- Home

- »

- Pharmaceuticals

- »

-

Osteoarthritis Injectables Market Size & Share Report, 2030GVR Report cover

![Osteoarthritis Injectables Market Size, Share & Trends Report]()

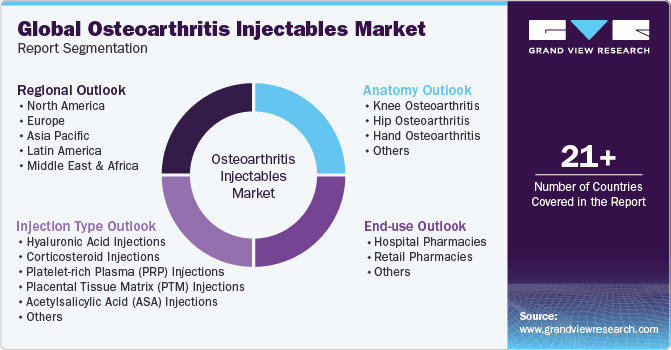

Osteoarthritis Injectables Market (2024 - 2030) Size, Share & Trends Analysis Report By Injection Type (Hyaluronic Acid Injections, Corticosteroids Injections), By Anatomy (Knee Osteoarthritis, Hip Osteoarthritis), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-291-5

- Number of Report Pages: 137

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Osteoarthritis Injectables Market Trends

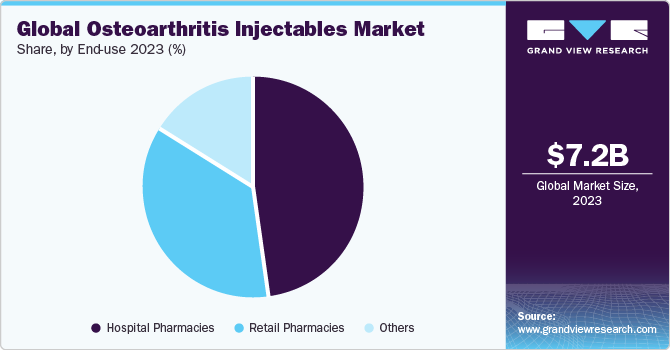

The global osteoarthritis injectables market size was estimated at USD 7.23 billion in 2023 and is projected to grow at a CAGR of 6.82% from 2024 to 2030. Space is primarily driven by the increasing prevalence of osteoarthritis (OA), particularly in the aging population. With approximately 1 in 5 adults in the U.S. affected by arthritis, of which osteoarthritis is the most prevalent form, totaling over 32.5 million individuals, the demand for effective treatment options is on the rise.

R&D activities in injectable drug development are playing a crucial role in shaping the market landscape. The inherent challenges in managing osteoarthritis, such as the dense tissue structure of affected joints, have prompted the exploration of targeted drug delivery systems, including intra-articular administration. Recent developments, such as the clinical data presented by OrthoTrophix, Inc. for TPX-100 and the promising results of lorecivivint from Samumed, LLC, highlight the ongoing efforts to develop novel therapeutic interventions for OA.

Moreover, the growing awareness of personalized medicine among healthcare professionals and patients is creating new opportunities in the market. With a focus on tailoring treatments to individual patient profiles, pharmaceutical companies, and research institutes are actively involved in the development of personalized treatment and cell-based therapies. Recent discoveries, such as the identification of stem cells capable of maintaining healthy cartilage by researchers at Columbia University, and the development of StemJEL, a patented osteoarthritis drug targeting early-to-mid-stage disease, showcase the potential for breakthrough innovations in the field.

