- Home

- »

- Pharmaceuticals

- »

-

Peptide Therapeutics Market Size, Industry Report, 2030GVR Report cover

![Peptide Therapeutics Market Size, Share & Trends Report]()

Peptide Therapeutics Market (2025 - 2030) Size, Share & Trends Analysis Report By Application, By Type (Innovative, Generic), By Type of Manufacturer (Inhouse, Outsourced), By Route Of Administration, By Synthesis Technology, By Region, And Segment Forecasts

- Report ID: 978-1-68038-179-5

- Number of Report Pages: 153

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Peptide Therapeutics Market Summary

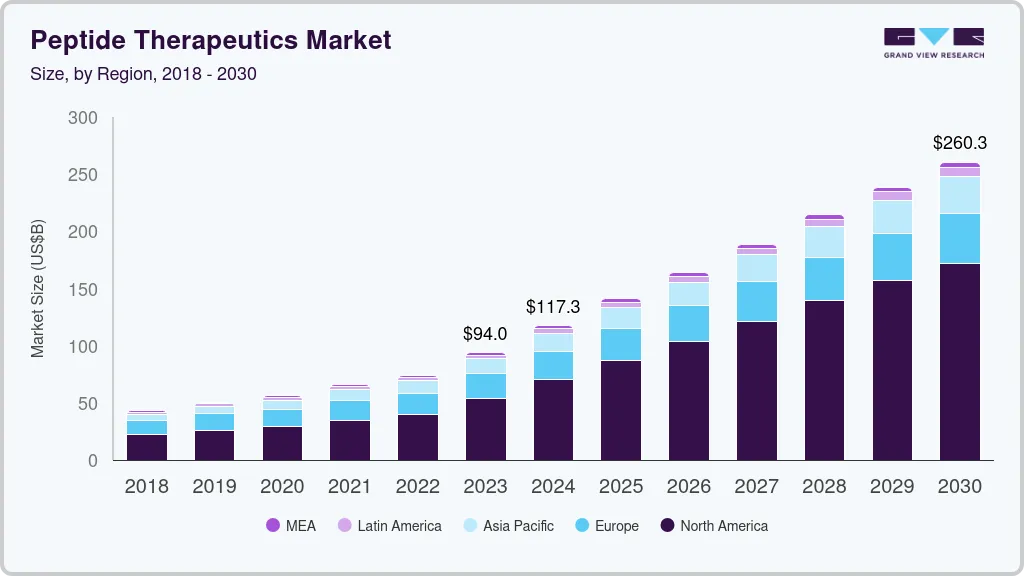

The global peptide therapeutics market size was estimated at USD 117.26 billion in 2024 and is projected to reach USD 260.25 billion by 2030, growing at a CAGR of 10.77% from 2025 to 2030. The increasing number of pediatric patients affected by these conditions, coupled with their widespread occurrence in low-income regions, underscores the need for affordable and effective treatment options.

Key Market Trends & Insights

- The North America Peptide Therapeutics market maintains a leading position in 2024 with share of 60.21% globally in 2024.

- The U.S. dominates the North America Peptide Therapeutics market due to strong biopharma investments, high R&D spending, and early regulatory approvals.

- Based on type, the innovative segment accounted for the largest revenue share of 79.13% in 2024.

- Based on application, the pain segment is expected to exhibit significant growth in the market over the forecast period.

