- Home

- »

- Medical Devices

- »

-

Muscle Stimulator Market Size, Share & Growth Report, 2030GVR Report cover

![Muscle Stimulator Market Size, Share & Trends Report]()

Muscle Stimulator Market (2024 - 2030) Size, Share & Trends Analysis Report By Modality (Handheld, Portable, Table Top), By Product, By Application (Pain Management, Musculoskeletal Disorder), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-510-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Muscle Stimulator Market Summary

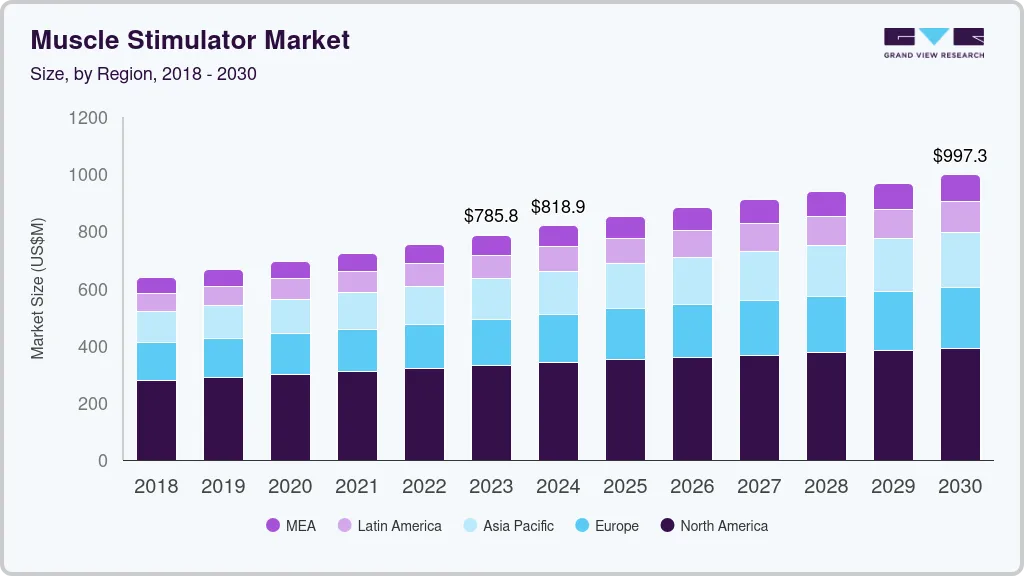

The global muscle stimulator market size was estimated at USD 785.8 million in 2023 and is projected to reach USD 997.3 million by 2030, growing at a CAGR of 3.3% from 2024 to 2030. The growing popularity of muscle stimulators among physiotherapists, increasing technological advancements in medical devices, and emphasis on pain management therapies in sports medicine are the key factors driving the market.

Key Market Trends & Insights

- North America muscle stimulator market dominated the overall global market and accounted for the 41.9% revenue share in 2023.

- The muscle stimulator market in the U.S. held a significant share of North America's market in 2023.

- By product, the transcutaneous electrical nerve stimulation (TENS) segment held the largest market share of 67.4% in 2023.

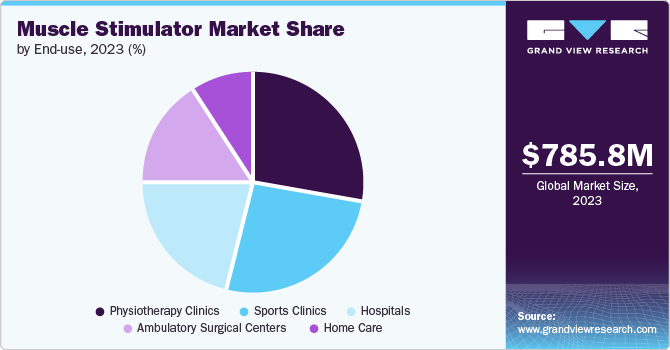

- By end use, the physiotherapy clinics segment dominated the market with the largest revenue share in 2023.

