- Home

- »

- Animal Health

- »

-

Pet Travel Services Market Size, Industry Report, 2030GVR Report cover

![Pet Travel Services Market Size, Share & Trends Report]()

Pet Travel Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Travel Type (Domestic, International), By Application (Transportation, Relocation), By Pet Type (Dog, Cat, Others), By Booking, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-029-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Travel Services Market Summary

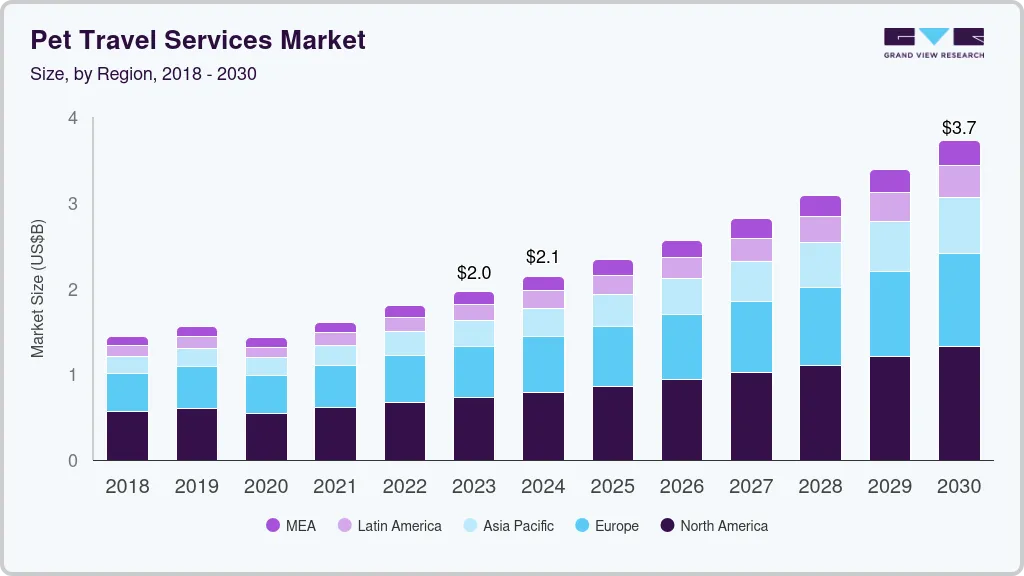

The global pet travel services market size was valued at USD 2.4 billion in 2024 and is projected to reach USD 3.9 billion by 2030, growing at a CAGR of 8.9% from 2025 to 2030. Market growth is propelled by factors such as increasing pet adoption & humanization, a rising number of tourists traveling along with their companion animals, pet-friendly traveling services & hotels, and increased enthusiasm among people for traveling after the pandemic lockdowns.

Key Market Trends & Insights

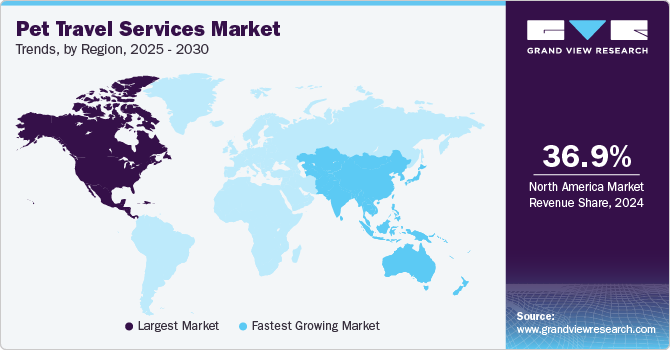

- North America pet travel services market dominated the market with the largest revenue share of 36.9% in 2024.

- The U.S. pet travel services market held the largest share in 2024.

- Based on travel type, the domestic travel segment dominated the market with the largest revenue share of 77.2% in 2024.

