- Home

- »

- Medical Devices

- »

-

Orthopedic Implants Market Size, Industry Report, 2030GVR Report cover

![Orthopedic Implants Market Size, Share & Trends Report]()

Orthopedic Implants Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Lower Extremity Implants, Spinal Implants, Dental Implants, Upper Extremity Implants), By End Use (Hospitals, Outpatient Specialties), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-020-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Orthopedic Implants Market Summary

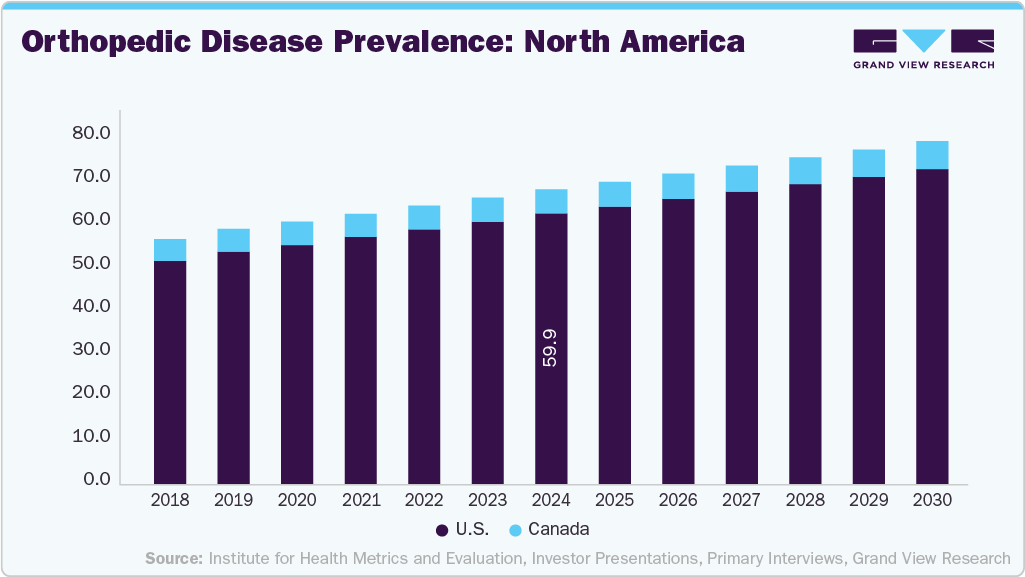

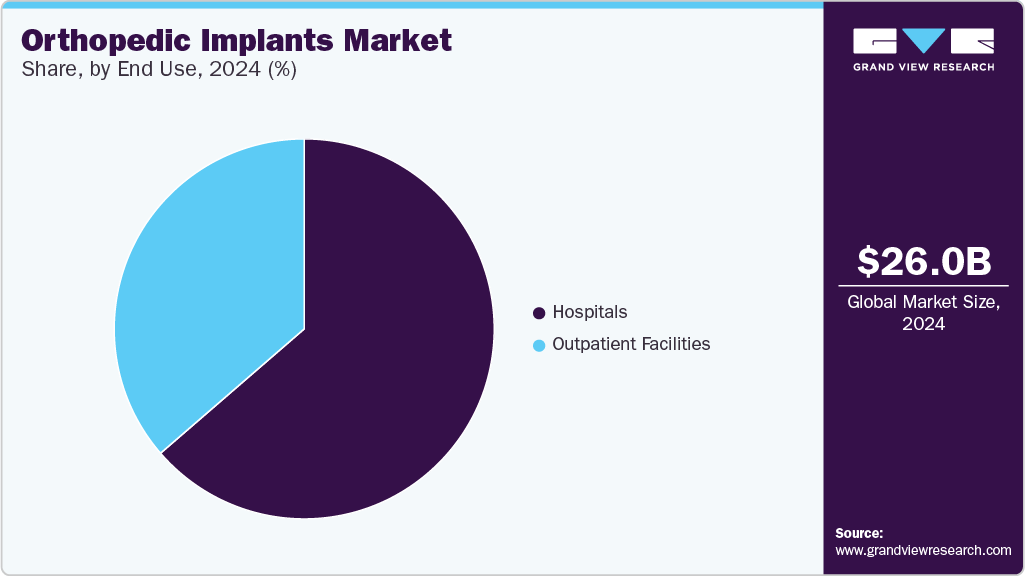

The global orthopedic implants market size was estimated at USD 26.05 billion in 2024 and is anticipated to reach USD 32.47 billion by 2030, growing at a CAGR of 3.78% from 2025 to 2030. The market is driven by the growing prevalence of reduced bone density, weakened bones, and musculoskeletal disorders.

