- Home

- »

- Advanced Interior Materials

- »

-

Pet Food Processing Market Size, Industry Report, 2030GVR Report cover

![Pet Food Processing Market Size, Share & Trends Report]()

Pet Food Processing Market (2025 - 2030) Size, Share & Trends Analysis Report By Equipment Type (Mixing & Blending, Forming, Baking & Drying, Coating), By Form (Wet, Dry), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-741-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Food Processing Market Summary

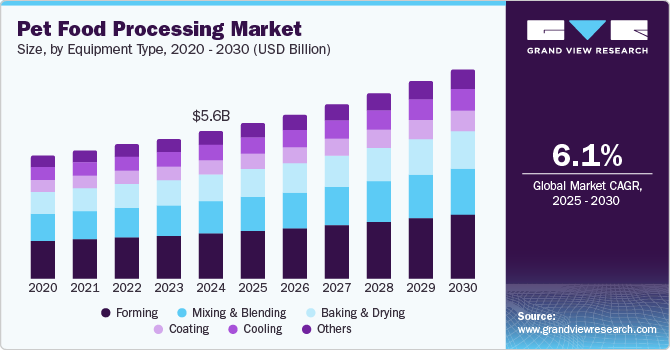

The global pet food processing market size was estimated at USD 5.62 billion in 2024 and is projected to reach USD 7.98 billion by 2030, growing at a CAGR of 6.1% from 2025 to 2030. The market growth can be attributed to the increasing demand for specialized and premium pet food products, fueled by pet humanization trends.

Key Market Trends & Insights

- The North America pet food processing market dominated the global market and accounted for the largest revenue share of 33.1% in 2024.

- The U.S. dominated North America and accounted for the largest revenue share in 2024.

- Based on equipment type, the forming equipment segment led the market and accounted for the largest revenue share of 30.6% in 2024.

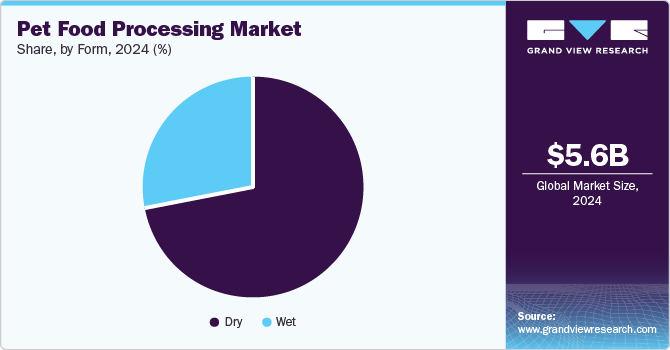

- Based on form, the dry pet food segment dominated the market and accounted for the largest revenue share of 71.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.62 Billion

- 2030 Projected Market Size: USD 7.98 Billion

- CAGR (2025-2030): 6.1%

- North America: Largest market in 2024

In addition, pet owners are prioritizing health benefits and convenience, leading to a rise in automation and advanced processing technologies. Furthermore, urbanization and rising disposable incomes, particularly are enhancing market expansion.

Pet food pricing refers to the cost associated with purchasing food for pets, which can vary based on factors such as quality, ingredients, and packaging. In recent years, there has been a noticeable increase in pet adoption rates, largely driven by individuals seeking companionship to combat feelings of loneliness and enhance their mental well-being. As people lead increasingly busy lives, the emotional support provided by pets has become invaluable. This growing trend has led to a heightened focus on ensuring that pets receive the best possible care, particularly when it comes to nutrition.

In addition, many pet owners are opting to buy pet food in larger quantities, necessitating high-quality packaging solutions that maintain freshness and appeal. This shift contributes significantly to expanding the pet food processing market. Furthermore, there is a burgeoning demand for various pet food options tailored to specific dietary needs and preferences. The availability of diverse shapes and sizes of pet food allows owners to select products that best suit their pets' requirements, fostering a competitive landscape among manufacturers who are investing heavily in attractive packaging.

