- Home

- »

- Medical Devices

- »

-

PET Scanners Market Size, Share & Trends Report, 2030GVR Report cover

![PET Scanners Market Size, Share & Trends Report]()

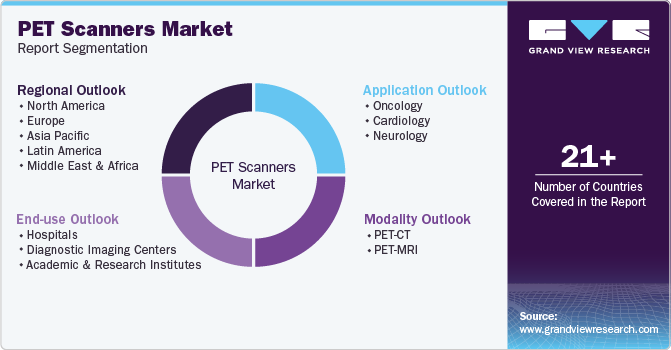

PET Scanners Market (2024 - 2030) Size, Share & Trends Analysis Report By Modality (PET-CT, PET-MRI), By Application (Oncology, Cardiology, Neurology), By End Use (Hospitals, Diagnostic Imaging Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-040-9

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

PET Scanners Market Summary

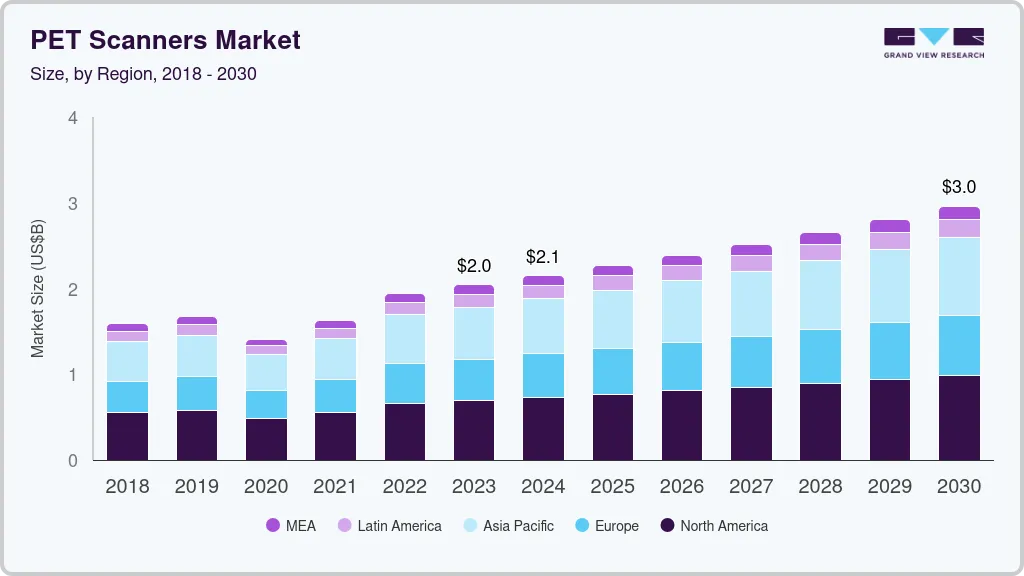

The global pet scanners market size was estimated at USD 2.04 billion in 2023 and is projected to reach USD 3.37 billion by 2030, growing at a CAGR of 3.65% from 2024 to 2030. Key drivers include advancements in PET imaging technology for sophisticated diagnostic applications and oncology, a growing demand for PET analysis in radiopharmaceuticals, and a notable shift towards image-guided interventions.

Key Market Trends & Insights

- North America PET scanners market held the largest revenue share, over 34.11%, in 2023.

- The PET scanners market in the U.S. is characterized by rapid innovation and product launches to improve imaging quality and reduce scan times.

- By modality, PET-CT dominated the PET scanner market, holding the largest revenue share of 81.91% in 2023.

- By application, the oncology segment is dominant, with the largest revenue share of 47.0% in 2023.

