- Home

- »

- Personal Care & Cosmetics

- »

-

Personal Care Contract Manufacturing Market Report, 2030GVR Report cover

![Personal Care Contract Manufacturing Market Size, Share & Trends Report]()

Personal Care Contract Manufacturing Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Manufacturing, Packaging, Custom Formulation and R&D), By Product (Skin Care, Hair Care, Make-up & Color Cosmetics), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-572-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Personal Care Contract Manufacturing Market Summary

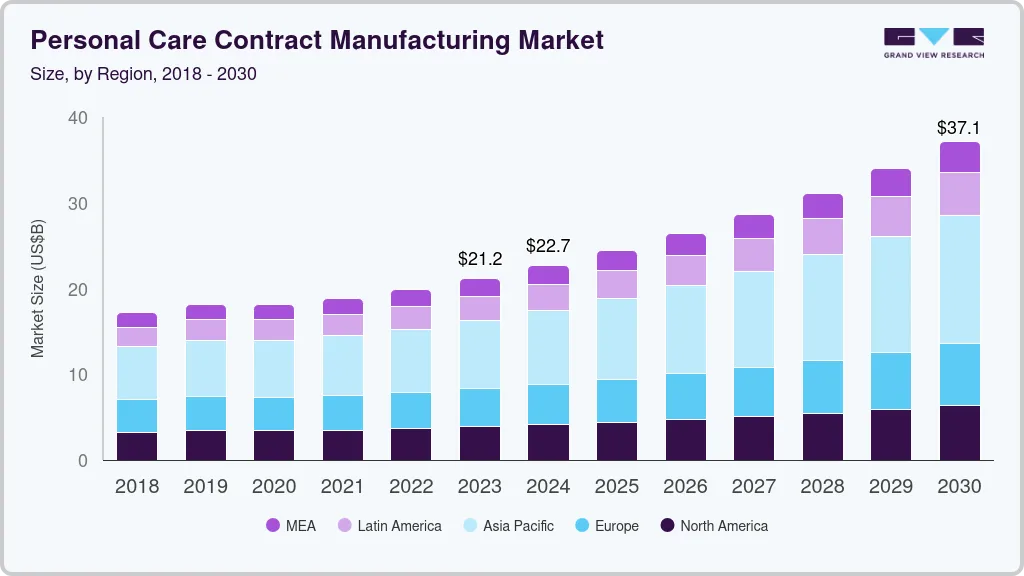

The global personal care contract manufacturing market size was valued at USD 22.67 billion in 2024 and is projected to reach USD 35.00 billion by 2030, growing at a CAGR of 7.7% from 2025 to 2030. The shifting focus of significant companies producing personal care products from in-house production to R&D and other promotional activities is projected to boost the contract manufacturing of these products.

Key Market Trends & Insights

- Asia Pacific dominated the global personal care contract manufacturing market with a share of 38.2% in 2024.

- The China personal care contract manufacturing market led the Asia Pacific market.

- In terms of service, the manufacturing service segment accounted for the largest share of 87.7% in 2024.

