- Home

- »

- Medical Devices

- »

-

Pen Needles Market Size And Share, Industry Report, 2030GVR Report cover

![Pen Needles Market Size, Share & Trends Report]()

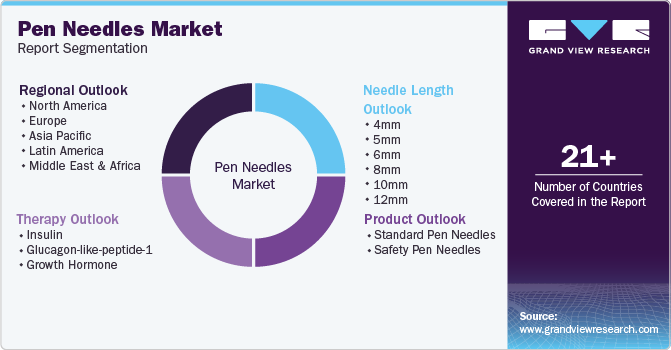

Pen Needles Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Standard Needles, Safety Needles), By Needle Length (4mm, 5mm, 6mm, 8mm, 10mm, 12mm), By Therapy (Insulin, Glucagon-like-Peptide-1), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-427-7

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pen Needles Market Summary

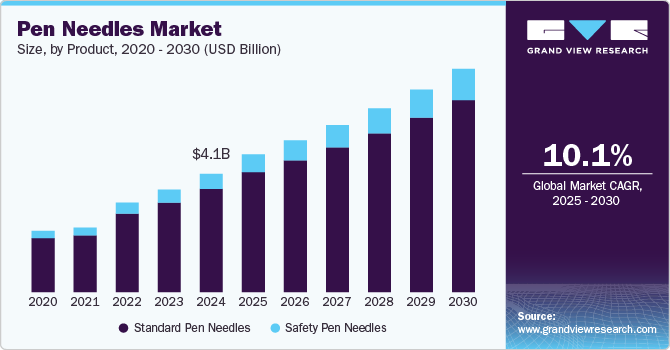

The global pen needles market size was estimated at USD 4.1 billion in 2024 and is projected to reach USD 7.8 billion by 2030, growing at a CAGR of 10.1% from 2025 to 2030. The increasing prevalence of diabetes is driving the demand for pen needles.

Key Market Trends & Insights

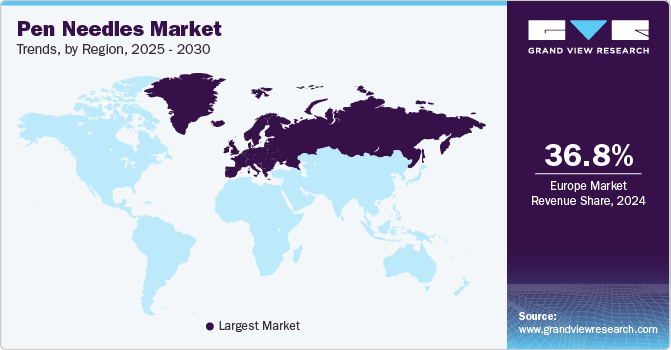

- The pen needles market in Europe dominated the global industry with a 36.8% share in 2024.

- The North American pen needles market held a dominant position, capturing 28.8% of the global revenue share in 2024.

- Based on product, the standard segment dominated the market, accounting for over 87.3% of the revenue share in 2024.

- Based on needle length, 5 mm-sized pen needles accounted for a lucrative market size in 2024, accounting for over 20.6% revenue share in 2024.

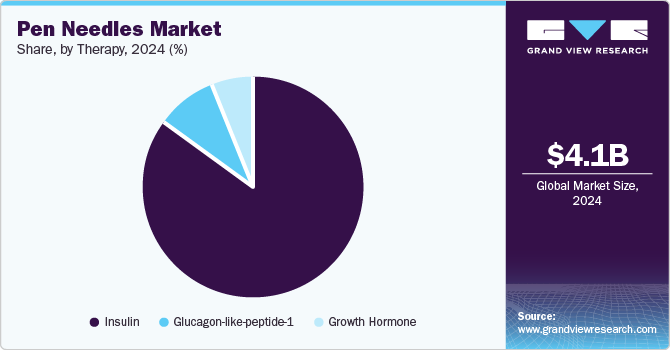

- Based on therapy, the insulin therapy segment dominated the market in 2024 with over 85.2% share and is also expected to showcase lucrative growth over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4.1 Billion