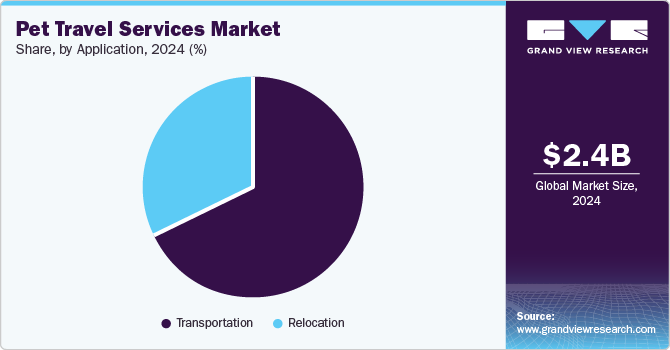

- Based on application, the transportation segment held the largest revenue share in 2024.

- Based on pet type, the dogs segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.4 billion

- 2030 Projected Market Size: USD 3.9 billion

- CAGR (2025-2030): 8.9%

- Asia Pacific: Fastest growing market in 2024

- North America: Largest market in 2024

For instance, in 2021, Condor Ferries, a passenger & freight ferry service operator in the UK, reported that over 53% of global pet owners take their furry animals for holiday travels, and pets now accompany 37% of families for a complete family trip. This rate has significantly increased by 19% in the last decade.

Increased rate of pet adoption and advancements in pet travel infrastructure are anticipated to impel growth of the pet travel services industry. As more people adopt pets, the demand for pet-friendly travel services rises. Improvements in infrastructure, such as pet-friendly accommodations, transportation, and travel amenities, make it easier for pet owners to travel with their animals. In addition, innovations in pet care, including specialized travel packages, pet passports, and airline services, further enhance convenience and safety, encouraging more pet owners to travel with their pets, thereby fueling market expansion.

Rising trend of pet luxury services, such as exclusive travel experience, private transportation, and high-end pet accommodations, drives demand for premium pet travel options. Pets are increasingly regarded as family members, prompting owners to invest in their comfort and well-being during travel. Besides, advancements in veterinary medicine have enhanced pet health, resulting in longer lifespans and more travel opportunities. Healthier pets require specialized care during travel, driving the need for services that cater to their unique needs, further contributing to the growth of the pet travel services market.

Travel Type Insights

The domestic travel segment dominated the market with the largest revenue share of 77.2% in 2024, due to its convenience and affordability. Many pet owners prefer traveling within their own country, as it eliminates the complexities of international travel, such as expensive vaccinations, quarantine regulations, and longer travel times. With an increasing number of pet-friendly accommodations, transportation options, and attractions, domestic travel offers a stress-free and accessible option for pet owners. Furthermore, growing awareness and availability of pet services across domestic destinations contribute to the dominance of this segment in the market.

The international travel segment is anticipated to emerge as the fastest-growing segment with a CAGR of 9.5% from 2025 to 2030, owing to increasing globalization and a rise in international pet-friendly destinations. As people seek to travel abroad with their pets, advancements in pet travel logistics, including smoother border regulations, pet passports, and airlines offering specialized services, make international travel more feasible. Moreover, the growing trend of pet inclusion in vacations, along with expanding awareness of international pet care services, drives the demand for seamless, stress-free international travel experiences for pets and their owners.

Application Insights

The transportation segment held the largest revenue share in 2024, attributed to its essential role in ensuring pets can travel safely and comfortably. As pet ownership increases, so does the need for reliable and efficient transportation options. Pet-friendly airlines, trains, and road travel services have become more widespread, offering specialized accommodations such as pet carriers, seats, and on-board care. These services address the growing demand for safe travel, making transportation the dominant segment in the pet travel services industry, especially for long-distance and international trips. In February 2025, BluSmart launched "Pet Rides" in Delhi and Gurugram, offering a pet-friendly electric ride-hailing service. The new service allows customers to pre-book reliable, pet-friendly transportation for both classic and rental trips.

