- Home

- »

- Healthcare IT

- »

-

Personal Health Record Software Market Size Report, 2033GVR Report cover

![Personal Health Record Software Market Size, Share & Trends Report]()

Personal Health Record Software Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Software & Mobile Apps, Services), By Deployment Mode, By Architecture Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-525-9

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Personal Health Record Software Market Summary

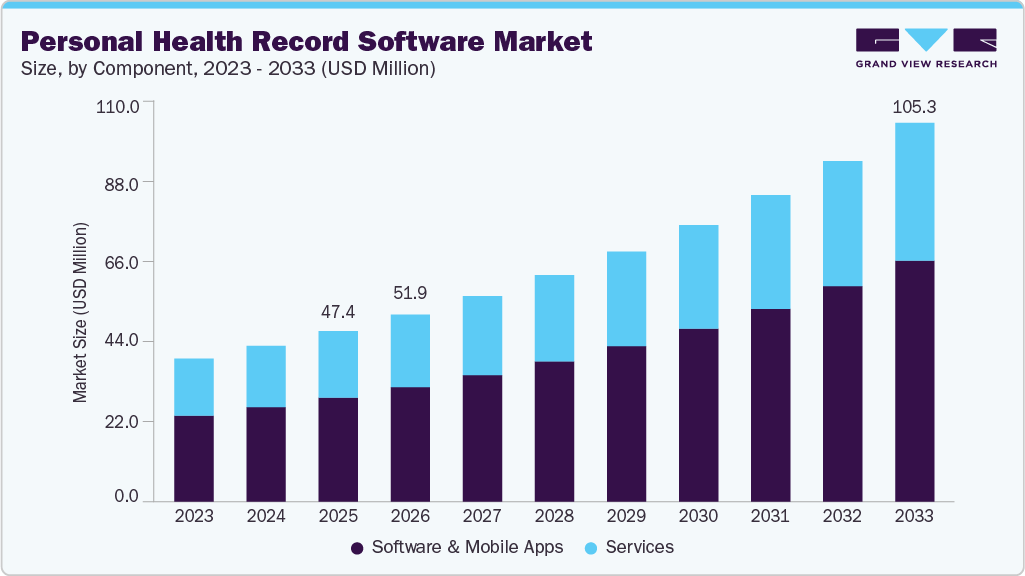

The global personal health record software market size was estimated at USD 47.40 million in 2025 and is projected to reach USD 105.30 million by 2033, growing at a CAGR of 10.61% from 2026 to 2033. This growth is attributed to increasing patient demand for accessing and managing their own health data, growing adoption of mobile health apps and wearable devices, increasing healthcare digitalization across hospitals and clinics, and expansion of telehealth, remote care, and virtual health ecosystems.

Key Market Trends & Insights

- North America dominated the personal health record software market with the largest revenue share of 45.34% in 2025.

- The U.S. personal health record software market is rapidly growing, fueled by patient demand for real-time medical access and smartphone-driven health management.

- Based on component, the software & mobile apps segment led the market with the largest revenue share of 60.9% in 2025.

- Based on deployment mode, the cloud-based segment accounted for the largest market revenue share in 2025.

- Based on architecture type, the integrated PHRs segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 47.40 Million

- 2033 Projected Market Size: USD 105.30 Million

- CAGR (2026-2033): 10.61%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Patients’ demand for direct access and control over their health data has strengthened as digital health tools have become integral to care delivery. According to the ASTP Data Brief of July 2025, 65% of individuals accessed their online medical records in 2024. This compares with 25% in 2014, reflecting a decade of sustained growth in digital health interaction. The upward trend aligns with broader shifts in consumer expectations. Patients now seek timely visibility into lab results, diagnoses, medications, and visit summaries, expecting experiences similar to other digital services. The increasing use of smartphones, the availability of more provider portals, and heightened awareness of personal health management have further accelerated this behavior. As a result, data access and control have become central drivers of the personal health records industry.

Growing adoption of mobile health apps and wearable devices is significantly strengthening the expansion of the personal health records industry. A 2025 cross-sectional study published in the Journal of Medical Internet Research found that the use of wearable healthcare devices among U.S. adults increased from approximately 28-30% in 2019 to 36.36% in 2022, reflecting a rise in user engagement with real-time health monitoring. As smartwatches, fitness trackers, and sensor-enabled devices become mainstream, users are generating a growing volume of personal health data related to vital signs, activity, sleep, and the monitoring of chronic conditions. This increase in patient-generated data naturally raises the need for centralized platforms such as PHRs that can consolidate, store, and support the sharing of this information with healthcare providers or caregivers. This behavioral and technological convergence makes mobile apps and wearables a critical driver of PHR software market growth.

