- Home

- »

- Beauty & Personal Care

- »

-

Pet Skin & Coat Care Products Market, Industry Report, 2030GVR Report cover

![Pet Skin & Coat Care Products Market Size, Share & Trends Report]()

Pet Skin & Coat Care Products Market Size, Share & Trends Analysis Report By Pet Type (Dog, Cat, Others), By Product (Shampoo, Spray, Supplements, Conditioner), By Application, By Type, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-046-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

The global pet skin & coat care products market size was estimated at USD 4.91 billion in 2024 and is expected to grow at a CAGR of 10.3% from 2025 to 2030. The expansion of the middle-class demographic and the increasing prevalence of pet ownership among millennial households, which often feature smaller family units, are driving the growth of the pet population in emerging economies. Concurrently, there is a growing recognition of the positive health benefits associated with pet ownership, including enhanced cardiovascular health, reduced anxiety, and improved mental well-being, all of which contribute to the market's expansion. The COVID-19 pandemic also had a profound effect on the pet care industry; according to a Forbes Advisor survey, 78% of pet owners acquired pets during this period.

Pet ownership rates have surged, particularly in regions where disposable incomes and urbanization levels are high. The evolving role of pets as family members has led to a "pet parenting" trend, where pet owners are more conscious of the need to provide specialized care, including skin and coat maintenance. This has driven demand for products that address specific skin conditions, improve coat health, and enhance pets’ overall appearance and comfort.

According to the American Veterinary Medical Association (AVMA), the U.S. dog population has experienced consistent growth, increasing from 52.9 million in 1996 to a record high of 89.7 million in 2024. This growth has been steady, despite a temporary decline to 80.1 million in 2023 from 88.3 million in 2022. In contrast, the cat population has demonstrated greater stability, rising from 59.8 million in 1996 to 73.8 million in 2024, with a peak of 81.7 million cats recorded in 2006.

These trends in pet ownership significantly impact the market for pet care products and services. The robust increase in the dog population, coupled with a consistently high cat population, underscores a sustained demand for pet healthcare, grooming, and wellness products. The growing number of pet owners seeking to ensure the well-being of their animals is driving market expansion, particularly for premium products that cater to pet health and quality of life. The consistent presence of cats in American households further strengthens market demand, contributing to stable and predictable growth in the pet care sector.

Countries such as the U.S., Russia, China, and France are home to some of the largest populations of pet dogs and cats, as highlighted by Petsecure. In the U.S. alone, pet owners spend over USD 50 billion annually on dogs, reflecting the strong commitment to pet care. As pet owners become more health-conscious, they extend this focus on wellness to their pets, driving demand for health-promoting products, including those specifically designed for skin and coat care.

Brands within the pet skin and coat care market have responded to these trends by launching products that emphasize natural and organic ingredients. Such formulations, known for their soothing and healing properties, are particularly suitable for pets with sensitive skin. For instance, 4-Legger offers USDA-certified organic skin and coat care products that include hampoos and conditioners made with natural ingredients such as aloe vera, lemongrass, and rosemary. With rising disposable incomes, pet owners are increasingly willing to invest in premium products to support their pets’ health and well-being. Data from the 2021-2022 National Pet Owners survey indicates that U.S. pet expenditures reached USD 123.6 billion, marking a 19% rise from USD 103.6 billion in 2020. This trend has enabled the success of high-quality brands like Earthbath, which offers natural grooming products formulated with ingredients such as oatmeal, aloe vera, and tea tree oil, free from harsh chemicals and synthetic fragrances.

Sustainability has also become a central focus in the pet skin and coat care industry, as consumers grow more aware of the environmental footprint of grooming products. Companies like Kin+Kind are responding to this demand by offering natural, organic grooming products in eco-friendly packaging, with ingredients sourced from sustainable farms. Kin+Kind’s products are plant-based, veterinarian-formulated, cruelty-free, and meet USDA Organic and USDA Bio-Based standards, appealing to environmentally conscious consumers seeking sustainable pet care solutions.