- 2030 Projected Market USD 7.8 Billion

- CAGR (2025-2030): 10.1%

- Europe: Largest market in 2024

With an estimated 642 million people projected to have diabetes by 2040, according to the International Diabetes Federation (IDF), the market for pen needles is poised for significant growth. As diabetes rates rise globally, the demand for efficient insulin delivery solutions is expected to fuel market expansion at a strong rate over the forecast period.Pen injectors are widely used by diabetic individuals to deliver insulin or other medications, making them a preferred choice for diabetes management. The global surge in diabetes cases, particularly linked to the growing obesity epidemic, has greatly influenced the demand for insulin pens and, by extension, pen needles. Obesity is considered a major risk factor for diabetes. According to Diabetes.co.uk, it accounts for 80-85% of the risk of developing Type 2 diabetes. As the global population becomes increasingly obese, the incidence of diabetes has been rising, creating a large demand for insulin delivery devices like pen needles.

Technological advancements in pen needle design have also contributed to the growth of the market. Manufacturers are continually improving the quality, comfort, and effectiveness of pen needles. For example, in 2021, BD (Becton, Dickinson and Company) introduced the BD Nano Ultra-Fine pen needle, a 4 mm needle designed to improve patient comfort and ensure reliable insulin delivery. These innovations are key drivers of market expansion, as they address patient concerns regarding pain, convenience, and safety.

In countries like South Africa, however, there have been significant challenges related to the supply of insulin pens. The National Department of Health (NDoH) in South Africa recently announced, in May 2024, anticipated stock-outs of insulin pen devices, directing health facilities to ration the distribution of insulin pens. This shortage arose after the previous supplier Novo Nordisk failed to meet the demand. As a result, diabetic patients were forced to switch to syringes and vials, a transition that can have serious consequences for their health. Doctors Without Borders (MSF) has raised concerns that this shift could lead to increased complications for people with diabetes, underlining the importance of a steady supply of insulin pens. This situation highlights the growing need for a reliable supply of pen needles and the essential role they play in global diabetes care.

The pen needles market is expected to continue expanding, driven by the increasing global prevalence of diabetes, the growing obesity epidemic, and continuous innovations in needle technology. As more patients switch from syringes to pen needles for insulin delivery, the demand for these devices will remain high. The industry will likely see further advancements that improve patient comfort, safety, and the overall effectiveness of diabetes management. Companies in the pen needles market must continue to focus on product innovation and ensuring a steady supply to meet the needs of a growing diabetic population worldwide.

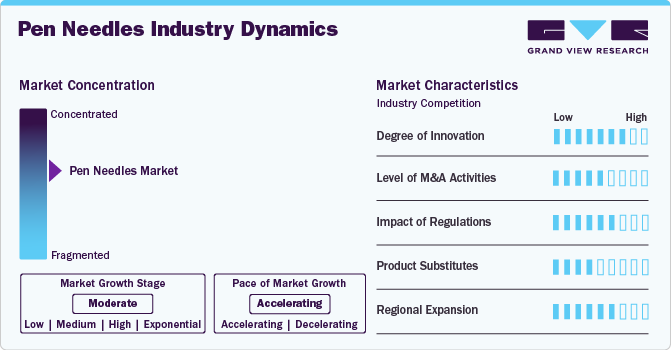

Market Concentration & Characteristics

The industry is moderately concentrated, with a few key players dominating it. Major companies like Becton, Dickinson and Company (BD), Novo Nordisk, and Terumo Corporation hold a significant share due to their strong product portfolios, global presence, and continuous innovation. The industry is characterized by technological advancements, such as ultra-fine needles and improved patient comfort features, driving competition. Additionally, the increasing prevalence of diabetes and the growing demand for efficient insulin delivery systems contribute to the market's expansion. Regulatory requirements and cost pressures also influence market dynamics, affecting product development and pricing strategies.

The degree of innovation in the industry is significant, driven by advancements aimed at improving patient comfort, safety, and ease of use. Innovations include ultra-fine needles, shorter lengths for less discomfort, and designs that reduce the risk of intramuscular injections. Companies are focusing on features like smoother, flatter needle bases for better skin contact and devices that prevent accidental needlestick injuries. For instance, in November 2024, evercare pen needles were introduced as an innovative solution for type I diabetes patients. These needles offer enhanced comfort, reduce the risk of intramuscular injections, and minimize accidental needlestick injuries. Designed for ease of use, they feature a wider grip, making them particularly beneficial for elderly users.