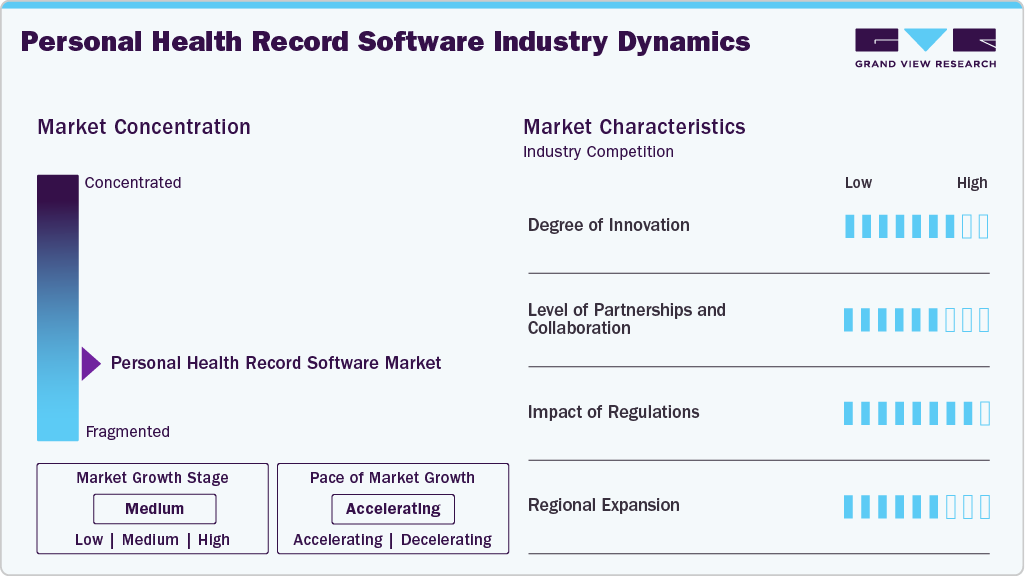

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion.

The personal health records software industry is advancing through improvements in data integration, user experience, and interoperability with clinical systems. Vendors are introducing secure cloud-based platforms, mobile-friendly interfaces, and automated syncing with electronic health records (EHRs), wearables, and health apps to enhance patient engagement and data accessibility.

The personal health record software industry exhibits a moderate yet growing level of partnerships and collaborations, primarily focused on enhancing interoperability, expanding patient access, and integrating PHR platforms into broader digital health ecosystems. Technology vendors are increasingly partnering with healthcare providers, academic institutions, and health IT organizations to advance data-sharing capabilities, support patient engagement, and align PHR solutions with real-world clinical workflows. For instance, in November 2025, Patients Know Best (PKB) launched in Saudi Arabia through a collaboration with Al Maarefa University, integrating its personal health record platform into the university’s medical and health IT programs and training 200 students in digital, patient-centric healthcare.

“The collaboration with PKB will teach students how a personal health record is designed and how it can be used effectively by both patients and healthcare providers in the coming years.”

Dr Nasriah Zakaria

Regulations strong influence on the personal health record software industry, requiring vendors to meet strict data privacy, security, and interoperability standards under frameworks such as HIPAA, GDPR, and ONC’s FHIR-based exchange rules. These mandates govern how patient data is stored, protected, and shared, ensuring confidentiality and the secure flow of trusted information across healthcare systems. While essential for safeguarding patient rights, compliance adds technical and operational complexity, prompting PHR providers to invest in secure cloud infrastructure, encryption, and robust interoperability capabilities.

The personal health record software industry is experiencing steady growth as vendors expand regionally, enhance data interoperability, strengthen privacy and security frameworks, and address rising patient demand for accessible, integrated, and user-friendly health data management solutions across diverse healthcare systems.