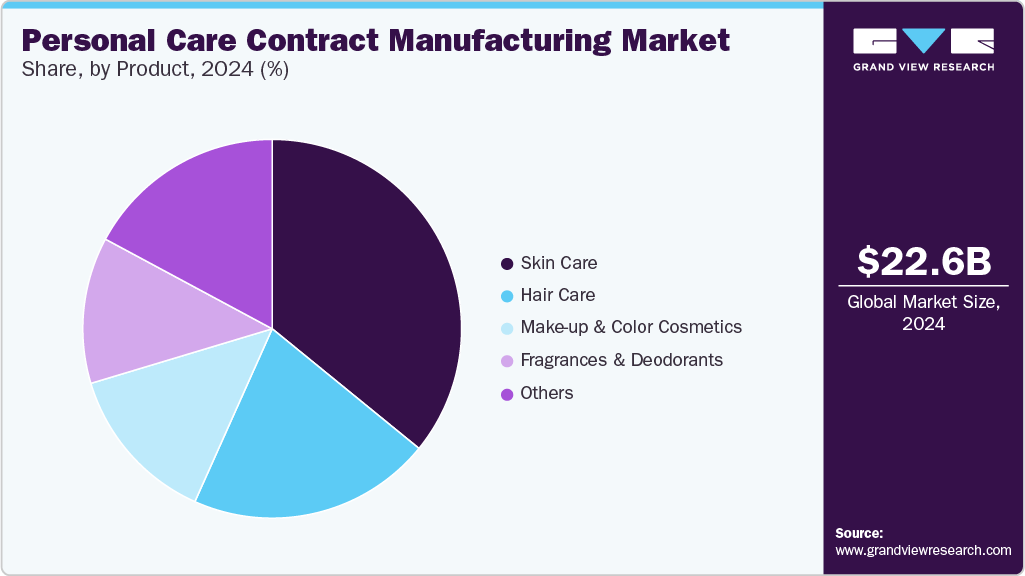

- In terms of product, the skin care products segment held the largest revenue share of 35.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 22.67 Billion

- 2030 Projected Market Size: USD 35.00 Billion

- CAGR (2025-2030): 7.7%

- Asia Pacific: Largest market in 2024

In addition, rising demand for innovative, sustainable products, cost-efficiency, and faster time-to-market also contribute to this growth. Furthermore, evolving consumer preferences, increased disposable incomes, the growth of e-commerce, and brands seeking specialized expertise for product development and packaging are driving market growth.Personal care contract manufacturing involves outsourcing certain production tasks, such as making physical products or handling packaging. This method allows personal care and cosmetic companies to avoid the high costs and complexities of running their own manufacturing facilities. The demand for these services is expected to grow significantly in the near future. This growth is driven by consumers becoming more conscious of personal hygiene and having greater spending power. The increasing preference for natural products is further propelling the expansion of the personal care contract manufacturing sector.

The personal care contract manufacturing market in the U.S. is expected to witness growth due to the increasing consumer demand for cosmetic items that are natural or organic, cruelty-free, and not tested on animals. The desire for creative and eco-friendly packaging designs is also anticipated to contribute to this growth. Both men and women in the U.S. are attracted to the design and exclusive packaging of cosmetic products, prompting manufacturers to place greater emphasis on the use of innovative packaging solutions for their products.

Furthermore, men in the U.S. use cosmetic products more frequently in their daily routine than in previous years. This is leading to the expansion of the cosmetics industry in the country. Ongoing innovations related to the development of eco-friendly packaging products and the surging preference of consumers for natural and organic personal care products are further anticipated to fuel the demand for personal care product contract manufacturing in the U.S. over the forecast period.

The high degree of competitiveness present in the personal care industry has encouraged companies to adopt strategies that are expected to aid them in gaining an increased market share by tapping new markets and increasing their penetration in the present market. For instance, in February 2021, G&M Cosmetics launched baby care and vegan beauty products. With the acquisition of P'URE Papayacare skincare, the company entered the vegan beauty space. Since then, the brand has grown to include 15 vegan-approved and certified products. These factors will drive demand for personal care products in the U.S, which will drive demand for the personal care contract manufacturing market as the personal care contract manufacturers provide them with high-quality products at a lower cost and in a shorter time.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. Personal care contract manufacturing market is characterized by a high degree of innovation owing to the rapid technological advancements. Moreover, the companies are further adopting various organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

The personal care contract manufacturing market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including increasing the reach of their products in the market and improving the availability of their products & services in diverse geographical areas. Key market players adopting this inorganic growth strategy include Knowlton Development Corporation (KDC/ONE), Vi-Jon, Cosmetic Essence Innovations, HATCHBEAUTY, LLC, SCHWAN Cosmetics, CoValence Laboratories, Tropical Products, Inc., Formula Corp., Mansfield-King, Fareva.

Regulations play a pivotal role in shaping the landscape of the personal care contract manufacturing market, influencing both its dynamics and evolution. Stringent safety and environmental regulations drive innovation in custom formulation, pushing manufacturers to develop new products that meet or exceed compliance requirements. As the regulatory landscape continues to evolve globally, market participants in the personal care contract manufacturing sector must navigate and adapt to these compliance standards, fostering a continuous cycle of innovation and improvement within the industry.