- Based on route of administration, the parenteral segment accounted for the largest revenue share of 84.08% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 117.26 Billion

- 2030 Projected Market Size: USD 260.25 Billion

- CAGR (2024-2030): 10.77%

- Asia-Pacific: Largest Market in 2023

The increasing number of pediatric patients affected by these conditions, coupled with their widespread occurrence in low-income regions, underscores the need for affordable and effective treatment options. Moreover, strong presence of peptide therapeutic drugs in clinical pipeline for different indications is expected to boost market growth over the forecast period. For instance, Zealand Pharma has a strong pipeline portfolio of peptide therapeutics for targeting metabolic, gastrointestinal, and cardiovascular diseases. Its most advanced candidate, Survodutide (Phase 3), a dual GLP-1 and glucagon receptor agonist, is positioned for obesity treatment, while Glepaglutide (Registration Phase) is nearing potential approval for short bowel syndrome. Petrelintide (Phase 2) is being explored for cardiovascular and metabolic disorders, while Dapiglutide (Phase 1) and ZP6590 (Phase 1) focus on metabolic and gastrointestinal conditions. Additionally, ZP9830 (Phase 1) and ZP10068 (Preclinical) highlight the company’s commitment to early-stage peptide innovation. Zealand Pharma’s diverse and advancing pipeline positions it as a strong contender in the growing peptide therapeutics market, with promising near-term commercialization prospects and long-term growth potential.

The rising prevalence of various cancers and the growing need for effective treatment options are expected to drive market growth. According to the WHO, in 2022, an estimated 20 million new cancer cases were reported globally, resulting in 9.7 million deaths. Approximately 53.5 million people were living within five years of a cancer diagnosis. Around one in five individuals develop cancer in their lifetime, with approximately one in nine men and one in twelve women succumbing to the disease. Peptide therapeutics offer early-stage cancer treatment, improving disease management and reducing mortality. The increasing demand for efficient, fast-acting therapeutics is anticipated to further fuel market expansion.

The market is expected to grow at a strong CAGR over the forecast period as companies focus on developing novel drugs. Extensive research and development (R&D) efforts are underway to create treatments for target diseases and expand market share. Peptide therapeutics R&D primarily targets metabolic disorders, followed by oncology and infectious diseases. Regulatory frameworks are becoming more stringent, with agencies such as the FDA and EMA implementing higher standards for efficacy, safety, and quality. These bodies are also evaluating new guidelines to streamline the approval process for peptide therapeutics.

However, challenges remain in peptide synthesis and purification. The limited capacity of solid-phase reactors hinders the production of long peptides, impacting chemical functionalization and resin swelling. Additionally, the incorporation of unnatural amino acids and complex 3D conformations further complicates separation and purification, increasing manufacturing difficulties.

