- Home

- »

- Pharmaceuticals

- »

-

Personalized Testing & Supplements Market Report, 2033GVR Report cover

![Personalized Testing & Supplements Market Size, Share & Trends Report]()

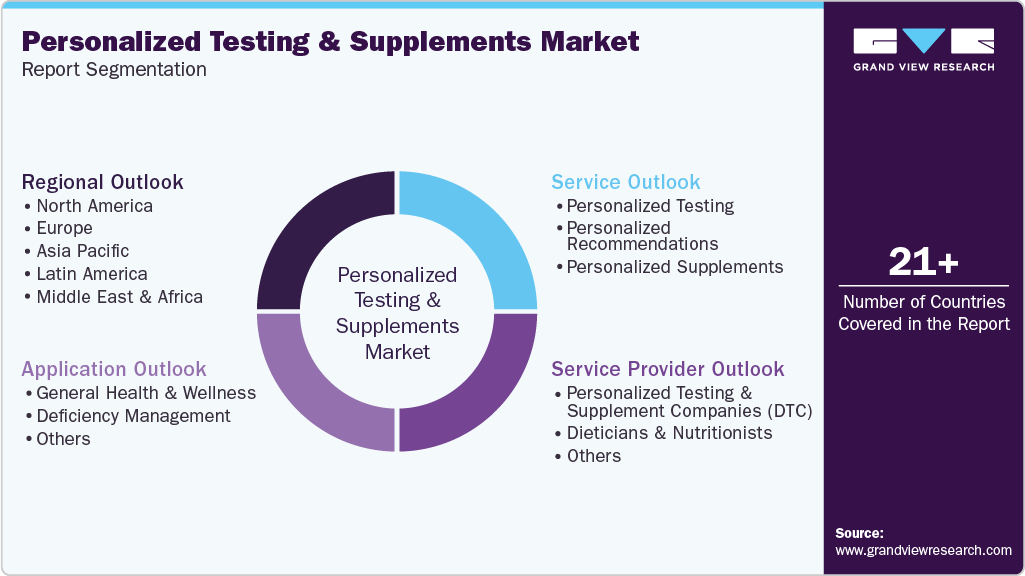

Personalized Testing & Supplements Market (2026 - 2033) Size, Share & Trends Analysis Report By Service (Personalized Testing, Personalized Recommendations, Personalized Supplements), By Application, By Service Provider, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-481-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Personalized Testing & Supplements Market Summary

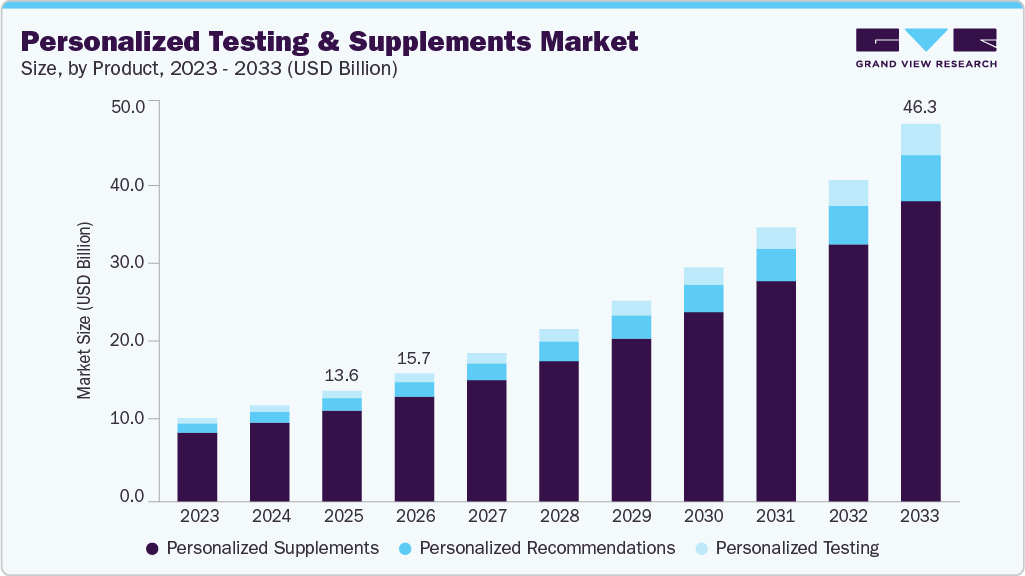

The global personalized testing & supplements market size was estimated at USD 13.58 billion in 2025 and is projected to reach USD 46.33 billion by 2033, growing at a CAGR of 16.72% from 2026 to 2033. The market has experienced significant growth due to the increasing consumer demand for tailored health solutions. As people become more health-conscious, they seek products that align with their specific nutritional needs, genetics, and health conditions.

