- Home

- »

- Animal Health

- »

-

Pet Herbal Supplements Market Size & Share Report, 2030GVR Report cover

![Pet Herbal Supplements Market Size, Share & Trends Report]()

Pet Herbal Supplements Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Omega 3 Fatty Acids, Multivitamins & Minerals), By Application, By Animal Type, By Dosage Form, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-152-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Herbal Supplements Market Summary

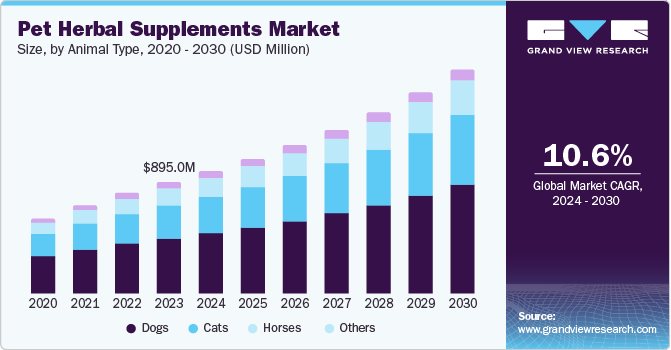

The global pet herbal supplements market was estimated at USD 895.0 million in 2023 and is projected to reach USD 1.79 billion by 2030, growing at a CAGR of 10.6% from 2024 to 2030. Some of the key drivers for the market growth include a growing number of aging dogs and cats require immune boosters, heart, and cognitive support products, as well as anti-inflammatory and pain management support, as pets live longer due to advancements in veterinary care and pet owners' interest in pet wellness and nutrition using herbal supplements.

Key Market Trends & Insights

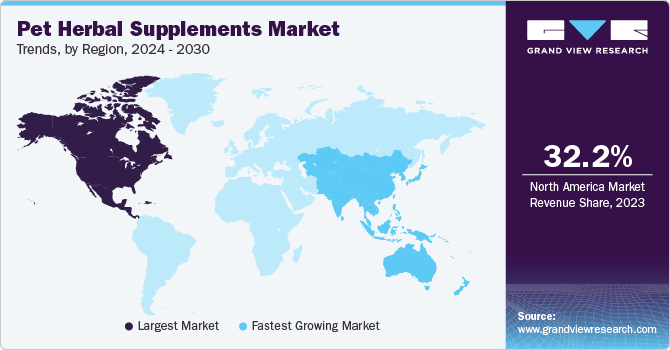

- North America held the highest share of the market in 2023.

- By product type, multivitamins & minerals segment dominated the market in 2023.

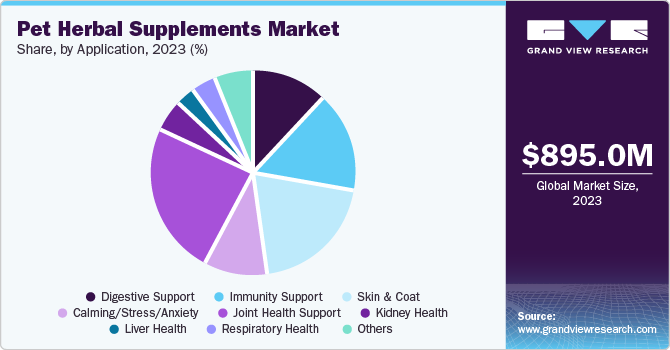

- By application, the Joint health support segment dominated the market with a share of over 24.4% in 2023.

- By animal type, the dogs segment held the highest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 895.0 Million

- 2030 Projected Market Size: USD 1.79 Billion

- CAGR (2024-2030): 10.6%

- North America: Largest Market in 2023

According to AniCura, a major provider of high-quality veterinary treatment in Europe, in 2024, 31% of dogs are categorized as senior dogs, compared to 9% for puppies, and 33% for senior cats versus 10% for kittens.

In comparison, senior pets are expected to make up 19 to 20% of global population. Due to the growing senior pet population, the demand for customized pet supplements is increasing in the market, creating huge opportunities for market players to develop multifunctional herbal supplements with improved efficacy

Furthermore, manufacturer's shift toward natural and herbal supplements for pet preventive care, rising pet expenditure, aging pet population, increasing demand for pet supplements and innovation in natural ingredients for the development of herbal pet supplements is driving pet herbal supplements market. As pets live longer, there is a greater emphasis on providing them with proper nutrition to support their aging bodies. Herbal supplements can help address age-related nutritional deficiencies and maintain vitality in senior pets. According to Packaged Facts' 2020 Survey of Pet Owners, 77% of pet supplement purchasers choose products with natural ingredients, while 68% prefer organic supplements for their companions. Thus, growing aging pet population is expected to drive demand for pet herbal supplements.

