Pates Market Summary

The global pates market size was estimated at USD 1.74 billion in 2023 and is anticipated to reach a value of USD 2.44 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030. The increased popularity of Western cuisine worldwide has primarily contributed to the demand for pates.

Key Market Trends & Insights

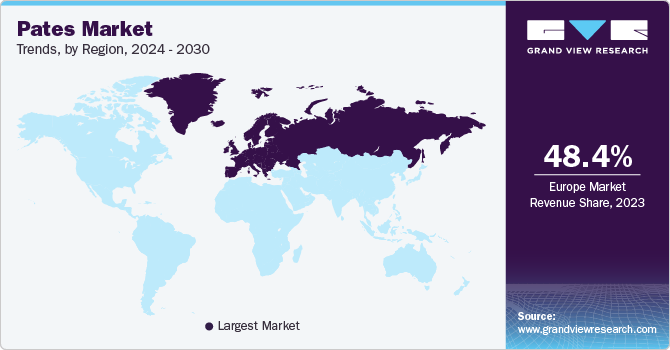

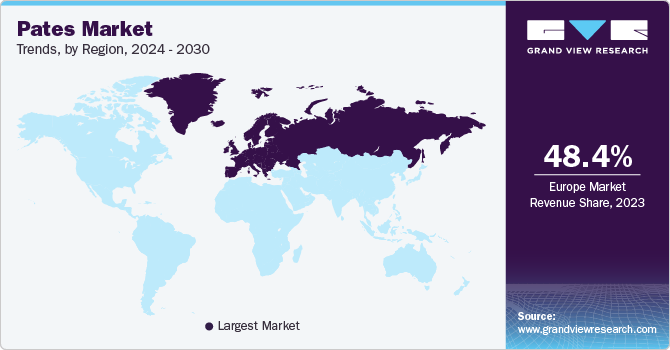

- Europe pates market represented over 48.4% of the global share in 2023.

- By product, the chicken segment secured the largest share of the global market with 35.2% in 2023.

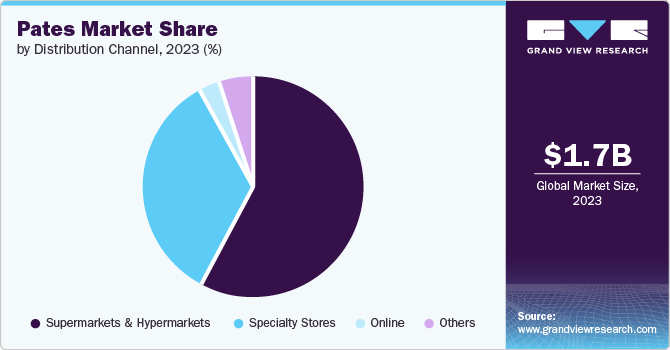

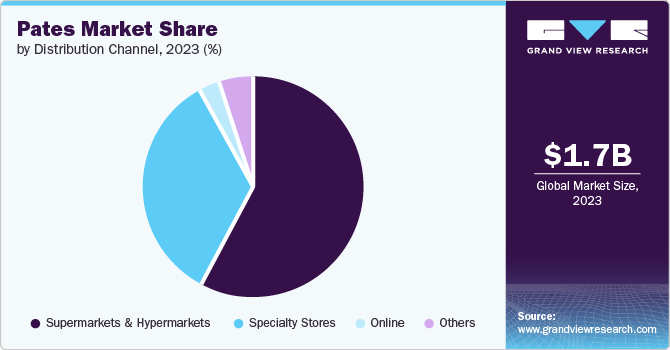

- By distribution channels, supermarkets & hypermarkets segment have led the market with a dominant share of 57.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.74 Billion

- 2030 Projected Market Size: USD 2.44 Billion

- CAGR (2024-2030):4.9%

- Europe: Largest market in 2023

As consumers explore diverse culinary experiences, pates - savory spreads made from finely chopped or pureed seasoned meat - have found their way onto menus. Furthermore, pates are rich in iron, copper, and vitamins A & B-12, which aligns with consumers’ growing dietary preferences.

Furthermore, as global travel and cultural exchange increase, consumers have become more open to trying diverse cuisines, which often include pates with unique flavors and textures. This has led leading market players to introduce novel pate variants. These include spreads made from beef, fish, and pork, catering to diverse tastes. Additionally, vegetarian pates crafted from cheese, vegetables, mushrooms, and herbs have attracted vegetarian consumers.

Another major driver of the market is the escalating demand for processed foods. Technological development has accelerated their consumption, as they offer convenience and an extended shelf life. With the rising prevalence of fast-paced lifestyles and busy schedules, consumers prefer ready-to-eat products such as pates foods as a convenient yet flavorful option.

The proliferation of global food chains and restaurants has also increased market growth. They are increasingly incorporating pates into menus as appetizers, sandwich fillings, and other accompaniments, making pates more accessible and appealing to a diverse consumer base.

Product Insights

“The duck product segment is expected to witness growth at 5.3% CAGR.”

