- Home

- »

- Pharmaceuticals

- »

-

Osteoarthritis Therapeutics Market Size & Share Report 2030GVR Report cover

![Osteoarthritis Therapeutics Market Size, Share & Trends Report]()

Osteoarthritis Therapeutics Market Size, Share & Trends Analysis Report By Drug Type (NSAIDs, Corticosteroids), By Anatomy (Hip Osteoarthritis), By Route Of Administration (Topical Route, Oral Route), By Sales Channel, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-221-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Osteoarthritis Therapeutics Market Trends

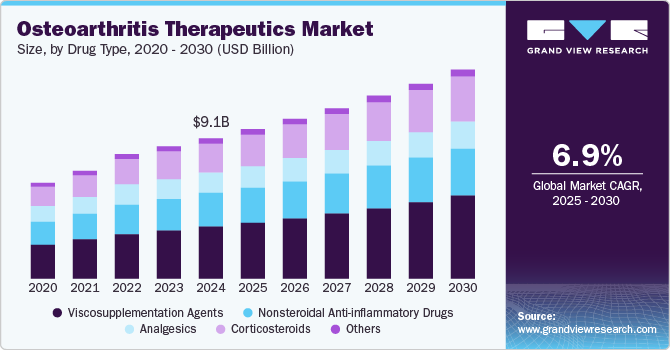

The global osteoarthritis therapeutics market size was valued at USD 9.13 billion in 2024 and is projected to grow at a CAGR of 6.89% from 2025 to 2030. The market is poised for significant growth, driven by the rising prevalence of osteoarthritis, particularly among the aging population, and substantial R&D investments in new treatments. According to CDC data from June 2023, over 32.5 million people in the U.S. are affected by osteoarthritis, highlighting the growing demand for effective therapies. Ongoing advancements in disease understanding and the development of therapeutic solutions are expected to further propel market expansion.

Arthritis is a major health crisis, with osteoarthritis (OA) being the most common type. According to an updated report on OA Prevalence & Burden by the Osteoarthritis Action Alliance (OAAA) in October 2023, the annual economic burden of OA in the U.S. is estimated at USD 136.8 billion. Data from Arthritis-health published in January 2021 indicates that women aged 50 to 60 are 3.5 times more likely to develop hand OA, 40% more likely to develop knee OA, and 10% more likely to develop hip OA compared to men. This increased risk in women is primarily attributed to hormonal changes associated with menstruation and menopause, as well as differences in the musculoskeletal system. Additionally, the National Institutes of Health reports that U.S. women have higher obesity rates than men, which further increases their risk for OA. These statistics underscore OA as a prevalent and costly issue, with women at greater risk, thus influencing market growth projections and the development of targeted solutions during the forecast period.

Managing OA poses significant challenges due to its dense and avascular tissue structure. However, the advent of intra-articular (IA) drug administration has spurred the development of targeted drug delivery systems. The emphasis on disease-modifying drugs and bioadaptive carriers is anticipated to enhance research and development for novel OA treatments. Various market players are implementing initiatives that support industry growth. For instance, in June 2022, OrthoTrophix, Inc. showcased clinical data and a registration plan for TPX-100 for knee OA at BIO 2022. Moreover, leading pharmaceutical companies and research institutions are actively engaged in R&D, particularly focusing on disease-modifying OA drugs. In January 2024, BioSenic presented Phase 3 data at the OARSI World Congress, highlighting the efficacy of JTA-004 in treating severe inflammatory knee OA. Post hoc analysis confirmed JTA-004's safety and effectiveness, offering targeted pain management for this condition. These advancements in drug delivery systems and disease-modifying treatments for OA, bolstered by promising trial results, are driving market expansion.