According to data from the American Society for the Prevention of Cruelty to Animals (ASPCA), nearly one in five American households added a cat or dog to their residence during the COVID-19 crisis' first year. Similarly, a Forbes Advisors poll found that 78% of pet owners purchased their pets during pandemic, with 16% doing so in 2020, 39% doing so in 2021, and 23% doing so in 2022. This growing pet ownership has increased pet spending to promote pet health using herbal supplements. Moreover, with lockdowns and stay-at-home orders in place, many people spend more time at home, leading to increased interactions with their pets. This closer bond may have made pet owners more attuned to their pets' health and well-being, prompting them to explore ways to improve their overall health using herbal supplements. Furthermore, pandemic contributed to a broader trend of people seeking natural and holistic approaches to pet health and wellness. This shift in mindset extended to pet care, with pet owners showing more interest in natural and organic pet products, including herbal supplements is expected to supplement the market growth.

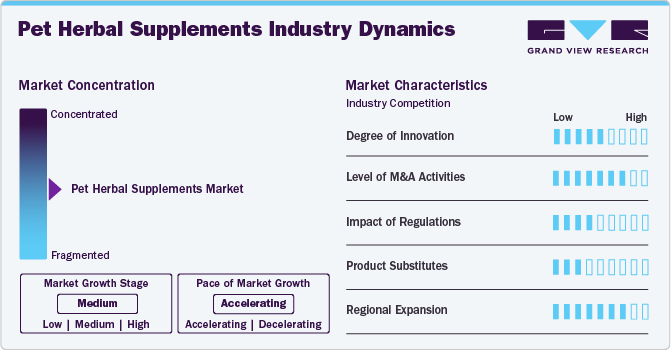

Market Concentration & Characteristics

The market exhibits moderate industry concentration, with a mix of small, specialized companies and larger or established players dominating the market. Leading companies, such as NaturVet; Zesty Paws; and Natural Dog Company Inc. hold significant market share due to strong brand recognition and broad product portfolios. The industry is competitive, with a growing number of new entrants focusing on organic and natural supplement lines to meet rising consumer demand for holistic pet health solutions. Expansion into online retail channels has also increased competition, allowing smaller brands to gain visibility and market traction.

The pet herbal supplements market has seen a significant degree of innovation, driven by growing consumer demand for natural, plant-based solutions. Key innovations include advanced formulations combining herbal ingredients with probiotics, omega-3 fatty acids, and antioxidants for targeted health benefits such as joint support, immunity, and anxiety relief. New delivery formats, like liquid supplements, dual-texture chews, and powder blends, have made dosing easier and more appealing to pet owners. Companies are also incorporating cutting-edge research into the gut-brain axis and microbiome to enhance supplement efficacy, further advancing product innovation. For instance, in April 2024, Cave Pets launched a line of premium pet supplements, incorporating ingredients like mushrooms, turmeric, and probiotics, and is the first pet brand to be Regenerative Organic Certified. These supplements promote pet health while supporting sustainable, regenerative farming practices.

M&A activities are on rise due to growing demand for natural pet wellness products. Major corporations are acquiring niche brands, such as General Mills' acquisition of Fera Pets, to enhance their portfolios with innovative, science-backed supplements. This trend reflects increasing consolidation and a focus on premium, transparent offerings in response to pet owners’ preferences for holistic health solutions. For Instance, In January 2024, General Mills acquired Fera Pets, a vet-founded pet supplement company known for blending Eastern and Western medicine to create science-backed, holistic supplements. This acquisition, through General Mills' new growth equity fund, aligns with the rising demand for natural, trustworthy pet wellness products.

Regulations significantly impact product formulation, labeling, and marketing claims in the market for pet herbal supplements. In the U.S., FDA’s oversight ensures that supplements comply with the Dietary Supplement Health and Education Act (DSHEA), which prohibits unproven health claims. This regulatory framework increases consumer trust by requiring safety and efficacy standards, while also creating barriers for new entrants. Consequently, brands must invest in research and compliance to effectively compete and meet growing demand for credible and safe pet wellness products.

