- Home

- »

- Electronic Devices

- »

-

Outdoor Solar LED Market Size, Share, Industry Report 2030GVR Report cover

![Outdoor Solar LED Market Size, Share & Trends Report]()

Outdoor Solar LED Market (2025 - 2030) Size, Share & Trends Analysis Report By Application, By Wattage (less than 39W, 40W to 149W, More than 150W), By End Use (Residential, Commercial, Industrial) By Region, And Segment Forecasts

- Report ID: GVR-4-68039-412-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Outdoor Solar Led Market Summary

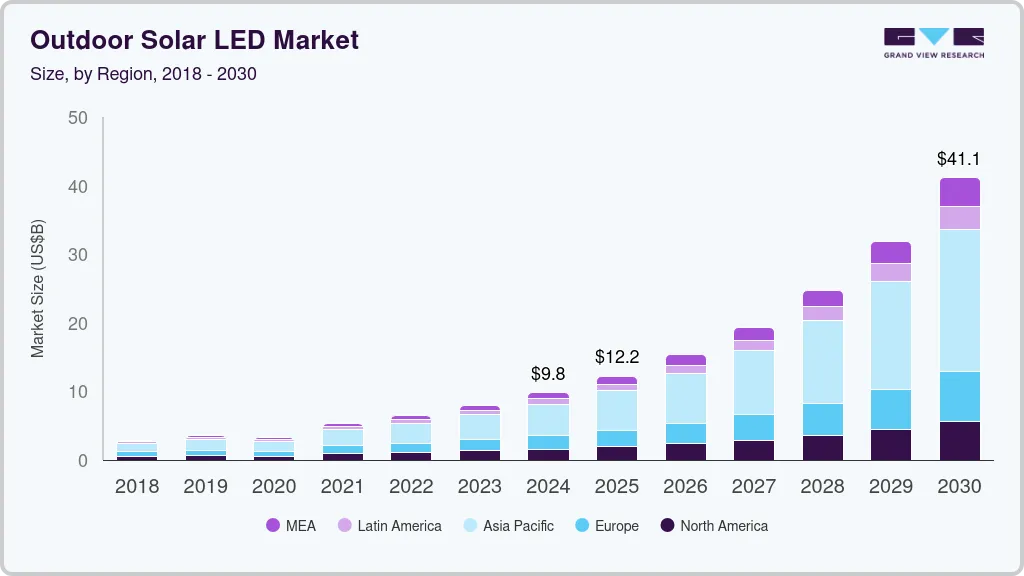

The global outdoor solar led market size was estimated at USD 9,823.9 billion in 2024 and is projected to reach USD 41,123.5 billion by 2030, growing at a CAGR of 27.5% from 2025 to 2030. The growth of this market is primarily influenced by factors such as increasing demand from urban consumers, growing awareness regarding energy efficiency and environmental impact of products, and increasing utilization, especially in street light applications.

Key Market Trends & Insights

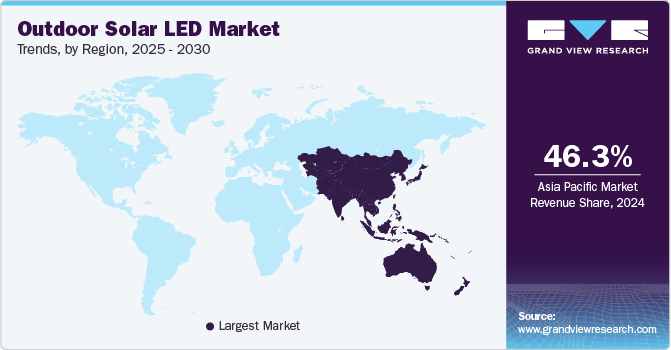

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, solar led street lights accounted for a revenue of USD 5,362.8 billion in 2024.

- Solar Garden LED Lights is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 9,823.9 Million

- 2030 Projected Market Size: USD 41,123.5 Million

- CAGR (2025-2030): 27.5%

- Asia Pacific: Largest market in 2024

Enhanced quality and efficiency offered by the outdoor solar LEDs, significant growth in awareness regarding renewable energy, and a rising number of smart city projects with improved infrastructural requirements are expected to add growth opportunities for this market during the forecast period.