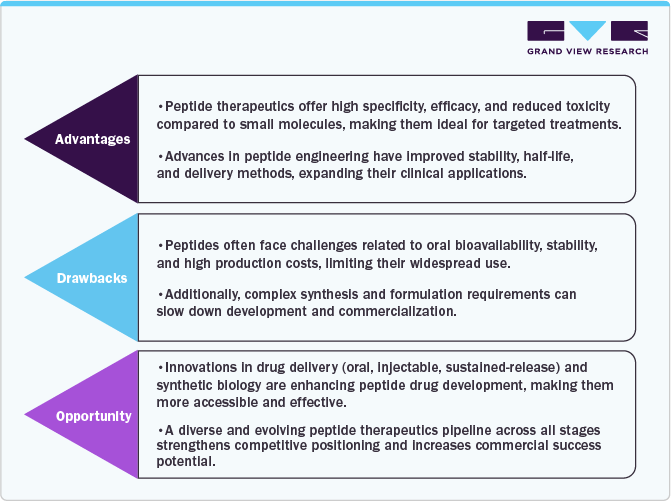

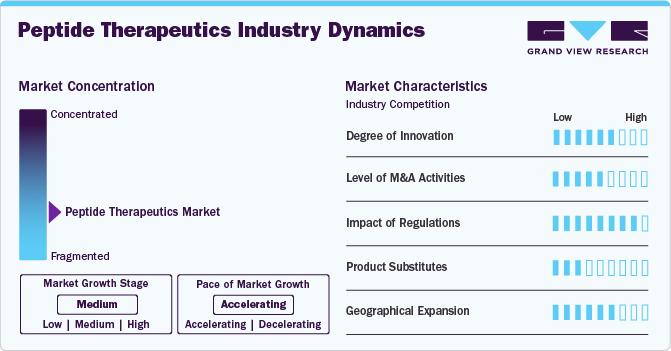

Market Concentration & Characteristics

The field of peptide therapeutics is rapidly advancing, driven by innovations in drug formulations, targeted delivery systems, and combination therapies. Research efforts focus on improving efficacy, minimizing side effects, and developing next-generation treatments with extended half-life and enhanced bioavailability. Emerging peptide-based therapies address a broad spectrum of conditions, including metabolic disorders, cancer, neurological diseases, gastrointestinal disorders, and cardiovascular conditions. Novel approaches such as oral peptide formulations, multi-targeted peptides, and long-acting injectable therapies aim to improve patient compliance and treatment outcomes.

Mergers and acquisitions (M&A) play a significant role in the expansion of the peptide therapeutics industry. Leading pharmaceutical companies are acquiring biotech firms to strengthen their pipelines in key therapeutic areas, including oncology, metabolic disorders, and infectious diseases. The growing demand for effective peptide-based treatments is driving industry consolidation, enabling companies to enhance production capabilities, access novel peptide synthesis technologies, and gain a competitive edge in an evolving landscape.

Regulatory bodies such as the FDA and EMA enforce stringent guidelines for peptide therapeutics, ensuring safety, efficacy, and quality. The approval process, which includes rigorous clinical trials and regulatory scrutiny, can extend market entry timelines and increase development costs. Additionally, reimbursement policies significantly impact market adoption, as peptide-based therapies often involve high manufacturing costs. Ensuring adequate insurance coverage and pricing strategies is crucial, particularly in emerging markets where accessibility remains a challenge.

While peptide therapeutics are gaining prominence across multiple disease areas, alternative treatment options exist. These include small-molecule drugs, monoclonal antibodies, gene therapy, and non-pharmacological interventions such as lifestyle modifications and surgical procedures. Despite competition, peptides remain a preferred treatment option due to their high specificity, improved safety profiles, and expanding applications across metabolic, neurological, renal, and respiratory disorders.

Companies are actively expanding their presence in high-growth regions such as Asia-Pacific, Latin America, and the Middle East, where rising disease prevalence and improving healthcare infrastructure present lucrative opportunities. Increased awareness, supportive healthcare policies, and expanding insurance coverage are driving market penetration. However, challenges related to affordability, supply chain logistics, and regulatory compliance continue to shape regional growth trajectories.

Type Insights

Based on type, the market has been categorized into innovative and generic. The innovative segment accounted for the largest revenue share of 79.13% in 2024. The field of innovative peptide therapeutics is driven by increased R&D investments from major pharmaceutical companies, leading to the discovery and development of new drugs and high prescription rates. Peptide therapeutics, known for their high specificity and potential for targeted treatments, emerge as a promising solution for addressing complex diseases. This growth is fueled by advancements in peptide synthesis, modification techniques, and drug delivery technologies, enabling the development of novel, more effective peptide-based therapies.

The generic segment is the second largest segment in the market. The rise of generic peptide therapeutics is an emerging trend in the pharmaceutical industry. As patents for original peptide drugs expire, generic manufacturers are developing bioequivalent alternatives, increasing patient access and potentially lowering healthcare costs. This shift aligns with the broader push for affordable and accessible healthcare solutions. Currently, over 70 peptide-based drugs are available worldwide, and several widely prescribed peptide therapies, such as Byetta and Victoza, are approaching generic status as their patents near expiration.

