- Home

- »

- Advanced Interior Materials

- »

-

Performance Fabric Market Size, Share, Industry Report 2033GVR Report cover

![Performance Fabric Market Size, Share & Trends Report]()

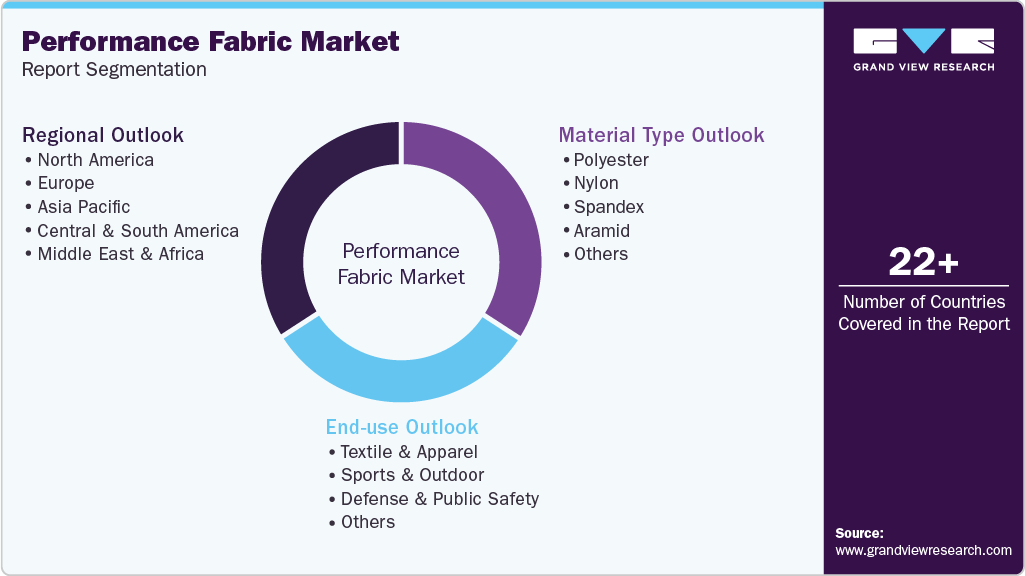

Performance Fabric Market (2025 - 2033) Size, Share & Trends Analysis By Material Type (Polyester, Nylon, Spandex), By End Use (Textile & Apparel, Sports & Outdoor), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-664-0

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Performance Fabric Market Summary

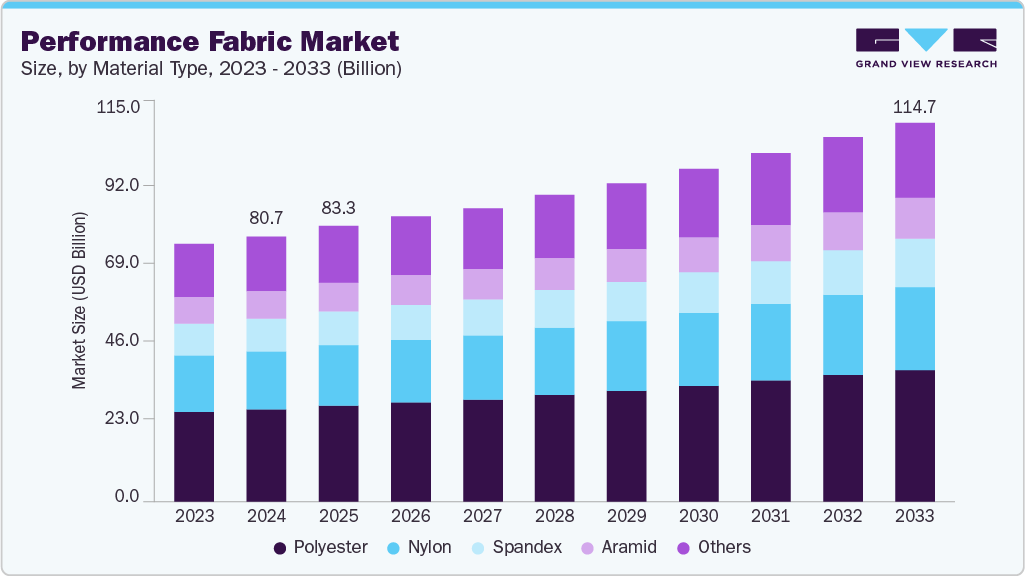

The global performance fabric market size was estimated at USD 80.70 billion in 2024 and is projected to reach USD 114.66 billion by 2033, growing at a CAGR of 4.1% from 2025 to 2033, driven by the growing demand for sportswear and active wear, fueled by rising health consciousness and fitness trends across developed and developing economies. Consumers are increasingly inclined toward apparel that offers functionality such as moisture management, breathability, UV protection, and stretchability, which are characteristics of performance fabrics.