Furthermore, the development of personalized OA treatments, including Bisphosphonates and Synvisc-ONE injections, is contributing to segment growth. Pharmaceutical companies and academic institutions are also focused on creating personalized therapies and cell-based treatments for OA. In December 2023, researchers at Columbia University identified stem cells in adult mice that maintain healthy joint cartilage and play a role in OA development when depleted due to age or injury. Investing in this area enables companies to take advantage of shifting market demands, securing a competitive edge. Leading the charge in innovative medication development allows companies to reinforce their market presence, with the introduction of personalized OA treatments and progress in cell-based therapies propelling industry growth and establishing companies as market leaders.

Drug Type Insights

The viscosupplementation agents segment accounted for the largest share of 37.06% in 2024 and is expected to grow at the fastest CAGR over the forecast period due to their adoption and efficacy in managing OA symptoms. These agents are composed of hyaluronic acid which offers lubrication and cushioning to the affected joints, reducing pain and improving mobility. They provide a minimally invasive treatment option, particularly suitable for patients with mild to moderate OA who have not responded adequately to other therapies. Moreover, according to an NCBI published article in July 2021, Viscosupplementation with hyaluronic acid injections effectively reduces pain and enhances functionality, delaying surgical intervention. Despite variable evidence, VS options offer a safe profile and demonstrate efficacy, contributing significantly to OA symptom management.

Analgesics is projected to grow at a moderate CAGR over the forecast period due to their widespread use in managing pain associated with the condition. As a first-line treatment option, analgesics offer immediate relief from osteoarthritis symptoms, making them highly preferred by patients and healthcare providers alike. Additionally, the availability of various forms of analgesics, including oral medications and topical creams, further contributes to their significant market share projection. Moreover, the aging population and the increasing prevalence of OA highlight the sustained demand for analgesics as a cornerstone of OA management.

Anatomy Insights

The knee osteoarthritis (KOA) segment held a dominant share of 42.07% in 2024. KOA is one of the most common forms of chronic articular disease and OA worldwide and is characterized by high disability & morbidity rates. This condition is associated with the aging population. According to the Population Reference Bureau, the number of people aged above 65 years is projected to increase from 58 million in 2022 to around 82 million by 2050. The 65 & older age group share of the total population is projected to increase from 17% to 23%.

Currently, available pharmacological therapies for KOA include Nonsteroidal Anti-inflammatory Drugs (NSAIDs); however, they tend to reduce pain & inflammation, leading to delay in disease progression. In addition, the rising prevalence of the condition is expected to propel the need for the prevention and treatment of KOA in the older population to improve quality of life and decrease disability rates in the elderly population.

The hip osteoarthritis segment is projected to grow at a lucrative CAGR over the forecast period. According to an article from Arthritis Research and Therapy in January 2022, the age-standardized incidence rate for hip osteoarthritis has risen from 17.02 per 100,000 individuals to 18.70 per 100,000 individuals. The prevalence of hip osteoarthritis has risen over the last 30 years and is expected to surge in the coming decade, driven primarily by the increasing aging population. Furthermore, ongoing research to develop novel and advanced treatment solutions is another key factor anticipated to drive segment growth. For instance, in August 2022, Cleveland Clinic Florida launched a phase 3 trial of orthobiologic for treating hip osteoarthritis. In addition, Bone Marrow Aspirate Concentrate (BMAC) is an emerging orthobiologic showing effective and promising results in treating early OA. With the rising demand for effective therapies, the hip OA market presents promising opportunities for growth and advancement in the coming years.

Route Of Administration Insights

The parenteral route segment held a dominant share in 2024 and is expected to grow at a CAGR of 7.57% over the forecast period due to its efficacy for certain therapies, better pharmacokinetics and pharmacodynamics, ease of administration, and higher projected growth rate. These factors underscore its suitability for delivering complex formulations and highlight its potential for continued expansion in the market. Moreover, the increasing use of placental tissue matrix injections in treating osteoarthritis is expected to be driven by the growing evidence supporting their effectiveness. For instance, a study published by NCBI in June 2023 showed that the application of PTM injections led to reduced levels of Matrix Metalloproteinase-1 (MMP-1) and increased levels of Interleukin-4 (IL-4) in a rat model of osteoarthritis, indicating the potential of these injections to alleviate symptoms of the condition.