Application Insights

Based on application, the market has been categorized into metabolic disorders, cancer, neurological disorders, gastrointestinal disorders, cardiovascular disorders, pain, infectious disease, renal disorders, dermatological disorders, respiratory disorders, and others. The metabolic disorders segment accounted for the largest revenue share of 61.86% in 2024. The increasing prevalence of metabolic disorders, such as diabetes, obesity, and osteoporosis, is a significant driver for the peptide therapeutics industry. According to the International Diabetes Federation (IDF), 537 million adults (20-79 years)-or 1 in 10-are currently living with diabetes. This number is projected to rise to 643 million by 2030 and 783 million by 2045, highlighting the growing global burden of the disease. With rising sedentary lifestyles, poor dietary habits, and an aging population, metabolic disorders have become a global health concern, necessitating the development of effective treatments. Peptide-based therapeutics are gaining traction due to their high specificity, improved efficacy, and ability to target underlying metabolic pathways with minimal side effects.

The pain segment is expected to exhibit significant growth in the market over the forecast period. According to the International Association for the Study of Pain, in 2023, chronic pain is a significant public health issue, affecting approximately 20% of adults in the Western world. The rising prevalence of pain indication is expected to boost demand for the market.

Route Of Administration Insights

Based on route of administration, the peptide therapeutics industry has been categorized into parenteral route, oral route, mucosal, pulmonary, and others. The parenteral segment accounted for the largest revenue share of 84.08% in 2024. This dominance can be attributed to the poor oral bioavailability of peptides, which are highly susceptible to enzymatic degradation and have low membrane permeability. The rising prevalence of chronic diseases such as diabetes, cancer, and autoimmune disorders further drives demand for injectable peptide drugs like insulin analogs and GLP-1 receptor agonists. Additionally, advancements in sustained release injectables, depot formulations, and novel drug delivery systems enhance patient compliance and extend drug efficacy, reducing dosing frequency.

The others segment is expected to exhibit significant growth in the market over the forecast period. The growing demand for patient-friendly and effective peptide therapeutics is driving innovations in alternative drug delivery routes beyond traditional parenteral, oral, mucosal, and pulmonary methods. Advances in transdermal, intranasal, ocular, and implantable systems are improving bioavailability, reducing dosing frequency, and enhancing patient compliance. Transdermal microneedle patches offer painless, sustained drug release, while intranasal delivery enables rapid absorption and CNS targeting. Ocular formulations utilizing nanocarriers and hydrogels are expanding peptide applications in ophthalmology, and implantable systems provide controlled, long-term peptide release in chronic diseases. These advancements are reshaping the market by offering novel, non-invasive, and efficient drug delivery solutions.

Synthesis Technology Insights

Based on synthesis technology, the market has been categorized into recombinant DNA technology, solid-phase peptide synthesis (SPPS), hybrid, liquid-phase peptide synthesis (LPPS), and Others. The recombinant DNA technology segment accounted for the largest revenue share of 79.26% in 2024. Recombinant DNA (rDNA) technology is a key driver in the peptide therapeutics industry, enabling the large-scale, cost-effective production of complex peptide-based drugs with high purity and bioactivity. Unlike chemical synthesis methods, rDNA technology allows for the biosynthesis of long and complex peptides, including biologics like insulin, growth hormones, and monoclonal antibodies, which are difficult to produce through traditional synthetic approaches.

The Solid-Phase Peptide Synthesis (SPPS) segment is expected to exhibit significant growth in the market over the forecast period. Solid-Phase Peptide Synthesis (SPPS) is a key driver in the market, enabling the rapid and efficient production of synthetic peptides with high purity and scalability. SPPS has revolutionized peptide manufacturing by allowing automated, stepwise synthesis, making it the preferred method for producing short-to-medium-length peptides used in therapeutics. Additionally, the rise of custom and personalized peptide therapeutics is driving SPPS innovations. The technique allows for rapid synthesis of modified and complex peptides, including cyclic peptides, stapled peptides, and peptide-drug conjugates, enhancing therapeutic efficacy in precision medicine.