Key Market Trends & Insights

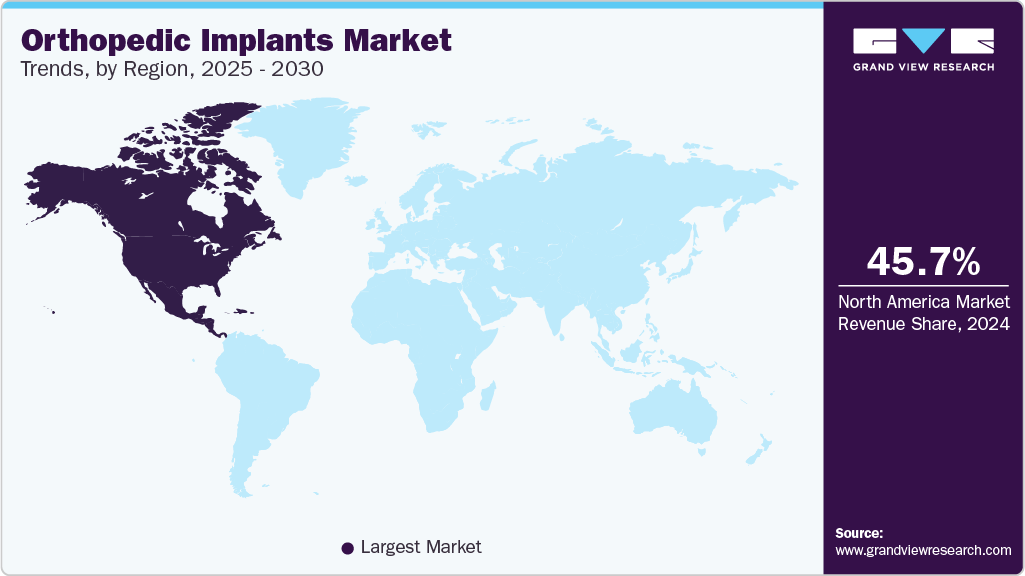

- North America orthopedic implants market dominated global market in 2024 and accounted for the largest revenue share of over 45.69%.

- The U.S. market for orthopedic implants is driven by factors such as an increase in healthcare expenditure across the globe.

- By product, the lower extremity implants segment held the largest revenue share of 52.37% in 2024.

- By material, the metallic material segment held the largest revenue share of 46.38% in 2024.

- By distribution channel, the offline segment held the largest revenue share of 84.05% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 26.05 Billion

- 2030 Projected Market Size: USD 32.47 Billion

- CAGR (2025-2030): 3.78%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The surging risk of degenerative bone disorders is another factor driving market growth over the forecast period. In addition, the availability of advanced orthopedic implants and rapid development in healthcare infrastructure globally are expected to impact market growth positively.

Role of Robotics in Orthopedic Surgery

The growing penetration of robots in orthopedic procedures is further supplementing the growth of the orthopedic implants market. For instance, in June 2021, Stryker UK Limited reported that approximately 13,000 patients worldwide receive Mako robotic arm surgery monthly. Companies investing in robotics are Stryker Corporation, Zimmer Biomet, Mazor Robotics, Smith & Nephew, Medtronic plc, Think Surgical, OMNlife Science Inc., Intuitive Surgical, and Verb Surgical. In addition, companies are increasingly receiving approvals for surgical robots, further driving the market’s growth. For instance, in April 2023, Think Surgical announced that its TMINI small robotic system, designed for orthopedic surgery, has been granted clearance under FDA 510(k) for compatibility with implants. The TMINI system features a wireless robotic handpiece, enhancing the precision of surgeons during total knee replacement procedures.

