- Home

- »

- Pharmaceuticals

- »

-

Personalized Vitamins Market Size, Industry Report, 2030GVR Report cover

![Personalized Vitamins Market Size, Share & Trends Report]()

Personalized Vitamins Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Wellness Supplements, Disease-Based Supplements), By Dosage Form (Tablets, Capsules), By Distribution Channel, By Age Group, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-500-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Personalized Vitamins Market Summary

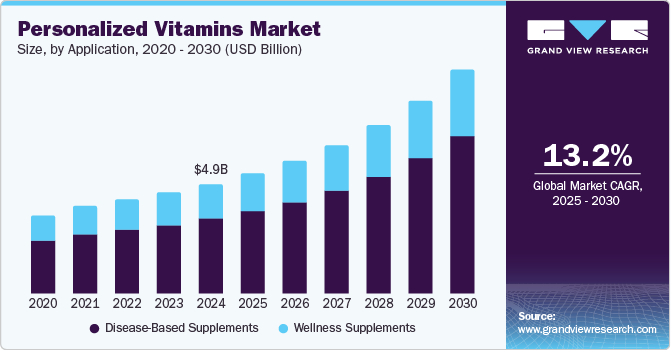

The global personalized vitamins market size was estimated at USD 4,877.4 million in 2024 and is projected to reach USD 9,893.6 million by 2030, growing at a CAGR of 13.15% from 2025 to 2030. The growing demand for customized health solutions is the primary driver of the personalized vitamins industry.

Key Market Trends & Insights

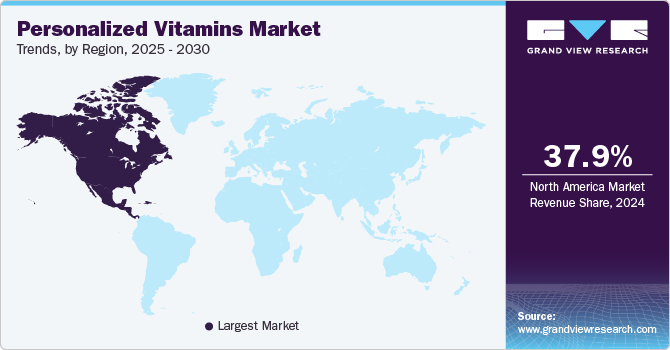

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, disease-based supplements accounted for a revenue of USD 3,691.8 million in 2024.

- Disease-Based Supplements is the most lucrative application segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4,877.4 Million

- 2030 Projected Market Size: USD 9,893.6 Million

- CAGR (2025-2030): 13.15%

- North America: Largest market in 2024

Increasing consumer awareness about the importance of nutrition and the role of vitamins in preventive healthcare has led to a shift from generic supplements to tailored solutions. Advances in DNA testing and digital health technologies have enabled companies to offer personalized vitamins based on individual genetic profiles, lifestyle, and health conditions. Additionally, increasing disposable incomes and the rise of e-commerce platforms have made these products more accessible, fueling market growth globally.

The COVID-19 pandemic significantly impacted the market by heightening health consciousness among consumers. With the pandemic emphasizing the importance of a robust immune system, the demand for immunity-boosting vitamins like Vitamin C, D, and Zinc surged. Personalized vitamins offered a tailored approach to addressing individual nutritional deficiencies during this period, leading to a rise in subscription-based models and digital consultations. The pandemic also accelerated the adoption of telemedicine and online health assessments, enabling consumers to access personalized nutrition solutions conveniently.

Moreover, technological advancements in diagnostics, such as at-home test kits and AI-driven health recommendations, are driving innovation in the market. Regulatory frameworks promoting transparency in labeling and safety are also encouraging consumer trust in personalized nutrition products. The integration of sustainable and clean-label practices, such as plant-based formulations, caters to the growing demand for environmentally conscious and health-focused products, further boosting the personalized vitamins industry growth trajectory.

