- Home

- »

- Biotechnology

- »

-

Personalized Retail Nutrition And Wellness Market Report, 2030GVR Report cover

![Personalized Retail Nutrition And Wellness Market Size, Share & Trends Report]()

Personalized Retail Nutrition And Wellness Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Fixed Recommendation, Repeat Recommendation, Continuous Recommendation), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-449-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Personalized Retail Nutrition And Wellness Market Summary

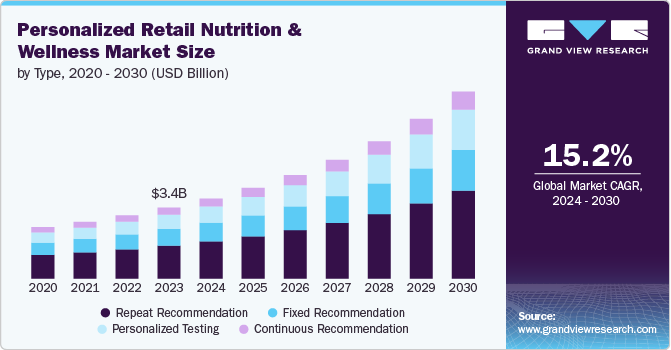

The global personalized retail nutrition and wellness market size was estimated at USD 3.39 billion in 2023 and is projected to grow at a CAGR of 15.19% from 2024 to 2030.The market has gained significant momentum in recent years, collectively attributed to the introduction of advanced wearable solutions, expanding integration of digital technologies, and targeted scalability of direct-to-consumer e-commerce models.

Key Market Trends & Insights

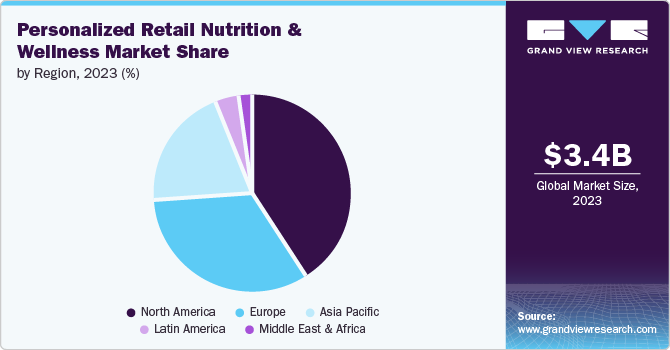

- North America dominated the personalized retail nutrition and wellness market with the largest revenue share of 41.43% in 2023.

- By type, the repeat recommendations segment led the market with the largest revenue share of 46.36% in 2023.

- The personalized retail nutrition and wellness market in the U.S. is expected to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 3.39 Billion

- 2030 Projected Market Size: USD 8.93 Billion

- CAGR (2024-2030): 15.19%

- North America: Largest market in 2023

For instance, in November 2020, Royal DSM entered in collaboration with Huami Corp. for developing personalized nutrition solutions to address health conditions such as cardiac health, sports performance, and pre-diabetes. DSM’s AVA digital platform combined with Huami’s Amazfit wearables and PAI (Personal Activity Intelligence) helps in measuring health data in real-time. Hence, such strategies will help individuals prevent and manage lifestyle-based health conditions by leveraging new and advanced solutions.

The growing inclination towards functional foods can be further attributed to the market growth for personalized retail nutrition and wellness. Functional foods especially protein supplements are gradually gaining prominence and are becoming an integral part of a consumer’s daily diet. Hence, owing to the increasing demand for functional food products, companies are focusing on expanding their production for the functional food product portfolio.

For instance, in February 2021, Merit Functional Foods opened a new plant-based protein manufacturing facility in Winnipeg, Manitoba. The new facility will increase the production of food-grade high purity pea and canola proteins that are used in food and beverage applications.

The COVID-19 pandemic is acting as a positive catalyst for the market growth for personalized retail nutrition and wellness. People are increasingly driven to vitamin and mineral supplements for enhancing immune response. For catering to these growing needs, companies are launching new supplements. For instance, in December 2020, THE BOUNTIFUL COMPANY launched Immune 24 Hour +. It is a Non-GMO vitamin C supplement with 24-hour immune support. In addition, the soft gel of the supplement also includes Zinc and vitamin D for added immunity plus antioxidant support.