Orthopedic Implants Market: Product Pipeline Analysis

Product

Company

Pipeline Phase

Smart Implants

Uteshiya Medicare

N/A

REMEOS Trauma Screw

Bioretec

Expert Panel Evaluation/Approval (Q2 2024)

Smaller Diameter

SI-BONE Inc

FDA 510(k) Clearance

Aging Population is Driving the Orthopedic Implants Demand

The global demand for orthopedic solutions is rising due to an aging population and age-related conditions such as bone loss, reduced bone density, arthritis, and weakened ligaments. According to WHO (Oct 2022), by 2030, one in six people will be aged 60 or older. The population aged 60+ is projected to grow from 1 billion in 2020 to 2.1 billion by 2050. As life expectancy increases, age-related orthopedic issues are becoming more prevalent, driving the need for surgeries and implants.

Growing use of Smart Implants in the Market

Advancements in orthopedic implants, healthcare infrastructure, and minimally invasive surgical techniques are driving market growth. Smart implants, which monitor real-time data such as pressure and strain, enable better clinical decisions and are increasingly used in procedures such as spine fusion and fracture fixation. For instance, in July 2023, Parkview Regional Medical Center and Orthopedics Northeast, in collaboration with Integrum, launched Indiana’s first osseointegration program using the OPRA Implant System-highlighting progress in bone-anchored prosthetics.

Some of the technologies used by companies for smart implants:

-

Verasense: A sensor-based device for Total Knee Arthroplasty (TKA), providing real-time data to help surgeons optimize knee balance and stability during surgery without disrupting workflow.

-

Sensor for the Spine: Intellirod Spine's LOADPRO and ACCUVISTA offer intraoperative and postoperative monitoring of spinal cord strain, helping achieve balance during fusion surgeries and tracking strain asymmetry afterward.

Technological Advancements in Orthopedic Implants Market

Digital tools are transforming orthopedic care by enabling real-time patient monitoring, enhancing rehabilitation outcomes, and supporting data-driven clinical decisions. These technologies promote personalized treatment, boost patient engagement, and streamline communication between patients and providers. The growing demand for orthopedic apps and software solutions is further fueling market growth, as they offer benefits such as improved practice management and better clinical outcomes. Popular platforms supporting this shift include Exer Health, iOrtho+, PeekMed Orthogeriatrics, AO Surgery Ref., myrecovery, OrthoClass, Ortho Traumapedia, and DrawMD Ortho.

List of orthopedic apps that can help enhance patient care and educational resources in practice through advanced technology.

App Name

Description

Pros

Cons

Use Cases

Pricing

Exer Health

An AI-driven app measuring patient mobility and participation in Home Exercise Protocols (HEPs) postorthopedic surgery

- Run higher-quality in-person sessions with less effort

- Collect more nuanced and reliable data

- Requires in-depth knowledge of orthopedic practices

Perfect for orthopedic surgeons & residents and physical therapists.

Subscription-based model

Rising Sports Participation and Related Injuries

Additionally, the rising number of people participating in sports and physical activities is directly linked to an increase in sports-related injuries that require medical attention, which is expected to further supplement the market's development. According to the American Academy of Pediatrics and the National SAFE KIDS Campaign, over 3.5 million children aged 14 and under suffer injuries each year while playing sports or engaging in recreational activities. More than 775,000 children in the same age group are treated in emergency rooms for sports-related injuries annually.

