- Home

- »

- Next Generation Technologies

- »

-

Payment Security Market Size & Share Analysis Report, 2030GVR Report cover

![Payment Security Market Size, Share & Trends Report]()

Payment Security Market (2023 - 2030) Size, Share & Trends Analysis Report By Solution (Encryption, Tokenization, Fraud Detection & Prevention), By Platform, By Organization, By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-507-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global payment security market was valued at USD 23.13 billion in 2022 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 13.9% from 2023 to 2030. The growth is driven by the need to protect consumer data, comply with regulations, and keep up with the evolving threat landscape. With advancements in technology, cybercriminals are becoming more sophisticated in their attacks. This has driven the development of new and more advanced payment security solutions to keep up with the evolving threat landscape.

Additionally, the rising adoption of smartphones and the growing preference for contactless payments worldwide are expected to drive the market's growth. Mobile payment options are fast and convenient to use. Customers can make payments quickly and easily using their smartphones without needing cash or physical cards. This convenience has made mobile payments an attractive option for consumers.

The rise of fintech has positively affected the payment security market. Fintech companies have invested heavily in developing new and improved payment security trends, such as two-factor authentication, biometric authentication, and tokenization. These trends or payment measures are designed to enhance the security of digital payments and protect against fraud. Additionally, fintech companies have raised awareness about the importance among consumers. As a result, customers are more likely to demand secure payment options and are willing to pay a premium for secure transactions.

Regulatory compliances play a crucial role by establishing standards and requirements that must be met to ensure the confidentiality, integrity, and availability of payment systems and data. Compliance with these regulations helps to prevent fraud, data breaches, and other security incidents that can compromise sensitive financial information and damage the reputation of payment providers and merchants. For instance, Payment Card Industry Data Security Standard (PCI DSS) sets requirements for organizations that process, transmit, or store cardholder data. PCI DSS compliance includes network security, access controls, data encryption, and regular testing and monitoring of payment systems.

Data breaches are becoming more frequent and severe with cybercriminals using increasingly sophisticated methods to steal sensitive information such as payment card data, Personally Identifiable Information (PII), and financial records. This puts individuals and businesses at risk of financial loss, identity theft, and reputational damage. The market must address these concerns to maintain trust in digital payment systems and prevent fraud. One of the main challenges for providers is to keep pace with cybercriminals' constantly evolving tactics and strategies. As these cybercriminals become more sophisticated in their methods, payment security providers must develop more advanced solutions to protect against them. This requires significant investment in research and development to stay ahead of emerging threats, which can be costly.

COVID-19 Impact Analysis

The COVID-19 pandemic positively impacted the growth of the market. According to the Red Book Statistics from the BIS Committee on Payments and Market Infrastructures (CPMI), the COVID-19 pandemic accelerated payment digitization. Consumers migrated from physical cash to contactless and digital payment instruments. Retailers were increasingly making efforts to use digital payments amid the COVID-19 pandemic. According to a report released by World Bank in November 2021, During the COVID-19 pandemic, the private sector shifted to electronic payments and finance.

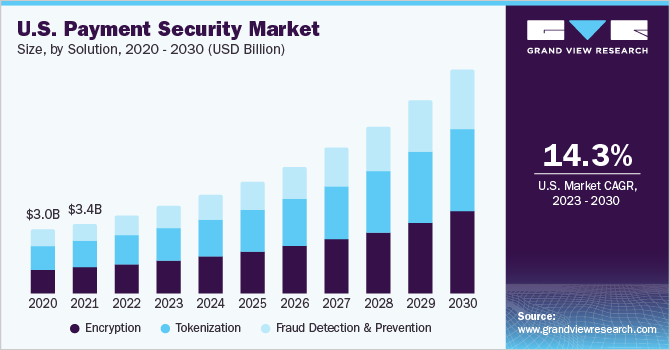

Solution Insights

The fraud detection & prevention segment dominated the market in 2022 and accounted for a revenue share of more than 52.0%. Fraud is one of the most significant threats to payment systems and data security. Fraud can occur in various forms, including card-not-present fraud, identity theft, account takeover, and social engineering attacks. As payment systems become more complex and transactions move online, the risk of fraud also increases, making fraud detection and prevention solution a critical aspect of payment security.

The tokenization segment is anticipated to register significant growth in the forecast period. Tokenization of payment methods enhances security and ease of use while transacting across various devices, including secure point-of-sale, on-the-go payments, traditional online shopping, and in-app payment systems. Payment tokenization replaces sensitive payment card data, such as the card number and expiration date, with a unique token identifier. The token is used for payment processing and can be securely stored on various devices, such as smartphones, wearables, or computers, to enable quick and easy payments across different channels and platforms.