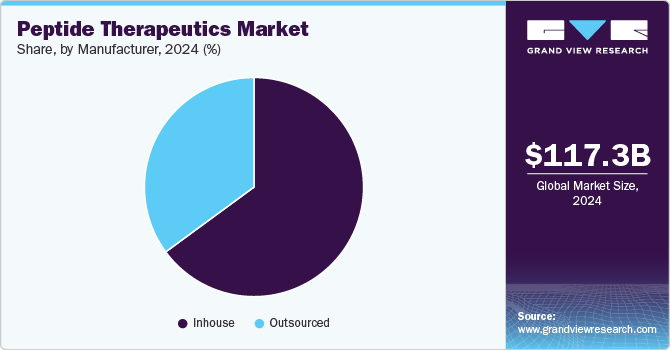

Type Of Manufacturer Insights

Based on type of manufacturers, the market has been categorized into inhouse and outsourced. The Inhouse segment held the largest revenue share of 64.92% in 2024. The shift toward in-house peptide manufacturing is driven by the need for greater control over production quality, cost efficiency, and intellectual property protection. This trend is further fueled by the rising demand for personalized and targeted therapies, where peptides are highly valued for their specificity and low toxicity. To ensure a reliable supply chain and faster development timelines, pharmaceutical companies are increasingly investing in in-house peptide production. This strategic move enhances operational efficiency, regulatory compliance, and market competitiveness, positioning firms at the forefront of the rapidly evolving peptide therapeutics landscape.

The outsourcing manufacturing segment is expected to grow at the fastest CAGR during the forecast period. Peptide manufacturing is a complex process that requires advanced technologies such as Solid-Phase Peptide Synthesis (SPPS), Liquid-Phase Peptide Synthesis (LPPS), or Hybrid approaches for the purification and synthesis of high-quality products, leading to high production costs. Additionally, increasing R&D funding and capital investments by key players through strategic agreements are expected to drive market growth. Furthermore, industry leaders are undertaking strategic initiatives that create attractive opportunities within the market. For example, in July 2020, CordenPharma expanded its peptide manufacturing capacity at its GMP API facility in Colorado.

Regional Insights

The North America Peptide Therapeutics market maintains a leading position in 2024 with share of 60.21% globally in 2024, driven by the rising prevalence of cancer, metabolic disorders, and rare diseases. The growing adoption of synthetic and recombinant peptides, alongside advancements in drug delivery technologies, is enhancing therapeutic efficacy. Expansion in biopharmaceutical R&D and regulatory approvals is supporting market growth. Hospital and retail pharmacies continue to be key distribution channels, with increasing demand for targeted peptide-based therapies.

U.S. Peptide Therapeutics Market Trends

The U.S. dominates the North America Peptide Therapeutics market due to strong biopharma investments, high R&D spending, and early regulatory approvals. The rising preference for peptide-based oncology and metabolic disorder treatments, coupled with the increasing use of peptides in vaccine development, is accelerating market expansion. The shift toward orally available peptides and advancements in chemical synthesis are driving accessibility and patient compliance.

Europe Peptide Therapeutics Market Trends

The Europe peptide therapeutics market is witnessing steady growth, with Germany, France, and the UK at the forefront. Government initiatives supporting biotech innovations, increasing investments in personalized peptide therapies, and strong clinical research infrastructure are key drivers. The expanding role of peptides in neurodegenerative diseases, autoimmune disorders, and cardiovascular treatments is fueling market expansion.

In the UK, the demand for therapeutic peptides is growing due to increased funding for biopharmaceutical R&D and a focus on rare disease treatment. The market benefits from expanding clinical trials, partnerships between academia and industry, and an increasing number of peptide-based drug approvals. Hospital pharmacies play a dominant role in oncology peptide distribution, while retail pharmacies are gaining traction for chronic disease management peptides.

Germany is a key player in the European peptide therapeutics market, driven by advanced peptide synthesis technologies, strong manufacturing infrastructure, and expanding biopharma pipelines. The demand for peptide-based treatments for metabolic disorders, infectious diseases, and cancer is rising. The government’s support for biotech funding and local peptide manufacturing is further propelling market growth.