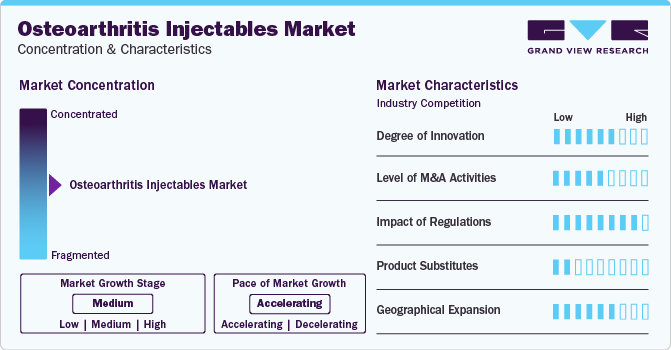

Market Concentration & Characteristics

The market shows significant innovation with the introduction of novel therapies and delivery methods. Advanced formulations and biologic agents offer enhanced efficacy and prolonged relief for osteoarthritis symptoms. Continuous research and development efforts focus on improving treatment outcomes and patient satisfaction. Innovations in injectable treatments aim to address unmet needs and provide targeted solutions for joint pain and inflammation. Novel drug delivery systems and formulations support the expanding landscape of OA management.

The level of M&A activity in the market can be considered moderate with several market players, such as Anika Therapeutics, Inc., Bioventus., Ferring Pharmaceuticals Inc. Sanofi S.A., being involved in merger and acquisition activities.

The marketing and approval process of large molecules used for the treatment of OA is complex. However, an increasing number of awareness programs and regulations encouraging market players to develop novel drugs are key market drivers. The availability of alternative therapies and over-the-counter pain relievers such as acetaminophen, nonsteroidal anti-inflammatory drugs, and corticosteroids is expected to impede the market growth.

Osteoarthritis injectables are witnessing regional expansion, with increased availability and accessibility of injectable treatments across various healthcare facilities and clinics nationwide. This expansion ensures that patients across different regions can access a diverse range of osteoarthritis injectables, including biologic agents, corticosteroids, and viscosupplements. Healthcare providers are increasingly offering these treatments, leading to improved patient care and outcomes in managing osteoarthritis symptoms.

Injection Type Insights

Hyaluronic Acid (HA) injections segment dominated the market, accounting for a share of 38.72% in 2023. HA has a high prescription rate in OA. Recent advancements in HA injection therapy have propelled space growth trajectory. Focus has shifted towards HA-based hydrogel therapeutics, which serve as innovative delivery systems for osteoarthritis treatment. These hydrogels not only enhance the biological effects of HA but also demonstrate potential in improving joint lubrication, delivering cells, and regenerating damaged tissue.

Studies highlight the importance of optimizing hydrogel properties for enhanced efficacy and safety, including backbone modification and crosslinking density. While Induced Pluripotent Stem Cells (iPSCs) present a promising alternative, safety concerns necessitate further exploration. Despite the promising prospects of HA hydrogels, there remains a need for additional research to facilitate clinical translation and maximize their therapeutic benefits.

The Corticosteroid Injections segment is anticipated to witness significant market growth over the forecast period. This growth is fueled by the continuous evolution of flow diverter technology, which enhances the efficacy of corticosteroid injections in OA treatment. Corticosteroids are commonly employed to alleviate inflammation in joints, particularly in the knee, thereby reducing pain and improving joint function.

Mechanistically, corticosteroid injections inhibit the synthesis of pro-inflammatory signaling molecules, such as Interleukin 1 (IL-1), leukotrienes, prostaglandins, and metalloproteinases. This multifaceted action accounts for the observed pain relief in patients receiving corticosteroid injections. Endorsed by guidelines from the Osteoarthritis Research Society International (OARSI), corticosteroid injections are recommended for short-term pain relief, particularly for patients exhibiting an inflammatory phenotype of osteoarthritis characterized by joint swelling, stiffness, and limited mobility.

Anatomy Insights

The knee osteoarthritis segment dominated the market, accounting for a share of 41.96% in 2023. Knee osteoarthritis is a prevalent condition particularly affecting older individuals, with the U.S. witnessing it as the second leading cause of incapacity among men aged 50 years and above. This condition significantly impacts the quality of life of patients, necessitating effective prevention and treatment strategies to alleviate pain and improve functionality.

While pharmacological therapies such as Nonsteroidal Anti-inflammatory Drugs (NSAIDs) offer relief from pain and inflammation, they often only provide symptomatic relief without addressing disease progression. As the aging population continues to grow, the prevalence of knee osteoarthritis is expected to rise, emphasizing the urgent need for comprehensive management approaches to mitigate disability rates and enhance quality of life.

