- Home

- »

- Homecare & Decor

- »

-

Pet Shampoo Market Size, Share And Growth Report, 2030GVR Report cover

![Pet Shampoo Market Size, Share & Trends Report]()

Pet Shampoo Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal (Dog, Cat), By Application (Household, Commercial), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-181-8

- Number of Report Pages: 88

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Shampoo Market Summary

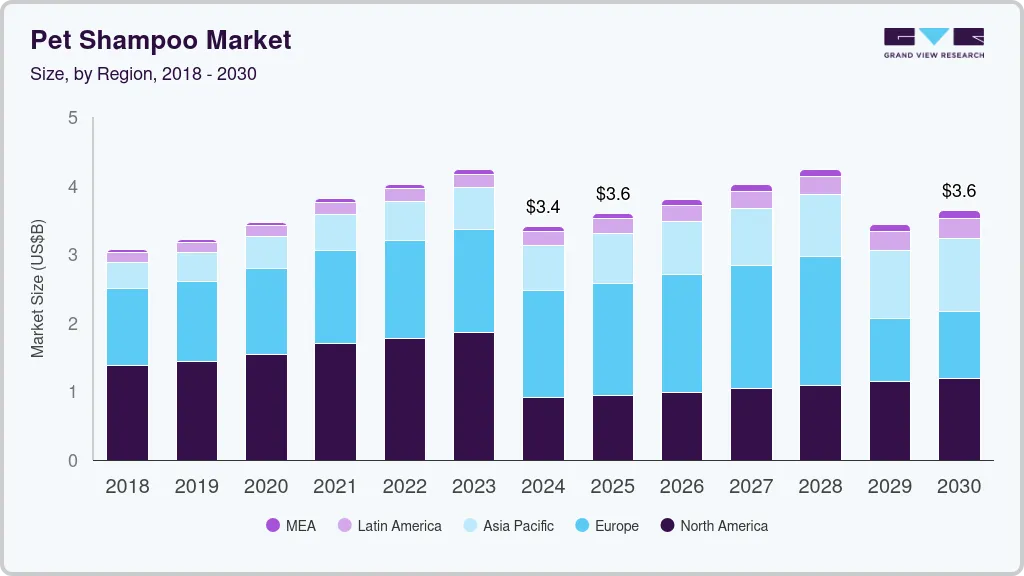

The global pet shampoo market size was estimated at USD 3.40 billion in 2024 and is expected to grow at a CAGR of 1.1% from 2025 to 2030. The market growth is primarily driven by the increasing pet population and the awareness among pet owners regarding the importance of maintaining proper pet hygiene.

Key Market Trends & Insights

- North America dominated the global pet shampoo market with the largest revenue share of 44% in 2023.

- The pet shampoo market in the U.S. led the North America market and held the largest revenue share in 2023.

- By animal, the orthopedic surgery segment led the market, holding the largest revenue share of 52% in 2023.

- By distribution channel, the offline channels segment held the dominant position in the market in 2024.

- By application, the household segment is expected to grow at the fastest CAGR of 6.4% from 2024 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 3.40 Billion

- 2030 Projected Market Size: USD 3.63 Billion

- CAGR (2025-2030): 1.1%

- North America: Largest market in 2023

According to a March 2023 report released by the American Pet Products Association (APPA), 86.9 billion households in America, which is about 66% of all households, own a pet.

The number of households adopting pets has increased in recent years. This is especially true among nuclear families, couples without children, and those living alone. Pets are known to reduce loneliness and provide companionship, especially during times of depression. They can also encourage healthy habits such as walking, and dogs offer security benefits. According to the March 2023 report released by the American Pet Products Association (APPA), the most popular pets in the U.S. are dogs, with 65.1 Billion households owning a dog. Cats come in second with 46.5 Billion households.

Due to changing lifestyles and increased disposable income, consumers are more willing to buy animal healthcare products to maintain their pets' health and hygiene. These products come in various forms, such as hair-smoothing shampoos and shampoos with a balanced pH formula. Pet owners are becoming increasingly aware of the benefits of regular grooming, which includes keeping their pets clean and improving their overall health and well-being.

There is an increasing demand for organic and natural pet shampoo products. Pet owners are becoming more conscious of their pets’ health and looking for safe and natural products, leading to an increased demand for organic and natural pet shampoos free from harsh chemicals and artificial fragrances. Pet owners seeking natural and organic alternatives to the harsh ingredients in grooming products present a unique opportunity for businesses to differentiate themselves by offering high-quality, all-natural pet shampoos.

Manufacturers are also developing eco-friendly and non-toxic shampoos that cater to specific pet needs, such as sensitive skin, allergies, fleas and tick prevention, and deodorizing. This is primarily because pet owners are increasingly recognizing the importance of maintaining their pets’ coat and skin health, leading to a surge in demand for specialized pet shampoos. In August 2023, Beaphar, a Dutch manufacturer of care products, food, and medicines for all types of pets, launched a new range of pet shampoos that are pH-neutral, paraben-free, and vegan-friendly. Each shampoo contains aloe vera and an additional ingredient to enhance skin and coat health.