- By modality, the portable devices segment dominated the market in 2023 and is estimated to witness the highest CAGR of 3.6% during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 785.8 Million

- 2030 Projected Market Size: USD 997.3 Million

- CAGR (2024-2030): 3.3%

- North America: Largest market in 2023

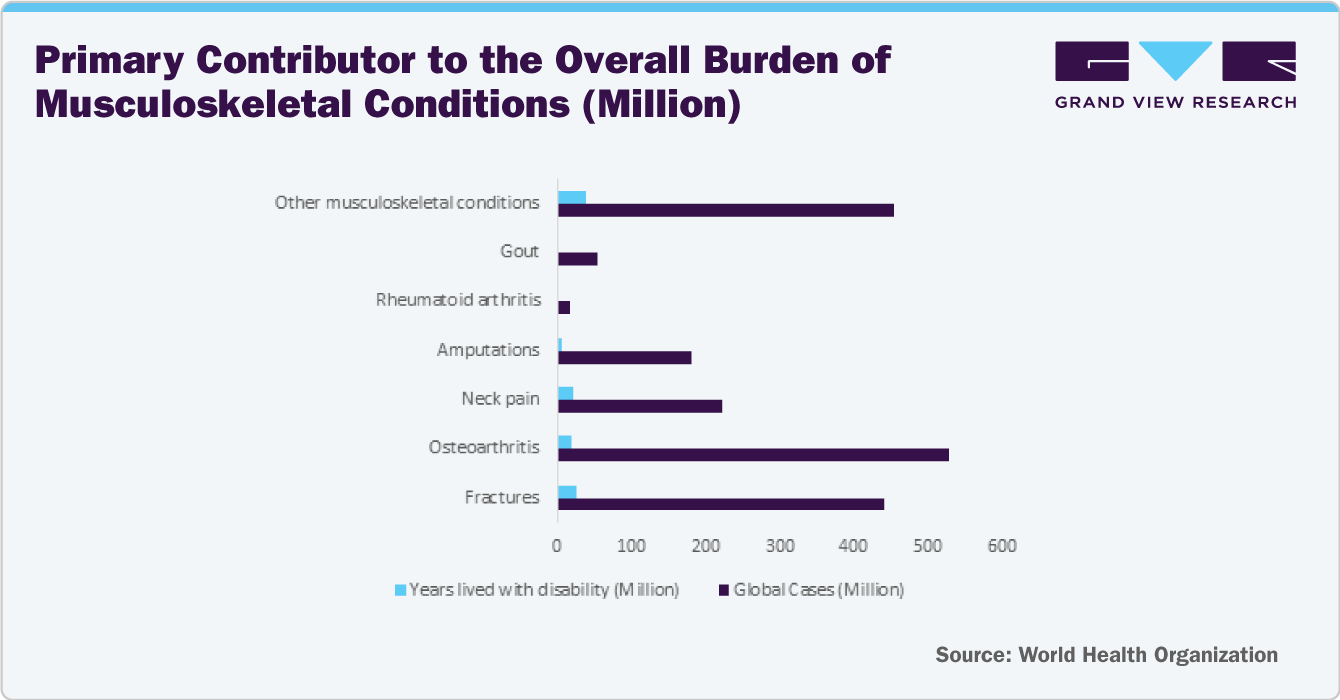

Moreover, the rising prevalence of musculoskeletal disorders among citizens is expected to further drive market growth. Poor body posture, lack of fitness activities, and unhealthy diet habits are common factors causing musculoskeletal disorders. According to the 2023 HSE Report, approximately 473,000 workers in Great Britain experienced work-related musculoskeletal disorders (MSDs), resulting in the loss of around 6.6 million working days. These disorders accounted for 27% of all work-related ill health cases.

In addition, according to the World Health Organization, approximately 1.71 billion people were suffering from musculoskeletal conditions worldwide in 2022, and it was the leading cause of disabilities worldwide, with low back pain being the leading cause of disability in 160 counties.

Furthermore, the market is anticipated to experience growth in the future owing to the emergence of innovative and technologically advanced products like wearable muscle stimulator devices. For instance, Neuro20 Technologies Corp, announced in March 2023 that it has received clearance from the U.S. Food and Drug Administration (FDA) for its Neuro20 PRO System. This regulatory approval comes as a 510(k)-pre-market clearance. The Neuro20 PRO System is a comprehensive solution that includes a full-body electrical muscle stimulator suit, accompanying software, and an operating system.

It can independently stimulate 42 different muscles, individually or in various combinations of co-contraction. The system can simultaneously treat 1 to 10 patients with specific control options for individual muscles. Also, the increasing demand for wireless and portable muscle stimulators and their compatibility with smartphones is creating growth opportunities for the market players.

