- Home

- »

- Advanced Interior Materials

- »

-

Passive Fire Protection Market Size, Industry Report, 2033GVR Report cover

![Passive Fire Protection Market Size, Share & Trends Report]()

Passive Fire Protection Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cementitious Materials, Intumescent Coating, Fireproofing Cladding), By Application (Oil & Gas, Construction, Industrial Plants), By Region, And Segment Forecasts

- Report ID: 978-1-68038-813-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Passive Fire Protection Market Summary

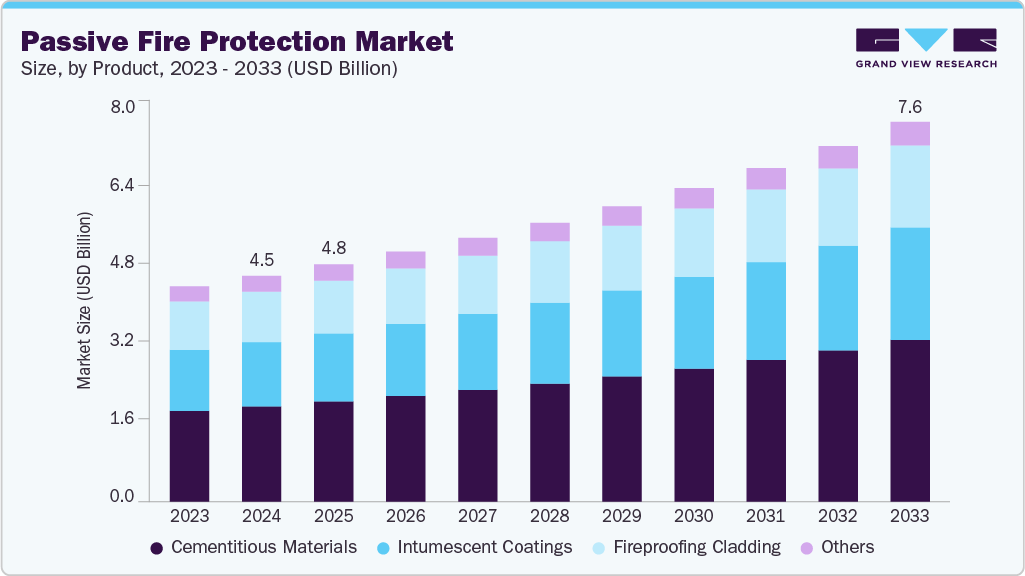

TThe global passive fire protection market size was estimated at USD 4,536.0 million in 2024 and is projected to reach USD 7,630.4 million by 2033, growing at a CAGR of 6.1% from 2025 to 2033. This growth is primarily driven by the increasing emphasis on fire safety across various sectors, coupled with stringent regulatory frameworks mandating fire protection measures.