Product substitutes include traditional pharmaceuticals, synthetic supplements, and alternative therapies such as homeopathy and acupuncture. Many pet owners opt for conventional medications for quicker results, while some explore holistic options, preferring natural remedies over herbal supplements. Natural remedies, like omega-3 fatty acids from fish oil or probiotics, are also gaining popularity as substitutes for herbal supplements, appealing to pet owners seeking holistic and preventive health solutions. Additionally, fortified s that contain added vitamins and minerals serve as a substitute, offering a more integrated approach to pet nutrition and health management. This competitive landscape challenges herbal supplement manufacturers to demonstrate their unique benefits and efficacy.

Regional expansion in the pet herbal supplements market is driven by increasing pet ownership and demand for natural pet care products. For example, North America and Europe lead the market due to high disposable incomes and consumer awareness of pet wellness. Companies like Zesty Paws have expanded into the Asia-Pacific region, particularly targeting markets like Japan and South Korea, where interest in natural pet products is growing. This expansion is fueled by e-commerce platforms and partnerships with local distributors, allowing brands to reach new consumers seeking alternative, herbal-based pet supplements.

Product Type Insights

By product type, multivitamins & minerals segment dominated the market in 2023, while the CBD segment is estimated to grow at the fastest rate of about 11%. Pet owners are using multivitamins and mineral supplements as a proactive measure to enhance their pets' overall well-being. These supplements can help maintain optimal health, support immune function, promote healthy skin and coat, and more.

Additionally, rising demand for herbal CBD supplements is anticipated to boost market growth throughout the forecast period. The usage of CBD-based pet products to reduce pet anxiety and increase all-around pet wellness worldwide, according to statistics from the American Pet Products Association released in September 2023. CBD supplements support cerebral stimulation, reduce boredom, and ease anxiety in pet owners through CBD-based herbal pet supplement products. Furthermore, the APPA National Pet Owners Survey conducted in 2023-2024 discovered that 53% of cat owners and 55% of dog owners utilize calming products. These products, which include chews, vitamins, and herbal CBD products, are capable of keeping pets happy and satisfied even in the presence of common anxieties like thunderstorms and huge gatherings, among other things.

Application Insights

The Joint health support segment dominated the market with a share of over 24.4% in 2023. Demand for pet herbal supplements is higher for joint health support due to increasing prevalence of arthritis and mobility issues in aging pets. Herbal supplements like turmeric, glucosamine, and chondroitin are used commonly due to their anti-inflammatory and pain-relieving properties, providing natural alternatives to traditional medications. As pet owners prioritize holistic care, these supplements offer a perceived safer, long-term solution to improve pets' joint health and quality of life.

The others (energy and electrolytes, growth promoters, etc.) segment is projected to grow at the highest CAGR during the forecast period. Synthetic medications or stimulants that boost energy in pets may have potential side effects or risks. Thus, herbal supplements are often considered safer and gentler, with fewer adverse effects for boosting pet energy levels. In addition, increased adoption of herbal pet supplements to enhance pet energy levels contributes to segment growth. Furthermore, owners of working dogs, such as police dogs, search and rescue dogs, and sporting dogs, are using energy-promoting herbal supplements to help their animals perform at their best during physically demanding activities.

Animal Type Insights

By animal type, the dogs segment held the highest market share in 2023. Dogs are the most widely adopted pets in the world with a very high adoption rate. The American Pet Products Association's National Pet Owners Survey 2023-2024 indicates that there were over 89.7 million pet dogs in the U.S. in 2023. Additionally, companies are offering new dog supplements, fueling market's growth over the forecast period. For instance, in August 2023, Dorwest Herbs launched BrainCopa, a cognitive support supplement designed to promote brain function in aging pets. It contains scientifically proven natural ingredients like Bacopa monnieri, DHA powder, lemon balm, and Ginkgo biloba, which support memory, cognitive function, and help manage symptoms of cognitive decline in older dogs.

The cats segment is estimated to witness the fastest CAGR of over 10% from 2024 to 2030. It is observed that cats provide greater comfort and companionship to their owners, which in turn has increased demand for cat food products and supplements. According to an article published in CNN Health in November 2023, approximately 30% of the American public suffers from insomnia and at least 25 million adults suffer from obstructive sleep apnea, and sleeping with cats might help perpetuate insomnia. Thus, the benefits of owning a cat have boosted their adoption and hence, creating opportunities for the segment.