A significant increase in awareness regarding energy efficiency and the focus of multiple municipal corporations, city councils, state authorities, and government agencies on reducing costs associated with energy consumption has resulted in an inclination towards using renewable energy solutions, such as outdoor solar LEDs. This trend is tethered to replacing existing street light systems with advanced solar street light systems equipped with solar PV modules, batteries, LED lights, mounting structures, and more.

For instance, in September 2024, ITI Limited, one of the public sector undertakings operated by the Department of Telecommunication, Ministry of Communications, Government of India, was given an order of nearly USD 35.0 million for the supply and installation process of 1,00,000 units of solar-based street light systems. The order was placed by the government agency of the Indian state, Bihar Renewable Energy Development Authority (BREDA).

Multiple cities and local authorities across various countries have been focusing on installing outdoor solar LEDs and advanced solar lighting systems on streets. These initiatives are often stimulated by cost-saving requirements, an inclination towards renewable energy solutions, and growing awareness regarding the technology's benefits. For instance, in August 2024, San Antonio City and Dalkia Energy Solution signed a contract to install 400 new units of solar-powered LED streetlights across identified areas in San Antonio.

The dependency of outdoor lighting systems on grids and the utilization of high-pressure sodium lights has posed significant challenges for multiple local authorities. The emergence of solar energy applications such as outdoor solar LEDs offered efficient alternatives powered by off-grid power generation. Ease of availability and growing advancements in the solar energy solutions industry have resulted in an increasing inclination towards adopting enhanced solutions based on renewable energy.

Multiple governments and organizations have been adding heavy investments in the renewable energy sector. Favorable regulatory scenarios, tax exemptions, and positive support from the government are also attracting greater investments in this industry. Government initiatives and sustainability and environmental goals set by nations and regions are expected to fuel demand for green energy solutions. For instance, the Netherlands wants to reach 100% sustainable sources-based energy generation by 2050.

Application Insights

The solar LED streetlights segment held the largest revenue share of 54.6% in the outdoor solar LED industry in 2024. This is attributed to many projects initiated by local authorities and energy companies. City councils and government agencies are increasingly ordering street light units equipped with mounting systems, LED luminaries, batteries, PV modules, and more. According to the solar technology for street lighting update shared by the City of Los Angeles in September 2024, nearly 350 solar lights have been deployed and installed throughout the city from the financial year 2022/23 to 2023/24. The Bureau of Street Lighting (BSL), City of Los Angeles Public Works initiated the Solar-Powered Lighting Initiative in 2021.

The BSL secured an investment of nearly USD 3.0 million from the Capital and Technology Improvement Expenditure Program (CTIEP) since the launch of the program. For the financial 2024/25, BSL has received additional funding of USD 1.6 million through the Capital and Technology Improvement Expenditure Program (CTIEP).

The solar garden LED lights segment is anticipated to experience the highest CAGR during the forecast period. Growth of this segment is primarily influenced by increasing awareness about the benefits offered by outdoor solar LED lights and the increasing focus of multiple city councils and other local authorities on cost savings and adoption of enhanced energy-efficient solutions. Additionally, increasing demand from residential users is also adding to the growth.

Wattage Insights

The less than 39W outdoor solar LEDs segment held the largest revenue share of the global market in 2024. This is attributed to factors such as increasing utilization by residential users, growing availability, and the focus of multiple manufacturers on research and innovation to deliver improved product portfolios. Factors such as affordability, energy efficiency, durability, and ability to address specific requirements of residential users are expected to add lucrative growth opportunities for this segment.

Outdoor solar LEDs with more than 150W capacity are projected to experience the fastest growth during the forecast period. Large commercial spaces, sports arenas, and other commercial sector users often use outdoor solar LEDs with such specifications. These lights are commonly installed in high mounting areas for the desired effect. Solar LEDs with lesser wattage cannot satisfy the continuous requirement for extensive lighting solutions. Therefore, commercial users with such requirements turn to outdoor solar LEDs with more than 150W capacity.

Increasing inclination towards renewable energy and growing investment in complete conversion from traditional grid support for energy consumption to self-sufficient green energy generation capacities is expected to add growth to this segment. For instance, in October 2024, The LLDC Solar Membrane Project work was initiated. This project aims to reduce carbon emissions and dependency on the national grid at the London Stadium by installing nearly 6,500 square meters of solar membrane panels, LED lighting, and kiosk energy-saving devices.