The peptide therapeutics market in France is expanding with growing clinical adoption of peptide drugs for autoimmune and inflammatory diseases. Regulatory advancements, public healthcare initiatives, and increased investments in biologics research are driving demand. Hospital pharmacies remain a key distribution channel, with rising accessibility through retail pharmacies.

Asia Pacific Peptide Therapeutics Market Trends

The Asia-Pacific region is experiencing robust growth in peptide therapeutics due to rising chronic disease burden, increasing healthcare access, and expanding biotech industry investments. Countries such as China, India, and Japan are leading this expansion, driven by growing clinical trials, local peptide manufacturing, and regulatory approvals. Advancements in peptide-based drug delivery, including nanocarriers and oral formulations, are improving market penetration.

Japan is witnessing increasing adoption of peptide-based drugs, particularly for oncology, metabolic disorders, and neurological diseases. Government funding for peptide research, growing pharmaceutical collaborations, and a focus on aging-related diseases are key growth factors. Hospital pharmacies dominate distribution, while retail pharmacies are expanding access to chronic disease peptides.

China peptide therapeutics market is growing rapidly due to expanding biopharma manufacturing, increasing R&D investments, and strong government support for peptide-based drug development. The demand for peptide therapies for cancer, diabetes, and infectious diseases is rising. Local production capabilities and international collaborations are strengthening the market landscape.

Latin America Peptide Therapeutics Market Trends

Latin America is witnessing growth in the peptide therapeutics market, led by rising healthcare expenditures, increasing awareness of peptide-based treatments, and expanding access to specialty pharmaceuticals. Brazil is a key market, driven by government health initiatives, growing peptide clinical research, and an increasing focus on biopharmaceutical manufacturing.

Brazil’s market growth is fueled by rising demand for peptide-based therapies in metabolic disorders and rare diseases. Hospital pharmacies are the dominant distribution channel, with expanding retail pharmacies. Regulatory improvements and increased investment in local biotech firms are accelerating market adoption.

Middle East & Africa Peptide Therapeutics Market Trends

The Middle East & Africa peptide therapeutics market is expanding due to the growing healthcare infrastructure, increasing investments in biotech, and the rising burden of chronic diseases. Countries such as Saudi Arabia and South Africa are experiencing increasing demand for peptide drugs, with government initiatives supporting healthcare accessibility.

Saudi Arabia’s peptide therapeutics market is growing rapidly, supported by government-driven healthcare modernization, increased investment in biotech R&D, and rising demand for targeted therapies. Hospital pharmacies remain the leading distribution channel, with retail pharmacies expanding peptide drug accessibility. Regulatory advancements under Vision 2030 are further promoting market growth.

Key Peptide Therapeutics Company Insights

Leading players in the peptide therapeutics industry include Amgen Inc., Eli Lilly and Company, F. Hoffmann-La Roche Ltd., GlaxoSmithKline plc, Novartis AG, Pfizer Inc., Sanofi, Takeda Pharmaceutical Company Limited, and Teva Pharmaceutical Industries Ltd. The market is driven by increasing demand for targeted therapies, advancements in peptide synthesis technologies, and growing adoption in oncology, metabolic disorders, and infectious diseases.

Product innovation and regulatory approvals are key strategies for leading companies in the peptide therapeutics market to maintain a competitive edge. Emerging players are targeting niche areas such as personalized peptide therapies and advanced drug delivery systems (oral, sustained-release, and nanoparticle-based formulations) to unlock new market opportunities. Additionally, strategic partnerships with biotech firms, research institutions, and contract manufacturing organizations (CMOs), along with active participation in clinical trials, enable companies to accelerate development, expand market reach, and strengthen their position in the evolving peptide therapeutics landscape.

Key Peptide Therapeutics Companies:

The following are the leading companies in the peptide therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Eli Lilly and Company

- Pfizer Inc.

- Amgen Inc.

- Takeda Pharmaceutical Company Limited

- AstraZeneca

- Teva Pharmaceutical Industries Ltd.