The relocation segment is projected to grow at the fastest CAGR during the forecast period, fueled by an increasing number of people relocating internationally and domestically with their pets. As more pet owners view their pets as family members, the demand for seamless relocation services grows. These services include specialized solutions such as pet passports, vaccinations, and customs handling, ensuring a safe and smooth transition. The growing trend of remote work and global mobility further fuels the need for efficient and reliable pet relocation services, making it a highly promising market segment. In October 2024, Starwood Pet Travel launched its innovative Pet Travel Portal, a user-friendly online platform designed to simplify pet relocation. Offering a comprehensive solution, it helps pet owners manage every aspect of their pet’s journey, ensuring a smooth transition worldwide.

Pet Type Insights

The dogs segment accounted for the largest revenue share in 2024, which can be attributed to dogs being the most owned pets worldwide. Dogs are frequently included in family trips and vacations, driving the demand for specialized travel services, including dog-friendly accommodation, transportation, and pet care options. The growing trend of treating dogs as family members, coupled with advancements in pet travel infrastructure, has strengthened the dog segment's dominance in the market.

The cat segment is expected to emerge as the fastest-growing segment from 2025 to 2030, propelled by the increasing number of cat owners seeking to travel with their pets. Cats are often considered more independent, but their owners are increasingly looking for services that cater to their needs, such as specialized carriers, accommodations, and transportation options. With growing awareness of cat welfare during travel, the demand for tailored services, including stress-free travel solutions and pet care during transit, is expected to grow, driving the segment.

Booking Insights

The online & phone bookings segment recorded the largest market share in 2024 due to the convenience and accessibility it offers to pet owners. With the rise of digital platforms, customers can easily research, compare, and book pet travel services from the comfort of their homes. Online and phone bookings provide instant confirmation, customer support, and a seamless booking experience, allowing pet owners to manage travel plans efficiently. As digital adoption continues to grow, this segment is projected to maintain its dominant position in the market.

The offline bookings segment is expected to experience significant growth over the forecast period, driven by a preference for personalized services and direct customer support. Many pet owners still value the reassurance of speaking with travel agents or service providers in person, particularly when arranging complex pet travel logistics. Offline booking allows for tailored advice and customized travel plans and helps address specific concerns, such as pet health and safety during transit. As customer demand for hands-on assistance increases, the offline bookings segment is set to experience substantial growth.

Regional Insights

North America pet travel services market dominated the market with the largest revenue share of 36.9% in 2024. This share is attributable to the growth in pet-friendly accommodations and the rising trend of premium pet travel services. As more hotels, airlines, and transport providers cater to pet owners, the availability of comfortable, convenient, and safe travel options for pets has increased. Furthermore, the growing demand for luxury services, such as private pet transport, high-end accommodations, and personalized care, attracts affluent pet owners willing to invest in superior travel experience for their pets, further fueling market expansion.

U.S. Pet Travel Services Market Trends

The U.S. pet travel services market held the largest share in 2024. The growth of pet airlines and transport services, along with the expansion of pet grooming and care services, is shaping the U.S. pet travel services industry. With more airlines offering specialized pet-friendly cabins and improved transport options, a growing number of pet owners travel with their pets more comfortably and safely. Besides, the rising availability of grooming, pet-sitting, and care services with travel ensures pets are well-cared for throughout their journey. These developments enhance the overall travel experience for pets, thereby propelling market growth and attracting more consumers.

Europe Pet Travel Services Market Trends

Europe pet travel services market is set to witness significant expansion over the forecast period. The growth of online and mobile booking platforms, offering convenience and ease of access, is projected to drive regional growth. Pet owners can effortlessly manage travel arrangements, contributing to increased demand for pet travel services. In addition, the rising awareness and need for pet travel insurance, covering potential risks and medical needs during transit, further drives the Europe pet travel services industry.

Asia Pacific Pet Travel Services Market Trends

Asia Pacific pet travel services market is expected to be the fastest-growing region with a CAGR of 10.6% from 2025 to 2030. This market is driven by increasing awareness of pet travel regulations and rising disposable income. As more pet owners in the region become aware of the health and safety regulations required for traveling with pets, the demand for specialized services such as documentation assistance, vaccinations, and transport solutions is rising. Moreover, the growing middle-class population, coupled with increasing disposable income, in the region enables more pet owners to invest in premium travel services, boosting the market expansion and ensuring pet convenience and safety.