Growing preference for muscle stimulators among physiotherapists is further aiding the market growth. Physiotherapists are increasingly shifting from manual techniques to muscle stimulators to treat patients in clinical and home care settings as they consume less time and are more effective. Moreover, growing cases of hip flexor strain, anterior cruciate ligament (ACL) tear, and hamstring strain among sports players requiring muscle stimulation therapy are further anticipated to drive the growth. According to The State of Play 2023 Report published in November 2023; a comprehensive analysis of sports injury trends revealed an alarming 12% rise in the annual incidence of ACL injuries when comparing data from one year to the next. This increase underscores the importance of ongoing efforts to prevent these injuries and improve treatment methods.

However, muscle stimulators' high cost encourages customers to opt for cheaper alternative therapies such as yoga, acupuncture, and aromatherapy. In developing countries such as China and India, yoga and acupuncture are preferred due to the convenience and flexibility of those therapies. Also, the lack of guidelines for using muscle stimulators is contributing to the increased usage of alternative therapies. This adoption of alternative therapies among the patient population is restraining market growth.

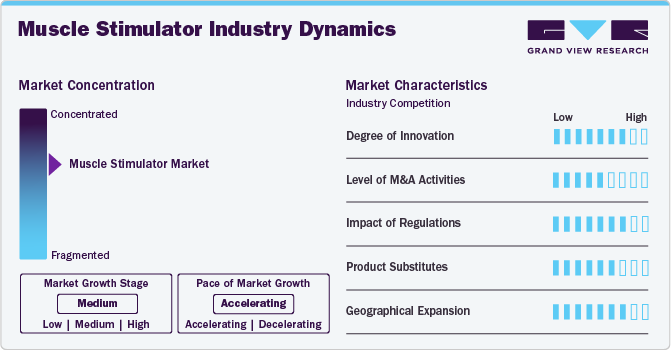

Industry Dynamics

The market exhibits moderate industry concentration, with several key players dominating the market. Initiatives to raise awareness about muscle weakness & poor motor control conditions and treatment options further stimulate market growth. Overall, the market is dynamic, driven by innovations to improve the efficiency and effectiveness of stimulators and therapies while prioritizing patient well-being.

The muscle stimulator industry is characterized by a high degree of innovation, with companies consistently developing products that enhance advancements in electrotherapy and neuromodulation technologies. These innovations enable manufacturers to develop more compact, portable, and user-friendly devices that cater to an increasingly diverse range of applications. For instance, transcutaneous electrical nerve stimulation (TENS) units are now available as wearable devices that can be controlled via smartphone applications.

Compliance with regulatory requirements, such as The Food and Drug Administration (FDA) regulates electrical muscle stimulators under the Federal Food, Drug, and Cosmetic Act. The FDA is responsible for ensuring that EMS devices are safe and effective for their intended uses. Most EMS devices intended for use in physical therapy and rehabilitation require a prescription from a healthcare professional. If a company wants to sell EMS devices directly to consumers, it must demonstrate that the device can be used safely and effectively in that setting.The FDA is concerned about the unregulated marketing of these devices because they may not comply with electrical safety standards, posing a risk of electrocution to users and other household members, including children. The agency is currently investigating firms that are illegally marketing EMS devices.

Mergers and acquisitions in the muscle stimulator industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in September 2023, Caldera Medical announced the acquisition of Atlantic Therapeutics. This acquisition expands Caldera’s product offerings to include non-invasive pelvic floor strengthening and nerve stimulation solutions for women. With this acquisition, Caldera Medical is now a comprehensive provider of women’s health solutions.

The main substitute products in the market are yoga, acupuncture, and aromatherapy. These alternative therapies are preferred in some regions, particularly in developing countries such as China and India, due to their convenience, flexibility, and lower cost compared to muscle stimulators. Additionally, the lack of guidelines for using muscle stimulators is contributing to the increased usage of alternative therapies among patients.

The muscle stimulator industry is experiencing robust global expansion due to increasing healthcare expenditure, technological advancements, and growing demand for muscle stimulator devices. Regional expansion in the muscle stimulator industry involves penetrating new geographical markets to broaden the customer base and increase market share. In July 2023, NeuroMetrix, Inc. (announced an expansion of its sales force to increase the adoption of Quell Fibromyalgia, which is the first and only medical device authorized by the U.S. FDA for the symptomatic relief of fibromyalgia. This expansion comes as part of NeuroMetrix’s ongoing efforts to make Quell more accessible to individuals suffering from this chronic condition.

