- Home

- »

- Medical Devices

- »

-

Patient Handling Equipment Market Size, Share Report, 2030GVR Report cover

![Patient Handling Equipment Market Size, Share & Trends Report]()

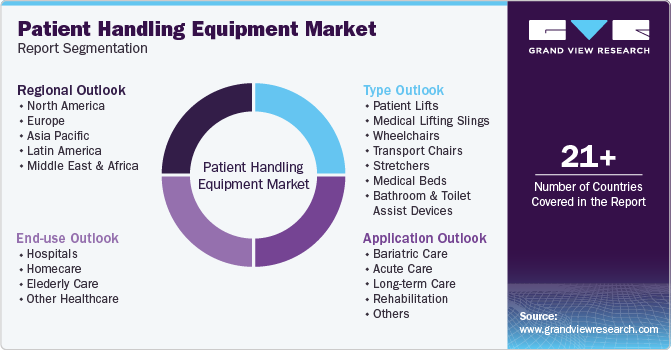

Patient Handling Equipment Market Size, Share & Trends Analysis Report By Type (Wheelchairs, Medical Lifting Slings), By Application (Bariatric Care, Long Term Care), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-025-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Patient Handling Equipment Market Trends

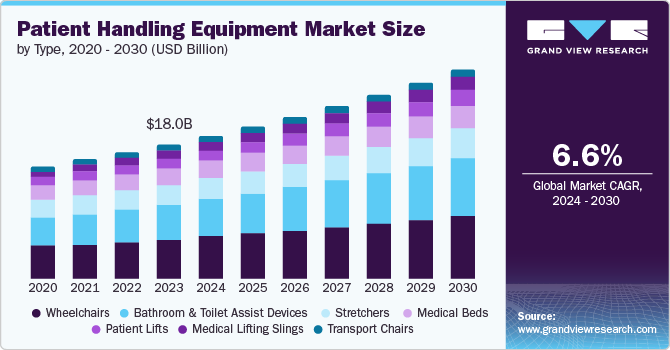

The global patient handling equipment market was valued at USD 18.0 billion in 2023 and is expected to grow at a CAGR of 6.6% from 2024 to 2030. This is attributable to the globally increasing elderly population, which has necessitated advanced care solutions to assist with mobility in healthcare facilities. Patient handling equipment has played a pivotal role in enhancing the quality and safety of healthcare delivery. These specialized devices ensure safe patient transport and positioning.

In addition, the increasing prevalence of conditions, including obesity and arthritis, has increased the demand for safe patient handling during transfers, repositioning, and mobility support. These devices minimize physical strain on healthcare staff and reduce the risk of injuries. Additionally, the rising awareness of quality care among patients has driven the adoption of these devices.

The rapid technological progress in the healthcare sector has considerably driven the market growth. Features, including better ergonomics, automation, and digital monitoring, have attracted investments from healthcare institutions. Hospitals have increasingly integrated advanced features to enhance patient comfort, safety, and efficiency.

Moreover, governments are increasingly emphasizing worker safety in healthcare settings. Several regulations from government initiatives have encouraged healthcare facilities to adopt mechanical aids, including lifts, transfer chairs, and stretchers, instead of manual lifting. As a result, compliance with safety guidelines has driven the adoption of patient-handling equipment.

Type Insights

Wheelchairs have registered for the dominant market share, with 28.7% in 2023. The growing aged population and people with reduced mobility seek wheelchairs as a primary supportive mobility solution. The rising awareness of accessibility rights drives demand for wheelchair-friendly infrastructure. Manufacturers have developed customized features in wheelchairs with lightweight materials and adjustable designs to enhance patient comfort. In addition, healthcare facilities heavily rely on wheelchairs to serve patients with chronic conditions, including arthritis and spinal injuries, as these necessitate long-term wheelchair use. Furthermore, the market has witnessed growth due to rapid technological advancements. Innovations, including electric-powered wheelchairs, intelligent controls, and ergonomic designs, improve user experience, ease of movement, and overall quality of life.

Medical lifting slings are expected to emerge as the fastest-growing segment during the forecast period. The increasing prevalence of chronic disorders among the geriatric population has primarily driven the demand for medical lifting slings. Elderly individuals at a higher risk of musculoskeletal conditions, including arthritis and fractures, necessitate safe patient handling. As the global aging population is expected to double by 2050, the need for these slings will rise significantly. Medical lifting slings assist disabled individuals and enhance their quality of life. Furthermore, regulations emphasizing patient safety during manual lifting have led healthcare providers to use lifting slings.

Application Insights

Bariatric care has dominated the market in 2023 owing to the increasing senior population and obesity rates. Bariatric patients require specialized handling solutions due to their weight and mobility challenges. They require tailored patient-handling equipment. Moreover, hospitals, clinics, and home care settings have increasingly invested in equipment designed for heavier patients, such as bariatric beds, lifts, and slings, to enhance patient comfort and safety. In addition, government regulations have encouraged the adoption of bariatric-specific equipment to prevent injuries during patient handling, further contributing to the market growth.

Long-term care is anticipated to grow substantially at a CAGR of 7.4% during the forecast period. The growing elderly population requires specialized long-term care owing to chronic health conditions such as arthritis, dementia, and mobility impairments. Long-term care facilities use lifts, slings, and transfer aids to ensure safe patient mobility. Additionally, these care settings adopt mechanical aids to reduce strain on staff and risk of injuries and enhance patient well-being. Healthcare manufacturers have introduced innovative patient-handling devices such as electric lifts, intelligent controls, and ergonomic designs to optimize long-term care.