Furthermore, the hip osteoarthritis segment is poised for significant growth and is expected to witness a notable Compound Annual Growth Rate (CAGR) over the forecast period. Hip osteoarthritis poses substantial challenges to individuals' mobility and functionality, potentially leading to the need for joint replacement in severe cases. The condition not only affects individual health but also presents a considerable public health concern.

According to a recent NCBI article published in January 2022, the age-standardized incidence rate for hip osteoarthritis has been on the rise, reflecting an increasing prevalence over the past three decades. This trend is anticipated to continue, driven primarily by the aging population demographic shift. As the population ages, the burden of hip osteoarthritis is expected to escalate, necessitating concerted efforts to develop effective interventions to address this growing health challenge.

End-use Insights

Hospital pharmacies segment dominated the market with a share of 47.64% in 2023. Hospital pharmacies play a pivotal role in OA management, owing to factors such as a higher number of treatments performed in the hospital setting. A study published by NCBI in May 2023 highlighted the growing importance of hospital pharmacies, evidenced by a significant increase in OA-related hospital admissions. This highlights their crucial role in effective treatment monitoring and management, facilitating prompt administration of injections for patients in need of immediate symptom relief. The direct patient access provided by hospital pharmacies further enhances their value proposition, ensuring efficient delivery of care.

The retail pharmacies segment is also anticipated to witness the fastest CAGR over the forecast period. Retail pharmacies serve as essential intermediaries between manufacturers and healthcare providers, stocking osteoarthritis injectables and ensuring their availability to patients. While they may not handle the same volume as hospital pharmacies, retail pharmacies prioritize accessibility and convenience, offering extended hours and personalized service to enhance patient satisfaction and adherence. With lower costs compared to hospital pharmacies, retail pharmacies play a critical role in expanding access to OA injectables, particularly for patients seeking convenience and affordability in their treatment options.

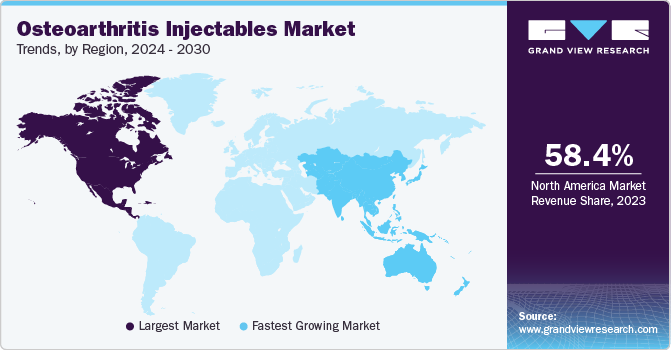

Regional Insights

North America osteoarthritis injectables market dominated the market and accounted for a 58.42% share in 2023. The North American market's dominance is evident due to various factors, including the region's high prevalence of obesity and supportive government policies. Key market players such as Teva Pharmaceuticals, Zimmer Biomet and Ferring Pharmaceuticals Inc. further solidify its position. Strategic initiatives such as therapeutics study trials, mergers, acquisitions, and partnerships among pharmaceutical giants are actively shaping the competitive landscape. For instance, in February 2024, Novartis announced further continuation of its study for biological interventions U.S., which are safety, tolerability and efficacy of intra-articular Canakinumab and LNA043 for patientswith knee osteoarthritis.

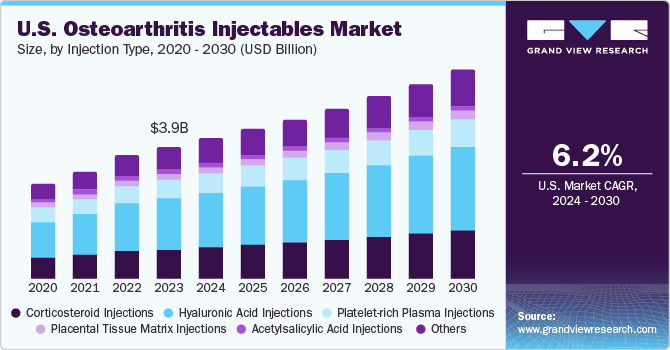

U.S. Osteoarthritis Injectables Market Trends

The osteoarthritis injectables market in the U.S. is expected to grow over the forecast period due to the strong pharmaceutical industry, with leading players and innovators like Zimmer Biomet, Bioventus, and Remedium Bio driving innovation in the field, particularly in the development of advanced therapeutics. In March 2023, Remedium Bio, a U.S. biotech company, formed a strategic collaboration with Exothera, a Belgian CDMO, focusing on advancing disease-modifying gene therapy, AAV2-FGF18, for osteoarthritis. This initiative aims to leverage expertise and resources for the development & enhancement of the potential market presence of its innovative therapy.

