- Home

- »

- Homecare & Decor

- »

-

Pet Grooming Products Market Size, Industry Report, 2033GVR Report cover

![Pet Grooming Products Market Size, Share & Trends Report]()

Pet Grooming Products Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Shampoo & Conditioner, Shear & Trimming Tools, Comb & Brush), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-253-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Grooming Products Market Summary

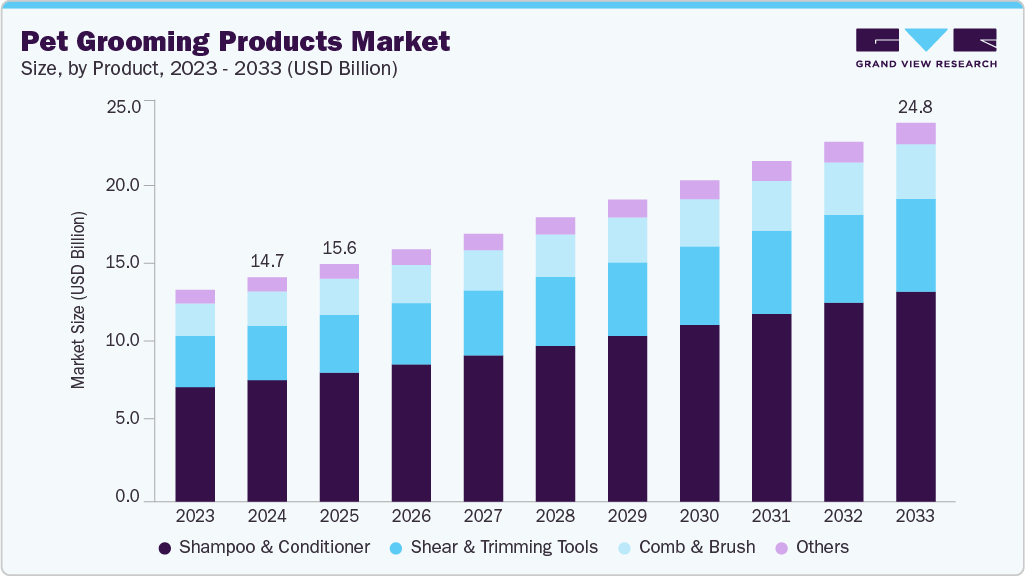

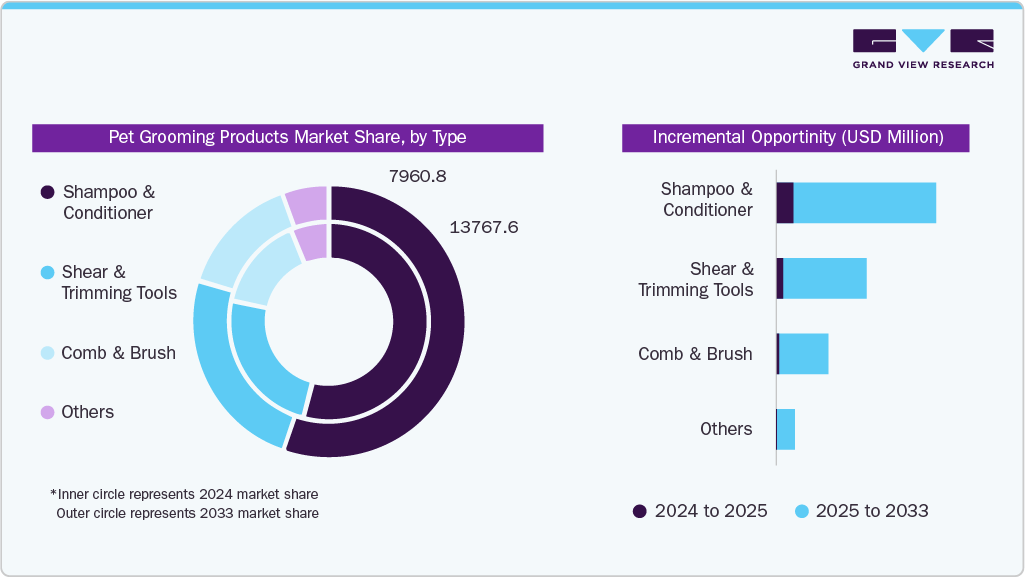

The global pet grooming products market size was estimated at USD 14.69 billion in 2024 and is projected to reach USD 24.82 billion by 2033, growing at a CAGR of 6.0% from 2025 to 2033. The market is experiencing strong growth, driven by several interrelated factors, including consumer, economic, and technological trends.

Key Market Trends & Insights

- North America dominated the global pet grooming products market with the largest revenue share of 45.3% in 2024.

- The pet grooming products market in U.S. accounted for a share of 78.2% of the global revenue in 2024.

- By type, the shampoos and conditioners segment led the market with the largest revenue share of 54.2% in 2024.

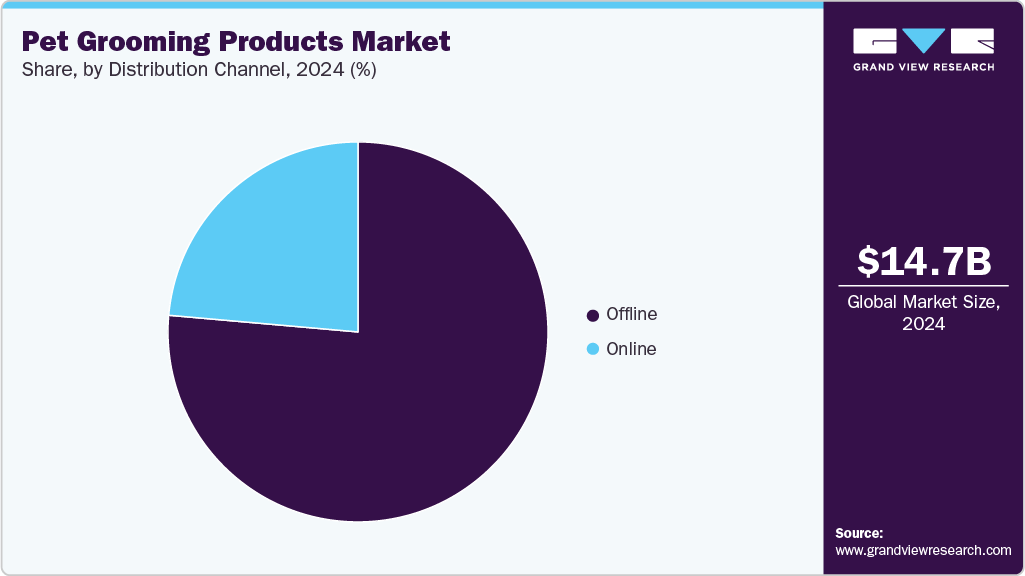

- By distribution channel, the offline segment led the market with the largest revenue share of 76.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.69 Billion

- 2033 Projected Market Size: USD 24.82 Billion

- CAGR (2025-2033): 6.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The major growth factors include the rising rate of pet ownership worldwide, increasing humanization of pets, and growing awareness about pet hygiene and health. As more households consider pets as part of the family, spending on their comfort and appearance has surged. This pet-parent mindset has led to higher demand for premium, natural, and specialized grooming products, from shampoos and conditioners to trimmers and combs.Another key driver is the expansion of e-commerce and digital retailing. Online platforms have made it easier for pet owners to access a wide variety of grooming products and compare their quality, price, and reviews before making a purchase. The convenience of home delivery and subscription-based models for pet supplies has further boosted repeat purchases. In addition, social media trends, influencer marketing, and pet-care communities are influencing consumer preferences, particularly among younger demographics who prioritize sustainable, cruelty-free, and health-oriented products. This has encouraged manufacturers to innovate with organic ingredients and eco-friendly packaging, appealing to this evolving audience.

