- Home

- »

- Healthcare IT

- »

-

Patient Engagement Solutions Market Size Report, 2030GVR Report cover

![Patient Engagement Solutions Market Size, Share & Trends Report]()

Patient Engagement Solutions Market Size, Share & Trends Analysis Report By Delivery Type (Web & Cloud-based, On-premise), By Component, By Functionality, By Therapeutic Area, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-024-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

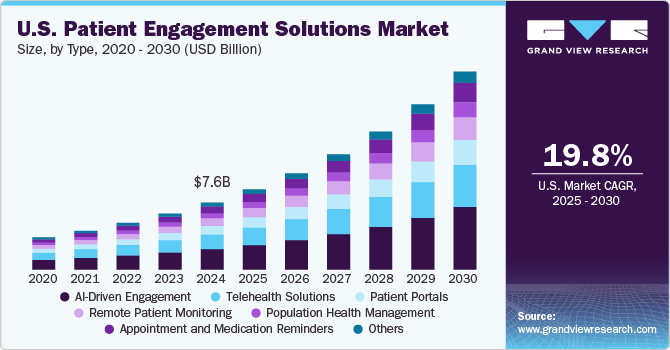

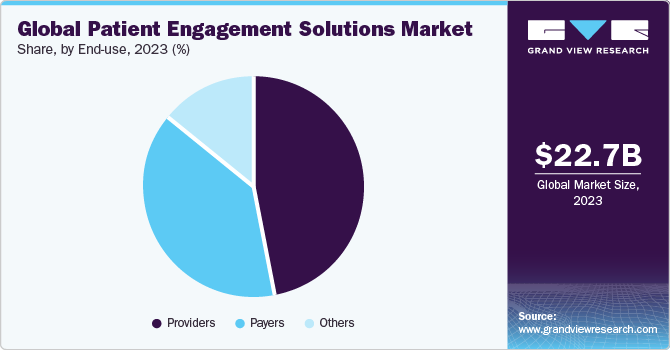

The global patient engagement solutions market size was valued at USD 22.7 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 17.7% from 2024 to 2030. Growing technological developments, adoption of EHR and mhealth solutions, prevalence of chronic diseases, supportive initiatives by key market stakeholders, and consumerism in healthcare are some of the key drivers of this market. As per a 2021 survey by NextGen Healthcare,83% of ambulatory healthcare survey respondents believed that patient engagement solutions played a key role in organizational financial success and patient outcomes. The survey also indicated that COVID-19 pandemic fueled the market growth.

COVID-19 had unprecedented consequences on daily lives and the global economy. A significant burden is formed on healthcare systems across the globe. Providers, payers, and life science companies started looking for solutions to increase patient engagement in various settings, such as remote home monitoring, virtual consultations, and clinical trials. Pandemic and the resulting movement restrictions propelled the need to facilitate virtual communication between customers and their care providers. This led to a surge in demand for patient engagement solutions during 2020. This growth, however, was observed to have dampened during 2021, and the market is anticipated to grow notably at a steady rate over the forecast period.

The COVID-19 outbreak has encouraged innovations in patient monitoring and cloud computing. For instance, in April 2020, GE Healthcare announced an innovative cloud-based remote-monitoring tool to assist clinicians looking after ventilated COVID-19 patients. A growing number of smartphone users around the globe expedited the adoption of mHealth across the sector, both from providers and consumers. Healthcare apps are rising, and they are easy to download on smartphones. These apps can be connected with wearable devices, and they support the users in overall health management, which, in turn, has augmented the dependability of patients on mHealth apps. Thus, COVID-19 pandemic is anticipated to play a substantial role in digital transformation.

Market Dynamics

Favorable government initiatives propel market growth. For instance, in March 2022, DeliverHealth's partner program was introduced, bolstering sales globally. This aids strategic partners in enhancing patient outcomes, reducing costs, and streamlining healthcare complexities. Moreover, developing countries like India benefit from supportive government initiatives. For example, in March 2019, Columbia Asia Hospitals collaborated with MphRx to launch a patient engagement application suite across Malaysia, India, Indonesia, and Vietnam. This initiative aims to digitally transform healthcare services and enhance patient engagement for clinical excellence.

Factors such as the increasing burden of chronic diseases and a rising geriatric population drive the global adoption of patient engagement solutions. For instance, in 2022, the Diabetes Research Institute Foundation reported 37.3 million new diabetes cases in the U.S. In response to this surge, companies are prioritizing the development of patient-centric engagement solutions.

Furthermore, there is a growing emphasis on technologically advanced product launches, collaborations, and partnerships to expand the utilization of advanced technologies, positively influencing market growth. In October 2023, CipherHealth, a notable player in patient-centered engagement and insights for leading healthcare systems, announced a strategic initiative to integrate cutting-edge AI technologies for revolutionizing hospital operations and patient care. This initiative highlights the trend of patient engagement solution providers turning to AI systems like Google Cloud's Vertex AI to accelerate model development, enhance solutions, and drive further market expansion.

