- Home

- »

- Consumer F&B

- »

-

Pet Snacks And Treats Market Size & Share Report, 2030GVR Report cover

![Pet Snacks And Treats Market Size, Share & Trends Report]()

Pet Snacks And Treats Market Size, Share & Trends Analysis Report By Product (Eatable, Chewable), By Pet Type (Dogs, Cats), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-948-1

- Number of Report Pages: 118

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Pet Snacks And Treats Market Size & Trends

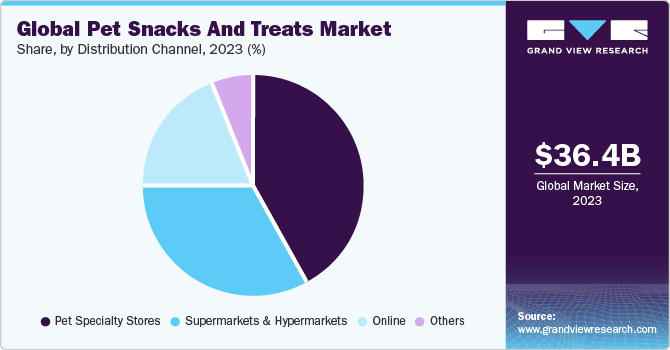

The global pet snacks and treats market size was estimated at USD 36.38 billion in 2023 and is projected to grow at a CAGR of 11.8% from 2024 to 2030.The high pet adoption rate over the years and the growing tendency to consider pets an integral part of the family have propelled the demand for natural, nutritious, tasty, and healthy pet snacks & treats essential for the overall growth and well-being of companion animals. Pet owners are willing to pay a premium for high-quality, gourmet, and specialty snacks and treats that offer unique flavors, textures, and formulations.

The market growth is especially visible in countries where the middle-income group is expanding, such as China and South Korea. This can also be attributed to changing attitudes when it comes to pets and a new pet culture centered on the increased humanization of pets and a rise in the number of pets kept just for companionship.

According to the American Pet Products Association (APPA), a total of USD 136.8 billion was spent on pets in the U.S. in 2022; the majority sales breakdown for the spending is as follows: pet food & treats (USD 58.1 billion); supplies, live animals, and OTC medicines (USD 31.5 billion); vet care and product sales (USD 35.9 billion); and other services such as boarding, grooming, insurance, training, pet sitting, and walking (USD 11.4 billion).

Overall, increased spending on pet care, especially pet food, reflects changing consumer attitudes towards pets and a greater emphasis on their health, happiness, and overall well-being. As a result, the market is experiencing steady growth, with opportunities for innovation, expansion, and market penetration.

With consumer buying habits and trends in the pet food industry constantly evolving, manufacturers are constantly enhancing their product offerings. Major players are focusing on key countries, which present strong opportunities for sales growth and the development of pet snacks & treats.

Product innovations in terms of clean-label ingredients, sustainable and eco-friendly packaging, health benefits, and longer shelf-stable life are also expected to provide lucrative opportunities for manufacturers. Players have been realizing the immense potential these new pet snacks & treats have and are focusing on creating similar options.

The most common dietary preferences of pet owners suggest a movement toward moderation and higher-quality ingredients. Consumers in the global market seek pet snacks and treats that are organic, natural, sugar-free, low-calorie, low-carb and contain plant-based ingredients. Furthermore, there is a growing demand for premium pet food and increasing interest in natural pet snacks & treats with limited ingredients and health claims such as grain-free.

Market Concentration & Characteristics

Technology integration has become a key focus area for many players in the global market. This includes the incorporation of smart packaging solutions, data analytics, and personalized nutrition offerings. Brands are leveraging these technological advancements to enhance the overall pet ownership experience, providing pet parents with insights into their pets' health, behavior, and dietary needs. Such innovations not only contribute to customer loyalty but also drive market growth.

The rising importance of sustainability in consumer decision-making has spurred initiatives within the pet snacks and treats industry to adopt eco-friendly practices. Companies are exploring alternative and renewable ingredients, as well as eco-conscious packaging solutions to align with the environmentally conscious preferences of pet owners. This commitment to sustainability is not only a response to market trends but also reflects a broader societal shift towards responsible and ethical business practices.