Technological advancements in product design and formulation also contribute to market expansion. Innovations such as ergonomic grooming tools, quiet trimmers for anxious pets, and smart grooming devices have improved the home grooming experience. At the same time, scientific progress in dermatology and veterinary care has led to the development of specialized shampoos, conditioners, and sprays targeting specific skin conditions, coat types, or allergies. This ongoing innovation cycle enhances customer satisfaction and drives brand loyalty, thereby further strengthening the global grooming products industry.

Growing awareness of animal welfare and preventive healthcare has prompted more owners to incorporate regular grooming into their pets' wellness routines. Veterinary professionals increasingly recommend grooming to prevent infections, matting, and other health issues, making grooming not just aesthetic but essential. The rise of pet salons and mobile grooming services in urban centers, along with government and NGO campaigns promoting responsible pet care, has also supported this trend. Together, these factors have turned pet grooming from an optional luxury into a core aspect of modern pet ownership, sustaining steady global market growth.

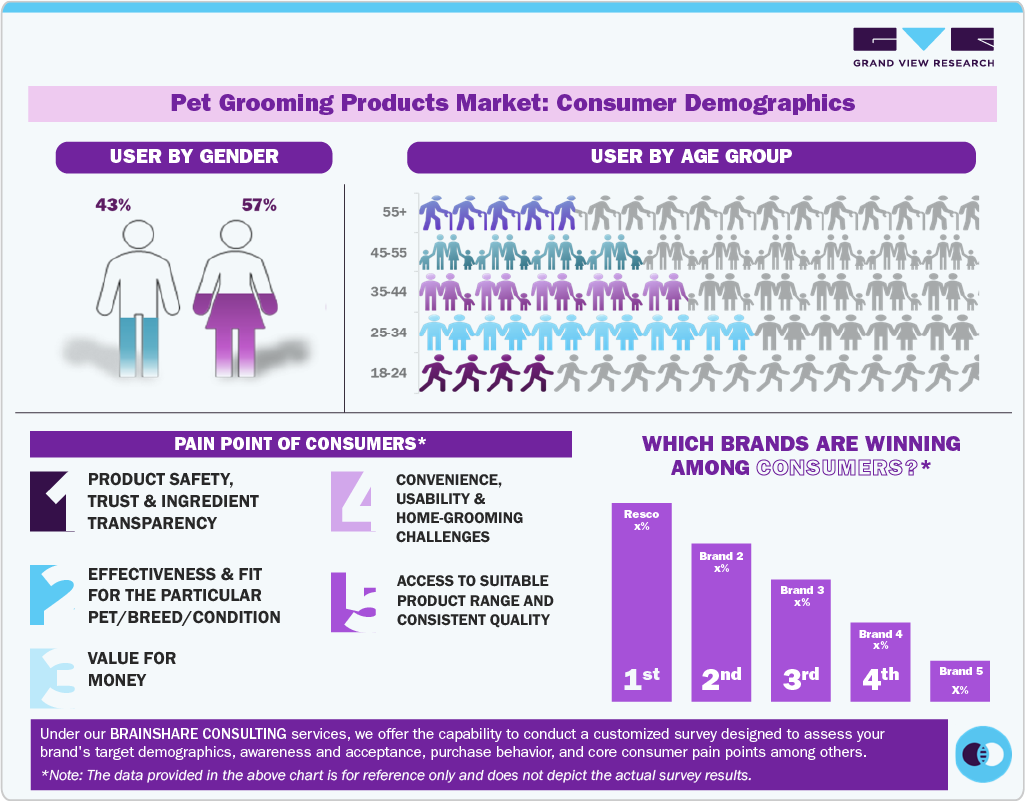

Consumer Demographic Insights

Consumers globally are increasingly drawn to pet grooming products due to their health, hygiene, and convenience benefits, as well as their ability to support pets’ targeted wellness needs such as coat health, skin protection, odor control, and stress relief. Millennials and Gen Z are at the forefront of this shift, motivated by proactive pet care, hygiene awareness, and a preference for natural, science-backed, and cruelty-free grooming solutions. These younger pet owners view grooming as an extension of overall wellness and emotional bonding, emphasizing transparency, ingredient safety, and environmental responsibility.