Key Market Trends & Insights

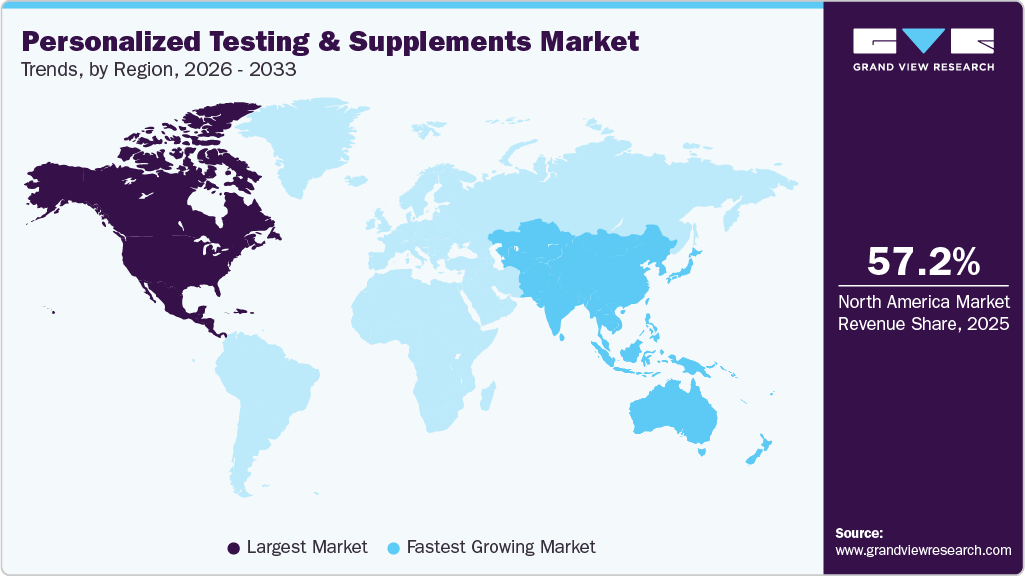

- The North America personalized testing & supplements market held the largest share of 57.24% of the global market in 2025.

- The personalized testing & supplements industry in the U.S. is expected to grow significantly over the forecast period.

- By service, the personalized supplements segment held the highest market share of 82.15% in 2025.

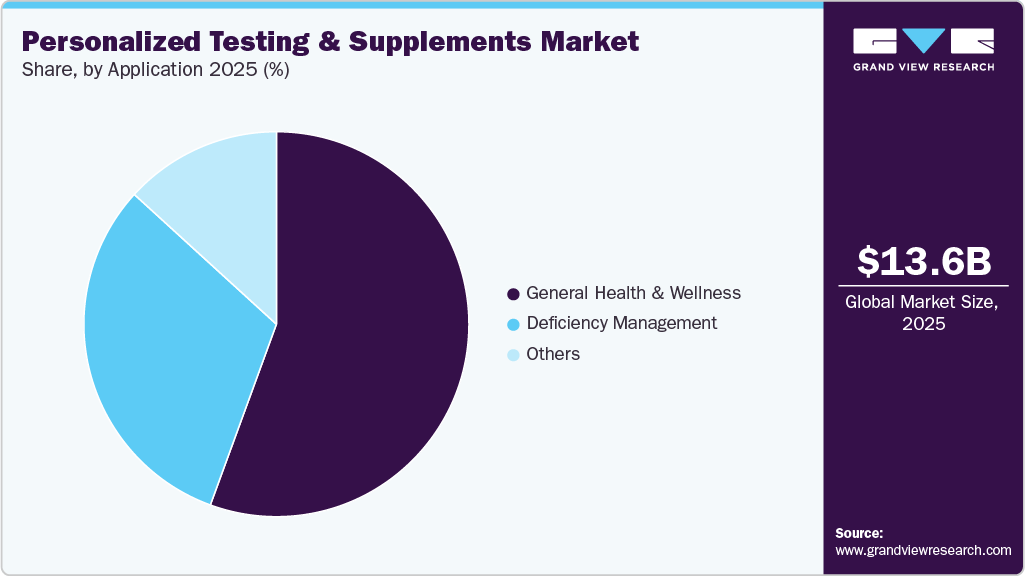

- Based on application, the general health and wellness segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 13.58 Billion