Regulations, particularly FDA approvals, significantly impact product development, market-entry, and patient safety. The recent FDA 510(k) clearance for KB’s Safety Insulin Pen Needle in January 2024 underscores the importance of regulatory compliance. These clearances enhance product portfolios and ensure that medical devices meet safety standards before reaching the market. Stringent regulations drive innovation, improve device reliability, and provide assurance to healthcare providers and patients, strengthening the industry’s credibility and trust in these essential tools.

Mergers and acquisitions (M&A) have been growing as companies seek to expand their technological capabilities, product portfolios, and market presence. In August 2024, MTD Group acquired Ypsomed's Pen Needles and Blood Glucose Monitoring Systems businesses. This acquisition enhances MTD’s production capacity to over 2.5 billion units and strengthens its diabetes and obesity care portfolio by integrating Ypsomed’s operations into its European network. Such strategic moves enable companies to improve operational efficiency and accelerate innovation, further driving competition and growth within the industry.

Product substitutes refer to alternative methods or devices used for drug delivery, potentially replacing traditional pen needles. These substitutes include insulin pumps, wearable injectors, and jet injectors, which provide alternatives to subcutaneous injections. Insulin pumps, for example, deliver continuous doses of insulin without the need for frequent needle use. Jet injectors use high-pressure air to deliver medication through the skin without a needle. These alternatives are gaining popularity due to their convenience, reduced pain, and enhanced patient compliance. However, pen needles remain a widely used and cost-effective option in diabetes care and other medical treatments.

Regional expansion involves companies targeting new geographic markets to increase their customer base and revenue. As demand for diabetes care and self-injection devices grows globally, companies are expanding their operations into emerging markets, such as Asia-Pacific, Latin America, and the Middle East. This expansion is driven by rising healthcare access, increasing chronic disease prevalence, and improving infrastructure. Companies are also adapting to regional regulatory requirements and cultural preferences to better serve local populations. Regional expansion helps drive growth, enhances market share, and positions companies to capitalize on the growing need for efficient drug delivery systems worldwide.

Product Insights

The standard segment dominated the market, accounting for over 87.3% of the revenue share in 2024 due to its daily usage of larger dosages by diabetic patients. People suffering from dexterity problems commonly use these needles. However, these needles are not preferred since there is a high risk of causing needlestick injuries, which hampers the safe applicability of pen needles; hence, their demand is anticipated to go down over the forecast period.

The rising number of diabetic population and awareness level regarding the usage of insulin pens are some of the factors supporting the growth of this segment. According to WHO, diabetes affects around 422 million people globally, with the vast majority residing in low- and middle-income countries. Also, it is directly responsible for 1.5 million fatalities per year. The prevalence and incidences of diabetes have been on the rise over the last decade.

Safety pen needles are expected to witness lucrative growth over the forecast period due to rising technological advancements in this field. These devices enable the minimization of needlestick injuries among patients. For instance, according to the National Library of Medicine, the majority of needlestick injuries (NSIs) are caused by faulty needles. A built-in sharps injury prevention function (SIPF) in safety pen needles (SPN) helps to prevent such injuries before, during, and after usage.

Needle Length Insights

Among the various needle lengths, 5 mm-sized pen needles accounted for a lucrative market size in 2024, accounting for over 20.6% revenue share in 2024 due to its optimal balance of comfort and effectiveness for subcutaneous injections. It is particularly popular for diabetes management, as it is shorter, reducing pain and anxiety for patients, while still delivering accurate doses. The 5mm needle size is ideal for patients with varying body types and is suitable for both adults and children. Additionally, its ability to provide efficient insulin delivery with minimal discomfort contributes to its growing adoption. This has led to a lucrative market demand as patient satisfaction and compliance improve.

4mm needles are anticipated to witness attractive CAGR over the forecast period owing to their short length. The shortest and thinnest needles are increasingly being used by patients due to the greater comfort level offered by them as compared to injections. Moreover, their short layer helps reach the subcutaneous tissue of the patients easily. According to recent studies, short-length needles are just as effective as their longer counterparts. People suffering from trypanophobia can simply use these needles. The use of 4mm and smaller needles helps to reduce intramuscular injection side effects and uneven dosages.

