- Home

- »

- Medical Devices

- »

-

Pain Management Devices Market, Industry Report, 2030GVR Report cover

![Pain Management Devices Market Size, Share & Trends Report]()

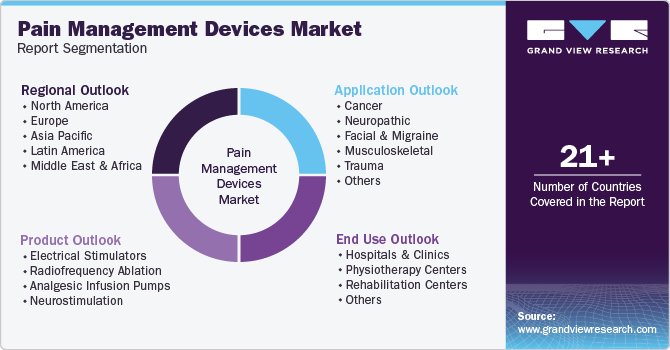

Pain Management Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Neuropathic, Cancer), By Product (Electrical Stimulators, Radiofrequency Ablation, Analgesic Infusion Pump), By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-799-5

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pain Management Devices Market Summary

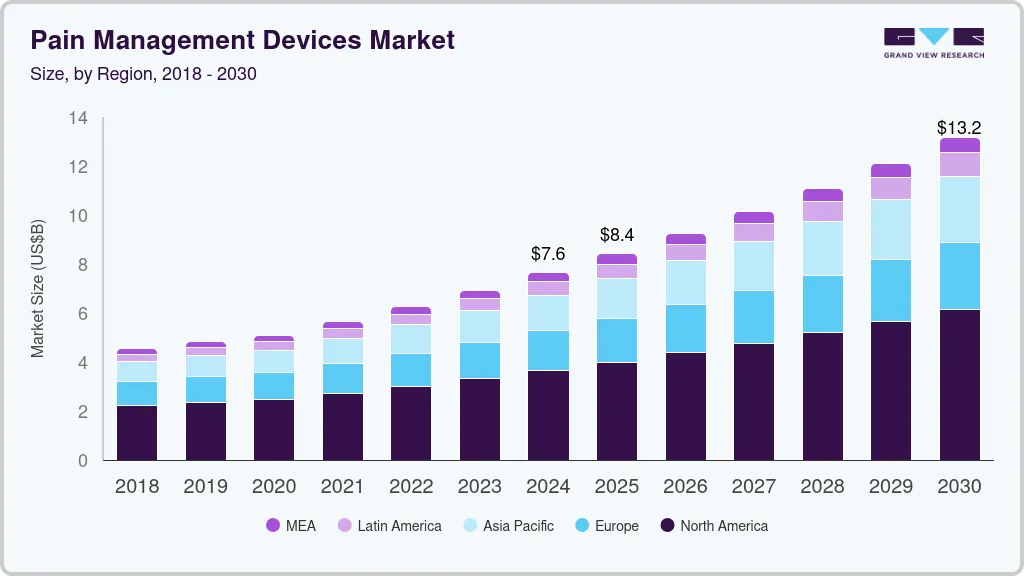

The global pain management devices market size was estimated at USD 7.65 billion in 2024 and is projected to reach USD 13.16 billion by 2030, growing at a CAGR of 9.5% from 2025 to 2030. The growing prevalence of chronic conditions is one of the key aspects anticipated contributing to the market growth during the forecast period.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Australia is expected to register the highest CAGR from 2025 to 2030.

- Based on products, neurostimulation products held the largest revenue share of 57.7% in 2024.

- Based on application, the neuropathic pain segment held the largest revenue share of around 32.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.65 Billion

- 2030 Projected Market Size: USD 13.16 Billion

- CAGR (2025-2030): 9.4%

- North America: Largest market in 2024

The increasing prevalence of lifestyle diseases, such as diabetes and obesity, has boosted the demand for nerve and muscle stimulators. The rising prevalence of hypertension or trauma is another significant factor expected to propel market growth. Hypertension significantly raises the risk of chronic conditions, such as brain aneurysms. As per the WHO report for 2024, nearly 1 in 3 adults worldwide is affected by hypertension, with a slightly greater prevalence in males than females in the under 50 age group. After age 50, the prevalence climbs to nearly 49%, indicating that about 1 in 2 individuals are affected, with both men and women exhibiting almost the same rates of hypertension.