The boom of e-commerce has also opened up new opportunities for pet shampoo manufacturers. Rising e-commerce has made it easier for pet owners to access a wide range of pet grooming products, including shampoos. Online retailers offer various pet shampoos at competitive prices, providing convenience and accessibility to pet owners.

Market Concentration & Characteristics

The degree of innovation in the market is notable, with manufacturers continuously introducing new formulations, ingredients, and packaging designs to meet the evolving needs and preferences of pet owners. Innovations range from specialized shampoos targeting specific pet skin and coat conditions, such as allergies or dryness, to eco-friendly and natural formulations free of harsh chemicals. Additionally, advancements in packaging, such as easy-to-dispense bottles and eco-conscious materials, reflect a growing emphasis on convenience and sustainability. These innovations not only enhance the efficacy and safety of pet shampoos but also contribute to the overall growth and dynamism of the pet care industry.

Regulations in the pet shampoo market have a significant impact on product safety, quality standards, and labeling requirements. Compliance with regulations ensures that pet shampoos meet stringent safety standards, protecting the health and well-being of pets. Additionally, regulations may dictate the use of certain ingredients or specify labeling requirements to provide consumers with accurate information about the product's composition, usage instructions, and potential risks.

End-user concentration in the market tends to be widespread, reflecting the diverse demographic of pet owners worldwide. Pet shampoo is a product utilized by a vast range of consumers, including owners of dogs, cats, and other companion animals across various breeds, sizes, and ages. Additionally, pet shampoo is used for different purposes such as routine grooming, treating skin conditions, and addressing specific coat types or sensitivities, further broadening its appeal among pet owners. With a large and diverse customer base, pet shampoo manufacturers must cater to various preferences, needs, and concerns, ensuring a competitive market landscape with a multitude of product options to meet the demands of pet owners.

Animal Insights

The dog segment accounted for a revenue share of around 52% in 2023. Shampoo plays a vital role in killing fleas and ticks that can impact the health of dogs with diseases such as Lyme disease, canine bartonellosis, and others. Pet shampoo specifically formulated for dogs helps address common concerns such as odor control, itch relief, and coat conditioning, catering to the specific needs of different breeds and skin types. Moreover, the growing pet ownership is further anticipated to contribute to the segment’s growth as pet owners are becoming significantly willing to spend on their dog’s health and wellness.

The cat segment is projected to grow at a CAGR of 5.2% over the forecast period. The increasing availability of shampoos specially formulated for cats and the increasing acceptance of cats as companion animals is favoring the market growth. Cats are increasingly becoming popular as companion animals, contributing to the rise in cat ownership. For instance, according to the RSPCA Australia, there were approximately 28.7 Billion pets in 2022, of which cats (33%) accounted for the second highest pet population after dogs (48%).

Distribution Channel Insights

The sales of pet shampoo through offline channels accounted for a revenue share of around 66% in 2023. Pet owners often prefer to physically browse and select products in-store, where they can inspect the packaging, read ingredient labels, and receive personalized recommendations from store staff, fostering a sense of trust and confidence in their purchase. Offline channels offer the convenience of immediate gratification, allowing pet owners to quickly purchase shampoo while shopping for other pet supplies or running errands, without the need to wait for shipping or delivery. Moreover, several pet shops employ staff based on their knowledge about the products, which helps the customers choose the shampoo suitable for their pet among the available alternatives, likely favoring the growth of the segment.

The sales of pet shampoo through online channel is projected to grow at a CAGR of 6.6% from 2024 to 2030. Online platforms offer pet owners the convenience of shopping from the comfort of their homes, with 24/7 accessibility and the option to compare prices and read reviews before making a purchase. Additionally, the availability of specialized pet care products and the ability to cater to specific pet needs, such as sensitive skin or allergies, contribute to the popularity of online channels for pet shampoo sales. In January 2024, The Wires launched its B2B2C platform PawWire at the 2024 Consumer Electronics Show Showstoppers media event in Las Vegas, U.S. This platform offers a range of pet products such as toys, training, grooming, and other products, including shampoos.

