- Home

- »

- Medical Devices

- »

-

Penile Implants Market Size & Share, Industry Report, 2030GVR Report cover

![Penile Implants Market Size, Share & Trends Report]()

Penile Implants Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Inflatable Penile Implant, Non-inflatable/Malleable Penile Implant), By End-use (Hospital, Ambulatory Surgery Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-918-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Penile Implants Market Size & Trends

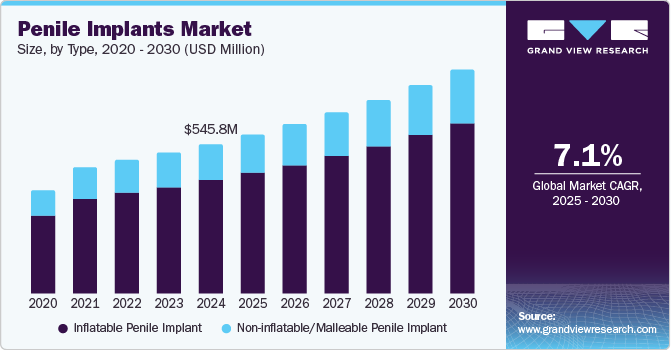

The global penile implants market size was estimated at USD 545.8 million in 2024 and is projected to grow at a CAGR of 7.1% from 2025 to 2030. The rising prevalence of Erectile Dysfunction (ED) is a major factor driving the demand for penile implants. ED becomes more common with age, and conditions such as diabetes, hypertension, cardiovascular disease, and obesity contribute to its rise. As the global population ages, the incidence of ED continues to grow, further boosting the need for effective treatments such as penile implants. In addition, poor lifestyle choices, including smoking, excessive alcohol consumption, and a lack of physical activity, are also contributing to higher rates of ED. These factors are leading to a greater demand for long-term solutions, thereby supporting the growth of the penile implants industry.

The availability of different types of penile implants, such as inflatable and malleable options tailored to meet individual needs and preferences, has contributed to the growing popularity of these treatments. Personalized solutions improve patient satisfaction, encouraging more men to consider penile implants as a viable option. In addition, the shift toward minimally invasive surgical techniques, which reduce complications and shorten recovery times, has further enhanced the appeal of penile implants. These advancements make the procedure more accessible and less intimidating for patients, driving growth in the penile implant industry.

Penile implants have significantly improved design, offering better comfort, durability, and functionality. Innovations such as inflatable implants, which mimic natural erection mechanisms, have enhanced patient outcomes and satisfaction. Moreover, minimally invasive surgical techniques have made the procedure safer and more efficient, with faster recovery times and fewer complications. These improvements have made penile implants a more appealing option for patients seeking long-term solutions for erectile dysfunction, driving growth in the penile implant industry.

Type Insights

The inflatable penile implant segment dominated the market with a revenue share of 75.8% in 2024. This dominance stems from the increasing prevalence of ED, which has prompted a surge in demand for effective treatment options. Inflatable implants are preferred due to their high patient satisfaction rates and lower complication rates than non-inflatable models. Innovations in implant technology, such as improved materials and design, have also contributed to their popularity, making them a cost-effective solution for many patients dealing with ED. These factors are driving growth in the penile implant industry.

The non-inflatable/malleable penile implant segment is anticipated to grow at a significant CAGR over the forecast period, fueled by the rising awareness and acceptance of surgical options for ED, particularly among older populations who may prefer simple, less invasive solutions. In addition, non-inflatable implants are often associated with lower initial costs and ease of use, appealing to patients looking for straightforward treatment methods without the complexities of inflatable devices. These factors are contributing to the expansion of the penile implant industry.