Therapy Insights

The insulin therapy segment dominated the market in 2024 with over 85.2% share and is also expected to showcase lucrative growth over the forecast period. This is due to the increasing awareness about the self-administration of insulin therapy amongst type 1 and type 2 diabetes patients. For instance, Lilly's MounjaroTM (tirzepatide) injectable has been approved by the FDA as the first and only GIP and GLP-1 receptor agonist for the management of individuals with type 2 diabetes. GLP-1 therapy is also expected to exhibit significant growth in the near future. This is due to its capability to minimize the blood glucose level among patients suffering from type 2 diabetes. In addition, Novo Nordisk is also focusing on the expansion of the GLP-1 market.

Dulaglutide, Exenatide (extended-release), and Semaglutide are some of the GLP-1 drugs that are taken once weekly. Along with blood sugar control, these help with weight loss, which is of high importance in diabetes patients. Growth hormone therapy includes injection either by traditional syringe-vial combination or injection pens. Owing to the complications and minimal user-friendliness of the syringe-vial combination, it is being replaced by injection pens. As most growth hormone deficiency patients are children, user acceptance is important in product development. Companies are focusing on pen needle development with minimum pain. Omnitrope is one of the leading brands of injection pens intended for growth hormone deficiency.

Regional Insights

North American pen needles market held a dominant position, capturing 28.8% of the global revenue share in 2024. This growth was fueled by the demand for pen needles, insulin syringes, and safety solutions like safety lancets, pen needles, and immunization products, all distributed under the Droplet and DropSafe brands. Known for their patented solutions, these brands prioritize comfort and ease of use for both patients and healthcare professionals. Droplet, the fastest-growing pen needle brand in North America, is the second-largest supplier in the US. Additionally, MTD has secured a 50% market share in safety lancets globally and 15% in personal lancets.

U.S. Pen Needles Market Trends

The pen needles market in U.S. held a significant share of North America's pen needles market in 2024. The U.S. pen needle market is one of the largest and fastest-growing segments within the global market, driven by the increasing prevalence of chronic conditions such as diabetes. In 2024, the market is expected to expand as more patients adopt insulin pens for self-injection due to their convenience and ease of use. The availability of various needle lengths, including shorter, more comfortable options like 5mm, has further fueled growth. Additionally, the demand for safety features, such as safety pen needles, is rising among healthcare providers to reduce needle-stick injuries. Major brands like Droplet and innovations in product design continue to shape the market.

Europe Pen Needles Market Trends

The pen needles market in Europe dominated the global industry with a 36.8% share in 2024 due to a high prevalence of diabetes, increasing adoption of self-injection devices, and strong healthcare infrastructure. The demand for user-friendly and safety-focused products, such as safety pen needles and shorter needle lengths, further drove market growth, alongside regulatory support for innovation.

The UK pen needles market is steadily growing, supported by government initiatives focused on investing in diabetes care and research to enhance treatment options for diabetic patients. The increasing number of diabetes cases in the region is a key factor driving market expansion. According to Diabetes UK, over 4.3 million people in the UK are affected by diabetes, with an additional 850,000 individuals potentially living undiagnosed.

The pen needles market in France is growing, driven by the distribution of a variety of PIC Solution brand medical devices for personal care. These include diabetes products like pen needles and blood glucose meters, as well as syringes, dressings, blood pressure monitors, nebulizers, thermometers, and other innovative healthcare solutions for everyday use.

Germany pen needles market is mainly driven by factors such as the rising prevalence of diabetes, increasing adoption of self-injection devices, and growing awareness about the benefits of pen needles for managing chronic conditions. Additionally, the demand for safer and more comfortable injection options further fuels market growth. According to the International Diabetes Federation, Germany has approximately 7.5 million people living with diabetes, contributing to the expanding market for pen needles.

Asia Pacific Pen Needles Market Trends

The pen needles market in Asia Pacific is anticipated to see strong growth during the forecast period. The increasing preference for pen needles over traditional syringes and vials is a key factor fueling this growth. Additionally, the rising elderly population in the region contributes significantly to the demand for pen needles, as older individuals often require more convenient and user-friendly injection options. The growing awareness of diabetes management and self-injection devices further supports the expansion of the market. As healthcare infrastructure improves, the adoption of pen needles is expected to continue to rise across the region.