Companies are leveraging cutting-edge technologies like DNA sequencing, microbiome analysis, and digital health platforms to provide hyper-personalized vitamin regimens. For instance, companies such as Persona Nutrition (a Nestlé Health Science brand) and Care/of have introduced subscription-based models that incorporate online health assessments to recommend custom vitamin packs. This personalized approach resonates with health-conscious consumers seeking solutions that align with their specific needs, propelling personalized vitamins industry growth.

Additionally, market expansion is fueled by recent corporate developments and partnerships. For example, in September 2020, Bayer AG acquired the U.S.-based personalized nutrition company Care/of, signaling an intensified focus on individual health solutions. Similarly, Unilever launched its brand-specific personalized supplement offerings through Nutrafol, targeting hair health supplements tailored to customer profiles. These strategic moves highlight the industry's growth potential and the increasing importance of customized wellness solutions. Companies are also responding to trends like sustainability and clean-label demands by incorporating vegan, allergen-free, and eco-friendly formulations, broadening their appeal across diverse consumer demographics.

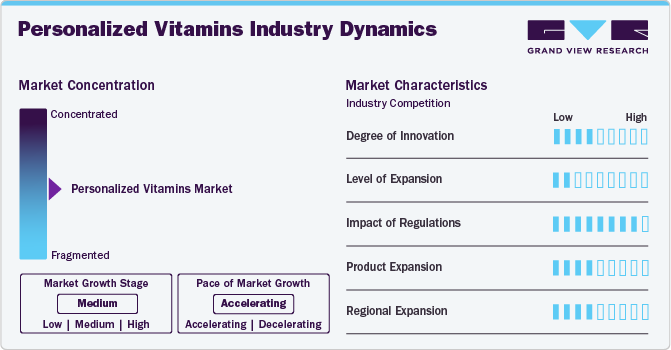

Market Concentration & Characteristics

The market is characterized by a high degree of innovation, driven by advancements in genomics, AI, and digital health platforms. Companies are integrating DNA testing, microbiome analysis, and real-time health monitoring to create tailored vitamin solutions. For instance, the use of AI-powered platforms to analyze lifestyle data and provide precise nutritional recommendations has gained traction, fostering competition and differentiation among market players.

The market is witnessing an increasing number of mergers and acquisitions as companies aim to enhance their capabilities and expand their market presence. Notable examples include Nestlé’s acquisition of Persona Nutrition and Bayer’s purchase of Care/of, which highlight the strategic focus on personalized health. Such activities consolidate market share and accelerate innovation by leveraging acquired expertise and technologies.

Regulatory frameworks significantly impact on personalized vitamins industry, with a growing emphasis on transparency, safety, and labeling standards. Governments and organizations are implementing stricter regulations to ensure consumer safety and product efficacy. For example, compliance with FDA and EFSA guidelines has become critical for market players, shaping product formulations and marketing strategies.

Product expansion remains a key strategy as companies diversify their offerings to cater to a broader range of consumer needs. New formulations, such as vegan, allergen-free, and sugar-free vitamins, are being developed to align with health trends. Companies are also expanding into niche segments like disease-based supplements and functional wellness products to capture emerging market opportunities.

Regional expansion is pivotal for market growth, with players targeting high-growth regions such as Asia-Pacific and the Middle East. Rising disposable incomes, urbanization, and growing awareness of personalized health in these regions provide lucrative opportunities. Companies are leveraging localized marketing strategies and distribution channels to establish a strong foothold in these emerging markets.

Application Insights

Based on application, disease-based supplements accounted for the largest revenue share of 69.01% in 2024 and is projected to witness the fastest growth rate over the forecast period. The market is driven by the growing prevalence of chronic illnesses such as diabetes, cardiovascular diseases, and osteoporosis, which require targeted nutritional support. Personalized vitamins tailored to manage these conditions offer precise formulations to address specific deficiencies or health risks, enhancing their appeal among patients and healthcare providers.

