects in the region.

Middle East & Africa Orthopedic Contract Manufacturing Market Trends

The orthopedic contract manufacturing market in the MEA region is expected to experience steady growth due to increasing healthcare investments and a growing demand for advanced implants. Governments in the region are promoting local manufacturing through favorable policies and the establishment of industrial hubs. Although challenges related to regulatory diversity exist, manufacturers are working to expand their capabilities. Collaborations with international OEMs are facilitating technology transfer and enhancing quality standards throughout the region.

UAE orthopedic contract manufacturing market growth is attributed to emergence of the country as a key orthopedic contract manufacturing hub in the Middle East, leveraging its strategic location and world-class logistics. Government initiatives, such as the Dubai Industrial Strategy 2030, are further fueling the innovation and production in the orthopedic contract manufacturing. As healthcare spending increases and the volume of procedures rises, demand for orthopedic products is on the upswing. In addition, evolving regulations that align with global standards are enhancing export opportunities and attracting foreign investment partnerships to the region.

Key Orthopedic Contract Manufacturing Company Insights

The key players operating across the market are adopting strategic initiatives such as service launches, mergers & acquisitions, partnerships & agreements, and expansions to gain a competitive edge in the market. For instance, in June 2025, Maxx Orthopedics mentioned partnership with Orchid Orthopedic Solutions to bring a new implant design to market using additive manufacturing. This technology is reshaping possibilities in the orthopedic sector, enabling the development of advanced, next-generation implants. The partnership combines Orchid’s additive manufacturing expertise with Maxx Orthopedics’ design vision, beginning with a cementless tibial baseplate engineered to promote bone in-growth and ensure long-term stability. It aims to expedite product launch timelines while delivering innovative solutions for improved patient outcomes.

Key Orthopedic Contract Manufacturing Companies:

The following are the leading companies in the orthopedic contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Tecomet, Inc

- Orchid Orthopedic Solutions

- Cretex companies

- Viant

- ARCH Medical Solutions Corp.

- Avalign Technologies

- LISI Medical

- Paragon Medical

- Norman Noble, Inc.

- Autocam Medical

Recent Developments

-

In July 2025, Straits Orthopaedics, mentioned the acquisition completion of Medin Technologies. Based in the U.S., Medin produces sterilization cases and trays for the orthopedic sector and runs operations in Totowa, New Jersey, and Manchester, New Hampshire.

-

In March 2025, Jabil mentioned the plans to establish a new manufacturing facility in Gujarat, marking its second site in India. This expansion follows MoU, which was signed in November 2024 aimed at exploring long-term objectives, potential opportunities, and regional support within Gujarat. Headquartered in St. Petersburg, Florida, Jabil operates over 100 facilities worldwide, serving sectors such as automotive, consumer electronics, medtech, and pharmaceuticals. Its medical device portfolio spans are orthopedics, surgical instruments, in-vitro diagnostics, robotics, chronic disease management solutions like insulin pumps, and autoinjectors for GLP-1 therapies.

Orthopedic Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.06 billion

Revenue forecast in 2033

USD 33.20 billion

Growth rate

CAGR of 13.49% from 2025 to 2033

Actual Data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

Tecomet, Inc; Orchid Orthopedic Solutions; Cretex companies; Viant; ARCH Medical Solutions Corp.; Avalign Technologies; LISI Medical; Paragon Medical; Norman Noble, Inc.; Autocam Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Orthopedic Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global orthopedic contract manufacturing market report based on type, service, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Implants

-

Instruments

-

Cases

-

Trays

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Forging/Casting

-

Hip Machining & Finishing

-

Knee Machining & Finishing

-

Spine & Trauma

-

Instrument Machining & Finishing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global orthopedic contract manufacturing market size was estimated at USD 11.01 billion in 2024 and is expected to reach USD 12.06 billion in 2025.

b. The global orthopedic contract manufacturing market is expected to grow at a compound annual growth rate (CAGR) of 13.49% from 2025 to 2033 to reach USD 33.20 billion by 2033.

b. The implants segment dominated the orthopedic contract manufacturing market in 2024 with a market share of 63.63%. The segment growth is attributed to the increasing prevalence of musculoskeletal disorders and the increased demand for joint reconstruction, trauma, and spinal implants. Further, contract manufacturers are increasingly facilitating the precision production of custom implants through advanced materials and technologies such as additive manufacturing, which further supports the market growth.

b. Some of the key market players include Tecomet, Inc, Orchid Orthopedic Solutions, Cretex companies, Viant, ARCH Medical Solutions Corp., Avalign Technologies, LISI Medical, Paragon Medical, Norman Noble, Inc., and Autocam Medical among others.

b. The orthopedic contract manufacturing market is gaining momentum owing to the increasing prevalence of musculoskeletal disorders, an aging population, and a rising demand for advanced orthopedic implants and instruments. Further, the growing advancements in materials science, additive manufacturing, and precision machining, which produce highly customized and minimally invasive devices, are expected to drive the market growth over the estimated time period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.