Market Concentration & Characteristics

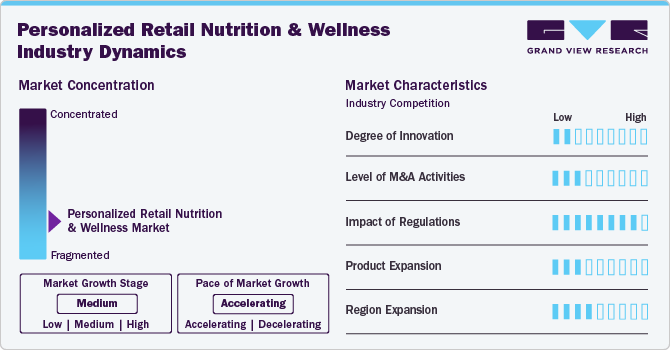

The industry is anticipated to experience a medium degree of innovation in personalized retail nutrition and wellness owing to several factors. The emphasis on data-driven personalized recommendations and incremental improvements in digital health platforms is contributing to the moderate growth pace of innovation.

The industry has seen a low level of merger and acquisition activity. This trend can be attributed to several factors, including the high fragmentation with numerous small players, and a focus on organic growth strategies by companies.

Regulations impact the personalized retail nutrition and wellness industry owing to several key factors, including stringent requirements for product safety and efficacy, variations in regulatory standards across different regions. In addition, evolving guidelines around personalized health claims and the need for scientific validation of personalized nutrition products further influence the industry's development and growth strategies.

The personalized retail nutrition and wellness industry has been experiencing relatively moderate growth in terms of product expansion. This growth is characterized by the development of niche products targeting specific consumer segments, along with an increased focus on enhancing existing product lines rather than launching a wide array of new items.

Regional expansion efforts are ongoing in the personalized retail nutrition and wellness industry, at a moderate level owing to several factors. This is attributed to the variability in consumer preferences and awareness across different markets, differing regulatory environments, and the logistical challenges of scaling personalized services globally.

Type Insights

Based on type, the repeat recommendations segment led the market with the largest revenue share of 46.36% in 2023. The launch of commercial apps that monitor an individual’s daily routine and lifestyle and help in generating ultra-personalized recommendations have made significant revenue contributions to this segment.

For instance, in August 2020, Nestlé launched a new customized lifestyle app that provides live coaching and custom nutrition plans for achieving personal wellness goals. Similarly, in June 2020, ZOE launched a test kit and app based on Artificial Intelligence (AI) for developing personalized eating plans based on an individual’s dietary inflammation and unique gut microbes.

The personalized testing segment is expected to grow at the fastest CAGR of 16.28% over the forecast period. Increasing consumer awareness about the benefits of personalized nutrition, advancements in genomic and microbiome testing technologies, and a growing demand for tailored health solutions are key contributors.

Regional Insights

North America dominated the personalized retail nutrition and wellness market with the largest revenue share of 41.43% in 2023. The growth in this region is driven by the presence of prominent players, the launch of new products, and growing FDA approval for functional food products. In addition, companies offering healthcare supplements are engaging in business development strategies such as acquisition and partnerships, which is further contributing to the market growth in the region. For instance, in February 2021, Nature’s Way announced the acquisition of Baze to expand its health and wellness portfolio based on evidence-based and personalized nutrition. The companies will leverage Baze’s platforms to develop high-quality personalized nutrition.

U.S. Personalized Retail Nutrition and Wellness Market Trends

The personalized retail nutrition and wellness market in the U.S. is expected to grow at the fastest CAGR over the forecast period. Increasing consumer demand for tailored health solutions and advancements in digital health technologies and genomic testing is driving the demand for personalized retail nutrition and wellness products.