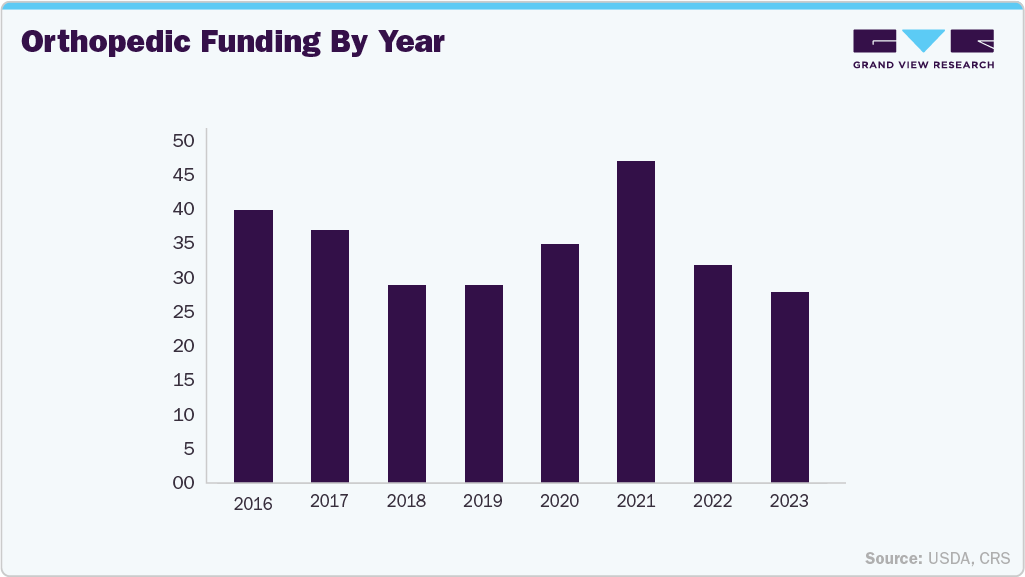

Investment Trends in Orthopedics

Furthermore, investors within the orthopedic sector are demonstrating caution, leading to a deceleration in investment flow. However, current trends indicate a pivot in investor interest towards sectors characterized by innovation, specifically enabling technology and sports medicine. Based on data extracted from 282 orthopedic funding announcements from 2016 to present, a 5% increase in total funding post-COVID has been observed, with notable activity increased by the unique market conditions of 2021.

While overall investment activity has decreased in the last two years, investments with disclosed funding amounts have seen a 10% growth post-pandemic, particularly towards later-stage companies and substantial investments aimed at driving profitability.

Market Concentration & Characteristics

The treatment of orthopedic conditions and injuries has been significantly transformed by recent advancements in the field of orthopedic implants. Advanced techniques such as 3D printing in orthopedic care provide new opportunities for patient-specific implants, which can eliminate the need for off-the-shelf implants. Furthermore, market players are investing in innovative technologies and procedures to keep up with the demand. For instance, in February 2023, Medline announced the launch of its UNITE Ankle Fusion Plating System, offering innovative features to aid foot and ankle surgeons in treating patients with ankle-related conditions.

The orthopedic implants market is characterized by a high level of merger and acquisition (M&A) activity by the leading players, owing to several factors, including the desire to expand the business to cater to the growing demand for orthopedic implants and to maintain a competitive edge. In February 2024, SATO Europe GmbH collaborated with Medacta, a Swiss-based pioneer in orthopedic implants, to optimize the logistics of orthopedic implantation using PJM RFID technology.

Orthopedic implants must meet strict regulatory requirements to ensure high quality, safety, and effective standards before they can be introduced to the market. In the U.S., the FDA regulates orthopedic medical devices. The FDA and EMA agencies heavily regulate the orthopedic implants market to ensure patient safety and product efficacy. However, these regulations create significant barriers for manufacturers, leading to a lengthy and costly approval process for new orthopedic implants. Furthermore, the stringent regulatory framework also hampers innovation and competition within the orthopedic implants market. This can limit patients' access to new and advanced orthopedic implant options.

Substitutes of orthopedic implants are non-surgical treatment options, such as physiotherapy, drug therapy, and allied product options. Moreover, technologically advanced products are likely to be considered as a substitute. The threat of substitutes is expected to be moderate in the industry because, even though substitutes are available for orthopedic implants, some key products still hold a strong place and are growing in demand because of established clinical evidence.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. In January 2022, TÜV SÜD company expanded its medical device testing laboratory in Minnesota with a 20,000-square-foot laboratory extension to its existing 36,000-square-foot facility.

Product Insights

By product, the lower extremity implants segment held the largest revenue share of 52.37% in 2024. The growth can be attributed to the aging population, increasing prevalence of orthopedic conditions, advancements in implant materials & designs, and the growing demand for improved quality of life through surgical interventions. In addition, the number of R&D initiatives by manufacturers is increasing to enhance these implants’ longevity, functionality, & biocompatibility through innovative materials and minimally invasive surgical techniques. For instance, in October 2023, DePuy Synthes, a company within the Johnson & Johnson Medical Devices Companies, received FDA clearance for the TRILEAP Lower Extremity Anatomic Plating System. This system is designed to aid in the treatment of various lower extremity conditions, providing orthopedic surgeons with advanced tools to address patient needs effectively.