- 2033 Projected Market Size: USD 46.33 Billion

- CAGR (2026-2033): 16.72%

- North America: Largest market in 2025

- Asia Pacific : Fastest growing market

Improved Personalized Testing TechniquesThe market for personalized testing and supplements is experiencing considerable growth due to improved personalized testing techniques, which are enhancing the precision, reliability, and accessibility of biological analysis to a huge extent. Advancements in genomics, metabolomics, microbiome sequencing, biomarker profiling, and epigenetic testing now enable deeper insights into an individual’s health status. Modern at-home diagnostic kits supported by high-throughput sequencing and AI-based interpretation allow accurate detection of nutrient deficiencies, hormonal imbalances, metabolic patterns, gut dysbiosis, and genetic predispositions. These scientific upgrades eliminate guesswork and give customers confidence that supplement recommendations are backed by measurable biological data, increasing adoption rates.

As the personalized health and wellness industry grows, supplement regimens are increasingly being customized using diverse testing methods. The leading techniques driving the market include Blood Tests, DNA Tests, and Wearable Device/App-based Tests, supported by additional approaches such as Urine and Gut Microbiome Tests. Each method varies in insight, accuracy, and accessibility, but collectively they enable highly tailored supplementation backed by biological data. Key players, along with the advantages and challenges of each testing type, demonstrate how these technologies are shaping and strengthening the personalized supplements market.

Key Personalized Testing Techniques

Testing Technique

Key Players

Metrics Tested

Advantages

Challenges

Blood Tests

Thorne, Everlywell

Vitamins, minerals, cholesterol, hormones, inflammation

Highly accurate, actionable data; comprehensive biomarkers

Requires lab access or home kits; expensive

DNA Tests

DNAfit, 23andMe, Everlywell

Genetic variants, nutrient absorption, metabolism

Long-term insights into genetics; non-invasive

Expensive; needs expert interpretation; not immediate

Wearable Device & App-based

Oura Ring, Levels Health

Activity, sleep, heart rate, glucose levels

Real-time data; continuous monitoring; non-invasive

Data overload; limited scope; battery and device maintenance

Other Tests

Viome

Gut microbiome, hydration, vitamin levels, metabolic markers

Unique insights into gut health and hydration; non-invasive

Requires expert interpretation; more specialized data

Source: Industry Journals, Secondary Research, Grand View Research

Moreover, continuous innovation in digital health platforms has facilitated the seamless integration of lab testing with personalized supplement formulation and progress tracking. User engagement and adherence to treatments have been positively impacted by AI wellness dashboards, real-time biomarker monitoring, and nutrient customization based on algorithms. There are already subscription-based models offered by several companies that allow for the automatic alteration of supplement formulas according to the outcomes of follow-up tests, thus making the health journey a continuous rather than a one-time event. The combination of such a high degree of personalization, guidance based on scientific evidence, and convenience is certainly attractive to health-conscious consumers and is already one of the main factors propelling the market forward.

Rising consumer demand for individualized health solutions

One of the major causes for the growth of the personalized testing and vitamins market is the increasing consumer demand for customized health solutions. The modern-day consumers are not only very active but also very well-informed, hence they are looking for products specifically made for them based on their biology and lifestyle instead of the common wellness tactics. Advances in genetic testing, microbiome analysis, and wearable health devices have enabled people to understand their nutrient deficiencies, genetic predispositions, and health goals in greater detail, increasing expectations for highly customized supplementation.

The trend of prevention-oriented and result-oriented wellness is leading to a rise in spending by customers on high-quality and individualized products. Market participants, on the other hand, are putting their resources into research and development, digital health tools, and personalized supplement delivery systems that are informed by test data. As individualized care continues to gain momentum within the broader wellness movement, the personalized testing and supplements market is positioned for sustained growth and innovation.

