- Home

- »

- Medical Devices

- »

-

Personal Mobility Devices Market Size, Share Report, 2030GVR Report cover

![Personal Mobility Devices Market Size, Share & Trends Report]()

Personal Mobility Devices Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Walking Aids, Wheelchairs, Scooters), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: 978-1-68038-358-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Personal Mobility Devices Market Summary

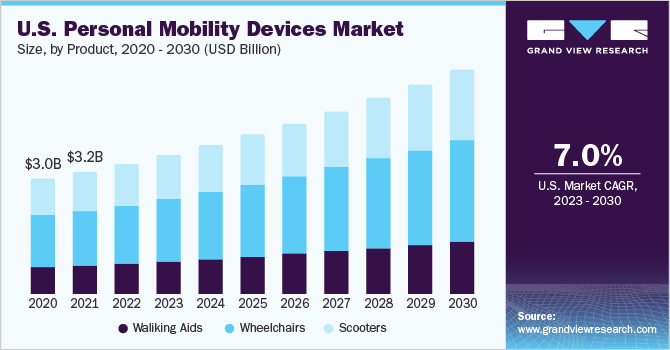

The global personal mobility devices market size was estimated at USD 10.58 billion in 2022 and is projected to reach USD 17.97 billion by 2030, growing at a CAGR of 6.8% from 2023 to 2030. The market has witnessed a decline in 2020 during the COVID-19 pandemic due to the disrupted transportation of the devices.

Key Market Trends & Insights

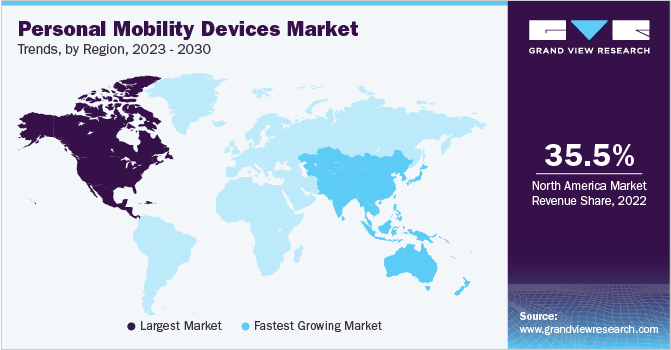

- North America dominated the overall personal mobility devices market in 2022 with a revenue share of 35.5%.

- The U.S. government doubled the funding for Rehabilitation Engineering Research Center programs for accelerating the research in the field of personal mobility.

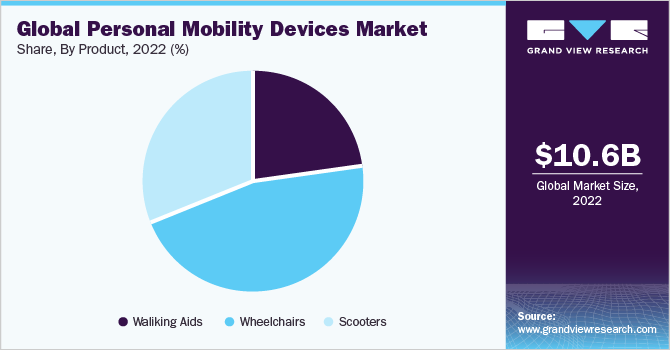

- By product, the wheelchair segment dominated the market for personal mobility devices and accounted for the largest revenue share of over 45.4% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 10.58 Billion

- 2030 Projected Market Size: USD 17.97 Billion

- CAGR (2023-2030): 6.8%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

An increasing population, growing product development, and a rising number of accidents causing disabilities are some of the key factors driving the market for personal mobility devices. The rising geriatric population and cases of chronic diseases across the globe are the major factors contributing to market growth.

The COVID-19 pandemic negatively affected the global market as the demand and production of personal mobility devices were decreased and revenues of key players took a hit owing to the pandemic. For instance, the annual revenue of Invacare fell by 8.3% in 2020. However, the implementation of proactive steps and policies has created better opportunities for the market players owing to the ease in distribution systems due to revised COVID-19 restrictions in different regions. Government initiatives such as favorable reimbursement policies, for instance, the Medicare reimbursement program for purchased and rented devices are expected to drive the market for personal mobility devices.

Few mobility devices, such as walkers, wheelchairs, canes and crutches, are also covered under Medicare insurance Part B. The market players are also adopting various strategic initiatives such as a change in distribution footprints to reduce the transit time and freight charges. For instance, the net sales of Invacare Corporation increased by 2.6% from 2020 to 2021 owing to the cost improvement strategy in supply-chain and administrative functions and global IT modernization initiatives for optimizing the operations structure of the company.