The dental implants product type segment is anticipated to witness the fastest growth with a CAGR over the forecast period. The rising incidence of dental injuries due to car accidents and sports injuries is one of the major factors supporting the need for dental implants. According to a report by the American Academy for Implant Dentistry, over 15 million individuals in the U.S. receive crown and bridge replacements for missing teeth annually. Dental implants are long-term replacements and are restorative treatments that protect & encourage natural bone while simultaneously serving as a secure foundation for a prosthesis. In a recent development in December 2022, ProSmile introduced SmartArches Dental Implants in the U.S. SmartArches provides an extensive range of affordable and trustworthy dental implant services, encompassing individual implants and full-mouth reconstruction.

Material Insights

By material, the metallic material segment held the largest revenue share of 46.38% in 2024, owing to the high preference for hospitals in case of any injury. The metallic material segment is further classified into stainless steel, titanium, titanium alloy, cobalt alloy, and others. Stainless steel is favored in orthopedic applications due to its excellent strength, corrosion resistance, and biocompatibility, making it suitable for various implants such as plates, screws, and rods used in fracture fixation and joint replacement surgeries. For instance, the mechanical strength of stainless steel allows it to withstand the stress encountered in load-bearing applications within the human body, which is crucial for ensuring the longevity and effectiveness of implants.

The titanium segment is expected to register the fastest growth over the forecast period. Titanium remains the preferred material for orthopedic applications, particularly in joint replacements like hip and knee implants, due to its unique combination of biocompatibility, strength, and durability. Its biocompatibility allows it to integrate well with human tissue and seamlessly fuse with surrounding bone, reducing the risk of rejection and enhancing long-term implant stability. Titanium forms a protective oxide layer, providing excellent corrosion resistance against bodily fluids, which ensures the longevity of the implant inside the body.

Distribution Channel Insights

By distribution channel, the offline segment held the largest revenue share of 84.05% in 2024. The physical infrastructure where these procedures occur, namely hospitals and surgical centers, is expanding, especially in emerging economies. The increasing number of hospitals, coupled with government initiatives aimed at improving the quality of healthcare and the development of private enterprises offering modern healthcare facilities, directly drives the need for effective physical distribution channels to supply these institutions with the necessary implants.

The online segment is expected to register the fastest growth over the forecast period due to the increasing demand for convenient and efficient purchasing options among healthcare providers and patients. With the rise of e-commerce, hospitals and clinics are turning to online platforms to streamline their procurement processes, allowing them to quickly access a wide range of products without the need for extensive in-person negotiations or lengthy supply chain delays. For instance, companies such as Stryker and Zimmer Biomet have begun offering their products through online portals, enabling healthcare professionals to order implants directly from manufacturers with ease.

End Use Insights

By end use, the hospitals segment held the largest revenue share of 63.65% in 2024 and is expected to witness the fastest growth during the forecast period. The growth is attributed to the high preference for hospitals in case of any injury. This trend is especially observed in developing countries. Furthermore, the rising number of hospital admissions in cases of bone fractures and injuries caused by road accidents is estimated to boost market growth. Favorable reimbursement policies for patients who visit hospitals as compared to those seeking treatment at outpatient facilities, and the presence of a large number of hospitals & primary care centers in developed & developing economies are key factors that can be attributed to the high demand for hospitals.

The orthopedic implants market is expected to experience significant growth over the forecast period. This is due to the increasing preference for day care centers and ambulatory surgery centers in surgical procedures. Outpatient facilities offer advantages such as reduced waiting times, quick discharge, lower procedural costs, and improved efficiency. In addition, they provide patients with adequate postoperative pain control, rapid discharge, minimal side effects, and overall cost containment.

Regional Insights

North America orthopedic implants market dominated global market in 2024 and accounted for the largest revenue share of over 45.69%. The growth is attributed to the growing need for advanced healthcare services, owing to the presence of major industry players, well-established healthcare infrastructure, and comprehensive reimbursement coverage. Moreover, the growing number of middle-aged & geriatric patients opting for orthopedic implants, the increase in prevalence of low bone density, and the introduction of biodegradable implants & internal fixation devices also drive the regional market.

U.S. Orthopedic Implants Market Trends

The U.S. market for orthopedic implants is driven by factors such as an increase in healthcare expenditure across the globe and a rise in the applications of 3D printing in the healthcare sector. The need for regulatory compliance and the requirement for high capital investment restrict the entry of new players into the market.