Millennials and Gen Z value grooming products that are easy to use, portable, and effective, aligning with their busy, urban lifestyles and growing trend toward home-based pet care. The appeal of compact, quick-acting, and low-mess grooming formats, such as waterless shampoos, wipes, and detangling sprays, reflects their desire for convenience and efficiency without compromising on quality or pet comfort. Expanding access through online retail channels and subscription models further supports adoption and repeat purchases.

Pricing Analysis

Type Insights

The shampoo & conditioner segment led the market with the largest revenue share of 54.2% in 2024. The segment is witnessing strong growth driven by rising pet humanization and owner emphasis on hygiene and wellness. Consumers are increasingly seeking premium, veterinary-tested formulations that address specific concerns such as shedding, odor control, skin sensitivity, and coat shine. The shift toward natural, hypoallergenic, and chemical-free ingredients reflects growing awareness of pet health and safety. Expanding e-commerce access and pet specialty retail channels have also made these products more widely available. In addition, the increasing trend of regular pet grooming and salon services is fueling demand for high-quality shampoos and conditioners that deliver visible results and long-term care benefits.

The shear & trimming tools segment is projected to grow at the fastest CAGR of 6.1% from 2025 to 2033. The market is driven by the rising trend of at-home grooming and the growing demand for professional-grade precision tools. Pet owners are increasingly investing in ergonomic, durable, and easy-to-use products to maintain their pets’ appearance and hygiene between salon visits. The introduction of electric and cordless trimmers with advanced safety features has further enhanced convenience and efficiency. In addition, the surge in pet ownership and the premiumization of grooming routines have encouraged consumers to opt for high-quality tools specifically designed for breed-specific styling. Continuous innovation in blade technology and noise reduction mechanisms is also attracting both professional groomers and home users, fueling sustained market expansion.

Distribution Channel Insights

The offline segment led the market with the largest revenue share of 76.4% in 2024. Some of the key factors driving market growth include the expansion of pet specialty stores, veterinary clinics, and organized retail outlets that offer a diverse range of premium pet products and services. Consumers are increasingly preferring in-store experiences that offer personalized consultations, expert recommendations, and the opportunity to assess product quality physically. The emergence of exclusive grooming boutiques and salons featuring curated product assortments has further fueled demand through this channel. In addition, rising urban pet ownership and spending on premium care products are boosting foot traffic in offline retail.

The online segment is anticipated to grow at the fastest CAGR of 7.6% from 2025 to 2033. The shift in consumer preference toward convenience, variety, and accessibility has driven the rapid growth of the online distribution channel for pet grooming products. Consumers are increasingly turning to e-commerce platforms and brand-owned websites for their extensive product ranges, competitive pricing, and doorstep delivery. The rise of digital awareness and pet care education through social media and influencer marketing has further enhanced online engagement and trust. In addition, subscription-based models and personalized product recommendations are fostering repeat purchases and brand loyalty. With the growing emphasis on time efficiency and hassle-free shopping, online platforms are becoming the preferred avenue for purchasing premium and specialized pet grooming solutions.