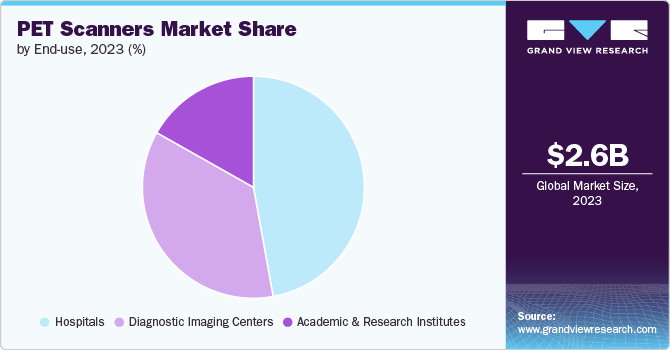

- By end use, the hospital segment held the largest revenue share of over 52.20% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.04 Million

- 2030 Projected Market Size: USD 3.37 Billion

- CAGR (2024-2030): 3.65%

- North America: Largest market in 2023

As the healthcare sector evolves, integrating these innovations is expected to boost the adoption of PET scanners across diverse medical fields. For instance, in November 2023, Siemens Healthineers received FDA clearance for the Biograph Vision.X PET/CT scanner, featuring industry-leading time-of-flight (TOF) performance of 178 picoseconds and advanced detector technology, enhancing sensitivity and image quality for improved diagnostic capabilities.

Technical advancements in PET imaging for advanced diagnostics applications and oncology and rising demand for PET analysis in radiopharmaceuticals are expected to drive market growth. Additionally, the increasing shift towards image-guided interventions and X-ray Tomography (CT) integration with PET is expected further to propel the development of the PET scanners market globally. According to an article published by GE Healthcare in November 2023, Positron Emission Tomography (PET) is a vital medical functional imaging technique. Ongoing innovations enhance PET detector technology, increasing sensitivity and advancing the future of molecular imaging.

The rising demand for PET analysis in radiopharmaceuticals is another significant market driver. As the field of molecular imaging expands, the need for effective radiotracers targeting specific biological processes has increased. The development of novel radiopharmaceuticals, such as non-18F-FDG tracers, is gaining traction, particularly for imaging tumors with low metabolic activity. Recent advancements led to introducing new tracers that can provide insights into tumor biology, further enhancing the diagnostic capabilities of PET imaging. This growing interest in targeted radiopharmaceuticals is expected to drive the market as healthcare providers seek more precise diagnostic tools.

Moreover, heightened government support for key companies in the sector is expected to propel the development of PET imaging techniques further. For instance, in March 2022, Novartis received FDA approval for PluvictoTM. The company stated that “Pluvicto” is the first FDA-sanctioned targeted radioligand therapy (RLT) aimed at aiding in the cure of patients with prostate-specific membrane antigen-positive metastatic castration-resistant prostate cancer. Conventional imaging methods typically used to diagnose prostate cancer include Magnetic Resonance Imaging (MRI), computed tomography (CT) scans, and bone scans.

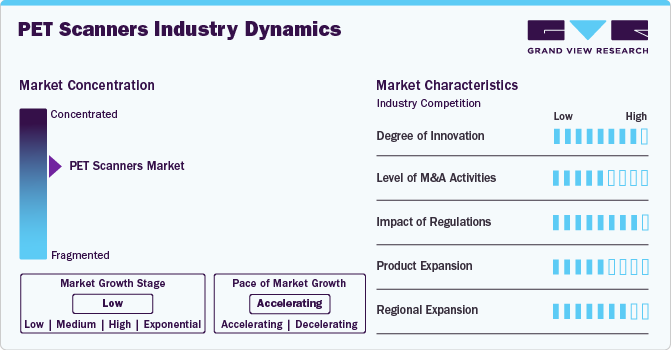

Market Concentration & Characteristics

Degree of innovation in the market is high. The market is driven by advancements in imaging technology and the integration of artificial intelligence (AI) for enhanced diagnostic capabilities. For instance, in June 2023, the House of Diagnostics (HOD) introduced the advanced 3-Ring Discovery IQ PET-CT scanner at its Green Park location, expanding services to seven sites across Delhi-NCR. This move highlights HOD's dedication to delivering cutting-edge diagnostic solutions to the local community.

Level of merger and acquisition (M&A) activities in the PET scanners market is moderate. Companies often engage in M&A to consolidate resources, acquire new technologies, and enhance their competitive edge. For instance, in October 2023, Philips and Quibim are collaborating to develop an integrated solution combining AI-powered MR imaging and AI-based image analysis software. This collaboration aims to expedite prostate cancer diagnosis, mitigate staffing challenges, and reduce costs, ultimately enhancing patient care and outcomes.