In addition, rolling issues of musculoskeletal conditions, such as osteoarthritis, orthopedic degenerative diseases, arthritis, and rheumatoid arthritis, are rising significantly. This has increased the prevalence of chronic pain in these people and the inability to carry out everyday chores. For instance, based on the research published by Elsevier B.V. in 2024, the prevalence of osteoarthritis (OA) is persistently rising around the world, influencing nearly 7.6% of the global population, with estimates suggesting a 60 to 100% increase by the year 2050. Furthermore, OA stands as the seventh leading cause of disability on a global scale for individuals over the age of 70, primarily affecting the knee joints. This has propelled the market for pain management stimulators to control chronic pain. In addition, an upsurge in the number of accident cases, obesity, bone-related diseases, and the comfort of advanced procedures are also anticipated to promote market expansion.

Obesity is the primary cause of arthritis. In 2024, the NCD Risk Factor Collaboration (NCD-RisC) released findings indicating that over one billion individuals worldwide are currently affected by obesity, which includes nearly 880 million adults, and 159 million children and adolescents aged 5 to 19 years. Moreover, according to the CDC, 31% of people with obesity have arthritis, compared to 23% of people who are overweight and 16% of people who are underweight or have a moderate BMI. In addition, as per the Cary Orthopaedics report, every pound of extra weight exerts nearly 4 to 6 pounds of additional pressure on the knees. The inefficacy of oral drugs is encouraging patients to look for other available treatment alternatives, such as pain control devices. Many individuals are addicted to painkillers. However, these medications show side effects and are sometimes inefficient. Furthermore, the lack of choice options for surgeries is one of the aspects of increasing the demand.

The WHO report released in 2022 indicates that more than 24% of individuals suffering from healthcare-associated sepsis die annually, while 52.3% of those receiving treatment in an intensive care unit die each year. The increased hospitalization expenses have boosted the need for shorter hospital stays and affordable care settings, thus growing the market demand. For instance, according to the article by Debt.Org, LLC published in March 2023, the average daily cost of hospitalization in the U.S. is approximately USD 2,883, and the average length of a hospital stay is about 4.6 days, resulting in an average total expense of USD 13,262.

Technological advances are also expected to propel market growth. For instance, in July 2024, Stryker introduced its MultiGen 2 Radiofrequency (RF) Generator, which offers physicians the efficiency, control, and reliability necessary for conducting RF ablation, a minimally invasive technique that can deliver long-term relief for individuals experiencing facet joint pain. In February 2024, Boston Scientific Corporation announced that the U.S. Food and Drug Administration (FDA) has granted an expanded indication for the WaveWriter SCS Systems, allowing it to treat chronic low back and leg pain in individuals who have not undergone previous back surgery, a condition typically known as non-surgical back pain (NSBP).

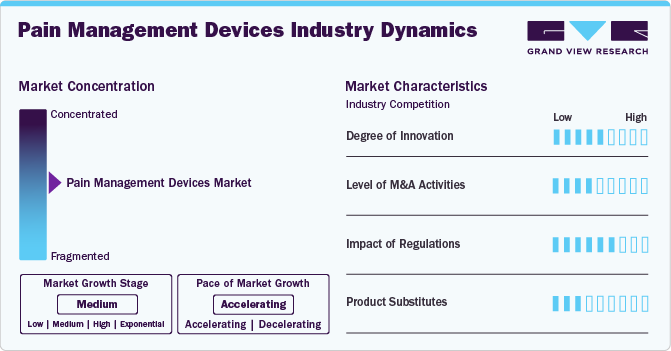

Market Concentration And Characteristics

The degree of innovation in pain management devices has significantly advanced in recent years, driven by the need for more effective, safer, and personalized solutions. Traditional pain management methods, such as oral medications and injections, are increasingly being supplemented or replaced by non-invasive and minimally invasive technologies that provide more targeted and sustainable relief.