Delivery Type Insights

In 2023, the web and cloud-based segment dominated the market with a 78.0% revenue share and is expected to grow at the fastest rate throughout the forecast period. Increased adoption of these solutions is driven by remote access to real-time data tracking, integrated features, easy accessibility, minimal handling costs, and straightforward data backup. Due to the aforementioned reasons, companies are increasingly investing in web and cloud-based patient engagement solutions.

For instance, in May 2020, Microsoft introduced Microsoft Cloud for Healthcare, its inaugural sector-specific cloud. This platform aims to enhance patient engagement and collaboration among health teams through telehealth and data analytics features. On-premise services offer secure patient data management and easy access. The desire for complete information access within the premises drives the preference for on-premise services.

Component Insights

In 2023, software and hardware segment accounted for the largest revenue share of 62.7% and is expected to grow at the fastest CAGR over the forecast period. Patient engagement software and hardware form core offering of the solution. It is simple to install, use, and retrieve records owing to intuitive user interfaces and continuous product upgrades. FollowMyHealth from Allscripts is a popular mobile-first, customizable, enterprise patient engagement solution. It is used by providers, hospitals, and health systems to drive the quality of care and increase patient satisfaction.

The services segment is one of the crucial parts of the effective operation of patient engagement solutions. It helps leverage and optimize patient engagement solutions as per customer needs and maximize patient health outcomes. These include consulting, implementation and training, support and maintenance, and other services such as interoperability and access to EHR data.

Functionality Insights

The communication segment accounted for the largest revenue share of 35.0% in 2023, as it forms the core offering of any patient engagement solution. This large share is attributed to a surge in demand and adoption of telehealth, mhealth, and other virtual communication solutions via audio, video, and text. The pandemic helped to adopt virtual communication solutions and expanded applications to remote patient monitoring, mental health, and many more modalities.

The health tracking and insights segment is projected to grow at the fastest rate of 19.1% over the forecast period, owing to increasing integration of data analytics, AI, and machine learning to present actionable insights to patients and their care providers. For instance, the Nuance Mix by Nuance Communications, Inc. is a conversational AI tooling platform with deep learning‑based speech and NLU technologies. In September 2021, Leidos partnered with Nuance to integrate the latter’s platform and omnichannel development tools to design and deliver custom patient engagement solutions.

End-use Insights

The providers segment held the largest revenue share of over 47.0% in 2023. Providers serve the largest volume of patients and are also primary line of treatment for consultation from general to specialist health concerns. These end-users are, thus, largest adopters of patient engagement solutions. In December 2021, Northwell Health in the U.S. deployed a patient engagement platform by Playback Health at its select clinical sites to promote mobility and share point-of-care medical data while adhering to security standards for health information.

The payers segment is estimated to expand at the fastest rate of 18.0% over the forecast period. Growth of the payer's segment can be attributed to increasing adoption of patient and customer engagement solutions that promote widespread coverage and enable value-based care delivery. To enhance growth, the payers intend to manage patient care and connect patients at each stage of the treatment.

Therapeutic Area Insights

Chronic disease management dominated the market in 2023 with a revenue share of over 44.7%. Rising geriatric population in key markets, prevalence of chronic diseases, and adoption of digital technologies catalyzed by COVID-19 pandemic have contributed to a large share of the segment. Patient engagement solutions support chronic disease management by facilitating prevention and detection of the condition, along with managing the condition with the provider or through self-management.

The health and wellness segment is anticipated to expand at the fastest rate of 18.0% over the forecast period, owing to initiatives by key companies, expansion of product offerings to cover mental health, weight management, and pregnancy, and increasing research activities. In June 2023, Cardinal Health finalized an agreement to contribute its Outcomes business to Transaction Data Systems, enhancing patient engagement and clinical pharmacy solutions. This expanded connections between payers and pharmaceutical companies in its extensive nationwide pharmacy network.

Application Insights

Outpatient health management dominated the market and held a revenue share of over 39.0% in 2023. The other application segment, which includes R&D and preventive care, is anticipated to expand at the fastest rate of 18.0% over the forecast period. Patients diagnosed with chronic disorders need to be monitored and kept updated about managing their ailment. The rising healthcare consumerism has also led to patients becoming more involved in care planning, tracking, and optimization.

Patient engagement solutions also help patients connect with their healthcare providers remotely, enabling the streamlined flow of information, patient feedback, and other health-related data. In November 2019, the CDC funded 13 state arthritis management and prevention programs to improve the quality of life and patient monitoring for rural arthritis patients. Adoption of patient engagement solutions for R&D by medical devices, pharmaceuticals, and other life science companies is estimated to grow notably owing to increasing product availability and demand.

Regional Insights

North America held the largest revenue share of over 35.0% in 2023 due to presence of key players, increasing adoption of mhealth and EHR, and growing investment in patient engagement software by major companies. Increasing awareness levels and government spending on healthcare sector are expected to accelerate the growth. Europe held the second-largest share in 2023 owing to publicly funded systems such as the UK National Health Services (NHS). By 2020, the NHS planned to go completely paperless and provide patients access to EHRs since 2018.