In recent years, market has witnessed a surge in innovations and merger and acquisition (M&A) activities as companies seek to capitalize on the growing demand for premium and functional pet food products. These developments are driven by evolving consumer preferences, increased awareness of pet health and wellness, and a desire for convenient and nutritious options for furry companions.

One notable trend in the pet snacks sector is the emphasis on natural and organic ingredients. Pet owners are increasingly looking for products for pets’ dietary choices, leading to a rise in the availability of treats made from high-quality, human-grade ingredients. Companies are investing in research and development to create innovative formulations that not only cater to the taste preferences of pets but also address specific health concerns such as allergies, digestive issues, and weight management.

Product Insights

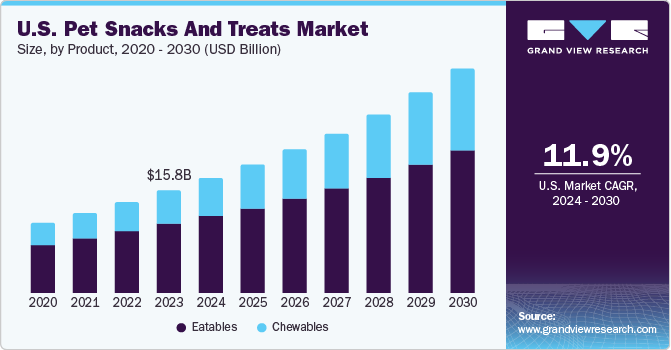

The eatable segment led the market with a revenue share of 67.41% in 2023 and is projected to grow at the fastest CAGR during the forecast period. Increasing awareness regarding pet food and treats that offer functional benefits, such as supporting joint, skin, and coat health, is driving the demand for eatable pet snacks & treats. Major industry players are actively introducing a diverse range of products to meet this growing consumer demand. For instance, in May 2022, Wellness Pet Company launched Good Dog by Wellness, a brand that offers treats crafted with high-quality, natural ingredients. The treats, which offer functional benefits and encourage positive behavior in dogs, come in three types: Happy Puppy, Training Rewards, and Tender Toppers.

The chewable segment is expected to grow at a fastest CAGR of 13.5% over the forecast period. There are growing concerns among dog caregivers regarding undigested food due to loss or broken teeth, particularly prevalent in ageing dogs. This has driven the demand for chewable treats and snacks for pets. Based on findings by the British Small Animal Veterinary Association in 2020, primary-care veterinary practices primarily rely on visual oral assessments of conscious dogs for diagnosing periodontal disease. These practices report an average prevalence of periodontal disease ranging from 9.3% to 18.2% within the dog population.

Pet Type Insights

Based on pet type, the dogs segment led the market with the largest revenue share of 67.15% in 2023. The increasing adoption of pet companions, such as dogs, is anticipated to present favorable opportunities for key players in the market over the forecast period. As per the findings of the 2023-2024 APPA National Pet Owners Survey, approximately 66% of households in the U.S., totaling 86.9 million households, are pet owners. Among these households, approximately 65.1 million own at least one dog.

The cats segment is expected to grow at the fastest CAGR of 13.0% from 2024 to 2030. The pet humanization trend has led to an increased focus on the health and well-being of cats. Many cat owners seek snacks and treats made with high-quality, natural ingredients that offer nutritional benefits and support their cat's overall health. Market players are capitalizing on the rising awareness about the health of pet animals, including cats, and are launching new snacks and treats to support the rising demand.

Distribution Channel Insights

Based on distribution channel, the specialty pet stores segment led the market with the largest revenue share of 42.21% in 2023. Growing initiatives by specialty pet stores, such as partnerships with prominent manufacturers of pet snacks and treats, are likely to boost segment growth and give players a competitive advantage. In September 2023, Pet Supermarket, a prominent specialty retailer of pet supplies with over 225 stores in the Southeast U.S., announced its new partnership with Fromm Family Foods. This collaboration highlighted Pet Supermarket's dedication to improving pet health and well-being by introducing Fromm Family Foods’ dry and wet treats and complete-and-balanced foods to its stores and online platform.