Regional Insights

North America dominated the global pet grooming products market with the largest revenue share of 45.3% in 2024. The growing prevalence of pet ownership and the deepening human-animal bond are key drivers of the North American pet grooming products industry. Consumers are increasingly seeking premium, health-oriented grooming solutions that promote coat health, hygiene, and overall well-being. The market is further propelled by innovation in natural, hypoallergenic, and eco-friendly formulations, reflecting a broader shift toward sustainable pet care. The expansion of professional grooming services and specialty retail outlets has enhanced accessibility and awareness of high-quality products. In addition, rising disposable incomes and willingness to invest in premium pet care continue to strengthen sales momentum across the region.

U.S. Pet Grooming Products Market Trends

The pet grooming products market in U.S. accounted for a share of 78.2% of the global revenue in 2024. The market is expanding due to several interconnected factors. A major driver is the growing trend of pet humanization, with owners increasingly treating pets as family members and investing in their overall wellness. This shift is reinforced by rising pet ownership rates, particularly during and after the COVID-19 pandemic, along with a heightened awareness of animal health and hygiene. The market is also boosted by the availability of premium grooming products and the widening range of services offered by pet salons. Innovations such as organic and hypoallergenic grooming solutions appeal to health-conscious consumers as well. As a result, people are purchasing grooming products and services not only to enhance their pets’ appearance but also to maintain health through regular cleaning and parasite control, address specific skin or coat concerns, and meet social expectations for well-groomed pets, especially as animals take part in more public activities, travel, and social events.

Europe Pet Grooming Products Market Trends

The pet grooming products market in Europe is projected to grow at a substantial CAGR of 5.0% from 2025 to 2033. A strong culture of pet ownership, animal welfare, and the integration of a premium lifestyle drives Europe’s market. Consumers are increasingly favoring high-quality, dermatologically tested, and eco-conscious formulations that align with Europe’s sustainability standards and ethical values. The market benefits from the expansion of specialized pet boutiques, grooming salons, and premium retail chains offering diverse product portfolios. In addition, the rise in urban pet ownership and the trend toward smaller living spaces has led to a greater emphasis on hygiene and regular grooming practices. The growing awareness of pet health, aesthetics, and preventive care continues to drive demand for advanced grooming solutions across the region.

Asia Pacific Pet Grooming Products Market Trends

The pet grooming products market in the Asia Pacific is projected to grow at the fastest CAGR of 8.3% from 2025 to 2033. Pet grooming products have become increasingly popular in the Asia Pacific due to the region’s rising pet ownership, growing disposable incomes, and expanding middle-class population. Consumers are increasingly demonstrating a preference for premium and specialized grooming solutions that enhance pet hygiene, appearance, and overall comfort. The influence of Western pet care trends and the growing presence of international and domestic brands are accelerating market penetration. In addition, urbanization and smaller living environments are driving the need for regular at-home grooming and maintenance.

