- Home

- »

- Next Generation Technologies

- »

-

Peer-To-Peer Electric Vehicle Charging Market Report, 2030GVR Report cover

![Peer-To-Peer Electric Vehicle Charging Market Size, Share & Trends Report]()

Peer-To-Peer Electric Vehicle Charging Market Size, Share & Trends Analysis Report By Charger Type (Level 1, Level 2), By Application (Residential, Commercial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-218-1

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global peer-to-peer electric vehicle charging market size was valued at USD 128,927.3 thousand in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 22.3% from 2023 to 2030. Factors such as the growing demand for electric vehicles worldwide and government policies and subsidies for purchasing electric vehicles and establishing charging infrastructure have led to an increase in the demand for peer-to-peer electric vehicle charging stations. According to a study by the European Association of Automobile Manufacturers (ACEA), the Netherlands, Germany, and France collectively account for nearly 70% of the region’s EV charging stations in 2020. Moreover, in 2020, electric vehicle sales in Europe grew by 89%, which is further expected to contribute to the growth of the market.

Various EV manufacturers and Original Equipment Manufacturers (OEMs) are making efforts to strengthen the interoperability of electric vehicles and charging infrastructure, which is further expected to enhance peer-to-peer charging networks. Additionally, governments across the globe are consistently allocating the necessary space for establishing electric vehicle charging infrastructure in residential places, which is likely to provide lucrative opportunities to the market. For instance, in March 2021, the Government of India directed that buildings in New Delhi, such as hotels, hospitals, and malls, with parking facilities of more than 100 vehicles need to reserve 5% of the parking space for electric vehicles and charging points.

Numerous companies are focusing on partnerships with utility and energy companies to expand the reach of their peer-to-peer EV charging solutions. For instance, in January 2020, EVmatch announced the pilot project with utilities based in the U.S. state of Vermont, including Green Mountain Power and Burlington Electric Department, to make EV charging available to multi-family residences affordably and logically for property owners. Apartment owners are also increasingly adopting EV charging stations to earn extra revenue, recoup electricity costs, and attract new tenants. For instance, Park Plaza Apartments in the Mountain View area and Revere Apartments in the Campbell area in California have started offering EVmatch’s level 2 charging access to the general public and tenants.

To address range anxiety issues related to electric vehicles, governments across the globe are focusing on providing funds for the development of peer-to-peer networks. For instance, the U.S. government has developed the Northeast Corridor Regional Strategy, through which it provides support for the integration and development of peer-to-peer electric vehicle charging networks and electrical vehicle charging infrastructures. Government grants provided to promote the adoption of EV charging stations are expected to create new opportunities for the market in the near future. For instance, in June 2020, EVmatch received funds from Silicon Valley Clean Energy (SVCE), an electricity provider, for installing 8 EV chargers across multifamily properties across SVCE’s thirteen-member communities in the U.S. by 2021.

Several companies are introducing peer-to-peer charging stations aimed to improve the customer experience. For instance, in October 2021, REVOS, an EV infrastructure provider, announced the launch of the Bolt, a peer-to-peer charging point compatible with any portable EV charger. The company is also planning to install more than one million EV charging points across 500 cities in India and other emerging markets. Such factors bode well for the growth of the market over the forecast period.

COVID-19 Impact Analysis

The COVID-19 pandemic has resulted in governments globally emphasizing the implementation of stringent lockdowns. Multiple industries are facing significant challenges owing to the pandemic and the subsequent global economic slowdown. The pandemic has also had a severe impact on the electric vehicle charging infrastructure market across the globe. All modes of transportation experienced losses due to their limited operability during lockdowns. This has caused limited usage of electric vehicle charging stations at malls and complexes.

Moreover, the global economic crisis is also likely to affect investments toward the development of smart cities, EV charging networks, and various industries and sectors such as automotive, electronics, and power. This factor is likely to impact the growth of the market in the next two years. Additionally, a decrease in the production of EVs owing to the shortage of lithium-ion cells in countries such as India, Brazil, and the U.K. has significantly affected the market growth.