Advancements in diagnostic tools, such as genetic testing and biomarker analysis, enable companies to design disease-specific supplements that align with individual health profiles. Moreover, the increasing adoption of preventive healthcare and the integration of personalized supplements into medical care plans, supported by endorsements from healthcare professionals, are further fueling demand in this segment. This trend is particularly pronounced in aging populations and regions with rising chronic disease burdens.

Dosage Form Insights

Based on dosage form, the tablets accounted for the largest revenue share of 32.45% in 2024. Tablets are easy to produce in bulk, allowing manufacturers to offer cost-effective personalized options tailored to individual needs. Their ability to incorporate a variety of vitamins and minerals into a single dosage makes them highly versatile for addressing diverse health requirements. Moreover, advancements in tablet formulations, such as extended-release and chewable tablets, cater to specific consumer preferences, enhancing their market appeal. The demand for tablets is further boosted by their compatibility with e-commerce platforms, where personalization algorithms can recommend tailored tablet-based vitamin regimens based on online health assessments.

The liquid segment is expected to witness the fastest growth over the forecast period. The liquid dosage form in the personalized vitamins industry is gaining traction due to its ease of consumption, particularly for individuals with swallowing difficulties, such as the elderly and children. Additionally, the rising popularity of clean-label and natural products has spurred demand for liquid vitamins, often perceived as more natural and freer from fillers or binders. Innovations in flavoring and packaging, such as single-serve bottles or droppers, enhance convenience and consumer appeal, driving growth in this segment.

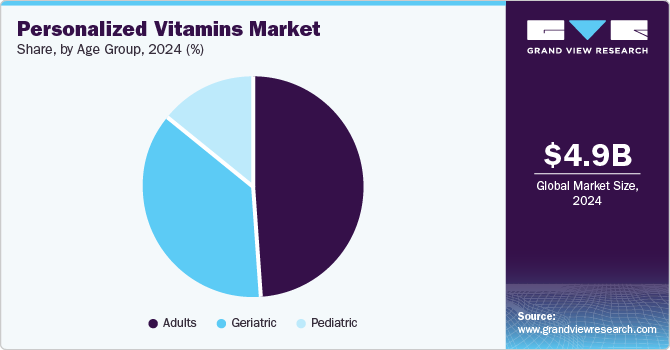

Age Group Insights

Based on age group, the adults segment accounted for the largest revenue share of 49.22% in 2024. Adults are actively seeking preventive healthcare solutions, including tailored vitamins, to address specific nutritional deficiencies and support overall wellness. Advances in health assessment technologies, such as DNA testing and biomarker analysis, have made it easier for adults to access customized vitamin plans. Additionally, the growing emphasis on stress management, mental health, and immunity post-COVID-19 has further heightened demand for personalized supplements.

The geriatric segment is expected to witness a significant growth rate over the forecast period. As individuals age, their nutritional needs evolve, and personalized vitamins offer a tailored approach to support bone health, cognitive function, immune support, and overall vitality. Many older adults suffer from deficiencies in essential nutrients like vitamin D, calcium, and B12, which personalized supplements can specifically address. Additionally, personalized vitamins cater to the unique health profiles of seniors, considering underlying medical conditions such as arthritis, diabetes, and cardiovascular diseases. Thus, propelling the demand for personalized vitamins industry.

Distribution Channel Insights

Based on distribution channel, the supermarkets/hypermarkets segment accounted for the largest revenue share of 43.01% in 2024. The visibility and trust associated with well-established supermarket chains enhance brand credibility, encouraging consumers to explore personalized supplements. Furthermore, advancements in retail technology, such as in-store kiosks and digital health assessment tools, allow supermarkets to offer tailored recommendations, bridging the gap between personalized health solutions and over-the-counter convenience. The growing preference for one-stop shopping, coupled with promotional campaigns and discounts frequently offered by hypermarkets, further fuels the adoption of personalized vitamins through these channels.