Key Market Trends & Insights

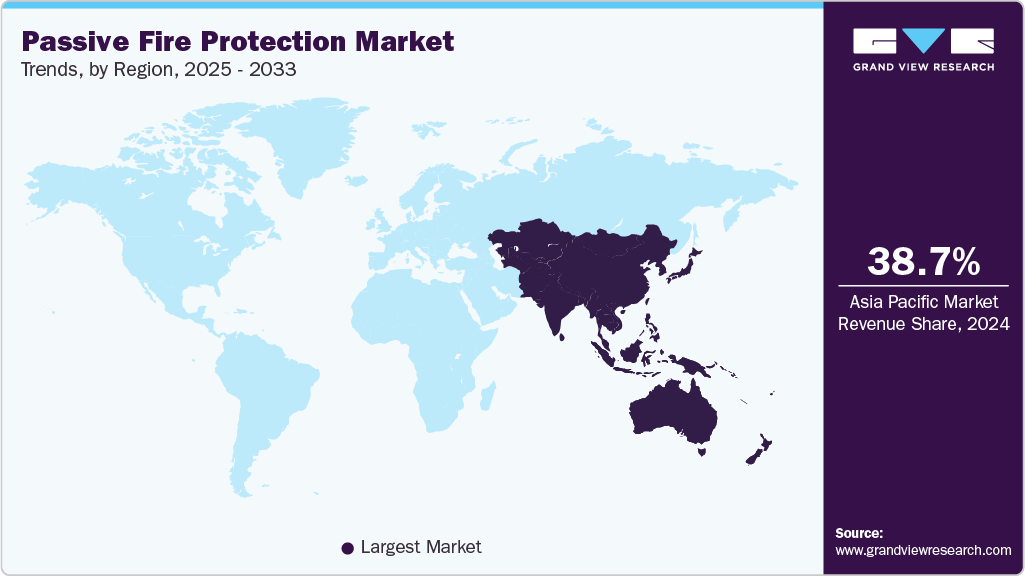

- Asia Pacific dominated the passive fire protection market with the largest revenue share of 38.7% in 2024.

- The passive fire protection industry in China is expected to grow at the fastest CAGR of 8.0% from 2025 to 2033.

- By product, the intumescent coatings segment is expected to grow at the fastest CAGR of 6.5% from 2025 to 2033 in terms of revenue.

- By application, the construction segment is expected to grow at the fastest CAGR of 6.4% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 4,536.0 Million

- 2033 Projected Market Size: USD 7,630.4 Million

- CAGR (2025-2033): 6.1%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Rising construction activity in commercial and industrial buildings, along with heightened safety standards in high-risk environments such as oil & gas facilities, is further contributing to the market expansion. Rapid urbanization and infrastructural development across emerging economies are further accelerating the growth of the passive fire protection industry. As new high-rise buildings, transport hubs, and energy facilities are constructed, the need for built-in fire containment systems is becoming critical. In sectors like oil & gas, construction, and manufacturing, passive fire protection ensures operational continuity and asset protection. Insurance incentives and risk assessment protocols also support the integration of these materials in modern design.

Market Concentration & Characteristics

The passive fire protection market is moderately concentrated, with a mix of established global players and regional manufacturers. Key companies hold significant market shares due to their broad product portfolios, strong distribution networks, and compliance with international standards. However, the presence of several local suppliers catering to niche applications adds a fragmented aspect to the landscape. This balance creates healthy competition while still allowing dominant firms to influence pricing and innovation trends.

The passive fire protection industry shows a moderate level of innovation, primarily focused on enhancing material durability and ease of application. Companies are investing in R&D to develop intumescent coatings, fire-resistant boards, and eco-friendly alternatives. Digital tools for fire risk modeling and testing are also gaining traction. However, innovation is often constrained by strict regulatory standards and long approval cycles.

The market for passive fire protection has seen steady M&A activity as larger firms aim to expand their market presence and product portfolios. Acquisitions are commonly used to enter new geographic markets or gain access to specialized technologies. Strategic partnerships and consolidations also help reduce competition and streamline supply chains. This trend is particularly strong among global players seeking regulatory compliance advantages.

Regulations have a significant impact on the passive fire protection industry, influencing both product development and market entry. Compliance with fire safety codes, such as EN, ASTM, and UL standards, is mandatory for market acceptance. Frequent updates in safety norms drive continuous product testing and certification efforts. These regulations ensure quality and performance, but can increase operational costs for manufacturers.

Drivers, Opportunities & Restraints

Stringent fire safety regulations and increased awareness of fire hazards are major drivers of the passive fire protection market. Growing urbanization and the rise in construction activities further fuel demand for fire-resistant materials. Industries such as oil & gas, transportation, and manufacturing are increasingly adopting these solutions. Insurance incentives and risk mitigation strategies also support market growth.

Emerging economies offer vast opportunities due to ongoing infrastructure development and low penetration of fire safety systems. Advancements in fire-resistant technologies and eco-friendly materials are opening new product development avenues. Integration of passive fire protection in green building certifications is gaining traction. Additionally, public and private investments in smart cities will boost long-term demand.