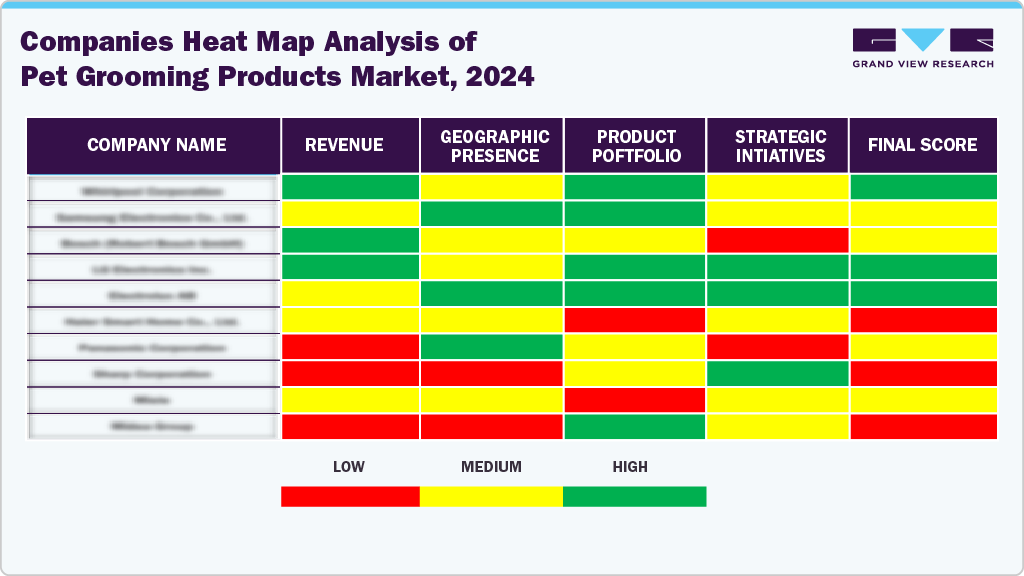

Key Pet Grooming Products Company Insights

Established and emerging players in the global pet grooming products industry operate within a highly competitive environment, driven by innovation in formulations, specialized functionality, and product diversification. Companies are investing heavily in omnichannel distribution strategies and digital engagement campaigns to connect with pet owners seeking convenience, quality, and wellness-oriented care solutions.

The growing preference for natural, sustainable, and veterinarian-approved ingredients is reshaping purchasing patterns, with a strong focus on clean formulations, transparency in labeling, and eco-friendly packaging. This shift toward premiumization and ethical product development is defining brand differentiation and long-term growth within the pet grooming industry.

Key Pet Grooming Products Companies:

The following are the leading companies in the pet grooming products market. These companies collectively hold the largest market share and dictate industry trends.

- Groomer’s Choice

- Resco

- Spectrum Brands

- Petco Animal Supplies, Inc.

- Coastal Pet Products

- Vet’s Best

- 4-Legger

- World 4 Pets

- Earthbath

- SynergyLabs

Recent Developments

-

In August 2025, Woof Gang Cosmetics launched a new salon-inspired grooming collection developed in partnership with Hydra, featuring shampoos, sprays, and colognes designed to bring the salon pet-care experience into the home. The line addresses skin and coat health with vegan-certified shampoos, detanglers, and deodorizer sprays, as well as signature scent colognes, making premium pet grooming more accessible.

-

In April 2025, FURminator introduced its new DeShedding Ultra Premium Shampoo, housed in innovative, spill-resistant AeroFlexx squeeze packaging that uses 66% less plastic while delivering the same premium de-shedding formula.

-

In May 2024, Paul Mitchell Pet launched a new grooming collection featuring shampoos, conditioners, treatments, and a unique no-rinse wash, formulated with vegan, cruelty-free ingredients and packaged in 50% post-consumer recycled bottles.

Pet Grooming Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.57 billion

Revenue forecast in 2033

USD 24.82 billion

Growth rate

CAGR of 6.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Groomer’s Choice; Resco; Spectrum Brands; Petco Animal Supplies, Inc.; Coastal Pet Products; Vet’s Best; 4-Legger; World 4 Pets; Earthbath; SynergyLabs

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Grooming Products Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels, providing an analysis of the latest industry trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global pet grooming products market report based on the type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Shampoo & Conditioner

-

Shear & Trimming Tools

-

Comb & Brush

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pet grooming products market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2033 to reach USD 24.82 billion by 2033.

b. North America dominated the pet grooming products market with a share of around 45.3% in 2024. The market in the region is witnessing a notable surge in the number of households adopting pets, stimulating a significant increase in demand for pet supplies, including grooming products.

b. Some of the key players operating in the pet grooming products market include Groomer’s Choice; Resco; Spectrum Brands; Petco Animal Supplies, Inc.; Coastal Pet Products; Vet’s Best; 4-Legger; World 4 Pets; Earthbath; SynergyLabs

b. Key factors that are driving the pet grooming products market growth include rising pet adoptions and humanization, which are driving an increase in consumer spending on various grooming, accessories, and food products.

b. The global pet grooming products market was estimated at USD 14.69 billion in 2024 and is expected to reach USD 15.57 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.