- Home

- »

- Medical Devices

- »

-

Peripheral Nerve Injury Market Size & Share Report, 2030GVR Report cover

![Peripheral Nerve Injury Market Size, Share & Trends Report]()

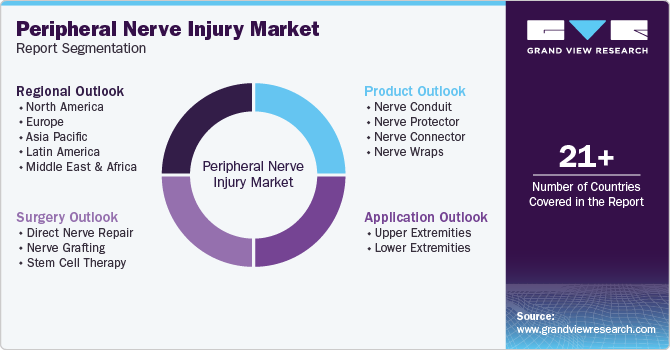

Peripheral Nerve Injury Market Size, Share & Trends Analysis Report By Product (Nerve Conduit, Nerve Protector), By Surgery (Direct Nerve Repair, Nerve Grafting), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-957-2

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Peripheral Nerve Injury Market Size & Trends

The global peripheral nerve injury market size was estimated at USD 1.54 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.7% from 2024 to 2030. The market growth is attributed to the increasing aging population and rising prevalence of peripheral nerve injuries (PNI) globally. Moreover, increasing government initiatives and reimbursement policies are expected to further boost market growth. The market is expected to expand due to the high number of orthognathic surgeries, third-molar surgeries, dental implants, anesthetic injections, and mandibular resection procedures. For instance, Axogen, Inc. research indicates that approximately 50,000 PNIs occur in the U.S. each year. Furthermore, they estimate that there are approximately 95,000 primary cubital tunnel relief surgeries and 488,000 primary carpal tunnels performed annually in the U.S.

Owing to these factors, the market is expected to advance in the near future. Moreover, the extensive application of biomaterials is a key market growth driver. It has applications in areas such as aesthetics, orthopedics, trauma, cardiology, and geriatric care. Improved life expectancy has created a necessity for treating age-related disorders, such as osteoporosis and arthritis. The evolution of 3D tissue engineering and utilization of the embryo cells along with stem cells indicates the opportunities for market growth. With the extensive results of therapies, increasing patient compliance, and improving quality of life, several private & government organizations are providing funds to conduct research to develop enhanced therapies. National Institute of Health (NIH) provided financial aid of USD 445 million and USD 180 million to human non-embryonic stem cell research and human embryonic stem cell research, respectively.

In addition, the growing incidence of PNIs globally is expected to boost market growth. More than 20 million Americans are thought to be affected by PNI, which can result in symptoms ranging from minor discomfort to profound paralysis. In addition, traumatic injury from events like workplace accidents, sports injuries, culinary accidents, and other mishaps like falls or cuts that frequently happen during daily activities is one of the main causes of peripheral nerve damage. Every year, over 700,000 Americans get surgery to potentially treat catastrophic peripheral nerve injury. The tremendous burden of PNIs has increased the demand for biomaterials as an alternative therapy. The market expansion is being supported by increased research into nerve regeneration and repair.

For instance, scientists from the Science Foundation Ireland Research Centre for Advanced Materials & Bioengineering Research (AMBER), Integra LifeSciences, and the RCSI University of Medicine & Health Sciences worked together on a project in January 2022. Extracellular matrix proteins, which are essential for tissue formation, may be used in a novel method to treat PNIs, according to research published in the Matrix Biology journal. Moreover, the development of an artificial nerve implant is in progress, which is expected to support the repair of damaged, long-distance PNIs. This project was EU-funded and was known as biohybrid templates for peripheral nerve regeneration or BIOHYBRID. This device graft is made of Chitosan and is designed specifically to bridge the gap resulting from nerve tissue damage and activate the nerve impulses between the distal & proximal nerve stumps by inducing regeneration.

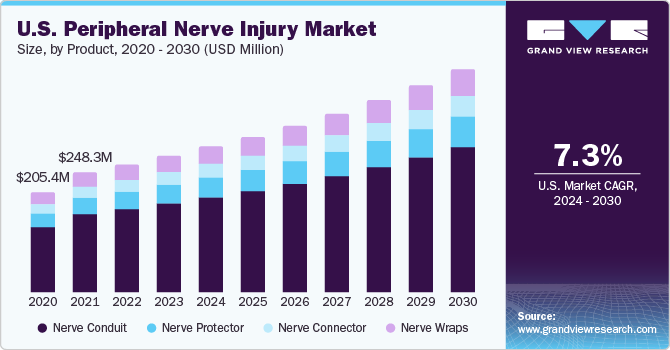

Product Insights

The nerve conduit led the market and accounted for a revenue share of more than 41.80% in 2023. This can be attributed to technological advancements, a wide range of applications, and government funding for innovations. Depending on the conduit material and manufacturing process, nerve conduits are of two types: biological and synthetic nerve conduits. Advanced products, such as biodegradable polymers, are expected to enhance spinal stabilization, heal fractures, and reduce hospitalization. Another instance of advancement is the development of stimuli-responsive biomaterials to achieve a feedback system for better integration and regeneration of tissues. Therefore, due to such key factors, the segment is expected to grow.