Regulations have a high impact on the market due to stringent guidelines governing medical devices and radiation safety standards. FDA (Food and Drug Administration) in the U.S. imposes rigorous testing and approval processes for new imaging technologies. For instance, in September 2023, the FDA approved the innovative AURA 10 specimen imager developed by Belgian MedTech pioneer XEOS. This approval positions the AURA 10 to improve surgical outcomes in the United States significantly.

Product expansion within the market is medium as manufacturers continuously seek to diversify their offerings while addressing specific clinical needs. Companies are introducing specialized systems tailored for oncology, cardiology, and neurology applications. For instance, MRI is widely used for soft tissue evaluation, making it a strong competitor in neurological assessments. However, advancements in hybrid imaging systems, such as PET/MRI, are helping to mitigate this threat by combining the strengths of both modalities, offering comprehensive diagnostic capabilities that enhance clinical decision-making.

Regional expansion within the PET scanners market is considered high as companies increasingly target emerging markets where healthcare infrastructure is improving rapidly. Asia-Pacific is witnessing significant growth due to rising healthcare expenditures and increasing awareness about early disease detection through advanced imaging technologies. For instance, in October 2023, a new PET-CT scanner was introduced at Norfolk and Norwich University Hospital to enhance access to advanced cancer diagnostics for East England patients.

Modality Insights

PET-CT dominated the PET scanner market, holding the largest revenue share of 81.91% in 2023. It is expected to continue its dominance with the fastest CAGR of 5.5% over the forecast period. The drivers behind this growth include technological advancements that improve image quality and reduce scan times, the rising prevalence of cancer and cardiovascular diseases necessitating early diagnosis, and increasing research activities focusing on personalized medicine. For instance, In June 2024, Siemens Healthineers introduced its latest PET/CT scanner, the Biograph Trinion, at the Society of Nuclear Medicine and Molecular Imaging's annual meeting.

The PET MRI segment is rapidly growing due to the rising demand for hybrid imaging technologies that merge PET’s metabolic insights with MRI’s anatomical clarity. This combination significantly improves diagnostic precision in fields like oncology, neurology, and cardiology, where understanding structure and function is essential. For instance, in June 2023, the Signa PET/MR Air system from GE HealthCare, which offers various technological advancements for diagnosing conditions such as Alzheimer’s and prostate cancer, was launched at the Chicago Society of Nuclear Medicine and Molecular Imaging conference.

Application Insights

The oncology segment is dominant, with the largest revenue share of 47.0% in 2023. The rise in cancer cases necessitates effective screening and monitoring tools, with PET scans being pivotal for detecting malignancies, assessing tumor metabolism, and evaluating treatment responses. According to the National Library of Medicine, PET scans are extensively utilized to stage various cancers such as lung, breast, and colorectal, allowing for timely interventions that can significantly improve patient outcomes.

The cardiology segment is expected to witness the fastest growth rate over the forecast period. This is owing to the rising incidence of cardiovascular diseases and increasing demand for non-invasive treatments for cardiovascular disease management. As per the article "Epidemiological Features of Cardiovascular Disease in Asia," published by JACC journals, cardiovascular disease (CVD) continues to be the leading cause of death and premature death worldwide.

End Use Insights

The hospital segment held the largest revenue share of over 52.20% in 2023. Hospitals have comparatively high patient volume and access to advanced diagnostic technologies that are not available in other healthcare facilities, including advanced PET scanners, which allow them to provide comprehensive medical care. Furthermore, Hospitals have established referral networks with the insurance providers. PET scans are considered an expensive diagnostic method and are generally covered by health insurance so that patients can use their health insurance for PET scans performed in hospitals.

The diagnostic imaging centers are expected to witness the fastest growth rate over the forecast period. Diagnostic imaging centers are expanding their services to provide a more comprehensive range of patient diagnostic options. PET scan imaging is a valuable add-on to these services, allowing these centers to offer more complete testing for various diseases. In addition, PET scanners were traditionally expensive. They were mainly used in hospitals, but advanced and innovative technology has decreased the costs, and diagnostic imaging centers can invest in PET scanners and try to provide imaging services at a lower cost to their patients.

Regional Insights

North America PET scanners market held the largest revenue share, over 34.11%, in 2023. Technological advancements in PET imaging for oncology and advanced diagnostic applications, along with the high demand for precision diagnostics, drive market growth significantly. The increasing prevalence of cancer, particularly breast and prostate cancer, further enhances this trend. According to the American Cancer Society's 2022 update, approximately 1,918,030 new cancer cases were expected in the U.S. in 2022, including an estimated 290,560 cases of breast cancer, 268,490 cases of prostate cancer, and 151,030 cases of colorectal cancer. These statistics underscore the urgent need for advanced cancer detection and treatment imaging technologies.

