- Home

- »

- Consumer F&B

- »

-

Pet Meal Kit Delivery Services Market Report,2021-2028GVR Report cover

![Pet Meal Kit Delivery Services Market Size, Share & Trends Report]()

Pet Meal Kit Delivery Services Market (2021 - 2028) Size, Share & Trends Analysis Report By Pet Type (Dogs, Cats), By Subscription Type (Topper, Full), By Food Type (Dry, Wet), By Region (APAC, Europe), And Segment Forecasts

- Report ID: GVR-4-68039-675-9

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

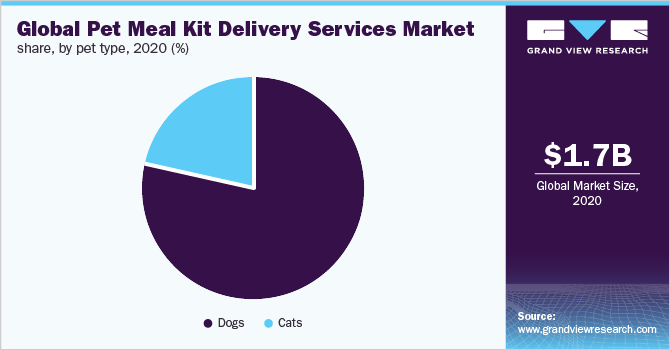

The global pet meal kit delivery services market size was valued at USD 1.67 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 15.3% from 2021 to 2028. Rising awareness among consumers related to personalized meal kits based on their pet’s profile and taste preferences, coupled with an increasing propensity to spend on pet food is expected to drive the market over the forecast period. The global COVID-19 pandemic has increased the demand for pet food including delivery services for the same. Primarily, countries, such as the U.S., India, Brazil, and the U.K., have witnessed a significant rise in the pet population, which has resulted in increased sales of such meal kits. Many service providers in the market have started offering both topper and full subscription plans along with discounted trials during the pandemic, which has providentially increased the demand from health-conscious pet owners.

The growing inclination towards dog adoption as a family companion is projected to propel the demand for dog meal kit delivery services. According to the 2021 - 2022 APPA National Pet Owners Survey, as of 2021, the number of households that owned a dog amounted to 69.1 million, while cat owners amounted to 45.3 million, which was a 9% increase since 2020. A rise in the pet population coupled with the need to provide fresh and healthy meals to these pets is anticipated to increase the demand during the forecast period.

A drastic rise in online purchases of pet consumables has been observed post-pandemic. According to China’s National Bureau of Statistics, approximately 90% of pet consumables sold in China were purchased through an online medium during 2020, which included pet meal kit delivery services. Also, the rising focus of key providers on shipping meals worldwide through their online platforms is anticipated to propel the adoption of these services across the globe.

Furthermore, according to the Association of American Feed Control Officials, pets, such as dogs and cats, have a minimum requirement of calorie intake along with basic nutrients based on their weight, activity, and health conditions. For instance, while a small-sized active dog requires approximately 320 calorie intake per day to stay healthy, a large dog could need as much as 1600 calories intake from their daily meals. As of 2020, nutrition deficiencies in pets have led to the demise of over 40% of pets including cats and dogs, across the globe.

Since, key companies offer customized meals, based on the pet’s overall profile and taste preferences, it becomes convenient for dog owners to measure their dog’s calorie intakes and ensure their wellbeing. Thus, the growing inclination of pet owners towards their pet’s health has resulted in a recent shift in consumer preference for customized meal kit subscriptions. Moreover, most service providers offer topper subscription services for pet owners who consider using meals on top of regular dry food. This makes the service more budget-friendly for the consumers, which resulted in the increased adoption of these services across the globe.

Subscription Type Insights

the full subscription type segment accounted for the largest revenue share of over 61% in 2020. The segment is projected to retain its market dominance growing at the fastest CAGR over the forecast period. The growth can be credited to the high consumer inclination towards meeting their pet’s daily calorie and nutritional needs based on their profile and health conditions. Full subscriptions are offered to consumers along with discounted/free monthly trial plans to attract consumers and instigate them to be new service adopters. For instance, companies like NomNomNow Inc., which caters to both dog and cat meal kit services, offer up to 50% discounts to new users for adopting their plans on a trial basis.

Furthermore, companies, such as The Farmer’s Dog, also offer refunds in case the pet doesn’t like their meals. Such promotional strategies are helping these companies in enhancing their customer base across the globe. The topper subscription plan segment is also expected to register a significant CAGR from 2021 to 2028. Purchasing topper plans to mix the meals on top of homemade meals have been gaining traction among consumers, especially those who have budget constraints. Furthermore, customers who are skeptical about the benefits of such meal kits prefer topper subscriptions over full subscription plans.