Moreover, the increasing awareness surrounding pet health is prompting owners to educate themselves about nutrition and well-being through accessible online resources. This knowledge empowers them to make informed choices about what they feed their pets, further driving demand for nutritionally rich and visually appealing food products. In response, companies are upgrading their processing technologies to meet these evolving consumer expectations.

Equipment Type Insights

The forming equipment segment led the market and accounted for the largest revenue share of 30.6% in 2024. This growth can be attributed to the increasing demand for premium pet food options, which has led manufacturers to adopt advanced extrusion technologies essential for producing high-quality products. In addition, growing awareness of pet health and nutrition encourages consumers to seek specialized food items, further boosting the need for efficient forming equipment. Furthermore, technological advancements in processing machinery enable greater flexibility and automation, allowing producers to meet diverse consumer preferences and enhance production efficiency.

The coating equipment segment is expected to grow at a CAGR of 7.1% from 2025 to 2030, owing to the increasing consumer preferences for enhanced flavors and textures in pet food. In addition, the trend toward premiumization encourages manufacturers to utilize coating technologies to improve product appeal and nutritional value. Furthermore, advancements in coating techniques allow for better application of functional ingredients, catering to health-conscious pet owners. Moreover, this segment is expected to expand as companies seek to differentiate their offerings in a competitive market landscape.

Form insights

The dry pet food segment dominated the market and accounted for the largest revenue share of 71.6% in 2024, driven by its convenience, extended shelf life, and health benefits. In addition, pet owners favor dry food for its ease of storage and feeding, especially among busy urban dwellers. Furthermore, it promotes better oral health due to its texture, which helps reduce tartar buildup. Moreover, the increasing adoption of pets and a growing awareness of their nutritional needs further enhance the demand for dry pet food products in the market.

The wet pet food segment is expected to grow at a CAGR of 6.5% over the forecast period, owing to its palatability and moisture content, which appeals to pets and their owners alike. In addition, wet food is often perceived as more nutritious and is preferred for its ability to cater to pets with specific dietary needs. Furthermore, the rise in pet humanization trends, where pets are treated as family members, drives demand for high-quality wet food options. Moreover, packaging and formulation innovations enhance wet pet food's appeal in the competitive market.

Regional Insights

The North America pet food processing market dominated the global market and accounted for the largest revenue share of 33.1% in 2024. This growth can be attributed to the increasing trend of pet humanization, where pets are viewed as family members. This has led to a surge in demand for premium and specialized pet food products. In addition, rising awareness about pet health and nutrition also encourages manufacturers to innovate and comply with stringent food safety standards. Furthermore, the robust distribution networks, including e-commerce platforms, further facilitate access to diverse pet food options, contributing to market expansion.

U.S. Pet Food Processing Market Trends

The pet food processing market In the U.S. dominated North America and accounted for the largest revenue share in 2024, primarily driven by high pet ownership rates and a growing focus on health-conscious consumer behavior. In addition, the demand for organic and premium pet foods is rising as owners prioritize quality. Innovations in processing technologies, such as microfiltration and high-pressure processing, enhance product appeal by preserving flavor and nutrition. Furthermore, strategic initiatives such as mergers and acquisitions among manufacturers are fostering competitive growth in this lucrative market.

Asia Pacific Pet Food Processing Market Trends

The Asia Pacific pet food processing market is expected to grow at a CAGR of 8.3% over the forecast period, owing to rising disposable incomes and urbanization, leading to increased pet ownership. In addition, the growing trend of pet humanization drives demand for high-quality and specialized pet food products. Furthermore, cultural shifts towards viewing pets as companions rather than property are influencing purchasing decisions. Moreover, the expansion of retail channels, including online platforms, supports accessibility to diverse pet food options, further propelling market growth.

The pet food processing market in China dominated Asia Pacific with the largest revenue share in 2024, driven by a significant increase in pet ownership among urban populations. In addition, the rising middle class is driving demand for premium and nutritious pet food products that cater to health-conscious consumers. Furthermore, increasing investments in local manufacturing capabilities and distribution networks enhance product availability. The growing trend of pet humanization also influences consumer preferences toward high-quality ingredients and innovative formulations in pet food.