Product Insights

The transcutaneous electrical nerve stimulation (TENS) segment held the largest market share of 67.4% in 2023. The growing prevalence of arthritis and increasing sports injuries are prominent factors augmenting the market growth. According to the Institute for Health Metrics and Evaluation study published in August 2023, approximately 1 billion people are projected to live with osteoarthritis (OA), the most prevalent form of arthritis, by the year 2050. Osteoarthritis, a degenerative joint disease, predominantly affects the knees and hands. According to the Centers for Disease Control and Prevention (CDC), by 2050, the prevalence of knee osteoarthritis is projected to increase by 75%, while hand osteoarthritis is anticipated to rise by 50%.

Burst mode alternating current (BMAC) is the fastest-growing segment during the forecast period.BMAC offers more efficient muscle stimulation compared to traditional constant current (CC) or pulsed current (PC) methods. BMAC has been shown to provide better clinical outcomes for various applications such as pain management, muscle rehabilitation, and athletic performance enhancement. For instance, studies have demonstrated that BMAC can significantly reduce pain and improve range of motion in patients with chronic low back pain. Additionally, research suggests that BMAC may enhance muscle strength and endurance more effectively than CC or PC stimulation in healthy individuals.

End-use Insights

The physiotherapy clinics segment dominated the market with the largest revenue share in 2023 and is anticipated to witness the highest CAGR of 4.0% during the forecast period. Growing preference of physiotherapists toward stimulators as compared to manual techniques is a major factor driving the growth of this segment. On the other hand, increasing patient visits for seeking stimulation therapies and the availability of these therapies at an affordable cost at physiotherapy clinics are the major factors anticipated to drive the market growth. Also, the medical reimbursement provided to patients seeking these therapies is further anticipated to drive the segment growth over the forecast period.

The sports clinics segment held the second-largest revenue share in 2023. The growth is attributed to the growing number of athletes seeking to optimize their performance and recover from injuries more effectively. Moreover, professional organizations and governing bodies within the sports industry are recognizing the value of EMS therapy in enhancing athlete performance and injury management. For instance, the National Athletic Trainers’ Association (NATA) has included electrical modality treatments like muscle stimulation as part of its evidence-based practice guidelines for managing various athletic injuries.

Modality Insights

The portable devices segment dominated the market in 2023 and is estimated to witness the highest CAGR of 3.6% during the forecast period. Portable muscle stimulators are used extensively for preventing muscle atrophy, relaxation of muscle spasms, managing chronic pain due to arthritis, and increasing blood circulation. Moreover, many key players in the market are offering various innovative stimulators under this segment.

For instance, the company NeuroMetrix, Inc. offers a portable pain relief kit, which is a TENS unit that fits like a brace on patients and provides stimulation for pain relief. The company Zynex, Inc. is offering JetStream, a portable system that can be used at home for treatment. OMRON Corporation is currently providing a small-sized portable electrotherapy TENS device that can be used to provide relief from sore and aching muscles. These factors are anticipated to drive the global market growth over the forecast period.

Application Insights

The pain management segment dominated the market in 2023 and is anticipated to grow at a fastest CAGR of 3.6% over the forecast period. The aging population is a significant driver for the pain management segment. With an increasing number of older adults experiencing chronic pain, there is a growing demand for safe and efficient pain management solutions. For instance, according to the CDC 2021, 20.9% of adults, about 51.6 million people in the U.S., were suffering from chronic pain, and 6.9% of U.S. adults, about 17.1 million people, had high-impact chronic pain. A similar situation is prevalent in many European and Asian countries. Muscle stimulators provide a viable option for this demographic, offering targeted pain relief without the potential side effects of medication. The growing usage of muscle stimulators for managing acute and chronic pain and the growing prevalence of arthritis are anticipated to drive the segment market over the forecast period.

Regional Insights

North America muscle stimulator market dominated the overall global market and accounted for the 41.9% revenue share in 2023. The presence of key participants, large investments by governments for innovation & development of medical devices, and the early introduction of novel muscle stimulators supplement the region's growth. Moreover, the high purchasing power of consumers and increased adoption of advanced technologies & innovative medical devices are further expected to drive growth.