The degree of innovation in the personal care contract manufacturing market has experienced a notable upswing in recent years. Manufacturers are increasingly integrating advanced technologies and formulations to meet the evolving demands of consumers seeking personalized and sustainable products. This shift is evident in the adoption of cutting-edge ingredients, such as plant-based extracts and biotechnologically derived components, reflecting a growing emphasis on eco-friendly and cruelty-free alternatives.

End users in the personal care industry are experiencing a heightened degree of innovation in product offerings. A shift towards customization and sustainability is prevalent, with brands tailoring formulations to cater to individual preferences and adopting eco-friendly practices. Consumers now seek advanced ingredients, such as natural extracts and scientifically backed components, aligning with the growing interest in health and wellness. Innovations also extend to packaging, focusing on sustainable materials and smart design.

Service Insights

The manufacturing service segment led the market and accounted for the largest revenue share of 87.7% in 2024, owing to the increasing demand for products in developed and developing nations. The major brands, including P&G and Unilever, outsource their mass-manufactured products and focus on producing innovative products, which is expected to aid the production of these products through contractors.

The packaging segment is expected to grow at a CAGR of 6.8% over the forecast period, fueled by increasing demand for innovative, sustainable, and customizable solutions, as brands respond to consumer preferences for eco-friendly and refillable packaging. Furthermore, outsourcing packaging allows brands to focus on core activities while leveraging advanced, circular systems from contract manufacturers.

Product Insights

The skin care products dominated the personal care contract manufacturing market and held the largest revenue share of 35.9% in 2024. Skin care products play a crucial role in developing a wide range of products designed to enhance and maintain skin health. These include various formulations, including cleansers, moisturizers, serums, masks, and specialized treatment products. For instance, McBride is a private label and contract manufacturer of personal care and household products. It provides a variety of skin care products, including body lotions, creams, and facial skincare solutions.

Hair care segment is expected to grow at a CAGR of 8.0% from 2025 to 2030, as it encompasses a variety of products designed to address the diverse requirements of consumers in terms of hair health, styling, and maintenance. For instance, KIK Custom Products is a contract manufacturer that offers a variety of personal care and hair care products. It works with different brands to formulate and create hair coloring products, including traditional hair dyes and specialty color treatment products.

Regional Insights

Asia Pacific personal care contract manufacturing dominated the global market and accounted for the largest revenue share of 38.2% in 2024. The personal care industry in the Asia Pacific is driven by the heightened demand for products such as deodorants and shaving creams among the younger population in emerging markets, including India and China, which is expected to impact industry growth significantly. Furthermore, the surge in demand for K-beauty, J-beauty, and Ayurveda-based products, along with the popularity of fast-moving consumer goods and premium packaging, is pushing brands to partner with contract manufacturers who offer end-to-end, scalable, and cost-effective solutions.

China Personal Care Contract Manufacturing Market Trends

The personal care contract manufacturing market in China led the Asia Pacific market. It held the largest revenue share in 2024, driven by its vast consumer base, strong e-commerce presence, and a deep understanding of local beauty preferences. In addition, domestic manufacturers excel at customizing products to suit cultural trends, often integrating traditional Chinese medicine with modern formulations. Furthermore, the market benefits from rapid technological advancements, automation, and a focus on R&D, enabling manufacturers to deliver innovative, high-quality products tailored to local and global markets.

North America Personal Care Contract Manufacturing Market Trends

The North America personal care contract manufacturing market is expected to grow at a CAGR of 6.4% over the forecast period, owing to advanced technological capabilities and supporting infrastructure, which have promoted highly sophisticated manufacturing of critical products on a large scale with high accuracy. The demand for custom formulations is also high in North America due to the presence of R&D hubs of key personal care industry players in the region and appealing advanced technological centers established by contract manufacturers to provide a one-stop solution to formulators.

The personal care contract manufacturing market in the U.S. dominated the North American market with the largest revenue share in 2024, owing to product innovation, regulatory standards, and rapid adoption of new beauty trends. In addition, the market is shaped by a strong presence of established and emerging brands seeking to differentiate through unique formulations and packaging.

Europe Personal Care Contract Manufacturing Market Trends

The European personal care contract manufacturing market is expected to register significant CAGR over the forecast period. Demand for personal care products, particularly in Germany, Italy, France, Spain, and the UK, is expected to drive demand due to consumer inclination towards grooming to inculcate positive self-esteem. Furthermore, the region’s market is shaped by a preference for natural, organic, and ethically produced products, prompting contract manufacturers to invest in clean-label formulations and eco-friendly packaging. Moreover, the influence of luxury and heritage brands drives demand for high-quality, innovative, and customizable manufacturing solutions.