Dosage Form Insights

The gummies & chewable segment dominated the market with a share of 32.9% in 2023. Many companion animals, including cats and dogs, have difficulty swallowing tablets or capsules or simply don't enjoy the sensation. Chewable supplements are the best option in these circumstances since pets instinctively chew all food, which drives this segment's growth.

The other segment is projected to grow at the fastest CAGR of around 12% during the forecast period. Other segment includes gels, jelly, and sprinkle formulations. This supplement is more readily absorbed than tablets or pills. It is simple to administer and incorporate into foods and beverages, which will increase the product's popularity throughout the forecast periods.

Distribution Channel Insights

The offline segment dominated the market with a share of over 59% in 2023. On the other hand, the online segment is projected to grow at the fastest CAGR during the forecast period. This is because a significant number of pet owners choose brick-and-mortar stores as their preferred channel of distribution. However, e-commerce and other internet outlets have become more popular recently. To boost sales, several offline retailers started letting customers choose between ordering online and making a purchase in person.

In addition, growing demand for e-commerce has created lucrative growth in the online segment over the forecast period. For instance, according to the data published by Kerry Group plc. in March 2021, for supplements, pet owners have been gradually moving away from brick-and-mortar stores and towards online retailers. Still, a substantial shift towards online pet supplement shopping has occurred since 2020. In North America, store-based retailing accounted for 66% of all pet supplement sales in 2019, falling to 53% in 2020. Additionally, the retail price of pet supplements sold online increased significantly-from 29% in 2019 to 42% in 2020-helping to close the gap with in-store sales. Additionally, Retailers have optimized digital marketing strategies, utilizing AI and targeted advertising, which has further boosted online sales, contributing to strong market growth over the forecast period. For instance, in February 2023, Finn, an online pet supplement retailer, utilized AI through Proxima to lower advertising costs and reach new customers more efficiently. By targeting interest-based and lookalike audiences, the brand has significantly reduced its cost per acquisition. This AI-driven approach, together with increased investment in direct-to-consumer channels, is boosting demand for Finn’s e-commerce pet herbal supplements sales.

Regional Insights

North America pet herbal supplements market held the largest share of 32.16% of the total market by region in 2023. The presence of key players, the growing trend of pet humanization, and the enhanced quality of pet products are the main drivers of the region's large market share. The leading companies are increasing their market presence by establishing subsidiaries, which are expected to propel the regional market. For instance, Pet Honesty introduced its pet health supplements in August 2023 at PetSmart, the country's top pet retailer. As a pioneer in developing herbal pet nutritional supplements, Pet Honesty products are currently offered in the top three pet shops in the U.S., along with Petco and Pet Supplies Plus. Additionally, the brand is extensively distributed in neighborhood and specialized pet stores and Tractor Supply Company, giving it access to pet parents in over 7,000 locations across the U.S. and online.

U.S. Pet Herbal Supplements Market Trends

The U.S. pet herbal supplements market is growing rapidly due to growing trend towards holistic pet care, with owners increasingly prioritizing natural and organic products; rising awareness of pet health and wellness, growing investments in preventive health measures; the humanization of pets, leading to higher spending on premium supplements; and the increasing popularity of e-commerce, providing pet owners with convenient access to a wider range of herbal options.

Additionally, the U.S. pet herbal supplements market is expected to grow rapidly as more dog owners turn to holistic treatments like herbal therapy, acupuncture, and homeopathy to enhance their pets' health and lifespan. These supplements, often used in conjunction with Western medicine, are seen as natural alternatives for preventative care and treating chronic conditions, reflecting the rising demand for holistic pet wellness. Moreover, the market is supported by ongoing research, such as the Dog Aging Project, which underscores the effectiveness of alternative treatments. With pet owners increasingly opting for holistic care, the market is set for continued growth, driven by a commitment to enhancing both the quality and duration of pets' lives.

Europe Pet Herbal Supplements Market Trends

The pet herbal supplements market in Europe is projected to grow significantly due to an increase in product launches and expansions by key players. Companies are introducing innovative herbal formulations developed to meet the specific health needs of European pets, capitalizing on the rising demand for natural and holistic pet care solutions. This trend is supported by heightened consumer awareness of pet wellness and the benefits of herbal ingredients. For instance, in April 2024, Swedencare expanded its pet health presence by launching NaturVet in Europe along with introduction of range of soft chews designed specifically for European pets. This move brings NaturVet’s 30 years of expertise in pet supplements, already proven in the U.S., to the growing Europe market for pet herbal supplements, with initial availability on Amazon UK. These expansions bring innovative, high-quality supplements, designed to local needs, boosting market growth and enhancing product availability across Europe. Additionally, collaborations with retail partners and online platforms, such as Amazon, enhance product accessibility, further driving market penetration. These strategic initiatives collectively bolster competition and stimulate market growth in the region.