High initial costs and long product approval processes act as key restraints in market adoption. Strict compliance requirements can limit innovation and delay product launches. Lack of awareness in developing regions hampers the widespread implementation of fire protection solutions. Furthermore, supply chain disruptions and raw material price fluctuations can impact profitability.

Product Insights

The cementitious materials segment led the passive fire protection market with a 42.2% share in 2024, due to their high fire resistance, durability, and cost-efficiency. They are commonly used for protecting structural steel in commercial, industrial, and infrastructural projects. These materials offer excellent adhesion and can be applied in thick layers for enhanced protection. Their low maintenance needs and proven performance in severe conditions further reinforce their dominance. Widespread regulatory acceptance also supports their continued use.

Intumescent coatings are witnessing the fastest growth driven by their thin, lightweight application and superior aesthetic appeal. These coatings expand when exposed to fire, forming a protective charm that insulates the underlying surface. They are ideal for modern construction where both safety and design flexibility are essential. The demand is rising in high-rise buildings, transport hubs, and energy facilities. Advances in water-based and eco-friendly formulations are also accelerating adoption.

Application Insights

The construction segment dominated the passive fire protection industry with a revenue share of 34.3% in 2024, due to strict fire safety codes and increasing urban infrastructure development. Commercial buildings, residential complexes, and public infrastructure projects widely adopt passive fire protection systems. Materials like fire-resistant boards, coatings, and sealants are used to ensure structural integrity during fire incidents. Growing awareness and mandatory compliance across regions further strengthen this segment’s leading position.

The oil and gas sector is a significantly growing application segment in the passive fire protection market, driven by the high risk of fire hazards in extraction, processing, and storage facilities. Passive fire protection is essential for safeguarding equipment, pipelines, and structural components in extreme conditions. Stringent industry safety standards and increasing investments in refinery expansions are boosting adoption. Advanced fireproofing technologies are being rapidly integrated to minimize downtime and ensure operational safety.

Regional Insights

The North America passive fire protection market is expected to grow at a significant CAGR of 5.6% over the forecast period, driven by well-established fire safety regulations and high enforcement standards. The region benefits from strong demand across sectors such as commercial construction, oil & gas, and transportation. Investments in smart buildings and infrastructure renovation further drive product adoption. The presence of major industry players and ongoing technological innovation enhances market maturity. Insurance incentives and liability concerns also promote widespread use of passive fire systems.

U.S. Passive Fire Protection Market Trends

The U.S. passive fire protection industry dominates North America, due to stringent fire safety regulations and widespread enforcement. High demand from commercial, industrial, and oil & gas sectors drives consistent product adoption. Ongoing infrastructure renovation and increased focus on building safety support market leadership. Additionally, the presence of major manufacturers and continuous innovation enhances the country’s strong position.

The Canada passive fire protection market is witnessing steady growth, supported by rising construction activities and updated building codes. Government initiatives to improve public infrastructure and housing safety are boosting demand. Increasing awareness of fire hazards and regulatory compliance is encouraging the adoption of modern fireproofing solutions. Though smaller in scale than the U.S., the market shows strong long-term potential.

Europe Passive Fire Protection Market Trends

Europe is experiencing gradual growth in the passive fire protection industry, supported by sustainability goals and the retrofitting of older structures. Countries such as Germany, France, and the UK are promoting green construction practices that include modern fireproofing solutions. Growing industrial activities and infrastructure upgrades contribute to rising demand. While the market is mature, innovation in eco-friendly materials is opening new opportunities.

The Germany passive fire protection market is experiencing growth, driven by strict fire safety regulations and the modernization of aging infrastructure. The country’s strong industrial base, particularly in manufacturing and energy, drives consistent demand for fire-resistant materials. Sustainability goals are also encouraging the use of eco-friendly fire protection solutions. Increased retrofitting of commercial and public buildings further supports market expansion.