Japan pen needles market is experiencing growth due to ongoing technological advancements in medical devices. Innovations in needle design, such as shorter, finer needles for less pain and improved ease of use, are contributing to higher adoption rates. Additionally, the integration of smart technology in pen needles for better dose accuracy and patient compliance is further driving market expansion. Japan’s large diabetic population, estimated at over 7 million people, is also a significant factor.

The pen needles market in China is anticipated to grow quickly, driven by the increasing number of diabetic patients in the region. According to the 2020 edition of the Guidelines for the Prevention and Treatment of Diabetes in China, the prevalence of diabetes among adults stands at 11.2%, with an estimated 141 million people affected. Furthermore, about 51.7% of these individuals remain undiagnosed. This growing diabetic population is a key factor fueling the expansion of the pen needles market in China.

India pen needles market is witnessing substantial growth, driven by the rising prevalence of diabetes and increasing adoption of self-injection devices. India has over 77 million people living with diabetes, making it one of the countries with the highest number of diabetic patients globally. According to the International Diabetes Federation, this number is expected to rise significantly in the coming years. As the demand for convenient, painless, and user-friendly insulin delivery options grows, pen needles are becoming increasingly popular. Additionally, government initiatives and improved healthcare infrastructure are contributing to the market’s expansion in the country.

Latin America Pen Needles Market Trends

The pen needles market in Latin America is growing rapidly, driven by the rising incidence of diabetes and increased adoption of self-injection devices. As healthcare access improves and awareness of diabetes management rises, more patients are turning to pen needles for convenient and efficient insulin delivery, fueling market expansion in the region.

Key Pen Needles Company Insights

The scenario in the pen needles market is highly competitive, with key players such as Novo Nordisk A/S, Inc., Terumo Corp., and others. The major companies are undertaking various organic and inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Pen Needles Companies:

The following are the leading companies in the pen needles market. These companies collectively hold the largest market share and dictate industry trends.

- Novo Nordisk A/S

- Becton Dickinson and Company

- Terumo Corp.

- Owen Mumford Ltd.

- Ypsomed

- B. Braun Melsungen AG

- HTL-STREFA

- UltiMed, Inc.

- Allison Medical, Inc.

- Artsana S.p.A.

Recent Developments

-

In September 2022, Terumo India launched FineGlide, a sterile pen needle designed for patients needing regular insulin injections or self-medication. Compatible with most pen devices in India, FineGlide focuses on enhancing patient comfort, aiming to improve drug compliance by offering a more comfortable and user-friendly injection experience.

-

In May 2022, Roche Diabetes Care India (RDC India) introduced ACCU-FINE, high-quality pen needles designed to make insulin delivery more comfortable and nearly painless for individuals with diabetes.

Pen Needles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.8 billion

Revenue forecast in 2030

USD 7.8 billion

Growth rate

CAGR of 10.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, needle length, therapy, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Novo Nordisk A/S; Becton Dickinson and Company; Terumo Corp.; Owen Mumford Ltd.; Ypsomed; B. Braun Melsungen AG; HTL-STREFA; UltiMed, Inc.; Allison Medical, Inc.; Artsana S.p.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pen Needles Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pen needles market report on the basis of product, needle length, therapy, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Standard Pen Needles

-

Safety Pen Needles

-

-

Needle Length Outlook (Revenue, USD Million, 2018 - 2030)

-

4mm

-

5mm

-

6mm

-

8mm

-

10mm

-

12mm

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Insulin

-

Glucagon-like-peptide-1

-

Growth Hormone

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pen needles market size was estimated at USD 4.1 billion in 2024 and is expected to reach USD 4.8 billion in 2025.

b. The global pen needles market is expected to grow at a compound annual growth rate of 10.1% from 2025 to 2030 to reach USD 7.8 billion by 2030.

b. Europe dominated the pen needles market with a share of 36.8% in 2024. This is attributable to the rising prevalence of the target disease in this region. Moreover, the U.K. government is also investing in diabetes care and research to improve treatment techniques for diabetic patients.

b. Some key players operating in the pen needles market include Novo Nordisk A/S, Becton, Dickinson and Company, TERUMO CORPORATION, Owen Mumford Ltd., Ypsomed, B. Braun Melsungen AG, HTL-STREFA, UltiMed, Inc., Allison Medical, Inc., and Artsana S.p.a.

b. Key factors that are driving the pen needles market growth include the growing prevalence of diabetes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.