Europe Personalized Retail Nutrition and Wellness Market Trends

The personalized retail nutrition and wellness market in Europe was identified as a lucrative region in this industry. This is attributed to the growing awareness of personalized health, increasing adoption of digital health tools, and supportive regulatory frameworks for health and wellness innovations.

The UK personalized retail nutrition and wellness market is expected to grow at a significant CAGR over the forecast period. The rising consumer interest in tailored nutrition solutions and increasing investment in health and wellness technologies is propelling the market growth.

The personalized retail nutrition and wellness market in France is anticipated to grow at the fastest CAGR over the forecast period. Increasing consumer awareness about personalized health solutions and a growing focus on preventative healthcare and wellness is boosting the market growth.

The Germany personalized retail nutrition and wellness market is expected to grow at a substantial CAGR over the forecast period, driven by a rising demand for customized health solutions, advancements in health technology, and increasing consumer interest in preventive healthcare.

Asia Pacific Personalized Retail Nutrition and Wellness Market Trends

The personalized retail nutrition and wellness market in Asia Pacific is anticipated to grow at the fastest CAGR of 17.06% from 2024 to 2030. This growth is increasing consumer awareness about health and wellness, rapid urbanization, rising disposable incomes, and advancements in digital health technologies and personalized nutrition solutions. In addition, a growing prevalence of lifestyle-related diseases and a rising demand for preventive healthcare measures are contributing to the market's expansion in the region. Key players are also investing heavily in research and development to offer innovative, personalized nutrition products and services, further boosting market growth.

The China personalized retail nutrition and wellness market is expected to grow at a significant CAGR over the forecast period. The increasing health consciousness among consumers, advancements in digital health technologies, and a growing demand for personalized health solutions. In addition, rising disposable incomes and government initiatives promoting healthy lifestyles are further propelling market growth. Thus, propelling the demand for personalized retail nutrition and wellness over the forecast period.

The personalized retail nutrition and wellness market in Japan is anticipated to grow at a significant CAGR over the forecast period. The aging population, increased focus on preventive healthcare, and rising consumer interest in personalized health and wellness solutions. The market growth is further supported by technological advancements in nutrition science and a growing trend toward customized dietary recommendations.

The India personalized retail nutrition and wellness market is anticipated to grow at the rapid CAGR over the forecast period. The advancements in technology and expanding digital platforms are facilitating the adoption of personalized nutrition and wellness products are driving demand for personalized products.

Middle East & Africa Personalized Retail Nutrition and Wellness Market Trends

The personalized retail nutrition and wellness market in the Middle East and Africa is expected to grow at a moderate CAGR during the forecast period, owing to increasing awareness about health and wellness, a rising prevalence of lifestyle-related diseases, and a growing interest in preventive healthcare solutions.

The Saudi Arabia personalized retail nutrition and wellness market is expected to grow at the fastest CAGR over the forecast period. Growing focus on health and wellness, increasing awareness of the benefits of personalized nutrition, and government initiatives promoting healthier lifestyles are driving demand for personalized retail nutrition and wellness products.

The personalized retail nutrition and wellness market in Kuwait is anticipated to witness at a significant CAGR over the forecast period. The rising demand for tailored health solutions and an increasing awareness of the importance of nutrition in maintaining a healthy lifestyle, is driving more individuals to seek preventive health measures, including personalized retail nutrition and wellness products.

Key Personalized Retail Nutrition And Wellness Company Insights

Key players operating in the global market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Personalized Retail Nutrition And Wellness Companies:

The following are the leading companies in the personalized retail nutrition and wellness market. These companies collectively hold the largest market share and dictate industry trends.

- Nature's Lab

- Cargill, Incorporated

- Nature's Bounty

- Bayer AG

- PlateJoy LLC

- Better Therapeutics Inc.

- Viome Life Sciences, Inc.

- Noom, Inc.