Moreover, the use of nerve conduits, a viable replacement for nerve autografts, is now restricted to peripheral nerves with modest abnormalities and small diameters. Investments by key companies to develop more effective products are likely to propel market growth in the coming years. For instance, in April 2022, a significant U.S. marketing campaign for Toyobo Co., Ltd.'s Nerbridge TM nerve conduit for peripheral nerve regeneration began. By the end of 2025, Toyobo intends to increase the product's production capacity and broaden the range of its therapeutic applications. Toyobo will expand its production and sales capabilities to meet the anticipated rise in demand for nerve conduits in the U.S. and elsewhere in the world.

As a result, this market is anticipated to grow. The nerve wraps segment is anticipated to witness the fastest CAGR from 2024 to 2030 due to high demand as nerve wraps prevent scar tissue ingrowth, minimize the potential for nerve entrapment, and guide regenerating nerve fibers as compared to other products. Furthermore, market participants are currently offering cutting-edge products that enhance treatment effectiveness. For instance, in July 2022, researchers at Northwestern University created a stretchable device wrap that could be used to wrap the nerves to reduce pain without using medicines, such as opioids.

Expected commercialization of the products in the coming years due to investments by companies & research institutes will also boost market growth. For instance, in June 2022, a grant from Regenerative Medicine Minnesota was given to Vascudyne, Inc., a biotechnology pioneer in regenerative medicine, for a study titled "Production of a Peripheral Nerve Wrap Using Tissue Tubes from Regenerative Engineering". The one-year, USD 100,000 funding from Vascudyne started in June 2022 and made use of TRUE Tissue technology. Such strategic initiatives by key manufacturers targeting niche patient subsets in this space will help accelerate segment growth.

Surgery Insights

The direct nerve repair segment led the market and accounted for more than 53.11% share of the global revenue in 2023. Around 20 million people in the U.S. suffer from PNIs, usually caused by trauma or medical disorders. Direct nerve repair is used for the treatment of peripheral nerve injuries. It is considered a gold-standard surgical treatment for severe injuries. These injuries lead to loss of ability to communicate due to malfunction of motor & sensory nerves between the peripheral organs and the Central Nervous System (CNS), resulting in impairment. Furthermore, organizations promote R&D for product development, which is expected to spur market growth.

For instance, in April 2023, scientists from the University of Oxford and MedUni Vienna demonstrated that nerve damage can be effectively repaired by using tubes made of a combination of silk from spiders and silkworms. The researchers used two distinct kinds of natural silk to create a novel kind of nerve guide. Silkworms created the tube wall, and dragline silk strands from spiders filled the interior of the tube. Rats with a ruptured nerve in their sciatica resulting in a 10 mm gap were used to test the tubes. The injured nerves developed along the silk threads and adapted to the new silk nerve guides, the researchers discovered, until the severed ends were effectively reunited. This is anticipated to boost segment growth.

The stem cell therapy segment is anticipated to witness the fastest CAGR from 2024 to 2030. Stem cells are perceived as the backbone of regenerative medicine wherein dynamic research activities are carried out. There are approximately 2,754 (2021) and 570 (2016) clinics in the U.S. that provide stem cell therapy, with the number likely to expand. A stem cell injection can cost anything from USD 8,000 to 30,000. Although many of these do not follow FDA regulations, they have been proven to be effective in the treatment of several conditions. The FDA has recommended that these cells be controlled like drugs because of the safety concerns raised by this situation. As a result, clinics may expect more stringent approval procedures in the future.

Rising government initiatives and approvals to conduct clinical trials are also anticipated to fuel segment growth. For instance, in October 2021, using a gingiva-derived mesenchymal stem cells (GMSCs), and 3D collagen hydrogel scaffold, a multidisciplinary team from the University of Pennsylvania School of Dental Medicine and Perelman School of Medicine (PA, USA) was able to restore the function of injured peripheral nerves. Human GMSCs were infused into collagen hydrogel in this novel method for guided nerve repair, allowing them to differentiate into Schwann precursor-like cells (SCPs) and neural crest stem-like cells (NCSCs). With the same efficiency as the "gold standard autograft method," these cells can migrate into natural nerve conduits and produce functionalized neurons.