Platform Insights

The POS based/mobile based segment dominated the market in 2022 and accounted for a revenue share of more than 57.0%. POS (Point of Sale) and mobile-based payment systems are widely used in various industries, including retail, hospitality, healthcare, and transportation. These systems enable merchants and consumers to process payments quickly and securely using various devices such as smartphones, tablets, and POS terminals. POS based/mobile based payment systems are vulnerable to a wide range of security threats, including card skimming, data breaches, malware attacks, and social engineering scams. As a result, payment security vendors have developed a wide range of solutions, such as encryption, tokenization, fraud detection, and multi-factor authentication, to protect these systems and ensure the security of payment transactions.

The web based segment is anticipated to register significant growth in the forecast period. The growth of the segment can be attributed to the increasing adoption of online payments and e-commerce. Web-based payment systems enable consumers to make payments online using their desktop or mobile devices without visiting a physical location or using a specific payment terminal. This convenience has significantly increased online transactions, making web-based payment systems a critical component of the overall payment ecosystem.

Organization Insights

The large enterprises segment dominated the market in 2022 and accounted for a revenue share of over 67.0%. Payment security is a critical aspect of business operations, and it is essential to have strong security measures in place to protect sensitive customer data and prevent fraud. Large enterprises typically have more resources to invest in the latest security technologies and systems. Additionally, large enterprises tend to have a higher volume of transactions and a more extensive customer base, which increases the risk of fraud and cyber-attacks. As a result, they are more likely to prioritize investment in advanced security measures to protect their business and customers.

The small & medium-sized enterprises (SMEs) segment is anticipated to register significant growth. The growth of the segment can be attributed to the increasing adoption of digital payment solutions, such as mobile payments, e-commerce platforms, and online payment gateways, to streamline their payment processes and reach a broader customer base. In April 2022, Microsoft surveyed above 150 small and medium enterprises in the U.S. to help understand their security needs. According to the survey, more than 70% of SMEs cyber threats and payment securities are becoming more of a business risk with nearly 25% of small businesses reporting a security breach in the previous year.

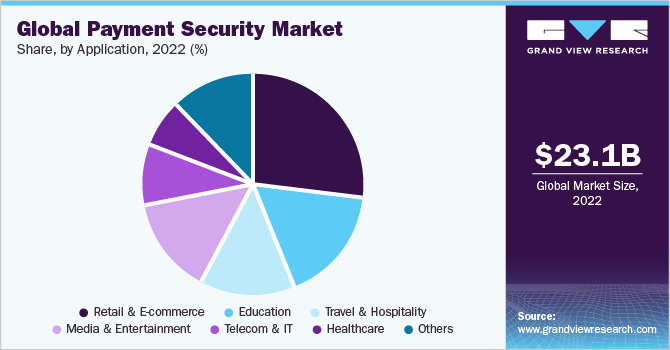

Application Insights

The retail & e-commerce segment dominated the market in 2022 and accounted for a global revenue share of over 26.0%. One of the main reasons is the significant growth of online retail and e-commerce over the past decade, which has led to an increased demand for secure payment processing solutions. As consumers increasingly shop online, they must feel confident that their payment information is safe and secure. Retail and e-commerce companies have responded to this demand by investing heavily in payment security technologies and solutions. They have developed sophisticated fraud detection and prevention systems that use machine learning algorithms and other advanced techniques to identify and prevent fraudulent transactions.

The education segment is anticipated to register significant growth in the forecast period. The education sector is increasingly adopting digital payment solutions, such as online tuition payment portals and mobile payment apps, to streamline payment processes and improve the overall payment experience for students and their families. Adopting digital payment solutions has increased the demand for payment security in the education sector. Additionally, cybercriminals often target educational institutions as they hold large amounts of sensitive information and are perceived to have weaker security measures than other industries. This makes it crucial for educational institutions to invest in robust solutions to protect against these threats.

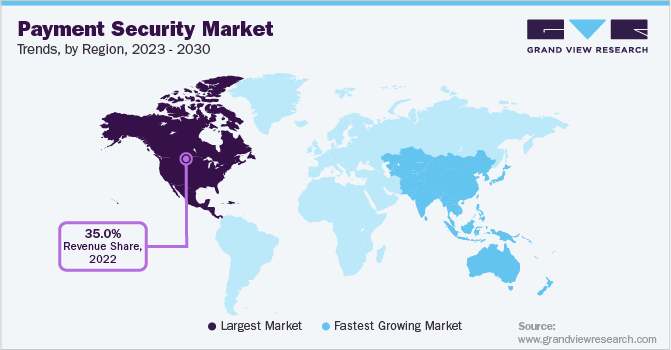

Regional Insights

North America dominated the payment security market in 2022 and accounted for a revenue share of more than 35.0%. The presence and focus of prominent payment security providers, such as Visa Inc., U.S. Bancorp, Mastercard, and Shift4, make North America a promising market for payment security. Moreover, the increasing adoption of digital payment for payments in malls and restaurants has increased growth opportunities for vendors and providers in the region, boosting the North America regional market growth. Additionally, the well-established IT industry in North America encourages technical innovation and new growth strategies, which are used to boost the adoption of a digital payment platform.