Component Insights

The software & mobile apps segment led the market with the largest revenue share of 60.9% in 2025, driven by increasing patient reliance on digital platforms for viewing, managing, and sharing health information. Growing smartphone penetration, interoperability improvements, and adoption of patient portals by hospitals and clinics further accelerated usage. The segment’s growth is further supported by the demand for mobile-friendly tools that consolidate records, enable secure communication, and support real-time access to personal health data across care settings.

The services segment is expected to grow at a significant CAGR during the forecast period. This growth is supported by rising demand for implementation, integration, customization, and ongoing maintenance of personal health record platforms. As healthcare providers prioritize secure data exchange, workflow alignment, and patient engagement optimization, service providers play a critical role in enabling seamless deployment and long-term functionality. Growing regulatory focus on interoperability and privacy compliance further increases reliance on specialized service capabilities, contributing to the segment’s growth.

Architecture Type Insights

The integrated PHRs segment led the market with the largest revenue share of 42.15% in 2025, and is expected to grow at the fastest CAGR during the forecast period. This growth is attributed to their ability to aggregate data from multiple sources, EHRs, wearables, pharmacy systems, lab networks, and remote monitoring tools, positioning them strongly as interoperability improves and patient-centric ecosystems expand.

The tethered/connected PHRs segment is anticipated to grow at a significant CAGR during the forecast period. These are most widely adopted as they link directly to hospital EHRs/clinic portals, automatically update patient data, and are easier for consumers to use without manual entry. Their integration with provider systems, higher trust, and wide deployment by major health systems support the large share of the segment.

Deployment Mode Insights

The cloud-based segment accounted for the largest market revenue share in 2025are expected to grow at the fastest CAGR during the forecast period, driven by demand for scalable, flexible, and cost-efficient platforms that support real-time data synchronization across devices. The cloud-based PHR's ability to integrate seamlessly with mobile apps, wearables, remote monitoring tools, and interoperable APIs positions it as the preferred deployment model for next-generation, patient-centric digital health ecosystems.

In addition, the web-based segment held significant share in 2025, driven by wide adoption of web based deployment model across hospitals, health systems, and payers. Their strong integration with patient portals, secure login frameworks, and established compatibility with provider EHR systems make them the default choice for organizations modernizing patient engagement and record-access workflows.

Functionality Insights

The lab results & diagnostic data access segment accounted for the largest market revenue share in 2025. Lab results & diagnostic data access remains the core feature most consistently used by patients and providers. Access to test results, imaging summaries, and clinical reports supports routine care coordination and aligns with interoperability regulations requiring health systems to make clinical data electronically available to patients.

The health monitoring and vital-tracking capabilities segment is expected to grow at the fastest CAGR during the forecast period. This growth is driven by the consumer adoption of wearables, and remote patient monitoring programs. PHR platforms now increasingly integrate continuous data streams from heart rate, glucose, sleep, activity, and home-based vitals. As a result, these functions are becoming central to personalized, proactive care models and are rapidly expanding throughout both clinical and consumer health ecosystems.