Pet Type Insights

In 2024, dog-specific skin and coat care products led the market, capturing a revenue share of 59.10%. Dogs remain the most prevalent pet globally, with one in three households owning a dog, according to HealthforAnimals. Factors such as rising pet ownership rates, growing disposable incomes, the increasing trend of pet humanization, and heightened awareness of pet health are driving the demand for targeted skin and coat care products for dogs. Additionally, the diverse skin and coat needs across dog breeds necessitate specialized care, prompting pet owners to seek breed-specific formulations tailored to their pet’s unique requirements.

The product demand for cat owners is anticipated to grow at a CAGR of 11.0% from 2025 to 2030. The increasing cat ownership across the globe is fueling the demand for cat skin and coat care products. According to the National Pet Owners Survey (2021 - 2022) conducted by the American Pet Products Association (APPA), cats are the most popular pets after dogs, and more than 45.3 million households owned cats in the U.S. in 2022. This is expected to boost the demand for cat care products in the coming years.

Skin diseases such as scratch disease, bacterial infection of hair follicles, and Sporotrichosis can also be transmitted to humans. This has changed pet owners’ view of cat skin and coat care products and their benefits, resulting in frequent product purchases. For instance, the Skin + Coat for Cats supplement by PETZPARK containing zinc, vitamin E, biotin, and a combination of Eicosapentaenoic Acid (EPA) and Docosahexaenoic Acid (DHA) offers several benefits in terms of cats’ skin health, such as minimized allergies, enhanced coat shine, and reduced shedding. Continuing further, rising awareness regarding cat health and cleanliness coupled with rising household spending on animal products is expected to boost the demand for cat skin and coat care products. Cat skin and coat care product manufacturers operating in the market are launching targeted products to help maintain the health and integrity of epithelial tissues and maintain overall skin health.

Product Insights

The pet shampoo led the market in 2024 and captured a revenue share of 42.15% in 2024. Shampoos are favored by consumers for their essential role in pet grooming, versatility, wide availability, cost-effectiveness, ease of use, and broad product variety. As pet owners increasingly focus on their pets' hygiene and grooming needs, demand for high-quality pet shampoos is expected to remain robust. In August 2022, Pet Releaf introduced a new line of plant-based CBD shampoos and conditioners, formulated with organic chamomile, organic aloe vera, and USDA-certified full-spectrum hemp extract containing naturally occurring CBD, reflecting a shift towards natural and wellness-oriented ingredients.

The demand for pet sprays is projected to grow at a CAGR of 11.1% from 2025 to 2030. With rising consumer demand for effective tick and flea control, high-quality sprays have become popular as they help protect pets from lice, ticks, and fleas and are gentle on sensitive skin. This demand has driven growth in the market in recent years. Additionally, manufacturers are pursuing strategies such as new product launches, partnerships, and acquisitions to capture customer interest and expand market share. For example, Absorbine Pet Care launched SaniPet, a sanitizing spray for pets that has been clinically proven to eliminate 99.9% of germs on paws, skin, and coats, showcasing innovation in pet hygiene solutions.

Application Insights

The household demand captured a revenue share of 82.59% in 2024. The European Pet Food Federation’s 2021 report indicated that nearly 88 million European households owned a pet. Enhanced product packaging, labeling, content marketing, and in-store promotions have increased pet owners’ awareness of the range of skin and coat care products available. This growing awareness enables consumers to make informed, health-conscious decisions for their pets, using these products effectively at home. Moreover, greater knowledge about pet skin and coat health has empowered consumers to detect early signs of potential issues, facilitating timely intervention with the appropriate care products to prevent minor conditions from escalating.

The commercial demand is estimated to grow at a CAGR of 11.2% from 2025 to 2030. This segment encompasses applications within pet grooming businesses, boarding facilities, and veterinary clinics. For instance, pet boarding facilities employ these products to maintain pets’ hygiene and comfort during their stay, while grooming services incorporate them into their offerings to cleanse, condition, and moisturize pets’ skin and coats. These products are also utilized to address specific skin and coat issues, enhancing the quality and scope of professional pet care services.