Europe Pet Food Processing Market Trends

The Europe pet food processing market is expected to witness substantial growth over the forecast period, owing to an increasing focus on sustainability and natural ingredients in pet food products. In addition, consumers are becoming more aware of their pets' nutritional needs, leading to a demand for premium offerings. Regulatory frameworks promoting food safety also encourage manufacturers to invest in advanced processing technologies. Furthermore, the rise of e-commerce platforms provides convenient access to various pet food options, further supporting market growth.

The growth of the pet food processing market in Germany is expected to be driven by benefits from a strong culture of pet ownership and increasing expenditures on premium pet products. Furthermore, the demand for high-quality ingredients and transparency in sourcing drives manufacturers to innovate in product development. Moreover, the growing popularity of natural and organic pet foods aligns with consumer preferences for healthier options.

Key Pet Food Processing Company Insights

Key companies in the global pet food processing industry include GEA Group, Buhler Holding AG, The Middleby Corporation, and others. These players adopt numerous strategies to improve their competitive edge. Strategic partnerships are formed to leverage complementary strengths, improve product offerings, and expand distribution networks. In addition, mergers and acquisitions enable companies to consolidate resources, enter new markets, and diversify their product lines. Furthermore, new product launches focus on innovation and meeting evolving consumer preferences, allowing companies to capture market share and respond effectively to pet nutrition and health trends.

-

ANDRITZ manufactures a wide range of machinery, including extruders, conditioners, and coating systems, designed to enhance the efficiency of pet food production. Operating within the pet food processing segment, the company delivers innovative solutions that improve productivity while ensuring optimal food safety and quality, helping manufacturers meet pets' growing nutritional demands.

-

Bakery Perkins Ltd. manufactures machinery such as mixers, ovens, and dryers tailored for dry and wet formulations. The company focuses on the pet food processing segment and enhances operational efficiency and product quality for its clients. Its expertise in baking technology and process engineering enables it to deliver customized solutions that cater to the diverse needs of the pet food industry.

Key Pet Food Processing Companies:

The following are the leading companies in the pet food processing market. These companies collectively hold the largest market share and dictate industry trends.

- ANDRITZ

- GEA Group

- Buhler Holding AG

- The Middleby Corporation

- Baker Perkins LTD.

- PFI

- Clextral SAS

- Reading Bakery Systems

- Mepaco Group

- F.N. Smith Corporation

- Selo

Recent Developments

-

In August 2024, Big Idea Ventures and Mars Petcare introduced the Next Gen Pet Food Program to foster innovation in sustainable pet food processing. This initiative was expected to invite start-ups to develop novel proteins and fats that can help in the reduction of carbon emissions in pet food production. Collaborating with AAK and Bühler, the program aimed at innovative solutions such as upcycling food waste and advanced extraction methods.

-

In July 2023, Hill's Pet Nutrition unveiled new products, presenting MSC-certified Alaskan Pollock and insect protein. These products were aimed at pets with sensitive stomachs and skin. This initiative highlighted the company's commitment to sustainable pet food processing by using traceable, wild-caught seafood and innovative insect protein. The new formulas were expected to promote digestive health and support skin nourishment, aligning with consumer demand for environmentally friendly options in pet nutrition.

Pet Food Processing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.93 billion

Revenue forecast in 2030

USD 7.98 billion

Growth rate

CAGR of 6.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment type, form, region

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; China; India; Japan; Australia; Germany; UK; France; Italy; Brazil; Argentina; UAE; Saudi Arabia

Key companies profiled

ANDRITZ; GEA Group; Buhler Holding AG; The Middleby Corporation; Baker Perkins LTD.; PFI; Clextral SAS; Reading Bakery Systems; Mepaco Group; F.N. Smith Corporation; Selo

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Food Processing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global pet food processing market report based on equipment type, form, and region:

-

Equipment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mixing & Blending

-

Forming

-

Baking & Drying

-

Coating

-

Cooling

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Wet

-

Dry

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.