Market Concentration & Characteristics

The personalized testing and supplements industry is experiencing vibrant innovation, which is primarily driven by advancements in the fields of ingredient formulations, delivery systems, and the incorporation of technology. Companies keep investing in R&D to improve the effectiveness, safety, and consumer satisfaction in this ever-changing sector. In addition, breakthroughs in genomics, AI-driven analysis, and precision nutrition allow companies to incorporate technologies related to DNA, microbiome, and metabolic testing, allowing them to provide tailored solutions. For instance, in February 2024, Herbalife unveiled its latest innovation, the Herbalife GLP-1 Nutrition Companion, introducing a new series of food and supplement product combinations. These offerings, available in both Classic and Vegan options, are now accessible in the U.S. and Puerto Rico, offering consumers a diverse array of flavors to choose from.

The level of mergers and acquisitions in the personalized testing and supplements industry remains moderate as companies form strategic alliances to strengthen their market presence and capitalize on emerging trends in health and wellness.

Regulations significantly shape the personalized testing and supplements industry by governing product safety, testing accuracy, data privacy, and marketing claims. While varying regional guidelines and compliance requirements can create challenges for market players, regulatory oversight ensures reliable results, safe formulations, and responsible use of personal health data. Overall, stronger regulations enhance consumer trust and support long-term market credibility and growth.

Service expansion in the personalized testing & supplements industry is evident through the introduction of innovative formulations targeting diverse consumer needs, including fat reduction, metabolism support, and appetite control.

The personalized testing and supplements industry is experiencing substantial regional growth. Companies strategically focus on different geographic regions to leverage diverse consumer preferences, health trends, and regulatory frameworks. This approach enhances market penetration and fosters overall growth.

Service Insights

Based on service, the personalized supplements segment dominated the market in 2025 with a revenue share of 82.15%, fueled by growing demand for health solutions tailored to individual nutritional needs, genetics, and lifestyle. A growing emphasis on preventive health care and progress in DNA testing, microbiome analysis, and AI-based evaluations have made it possible to provide extremely personalized products, which not only improved customer involvement but also contributed to the expansion of the segment.

The personalized testing segment is expected to grow at the highest CAGR from 2026 to 2036, mainly because of the increasing awareness of the impact of genetics and lifestyle on human health, as well as on supplements. Greater availability of affordable genetic testing kits and AI-based analysis has made personalized health insights more accessible, encouraging wider adoption and supporting strong market growth.

Service Provider Insights

The personalized testing & supplement companies (DTC) segment dominated the market in 2025 with a share of 65.48% and is projected to grow at the fastest CAGR from 2026 to 2033. Growth is driven by rising consumer preference for convenient and customized direct-to-consumer models supported by at-home testing kits, data analytics, and digital platforms. By delivering tailored health insights and products directly to customers, DTC companies strengthen personalization, improve customer retention, and fuel overall market expansion. For instance, In March 2024, reports emerged about the upcoming Samsung Galaxy Ring, which is expected to transform personalized nutrition by providing meal plans based on caloric intake and BMI. It will integrate with Samsung Food to offer tailored recipes.

The dieticians & nutritionists segment is expected to grow significantly over the forecast period, fueled by rising demand for expert guidance on individualized health and nutrition plans. With consumers showing an ever-increasing demand for personalized products derived from their genes, lifestyle, and health data, professionals have been able to use individualized testing to provide targeted suggestions, which have, in turn, led to the prevalence of custom supplements and segment growth.

Application Insights

Based on application, the general health and wellness segment dominated the market with a revenue share of 55.58% in 2025 and is expected to grow at the highest CAGR from 2026 to 2033. As individuals seek to maintain long-term health, they turn to personalized solutions catering to their unique genetic makeup, lifestyle, and health goals. This has led to a surge in demand for tailored supplements and health testing, allowing consumers to address specific deficiencies, optimize their nutrition, and manage potential health risks more effectively.

The deficiency management segment is expected to grow significantly over the forecast period. The main factor fueling the market for deficiency management is the increased understanding of nutrient shortages and their negative effect on health in general. The development of diagnostic technologies has simplified the process of individuals recognizing their nutrient deficiencies and, therefore, allowed the use of specific supplementation.

Regional Insights

North America held the largest market share of 57.24% in 2025 for the personalized testing and supplements market, due to rising health consciousness, increased disposable income, and health issues associated with sedentary lifestyles. Adoption is still being strengthened by increasing awareness of preventive wellness and sophisticated healthcare infrastructure. Regional market growth has also been aided by the quick development of e-commerce and direct-to-consumer platforms, which have made personalized testing and supplements more accessible.