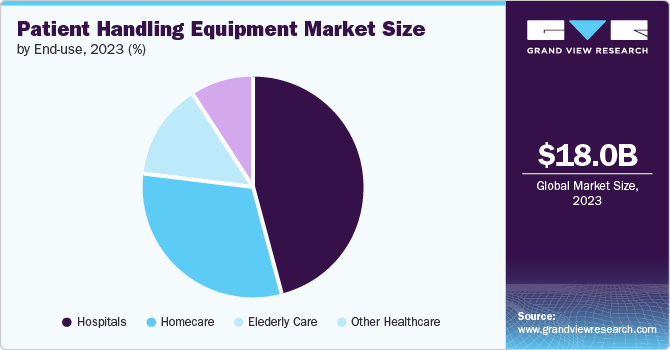

End Use Insights

Hospitals secured the dominant market share with 46.4% in 2023 due to the geriatric population's increasing prevalence that necessitates specialized patient handling equipment. The market witnessed hospitals increasingly investing in lifts, slings, and beds to ensure efficient and safe patient positioning. Moreover, stricter regulations on safety norms implemented by governments have led hospitals to adopt advanced equipment that minimizes the risk of injuries to patients and caregivers.

Homecare is expected to emerge as the fastest-growing segment during the forecast period. This can be attributed to the increasing demand for specialized patient-handling home-use equipment. Patients with arthritis, mobility impairments, and post-surgery recovery conditions require safe transfers and positioning. The market witnessed tangible growth in homecare settings, investing in lifts, transfer aids, and adjustable beds to enhance patients' comfort and caregiver support.

Regional Insights

The North America patient handling equipment held the dominant market share, with 36.6% in 2023, owing to strict safety regulations implemented by healthcare institutions that ensure patient safety during handling and transport. Furthermore, manufacturers have increasingly invested in R&D for ergonomic, user-friendly products. They have developed cutting-edge designs to improve caregiver productivity and patient comfort.

U.S. Patient Handling Equipment Market Trends

The patient-handling equipment market in the U.S. was propelled by the increasing prevalence of lifestyle diseases and the growing aged population. This has resulted in strict government regulations to promote patient safety during handling and transport. U.S. manufacturers have increasingly invested in R&D activities to develop multifunctional, ergonomic, user-friendly, affordable devices and drive market expansion.

Europe Patient Handling Equipment Market Trends

The Europe patient handling equipment market secured a market share of 30.8% in 2023. The region boasts multiple healthcare facilities equipped to handle patient needs with advanced equipment. In addition, European countries increasingly prioritize patient safety through regulations and policies, including safe patient handling programs, minimal lift policies, and reduced caregiver injuries.

Asia Pacific Patient Handling Equipment Market Trends

The Asia Pacific patient handling equipment market accounted for 19.7% of the market share and is expected to emerge substantially over the forecast period. The region's growing patient population with chronic conditions such as arthritis, stroke, and mobility impairments drive demand. These patients benefit from assistive equipment, including motorized wheelchairs, electric beds, and sophisticated transfer devices for safe movement. Additionally, the growing awareness of safety during manual handling has fueled the adoption of patient-handling equipment for enhanced patient outcomes.

Key Patient Handling Equipment Company Insights

The patient handling equipment market exhibits fierce competition with key market players increasingly active in strategic collaborations, product launches, acquisition initiatives, and technological advancements.

-

Stryker Corporation is a medical technology firm that caters to comprising reconstructive, medical & surgical, and neurotechnology/spine. Their product portfolio includes surgical equipment and navigation systems, implants for trauma surgeries/joint replacement, emergency medical patient handling equipment, communications, and imaging systems, and endoscopic systems.

-

Hill-Rom is a global manufacturer and provider of medical technologies known for its hospital furniture, beds, and medical equipment. The company’s products and solutions segment offer handling solutions, non-invasive therapeutic products for acute and chronic conditions, and patient support systems.

Key Patient Handling Equipment Companies:

The following are the leading companies in the patient handling equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Stryker Corporation

- Hill-Rom Holdings, Inc.,

- Invacare Corporation

- Getinge Group

- ArjoHuntleigh, Inc.,

- Joerns Healthcare, Inc.,

- Stiegelmeyer, Inc.

- Benmor Medical Ltd.

- Prism Medical Ltd.

- Etac Ltd.

- Mangar International Ltd.

- Linet Americas, Inc.

Recent Development

- In March 2024, Stryker Corporation expanded its prototype and testing facility in India. This strategic move signified substantial growth in its research and development (R&D) presence within the country.

Patient Handling Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.2 billion

Revenue forecast in 2030

USD 28.2 billion

Growth rate

CAGR of 6.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Kuwait, Saudi Arabia, UAE

Key companies profiled

Stryker Corporation; Hill-Rom Holdings, Inc.; Invacare Corporation; Getinge Group; ArjoHuntleigh, Inc.; Joerns Healthcare, Inc.; Stiegelmeyer, Inc.; Benmor Medical Ltd.; Prism Medical Ltd; Etac Ltd.; Mangar International Ltd; Linet Americas, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Patient Handling Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global patient handling equipment market report based on type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Patient Lifts

-

Medical Lifting Slings

-

Wheelchairs

-

Transport Chairs

-

Stretchers

-

Medical Beds

-

Bathroom & Toilet Assist Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bariatric Care

-

Acute Care

-

Long-term Care

-

Rehabilitation

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Homecare

-

Elederly Care

-

Other Healthcare

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."