The topical route is projected to grow at a significant CAGR over the forecast period, driven by its user-friendly nature, precise drug delivery capabilities, and widespread acceptance among patients and healthcare professionals. With advancements in dermal drug delivery technologies and a burgeoning market for topical drugs globally, this segment presents an attractive opportunity for industry players. Moreover, the rapid expansion of this segment in the Asia Pacific region underscores its promising prospects for business expansion and investment.

Sales Channel Insights

Prescription drugs are poised to maintain dominance in the osteoarthritis therapeutics market' sales Channel segment in 2024. This supremacy is attributed to stringent regulatory oversight, necessitating healthcare professional involvement in administration. The approval process instills confidence in their efficacy and safety, fostering trust among consumers. Furthermore, prescription drugs offer long-term management strategies crucial for chronic conditions like osteoarthritis. This reliance on prescribed therapeutics highlights the significance of healthcare providers in treatment decisions and ensures sustained market dominance for prescription drugs in the osteoarthritis therapeutics sector.

Over-the-counter (OTC) drugs are projected to grow at a moderately high CAGR of 5.43% over the forecast period. Factors driving this growth include the increasing prevalence of OA, wide accessibility of OTC medications without prescription requirements, patient preference for convenient self-care options, cost-effectiveness compared to prescription drugs, growing awareness and education about osteoarthritis treatments, rising healthcare expenditures, and a shift towards patient empowerment and self-management of health conditions. These factors collectively contribute to the expected significant expansion of the OTC segment in the market.

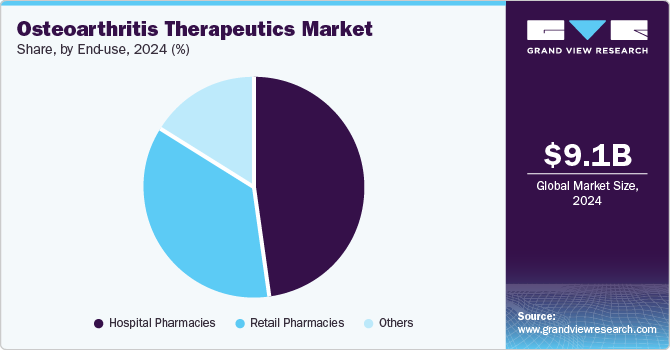

End-use Insights

The hospital pharmacies segment held a dominant share in 2024, accounting for 47.50%. According to an article published by NCBI in May 2023, the significance of hospital pharmacies in managing osteoarthritis is underscored by a notable 112.1% increase in osteoarthritis-related hospital admissions. This highlights the vital role of hospital pharmacies in effectively monitoring and managing OA treatment. Additionally, direct patient access enables hospital pharmacies to promptly administer injections, which is particularly advantageous for patients in need of immediate symptom relief. In contrast, the indirect delivery process of retail pharmacies may result in complexities and delays in injection administration, further emphasizing the essential role of hospital pharmacies in ensuring timely and effective treatment for osteoarthritis.

Retail pharmacies are projected to experience a high compound annual growth rate (CAGR) during the forecast period. Serving as intermediaries between manufacturers and healthcare providers, retail pharmacies purchase osteoarthritis therapeutics in bulk and store them until needed. Although they may not handle the volume required for regular purchases, they play a vital role in ensuring product availability for healthcare providers. With lower costs than hospital pharmacies, retail pharmacies focus on accessibility and convenience for patients, offering extended hours and personalized service to improve satisfaction and adherence. However, they may lack the specialized care and monitoring capabilities necessary for comprehensive osteoarthritis management. Despite this limitation, their accessibility and personalized service make them preferred choices for many patients seeking convenience in obtaining medications.