- Savor Health

- Nutrigenomix

- DNAfit (Prenetics Global)

Recent Developments

-

In January 2024, Meijer announced the launch of a new virtual personalized nutrition coaching service, starting exclusively in Michigan, with plans to expand it across its Midwest locations in the future

-

In January 2024, GenoPalate announced their partnership with Earth Fare, a clean grocery store, as its first retail partner. They aim to revolutionize grocery wellness by offering personalized nutrition using advanced technology and data

Personalized Retail Nutrition And Wellness Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.82 billion

Revenue forecast in 2030

USD 8.93 billion

Growth rate

CAGR of 15.19% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Nature's Lab; Cargill, Incorporated; Nature's Bounty; Bayer AG; PlateJoy LLC; Better Therapeutics, Inc.; Viome Life Sciences, Inc.; Noom, Inc.; Savor Health; Nutrigenomix; DNAfit (Prenetics Global)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

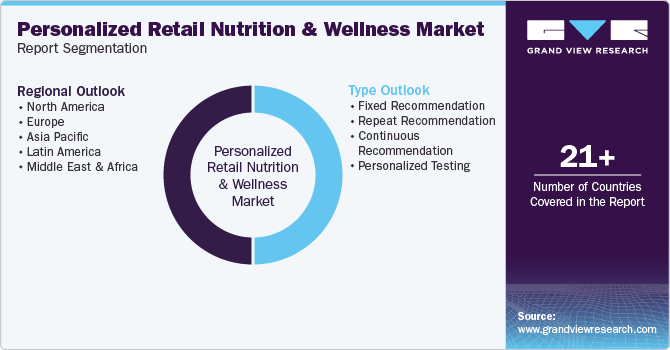

Global Personalized Retail Nutrition And Wellness Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global personalized retail nutrition and wellness market report based on type, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed Recommendation

-

Dietary Supplements & Nutraceuticals

-

Vitamins

-

Proteins

-

Minerals

-

Amino Acids

-

Enzymes

-

Others

-

-

Functional Foods

-

Proteins

-

Vitamins

-

Dietary Fibers

-

Fatty Acids

-

Minerals

-

Prebiotics & Probiotics

-

Carotenoids

-

-

Traditional Botanicals

-

-

Repeat Recommendation

-

Dietary Supplements & Nutraceuticals

-

Vitamins

-

Proteins

-

Minerals

-

Amino Acids

-

Enzymes

-

Others

-

-

Functional Foods

-

Proteins

-

Vitamins

-

Dietary Fibers

-

Fatty Acids

-

Minerals

-

Prebiotics & Probiotics

-

Carotenoids

-

-

Traditional Botanicals

-

-

Continuous Recommendation

-

Dietary Supplements & Nutraceuticals

-

Vitamins

-

Proteins

-

Minerals

-

Amino Acids

-

Enzymes

-

Others

-

-

Functional Foods

-

Proteins

-

Vitamins

-

Dietary Fibers

-

Fatty Acids

-

Minerals

-

Prebiotics & Probiotics

-

Carotenoids

-

-

Traditional Botanicals

-

-

Personalized Testing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global personalized retail nutrition and wellness market size was estimated at USD 3.39 billion in 2023 and is expected to reach USD 3.82 billion in 2024.

b. The global personalized retail nutrition and wellness market is expected to grow at a compound annual growth rate of 15.19% from 2024 to 2030 to reach USD 8.93 billion by 2030.

b. North America dominated the personalized retail nutrition & wellness market with a share of 41.43% in 2023. This is attributed to a rise in awareness among consumers about the importance of boosting their health.

b. Some key players operating in the personalized retail nutrition & wellness market include Nature's Lab; Cargill, Incorporated; Nature's Bounty; Bayer AG; PlateJoy LLC; Better Therapeutics Inc.; Viome Life Sciences, Inc.; Noom, Inc.; Savor Health; Nutrigenomix; DNAfit (Prenetics Global)

b. Key factors that are driving the personalized retail nutrition and wellness market growth include rising competition due to growth in the number of new entrants, a wide range of program options with respect to type and price, and increasing consumer health awareness coupled with a growing demand for retail nutrition products.

b. The repeat recommendation segment dominated the market for personalized retail nutrition and wellness and accounted for the largest revenue share of 46.36% in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.