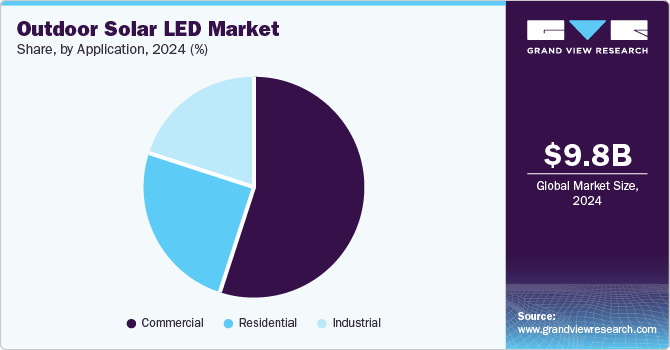

End Use Insights

The commercial users segment dominated the global outdoor solar LED industry in 2024. The growth of this segment is mainly influenced by the increasing demand for effective green energy solutions that simultaneously reduce energy expenditure and carbon emissions. Awareness of the environmental impact of growing energy consumption and emission of greenhouse gasses linked with certain devices adds to the growth. The rising demand for energy in commercial spaces dependent on machinery, modern technology-driven devices, and uninterrupted electricity supply has stimulated multiple organizations and governments to turn to solar energy.

Investments and fund-raises by key participants in the solar energy industry are adding lucrative opportunities for this market. For instance, in December 2024, Solar Landscape, one of the market participants in industrial and commercial rooftop solar development, announced that the company had secured nearly USD 847 million in financing and project investments in 2024. The company also announced that in 2024, it has engaged in contracts for 40 million square feet of industrial and commercial rooftop space to deploy solar projects.

The residential users segment is projected to experience significant growth during the forecast period. The growth of this segment is mainly influenced by the increasing availability of affordable outdoor LED products and ease of accessibility through online portals. Growing utilization by residential users for lighting backyards and garden areas outside houses while also deploying solar LEDs throughout empty outdoor spaces near fences is adding to the growth in demand. Enhanced availability of information regarding benefits associated with solar LEDs and the launch of products with specifications associated with the requirements of residential users is also contributing to the growth.

Regional Insights

Asia Pacific outdoor solar LED market dominated the global market with a revenue share of 46.3% in 2024. This is attributed to the increasing demand for outdoor solar LEDs driven by the multiple government projects, the rising focus of numerous countries on embracing green energy solutions, and increasing awareness regarding benefits offered by the product such as cost saving, energy efficiency, reduced dependency on the national grid and a significant reduction in carbon emissions. Countries such as India, China, and others have been experiencing heavy investments in the solar energy industry, which is likely to add growth. According to The International Energy Agency (IEA), from 2019 to 2024, China is estimated to hold a 40.0% share of global renewable energy capacity extension.

China Outdoor Solar LED Market Trends

China held the largest revenue share of the regional industry in 2024. This market is mainly influenced by the country's significant participation in the global solar energy industry, growing capacity in manufacturing solar photovoltaic panels, and lower curtailments. China holds a substantial share in global green energy developments and has experienced large investments from domestic and foreign investors. Government support, a competitive market scenario, and the government's focus on embracing advancements in renewable energy at a rapid rate are likely to add lucrative growth for this market during the forecast period.

North America Outdoor Solar LED Market Trends

North America was identified as one of the key global outdoor solar LED industry regions in 2024. This market is primarily driven by the increasing number of conversion projects initiated by local government agencies and city councils for street lights and many investments and funding deployed for public work projects associated with solar lighting. Multiple cities and commercial spaces have been turning to outdoor LEDs to replace existing street and other outdoor lights.

The U.S. held the largest revenue share of the regional industry in 2024. This is attributed to factors such as ease of availability and growing demand from commercial buyers, such as commercial buildings, public welfare projects initiated by municipal authorities, sports arenas, and others. Government investments in the solar energy industry are also anticipated to drive the growth of outdoor solar LED industry during the forecast period.

MEA Outdoor Solar LED Market Trends.

The MEA outdoor solar LED market is projected to experience noteworthy growth from 2025 to 2030. This market is primarily driven by increasing awareness regarding benefits offered by the product and the growing availability of products equipped with advanced features and specifications designed according to customer requirements. The focus of multiple government agencies on embracing green energy while reducing dependency on traditional energy solutions is likely to growth opportunities for this market.