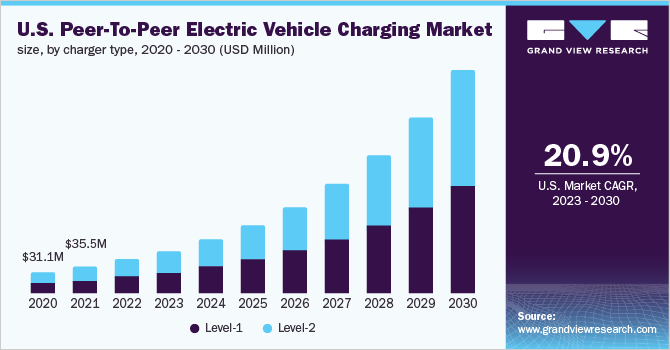

Charger Type Insights

The level 2 segment dominated the market in 2021 and accounted for more than 73.0% share of the global revenue in 2022. The segment growth can be attributed to the increase in the adoption of level 2 chargers among corporates such as The Coca-Cola Company and GENERAL MOTORS. Furthermore, electricity providers are emphasizing the establishment of partnerships with peer-to-peer EV charging software developers to develop level 2 chargers for public and tenant use. For instance, in June 2020, Silicon Valley Clean Energy (SVCE) announced its partnership with EVMATCH, INC. Through this partnership, EVMATCH, INC developed and installed eight wi-fi connected level 2 electric vehicle charging stations for both public and tenant use in Santa Clara. SVCE provided funding to cover the infrastructure cost for each multi-unit dwelling that participated in the pilot program.

The level 1 segment is anticipated to register significant growth over the forecast period. The segment growth can be attributed to a rise in the number of government initiatives such as the Workplace Charging Challenge. The Workplace Charging Challenge focuses on adding level 1 chargers at private company workplaces under their P2P network. Under this initiative, the U.S. Department of Energy has covered level 1 chargers at facilities of private organizations such as Hewlett Packard Enterprise Development LP and Thomas College across their P2P networks.

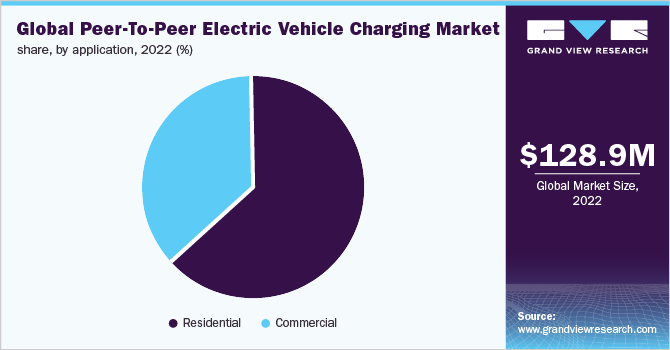

Application Insights

The residential segment led the market and accounted for more than 61.0% share of the global revenue in 2022. The segment growth can be attributed to the increase in emphasis of Original Equipment Manufacturers (OEMs) on the expansion of residential chargers specific to peer-to-peer networks. For instance, in October 2020, Enel X announced the launch of JuiceBox, an electric vehicle charger that can be used in parking spaces at homes. JuiceBox can be remotely managed through the Enel X JuicePass app.

The commercial segment is anticipated to register the fastest growth rate over the forecast period. The rising demand for EV charging stations in commercial buildings globally is chiefly attributed to the promising growth prospects of the segment. For instance, a joint contract was awarded to EVE Australia Pty Ltd. and AGL Energy for the development of P2P networks at various commercial buildings across the Australian cities of Brisbane and Melbourne. Moreover, petroleum refinery companies are also making efforts to set up electric vehicle charging stations across complexes, malls, corporate tech parks, and hotels. For instance, in November 2021, Indian Oil Corporation Limited announced that it has planned to set up 10,000 electric vehicle charging stations across India at malls, complexes, and corporate offices by 2024. Such factors bode well for the growth of the segment.

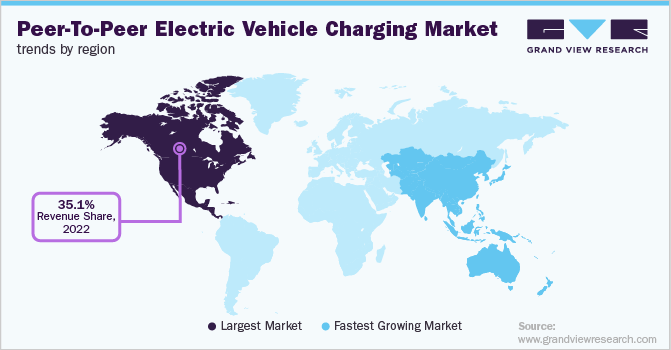

Regional Insights

The North American region dominated the peer-to-peer electric vehicle charging market and accounted for over 35.1% share of the global revenue in 2022. The market growth can be attributed to the increasing number of companies operating in the peer-to-peer electric vehicle charging space across the region. Moreover, electric vehicle charging station manufacturers are extending partnerships with car manufacturers to provide a seamless charging experience. For instance, in March 2021, Charge Point announced the extension of its partnership with Volvo to launch an in-car Charge Point app and provide seamless charging functionality to Volvo car drivers. This app would help drivers locate the charging stations in North America from the vehicle infotainment system.

Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period. Countries are making efforts to boost the sales of electric vehicles, creating opportunities for market growth. The government bodies of China provide incentives to boost the electric vehicle sales of the country. For instance, Guangzhou, a city in China, announced a subsidy of USD 1,552.94 for the vehicles sold in March and the end of December in 2020. At the same time, the state-level subsidy provided to new energy vehicles was extended to 2022. Thus, increasing government efforts toward promoting the sales of electric vehicles in the country are expected to create opportunities for market growth in the coming years.

Key Companies & Market Share Insights

The market is moderately fragmented. Prominent players are pursuing numerous strategies, such as strategic joint ventures and partnerships, product innovation, geographical expansion, mergers & acquisitions, and research & development initiatives, to cement their foothold in the market. Market players are focusing on offering cloud-based solutions to both large and small & medium enterprises. Moreover, these solutions are being particularly designed to help financial firms in managing the assets and wealth of the clients efficiently.

Meanwhile, players in the market are focusing on strategies such as high investments in R&D activities and new product launches. For instance, AeroVironment, Inc. invested approximately 30% of its expenses on R&D activities in FY 2019. Furthermore, in April 2021, Enel X launched the JuiceRoll Race edition charging station for MotoE. In February 2020, ClipperCreek, Inc. updated its HCS-40 charger, which is a level-2 charger suitable for residential and commercial charging stations. The updated products support the compatibility of P2P EV charging. Some prominent players in the peer-to-peer electric vehicle charging market are:

-

Chargepoint Inc.

-

ClipperCreek, Inc.

-

Enel X

-

EVBox

-

EV Meter

-

Greenlots

-

has·to·be gmbh

-

innogy

-

Power Hero

-

Webasto Group

Peer-To-Peer Electric Vehicle Charging Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 156,646.6 thousand

Revenue forecast in 2030

USD 644,982.3 thousand

Growth rate

CAGR of 22.3% from 2023 to 2030

Base year of estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD thousand and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Charger type, application, region

Regional scope

North America; Europe; Asia Pacific; RoW

Country scope

U.S.; Canada; Netherlands; France; Norway; Germany; U.K.; China; South Korea; Japan

Key companies profiled

Chargepoint Inc.; ClipperCreek, Inc.; Enel X; EVBox; EV Meter; Greenlots; has·to·be gmbh; innogy; Power Hero; Webasto Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThe report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the peer-to-peer electric vehicle charging market report based on charger type, application, and region:

-

Charger Type Outlook (Revenue, USD Thousand, 2018 - 2030)

-

Level 1

-

Level 2

-

-

Application Outlook (Revenue, USD Thousand, 2018 - 2030)

-

Residential

-

Private Homes

-

Apartments

-

-

Commercial

-

Destination Charging Station

-

Fleet Charging Station

-

Workplace Charging Station

-

Others

-

-

-

Regional Outlook (Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Netherlands

-

France

-

Norway

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

South Korea

-

Japan

-

-

Rest of the World

-

Frequently Asked Questions About This Report

b. The global peer-to-peer electric vehicle charging market size was estimated at USD 106,719.5 thousand in 2021 and is expected to reach USD 129,397.3 thousand in 2022

b. The global peer-to-peer electric vehicle charging market is expected to grow at a compound annual growth rate of 22.2% from 2022 to 2030 to reach USD 644,982.3 thousand by 2030.

b. North America dominated the peer-to-peer electric vehicle charging market with a share of 35.4% in 2021. This is attributable to the rise in the number of companies in the region that are operating in the P2P market.

b. Some key players operating in the P2P electric vehicle charging market include Chargepoint Inc; ClipperCreek Inc, Inc.; Enel X; EVBox; EV Meter; Greenlots; has·to·be gmbh; Innogy; Power Hero; Webasto Group, and others.

b. Key factors that are driving the P2P electric vehicle charging market growth include the rising need to eliminate range anxiety among electric vehicle drivers and the rise in the number of residential charging stations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."