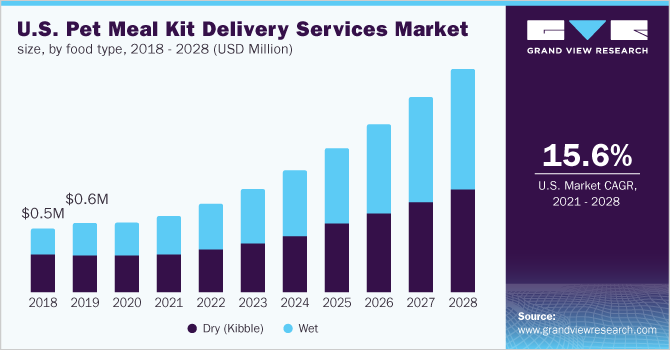

Food Type Insights

The dry (kibble) food type segment accounted for the largest revenue share of 52% in 2020 as it is the most popular among consumers for their daily pet food needs. With the growing focus of key providers on offering fresh dry meals, there is a rise in consumer adoption for this segment. Moreover, dry food has a higher preference because of the factors, such as ease of mixing with current homemade food and lower prices as compared to wet food, which has led to increased consumer spending in this segment.

However, the wet food segment is expected to account for the maximum revenue share by 2028. The segment is also estimated to register the fastest CAGR over the forecast period due to rising product demand. Wet food has higher moisture, is more aromatic & flavorful, and is easier to chew. The high water contents in wet food help cover the pet’s fluid intake.

Pet Type Insights

The dogs pet type segment held the largest market share of over 78% in 2020 and is expected to maintain dominance over the forecast period. These services are specially tailored based on the dog’s age, weight, breed, gender, activity level, allergies, and taste preferences. The meal box comprises a mix of ingredients including meat and other proteins, vegetables, fruits, grains and seeds, vitamins and minerals, and specialty ingredients, such as fish oil, cod liver oil, and coconut oil, for meeting the dog’s health requirements.

Furthermore, an upward trend has been observed in terms of investments in dog meal kit service providers, which has led several service providers to opt for expansion by offering free shipping across the globe. For instance, in February 2020, PetPlate, U.S., announced that it closed USD 9.1 million in series A funding. The company announced to utilize its new funding to expand their product/service offerings that would include new ingredients, recipes for their meal kits, and expand their customer base by shipping products to more regions, such as Europe. Thus, expansions and new product/service launches are expected to drive the market.

Regional Insights

North America accounted for the largest revenue share of over 40.0% in 2020 and is expected to retain its dominance throughout the forecast period. The increasing adoption of dogs and cats as companion animals in the U.S. along with a rise in spending on pet food is anticipated to drive the demand.

Asia Pacific is expected to be the fastest-growing regional market from 2021 to 2028. There has been a huge growth in pet population in countries, such as, China, Japan, India, and Australia, over the past few years, which supports market growth. Moreover, the increasing disposable income of consumers is enabling them to spend more on pet food including pet meal kit delivery services.

Key Companies & Market Share Insights

The market has a presence of many multinationals as well as domestic manufacturers making the service charges highly competitive. Also, many of the major food manufacturers are focusing on investing and acquiring pet meal kit delivery services companies to expand their customer base. For instance, in April 2018, Nestle Purina PetCare, an American subsidiary of Nestle group, acquired Tails.com to expand its reach in the market. Some of the key players operating in the global pet meal kit delivery services market include:

-

The Farmer’s Dog, Inc.

-

PetPlate

-

NomNomNow Inc.

-

Ollie Pets Inc.

-

Spot and Tango

-

Butternutbox

-

Kabo Labs

-

Lyka

-

Tailsco Ltd

-

Lucky Dog Cuisine Inc.

Pet Meal Kit Delivery Services Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 1.92 Billion

Revenue forecast in 2028

USD 5.20 Billion

Growth rate

CAGR of 15.3% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet type, food type, subscription type, region

Regional scope

North America; Europe; Asia Pacific; Rest of the World

Country scope

U.S.; U.K.; France; Spain; China; Japan; India; Australia; Brazil; South Africa

Key companies profiled

The Farmer’s Dog, Inc.; PetPlate; NomNomNow, Inc.; Ollie Pets, Inc.; Spot & Tango; Butternutbox; Kabo Labs; Lyka; Tailsco Ltd.; Lucky Dog Cuisine, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global pet meal kit delivery services market report on the basis of pet type, food type, subscription type, and region:

-

Pet Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Dogs

-

Cats

-

-

Food Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Dry (Kibble)

-

Wet

-

-

Subscription Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Topper

-

Full

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

-

Europe

-

U.K.

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Rest of the World

-

Brazil

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pet meal kit delivery services market size was estimated at USD 1.67 billion in 2020 and is expected to reach USD 1.92 billion in 2021.

b. The global pet meal kit delivery services market is expected to grow at a compound annual growth rate of 15.3% from 2021 to 2028 to reach USD 5.20 billion by 2028.

b. North America dominated the pet meal kit delivery services market with a share of 40% in 2020. The increasing adoption of dogs and cats in the U.S. along with a rise in spending on pet food is anticipated to drive the demand for pet meal kit delivery services market.

b. Some key players operating in the pet meal kit delivery services market include The Farmer’s Dog, Inc., PetPlate, NomNomNow Inc., Ollie Pets Inc., Spot and Tango, Butternutbox, Kabo Labs, Lyka, Tailsco Ltd, and Lucky Dog Cuisine Inc.

b. Rising awareness among consumers related to personalized meal kits based on their pet’s profile and taste preferences, coupled with an increasing propensity to spend on pet food is expected to drive market demand throughout the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.