The pain management devices market is characterized by a medium level of merger and acquisition (M&A) activity. These M&A activities enable access to complementary expertise, technologies, and various distribution channels, enabling companies to enhance operational efficiency, accelerate product development, and capture a larger market share.

The impact of regulations on pain management devices is significant, as regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) play a critical role in ensuring the safety, efficacy, and quality of these devices. Stringent regulatory requirements for clinical testing, pre-market approval, and post-market surveillance help ensure that pain management devices, such as implantable drug delivery systems, neuromodulation devices, and PCA pumps, meet high standards before reaching patients.

Pharmaceutical interventions, particularly opioids, NSAIDs (non-steroidal anti-inflammatory drugs), and acetaminophen, are the most common alternatives to devices, providing systemic pain relief, though with concerns about side effects, addiction, and long-term use. For chronic pain management, topical analgesics, including creams, patches, and gels that deliver pain-relieving compounds directly to the site of discomfort, serve as a non-invasive option.

Product Insights

Based on products, neurostimulation products held the largest revenue share of 57.7% in 2024. The dominance can be attributed to the rise in the cases of neurological diseases. These neurostimulators are essential in treating Parkinson’s, epilepsy, chronic pain, movement diseases, and depression. Moreover, factors, such as the launch of cutting-edge products, growing product demand, and the rising geriatric population, are expected to drive the market. According to data from UNFPA, the worldwide percentage of individuals aged 65 and older has almost doubled, rising from 5.5% in 1974 to 10.3% in 2024. It is anticipated that this percentage will increase to 20.7% by 2074, with the population of those aged 80 and above more than tripling. The growing aging population is projected to propel the market, as the aged population is at a tremendous risk of chronic disease.

Radiofrequency Ablation (RFA) is anticipated to exhibit the fastest CAGR during the forecast period owing to its vast application in pain management, gynecology, surgical oncology, cosmetology, cardiology & cardiac rhythm management. Radiofrequency ablation treatment is more helpful in treating patients with numerous tumors than patients via open surgery, thus boosting segment growth.

Application Insights

Based on application, the neuropathic pain segment held the largest revenue share of around 32.0% in 2024. The dominance can be attributed to the growing initiatives by the industry players and the rising number of target individuals. As stated in a report from the National Library of Medicine in 2024, more than twenty-five percent of individuals in the United States experience chronic pain, which is one of the most common problems faced in outpatient medical environments. Similarly, the British Pain Society 2024 reports that in England, approximately 28 million adults, which is around 43% of the population, experience chronic pain. The factors mentioned above are anticipated to fuel growth.

The cancer segment is anticipated to grow at the fastest CAGR during the forecast period. The growing number of cancer patients has augmented the need for pain management devices to alleviate the pain caused owing to nerve compression, primarily because of the tumor compressing and other variables relying upon cancer’s advancement. In addition, most genetic disorders, such as Acute Lymphoblastic Leukemia (ALL), are projected to propel the market demand over the forecast period. The National Cancer Institute projects about 2,001,140 new cancer diagnoses in the United States for 2024, with an estimated 611,720 deaths due to the illness.

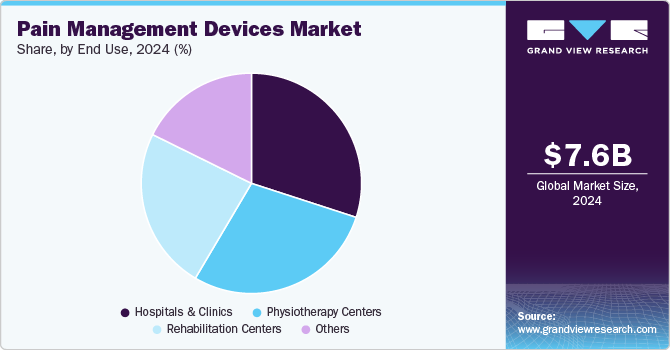

End Use Insights

Based on end use, The hospitals and clinics segment held the largest revenue share of around 31.9% in 2024. The increasing prevalence of chronic pain conditions, such as arthritis, musculoskeletal disorders, and neuropathic pain, is resulting in a higher number of patients who require effective pain management solutions. Hospitals and clinics are at the forefront of providing medical treatments, and as the population ages and chronic diseases become more common, the demand for advanced pain management technologies is growing. Additionally, hospitals and clinics are increasingly investing in cutting-edge technologies that offer targeted pain relief, improve recovery times, and reduce hospital readmissions. Furthermore, the rising number of hospitals worldwide is also contributing to market growth. For instance, according to the 2022 AHA Annual Survey, there were a total of 6,120 hospitals in the U.S.