The online sales channel segment is expected to grow at the fastest CAGR of 13.1% from 2024 to 2030. E-commerce has significantly altered consumer shopping behavior, offering several advantages, such as doorstep delivery, attractive discounts, and the convenience of finding various items on a single platform. Moreover, the availability of a diverse array of pet snacks and treats and growing customer loyalty facilitated by 'Subscribe & Save' programs are anticipated to strengthen the online channel. Chewy, an online retailer specializing in pet snacks and treats, boasts a selection of over 2,000 pet brands and offers round-the-clock customer service.

Regional Insights

North America dominated the pet snacks and treats market with a revenue share of over 52.52% in 2023. The ascendance of e-commerce, coupled with a notable rise in pet ownership among high-revenue households in North America, has paved the way for innovations in pet snacks and treats. Developments in the market underscore the continuation and affirmation of prevailing trends within the pet care industry. Notably, there is an emphasis on premiumization, wherein pet owners increasingly seek and invest in high-quality, premium products for their furry companions. Simultaneously, a growing demand for preventive care solutions is evident, indicating a proactive approach among pet owners to address their pets' health and well-being.

U.S. Pet Snacks And Treats Market Trends

The pet snacks and treats market in the U.S. is expected to grow at a CAGR of 11.9% from 2024 to 2030. According to data provided by Forbes, in 2023, a substantial 66% of households in the U.S., totaling 86.9 million homes, had pets. Dogs were the most favored, with 65.1 million U.S. households having a canine companion. Cats claimed the second spot with 46.5 million households, while 11.1 million households had freshwater fish. When it comes to the demographics of pet ownership, millennials constitute the largest percentage at 33%. The Gen X generation follows closely at 25%, while baby boomers make up 24% of the pet owners in the country.

Asia Pacific Pet Snacks And Treats Market Trends

The pet snacks and treats market in Asia Pacific is expected to witness a CAGR of 12.7% from 2024 to 2030. This surge in pet ownership has resulted in the substantial growth of the pet snacks and treats market in Asia Pacific, supported by changing consumer lifestyles and a growing emphasis on pet health and wellness. As pet ownership becomes more prevalent across countries in Asia Pacific, pet owners are increasingly seeking specialized and premium snacks and treats for their companion animals. Asia Pacific is home to the largest population of pet dogs and cats globally. According to a 2022 article by the Pet Food Industry, nearly 300 million pet dogs and cats reside in households across Asia Pacific, surpassing the number in North America by approximately 100 million. This pet population has exhibited significant growth, experiencing an impressive compound annual growth rate of 11.8% from 2016 to 2021.

Europe Pet Snacks And Treats Market Trends

The pet snacks and treats market in Europe is expected to witness a CAGR of 11.4% from 2024 to 2030. The surge in pet snack and treat sales in Europe can be attributed to the increasing pet population across the continent. In 2022, the European Pet Food Industry Federation reported a significant presence of pets in European households, reaching a total of 91 million, which is approximately 46% of all households. Among the various pets, cats emerged as the most favored, with a population of 127 million and a presence in 26% of households. Following closely, dogs secured the second position, residing in around 25% of European households and boasting a population of 104 million. This data underscores the substantial impact of pets on European households, highlighting the need for high-quality and diverse pet food options to cater to the preferences and nutritional requirements of this growing and diverse pet population

Key Pet Snacks And Treats Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Companies consistently innovate, integrating the latest trends and insights into their product development process to stay ahead in a competitive market. Strategic collaborations and acquisitions have further enriched their product offerings, ensuring a diverse and appealing portfolio.