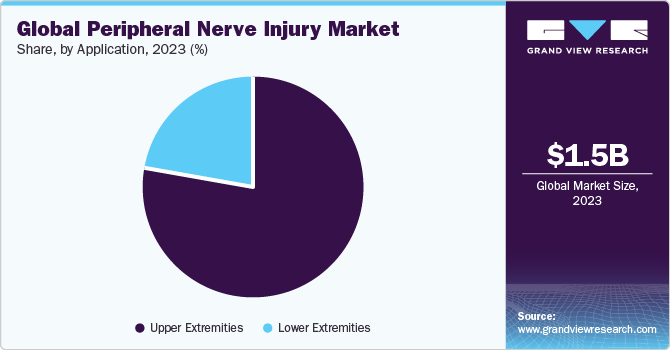

Application Insights

The upper extremities segment accounted for a share of more than 77.90% in 2023 and is anticipated to grow further at the fastest CAGR from 2024 to 2030. PNIs in the upper extremity are extremely common. Peripheral nerves are also damaged due to compression injuries. For instance, recurrent & severe carpal and cubital tunnel syndrome instances can lead to problems and PNI, necessitating surgical intervention and peripheral nerve protection. The "Upper Extremity Compression" is PNI brought on by recurring cubital tunnel and carpal tunnel syndrome.

However, manufacturers, for instance, have helped surgeons with their needs for healing damaged or transected peripheral nerves. Axogen develops new and next-generation devices. According to Axogen, there are still opportunities to create or buy complementing products for peripheral nerve healing. In addition, there are prospects to broaden the current product line through additional peripheral nerve repair procedures in urology, head and neck surgery, lower extremity surgery, and the surgical management of pain.

Regional Insights

North America accounted for the largest share of 30.62% in 2023 due to the high prevalence of PNIs coupled with the growing geriatric population in the region. The geriatric population is highly susceptible to these disorders. In addition, a rise in government funding and initiatives for raising awareness about PNIs is expected to drive regional market growth. Moreover, one of the main variables influencing regional market growth is technological progress due to industry leaders’ active involvement in the launch of new, more effective products. For instance, in March 2022, Integra LifeSciences launched a resorbable implant product to fix discontinuities in peripheral nerves, the NeuraGen 3D Nerve Guide Matrix.

NeuraGen 3D is a nerve healing device designed to provide an optimal environment that, when compared to hollow nerve conduits alone, may facilitate a more fully functional recovery after mid-gap nerve repair. Asia Pacific is expected to register the highest CAGR from 2024 to 2030. Rising cases of PNIs coupled with an unmet need for effective and long-term treatment solutions are expected to present significant growth opportunities for the regional market. Moreover, technological advancements and rising government initiatives to reduce the risk of PNIs will support market growth. It is projected that increased investments and pharmaceutical company expansions will accelerate market growth. Growing awareness about health & fitness, adoption of pain management therapies, and wide usage of smart devices for maintaining health also drive regional growth.

Key Companies & Market Share Insights

Key players are focusing on growth strategies, such as new product launches, regulatory approvals, expansions, collaborations, acquisitions, and partnerships. For instance, in September 2023, Axogen, Inc. launched Axoguard HA + Nerve Protector. It is a patented nerve protection device that is specifically made to prevent peripheral nerve injury in both the short and long term. Because of this, the market is anticipated to grow.

Key Peripheral Nerve Injury Companies:

- AxoGen, Inc.

- Stryker

- Baxter International, Inc.

- Polyganics BV

- Integra Lifesciences Corporation

- Renerva, LLC

- Medovent GmbH

- Toyobo Co., Ltd.

Peripheral Nerve Injury Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.65 billion

Revenue forecast in 2030

USD 2.58 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, surgery, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AxoGen, Inc.; Stryker; Baxter International, Inc.; Polyganics BV; Integra Lifesciences; Renerva, LLC; Medovent GmbH; Toyobo Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Peripheral Nerve Injury Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the peripheral nerve injury market report based on product, surgery, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Nerve Conduit

-

Nerve Protector

-

Nerve Connector

-

Nerve Wraps

-

-

Surgery Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Nerve Repair

-

Nerve Grafting

-

Stem Cell Therapy

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Upper Extremities

-

Lower Extremities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global peripheral nerve injury market size was estimated at USD 1.54 billion in 2023 and is expected to reach USD 1.65 billion in 2024.

b. The global peripheral nerve injury market is expected to grow at a compound annual growth rate of 7.7% from 2024 to 2030 to reach USD 2.58 billion by 2030.

b. North America dominated the peripheral nerve injury market in 2023 and is expected to witness a growth rate of 7.0% over the forecast period. This is due to rising prevalence of peripheral nerve injuries coupled with growing geriatric population in the region. The geriatric population is highly susceptible to these injuries. In addition, an increase in government funding and initiatives for raising awareness about peripheral nerve injuries is expected to drive the demand for peripheral nerve injury in the region.

b. Prominent key players operating in the peripheral nerve injury market include AxoGen, Inc., Stryker, Baxter International, Inc., Polyganics BV, Integra Lifesciences Corporation, Renerva, LLC., Medovent GmbH, Toyobo Co., Ltd., and others.

b. The market is expected to grow due to the ongoing clinical trials focused on nerve repair, technological advancements, an increase in research and development activities, and rise in awareness among people about different regenerative medicines, supporting the market growth of peripheral nerve injuries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."