The UAE outdoor solar LED market held the largest revenue share of the regional industry in 2024. This is attributed to factors such as the increasing participation of the country in International Solar Alliance activities, the growing focus of authorities on adopting solar energy solutions to reduce carbon emissions and spending on energy, and rising awareness regarding benefits offered by outdoor solar LEDs. In February 2023, India, UAE, and France set up a trilateral cooperation that plans to work on initiatives to endorse collaboration on multiple fronts, such as climate change, energy, and biodiversity protection. Such developments associated with the industry are likely to generate greater growth for this market during the forecast period.

Key Outdoor Solar LED Company Insights:

Some key players in the global outdoor solar LED industry include Greenshine New Energy (Oceania International LLC), Wipro Lighting, Signify Holding, Polybrite - SBM NewTech Co., Ltd., and SOKOYO Solar Lighting Co., Ltd. To address the growing demand from public projects and residential buyers worldwide, the key market participants have been embracing strategies such as innovation, product portfolio expansion, collaboration with other organizations, and more.

-

Signify Holding, formerly known as Philips Lighting, is one of the market participants in the advanced LED lights market. Some of its brands include Philips, COLORKINETICS, Philips Dynalite, Cooper Lighting Solutions, Genlyte Solutions, WiZ, and others. Its solar offerings feature SolarForm Gen2 Small, SolarForm Gen2 Large, OptiForm Solar, RoadFocus Plus Solar, and more.

-

SOKOYO Solar Lighting Co., Ltd., a solar street lamp manufacturer, offers various products. These include all-in-one solar street lights, all-in-two solar street lights, split solar street lights, solar garden lights, AC LED street lights, and Internet of Things solar street lights.

Key Outdoor Solar LED Companies:

The following are the leading companies in the outdoor solar LED market. These companies collectively hold the largest market share and dictate industry trends.

- Greenshine New Energy (Oceania International LLC)

- Polybrite - SBM NewTech Co., Ltd

- Signify Holding

- Wipro Lighting

- LEADSUN

- Bridgelux, Inc

- SEPCO Solar Electric Power Company

- SOKOYO Solar Lighting Co., Ltd.

- Brightown

- Sunna Design

Recent Developments

-

In June 2024, energy saving LED lighting products manufacturer HAICHANG OPTOTECH CO., LIMITED introduced Decorative Lighting IP65 Waterproof and Solar LED Pillar Lights for Outdoor Fence Deck. Polycarbonate (PC)-based lamp bodies, anti-UV lampshade, built-in battery, solar column cap lights are some of the key product features.

-

In May 2023, AGC launched ST57 Solar LED Street Light. The product is made available in six sizes with capacity varying between 10W and 60W. Some of the significant product features include MPPT controller, mono-crystalline solar panels, smart control, 360° adjustable spigot, plug-and-play system and others.

Outdoor Solar LED Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.22 billion

Revenue forecast in 2030

USD 41.12 billion

Growth rate

CAGR of 27.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, wattage, end use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, South Korea, Australia, Brazil, KSA, UAE, South Africa

Key companies profiled

Greenshine New Energy (Oceania International LLC); Polybrite - SBM NewTech Co., Ltd; Signify Holding; Wipro Lighting; LEADSUN; Bridgelux, Inc; SEPCO; Solar Electric Power Company; SOKOYO Solar Lighting Co., Ltd.; Brightown; Sunna Design

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

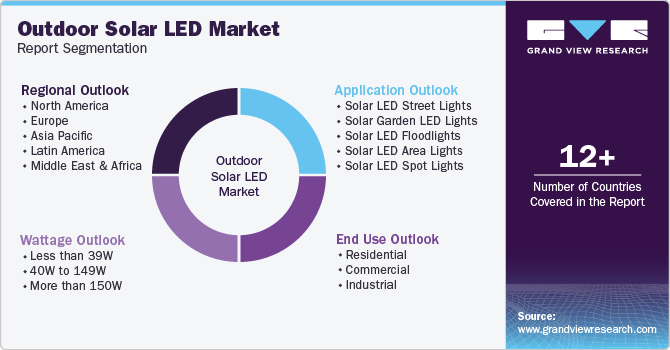

Global Outdoor Solar LED Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global outdoor solar LED market report based on application, wattage, end use, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Solar LED Street Lights

-

Solar Garden LED Lights

-

Solar LED Floodlights

-

Solar LED Area Lights

-

Solar LED Spot Lights

-

-

Wattage Outlook (Revenue, USD Million, 2018 - 2030)

-

less than 39W

-

40W to 149W

-

More than 150W

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.