U.S. PET Scanners Market Trends

The PET scanners market in the U.S. is characterized by rapid innovation and product launches to improve imaging quality and reduce scan times. Notable advancements include the introduction of digital PET scanners that offer enhanced sensitivity and resolution. The U.S. healthcare system's focus on personalized medicine has led to increased utilization of PET scans for precise tumor localization and monitoring treatment responses. Additionally, partnerships between technology firms and healthcare providers foster research into new radiotracers that can target specific diseases more effectively, thereby expanding clinical applications.

Europe PET Scanners Market Trends

A strong emphasis on research collaborations and regulatory support for advanced imaging technologies marks the European PET scanner market. Germany and France are leading in adopting innovative PET solutions due to their robust healthcare infrastructure and investment in medical research. The European Union's initiatives to promote early diagnosis of diseases through advanced imaging techniques are further propelling market growth. Moreover, there is a notable trend toward integrating artificial intelligence (AI) with PET imaging to enhance diagnostic accuracy, streamline workflows, and improve patient management strategies.

The UK PET scanner market is influenced by government initiatives to improve cancer care pathways through enhanced diagnostic capabilities. The National Health Service (NHS) has been actively investing in state-of-the-art imaging technologies to ensure timely diagnosis and treatment of cancers. Integrating AI-driven analytics into PET imaging processes is gaining traction as it aids clinicians in making informed decisions quickly. For instance, in October 2023, the UK launched its national total-body PET imaging initiative, the National PET Imaging Platform (NPIP). This groundbreaking project aims to bolster medical research and facilitate drug discovery processes. The NPIP is a collaborative effort involving several key organizations, including the Medicines Discovery Catapult, the Medical Research Council, and Innovate UK.

The PET scanner market in France showcases a growing interest in hybrid imaging modalities that combine PET with other techniques, such as CT or MRI, for comprehensive diagnostics. The French healthcare system emphasizes preventive care, which aligns with increased investments in advanced imaging technologies for early disease detection. Furthermore, collaborations between academic institutions and industry players are fostering innovation in radiotracer development tailored for specific diseases such as Alzheimer's disease or various cancers. With an aging population projected to rise significantly by 2050, there is an urgent need for practical diagnostic tools that can cater to age-related health issues.

Asia Pacific PET Scanners Market Trends

The Asia Pacific region is witnessing a significant transformation in the PET scanner market, driven by technological advancements and an increasing prevalence of chronic diseases such as cancer and cardiovascular disorders. The rise in healthcare expenditure across India, China, and Japan has led to enhanced infrastructure and accessibility to advanced imaging technologies. Innovations such as hybrid imaging systems combining PET with MRI are gaining traction, providing more comprehensive diagnostic capabilities.

China PET scanner market is experiencing significant growth, driven by increasing healthcare expenditures and a rising prevalence of chronic diseases such as cancer. The Chinese government actively promotes advanced imaging technologies as part of its healthcare reforms, leading to increased investments in medical infrastructure. Notably, there was a surge in the adoption of hybrid imaging systems such as PET/CT and PET/MRI, which offer enhanced diagnostic capabilities. Furthermore, local manufacturers are innovating with cost-effective solutions to cater to the growing demand from hospitals and diagnostic centers.

The PET scanner market in Japan because it focuses on innovation and high-quality healthcare delivery systems. For instance, in March 2021, in Kyoto, Japan, Shimadzu Corporation announced the new Time-of-flight PET (TOF-PET) “BresTome,” a functional imaging solution dedicated to breast and head within the Japanese domestic healthcare market. It provides double resolution of conventional whole-body PET systems. It can be utilized to encourage the clinical treatment of Alzheimer’s disease and other degenerative neurological disorders in addition to the clinical applications for epilepsy and brain tumors and is covered by Japanese public health insurance.

Latin America PET Scanners Market Trends

The PET scanner market in Latin America is experiencing significant growth, driven by an increasing prevalence of chronic diseases such as cancer and cardiovascular disorders. The region saw a rise in healthcare investments, particularly in Brazil and Mexico, where government initiatives aim to enhance diagnostic imaging capabilities. Additionally, the aging population is contributing to higher demand for advanced imaging solutions; by 2030, approximately 12% of Latin America’s population is projected to be over 60.