UK pet herbal supplements market is experiencing significant growth during forecast period. Pet owners increasingly seek personalized products and services designed to their pets' specific needs, fueling demand for customized diets and supplements. Technological advancements, including smart pet devices, enhance pet care and monitoring, while a growing emphasis on holistic and natural products aligns with consumer preferences for organic and eco-friendly options. E-commerce continues to dominate pet retail, offering convenience and diverse choices. Additionally, the focus on pet health and wellness has led to increased investments in preventive care and nutritional supplements, creating a receptive market for herbal solutions.

The growth of the German pet herbal supplements market is driven by increasing pet ownership and a rising demand for natural health solutions among pet owners. Consumers are increasingly prioritizing holistic care and premium products, reflecting a trend toward natural and organic ingredients. Additionally, the humanization of pets and a growing interest in preventive healthcare contribute to the market's expansion, alongside the convenience of e-commerce platforms facilitating access to these products.

Asia Pacific Pet Herbal Supplements Market Trends

Asia Pacific is estimated to grow at the fastest CAGR of 11.8% from 2024 to 2030. The growing pet population and concern about the well-being of pets are the factors that are anticipated to propel the market in the region. Market players are engaged in regional product launches or regional expansion for veterinary use. For instance, Wai Yuen Tong Medicine Co., Ltd. diversified into the pet supplement market in August 2020 by releasing a line of labeled herbal supplements for pets.

The India pet herbal supplements market is witnessing growth fueled by increased investment in pet-care companies. For instance, in February 2024, Emami has invested ₹1.95 crore (USD 0.23 Mn) in Cannis Lupus a pet-care company that will expand its offerings to include medicinal products, food, and supplements for pets, enhancing its commitment to the pet-care sector. This investment aligns with Emami's strategy to develop a range of ayurvedic and natural products for pets, reflecting the rising demand for herbal solutions in pet wellness.

Latin America Pet Herbal Supplements Market Trends

A rising trend in pet adoption across Latin America is boosting the demand for various pet products, including herbal supplements aimed at enhancing pet health and wellness. Furthermore, pet owners are becoming more health-conscious, leading to a growing preference for natural and organic products. This trend supports the demand for herbal supplements perceived as safer and more beneficial for pets.

Brazil pet herbal supplements market is anticipated to grow during the forecast period. Brazil has one of the largest pet populations globally, with a growing number of households adopting pets. This increase in pet ownership fuels demand for health and wellness products, including herbal supplements. Many veterinarians are endorsing herbal supplements as part of holistic care approaches for pets, increasing consumer trust and acceptance of these products.

Middle East & Africa Pet Herbal Supplements Market Trends

The Middle East & Africa pet herbal supplements market is witnessing growth due to increasing pet ownership, rising awareness of natural and organic pet care products, and a growing focus on pet health. Pet owners are increasingly seeking herbal supplements as alternatives to synthetic products to address common health concerns like digestion, joint health, and anxiety in pets. The market is also driven by a shift towards premium and specialized pet products, along with a greater emphasis on sustainability and natural ingredients. Furthermore, urbanization and a rising disposable income in countries like the UAE and South Africa are contributing to the demand for herbal pet supplements.

South Africa's pet herbal supplements market is experiencing significant growth, driven by an increasing number of local product developers focusing on natural and organic pet health solutions. The rising awareness among pet owners about the benefits of herbal supplements for improving pet well-being, addressing issues like joint health, digestion, and anxiety, is boosting demand. Additionally, the expanding pet care industry and consumer preference for premium, health-focused products further contribute to the market's development in South Africa.increasing urbanization, higher disposable incomes, and a shift toward pet adoption. Key trends in the South Africa market for pet herbal supplements include rising demand for products addressing muscle and joint health, eye care, tooth care, immunity, and digestive health. South Africans associate pet nutrition with proteins, vitamins, and minerals

Key Pet Herbal Supplements Company Insights

Key companies in the pet herbal supplements market include Only Natural Pet LLC, AMORVET, NaturVet, Veesure, Ayurvet, and Mars. These players dominate the market by offering products focused on pet health, such as supplements for muscle and joint health, immunity, and digestive care. Many brands leverage veterinary channels to market their specialized nutraceuticals, emphasizing health benefits like weight management and disease prevention. Companies like Hills support animal welfare efforts and promote their nutritional products through strategic partnerships and vet clinics, helping them maintain a strong foothold in the market.