Asia Pacific is anticipated to emerge as the fastest-growing market from 2023 to 2030. The region’s growth can be attributed to the increasing number of regulatory requirements and compliance standards for payment security. Many Asia Pacific countries such as China, India, and Japan, have implemented strict regulations and guidelines for payment security, leading to the market's growth. For instance, the Indian government established the Payments Infrastructure Development Fund (PIDF) in January 2021 and deployed quick digital payment services such as Unified Payments Interface (UPI) and BHIM. Authorities have been guiding the payments industry through litigation and regulations to raise a competitive environment that prioritizes consumer protection.

Key Companies & Market Share Insights

The latest trends adopted by payment security providers are multi-factor authentication, tokenization, machine learning, artificial intelligence, end-to-end encryption, fraud detection and prevention, and blockchain technology. Providers are adopting blockchain technology to enhance the security of transactions. Blockchain technology creates a decentralized and transparent ledger of transactions that is difficult to manipulate or tamper with. Additionally, the providers are adopting multi-factor authentication by requiring customers to provide additional information or use biometric factors such as facial recognition or fingerprints to authenticate transactions.

Prominent companies are aggressively investing in strategic initiatives, such as partnerships, mergers and acquisitions, and product launches, to stay ahead of the competition and offer innovative solutions to their customers. For instance, in April 2022, Bluefin Payment Systems announced the deployment of the company’s PCI-validated point-to-point encryption (P2PE) system at 458 car cleaning locations across the U.S. in partnership with Datacap and DRB. The partnership is part of a multi-location P2PE venture with a leading C-store brand, Phase I, which includes the installation of the car wash. P2PE for the pump and the omnichannel C-store environment would follow later. The solution would benefit customers in the form of a 90% reduction in PCI scope while ensuring the highest level of data protection for consumers' credit card data. Some of the prominent players in the global payment security market include:

-

Elavon Inc.

-

Ingenico

-

Utimaco Management GmbH

-

Shift4 Payments Inc.

-

Mastercard

-

Intelligent Payment Solutions Pvt Ltd.

-

TokenEx, LLC

-

Paypal Holdings, Inc.

-

Bluefin Payment Systems

-

Visa Inc.

Payment Security Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 25.82 billion

Revenue forecast in 2030

USD 64.34 billion

Growth rate

CAGR of 13.9% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Solution, platform, organization, application, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Turkey; Sweden; Spain; Poland; China; India; Japan; South Korea; Taiwan; Thailand; Malaysia; Singapore; Indonesia; Australia; Brazil; Argentina; Kingdom of Saudi Arabia (KSA); UAE; Egypt; South Africa

Key companies profiled

Elavon Inc.; Ingenico; Ultimaco Management Gmbh; Shift4 Payment Inc.; Mastercard; Intelligent Payment Solutions Pvt Ltd.; TokenEx, LLC; Paypal Holdings, Inc.; Bluefin Payment Systems; Visa Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Payment Security Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global payment security market report based on solution, platform, organization, and application and region.

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

Encryption

-

Tokenization

-

Fraud Detection & Prevention

-

-

Platform Outlook (Revenue, USD Million, 2017 - 2030)

-

Web Based

-

POS Based/Mobile Based

-

-

Organization Outlook (Revenue, USD Million, 2017 - 2030)

-

Small & Medium-Sized Enterprises (SMEs)

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail & E-commerce

-

Travel & Hospitality

-

Healthcare

-

Telecom & IT

-

Education

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Turkey

-

Sweden

-

Spain

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

Thailand

-

Malaysia

-

Singapore

-

Indonesia

-

Australia

-

-

South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

Egypt

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global payment security market size was estimated at USD 23.13 billion in 2022 and is expected to reach USD 25.82 billion in 2023.

b. The global payment security market is expected to grow at a compound annual growth rate of 13.9% from 2023 to 2030 to reach USD 64.34 billion by 2030.

b. Retail & e-commerce application dominated the payment security market with a share of 26.9% in 2022. This is attributable to the rising smartphone usage, adoption of 4G technology, and increasing consumer spending power.

b. Some key players operating in the payment security market include Elavon Inc.; Ingenico; Ultimaco Management Gmbh; Shift4 Payment Inc.; Mastercard; Intelligent Payment Solutions Pvt Ltd.; TokenEx, LLC; Paypal Holdings, Inc.; Bluefin Payment Systems; and Visa Inc.

b. Key factors that are driving the market growth include booming e-commerce and retail industry in Asia Pacific, need for PCI DSS compliance, increasing spending of consumers on travel and hospitality, and advent of artificial intelligence (AI) and machine learning.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.