Brazil PET scanner market is experiencing significant advancements as healthcare providers upgrade their PET/CT scanners to meet the growing demands of an expanding population. For instance, in April 2023, doctors in major cities including São Paulo, Brazil, Buenos Aires, and Argentina found that modernized scanning technology enables them to respond more effectively to patient needs, alleviating scheduling pressures and improving diagnostic capabilities. The enhanced imaging quality and faster processing times of new PET/CT scanners allow for quicker diagnoses of conditions such as cancer and cardiovascular diseases. This helps manage patient flow more efficiently and opens up new areas of care, such as early detection of neurodegenerative diseases, ultimately leading to better patient outcomes and satisfaction in Brazil's healthcare system.

Middle East & Africa PET Scanners Market Trends

The PET scanner market in the Middle East & Africa (MEA) is witnessing a surge fueled by increasing awareness about early disease detection and advancements in healthcare infrastructure. The UAE and South Africa are leading this trend with substantial investments in modern healthcare facilities with state-of-the-art imaging technologies. The region’s unique challenges include a high burden of infectious diseases alongside non-communicable diseases such as cancer, necessitating a dual approach to diagnostics.

Saudi Arabia PET scanner market is characterized by rapid technological advancements supported by Vision 2030 initiatives to transform the healthcare landscape. The government is investing heavily in health infrastructure improvements, including acquiring advanced imaging technologies such as PET scanners to enhance hospital diagnostic capabilities. Recent mergers between local health organizations and international firms have facilitated knowledge transfer and innovation within the sector.

Key PET Scanners Market Company Insights

Key PET scanner companies focus on providing a more comprehensive range of advanced imaging products that incorporate cutting-edge technology, driving market growth. For instance, in October 2022, GE Healthcare launched the "Omni" PET/CT platform, designed to enhance operational efficiency. This platform features AI-driven workflow solutions, including an Auto Positioning Camera and Precision DLi for deep learning image processing, addressing healthcare challenges effectively.

Key PET Scanners Companies:

The following are the leading companies in the pet scanners market. These companies collectively hold the largest market share and dictate industry trends.

- Canon Medical Systems

- GE Healthcare

- Kindsway Biotech

- Koninklijke Phillips N.V.

- Mediso Ltd.

- PerkinElmer

- Positron

- Shimadzu Corporation

- Siemens Healthineers AG

Recent Developments

-

In June 2024, a recently launched technology known as augmented whole-body scanning via magnifying PET (AWSM-PET) has shown significant advancements in image clarity and system sensitivity for clinical whole-body PET/CT imaging.

-

In April 2024, CDL Nuclear Technologies announced the launch of its innovative Mobile dedicated Cardiac PET/CT Trailer, designed to transform cardiac care by providing advanced PET/CT imaging services directly to medical facilities as per their schedules.

-

In April 2022, Royal Victoria Regional Health Centre (RVH) installed new medical imaging technology to detect some cancers earlier.

PET Scanners Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.72 billion

Revenue forecast in 2030

USD 3.37 billion

Growth rate

CAGR of 3.65% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Sweden, Denmark, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, Saudi Arabia, South Africa, UAE, Kuwait

Key companies profiled

Siemens Healthineers AG, GE Healthcare, Koninklijke Phillips N.V., Shimadzu Corporation, Canon Medical Systems, PerkinElmer, Positron, Kindsway Biotech , Mediso Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global PET Scanners Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global PET scanners market report based on modality, application, end use and region:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

PET-CT

-

PET-MRI

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiology

-

Neurology

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global PET scanners market size was estimated at USD 2.64 billion in 2023 and is expected to reach USD 2.72 billion in 2024.

b. The global PET scanners market is expected to grow at a compound annual growth rate of 3.65% from 2024 to 2030 to reach USD 3.37 billion by 2030.

b. North America dominated the PET scanners market with a share of 34.11% in 2023. This is owing to the rapid technological developments in the medical imaging & diagnostic sector and the advanced healthcare infrastructure of the region.

b. Some key players operating in the PET scanners market include Siemens Healthineers; GE Healthcare; Koninklijke Phillips N.V.; Canon Medical Systems, USA.; Mediso Ltd.; Shimadzu Corporation; Neusoft Medical Systems Co., Ltd.; MinFound Medical Systems Co., Ltd; Perkin Elmer, Inc.; Positron Corporation; Yangzhou Kindsway Biotech Co. Ltd.

b. Key factors that are driving the market growth include technological advancements in PET imaging for advanced diagnostics applications and oncology and Rising Demand for PET analysis in radiopharmaceuticals are expected to drive the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.