Type Insights

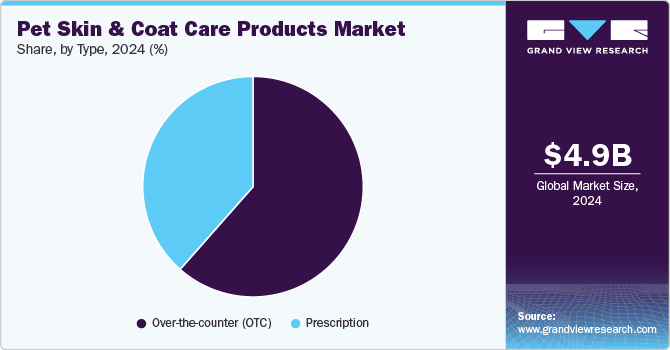

The OTC products accounted for a market share of 61.51% in 2024. Pet owners predominantly choose over-the-counter (OTC) products for their pets due to their affordability compared to prescription-based alternatives. OTC products also offer the advantage of in-store consultations, where knowledgeable sales representatives provide guidance and product recommendations. Notably, in December 2022, the UK-based plant-based pet care brand Hownd launched a selection of its pet shampoos and body mists in select Whole Foods Market stores across the U.S.

The demand for prescribed products is anticipated to rise at a CAGR of 10.7% from 2025 to 2030. According to a 2021 report from the American Pet Products Association, Americans spent nearly USD 34.3 billion on veterinary care and product sales. Prescribed skin and coat care products, recommended by veterinarians and other pet care professionals, offer tailored solutions for specific dermatological issues in pets. These professionals, leveraging their expertise in diagnosing and managing pet skin and coat health, can recommend targeted treatments that address individual care needs effectively.

Regional Insights

The pet skin & coat care products market in North America held a share of 34.73% of the global revenue in 2024. In North America, the market for pet skin and coat care products is expanding due to heightened awareness around pet wellness, driven by a shift in consumer focus toward preventative care. Rising cases of skin allergies and dermatological diseases, such as dermatitis, which can be exacerbated by environmental factors like seasonal allergens, have increased the demand for specialized skin care solutions. The presence of leading pet care brands and ongoing innovations in product formulations-ranging from natural and hypoallergenic ingredients to advanced therapeutics-are also fueling growth. Additionally, favorable regulations on pet product safety standards support high-quality product availability, encouraging consumer trust and adoption.

U.S. Pet Skin & Coat Care Products Market Trends

The pet skin & coat care products market in the U.S. is expected to grow at a CAGR of 8.6% from 2025 to 2030. In the U.S., the demand surge is further propelled by increasing rates of pet ownership, particularly among millennials and Gen Z, who prioritize their pets' health and view them as family members. Skin-related issues in pets, such as flea allergies, mange, and seborrhea, are frequently diagnosed in veterinary practices, creating a sustained need for effective treatment products. The American Pet Products Association’s reported spending on pet health underlines this trend, while supportive policies by organizations like the FDA for OTC pet care solutions are improving product accessibility. Furthermore, the growing availability of pet grooming services with an emphasis on skin and coat care has strengthened product demand.

Europe Pet Skin & Coat Care Products Market Trends

In Europe, stringent regulations governing the use of safe and environmentally friendly ingredients in pet care products are driving demand, especially for natural and organic options. Pet skin ailments, such as fungal infections and atopic dermatitis, are increasingly common due to regional climate variations and high humidity levels in some areas. The market is also influenced by rising pet ownership among urban populations in countries such as Germany, France, and the UK Pet care brands in Europe are responding to this demand by innovating with eco-friendly, vegan, and cruelty-free skin and coat care solutions, aligning with the region's environmental values and regulatory standards.

Asia Pacific Pet Skin & Coat Care Products Market Trends

The Asia Pacific region is experiencing rapid growth in the pet skin and coat care market, spurred by an upsurge in pet ownership, particularly in emerging markets like China and India, where disposable incomes are rising. Skin conditions such as parasitic infections and fungal dermatitis are prevalent in pets due to tropical climates in parts of the region, making skincare an essential aspect of pet wellness. Government regulations on pet health and hygiene are becoming stricter, especially in urbanized areas, promoting the development of safe and certified pet care products. Furthermore, an increasing number of pet grooming and veterinary services in countries like Japan and Australia provide professional skin and coat care, encouraging the adoption of specialized products for enhanced pet health.