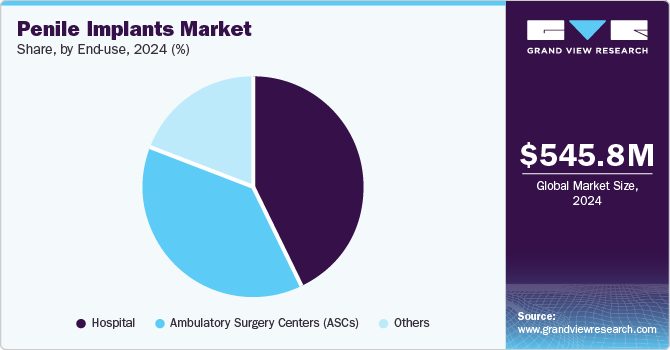

End-use Insights

The hospital segment dominated the market with the largest revenue share in 2024, which can be attributed to most penile implant surgeries performed in hospital settings. Hospitals provide comprehensive care, including pre-operative assessments and post-operative follow-ups, ensuring better patient outcomes. The availability of advanced surgical facilities and trained medical professionals further enhances the appeal of hospitals as primary venues for these procedures.

The Ambulatory Surgery Centers (ASCs) segment is expected to grow significantly over the forecast period, driven by the increasing preference for outpatient procedures. ASCs offer several advantages, including shorter waiting times, lower costs, and the convenience of same-day discharge. These benefits make ASCs a more attractive option for patients seeking penile implant surgeries. The ability to undergo surgery and return home the same day appeals to many patients, especially those looking for less disruption to their daily lives. As awareness of these advantages grows, more individuals will likely choose ASCs for their treatments.

Regional Insights

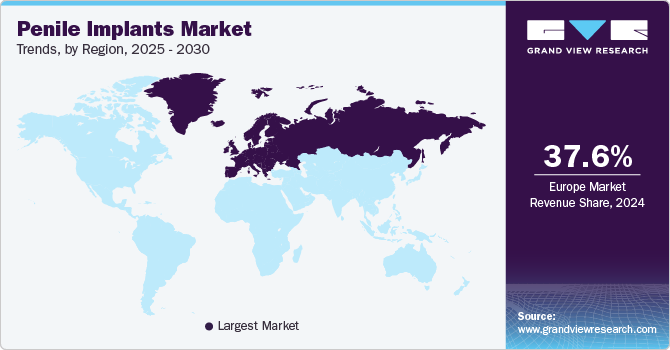

North America penile implants market held a substantial market share in 2024, driven by high healthcare expenditure and advanced medical infrastructure. The region's strong emphasis on treating ED, coupled with increasing awareness about treatment options, has led to a higher adoption rate of penile implants. Furthermore, the presence of major market players and ongoing innovations in implant technology have solidified North America's leading position in this market.

Europe Penile Implants Market Trends

Europe penile implants market held the highest revenue share of 37.6% in 2024 due to a high prevalence of ED and well-established healthcare systems that support surgical interventions. European countries have also proactively adopted advanced technologies and improved patient access to various treatment options. The region's strong healthcare infrastructure ensures patients can access effective solutions, including penile implants. Moreover, the increasing awareness and acceptance of ED treatments further contribute to the market growth. These factors combined make Europe a leading market for penile implants.

Germany penile implants market dominated Europe with a significant revenue share in 2024, fueled by its advanced healthcare infrastructure and high rates of ED diagnoses among men. The German market benefits from a strong focus on medical innovation and patient care quality, which encourages more individuals to seek surgical solutions for ED. Moreover, ongoing research and development efforts within Germany's healthcare sector continue to enhance treatment options available to patients.

Asia Pacific Penile Implants Market Trends

Asia Pacific penile implants market is expected to register the highest CAGR of 7.7% over the forecast period, which can be attributed to rising awareness about ED treatments and improvements in healthcare access across the region. As lifestyles change and chronic health conditions become more prevalent among aging populations, there is an increasing need for effective treatment options such as penile implants. Furthermore, advancements in surgical techniques are making these procedures more accessible and appealing.