Europe Osteoarthritis Injectables Market Trends

Europe osteoarthritis injectables market presents a lucrative opportunity for pharmaceutical companies, with significant growth potential in the region, driven by the rising prevalence of OA, particularly in aging populations. Pharmaceutical advancements and a growing focus on disease-modifying drugs contribute to market expansion. Regulatory trends emphasize stringent evaluation criteria for drug efficacy and eligibility criteria in clinical trials. Viscosupplementation agents dominate, offering effective symptom management.

The UK osteoarthritis injectables market is on the rise, driven by an aging population and increasing awareness of osteoarthritis. Hyaluronic acid injections lead the market, offering effective pain relief and improved joint function. Corticosteroid injections also play a role in managing symptoms, particularly for short-term relief. With a growing emphasis on early diagnosis and intervention, the market is expected to continue expanding in the coming years.

The osteoarthritis injectables market in France is experiencing steady growth, driven by an aging population and increasing prevalence of osteoarthritis. Key players are innovating to develop more effective and safer injectable treatments.

Germany osteoarthritis injectables market is expected to grow over the forecast period. Germany's market is driven by factors such as an aging population, increasing obesity rates, and rising injury incidents. Major players focus on R&D to meet demand. The market is projected to grow, influenced by similar factors.

Asia Pacific Osteoarthritis Injectables Market Trends

The osteoarthritis injectables market in Asia Pacific is expanding due to high prevalence, increased healthcare spending, population growth, medical advancements, regulatory support, and improved awareness. It's projected to experience significant growth, driven by aging populations and treatment innovation in countries such as China, Japan, and India. Pharmaceutical firms are investing in research.

The China osteoarthritis injectables market is expected to grow over the forecast period due to factors such as increasing prevalence, adoption of pain medications, a growing susceptible population, emerging markets, collaborations for product development, and a favorable regulatory scenario, driving demand for both symptomatic relief and disease-modifying treatments.

The osteoarthritis injectables market in Japan is expected to grow over the forecast period, due to rapidly expanding market, with Japanese pharma firms entering the space and observing growing demand due to lifestyle changes.

Latin America Osteoarthritis Injectables Market Trends

The osteoarthritis injectables market in Latin America is expected to grow over the forecast period. According to an NCBI published article in January 2022, Limited evidence suggests weight-bearing osteoarthritis (OA) is a significant issue in Latin America, impacting health-related quality of life (HRQoL) and posing economic challenges. Gaps exist in understanding HRQoL and socioeconomic outcomes, emphasizing the need for further research, especially in regions with limited healthcare resources.

The Brazil osteoarthritis injectables market is expected to grow over the forecast period. According to an NCBI article published in 2021, osteoarthritis (OA) is highly prevalent in Brazil, being the third most common disease among those insured for Social Security, contributing to 65% of disability cases.

MEA Osteoarthritis Injectables Market Trends

The osteoarthritis injectables market in MEA is expected to grow over the forecast period due to an aging population, increased adoption of viscosupplementation, drug development innovations, regulatory approvals, anatomical segmentation focusing on knee osteoarthritis, and diverse distribution channels, reflecting an expanding landscape.

The Saudi Arabia osteoarthritis injectables market is expected to grow over the forecast period. Market players in the region are taking various initiatives to contribute to market expansion. For instance, in June 2023, Pennsylvania-based Levolta Pharmaceuticals entered into an exclusive licensing and distribution agreement with Saudi Arabia's Tabuk Pharmaceutical Manufacturing Company to commercialize VOLTO1, a therapy for osteoarthritis, in the Middle East and Africa region, excluding South Africa.