Key Personal Care Contract Manufacturing Company Insights

Key global personal care contract manufacturing players include Vi-Jon, MAESA, HatchBeauty Brands, LLC, Fareva, and others. These companies employ strategies such as investing in advanced technologies, expanding service offerings, and focusing on sustainable practices. They enhance R&D capabilities, pursue strategic partnerships, and localize manufacturing to optimize supply chains, maintain regulatory compliance, and respond swiftly to evolving consumer preferences.

-

Albea produces a wide range of packaging products, including tubes, caps, applicators, compacts, mascaras, jars, and turnkey solutions tailored for skincare, color cosmetics, and fragrance segments. Albea operates primarily within the cosmetic and personal care packaging segment, offering standard and customized options to brands seeking advanced, sustainable, and visually appealing product packaging.

-

Vi-Jon is known for producing a broad assortment of products, such as mouthwash, hand sanitizers, soaps, first aid items, baby care products, and hair care products. The company operates extensively in the private label and branded product segments, supplying major retailers and store brands across North America.

Key Personal Care Contract Manufacturing Companies:

The following are the leading companies in the personal care contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Albea

- Accupac

- Knowlton Development Corporation

- Vi-Jon

- MAESA

- HatchBeauty Brands, LLC

- Fareva

- Colep

- Intercos S.p.A

- Oxygen Development

- Voyant Beauty

- Mansfield-King

- NuWorld

- Biogenesis

- Bright International

- Eco Lips

Recent Developments

-

In July 2024, Debut launched BiotechXBeautyLabs. It enables large and small beauty brands to develop sustainable, clinically tested, high-performing, and differentiated biotech products with no upfront research cost and high speed.

-

In May 2024, Bright Innovation Labs announced the expansion of hair bleach powder & cream production in the Arizona facility. This move is driven by rising customer demand and the company’s focus on innovation and sustainability.

-

In August 2023, Eco Lips broadened its range of organic lip care products by introducing the first-ever OTC-certified organic medicated lip balm. This innovative product is designed to provide soothing relief and protection for painful fever blisters and cold sores. Securing placement at CVS, the largest drugstore chain in the U.S., represents a significant milestone in the retail rollout of this product. The inclusion strengthens confidence in Eco Lip's offerings as well as addresses consumer demand in this category.

-

In January 2021, Bright International LLC acquired Bocchi Laboratories. By combining their respective strengths, Bright International LLC and Bocchi Laboratories are poised to create one of the most diverse and comprehensive full-service beauty & personal care platforms in the North American market. This strategic move expands the range of products and services offered by the combined entity as well as enhances its overall competitiveness and market positioning. The synergy between the two companies is likely to result in a powerhouse with the ability to cater to a wide array of consumer needs in the beauty and personal care sectors.

Personal Care Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.18 billion

Revenue forecast in 2030

USD 35.00 billion

Growth rate

CAGR of 7.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, product, region

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East and Africa.

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Finland; Sweden; Italy; Spain; Benelux; China; India; Japan; South Korea; Brazil; Chile; Peru; Saudi Arabia; South Africa

Key companies profiled

Albea; Accupac; Knowlton Development Corporation; Vi-Jon; MAESA; HatchBeauty Brands, LLC; Fareva; Colep; Intercos S.p.A; Oxygen Development; Voyant Beauty; Mansfield-King; NuWorld; Biogenesis; Bright International; Eco Lips

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Personal Care Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global personal care contract manufacturing market report based on service, product, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Skin Care

-

Hair Care

-

Make-up & Color Cosmetics

-

Fragrances & deodorants

-

Others

-

-

Custom Formulation and R&D

-

Skin Care

-

Hair Care

-

Make-up & Color Cosmetics

-

Fragrances & deodorants

-

Others

-

-

Packaging

-

Skin Care

-

Hair Care

-

Make-up & Color Cosmetics

-

Fragrances & deodorants

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin Care

-

Hair Care

-

Make-up & Color Cosmetics

-

Fragrances & deodorants

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.