- Sanofi

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Novo Nordisk A/S

- GSK plc

- Ironwood Pharmaceuticals, Inc.

- Radius Health, Inc. (Subsidiary of Gurnet Point Capital and Patient Square Capital)

- Ipsen Pharma

Recent Developments

-

In January 2025, Cytovance Biologics and PolyPeptide announced a strategic partnership to address the rising demand for peptide drugs. This collaboration integrates Cytovance’s expertise in microbial and mammalian expression, process development, and cGMP manufacturing with PolyPeptide’s proficiency in complex peptide development and production. By combining their capabilities, the partnership aims to enhance efficiency, scalability, and innovation in peptide therapeutics manufacturing.

-

In March 2023, Ono Pharmaceutical Co., Ltd. entered into a drug discovery collaboration agreement with PeptiDream Inc. to develop novel macrocyclic constrained peptide drugs targeting multiple areas of interest for Ono.

-

In October 2023, Biosynth acquired Pepceuticals Limited, a British synthetic peptide manufacturer, and through this acquisition company aimed to strengthen its peptide division Pepceuticals.

Peptide Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 140.85 billion

Revenue forecast in 2030

USD 260.25 billion

Growth rate

CAGR of 10.77% from 2025 to 2030

Actual data

2018 - 2024

forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, type, type of manufacturer, route of administration, synthesis technology, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE, Saudi Arabia, and Kuwait

Key companies profiled

Eli Lilly and Company, Pfizer Inc., Amgen Inc., Takeda Pharmaceutical Company Limited, AstraZeneca, Teva Pharmaceutical Industries Ltd., Sanofi, F. Hoffmann-La Roche Ltd, Novartis AG, Novo Nordisk A/S, GSK plc, Ironwood Pharmaceuticals, Inc., Radius Health, Inc. (Subsidiary of Gurnet Point Capital and Patient Square Capital), Ipsen Pharma

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Peptide Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. for the purpose of this study, Grand View Research has segmented the global peptide therapeutics market report on the basis of application, type, type of manufacturer, route of administration, synthesis technology, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Metabolic Disorders

-

Cardiovascular Disorders

-

Respiratory Disorders

-

Gastrointestinal Disorders

-

Infectious Diseases

-

Pain

-

Dermatological Disorders

-

Neurological Disorders

-

Renal Disorders

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Generic

-

Innovative

-

-

Type of Manufacturers Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Outsourced

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Parenteral Route

-

Oral Route

-

Pulmonary

-

Mucosal

-

Others

-

-

Synthesis Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Solid Phase Peptide Synthesis (SPPS)

-

Recombinant DNA Technology

-

Hybrid Technology

-

Liquid-Phase Peptide Synthesis (LPPS)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global peptide therapeutics market size was valued at USD 117.26 billion in 2024 and is anticipated to reach USD 140.85 billion in 2025.

b. The global peptide therapeutics market is expected to witness a compound annual growth rate of 10.77% from 2025 to 2030 to reach USD 260.25 billion by 2030.

b. Based on application, the metabolic diseases segment accounted for a share of 61.86% in 2024 due to the high prevalence of these disorders and the relatively higher number of products approved.

b. Some of the key players in peptide therapeutics market are Eli Lilly and Company, Pfizer Inc., Amgen Inc., Takeda Pharmaceutical Company Limited, AstraZeneca, Teva Pharmaceutical Industries Ltd., Sanofi, F. Hoffmann-La Roche Ltd, Novartis AG, Novo Nordisk A/S, GSK plc, Ironwood Pharmaceuticals, Inc., Radius Health, Inc. (Subsidiary of Gurnet Point Capital and Patient Square Capital), Ipsen Pharma

b. North America held the largest share of 60.21% in 2024 due to the rise in awareness levels pertaining to peptide therapeutics products, increasing demand for diagnostics in cancer & other diseases, and the growing biotechnology industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.