In addition, the increasing adoption of non-invasive and drug-free pain management solutions is driving the market in the North American region. Many individuals are seeking alternatives to medication or invasive procedures for pain relief. Muscle stimulators provide a non-pharmacological approach in managing pain and discomfort, making them appealing to a wide range of consumers in the region.

U.S. Muscle Stimulator Market Trends

The muscle stimulator market in the U.S. held a significant share of North America's market in 2023, driven by the growing product approvals in the country. For instance, in January 2024, electronic muscle stimulators received U.S. FDA approval for use in strengthening, tightening, and toning core muscles. These devices are commonly employed in physical therapy or rehabilitation settings. Doctors often prescribe electronic muscle stimulators for various conditions such as muscle spasms, to improve range of motion, prevent muscle atrophy, and aid in muscle recovery following significant injuries or major surgeries.

Europe Muscle Stimulator Market Trends

Europe muscle stimulator market is witnessing growth fueled by the increasing prevalence of musculoskeletal disorders is a major driver. According to the European League Against Rheumatism (EULAR), musculoskeletal conditions affect around 120 million Europeans, making it one of the leading causes of disability in Europe. Muscle stimulators are used to treat various musculoskeletal conditions such as muscle atrophy, muscle spasms, and pain management. Moreover, there is a growing focus on pain management treatments in sports medicine. Muscle stimulators are increasingly being used by athletes and sports teams to prevent injuries, reduce recovery time, and improve performance. For instance, during the UEFA Euro 2020 championships, several teams used muscle stimulators to treat injuries and prevent muscle strains.

The muscle stimulator market in the UK is expected to grow over the forecast period owing to the increasing prevalence of musculoskeletal disorders is a major driver. According to the data by osteopaths for industry, in 2021 - 22, 477,000 workers in the UK had work-related musculoskeletal disorders, whereas 7.3 million working days were lost due to work-related musculoskeletal disorders in 2021/22. The work-related musculoskeletal disorders most frequently affected the "back" area, accounting for 42% of cases.

Germany muscle stimulator market is projected to expand over the forecast period due to the rising regulatory approvals and reimbursement policies. For instance, in Germany, muscle stimulators are reimbursed under the statutory health insurance scheme for certain indications such as post-stroke rehabilitation and chronic pain management.

Asia Pacific Muscle Stimulator Market Trends

The muscle stimulator market in the Asia Pacific region is expected to grow at the fastest CAGR during the forecast period. China and Japan are poised to lead the Asia Pacific market in the upcoming period. Moreover, the availability of trained professionals and the presence of developing healthcare facilities are expected to drive market growth over the forecast period. Moreover, growing awareness related to health and fitness, increasing adoption of pain management therapies, and rising usage of smart devices for maintaining health are the key growth stimulants of the region. Moreover, increasing sports injuries in this region are poised to stir the demand for muscle stimulators during the forecast period.

China muscle stimulator market is expected to grow in the Asia Pacific in 2023. The expanding healthcare infrastructure, growing healthcare workforce, and well-established medical facilities in China are anticipated to drive market expansion in the future. For instance, according to CEIC data from 2022, the number of hospitals in China increased to 36,976 units from the previous figure of 36,570 units in 2021.

Latin America Muscle Stimulator Market Trends

The muscle stimulator market in Latin America is driven by awareness of women's health, rise in healthcare spending, and infrastructural investmentsMoreover, the increasing prevalence of musculoskeletal disorders and sports injuries, which create a growing demand for non-invasive rehabilitation and pain management solutions. Additionally, the rising awareness about the benefits of muscle stimulation therapy among athletes, fitness enthusiasts, and aging populations fuels market growth. Technological advancements leading to the development of portable, wireless, and customizable devices further stimulate market demand.

Brazil muscle stimulator market is expected to grow in the Latin America in 2023. The technological advancements leading to the development of portable, wireless, and customizable muscle stimulation devices enable users to conveniently incorporate muscle stimulation into their daily routines. Additionally, government initiatives to expand access to healthcare services and invest in medical technology further support the growth of the Brazilian muscle stimulator market.