In U.S., the personal mobility devices market, the walking aids product segment is expected to witness a CAGR of 6.1% over the forecast period. The Indian government has initiated the Scheme of Assistance to Disabled Persons to help in procuring sophisticated, durable and modern, scientifically manufactured, standard aids and medical devices to promote social, psychological, and physical rehabilitation of people with disabilities. Moreover, this provision is expected to assist in enhancing the economic potential for purchasing mobility devices. Assistive devices are given to public work departments to promote independent living and to reduce the extent of disability. Technological advancements in products are among the most important drivers for the market.

The introduction of advanced mobility scooters, transfer lifts, and automated rollators are expected to significantly improve the usage rates of mobility devices. For instance, Phoenix Instinct is the first lightweight wheelchair with smart technology which comes with a carbon fiber body and other life-enhancing features.

Product Insights

The wheelchair segment dominated the market for personal mobility devices and accounted for the largest revenue share of over 45.4% in 2022. The segment is expected to retain the leading position throughout the forecast period. Wheelchairs are one of the most common assistive devices used in personal mobility. United Nations provides appropriate legislation for requesting member states in supporting the development, production, distribution, and servicing of these mobility devices. The usage of appropriate wheelchairs enhances the quality of life, reduces common problems, such as deformities and pressure sores, and improves digestion and respiration.

There are approximately 2 million new users every year, which translates to increased demand for wheelchairs in the country. Powered wheelchairs emerged as the largest sub-segment, in terms of revenue, in 2021. The increasing global geriatric population, chronic diseases, and growing adoption of powered wheelchairs are the key factors responsible for the growth of the wheelchair market.

Regional Insights

North America dominated the overall personal mobility devices market in 2022 with a revenue share of 35.5%. The regional market will grow at a steady rate during the forecast years due to the increasing geriatric population, rising prevalence of age-associated diseases, presence of improved healthcare infrastructure, high healthcare expenditure, and favorable reimbursement policies for purchase or rental services.

However, Asia Pacific is expected to emerge as the fastest-growing regional market of 8.2% from 2023 to 2030. This is attributed to the increasing geriatric population in Asian countries, such as Japan, China, and India. In addition, extensive R&D activities undertaken by various organizations, such as the China Rehabilitation Research Center (CRRC), are expected to drive the regional market. Increasing disposable income levels, rising awareness, high healthcare expenditure, and government initiatives aimed at improving healthcare access are also expected to boost the market growth in Asia Pacific. The U.S. government doubled the funding for Rehabilitation Engineering Research Center programs for accelerating the research in the field of personal mobility.

Key Companies & Market Share Insights

The market players are focusing on adopting various growth strategies, such as partnership and expansion of product portfolio, to retain their market position. For instance, in June 2021, Rollz international launched a new Rollz Flex 2 rollator which provides better comfort, stability, and design to the user. This rollator is among the most innovative creations of the company. Some of the prominent players in the global personal mobility devices market include:

-

Drive DeVilbiss Healthcare

-

GF Health Products, Inc.

-

Invacare Corporation

-

Carex Health Brands, Inc.

-

Kaye Products, Inc.

-

Briggs Healthcare

-

Medline Industries, Inc.

-

NOVA Medical Products

-

Performance Health

-

Rollz International

Personal Mobility Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.31 billion

Revenue forecast in 2030

USD 17.97 billion

Growth rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historic data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; France; U.K.; Germany; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; South Korea; Thailand; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Drive DeVilbiss Healthcare; GF Health Products, Inc.; Invacare Corporation; Carex Health Brands, Inc.; Kaye Products, Inc.; Briggs Healthcare; Medline Industries, Inc.; NOVA Medical Products; Performance Health; Rollz International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Personal Mobility Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global personal mobility devices market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Walking Aids

-

Rollators

-

Premium Rollators

-

Low-Cost Rollators

-

-

Others (Canes, Crutches, and Walkers)

-

-

Wheelchairs

-

Manual wheelchairs

-

Powered Wheelchairs

-

-

Scooters

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global personal mobility devices market size was estimated at USD 10.58 billion in 2022 and is expected to reach USD 11.31 billion in 2023.

b. The global personal mobility devices market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 17.97 billion by 2030.

b. North America dominated the personal mobility devices market with a share of 35.5% in 2022. This is attributable to the growing prevalence of age-associated diseases, increasing geriatric population, presence of improved healthcare infrastructure, and high healthcare expenditure.

b. Some key players operating in the personal mobility devices market include Drive DeVilbiss Healthcare; GF HEALTH PRODUCTS, INC.; Invacare Corporation; Carex Health Brands, Inc.; Kaye Products, Inc.; Briggs Healthcare; Medline Industries, Inc.; NOVA Medical Products; Performance Health; and Rollz International.

b. Key factors that are driving the personal mobility devices market growth include an increase in disability cases, increasing product development, and growth in the number of accidents causing impairment of the limbs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.