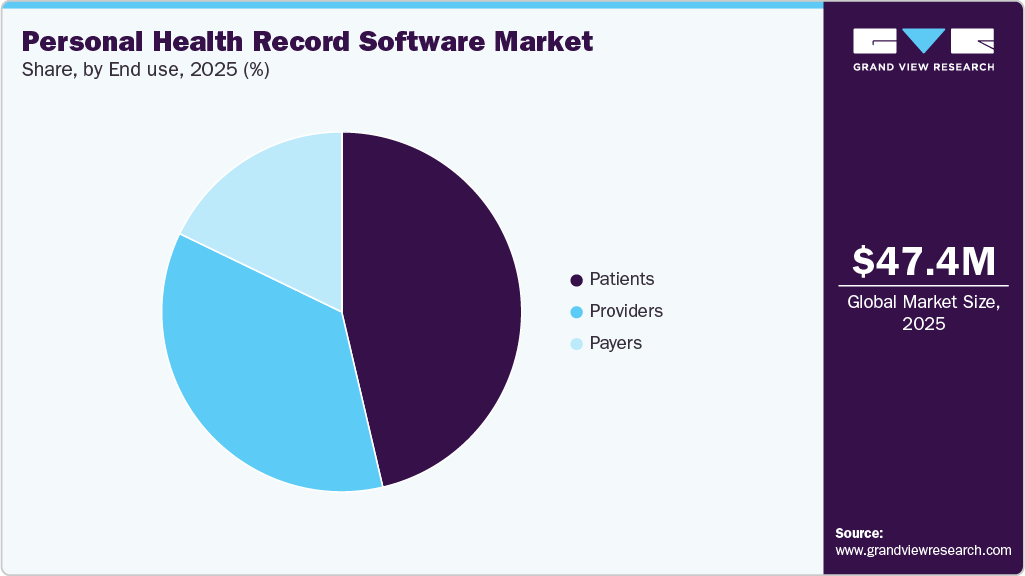

End Use Insights

The patients segment accounted for the largest market revenue share in 2025, driven by rising adoption of digital health tools, greater access to clinical data through interoperability mandates, and growing expectations for self-management of chronic conditions. As more individuals engage with lab results, visit summaries, medication lists, and mobile app-based tracking features, patient-facing PHR use continues to anchor overall market demand and remains the dominant contributor to revenue.

The providers segment is expected to grow at the fastest CAGR during the forecast period, as health systems increasingly integrate PHR platforms into clinical workflows to improve care coordination, reduce administrative burden, and meet patient-access and data-sharing requirements under federal interoperability rules. Expanding use of patient-generated health data, remote monitoring inputs, and secure messaging features is accelerating provider adoption, positioning this segment for sustained high growth over the forecast period.

Regional Insights

North America dominated the global personal health record software market with the largest revenue share of 45.34% in 2025, due to increasing patient engagement, widespread adoption of portals, and supportive regulations. In 2024, nearly all U.S. hospitals will enable core digital patient engagement capabilities, including record viewing, downloading, sharing, and secure messaging. Growing smartphone penetration and comfort with digital health tools are driving demand for PHR solutions that aggregate records, support mobile access, and enable seamless provider sharing.

U.S. Personal Health Record Software Market Trends

The personal health record software market in the U.S. is expanding as patients increasingly use digital tools to access and manage their medical information, driven by rising expectations for real-time access to lab results, visit summaries, and care plans, along with growing reliance on smartphone-based health management. The growth is further propelled by national efforts to improve interoperability and simplify patient-controlled data sharing across providers and systems. For instance, the U.S. government’s July 2025 plan to introduce a new private health-tracking system, developed in collaboration with major technology partners, will enable users to upload and share their medical records and health data. This initiative is expected to streamline cross-platform data integration and accelerate adoption of PHR platform.

Europe Personal Health Record Software Market Trends

The personal health record software market in Europe is growing steadily, driven by healthcare digitization, increasing patient demand for data access, and regulatory support for secure and interoperable systems. Initiatives like Germany’s Elektronische Patientenakte (ePA) and the European Health Data Space (EHDS) are expanding access and cross-border data sharing. At the same time, national eHealth portals in countries such as Denmark demonstrate increasing patient engagement. Adoption is further supported by telehealth and remote monitoring, positioning Europe as a favorable market for the growth of PHR software.

The UK personal health record software market is driven by increasing patient demand for digital access to health data, government support for interoperable healthcare systems, and the adoption of mobile- and cloud-based PHR platforms. In January 2025, Patients Know Best (PKB) secured USD 7.99 million (£6 million) in funding to scale its PHR platform in the UK and support international expansion, enabling enhancements to its unified health-data system that allow patients to securely access, manage, and share their complete medical history across multiple providers. Initiatives like this reflect the growing emphasis on patient-centered care and the integration of digital health.

The personal health record software market in Germany’s growth is driven by national initiatives aimed at digitizing healthcare and enhancing patient access to medical data. The growing adoption of mobile health tools, telemedicine, and integrated digital health platforms is enabling patients to securely manage and share their health information, thereby improving care coordination and supporting more patient-centered healthcare delivery.

Asia Pacific Personal Health Record Software Market Trends

The personal health record software market in Asia-Pacific is anticipated to grow at the fastest CAGR during the forecast period, driven by increasing digital health adoption, rising patient awareness, and government-led initiatives aimed at centralizing health data. For instance, in September 2023, South Korea expanded its MyHealthWay platform, enabling citizens to access 113 types of personal health data from 860 healthcare institutions, centralizing records for easier management and secure sharing. Such initiatives enhance patient control, improve continuity of care across providers, and highlight the region’s focus on interoperable, patient-centered digital health systems, creating significant growth opportunities for PHR solutions.