The physiotherapy centers segment is anticipated to grow at the fastest CAGR during the forecast period owing to the increasing focus on non-invasive, drug-free treatments for musculoskeletal pain and rehabilitation. Furthermore, rapid development of new technologies, such as wearable devices and smart pain management systems, is enhancing the effectiveness and convenience of pain treatment in physiotherapy centers. Moreover, increasing cases of sports-related injuries across the globe is anticipated to boost market growth. According to a report from Johns Hopkins University, approximately 30 million children and teenagers engage in various organized sports, leading to over 3.5 million injuries each year.

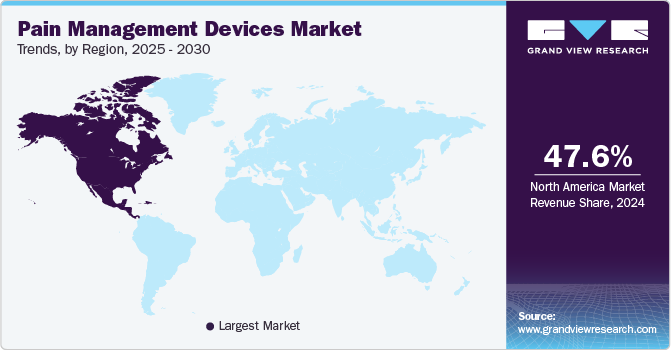

Regional Insights

North America pain management devices market held the largest revenue share of 47.6% in 2024 owing to the advanced healthcare infrastructure enabling easy access to cutting-edge pain management devices. In addition, the regional market is driven by factors, such as the presence of established healthcare facilities, a growing geriatric population, and a high prevalence of stroke & hypertension.

U.S. Pain Management Devices Market Trends

The pain management devices market in the U.S. held the largest share of 81.6% in 2024. Presence of extensive public & private funding initiatives, especially in the U.S., to create awareness regarding advanced devices. These initiatives, including the U.S. Affordable Care Act (ACA), focus on reducing the cost of medical devices.

Europe Pain Management Devices Market Trends

Europe pain management devices market is anticipated to register a significant growth rate during the forecast period. The presence of market players such as B. Braun Melsungen AG and Medtronic is expected to boost market growth.Increasing awareness regarding chronic pain disorders and pain management devices for treatment is expected to propel market growth.

Germany pain management devices market is anticipated to register a considerable growth rate during the forecast period. This can be attributed to the large population suffering from different musculoskeletal disorders and the high adoption of advanced technologies & devices.

The pain management devices market in UK is anticipated to register a considerable growth rate during the forecast period. Rising demand for noninvasive treatment procedures and growing prevalence of musculoskeletal diseases, such as bone degenerative diseases & osteoarthritis, are expected to drive market growth.

Asia Pacific Pain Management Devices Market Trends

The Asia Pacific pain management devices is expected to witness the fastest growth over the forecast period. Increasing adoption of pain management devices due to growing awareness about them is expected to boost regional growth.Moreover, the rising prevalence of obesity and other lifestyle disorders, which lead to an increase in the incidence of chronic pain disorders, is expected to boost market growth.

The India pain management devices market is anticipated to register the fastest growth rate during the forecast periodowing to increasing geriatric population. According to the report by NITI Aayog from the Government of India released in 2024, senior citizens currently make up slightly more than 10% of India's population, which equates to approximately 104 million people. It is anticipated that this percentage will rise to 19.5% of the total population by the year 2050.

The pain management devices market in China is anticipated to register the fastest growth rate during the forecast periodowing to increasing geriatric population owing to the country's large and aging population, rising prevalence of chronic conditions, and increasing healthcare infrastructure development.