U.S Personalized Testing & Supplements Market Trends

The U.S. personalized testing and supplements market is witnessing significant growth, driven by increasing consumer awareness of preventive healthcare, rising health consciousness, and demand for tailored wellness solutions.

Europe Personalized Testing & Supplements Market Trends

The Europe personalized testing and supplements market continued to expand in 2025, supported by increasing consumer focus on preventive healthcare, growing acceptance of customized nutrition, and rising usage of at-home diagnostic tools. The region benefits from strong regulatory standards, high healthcare literacy, and a mature wellness ecosystem that encourages evidence-based, individualized health interventions, which further support the regional demand.

The UK personalized testing and supplements market is evolving rapidly as consumers move toward precision-based health management supported by genetic, metabolic, and microbiome insights. The focus on immune health, gut health, cognitive wellness, and energy optimization is further shaping product innovation in the supplements landscape.

The Germany personalized testing and supplements industry is experiencing robust growth, driven by rising consumer awareness of preventive healthcare, increasing demand for individualized wellness solutions, and advanced digital health adoption.

Asia Pacific Personalized Testing & Supplements Market Trends

The personalized testing & supplements industry in the Asia Pacific is projected to grow at the fastest CAGR of 16.72% over the forecast period, largely driven by factors such as increasing health consciousness, rising obesity rates, and a growing preference for natural and herbal products. The expansion of digital health ecosystems, widespread smartphone penetration, and growing familiarity with at-home testing kits are accelerating adoption.

China personalized testing & supplements market is experiencing significant growth, driven by factors such as increasing health consciousness, a rising middle class, and the growing prevalence of obesity and lifestyle-related diseases. In a study conducted in August 2023, it was found that among the participants, 34.8% were classified as overweight, while 14.1% were identified as obese in China. Notably, the prevalence of overweight and obesity was higher in males than in females across the overall study population.

The personalized testing & supplements market in Japan is witnessing notable growth. Manufacturers and retailers in Japan are responding to these trends by introducing new, high-quality markets that cater to the diverse preferences of Japanese consumers.

MEA Personalized Testing & Supplements Market Trends

The personalized testing & supplements industry in MEA has experienced considerable growth in recent years, driven by several factors. Rising health consciousness among consumers, increasing obesity rates, and growing disposable incomes have contributed to the expansion of this market. Moreover, advancements in product formulations, marketing strategies, and distribution channels have further propelled market growth. With consumers increasingly prioritizing health and wellness, the market in the Middle East and Africa is poised for continued expansion in the coming years.

The personalized testing & supplements industry in Kuwait is experiencing notable growth. The demand is rising as the health-conscious population in Kuwait is becoming more and more health-aware and taking an active role in weight control. The factors contributing to this trend include health awareness, obesity, and the popularity of natural and herbal products.