The online pharmacies & E-commerce site segment is expected to witness the fastest growth rate over the forecast period. The rise of online pharmacies and e-commerce sites is a major driver for the market, fueled by the increasing preference for digital health solutions and convenient shopping experiences. These platforms enable consumers to access personalized vitamin regimens through comprehensive online health assessments, DNA testing kits, and AI-driven recommendations. Companies like Persona Nutrition and Care/of have successfully leveraged subscription models to offer tailored vitamin packs, which can be easily reordered online.

E-commerce also caters to a global audience, breaking geographical barriers and making personalized nutrition accessible in remote areas. The ability to compare products, read reviews, and benefit from discounts further drives consumer trust and engagement. Additionally, the COVID-19 pandemic accelerated the adoption of online platforms, as consumers prioritized contactless delivery and at-home solutions, establishing e-commerce as a dominant channel for personalized vitamin sales.

Regional Insights

North America has dominated the market with a share of 37.87% in 2024 for the personalized vitamins market. The region’s strong focus on personalized wellness is supported by the widespread availability of genetic testing, microbiome analysis, and AI-driven health platforms that enable tailored vitamin recommendations. Additionally, the region benefits from favorable economic conditions, high disposable income, and a strong emphasis on innovation, fostering the development and adoption of personalized solutions. Thereby propelling the demand for personalized vitamins industry in the region over the forecast period.

U.S. Personalized Vitamins Market Trends

The U.S. leads the personalized vitamins market, driven by high consumer awareness, advanced healthcare infrastructure, and the widespread adoption of genetic testing and AI-based solutions. Companies like Persona Nutrition and Care/of dominate with subscription-based personalized vitamins, supported by e-commerce platforms. The rising focus on preventive healthcare and condition-specific supplements has further fueled market growth.

Europe Personalized Vitamins Market Trends

Europe’s personalized vitamins market is growing due to increasing health-consciousness, an aging population, and a strong emphasis on preventive care. Advancements in nutritional science and genetic testing are enabling tailored supplement solutions. Countries like Germany and France are key contributors due to high disposable incomes and the adoption of innovative health products.

The UK market benefits from strong awareness about health and wellness trends, with a rising interest in personalized nutrition. The integration of online platforms and in-store kiosks for customized health assessments has driven growth. Regulatory support for dietary supplements also enhances market opportunities.

France is experiencing significant growth in personalized vitamins, driven by consumer demand for clean-label, high-quality products. The country’s focus on holistic wellness and preventive healthcare is encouraging the adoption of personalized supplements tailored to individual health goals.

Germany's advanced healthcare ecosystem and technological innovations in genetic testing support the growth of the personalized vitamins market. The demand for high-quality, locally manufactured supplements further drives the market, as does the aging population’s interest in targeted health solutions.

Asia Pacific Personalized Vitamins Market Trends

The Asia Pacific market is expanding rapidly due to increasing disposable incomes, urbanization, and growing health awareness. Countries like China, Japan, and India are emerging as key markets, driven by the adoption of personalized healthcare technologies and the rising prevalence of lifestyle-related diseases.

China’s personalized vitamins market is fueled by the growing middle-class population and rising awareness of preventive healthcare. The integration of AI and big data in health assessments has accelerated adoption, with e-commerce giants playing a pivotal role in distribution.

In Japan, the market is driven by an aging population seeking tailored health solutions and the cultural emphasis on holistic wellness. Advanced technologies and government support for healthcare innovation further boost personalized vitamin adoption.

India’s market is growing due to increasing health consciousness among urban populations and the rising prevalence of chronic diseases. The affordability of genetic testing and the expansion of e-commerce platforms are enabling personalized vitamin solutions to reach a wider audience.