Key Market Trends & Insights

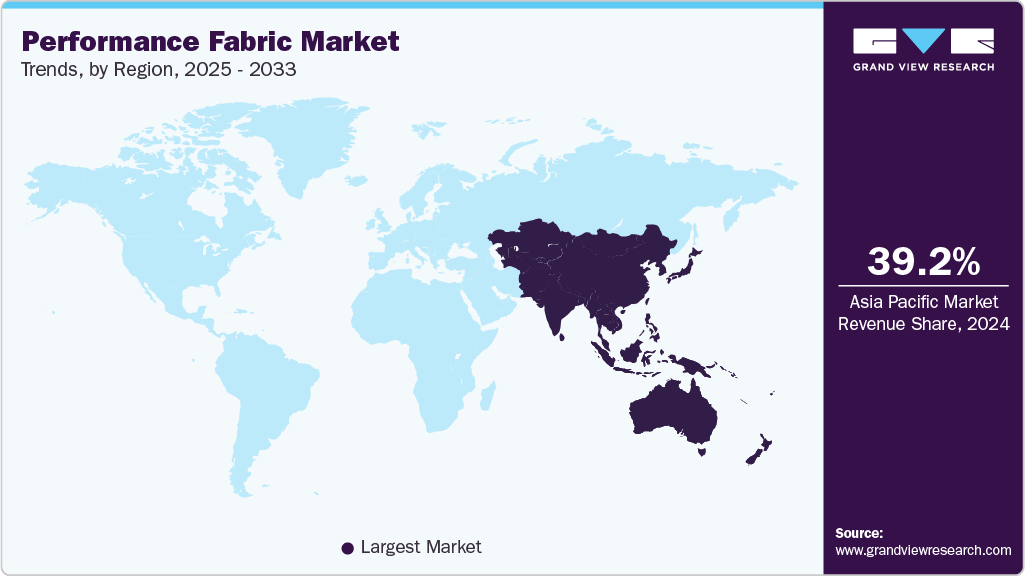

- Asia Pacific dominated the performance fabric market with the largest revenue share of 39.2% in 2024.

- By material type, the aramid segment is expected to grow at the fastest CAGR of 4.8% over the forecast period.

- By end use, the defense & public safety segment is expected to grow at the fastest CAGR of 4.5% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 80.70 Billion

- 2033 Projected Market Size: USD 114.66 Billion

- CAGR (2025-2033): 4.1%

- Asia Pacific: Largest market in 2024

This trend is further supported by the expansion of athleisure, a style that blends athletic and casual wear, prompting established brands and new entrants to invest in performance textiles to meet evolving consumer preferences. Ongoing innovations in textile technology and material science drive the development of high-performance fabrics with improved characteristics. Advancements such as nanotechnology, smart textiles, and the integration of phase-change materials have created fabrics that adapt to environmental conditions, regulate temperature, and even monitor physiological data. These innovations enhance the functionality of performance fabrics and expand their applicability in sectors such as healthcare, defense, and consumer electronics, thereby supporting sustained market growth.

Another critical driver is the rising end use of performance fabrics in industrial and protective clothing. These fabrics offer enhanced durability, flame resistance, chemical resistance, and high tensile strength, making them ideal for use in construction, manufacturing, military, and law enforcement sectors. With increasing global awareness of workplace safety and stringent regulations mandating protective gear, the demand for specialized performance textiles in these sectors continues to escalate, propelling market growth.