India Pet Travel Services Market Trends

India pet travel services market is expected to grow at the highest CAGR in the regional market. The rise of pet travel apps has simplified the booking process for pet owners in India, making it easier to find and book pet-friendly accommodations, flights, and transportation services. These platforms enhance convenience and accessibility, driving market demand. Besides, the growing interest in pet tourism encourages more pet owners to seek out vacation destinations that accommodate pets. The growing number of pet-friendly destinations, hotels, and travel companies is expected to drive the India pet travel services industry, catering to the rising number of pet owners traveling with their animals.

Key Pet Travel Services Company Insights

Some of the key companies in the pet travel services market include AirPets International; Air Animal, Inc.; Happy Tails Travel, Inc.; Royal Paws; Bluecollar Pet Transport; CitizenShipper; Starwood Pet Travel; World Care Pet Transport, LLC; PetRelocation, Inc.; Worldwide Animal Travel Ltd.; All Care Pet Transport.; Tails-A-Wagon Pet and Vehicle Transport; Aark Air International, Inc.; Across the Pond Pets Travel.; Fetchapet Ltd.; FlyPets UK; AeroPets Worldwide; Petport; and Jet Pet Global.

-

Royal Paws offers premium pet care services, including grooming, boarding, and personalized wellness plans. It focuses on providing exceptional comfort, safety, and luxury experiences for pets, ensuring high-quality care for furry companions.

-

Starwood Pet Travel specializes in comprehensive pet transportation services, ensuring safe, comfortable, and stress-free pet travel. It provides door-to-door service, customized travel plans, and handles all aspects of pet care during transit.

Key Pet Travel Services Companies:

The following are the leading companies in the pet travel services market. These companies collectively hold the largest market share and dictate industry trends.

- AirPets International

- Air Animal, Inc.

- Happy Tails Travel, Inc.

- Royal Paws

- Bluecollar Pet Transport

- CitizenShipper

- Starwood Pet Travel

- World Care Pet Transport, LLC

- PetRelocation, Inc.

- Worldwide Animal Travel Ltd.

- All Care Pet Transport.

- Tails-A-Wagon Pet and Vehicle Transport

- Aark Air International, Inc.

- Across the Pond Pets Travel.

- Fetchapet Ltd.

- FlyPets UK

- AeroPets Worldwide

- Petport

- Jet Pet Global

Recent Developments

-

In April 2024, GlobalVetLink (GVL) partnered with Airpets International to streamline international pet travel. By combining GVL's Pet Travel Concierge Service with Airpets International's logistics expertise, the collaboration offers pet owners a seamless and enhanced global travel experience.

-

In June 2022, Hilton and Mars Petcare extended their collaboration across Hilton's seven pet-friendly brands to meet the changing requirements of travelers accompanied by cats and dogs.

-

In April 2022, Avvinue, which advertises itself as an exclusive self-service platform for booking pet travel, announced its beta launch on National Pet Day.

Pet Travel Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.6 billion

Revenue forecast in 2030

USD 3.9 billion

Growth Rate

CAGR of 8.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Travel type, application, pet type, booking, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

AirPets International; Air Animal, Inc.; Happy Tails Travel, Inc.; Royal Paws; Bluecollar Pet Transport; CitizenShipper; Starwood Pet Travel; World Care Pet Transport, LLC; PetRelocation, Inc.; Worldwide Animal Travel Ltd.; All Care Pet Transport.; Tails-A-Wagon Pet and Vehicle Transport; Aark Air International, Inc.; Across the Pond Pets Travel.; Fetchapet Ltd.; FlyPets UK; AeroPets Worldwide; Petport; Jet Pet Global.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Travel Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global pet travel services market report on the basis of travel type, application type, pet type, booking type, and region:

-

Travel Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Domestic

-

International

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Relocation

-

-

Pet Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Booking Outlook (Revenue, USD Million, 2018 - 2030)

-

Online & Phone Bookings

-

Offline Bookings

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.