Key Pet Skin & Coat Care Products Company Insights

The competitive landscape of the pet skin and coat care products market is characterized by intense competition, product innovation, and strategic partnerships among key players to capture market share in a rapidly growing segment. Leading companies, such as Zoetis, Bayer AG, Virbac, and Petco, are driving innovation in this space, focusing on dermatological advancements that address common issues like allergies, infections, and coat maintenance with targeted, science-backed formulations. These players are expanding their portfolios to include hypoallergenic, organic, and vegan options, aligning with consumer demand for natural ingredients and cruelty-free products.

The market is further diversified by smaller, specialized brands that offer niche solutions tailored to specific pet dermatological conditions or unique breed requirements, such as targeted solutions for dogs with dense undercoats or cats prone to dry skin. Additionally, product differentiation is often achieved through the inclusion of proprietary ingredients and exclusive formulations aimed at providing therapeutic benefits. The industry is also marked by a robust D2C model, where brands engage consumers through online channels and subscription-based services, offering convenience and fostering brand loyalty.

Key Pet Skin & Coat Care Products Companies:

The following are the leading companies in the pet skin & coat care products market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé Purina Petcare

- Virbac

- Groomer's Choice

- SynergyLabs

- Zesty Paws

- Petco Animal Supplies, Inc.

- Logic Product Group LLC

- Wahl Clipper Corporation

- Earthwhile Endeavors, Inc.

- Nutramax Laboratories, Inc.

Recent Developments

-

In October 2024, Groomer's Choice, a prominent manufacturer and supplier of pet grooming products, unveiled its new line of coat care products, Crown Coat. This innovative range combines high-quality cleansing ingredients with a specially formulated, fragrance-enhancing system designed to provide long-lasting scents. The initial launch featured a comprehensive selection, including an all-purpose shampoo and conditioner duo, a detangling shampoo, and a soothing shampoo, all accompanied by coordinating colognes. Crown Coat products, renowned for their enduring fragrances, became available on October 10, with the detangling shampoo set for release in December. The gallon-sized shampoo and conditioner were priced at $59.97, while the 8 oz. cologne sprays were offered at $16.97.

-

In February 2024, Dogtopia, a prominent leader in the dog wellness franchise sector, introduced its comprehensive Dogtopia Spa product line, now accessible to pet owners through DogtopiaShop.com, with the added benefit of complimentary shipping. Developed with a focus on canine health and comfort, the product line encompassed 12 new offerings designed to address various aspects of dog care. Key products included an array of conditioners, deodorizing sprays, and shampoos, each carefully formulated to meet the highest standards of canine wellness. Notably, all Dogtopia Spa products were water-based, hypoallergenic, and alcohol-free, ensuring safety for all dog coats and skin types, including those with sensitive skin.

Pet Skin & Coat Care Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.37 billion

Revenue forecast in 2030

USD 8.76 billion

Growth rate

CAGR of 10.3% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet type, product, application, type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Nestlé Purina Petcare; Virbac; Groomer's Choice; SynergyLabs; Zesty Paws; Petco Animal Supplies, Inc.; Logic Product Group LLC; Wahl Clipper Corporation; Earthwhile Endeavors, Inc.; Nutramax Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Skin & Coat Care Products Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet skin & coat care products market report based on pet type, product, application, type, and region:

-

Pet Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dog

-

Cat

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Spray

-

Supplements

-

Shampoo

-

Conditioner

- Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Household

-

Commercial

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Prescription

-

Over-the-Counter (OTC)

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Australia & New Zealand

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pet skin and coat care products market was estimated at USD 4.91 billion in 2024 and is expected to reach USD 5.37 billion in 2025.

b. The global pet skin and coat care products market is expected to grow at a compound annual growth rate of 10.3% from 2025 to 2030, reaching USD 8.76 billion by 2030.

b. The North American region dominated the pet skin and coat care products market, with a share of around 34.73% in 2024. This is owing to the region's increasing pet ownership and the pet-friendly culture that persuades pet owners to spend on pet health and wellness products.

b. Some key players operating in the pet skin and coat care products market include Nestlé Purina Petcare, Virbac, Groomer's Choice, SynergyLabs, Zesty Paws, Petco Animal Supplies, Inc.; Logic Product Group LLC; Wahl Clipper Corporation; Earthwhile Endeavors, Inc.; Nutramax Laboratories, Inc.

b. Key factors that are driving the pet skin & coat care products market growth include the humanization of pets, growing awareness about the benefits of having a pet, new product launches in the category, and rising disposable incomes.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."