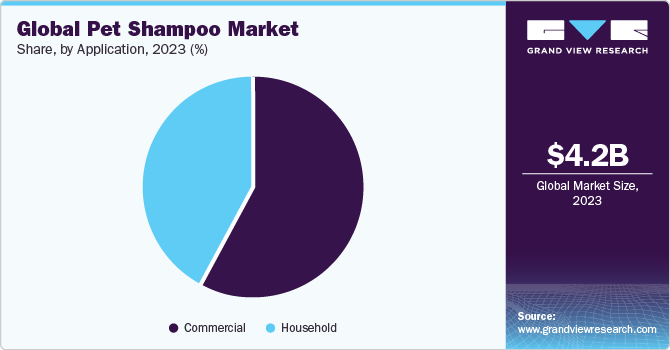

Application Insights

The commercial segment accounted for a revenue share of around 57% in 2023. The increasing spending on pet grooming is generating opportunities for several businesses associated with pet grooming, such as pet stores and pet care & wellness centers globally. Several developed and developing countries worldwide are witnessing the rise of pet care centers, which are one of the major contributors to the segment growth.

The household segment is estimated to grow at a CAGR of 6.4% from 2024 to 2030. The adoption of pet shampoo for household application is driven by the increasing awareness of pet hygiene and health among pet owners, who prioritize keeping their furry companions clean and comfortable within the home environment. Additionally, the desire to minimize pet-related odors, reduce allergens, and maintain a clean living space for both pets and their owners further incentivizes the use of pet shampoo as a convenient and effective solution for regular grooming and hygiene routines.

Regional Insights

The pet shampoo market in North America held 44% of the global revenue in 2023. The popularity of pet grooming services has led to an increased demand for high-quality and specialized pet shampoos in North America. Many grooming salons and veterinary clinics offer medicated shampoos for pets with skin allergies or irritations and are formulated explicitly for certain breeds or coat types. This has created a growing market for pet shampoos designed to meet the unique needs of different pets.

U.S. Pet Shampoo Market Trends

The pet shampoo market in the U.S. is expected to grow at a CAGR of 5.0% from 2024 to 2030. The U.S. market for pet shampoo has witnessed a growing preference for online retail and e-commerce channels due to their convenience, product selection, competitive pricing, and access to product information.

Asia Pacific Pet Shampoo Market Trends

Asia Pacific pet shampoo market is projected to grow at a CAGR of 8.1% from 2024 to 2030. The trend of organic and natural products has also reached the pet care industry. Many pet owners in the region are now looking for pet shampoos that are made from natural and organic ingredients, free from harsh chemicals and artificial fragrances. For instance, the Himalaya Erina-EP Shampoo by Himalaya Wellness Company is gaining popularity in India. This shampoo is specifically formulated for dogs and contains natural ingredients such as neem and eucalyptus, which help in maintaining a healthy coat and skin for cats, dogs, and other pet animals.

Key Pet Shampoo Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key Pet Shampoo Companies:

The following are the leading companies in the pet shampoo market. These companies collectively hold the largest market share and dictate industry trends.

- GroomersChoice.com

- SynergyLabs

- Compana (Vet’s Best)

- Himalaya Wellness Company

- Petco Animal Supplies, Inc.

- LOGIC PRODUCT GROUP LLC

- Wahl Clipper Corporation

- 4-Legger

- Earthwhile Endeavors, Inc.

- WildWash

Recent Developments

-

In June 2023, Earthwhile Endeavors, Inc. announced the launch of a Shea Butter Shampoo. This shampoo is specially formulated for dander care and moisture repair in cats and dogs of all breeds, especially those with sensitive, allergy-prone, and dry skin.

-

In April 2023, Petco Animal Supplies, Inc. announced the launch of Clean Grooming initiatives, which include clean grooming and services for pets across the 1,350 Petco care centers, the company’s website, and the app. The primary products used in grooming services include shampoos, balms, and conditioners.

Pet Shampoo Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.59 billion

Revenue forecast in 2030

USD 3.63 billion

Growth rate

CAGR of 1.1% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

GroomersChoice.com; SynergyLabs; Compana (Vet’s Best); Himalaya Wellness Company; Petco Animal Supplies, Inc.; LOGIC PRODUCT GROUP LLC; Wahl Clipper Corporation; 4-Legger; Earthwhile Endeavors, Inc.; WildWash

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Shampoo Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet shampoo market report based on animal, application, distribution channel, and region:

-

Animal Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dog

-

Cat

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Household

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pet shampoo market was estimated at USD 4.23 billion in 2023 and is expected to reach USD 4.46 billion in 2024.

b. The global pet shampoo market is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 6.22 billion by 2030.

b. North America dominated the pet shampoo market with a share of around 44.0% in 2023. The popularity of pet grooming services has led to an increased demand for high-quality and specialized pet shampoos in North America.

b. Some of the key players operating in the pet shampoo market include GroomersChoice.com; SynergyLabs; Compana (Vet’s Best); Himalaya Wellness Company; Petco Animal Supplies, Inc.; LOGIC PRODUCT GROUP LLC; Wahl Clipper Corporation; 4-Legger; Earthwhile Endeavors, Inc.; WildWash.

b. Key factors that are driving the pet shampoo market growth include rising pet adoption worldwide, rising awareness of pet health & hygiene, growing trend of humanization of pets, and increased spending on pet care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.