The China penile implants market dominated the Asia Pacific with a significant revenue share in 2024, driven by its large population base and growing incidence of ED. The country's expanding healthcare infrastructure and increasing investment in medical technologies are facilitating greater access to surgical treatments for ED. As awareness about these options continues to rise among Chinese men, demand for penile implants is expected to grow substantially.

Key Penile Implants Company Insights

Some key companies operating in the market are Zephyr Surgical Implants, Boston Scientific Corporation, Coloplast Corp, Promedon S.A., and Rigicon, Inc. Companies are undertaking strategic initiatives, such as mergers, acquisitions, and product launches, to expand their market presence and address the evolving healthcare demands in the penile implants market.

-

Zephyr Surgical Implants provides various innovative products in the penile implants market, focusing on malleable and inflatable devices. The ZSI 100 FTM is tailored for trans men, offering stability and a realistic appearance with its durable NUSIL silicone construction. In addition, the ZSI 475 FTM features inflatable cylinders that allow users to adjust firmness and length for enhanced satisfaction. The company also manufactures related solutions, including devices for urinary incontinence and surgical meshes, ensuring comprehensive care for diverse patient needs.

-

Boston Scientific Corporation offers a wide range of products in the penile implants market, including the AMS 700 Inflatable Penile Prosthesis, which features customizable options, and the innovative TENACIO Pump for easier operation. In addition, the Spectra Concealable Penile Prosthesis provides excellent concealment and rigidity. The Tactra Malleable Penile Prosthesis combines durability with a natural feeling, enhancing patient comfort and ease of use during implantation.

Key Penile Implants Companies:

The following are the leading companies in the penile implants market. These companies collectively hold the largest market share and dictate industry trends.

- Zephyr Surgical Implants

- Boston Scientific Corporation

- Coloplast Corp

- Promedon S.A.

- Rigicon, Inc

- SILIMED

- Advin Health Care

- G. SURGIWEAR LTD

- Corza Medical.

- TIMM Medical

Recent Developments

-

In November 2023, Boston Scientific Corporation received FDA approval for its new penile prosthesis pump, marking a significant advancement in treatment options for erectile dysfunction. This innovative device is designed to enhance patient satisfaction and ease of use, featuring a streamlined design that simplifies the inflation process.

-

In June 2023, Rigicon launched the HL Levine Combo Prosthesis Tool, a significant innovation in penile implant surgery. This new tool is designed to enhance the efficiency and precision of the implantation process, providing surgeons with improved capabilities during procedures.

Penile Implants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 580.3 million

Revenue forecast in 2030

USD 817.0 million

Growth rate

CAGR of 7.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type,end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden;Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Zephyr Surgical Implants; Boston Scientific Corporation; Coloplast Corp; Promedon S.A.; Rigicon, Inc; SILIMED; Advin Health Care; G. SURGIWEAR LTD; Corza Medical.; TIMM Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Penile Implants Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global penile implants market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Inflatable Penile Implant

-

Non-inflatable/Malleable Penile Implant

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Ambulatory Surgery Centers (ASCs)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global penile implants market size was estimated at USD 545.80 million in 2024 and is expected to reach USD 580.28 million in 2025.

b. The global penile implants market is expected to grow at a growth rate of 7.08% from 2025 to 2030 to reach USD 817.03 million by 2030.

b. Inflatable penile implant dominated the global penile implants market with the highest share of 75.82% in 2024. This is attributed to decreased malfunction rates, lower rates of associated infections, and high patient satisfaction rates.

b. Some key players operating in the penile implants market include Boston Scientific, Coloplast Corp, Gust, Inc., Promedon, Zephyr Surgical Implants, Pos-T-Vac, Inc., Reflexonic, LLC, Owen Mumford Ltd, Vacurect Manufacturing (Pty) Ltd., Silimed, and Eska Medical Gmbh.

b. Key factors driving the penile implants market growth include rising incidence of erectile dysfunction and increasing awareness about penile diseases and advanced products in the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.