Companies offering various types of implants are increasingly adopting expansion strategies, such as product launches, mergers, acquisitions, partnerships, and collaborations. For instance, in March 2023, Bioretec Ltd received FDA approval for its bioresorbable metal product, RemeOs trauma screw, for the healing of bone fractures. This product is a combination of traditional surgical techniques with the latest bioresorbable polymer implants, which are patient-friendly and eliminate the need for implant removal operations.

Canada orthopedic implants market is anticipated to register the fastest growth rate during the forecast period. Market players are concentrating on boosting R&D efforts to introduce advanced products and maintain their market position through various strategies. In February 2024, Tyber Medical LLC, an orthopedic device manufacturer, received clearance from Health Canada for its anatomical plating system. The plating system includes a comprehensive range of titanium and stainless-steel plates.Previously, the portfolio had received clearance for FDA 510(k) in the U.S.

Europe Orthopedic Implants Market Trends

Europe orthopedic implants market is anticipated to register a significant growth rate during the forecast period. This is attributed to several factors, including increased healthcare spending as well as a rise in the number of elderly people suffering from osteoarthritis, osteoporosis, bone injuries, and obesity. According to Eurostat, as of January 2023, the EU population reached 448.8 million, with 21.3% of the population aged 65 or older.

Germany orthopedic implants market is anticipated to register a considerable growth rate during the forecast period. In 2021, Germany was among the countries with the highest rate of hip and knee replacement procedures. According to the Organization for Economic Co-operation and Development (OECD), in Germany, 301 individuals per 100,000 population required hip replacements and 201 per 100,000 required knee replacements. Thus, an increase in the incidence of these diseases is fueling the orthopedic implants market in Germany.

Asia Pacific Orthopedic Implants Market Trends

Asia Pacific orthopedic implants market is anticipated to be the fastest-growing region in the global market. The rapidly developing healthcare infrastructure in major countries, such as India, China, & Japan, and the booming medical tourism industry are propelling demand for orthopedic implants in the region. The number of orthopedic implantations performed in the region is growing due to the rising incidence of chronic orthopedic ailments and improved diagnostic tools.

The orthopedic implants market in Japan is expected to grow over the forecast period. Japan has a highly developed medical device industry with advanced manufacturing facilities and technologies. Major locally present companies are adopting strategies such as mergers, collaborations, and product launches to maintain a competitive edge. For instance, in September 2022, Smith+Nephew announced the introduction of its OR3O Dual Mobility System in Japan; the system can be used in both revision and primary hip arthroplasty procedures.

Latin America Orthopedic Implants Market Trends

Latin America orthopedic implants market is anticipated to register a considerable growth rate during the forecast period. Moreover, technological advancements in implant materials and surgical techniques are crucial in driving the adoption of orthopedic implants in this region. The growing number of sports-related injuries and road accidents that require orthopedic interventions further impels market growth. In addition, the availability of favorable reimbursement policies and government initiatives aimed at improving healthcare infrastructure & accessibility are essential drivers for the orthopedic implants market in Latin America.

The orthopedic implants market in Brazil is expected to grow over the forecast period. Medical tourism is growing in the country, the healthcare infrastructure is constantly improving, and patients are becoming more aware of the commercial availability of orthopedic implants. All these factors are contributing to market growth in the country. The rising geriatric population, with a higher susceptibility to musculoskeletal disorders, also contributes to market growth.

Middle East and Africa Orthopedic Implants Market Trends

The Middle East and Africa orthopedic implants market is anticipated to register a considerable growth rate during the forecast period. Technological advancements, government initiatives, and an increase in awareness about bone-related treatments drive the market. In addition, the growing investment in R&D activities and the rising availability of smart orthopedic implants are expected to fuel the market growth further.

The UAE orthopedic implants market is anticipated to register a considerable growth rate during the forecast period. The UAE orthopedic implants market is likely to be driven by the growing prevalence of osteoporosis & osteoarthritis and the rise in sports & road injuries. Furthermore, the market witness new growth prospects over the forecast period owing to an increase in the reconfiguration of supply chain models by medical device manufacturers and an increase in the demand for orthopedic implants.

Key Orthopedic Implants Company Insights

Key participants in the orthopedic implants market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Orthopedic Implants Companies:

The following are the leading companies in the orthopedic implants market. These companies collectively hold the largest market share and dictate industry trends.

- DePuy Synthes

- Zimmer Biomet

- Stryker Corporation

- Smith+Nephew

- Medtronic

- NuVasive, Inc. (mergerd with Globus Medical)

- Arthrex, Inc.