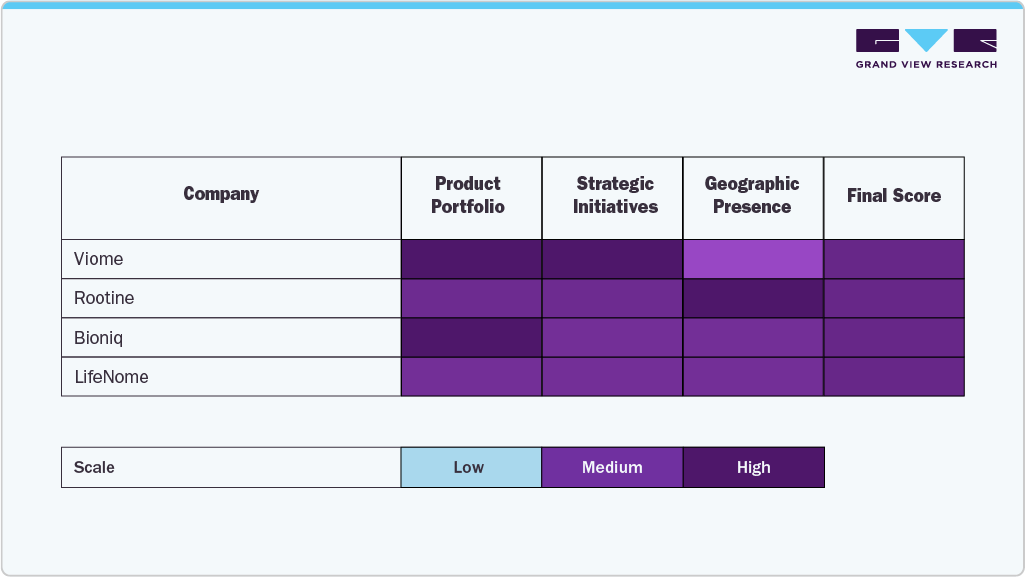

Key Personalized Testing & Supplements Company Insights

The personalized testing & supplements industry is dominated by several well-established companies that take advantage of powerful product portfolios, alliances with strategists, and continuous investments in research, technology, and consumer engagement. Key players area also focusing on wide range of testing, personalized supplement production, and distribution networks in either global or regional regions.

Companies, including The Vitamin Shoppe and LifeNome, are expanding their footprint by offering innovative solutions such as DNA-based nutrition, microbiome analysis, AI-driven health assessments, and subscription-based personalized supplement services. Companies that effectively merge technological innovation with consumer-centric services are poised to drive sustained growth and value in the customized testing & supplements sector.

Key Personalized Testing & Supplements Companies:

The following are the leading companies in the personalized testing & supplements market. These companies collectively hold the largest Market share and dictate industry trends.

- Viome

- Rootine

- Bioniq

- LifeNome

- Vitl

- Nutrigenomix Inc.

- CircleDNA

- GenoPalate

- Sova Health

- Myoform

- VitaminLab

Recent Developments

-

In October 2025, Know Wellness launched its holistic health platform, combining at-home biomarker testing and AI-powered diagnostics to deliver personalized supplement formulations tailored to individual health needs and wellness goals.

-

In September 2025, Stride launched StrideOne in the UK, a comprehensive health membership offering DNA, microbiome, and blood testing, along with precision supplements and telehealth support tailored to individual biomarker profiles.

-

In September 2024, Bioniq announced a new partnership with Truemed. This collaboration allows Bioniq's pharmaceutical-grade nutritional supplements to be recognized as medically necessary, enabling eligible consumers to use HSA and FSA funds for their preventative healthcare routines. Typically, qualified consumers utilizing HSA/FSA funds can enjoy savings of approximately 30%

-

In April 2024, Hexis, a UK-based personalized sports nutrition company, announced a strategic integration with "TrainingPeaks," a platform for coaches and athletes. This makes Hexis the first app that dynamically estimates an athlete's nutritional needs, tailoring them to precise workout requirements.

Personalized Testing & Supplements Report Scope

Report Attribute

Details

Market size value in 2026

USD 15.70 billion

Revenue forecast in 2033

USD 46.33 billion

CAGR

CAGR of 16.72% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, service provider, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Viome; Rootine; Bioniq; LifeNome; Vitl; Nutrigenomix Inc.; CircleDNA; GenoPalate; Sova Health; Myoform; VitaminLab

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Personalized Testing & Supplements Market Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the global personalized testing & supplements market on the basis of service, service provider, application, and region.

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Personalized Testing

-

Blood Tests

-

DNA Tests

-

Wearable Device & App-based Tests

-

Others

-

-

Personalized Recommendations

-

Fixed

-

Repeat

-

Continuous

-

-

Personalized Supplements

-

Proteins & Amino Acid

-

Vitamins

-

Minerals

-

Probiotics

-

Herbal/Botanic

-

Others

-

-

-

Service Provider Outlook (Revenue, USD Million, 2021 - 2033)

-

Personalized Testing & Supplement Companies (DTC)

-

Dieticians & Nutritionists

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

General Health & Wellness

-

Deficiency Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global personalized testing and supplements market size was estimated at USD 13.58 billion in 2025 and is expected to reach USD 15.70 billion in 2026.

b. The global personalized testing and supplements market is expected to grow at a compound annual growth rate of 16.72% from 2026 to 2033 to reach USD 46.33 billion by 2033.

b. North America dominated the personalized testing and supplements market with a share of 16.72% in 2025. This is attributable to the rising demand for effective supplement products and growth in healthcare awareness.

b. Some key players operating in the personalized testing & supplements market include Viome, DSM Nutritional Products AG, Thorne, Pharmavite, Baze, GNC Holding, The Vitamin Shoppe, Nestlé Health Science, Vitaminpacks, Inc., myDNA, LifeNome

b. Key factors that are driving the market growth include increasing awareness about health and wellness, rising demand for personalized supplement options, and technological innovation in supplement products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.