Based on product, the chicken segment secured the largest share of the global pates market with 35.2% in 2023, and is projected to grow steadily during the forecast period. This continued growth can be primarily attributed to the product’s affordability and convenience. Chicken meat is widely accessible, and its versatility allows for various culinary applications, making it a popular choice for pates. In addition, chicken is lean, low in fat, and rich in protein, and the meat provides a balance of taste and health, which aligns with health-conscious consumers’ dietary preferences. Furthermore, increasing urbanization with rising per capita incomes drives demand for convenient ready-to-eat foods. This has led leading players to introduce unique chicken pate variants - infused with herbs, spices, and complementary ingredients. These innovations expand the product portfolio and attract discerning diners.

The duck segment is emerging as the fastest-growing segment in the global pates market during the forecast period owing to the rising production of duck meat worldwide. It contributes to the abundant availability of raw materials for pates. Consumers seeking nutritious options appreciate duck pates as the meat is nutrient-dense including zinc and contains essential B vitamins, minerals, and healthy fats. Additionally, with the rising demand for exotic and gourmet foods, duck pates find their way into global menus through international trade.

Distribution Channels Insights

“The online distribution channel is expected to grow at a CAGR of 8.5%.”

Supermarkets & hypermarkets have led the market with a dominant share of 57.9% in 2023 owing to urbanization, coupled with growing disposable incomes, which drove major demand for diverse food products, including pates. Supermarkets & hypermarkets provide a wide range of products and brands, enhancing brand visibility and ensuring a convenient shopping experience. Their emphasis on high-quality food items contributes to the growth of the pates industry.

The online distribution channel is emerging as the fastest-growing segment during the forecast period. Online channels enable consumers to access both regional and global pate brands, which has resulted in gaining traction. The sales of ready-to-eat food products including pates through this channel are expected to rise significantly, particularly in developing countries. Furthermore, the online distribution model allows vendors to offer substantial discounts directly to consumers. By eliminating costs associated with physical stores and in-person merchandising, competitively priced offerings, and swift delivery services fuel market growth through online channels.

Regional Insights

“The Asia Pacific pates market is expected to grow at a CAGR of 5.4%.”

Europe pates market represented over 48.4% of the global share in 2023. The love for foie gras - a traditional French dish that originated in Europe, contributes to the pates market’s prominence. In addition, the escalating number of food chains, upscale restaurants, and eateries across Europe expands the reach of pates. These establishments offer pates as appetizers, sandwich fillings, or accompaniments to the urban population. Furthermore, pates are frequently enjoyed with baguette slices and crispy toasts. They also play a crucial role in main dishes such as Beef Wellington, where mushroom pate is spread over fillet steaks and encased in pastry. Another popular dish, Ballotine, features pate as a filling for chicken breasts. While pates are commonly consumed as spreads in Europe, innovative variations also include loaf or sliced formats.

North America Pates Market Trends

The pates market in North America dominated the market with 20.3% in 2023. The region’s multicultural landscape fosters diverse culinary exploration. Pates adapt well to diverse tastes with their versatile fillings ranging from duck and chicken to gourmet liver. In addition, consumers increasingly seek nutritious options, including pates, which are rich in vitamins and protein that align with the wellness trends. Its ability to preserve meat and prevent spoilage further enhances its appeal.

U.S. Pates Market Trends

The increasing trend toward gourmet and exotic gourmet and exotic food preferences among consumers has propelled the demand for premium pates food. Moreover, the rising awareness of health-conscious consumption patterns has led to a growing demand for pates made from organic and high-quality ingredients, which has further stimulated market growth.

Asia Pacific Pates Market Trends

The pates market in Asia Pacific is poised for growth over the forecast period and is fueled by cultural diversity. The region, with its rich tapestry of cultures, attracts consumers with diverse cuisines, which include pates. In addition, increasing awareness of pate’s health benefits and the availability of vegetarian variants contribute to the market expansion. Moreover, the rise of regional Western-themed restaurants further supports market development.

Key Pates Company Insights

The presence of a few well-established players with a large consumer base, vast distribution networks, and strong brand recognition characterizes the global pates market. Major market players are increasingly implementing various expansion strategies, including mergers & acquisitions, capacity expansion, and strengthening their online presence.

Key Pates Companies:

The following are the leading companies in the pates market. These companies collectively hold the largest market share and dictate industry trends

- Murray’s Cheese

- Alexian Pate

- Rougie USA

- Terroirs d’Antan, USA

- MyPanier, Inc.

- Henaff;

- Army Brand

- Pate France

- Despaña Brand Foods

- Prodo Group

Recent Development

Pates Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 1.83 billion

|

|

Revenue forecast in 2030

|

USD 2.44 billion

|

|

Growth Rate

|

CAGR of 4.9% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, distribution channel, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; MEA

|

|

Country scope

|

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Austria; China; Japan; South Korea; Australia; Brazil; Saudi Arabia

|

|

Key companies profiled

|

Murray’s Cheese; Alexian Pate; Rougie USA, Terroirs d’Antan, USA; MyPanier, Inc.; Henaff; Army Brand; Pate France; Despaña Brand Foods; Prodo Group

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Pates Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pates market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)