- Home

- »

- Biotechnology

- »

-

Personalized Retail Nutrition And Wellness Market Report 2030GVR Report cover

![Personalized Retail Nutrition And Wellness Market Size, Share & Trends Report]()

Personalized Retail Nutrition And Wellness Market Size, Share & Trends Analysis Report By Type (Fixed Recommendation, Repeat Recommendation, Continuous Recommendation), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-449-9

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

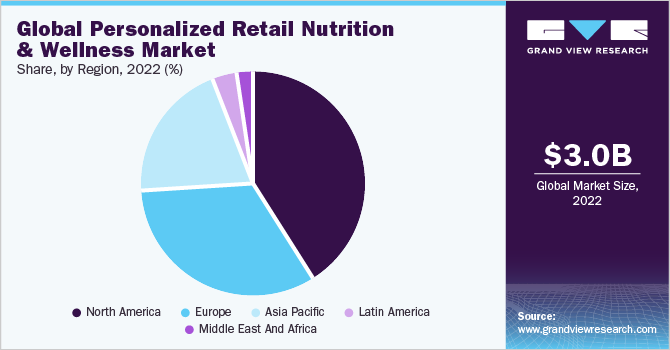

The global personalized retail nutrition and wellness market size was valued at USD 3.03 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.84% from 2023 to 2030. The market has gained significant momentum in recent years, collectively attributed to the introduction of advanced wearable solutions, expanding integration of digital technologies, and targeted scalability of direct-to-consumer e-commerce models. For instance, in November 2020, Royal DSM entered in collaboration with Huami Corp. for developing personalized nutrition solutions to address health conditions such as cardiac health, sports performance, and pre-diabetes. DSM’s AVA digital platform combined with Huami’s Amazfit wearables and PAI (Personal Activity Intelligence) helps in measuring health data in real-time. Hence, such strategies will help individuals prevent and manage lifestyle-based health conditions by leveraging new and advanced solutions.

In addition, the growing inclination towards functional foods can be further attributed to the growth of the market for personalized retail nutrition and wellness. Functional foods especially protein supplements are gradually gaining prominence and are becoming an integral part of a consumer’s daily diet. Hence, owing to the increasing demand for functional food products, companies are focusing on expanding their production for the functional food product portfolio.

For instance, in February 2021, Merit Functional Foods opened a new plant-based protein manufacturing facility in Winnipeg, Manitoba. The new facility will increase the production of food-grade high purity pea and canola proteins that are used in food and beverage applications.

Moreover, the COVID-19 pandemic is acting as a positive catalyst for the growth of the market for personalized retail nutrition and wellness. People are increasingly driven to vitamin and mineral supplements for enhancing immune response. For catering to these growing needs, companies are launching new supplements. For instance, in December 2020, THE BOUNTIFUL COMPANY launched Immune 24 Hour +. It is a Non-GMO vitamin C supplement with 24-hour immune support. In addition, the soft gel of the supplement also includes Zinc and vitamin D for added immunity plus antioxidant support.

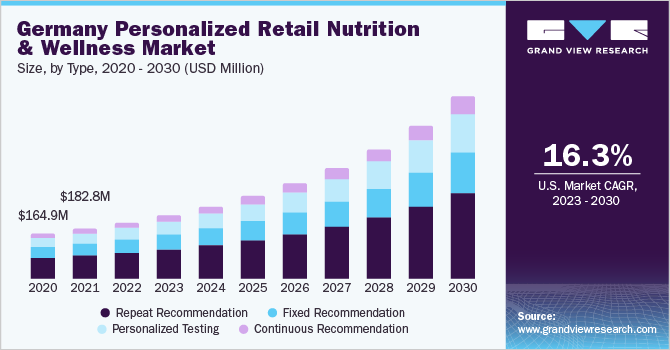

Type Insights

The repeat recommendations segment dominated the market for personalized retail nutrition and wellness and accounted for the largest revenue share of 46.22% in 2022. The launch of commercial apps that monitor an individual’s daily routine and lifestyle and help in generating ultra-personalized recommendations have made significant revenue contributions to this segment.

For instance, in August 2020, Nestlé launched a new customized lifestyle app that provides live coaching and custom nutrition plans for achieving personal wellness goals. Similarly, in June 2020, ZOE launched a test kit and app based on Artificial Intelligence (AI) for developing personalized eating plans based on an individual’s dietary inflammation and unique gut microbes.

The dietary supplements and nutraceuticals sub-segment of repeat recommendations is expected to witness lucrative growth of 15.82% over the forecast period. Companies are expanding their product offerings in the market, which in turn is driving the sub-segment growth. For instance, in January 2019, Advanced Orthomolecular Research (AOR) launched Tri B12 Synergy, a nutraceutical containing three independent forms of vitamin B12.

Regional Insights

North America dominated the personalized retail nutrition and wellness market and accounted for the largest revenue share of 41.13% in 2022. The region is expected to continue its dominance during the forecast period. The growth in this region is driven by the presence of prominent players, the launch of new products, and growing FDA approval for functional food products.