The passive fire protection market in the UK is expected to grow, driven by heightened fire safety awareness and revised building codes following recent high-profile fire incidents. Government-led housing and infrastructure projects are fueling demand for passive fire protection systems. The push for compliance with updated safety standards is encouraging investments in advanced materials. Additionally, efforts toward greener construction are creating opportunities for innovative fire-resistant products.

Asia Pacific Passive Fire Protection Market Trends

Asia Pacific dominated the passive fire protection industry with a revenue share of 38.7% in 2024, driven by rapid urbanization, industrial expansion, and large-scale infrastructure projects. Countries like China, India, and Japan are investing heavily in commercial buildings, transportation networks, and energy facilities. Increasing enforcement of fire safety regulations and the rise of smart city developments are accelerating adoption. Additionally, cost-effective manufacturing and growing awareness about fire protection further strengthen the region’s leading position.

China's passive fire protection market is growing rapidly due to large-scale urbanization and massive infrastructure development. Government regulations are becoming stricter, especially for high-rise buildings, transportation hubs, and industrial facilities. The country's expanding construction and energy sectors are major drivers of demand. Additionally, rising public awareness of fire safety is pushing the adoption of advanced fireproofing materials.

The passive fire protection market in India is witnessing strong growth, fueled by increased investment in commercial real estate, metros, and smart city projects. The implementation of updated fire safety norms and building codes is accelerating market adoption. Industrial expansion and growing foreign direct investment in infrastructure are key contributors. Moreover, rising demand for affordable and efficient fire-resistant materials supports long-term growth.

Middle East & Africa Passive Fire Protection Market Trends

The Middle East and Africa passive fire protection industry is growing, due to the ongoing infrastructure development and major oil & gas investments. Countries such as the UAE and Saudi Arabia are integrating fire safety into large-scale commercial and industrial projects. Improved regulatory frameworks and rising safety concerns are encouraging the adoption of passive fire protection systems. Despite logistical and enforcement challenges, the region holds significant growth potential.

The Saudi Arabia passive fire protection market is growing steadily, driven by large-scale infrastructure and commercial projects under Vision 2030. The rapid development of smart cities, airports, and industrial zones is boosting demand for advanced fire safety systems. Increasing enforcement of international fire codes and building regulations supports market adoption. Additionally, the expansion of the oil & gas sector further contributes to the need for high-performance fire-resistant materials.

Latin America Passive Fire Protection Market Trends

Latin America is showing moderate growth in the passive fire protection industry, driven by increasing construction activity and industrial expansion in countries like Brazil and Argentina. Government efforts to strengthen building codes and attract foreign investments are supporting adoption. However, inconsistent regulation and economic instability pose challenges to faster growth. Improved safety awareness and urban development projects are expected to fuel long-term demand.

The Brazil passive fire protection market is experiencing growth due to expanding urban infrastructure and rising construction activities. Government initiatives to improve fire safety regulations are encouraging the adoption of certified fire-resistant materials. The industrial and commercial sectors are increasingly implementing passive fire systems to reduce risk and enhance compliance. Additionally, growing awareness of building safety is driving demand in both new construction and retrofitting projects.

Key Passive Fire Protection Company Insights

Some of the key players operating in the market include Lloyd Insulations (India) Limited, Illbruck, and Sharpfibre Limited.

-

Lloyd Insulations (India) Limited specializes in providing passive fire protection solutions tailored for industrial environments, including refineries, petrochemical plants, and power stations. The company is known for its proprietary fire-resistant insulation systems that ensure thermal stability and fire containment. It has executed critical fireproofing projects for high-risk infrastructure across India. Their services often include turnkey installation and customized design based on project-specific fire safety standards. Lloyd’s expertise lies in integrating fire protection within broader thermal and acoustic insulation frameworks.

-

Illbruck focuses on passive fire protection through advanced sealing, bonding, and insulating products used in commercial and high-performance buildings. Their fire-rated foams, sealants, and joint systems are engineered for compliance with European fire safety regulations. The brand is recognized for its innovation in facade fire protection, especially in curtain wall and perimeter sealing applications. Illbruck’s solutions are often specified in architecturally complex projects requiring both fire resistance and airtightness. Their products are designed for easy application and durability, even under challenging environmental conditions.