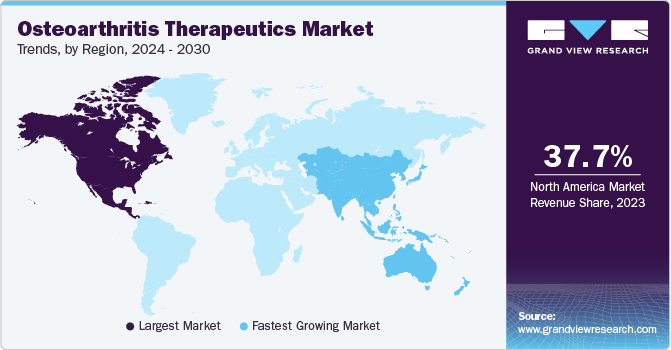

Regional Insights

North America osteoarthritis therapeutics market dominated the global industry and accounted for a 37.31% share in 2024. The North American market maintains its dominance due to several factors, including a high prevalence of obesity and supportive government policies. Leading companies like Novartis AG, Pfizer, Zimmer Biomet, and GlaxoSmithKline plc strengthen the region's position. Strategic initiatives such as clinical trials, acquisitions, and partnerships among major pharmaceutical firms are shaping the competitive landscape. For example, in February 2024, Novartis announced the continuation of its study on biological interventions in the U.S., focusing on the safety, tolerability, and efficacy of intra-articular Canakinumab and LNA043 for patients with knee osteoarthritis.

U.S. Osteoarthritis Therapeutics Market Trends

The U.S. osteoarthritis therapeutics market is expected to grow during the forecast period, driven by a robust pharmaceutical sector and key innovators like Zimmer Biomet, Bioventus, and Remedium Bio, who are leading advancements in therapeutics. In March 2023, U.S. biotech company Remedium Bio formed a strategic collaboration with Belgian CDMO Exothera to advance AAV2-FGF18, a disease-modifying gene therapy for osteoarthritis. This partnership aims to combine expertise and resources to further develop and enhance the market potential of this innovative therapy.

Europe Osteoarthritis Therapeutics Market Trends

The Europe osteoarthritis therapeutics market offers lucrative opportunities for biotech & pharmaceutical companies, with significant growth potential fueled by the increasing prevalence of OA, especially among aging populations. Advancements in pharmaceuticals and a growing focus on disease-modifying drugs are key drivers of market expansion. Regulatory trends emphasize stringent evaluation of drug efficacy and strict eligibility criteria for clinical trials. Viscosupplementation agents lead the market, providing effective symptom management. The market is evolving with precision medicine approaches and multicenter trials to ensure a comprehensive evaluation of therapies.

UK osteoarthritis therapeutics market is projected to grow during the forecast period, driven by factors such as ongoing research and physiotherapy treatments for individuals with painful knee osteoarthritis. In January 2023, the University of Salford and Northern Care Alliance NHS Foundation Trust initiated a collaborative study on physiotherapy for KOA patients. The study focuses on Cognitive Muscular Therapy, which aims to reduce muscle overactivity and promote better movement habits. Early tests yielded positive results, leading to a two-year grant for further research. Starting in 2023, the feasibility study will compare CMT with standard care for KOA patients who haven't benefited from traditional physiotherapy exercises.

The Germany osteoarthritis therapeutics market is anticipated to grow over the forecast period, driven by an aging population, rising obesity rates, and increasing injury cases. Leading companies like Bayer AG are focused on research and development to meet growing demand. These factors are expected to continue fueling market expansion.

France osteoarthritis therapeutics market is influenced by several factors, including the increasing prevalence of OA due to an aging population and rising obesity rates. Major companies like Sanofi are actively participating in this market. While the initial impact of COVID-19 affected the market, it is anticipated to recover as research and development initiatives continue to progress.