Middle East & Africa (MEA) Personalized Vitamins Market Trends

The Middle East market is driven by growing awareness of preventive healthcare and increasing disposable incomes. The demand for personalized solutions is rising, particularly in urban centers, supported by the adoption of advanced diagnostic tools.

Saudi Arabia’s personalized vitamins market benefits from government initiatives to promote health and wellness as part of Vision 2030. The rising prevalence of chronic diseases and high disposable incomes are encouraging the adoption of personalized supplements.

In Kuwait, the market is driven by high healthcare spending and growing consumer interest in personalized nutrition. The adoption of online health assessments and e-commerce platforms is further enabling access to tailored vitamin solutions.

Key Personalized Vitamins Company Insights

The market players operating in the personalized vitamins industry are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Personalized Vitamins Companies:

The following are the leading companies in the personalized vitamins market. These companies collectively hold the largest market share and dictate industry trends.

- Amway Corporation,

- Abbott Laboratories

- Herbalife Nutrition

- Metagenics, Inc.

- DNAfit

- Viome Life Sciences, Inc.

- Care/of (Bayer)

- Persona Nutrition (Nestlé Health Science)

- HUM Nutrition

- Vous Vitamin

Recent Developments

-

In December 2023, Danaher Corporation acquired Abcam plc. Abcam will continue to operate as an independent brand within Danaher's Life Sciences division, which also includes laser capture microdissection devices. This acquisition supports Danaher's strategy to use its technology to better understand complex diseases and speed up drug discovery.

-

In November 2023, Laxco announced the launch of Accuva Cellect Laser Capture Microdissection (LCM) system. This system is anticipated to enable accurate isolation along with capturing cells at individual levels, thus providing an unparallel precision for elevating research analysis.

-

In March 2020, Fluidigm Corporation announced the launch of the AccuLift Laser Capture Microdissection System, a new product portfolio designed for translational and clinical pathology research. The AccuLift system is anticipated to enable precise and efficient capture of individual cells or larger tissue regions for DNA, RNA, and protein biomarker analysis.

Personalized Vitamins Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.33 billion

Revenue forecast in 2030

USD 9.89 billion

Growth Rate

CAGR of 13.15% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, dosage form, distribution channel, age group, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Amway Corporation; Abbott Laboratories; Herbalife Nutrition; Metagenics, Inc.; DNAfit; Viome Life Sciences, Inc.; Care/of (Bayer); Persona Nutrition (Nestlé Health Science); HUM Nutrition; Vous Vitamin

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Personalized Vitamins Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global personalized vitamins market report based on application, dosage form, distribution channel, age group, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Wellness Supplements

-

Disease-Based Supplements

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Powders

-

Gummies/Chewable

-

Liquids

-

Softgels

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Retail Pharmacies

-

Online pharmacies & E-commerce site

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Pediatric

-

Adults

-

Geriatric

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global personalized vitamins market size was estimated at USD 4.88 billion in 2024 and is expected to reach USD 5.33 billion in 2025.

b. The global personalized vitamins market is expected to grow at a compound annual growth rate of 13.15% from 2025 to 2030 to reach USD 9.89 billion by 2030.

b. Based on application, disease-based supplements accounted for the largest revenue share in 2024 and is projected to witness the fastest growth rate over the forecast period. The market is driven by the growing prevalence of chronic illnesses such as diabetes, cardiovascular diseases, and osteoporosis, which require targeted nutritional support.

b. Some key players operating in the personalized vitamins market include Amway Corporation, Abbott Laboratories, Herbalife Nutrition, Metagenics, Inc., DNAfit, Viome Life Sciences, Inc., Care/of (Bayer), Persona Nutrition (Nestlé Health Science), HUM Nutrition, Vous Vitamin

b. Increasing consumer awareness about the importance of nutrition and the role of vitamins in preventive healthcare has led to a shift from generic supplements to tailored solutions. Additionally, increasing disposable incomes and the rise of e-commerce platforms have made these products more accessible, fueling market growth globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.