Latin America Pain Management Devices Market Trends

The Latin America pain management devices market is anticipated to register a considerable growth rate during the forecast period. The rising adoption of advanced medical technologies and the shift towards non-invasive,drug-free pain management solutions are key factors propelling market growth.

Brazil pain management devices market is anticipated to register a considerable growth rate during the forecast period owing to an increasing healthcare spending, expanding private healthcare facilities, and a growing demand for non-pharmaceutical pain treatments.

Middle East & Africa Pain Management Devices Market Trends

The Middle East and Africa regions are experiencing lucrative growth in the pain management devices market. High disposable incomes, advanced healthcare infrastructure, and increasing patient awareness about non-pharmacological pain relief methods are fostering market growth.

South Africa pain management devices market is anticipated to register a considerable growth rate during the forecast period owing tohigh burden of chronic diseases, including musculoskeletal and neuropathic disorders. Additionally, improving healthcare infrastructure and greater awareness about chronic pain management are supplementing market growth.

Key Pain Management Devices Company Insights

Key participants in the market focus on developing innovative business growth strategies through mergers and acquisitions, partnerships and collaborations, product portfolio expansions, and business footprint expansions.

Key Pain Management Devices Companies:

The following are the leading companies in the pain management devices Market. These companies collectively hold the largest market share and dictate industry trends.

- B Braun Melsungen AG

- Baxter

- Boston Scientific Corporation or its affiliates

- Nevro Corp.

- Enovis

- OMRON Healthcare INC

- Medtronic

- ICU Medical Inc

- Abott

- Stryker

- Stimwave LLC

Recent Developments

-

In September 2024, Zynex Inc., a prominent medical technology firm focused on non-invasive devices for pain management and rehabilitation, announced that it has received FDA clearance for its new TensWave device.

-

In September 2024, Nevro Corp., a worldwide medical device company providing extensive, transformative solutions for managing chronic pain, revealed that it received FDA approval and began a confined market release of HFX iQ with HFX AdaptivAI, a tailored, responsive pain management platform that powers the HFX iQ spinal cord stimulation system.

-

In April 2024, Medtronic plc, a worldwide leader in healthcare technology, announced that the Inceptiv closed-loop rechargeable spinal cord stimulator (SCS) has received approval from the U.S. FDA for the management of chronic pain.

Pain Management Devices Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 8.42 billion

The revenue forecast in 2030

USD 13.16 billion

Growth rate

CAGR of 9.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain;Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

B Braun Melsungen AG; Baxter;Boston Scientific Corporation or its affiliates; Nevro Corp.; Enovis; OMRON Healthcare INC; Medtronic; ICU Medical Inc; Abott; Stryker; Stimwave LLC;

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pain Management Devices Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the pain management devices market based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Electrical Stimulators

-

TENS

-

Others

-

-

Radiofrequency Ablation

-

Analgesic Infusion Pumps

-

Intrathecal Infusion Pumps

-

External Infusion Pumps

-

-

Neurostimulation

-

Spinal Cord Stimulators

-

Deep Brain Stimulators

-

Sacral Neurostimulators

-

Others

-

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Cancer

-

Neuropathic

-

Facial & Migraine

-

Musculoskeletal

-

Trauma

-

Others

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospitals & Clinics

-

Physiotherapy Centers

-

Rehabilitation Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pain management devices market size was estimated at USD 7.65 billion in 2024 and is expected to reach USD 8.42 billion in 2025.

b. The global pain management devices market is expected to grow at a compound annual growth rate of 9.4% from 2025 to 2030 to reach USD 13.16 billion by 2030.

b. North America dominated the pain management devices market with a share of over 47.6% in 2024. This is attributable to favorable healthcare infrastructure, government initiatives, and well-planned reimbursement policies.

b. Some key players operating in the pain management devices market include B Braun Melsungen AG; Baxter International, Inc.; Boston Scientific Corp.; Codman and Shurtleff; DJO Global LLC; Pfizer, Inc.; Medtronic Plc; Smiths Medical; St. Jude Medical, Inc.; and Stryker Corp.

b. Key factors that are driving the pain management devices market growth include the high prevalence of diabetes, rising geriatric population base, and increasing cases of cancer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.