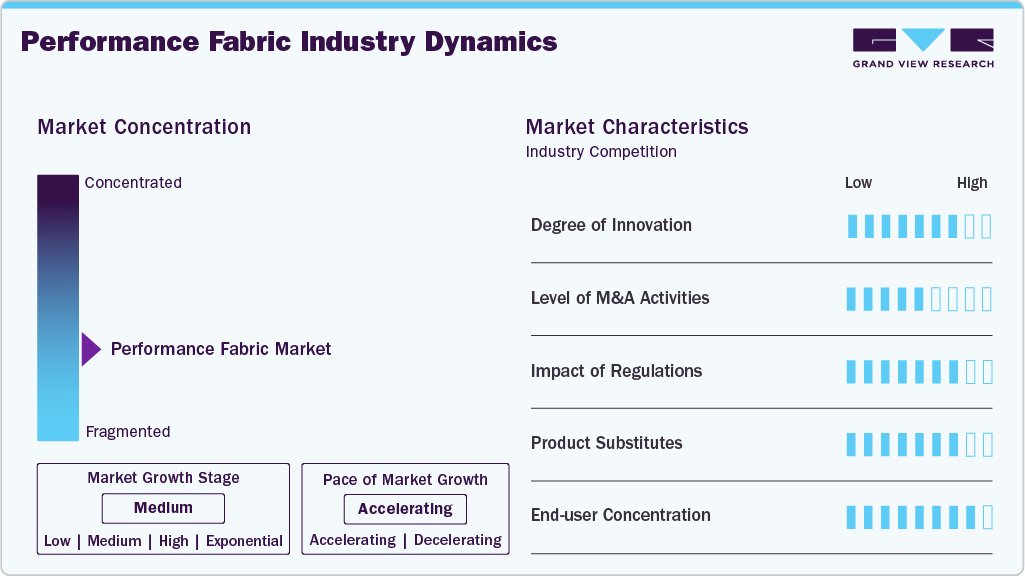

Market Concentration & Characteristics

The global performance fabrics industry exhibits moderate to high market concentration, with a few key multinational players dominating the space due to their strong distribution networks, advanced R&D capabilities, and brand recognition. The degree of innovation in this market is substantial, driven by the integration of nanotechnology, smart fabrics, and bio-based materials to enhance durability, comfort, and functionality. Leading companies continuously invest in material type development to maintain a competitive edge, particularly in high-growth segments such as sportswear, defense, and industrial protective wear. The market also witnesses strategic collaborations, partnerships, and frequent mergers and acquisitions, indicating a high level of consolidation and a focus on expanding technological capabilities and regional presence.

Regulatory frameworks significantly impact market dynamics, particularly in terms of environmental sustainability and worker safety standards. Regulations by agencies such as the Environmental Protection Agency (EPA), Occupational Safety and Health Administration (OSHA), and European Chemicals Agency (ECHA) have driven the adoption of eco-friendly and non-toxic performance fabrics, encouraging innovation in sustainable material sourcing and material type methods. Although substitutes such as conventional fabrics exist, they fail to offer the specialized functionalities of performance fabrics, limiting the threat of substitution. End-use concentration is notable, with the sportswear, industrial, and military sectors comprising a large share of demand. However, newer end uses in healthcare and consumer electronics are emerging, broadening the market scope.

Material Type Insights

Polyester dominated the market and accounted for about 35.5% share of the revenue in 2024. Advancements in recycling technologies have enabled the widespread use of recycled polyester (rPET) derived from post-consumer plastic waste, particularly PET bottles. This reduces environmental impact and aligns with growing consumer demand for eco-friendly and circular textile solutions. Major apparel brands are increasingly incorporating rPET-based fabrics into their product lines, thereby reinforcing the growth trajectory of the polyester-based performance fabric segment. Furthermore, polyester’s adaptability to digital printing, lightweight design, and cost-efficiency make it a preferred material choice for manufacturers looking to meet both performance expectations and environmental mandates.

Aramid is expected to grow at the fastest CAGR of 4.8% over the forecast period. Aramid fabrics are widely used in reinforced cables, hoses, belts, gaskets, and composites due to their superior mechanical properties, resistance to abrasion, and minimal elongation under stress. These characteristics make them well-suited for oil & gas, construction, and heavy machinery, where extreme operational conditions require materials that can withstand high temperatures, friction, and mechanical loads. As these industries undergo modernization and safety upgrades, the reliance on high-performance materials such as aramid continues to increase.