- Acumed LLC

- Paragon Medical (AMETEK)

- Globus Medical

Recent Developments

-

In April 2025, MicroPort Orthopedics, announced the introduction of its flagship second-generation solution, the Evolution Medial-Pivot Knee, in India. The solution is designed to deliver superior flexion stability, anatomic motion, and a wear-limiting design, aiming to replicate the natural stability and motion of the knee to allow superior patient outcomes after total knee replacement surgery.

-

In March 2025, Johnson & Johnson MedTech showcased its latest digital orthopaedics advancements at the AAOS 2025 Annual Meeting in San Diego from March 10-14. Building on last year’s innovations, the company is introducing advanced implants, techniques, and data-driven technologies across various orthopaedic specialties, including joint reconstruction, trauma, extremities, and spine, all aimed at meeting the needs of surgeons and patients.

-

In February 2024, Zeda, Inc. acquired the Orthopaedic Implant Company (OIC), based in Nevada. The acquisition can allow Zeda to produce OIC implants for its customers and strengthen its position in the orthopedic industry.

-

In January 2024, Pacific Research Laboratories, Inc. launched a web application, ENDPOINT, which can allow orthopedic implant manufacturers to test devices using automated simulation applications.

-

In January 2024, Accelus launched Linesider, a spinal implant system with a modular-cortical design. The technology can enable surgeons to insert screw shanks at the beginning of the procedure and customize the construct using modular rods & tulips.

-

In May 2023, Henry Schein signed an agreement to acquire S.I.N. Implant System, a Brazil-based manufacturer of dental implants. This strategy helped the company expand its dental specialty businesses.

-

In February 2023, Invibio opened a new orthopedic medical device product development and manufacturing center in Leeds, UK.

Orthopedic Implants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 26.97 billion

Revenue forecast in 2030

USD 32.47 billion

Growth rate

CAGR of 3.78% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, distribution channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

DePuy Synthes; Zimmer Biomet; Stryker Corporation; Smith+Nephew; Medtronic; NuVasive, Inc. (mergerd with Globus Medical); MArthrex, Inc.; Acumed LLC; Paragon Medical (AMETEK); Globus Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Orthopedic Implants Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global orthopedic implants market report based product, material, distribution channel, end use, and region:

-

Product Outlook (Revenue USD Million, 2018 - 2030)

-

Lower Extremity Implants

-

Knee Implants

-

Hip Implants

-

Foot & Ankle Implants

-

-

Spinal Implants

-

Dental

-

Dental Implants

-

Craniomaxillofacial Implants

-

-

Upper Extremity Implants

-

Elbow Implants

-

Hand & Wrist Implants

-

Shoulder Implants

-

-

-

Materials Outlook (Revenue USD Million, 2018 - 2030)

-

Metallic Material

-

Stainless steel

-

Titanium

-

Titanium Alloy

-

Cobalt Alloy

-

Others

-

-

Ceramic Biomaterials

-

Polymeric Biomaterials

-

Others

-

-

Distribution Channel Outlook (Revenue USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

End Use Outlook (Revenue USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global orthopedic implants market size was estimated at USD 26.05 billion in 2024 and is expected to reach USD 32.47 billion in 2025.

b. The global orthopedic implants market is expected to grow at a compound annual growth rate of 3.78% from 2025 to 2030 to reach USD 32.47 billion by 2030.

b. By product, the lower extremity implants segment dominated the orthopedic implants market in 2024 and accounted for the largest revenue share over 52.37%. The growth is attributed to the aging population, increasing prevalence of orthopedic conditions, advancements in implant materials & designs, and the growing demand for improved quality of life through surgical interventions.

b. Some key players operating in the orthopedic implants market include DePuy Synthes, Zimmer Biomet, Stryker Corporation, Smith+Nephew, Medtronic, NuVasive, Inc. (mergerd with Globus Medical), Arthrex, Inc., Acumed LLC, Paragon Medical (AMETEK), Globus Medical.

b. The market is driven by the growing prevalence of reduced bone density, weakened bones, and musculoskeletal disorders. The surging risk of degenerative bone disorders is another factor driving market growth over the forecast period. In addition, the availability of advanced orthopedic implants and rapid development in healthcare infrastructure globally are expected to impact market growth positively.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.