In addition, companies offering healthcare supplements are engaging in business development strategies such as acquisition and partnerships, which is further contributing to the market for personalized retail nutrition and wellness in the region. For instance, in February 2021, Nature’s Way announced the acquisition of Baze to expand its health and wellness portfolio based on evidence-based and personalized nutrition. The companies will leverage Baze’s platforms to develop high-quality personalized nutrition.

In the Asia Pacific, the market for personalized retail nutrition and wellness is expected to witness lucrative growth from 2023 to 2030. The growth in the region can be attributed to the factors such as the growing prevalence of diabetes, obesity, and cardiovascular diseases, the growing interest of consumers in customized approaches, and the expansion of prominent players to strengthen their foothold in the region.

In addition, the growing number of major companies entering in partnership with nutrigenomics startups for leveraging their respective capabilities can be further boosting the growth of the market for personalized retail nutrition and wellness in the region. For instance, in July 2020, Amway entered into a partnership with Holzapfel Effective Microbes (HEM) a South Korea-based company for developing personalized probiotics. HEM offers test solutions for assessing the gut microbiome which will be employed for developing probiotics for gut-related benefits such as weight management, immunity, brain health, and skin health.

The growing initiatives by companies for providing comprehensive genetic algorithms for specific nutrients and foods are contributing to the growth of the market for personalized retail nutrition and wellness. For instance, in June 2020, Nutrigenomix launched an exclusive new line of genetic tests, a dietary assessment tool for catering to the needs of customers seeking plant-based personalized nutrition by providing DNA-based recommendations based on an individual’s genetic profile. Some of the prominent players in the personalized retail nutrition and wellness market include: Some of the key players in the global personalized retail nutrition and wellness market include:

-

Nature's Lab

-

Cargill, Incorporated

-

Nature's Bounty

-

Bayer AG

-

PlateJoy LLC

-

Better Therapeutics Inc.

-

Viome Life Sciences, Inc.

-

Noom, Inc.

-

Savor Health

-

Nutrigenomix

-

DNAfit (Prenetics Global)

Personalized Retail Nutrition And Wellness Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.39 billion

Revenue forecast in 2030

USD 8.93 billion

Growth rate

CAGR of 14.84% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Cargill, Incorporated, Nature's Bounty, Bayer AG, PlateJoy LLC, Better Therapeutics, Inc, Viome Life Sciences, Inc., Noom, Inc, Savor Health, Nutrigenomix, DNAfit (Prenetics Global)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Personalized Retail Nutrition and Wellness Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global personalized retail nutrition and wellness market on the basis of type and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed Recommendation

-

Dietary Supplements & Nutraceuticals

-

Vitamins

-

Proteins

-

Minerals

-

Amino Acids

-

Enzymes

-

Others

-

-

Functional Foods

-

Proteins

-

Vitamins

-

Dietary Fibers

-

Fatty Acids

-

Minerals

-

Prebiotics & Probiotics

-

Carotenoids

-

-

Traditional Botanicals

-

-

Repeat Recommendation

-

Dietary Supplements & Nutraceuticals

-

Vitamins

-

Proteins

-

Minerals

-

Amino Acids

-

Enzymes

-

Others

-

-

Functional Foods

-

Proteins

-

Vitamins

-

Dietary Fibers

-

Fatty Acids

-

Minerals

-

Prebiotics & Probiotics

-

Carotenoids

-

-

Traditional Botanicals

-

-

Continuous Recommendation

-

Dietary Supplements & Nutraceuticals

-

Vitamins

-

Proteins

-

Minerals

-

Amino Acids

-

Enzymes

-

Others

-

-

Functional Foods

-

Proteins

-

Vitamins

-

Dietary Fibers

-

Fatty Acids

-

Minerals

-

Prebiotics & Probiotics

-

Carotenoids

-

-

Traditional Botanicals

-

-

Personalized Testing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global personalized retail nutrition and wellness market size was estimated at USD 3.03 billion in 2022 and is expected to reach USD 3.39 billion in 2023.

b. The global personalized retail nutrition and wellness market is expected to grow at a compound annual growth rate of 14.84% from 2023 to 2030 to reach USD 8.93 billion by 2030.

b. North America dominated the personalized retail nutrition & wellness market with a share of 41.13% in 2022. This is attributed to a rise in awareness among consumers about the importance of boosting their health.

b. Some key players operating in the personalized retail nutrition & wellness market include Nature's Lab; Cargill, Incorporated; Nature's Bounty; Bayer AG; PlateJoy LLC; Better Therapeutics Inc.; Viome Life Sciences, Inc.; Noom, Inc.; Savor Health; Nutrigenomix; DNAfit (Prenetics Global)

b. Key factors that are driving the personalized retail nutrition and wellness market growth include rising competition due to growth in the number of new entrants, a wide range of program options with respect to type and price, and increasing consumer health awareness coupled with a growing demand for retail nutrition products.

b. The repeat recommendation segment dominated the market for personalized retail nutrition and wellness and accounted for the largest revenue share of 46.22% in 2022.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."