Key Osteoarthritis Injectables Company Insights

Key players such as Anika Therapeutics, Inc., Bioventus, Ferring Pharmaceuticals Inc., and Sanofi S.A. employ a range of strategies to maintain their competitive edge. These strategies include continuous investment in new product development, securing patent protection for their innovations, obtaining regulatory approvals, and fostering collaborations and partnerships to expand their market reach and enhance product offerings. Additionally, there are notable competitors in the market such as Flexion Therapeutics, Inc., Zimmer Biomet, Arthrex, Inc., and Royal Biologics.

These emerging players employ diverse strategies to bolster their presence in the market. Strategies such as a relentless focus on innovation to differentiate their products, expanding their geographic footprint to tap into new markets, and forging strategic partnerships to leverage complementary strengths help these companies in achieving their growth objectives. As competition intensifies, the ability to innovate, adapt to evolving regulatory landscapes, and forge strategic alliances will be pivotal for both established and emerging players to maintain and expand their market share in the dynamic landscape of OA injectables.

Key Osteoarthritis Injectables Companies:

The following are the leading companies in the osteoarthritis injectables market. These companies collectively hold the largest market share and dictate industry trends.

- Anika Therapeutics, Inc.

- Bioventus.

- Ferring Pharmaceuticals Inc.

- Sanofi S.A.

- Flexion Therapeutics, Inc.

- Zimmer Biomet

- Arthrex, Inc.

- Royal Biologics

- Teva Pharmaceutical Industries Ltd.

Recent Developments

-

In November 2023, Smith+Nephew strategically acquired a novel cartilage regeneration technology, showcasing a commitment to enhancing sports medicine knee repair and maintaining innovation leadership.

-

In March 2023, Remedium Bio, a U.S. biotech company, form a strategic collaboration with Exothera, a Belgian CDMO, to advance disease-modifying gene therapy, AAV2-FGF18, for osteoarthritis. This initiative aims to leverage expertise and resources for market presence enhancement.

-

In May 2023, Grünenthal achieved a strategic milestone, as their nonopioid medicine, Resiniferatoxin (RTX), received FDA breakthrough therapy designation for treating knee osteoarthritis pain. This recognition was based on promising phase I & II clinical data, emphasizing substantial pain relief and a favorable safety profile.

Osteoarthritis Injectables Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.68 billion

Revenue forecast in 2030

USD 11.42 billion

Growth rate

CAGR of 6.82% from 2024 to 2030

Actual Years

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Injection type, anatomy, end-use, region

Key companies profiled

Anika Therapeutics, Inc.; Bioventus; Ferring Pharmaceuticals Inc.; Sanofi S.A.; Flexion Therapeutics, Inc.; Zimmer Biomet; Arthrex, Inc.; Royal Biologics; Teva Pharmaceutical Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Osteoarthritis Injectables Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global osteoarthritis injectables market report based on injection type, anatomy, end-use, and region:

-

Injection Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Hyaluronic Acid Injections

-

Corticosteroid Injections

-

Platelet-rich Plasma (PRP) Injections

-

Placental Tissue Matrix (PTM) Injections

-

Acetylsalicylic Acid (ASA) Injections

-

Others

-

-

Anatomy Outlook (Revenue in USD Million, 2018 - 2030)

-

Knee Osteoarthritis

-

Hip Osteoarthritis

-

Hand Osteoarthritis

-

Others

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global osteoarthritis injectables market size was estimated at USD 7.23 billion in 2023 and is expected to reach USD 7.68 billion in 2024.

b. The global osteoarthritis injectables market is expected to grow at a compound annual growth rate of 6.82% from 2024 to 2030 to reach USD 11.42 billion by 2030.

b. Hyaluronic Acid (HA) injections segment dominated the market, accounting for a share of 38.73% in 2023. HA has high prescription rate in OA. Recent advancements in HA injection therapy have propelled space growth trajectory.

b. Market players operating in market include Anika Therapeutics, Inc., Bioventus., Ferring Pharmaceuticals Inc., Sanofi S.A., Flexion Therapeutics, Inc., and Zimmer Biomet.

b. The increasing prevalence of osteoarthritis, growing risk of developing osteoarthritis in the aging population, and rising Research & Development (R&D) activities to develop novel therapies are some key factors expected to drive market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.