MEA Muscle Stimulator Market Trends

The muscle stimulator market in MEAis driven by the rising awareness about health and fitness among consumers in both regions. Muscle stimulators are increasingly being used for bodybuilding, athletic training, and rehabilitation purposes to enhance muscle strength, tone, and endurance. Furthermore, governments in Middle Eastern countries like Saudi Arabia and the UAE are investing heavily in healthcare infrastructure development, which is expected to create new opportunities for muscle stimulator manufacturers.

Saudi Arabia muscle stimulator market is anticipated to expand in the forecast period. The rise in healthcare spending, projected at USD 50.4 billion for 2023 according to a report by the International Trade Administration and the U.S. Department of Commerce, is expected to drive this expansion. Additionally, the increasing presence of hospitals and healthcare professionals stands as a key factor fueling market growth.

Key Muscle Stimulator Company Insights

The competitive scenario in the market is highly competitive, with key players. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Muscle Stimulator Companies:

The following are the leading companies in the muscle stimulator market. These companies collectively hold the largest market share and dictate industry trends.

- NeuroMetrix, Inc.

- OMRON Corporation

- BioMedical Life Systems, Inc.

- Zynex, Inc.

- EMS Physio Ltd.

- DJO Global, Inc.

- Zimmer MedizinSysteme GmbH

- Beurer GmbH.

- RS Medical, Inc.

- OG Wellness Technologies Co., Ltd.

Recent Developments

-

In March 2023, Neuro20 Technologies Corp, announced that FDA has granted clearance for its 510(k)-pre-market approval application for the Neuro20 PRO System. The Neuro20 PRO System consists of next-generation wireless wearable textiles designed to address neuromuscular injuries and diseases while improving human performance outcomes. The System enables the independent or combined involuntary contraction of 42 muscles for up to 10 patients simultaneously.

-

In January 2023, NeuroMetrix, Inc. launched DPNCheck 2.0, a new point-of-care device from the company. This device utilizes gold-standard nerve conduction technology for the detection of peripheral neuropathy. DPNCheck 2.0 offers rapid patient screening with quantitative measurement of peripheral nerve function. Furthermore, NeuroMetrix plans to introduce cloud-based aggregation of population-health data and integration with provider Electronic Health Records (EHR) systems later this year.

-

In November 2023, Motive Health introduced Motive Knee to the market, an FDA-cleared over the counter (OTC) muscle stimulation device designed to alleviate knee pain.This non-invasive treatment is particularly beneficial for those suffering from arthritis, tendinitis, or other knee injuries. Motive Health’s Motive Knee has been clinically proven to provide significant pain relief and improve mobility in patients with knee pain.

Muscle Stimulator Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 818.9 million

Revenue forecast in 2030

USD 997.3 million

Growth rate

CAGR of 3.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, modality, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

NeuroMetrix, Inc.; OMRON Corporation; BioMedical Life Systems, Inc.; Zynex, Inc.; EMS Physio Ltd.; DJO Global, Inc.; Beurer GmbH., RS Medical, Inc., OG Wellness Technologies Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Muscle Stimulator Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global muscle stimulator market report based on product, modality, application, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Neuromuscular Electrical Stimulation

-

Functional Electrical Stimulation

-

Transcutaneous Electrical Nerve Stimulation

-

Interferential

-

Burst Mode Alternating Current

-

Micro Current Electrical Neuromuscular Stimulator

-

Others

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld

-

Portable

-

Tabletop

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pain Management

-

Neurological Disorder

-

Musculoskeletal Disorder

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Physiotherapy Clinics

-

Sports Clinics

-

Home Care

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

- Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global muscle stimulator market size was estimated at USD 785.8 million in 2023 and is expected to reach USD 818.9 million in 2024.

b. The global muscle stimulator market is expected to grow at a compound annual growth rate of 3.3% from 2024 to 2030 to reach USD 997.3 million by 2030.

b. Transcutaneous electrical nerve stimulation dominated the muscle stimulator market with a share of 67.4% in 2023. This is attributable to the growing prevalence of arthritis and increasing sports injuries are some of the prominent factors augmenting the market growth.

b. Some key players operating in the muscle stimulator market include NeuroMetrix, Inc.; OMRON Corporation; BioMedical Life Systems, Inc.; Zynex, Inc.; EMS Physio Ltd.; DJO Global, Inc.; and Beurer GmbH.

b. Key factors that are driving the muscle stimulator market growth include the introduction of technologically advanced products such as wearable muscle stimulator devices is projected to drive the market growth in the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.