Asia Pacific Osteoarthritis Therapeutics Market Trends

The osteoarthritis therapeutics market in Asia Pacific is expanding due to factors such as high disease prevalence, growing healthcare spending, population growth, medical advancements, regulatory support, and increased awareness. Significant growth is expected, driven by aging populations and innovative treatments in countries like China, Japan, and India, with pharmaceutical companies investing heavily in research. A study published by The Lancet in September 2023 reported that 595 million people worldwide had osteoarthritis in 2020, with the Asia Pacific region showing a prevalence of 8,632.7 per 100,000. These high figures highlight the growing demand for therapeutics in the region.

China osteoarthritis therapeutics market is projected to expand during the forecast period, driven by factors such as a rising prevalence of the condition, increased use of pain medications, a growing at-risk population, emerging market opportunities, collaborations for product development, and a supportive regulatory environment. These elements are collectively fueling demand for both symptomatic relief and disease-modifying treatments.

The osteoarthritis therapeutics market in Japan is projected to grow over the forecast period, driven by a rapidly expanding market and increasing demand due to lifestyle changes. Japanese pharmaceutical companies are increasingly entering this space. For example, in August 2022, Shionogi and Grünenthal partnered to commercialize the knee osteoarthritis treatment RTX in Japan. Under the agreement, Shionogi holds exclusive distribution rights while Grünenthal oversees development and manufacturing. The deal includes an upfront payment and potential royalties exceeding USD 500 million.

Latin America Osteoarthritis Therapeutics Market Trends

The osteoarthritis therapeutics market in Latin America is expected to grow over the forecast period. A January 2022 article published by NCBI indicates that weight-bearing osteoarthritis (OA) is a significant concern in the region, affecting health-related quality of life (HRQoL) and presenting economic challenges. There are gaps in understanding the HRQoL and socioeconomic impacts of OA, particularly in areas with limited healthcare resources, highlighting the need for further research. Addressing this burden is essential to improving patient outcomes, especially in regions with restricted healthcare access. Developing tailored solutions to mitigate the challenges of weight-bearing osteoarthritis in Latin America presents an opportunity for market expansion and better healthcare access.

Brazil osteoarthritis therapeutics market is expected to grow over the forecast period. A 2019 NCBI article highlights that OA is highly prevalent in Brazil, ranking as the third most common condition among Social Security beneficiaries and accounting for 65% of disability cases. With a 33% prevalence among adults, the aging population-projected to triple by 2050-will likely intensify OA prevalence and drive increased demand for treatment.

MEA Osteoarthritis Therapeutics Market Trends

The osteoarthritis therapeutics market in the Middle East & Africa is expected to grow over the forecast period due to an aging population, increased adoption of viscosupplementation, drug development innovations, regulatory approvals, anatomical segmentation focusing on knee osteoarthritis, and diverse distribution channels, reflecting an expanding landscape.

Saudi Arabia osteoarthritis therapeutics market is projected to grow during the forecast period. Companies in the region are implementing various initiatives to drive market expansion. For instance, in June 2023, Levolta Pharmaceuticals, based in Pennsylvania, signed an exclusive licensing and distribution agreement with Tabuk Pharmaceutical Manufacturing Company in Saudi Arabia to commercialize VOLTO1, a therapy for osteoarthritis, in the Middle East and Africa, excluding South Africa.

Key Osteoarthritis Therapeutics Company Insights

Some of the leading players in the market include Sanofi SA, GlaxoSmithKline plc, Pfizer Inc., Bayer AG, Zimmer Biomet, and Novartis AG. These companies employ various strategies to strengthen their market positions, such as expanding their presence in emerging economies through agreements with other players. Product approval is another key strategy used by these companies.

Emerging players like Flexion Therapeutics, Inc., Arthrex, Inc., and Royal Biologics are also pursuing strategic initiatives, including collaborations and partnerships with key industry participants to enhance their market presence. They focus on capturing niche areas of the supply chain, such as the distribution and delivery of products and solutions, to establish themselves more firmly in the market.

Key Osteoarthritis Therapeutics Companies:

The following are the leading companies in the osteoarthritis therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Sanofi SA

- GlaxoSmithKline plc

- Pfizer Inc

- Bayer AG

- Zimmer Biomet

- Novartis AG

- Anika Therapeutics

- Assertio Therapeutics, INC.