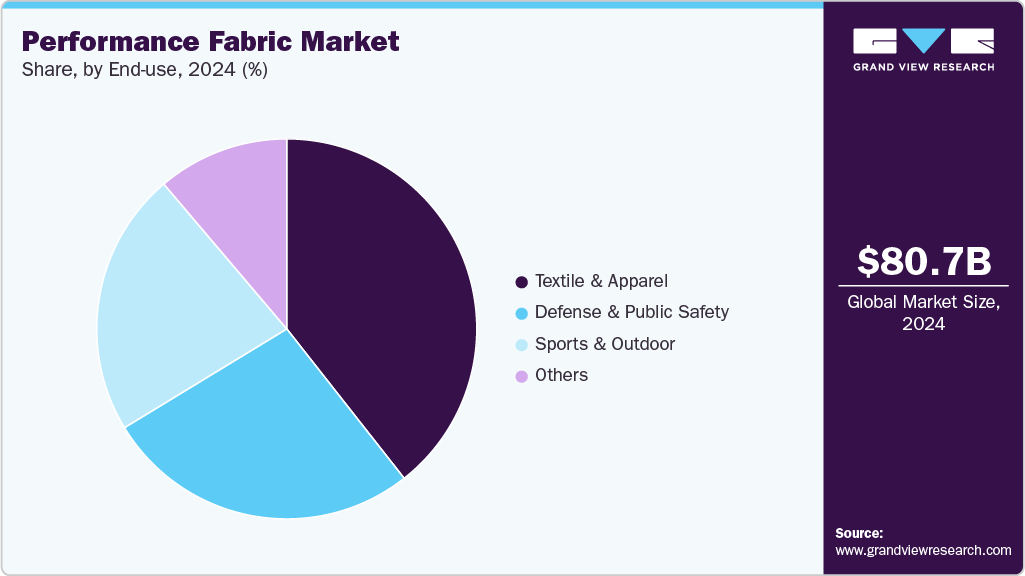

End Use Insights

Textile & apparel led the market and accounted for a 39.4% share in 2024, driven by the growing consumer demand for functional, comfortable, and durable clothing. Performance fabrics-offering attributes such as moisture-wicking, antimicrobial resistance, UV protection, stretchability, and breathability-are increasingly integrated into everyday wear, work wear, uniforms, and fashion apparel. The rise of athleisure and activewear, blending style with high performance, has transformed consumer preferences across all age groups and regions. Leading global brands continuously innovate with advanced materials to meet the demand for garments that perform in various environmental conditions while maintaining aesthetic appeal.

Defense & public safety is expected to grow at the fastest CAGR of 4.5% over the forecast period, due to the growing demand for advanced protective clothing and gear. Military forces and law enforcement agencies worldwide increasingly rely on high-performance textiles with flame resistance, ballistic protection, chemical resistance, and environmental durability. These fabrics are engineered using advanced materials such as aramids, ultra-high molecular weight polyethylene (UHMWPE), and other technical fibers that enhance survivability in hostile conditions. As geopolitical tensions persist and military modernization programs intensify, especially in regions such as North America, Asia Pacific, and the Middle East, the demand for technologically superior combat uniforms, tactical gear, and body armor continues to grow-fueling the adoption of performance fabrics globally.

Regional Insights

Asia Pacific dominated the market and accounted for 39.2% in 2024, driven by rapid industrialization and growing demand for protective and functional textiles across key sectors such as construction, manufacturing, and sportswear. The rising disposable income among middle-class consumers in countries like India, Japan, and South Korea fuels interest in high-performance sports and casual apparel. In addition, a large textile manufacturing base, coupled with ongoing investments in smart textiles and sustainable materials, is propelling regional market growth.

China Performance Fabric Market Trends

Theperformance fabric market in China is driven by strong domestic demand for high-quality functional apparel, particularly in urban centers where fitness, athleisure, and outdoor activities are gaining popularity. The government’s emphasis on industrial safety and rising export opportunities has led to increased adoption of technical textiles in the defense, automotive, and healthcare sectors.

North America Performance Fabric Market Trends

The performance fabric market in North America is supported by a mature consumer base that values technologically advanced and comfortable textiles. The region has seen sustained demand from the sportswear and outdoor apparel segments, driven by high levels of physical activity and health-conscious lifestyles. Moreover, significant defense spending in the U.S. and Canada promotes using performance fabrics in military End Uses, while stringent occupational safety regulations encourage industrial workwear and protective gear adoption.

The U.S. performance fabric market is dominant due to its well-developed textile R&D infrastructure and high consumer spending on premium activewear and smart fabrics. The growing popularity of fitness culture and a strong presence of global performance fabric brands also contribute to market momentum. Moreover, the U.S. military’s consistent investment in advanced protective gear made from high-performance textiles is a major demand driver.

Europe Performance Fabric Market Trends

The performance fabric market in Europe is influenced by stringent environmental and material safety regulations, encouraging the adoption of sustainable and recyclable materials. The demand for technical textiles in automotive interiors, industrial safety gear, and high-end fashion is robust, particularly in countries like France, Italy, and the UK. Furthermore, the region’s focus on circular economy initiatives and innovation in textile engineering supports long-term market growth.

Germany performance fabric market stands out in the European market as a leader in technical textiles, with strong demand across automotive, industrial, and defense sectors. Its well-established textile machinery industry and focus on sustainable Material Type development position it as a key contributor to innovation in performance fabrics. Moreover, the country’s high safety standards and emphasis on quality fuel the adoption of advanced occupational and protective clothing materials.