The Japan personal health record software market is driven by growing adoption of mobile health apps, wearable devices, and telemedicine platforms, which enable patients to monitor, manage, and share their health information more effectively. Government initiatives promoting digital health and the integration of health IT systems across hospitals and clinics are further supporting the adoption of personal health records software.

The personal health record software market in India is driven by increasing smartphone penetration, rising health awareness, and government initiatives aimed at digitizing healthcare. In January 2025, Samsung Health introduced a new PHR feature, allowing users to create or link their Ayushman Bharat Digital Mission (ABHA) account directly within the app and securely manage their medical history. This development enhances patient access to consolidated health records, promotes data interoperability, and supports secure sharing across providers, reinforcing the adoption of PHR solutions in India.

Latin America Personal Health Record Software Market Trends

The personal health record software market in Latin America is driven by the expansion of telemedicine services, the increasing adoption of cloud-based health platforms, and government initiatives to implement national health data strategies. Mobile apps and integrated digital tools are enabling patients to securely manage and share their medical information, while improving care coordination and fostering greater patient engagement.

Middle East & Africa Personal Health Record Software Market Trends

The personal health record software market in Middle East & Africa’s growth is supported by increasing digital health initiatives, government investments in eHealth infrastructure, and rising patient interest in managing personal medical data.

Key Personal Health Record Software Company Insights

New product developments, geographic expansions, acquisitions, and collaborations are the key strategic undertakings influencing the industry dynamics.

Key Personal Health Record Software Companies:

The following are the leading companies in the personal health record software market. These companies collectively hold the largest market share and dictate industry trends.

- Healthbook LLC

- OneRecord (acquired by MRO in 2023)

- Seqster

- xCures

- Health Wealth Safe Inc.

- NoMoreClipboard

- Tiga Healthcare Technologies

- Global Health Limited (MasterCare)

- Inform Health Limited

- CareClinic

Recent Developments

- In October 2022, Milliman IntelliScript acquired digital health platform OneRecord. This acquisition enables IntelliScript to enhance its digital health data capabilities by integrating OneRecord’s consumer app and API, which allows individuals to access, aggregate, and share their clinical and financial healthcare records.

Personal Health Record Software Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 51.99 million

Revenue forecast in 2033

USD 105.30 million

Growth rate

CAGR of 10.61% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

component, architecture type, deployment mode, functionality, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Healthbook LLC; OneRecord (acquired by MRO in 2023); Seqster; xCures; Health Wealth Safe Inc.; NoMoreClipboard; Tiga Healthcare Technologies; Global Health Limited (MasterCare); Inform Health Limited; CareClinic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Personal Health Record Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global personal health record software market report based on component, architecture type, deployment mode, functionality, end use, and region:

-

Component Outlook Revenue, USD Million, 2021 - 2033)

-

Software & Mobile Apps

-

Services

-

-

Architecture Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Standalone PHRs

-

Tethered/Connected PHRs

-

Integrated PHRs

-

-

Deployment Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Web-based

-

Cloud-based

-

-

Functionality Outlook (Revenue, USD Million, 2021 - 2033)

-

Appointment Scheduling & Reminders

-

Lab Results & Diagnostic Data Access

-

Health Monitoring & Vital Tracking

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Patients

-

Providers

-

Payers

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global personal health record software market size was estimated at USD 47.40 million in 2025 and is expected to reach USD 51.99 million in 2026.

b. The global personal health record software market is expected to grow at a compound annual growth rate of 10.61% from 2026 to 2033 to reach USD 105.30 million by 2033.

b. North America dominated the personal health record software market with a share of 45.34% in 2025. This is attributable to the growing smartphone penetration and comfort with digital health tools are driving demand for PHR solutions that aggregate records, support mobile access, and enable seamless provider sharing.

b. Some key players operating in the personal health record software market include Healthbook LLC, OneRecord (acquired by MRO in 2023), Seqster, xCures, Health Wealth Safe Inc., NoMoreClipboard, Tiga Healthcare Technologies, Global Health Limited (MasterCare), Inform Health Limited, CareClinic.

b. Key factors that are driving the personal health record market growth include increasing patient demand for accessing and managing their own health data, growing adoption of mobile health apps and wearable devices, increasing healthcare digitalization across hospitals and clinics and expansion of telehealth, remote care, and virtual health ecosystems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.