The Asia Pacific market is expected to register a lucrative growth rate of 19.2% during the estimated period. The growing penetration of internet and smartphone users, a large patient population, improving healthcare infrastructure and care quality, and presence of local players are some key factors anticipated to offer lucrative growth opportunities to the market over the forecast period. In addtion, economic development in countries such as India and China supports this region's growth.

Key Companies & Market Share Insights

The market for patient engagement solutions has been characterized by intense competition owing to the presence of large and small businesses. Key participants are holding a significant share of the market. Major players are aiming at implementing new approaches such as geographic penetration,new product/solution development, mergers & acquisitions, partnerships, and strategic collaborations to expand their market footprint.

For instance:

-

In December 2022, EnlivenHealth, the retail pharmacy solutions division of Omnicell, Inc., introduced the Patient Engagement Network (PEN). This comprehensive solution integrates EnlivenHealth's national pharmacy network with advanced data insights and digital engagement technologies, aiming to enhance patient health outcomes, boost brand loyalty, and drive revenue growth.

-

In March 2022, UST and Well-Beat, an Israeli start-up, collaborated to create a pioneering digital patient engagement SaaS solution. Compatible with existing Electronic Health Record (EHR) systems and connected devices, the solution eliminates the need for changes to clinical workflows or onboarding to a new platform. Administrators gain a blockchain-based patented tool to assess the patient ecosystem, enhancing existing EHR capabilities through a unique set of APIs.

-

In March 2020, PatientPoint, an engagement solutions provider, introduced three new digital products— hospital bedside tablet PatientPoint Interact—Hospital, mobile solution PatientPoint Extend, and the adherence-focused infusion suite tablet PatientPoint Infuse. These extend the digital footprint of patient education and engagement, enhancing communication across additional points of care.

Key Patient Engagement Solutions Companies:

- Cerner Corporation (Oracle)

- NextGen Healthcare, Inc.

- Epic Systems Corporation

- Allscripts Healthcare, LLC

- McKesson Corporation

- ResMed

- Koninklijke Philips N.V.

- Klara Technologies, Inc.

- CPSI

- Experian Information Solutions, Inc.

- athenahealth, Inc.

- Solutionreach, Inc.

- IBM

- MEDHOST

- Nuance Communications, Inc.

Patient Engagement Solutions Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 26.4 billion

Revenue forecast in 2030

USD 70.3 billion

Growth rate

CAGR of 17.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Delivery type, component, functionality, therapeutic area, application, end-use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia;Kuwait; UAE

Key companies profiled

Cerner Corporation (Oracle); NextGen Healthcare, Inc.; Epic Systems Corporation; Allscripts Healthcare, LLC; McKesson Corporation; ResMed; Koninklijke Philips N.V.; Klara Technologies, Inc.; CPSI; Experian Information Solutions, Inc.; athenahealth, Inc.; Solutionreach, Inc.; IBM; MEDHOST; Nuance Communications, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Patient Engagement Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global patient engagement solutions market report based on delivery type, component, functionality, therapeutic area, application, end-use, and region:

-

Delivery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Web & Cloud-based

-

On-premise

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software & Hardware

-

Standalone

-

Integrated

-

-

Services

-

Consulting

-

Implementation & Training

-

Support & Maintenance

-

Others

-

-

-

Functionality Outlook (Revenue, USD Million, 2018 - 2030)

-

Communication

-

Health Tracking & Insights

-

Billing & Payments

-

Administrative

-

Patient Education

-

Others

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Health & Wellness

-

Chronic Disease Management

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Population Health Management

-

Outpatient Health Management

-

In-patient Health Management

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Payers

-

Providers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global patient engagement solutions market size was estimated at USD 22.7 billion in 2023 and is expected to reach USD 26.4 billion in 2024.

b. The global patient engagement solutions market is expected to grow at a compound annual growth rate of 17.7% from 2024 to 2030 to reach USD 70.3 billion by 2030.

b. North America held over 35.0% of the patient engagement solutions market in 2023. The large share of the North American region is due to the presence of key players, increasing adoption of mhealth & EHR, and growing investment in patient engagement software by the major companies. Moreover, increasing awareness level coupled with government spending on the healthcare sector is further expected to accelerate the growth.

b. Some key players operating in the patient engagement solutions market include Cerner Corporation (Oracle); NextGen Healthcare, Inc.; Epic Systems Corporation; Allscripts Healthcare, LLC; McKesson Corporation; ResMed; Koninklijke Philips N.V.; Klara Technologies, Inc.; CPSI; Experian Information Solutions, Inc.; athenahealth, Inc.; Solutionreach, Inc.; IBM; MEDHOST; and Nuance Communications, Inc.

b. Key factors that are driving the patient engagement solutions market growth include increasing adoption of EHR & mhealth solutions, the prevalence of chronic diseases, supportive initiatives by key market stakeholders, and consumerism in healthcare

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."