Key Passive Fire Protection Companies:

The following are the leading companies in the passive fire protection market. These companies collectively hold the largest market share and dictate industry trends.

- Lloyd Insulations (India) Limited

- Illbruck

- Sharpfibre Limited

- Hempel A/S

- Rudolf Hensel GmbH.

- HILTI

- Carboline

- Morgan Advanced Materials plc

- Contego International Inc

- Tecresa Protección Pasiva, S.L.

- Isolatek International

- 3M

- PPG Industries, Inc.

- Etex Group

- The Sherwin-Williams Company

Recent Developments

-

In January 2025, The ASFP launched a new membership category for manufacturers of passive fire protection products. This aims to promote better industry collaboration and raise product quality standards. It supports ASFP’s goal of advancing professionalism in fire safety.

-

In November 2024, Triangle Fire Systems acquired Intrinsic Fire Protection to strengthen its position in the UK’s passive fire safety market. Intrinsic will continue operating under its brand, focusing on fire-stopping and structural protection. The move expands Triangle’s capabilities across key sectors like healthcare and housing.

-

In February 2023, PPG Industries, Inc. launched an epoxy intumescent fire protection coating, PPG STEELGUARD 951, developed to fulfill modern architectural steel demands, offering up to three hours of cellulosic fire protection. In the case of fire incidents, the coating expands from a lightweight, thin film to a foam-like, thick layer that protects the steel and maintains its structural integrity.

-

In August 2023, Nullifire, under Tremco CPG UK, introduced new cavity fire barriers aimed at strengthening its passive fire protection offerings. These products are engineered to block the movement of fire and smoke through gaps in walls and floors. The launch supports the company’s focus on enhancing fire safety in contemporary construction environments. This expansion aligns with its goal of delivering reliable, regulation-compliant safety solutions.

Passive Fire Protection Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,767.8 million

Revenue forecast in 2033

USD 7,630.4 million

Growth rate

CAGR of 6.1% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; UK; Russia; China; India; Japan; South Korea; Thailand; Malaysia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Lloyd Insulations (India) Limited; Illbruck; Sharpfibre Limited; Hempel A/S.; Rudolf Hensel GmbH; HILTI; Carboline; Morgan Advanced Materials plc; Contego International Inc.; Tecresa Protección Pasiva, S.L.; Isolatek International; 3M; PPG Industries, Inc.; Etex Group; The Sherwin-Williams Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Passive Fire Protection Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global passive fire protection market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cementitious Materials

-

Intumescent Coating

-

Fireproofing Cladding

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil & Gas

-

Construction

-

Industrial Plants

-

Warehousing

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

- U.S.

- Canada

- Mexico

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global passive fire protection market size was estimated at USD 4,536.0 million in 2024 and is expected to be USD 4,767.8 million in 2025.

b. The global passive fire protection market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2033 to reach USD 7,630.4 million by 2033.

b. Cementitious materials lead the passive fire protection market and accounted for 42.2% share, due to their high fire resistance, durability, and cost-efficiency. They are commonly used for protecting structural steel in commercial, industrial, and infrastructural projects.

b. Some of the key players operating in the global passive fire protection market include Lloyd Insulations (India) Limited, Illbruck, Sharpfibre Limited, Hempel A/S., Rudolf Hensel GmbH, HILTI, Carboline, Morgan Advanced Materials plc, Contego International Inc, Tecresa Protección Pasiva, S.L., Isolatek International, 3M, PPG Industries, Inc., Etex Group, The Sherwin-Williams Company.

b. The market growth is expected to be driven by the growing importance of fire safety and increasing regulatory compliance in commercial buildings, industrial spaces, and the oil & gas sector. The increasing consumption of fossil fuels has led to increased exploration and refining activities in the oil & gas sector to cater to the rising demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.