Key Pet Herbal Supplements Companies:

The following are the leading companies in the pet herbal supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Blackmores

- NaturVet (The Garmon Corp.)

- Natural Dog Company Inc.

- AdvaCare Pharma

- Pet Natural Remedies

- Dorwest Herbs Ltd.

- Only Natural Pet LLC

- AMORVET

- Rockwell Pets Pro

- Nutri-Pet Research, Inc.

- Health Extension.

Recent Developments

-

In August 2024, Pet Honesty launched a new line of liquid supplements for dogs, including Hip + Joint Health, Skin + Coat Health, and 10-in-1 Multivitamin. These supplements, made with salmon oil, bone broth, glucosamine, biotin, and essential vitamins, offer easy-to-use, in-bowl nutrition.

-

In April 2024, Cymbiotika introduced a new pet nutrition range with supplements targeting gut health, calm, joint health, allergies, and immunity. Formulated with premium ingredients like probiotics, prebiotics, L-theanine, chamomile, colostrum, and wild Alaskan salmon oil, these supplements support overall pet well-being.

-

In December 2023, EverRoot, powered by Purina, entered into partnership with athlete and wellness advocate Laila Ali to launch EverRoot Dog Supplements Soft Chews. These new supplements offer a convenient, palatable option for dog owners to support their pets' health across various key areas like immunity, digestion, skin, coat, hip and joint health, and calming. The soft chews are made with high-quality, natural ingredients, including organic chamomile and oils from wild-caught Alaskan fish, providing tailored nutrition for dogs' individual needs.

Pet Herbal Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 980.8 million

Revenue Forecast in 2030

USD 1.79 billion

Growth rate

CAGR of 10.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product type, animal type, application, dosage form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Blackmores; NaturVet (The Garmon Corp.); Natural Dog Company Inc.; AdvaCare Pharma; Pet Natural Remedies; Dorwest Herbs Ltd.; Only Natural Pet LLC; AMORVET; Rockwell Pets Pro; Nutri-Pet Research, Inc.; Health Extension

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Herbal Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet herbal supplements market report based on product type, application, animal type, dosage form, distribution channel, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Omega 3 Fatty Acids

-

Probiotics & Prebiotics

-

Multivitamins & Minerals

-

CBD

-

Proteins & Peptides

-

Others

-

-

Pet Herbal Supplements Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Digestive Support

-

Immunity Support

-

Skin & Coat

-

Calming/Stress/Anxiety

-

Joint Health Support

-

Kidney Health

-

Liver Health

-

Respiratory Health

-

Others (energy and electrolytes, growth promoters, etc.)

-

-

Pet Herbal Supplements Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Pet Herbal Supplements Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets & Capsules

-

Gummies & Chewable

-

Powders

-

Liquids

-

Other

-

-

Pet Herbal Supplements Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Pet Specialty Stores

-

Retail

-

Others

-

-

-

Pet Herbal Supplements Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global pet herbal supplements market size was estimated at USD 895.0 million in 2023 and is expected to reach USD 980.8 million in 2024.

b. The global pet herbal supplements market is expected to grow at a compound annual growth rate of 10.6% from 2024 to 2030 to reach USD 1.79 billion by 2030.

b. North America dominated the pet herbal supplements market with a share of 32.16% in 2023 The presence of key players, the growing trend of pet humanization, and the enhanced quality of pet products are the main drivers of the region's large market share.

b. Some key players operating in the pet herbal supplements market include Blackmores, NaturVet (The Garmon Corp.), Natural Dog Company Inc., AdvaCare Pharma, Pet Natural Remedies, Dorwest Herbs Ltd., Only Natural Pet LLC, AMORVET, Rockwell Pets Pro, Nutri-Pet Research, Inc., Health Extension

b. Key factors that are driving the market growth include manufacturer's shift toward natural and herbal supplements for pet preventive care, rising pet expenditure, the aging pet population, increasing demand for pet supplements and innovation in natural ingredients for the development of herbal pet supplements

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.