Central & South America Performance Fabric Market Trends

The performance fabric market in Central & South America is driven by a growing sportswear culture and increasing awareness of functional textiles in countries like Brazil, Argentina, and Chile. Rising urbanization and lifestyle shifts are boosting demand for breathable, water-resistant, durable clothing. Though still in a developing phase, the region is witnessing steady investment in local textile material and adoption of global trends in activewear and protective clothing.

Middle East & Africa Performance Fabric Market Trends

The performance fabric market in the Middle East & Africa is primarily propelled by increasing demand for protective fabrics in oil & gas, construction, and military sectors, particularly in countries like Saudi Arabia, UAE, and South Africa. Extreme climatic conditions and a growing interest in sports and fitness are also encouraging the use of moisture-wicking and UV-resistant textiles. In addition, the region is gradually embracing technological advancements in textile manufacturing, further supporting market development.

Key Performance Fabric Company Insights

Some key players operating in the market include DuPont and Royal TenCate N.V.

-

DuPont is a global leader in advanced materials and specialty chemicals. Under its renowned brands, DuPont offers materials such as Kevlar, Nomex, and Tyvek. Due to their strength, flame resistance, and lightweight properties, these fabrics are widely used in protective clothing, industrial end uses, military gear, and high-performance sportswear.

-

Royal TenCate, a Dutch company, specializes in advanced materials for protective and industrial markets. Its performance fabric offerings include flame-retardant textiles for military, fire services, and industrial work wear, along with geosynthetics and composites used in aerospace and infrastructure sectors. TenCate’s focus is on high-durability, functional fabrics designed for extreme environments.

Toray Industries, Inc., and Hexcel Corporation are some of the emerging market participants.

-

Toray Industries, headquartered in Japan, is a leading manufacturer of fibers and textiles, including advanced-performance fabrics. The company provides materials such as high-strength carbon fiber fabrics and breathable, waterproof textiles used in outdoor apparel, sportswear, and automotive interiors. Brands like Entrant and Dermizax exemplify their innovation in functional textiles.

-

Hexcel Corporation, based in the U.S., specializes in advanced composites and reinforcements. In the performance fabric space, Hexcel supplies woven carbon fiber and glass fiber fabrics used in aerospace, defense, and high-performance sporting goods. Its fabrics offer lightweight, high-strength solutions for demanding structural and technical end uses.

Key Performance Fabric Companies:

The following are the leading companies in the performance fabric market. These companies collectively hold the largest market share and dictate industry trends.

- DuPont

- Royal TenCate N.V.

- Toray Industries, Inc.

- Hexcel Corporation

- Omnova Solutions, Inc.

- Owens Corning

- Spradling International, Inc.

- Novustex

- Royal DSM

Recent Developments

-

In May 2025, Teijin Frontier Co., Ltd. announced the launch of an innovative polyester fabric designed to replicate natural fibers' sophisticated appearance and tactile sensation while offering enhanced performance and comfort. This new development represents a significant advancement in textile engineering, as it successfully combines the aesthetic and soft texture typically associated with materials like cotton or wool with the superior durability, breathability, and moisture-wicking capabilities of modern synthetic fabrics.

Performance Fabric Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 83.27 billion

Revenue forecast in 2033

USD 114.66 billion

Growth rate

CAGR of 4.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

DuPont; Royal TenCate N.V.; Toray Industries, Inc.; Hexcel Corporation; Omnova Solutions, Inc.; Owens Corning; Spradling International, Inc.; Novustex; Royal DSM

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Performance Fabric Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global performance fabric market report based on material type, end use, and region:

-

Material Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Polyester

-

Nylon

-

Spandex

-

Aramid

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Textile & Apparel

-

Sports & Outdoor

-

Defense & Public Safety

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global performance fabric market size was estimated at USD 80.70 billion in 2024 and is expected to reach USD 83.27 billion in 2025.

b. The global performance fabric market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2033 to reach USD 114.66 billion by 2033.

b. Textile & apparel led the market and accounted for a 39.41% share in 2024, driven by the growing consumer demand for functional, comfortable, and durable clothing.

b. Key players in the performance fabric market included DuPont, Royal TenCate N.V., Toray Industries, Inc., Hexcel Corporation, Omnova Solutions, Inc., Owens Corning, Spradling International, Inc., Novustex, and Royal DSM

b. Key factors driving the performance fabric market include rising demand for functional textiles, technological advancements, and increased application in defense, sportswear, and industrial sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.