-

Colgate-Palmolive Company is a multinational consumer goods corporation. While its primary focus lies in oral and personal care products, the company has diversified its portfolio to include the pet care sector. Its subsidiary, Hill's Pet Nutrition, is a key player in this domain, specializing in premium pet food. Hill's Pet Nutrition is renowned for offerings like Hill's Science Diet and Hill's Prescription Diet, which address the specific nutritional requirements of both dogs and cats. With a global footprint, Colgate-Palmolive's products are widely distributed across North America, Latin America, Europe, Asia, and Africa, solidifying its reputation as a trusted and recognized brand in diverse markets

-

Nestlé's offerings under pet care include a variety of pet snacks and foods under brands such as Purina, which is one of the largest pet care companies in the world. Within the pet snacks category, Nestlé offers treats tailored for dogs, cats, and other small animals, providing options for pet owners seeking both nutrition and indulgence for their beloved companions. Nestlé operates in over 180 countries around the globe. Its products are readily available in diverse markets, making it a household name in many regions

Key Pet Snacks And Treats Companies:

The following are the leading companies in the pet snacks and treats market. These companies collectively hold the largest market share and dictate industry trends.

- Mars, Incorporated

- Nestlé S.A.

- The J.M. Smucker Company

- General Mills Inc.

- Colgate Palmolive Company

- Off-Leash Pet Treats

- Wellness Pet, LLC

- Merrick Pet Care

- Spectrum Brands, Inc.

- VAFO Group a.s.

Recent Developments

-

In February 2024, VAFO Group, a European producer of super premium pet foods, acquired Finnish company Dagsmark Pet food, making VAFO the leading player in the Nordic pet food market. Dagsmark specializes in wet pet food production and will complement VAFO's product range in Finland. The acquisition allows for expansion into other Nordic markets and provides resources for further development. The Finnish company's products will continue unchanged, utilizing local ingredients and aligning with VAFO's sustainability strategy

-

In August 2023, Spectrum Brands, Inc. introduced Meowee! cat treats. Exclusively accessible at Chewy.com, Meowee! Products aim to enhance treat time for both cats and pet owners, offering a diverse range of textures and delightful flavors. Crafted by veterinarians, Meowee! treats prioritize natural ingredients and are devoid of artificial colors, flavors, or animal by-products

-

In August 2022, In a strategic move to support the expansion of its Hill's Pet Nutrition business, Colgate-Palmolive Company agreed to acquire three pet food manufacturing plants from Red Collar Pet Foods. The acquisition, valued at USD 700 million, is aimed at fortifying Colgate-Palmolive's commitment to the global growth of its pet food business under Hill's Pet Nutrition

Pet Snacks And Treats Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 40.52 billion

Revenue forecast in 2030

USD 79.23 billion

Growth rate

CAGR of 11.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

April 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, pet type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; South Korea; Australia & New Zealand; India; Brazil; South Africa

Key companies profiled

Mars, Incorporated; Nestlé S.A.; The J.M. Smucker Company; General Mills Inc.; Colgate Palmolive Company; Off-Leash Pet Treats; Wellness Pet, LLC; Merrick Pet Care; Spectrum Brands, Inc.; VAFO Group a.s.

Customization scope

Free Report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Pet Snacks And Treats Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet snacks and treats market report based on product, pet product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Eatable

-

Chewable

-

-

Pet Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Pet Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

Australia & New Zealand

-

South Korea

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pet snacks and treats market size was estimated at USD 36.38 billion in 2023 and is expected to reach USD 40.52 billion in 2024.

b. The global pet snacks and treats market is expected to grow at a compounded growth rate of 11.8% from 2024 to 2030 to reach USD 79.23 billion by 2030.

b. In 2023, North America captured a revenue share of over 52.5% in the pet snacks and treats market. North America market is witnessing an inclination toward natural and clean-label diets for pets. This trend aligns with the broader consumer movement of healthier and more transparent nutritional choices, reflecting a desire among pet owners to provide their animals with nutritionally superior and wholesome options.

b. Some key players operating in the market include Mars, Incorporated; Nestlé S.A.; The J.M. Smucker Company; General Mills Inc.; Colgate Palmolive Company; Off-Leash Pet Treats; Wellness Pet, LLC; Merrick Pet Care; Spectrum Brands, Inc.; VAFO Group a.s.

b. The high pet adoption rate over the years and the growing tendency to consider pets an integral part of the family have propelled the demand for natural, nutritious, tasty, and healthy pet snacks & treats essential for the overall growth and well-being of companion animals

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."