- Bioventus

- Ferring Pharmaceuticals Inc.

View a comprehensive list of companies in the Osteoarthritis Therapeutics Market

Recent Developments

-

In September 2024, the FDA granted fast-track designation (FTD) to MM-II, a non-opioid product developed by Sun Pharma and Moebius Medical Limited. This product utilizes a proprietary liposome suspension to alleviate joint pain associated with osteoarthritis (OA) in the knee, as announced in a recent news release.

-

In March 2023, Remedium Bio, a U.S.-based biotech company, established a strategic partnership with Exothera to advance its disease-modifying gene therapy for osteoarthritis. This initiative aims to leverage their combined expertise and resources to further develop and enhance the market presence of this innovative therapy.

-

In May 2023, Grünenthal announced that its experimental non-opioid drug, resiniferatoxin (RTX), which is currently undergoing Phase III clinical development, received breakthrough therapy designation from the U.S. FDA for the treatment of knee osteoarthritis pain. This recognition was based on encouraging Phase I and II clinical data, which demonstrated significant pain relief and a favorable safety profile.

Osteoarthritis Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.72 billion

Revenue forecast in 2030

USD 13.57 billion

Growth rate

CAGR of 6.89% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug type, anatomy, route of administration, sales channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; Spain; Denmark, Sweden, Norway, France; Italy; China; India; Japan, Thailand, South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE, Kuwait

Key companies profiled

Sanofi SA, GlaxoSmithKline plc, Pfizer Inc, Bayer AG, Zimmer Biomet, Novartis AG, Anika Therapeutics, Assertio Therapeutics, INC., Bioventus, Ferring Pharmaceuticals Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Osteoarthritis Therapeutics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global osteoarthritis therapeutics market report on the basis of drug type, anatomy, route of administration, sales channel, end-use and region

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Viscosupplementation Agents

-

Nonsteroidal Anti-inflammatory Drugs

-

Naproxen

-

Aspirin

-

Diclofenac

-

Ibuprofen

-

Celecoxib

-

Meloxicam

-

Piroxicam

-

Ketoprofen

-

Other NSAIDs

-

-

Analgesics

-

Duloxetine

-

Acetaminophen

-

-

Corticosteroids

-

Others

-

-

Anatomy Outlook (Revenue, USD Million, 2018 - 2030)

-

Knee Osteoarthritis

-

Hip Osteoarthritis

-

Hand Osteoarthritis

-

Others

-

-

Route Of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Parenteral Route

-

Hyaluronic Acid Injections

-

Corticosteroid Injections

-

Platelet-rich Plasma (PRP) Injections

-

Placental Tissue Matrix (PTM) Injections

-

Acetylsalicylic Acid (ASA) Injections

-

Others

-

-

Topical Route

-

Oral Route

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription Drugs

-

Over-the-Counter Drugs

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

France

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global osteoarthritis therapeutics market size was estimated at USD 9.13 billion in 2024 and is expected to reach USD 9.72 billion in 2025.

b. The global osteoarthritis therapeutics market is expected to grow at a compound annual growth rate of 6.89% from 2025 to 2030 to reach USD 13.57 billion by 2030.

b. The viscosupplementation agents segment accounted for the largest share of 37.06% in 2024 due to their adoption and efficacy in managing OA symptoms.

b. Some of the companies catering to the osteoarthritis therapeutics industry Sanofi SA, GlaxoSmithKline plc, Pfizer Inc, Bayer AG, Zimmer Biomet, Novartis AG, Anika Therapeutics, Assertio Therapeutics, INC., Bioventus, and Ferring Pharmaceuticals Inc..

b. The osteoarthritis therapeutics market shows promising growth prospects, driven by factors such as the increasing prevalence of osteoarthritis, particularly among the aging demographic, and substantial investments in R&D for new therapies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."