- Home

- »

- Sensors & Controls

- »

-

Pet Wearable Market Size, Share & Growth Report, 2030GVR Report cover

![Pet Wearable Market Size, Share & Trends Report]()

Pet Wearable Market Size, Share & Trends Analysis Report By Technology (RFID, GPS, Sensors), By Product, By Animal Type, By Component, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-729-2

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Semiconductors & Electronics

Pet Wearable Market Size & Trends

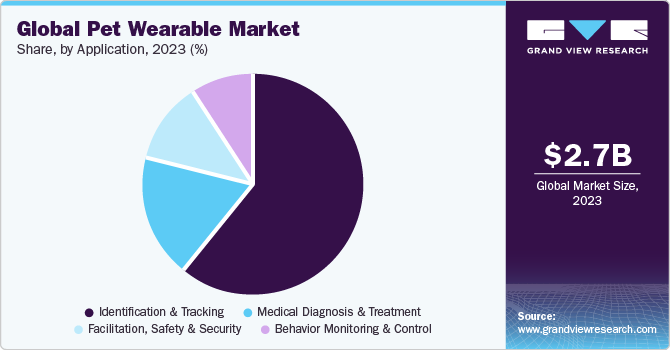

The global pet wearable market size was valued at USD 2.70 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 14.3% from 2023 to 2030. The market growth is supported by awareness among owners regarding the well-being of their pets. Further, the pet wearable industry has attracted considerable funding over the last couple of years for an array of technology-enhanced products for pets, including cameras and wearables. The pet wearable industry is still in its initial stages of development. However, it is still characterized by increasing competition among key stakeholders and the threat of new entrants. The focus of OEM will be the development of products with the capability of efficiently collecting health metrics.

IoT will play a crucial role in driving market growth in the future. Transmitting real-time data concerning pet health to veterinarians or pet owners will be supported by the connectivity offered by these devices. The non-invasive wearable sensor system combining photoplethysmograph (PPG), electrocardiogram (ECG), and inertial measurement units (IMU) is used to continuously monitor the health condition of pets integrated with the wireless technology, and handheld devices can make pet health monitoring easier.

Advancements in technologies including sensors, cameras, GPS, etc. will further elevate market demand in the future. Technology plays an important role in any electronic device, therefore any advancements in the aforementioned fields will be conducive to the growth of the pet wearables industry. Short battery life and high consumption of power may reduce the usage and adoption of the technology. Moreover, compliance with stringent government regulations is expected to hamper the pet wearable technology market growth.

The rising investment and advancement of technology results in increased purchase of products, which includes wearable tracking technology, that enables both pet owners and brands to delve into a pet's peculiar needs. Enterprises' specializations in pet health and wellness are utilizing insights into pet behavior as more comprehensive data is available. Moreover, effective monitoring and a better understanding of the pet enable companies to easily identify new health conditions and potential health-related issues with insights into exercise, nutrition, and sleep patterns. These attributes enable companies to manufacture solutions that are in line with the wearable pet technology market demand.

Regulatory compliance and consumer education are major factors that have been challenged as far as pet wearable devices market is concerned. Regulatory compliance has been a concern that has been troubling the companies operating in pet care market, especially for the pet care companies operating in food segment, owing to various restrictions that are sometimes conflicting by country/region/state. Even among pet care companies offering pet foods, the products that contain meat substances are subject to additional regulations. A majority of pet owners need to learn about the intricacies of pet wellness, which has resulted in brands investing in educational efforts aimed at assisting consumers understand the importance of holistic pet products.

Market Concentration & Characteristics

Pet owners in Latin America are increasingly concerned with the safety and security of their pets, which has resulted in the increased growth of the wearable in the region, especially for products such as GPS tracking and live positioning functionalities. Moreover, the increasing number of missing pets in the Latin American region has also increased pet safety awareness among other pet owners. Moreover, stricter safety regulations are also being imposed to curb the event, such as missing pets. For instance, the Peruvian government launched initiatives that included chip placement for lost pet searches and a special registry for dogs. Initiatives of this kind have spurred the adoption of pet wearable devices across Latin America, especially in Peru and Argentina. Further, the integration of advanced technologies and the increasing concerns related to pets' health and safety are expected to create increased opportunities for pet wearable devices market companies operating in the Latin American region.

The ease of collecting certain pet health metric data has fueled the interest of pet owners in these products. Moreover, the increasing trend of healthier pet lives, primarily focused on feeding and obesity control, has created an increased demand for wearable devices which have real time monitoring capability. Moreover, according to a survey by the Association of Pet Obesity and Prevention, around 56% of dogs and 60% of cats are clinically overweight, which has been fueling the adoption of pet wearable products. To facilitate the requirement of real time decision-making among veterinarians, leading pet wearable companies are focused on the development of devices that are integrated with cloud-based analytics. Location tracking is another major feature that has been once the preferred functionality among pet owners. Manufacturers are integrating sensors into their pet wearable solutions, enabling pet owners to track the activities of their pets via smartphones.

Technology Insights

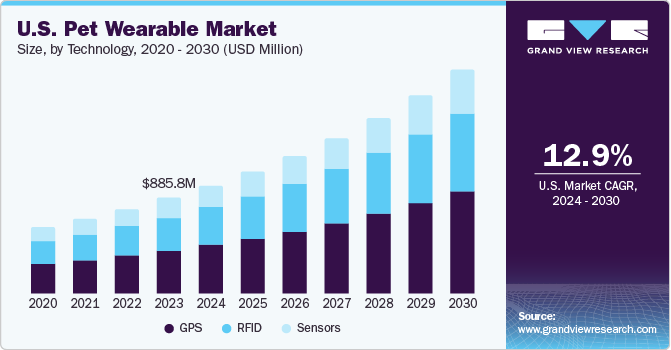

The RFID segment in pet wearable devices recorded the highest revenue share surpassing 30% in 2022. Reliability and accuracy are the two key features contributing to the pet wearable segment’s growth. The RFID trackers help monitor parameters concerning health such as variability in heart rate, calorie intake, body temperature, and pulse. These benefits play a key role in up-keeping segment growth, a trend expected to continue from 2023 to 2030.

GPS enabled devices segment is projected to grow at a CAGR of 15.0% from 2023 to 2030, contributing to a high revenue share over 2023 to 2030. Growing demand to monitor pet activities while ensuring security is creating avenues for GPS-based pet wearable devices. Growth in real-time positioning, increasing penetration of smartphones, and growth in mapping portals worldwide are estimated to fuel demand. Moreover, GPS providers have established strategic alliances with stores, mobile phone manufacturers, and application developers to increase GPS usage in new applications.

Application Insights

The demand for identification & tracking pet wearable devices held a revenue share nearly of 61 % in 2022. Access to location history and weight & dimensions are key features driving the segment’s growth. These devices offer pet owners a secure and easy way to monitor pet activity contributing to the segment's popularity.

Apart from activity monitoring, the demand for pet wearables for medical diagnosis & treatment is projected to witness growth at a CAGR around 16% from 2023 to 2030. The expenditure on pet health diagnostics is creating opportunities for segment growth. Without a doubt, we can say that pet wearables have a bright future, with pet owners spending more daily. To a certain extent, this spending is driven by emotional motives such as increasing emotional attachment as well as dependence on pets for entertainment, companionship, and mental well-being.

Regional Insights

North America Pet Wearable Market

The North America pet wearable market held the highest market share nearly of 38% in 2022. The availability of sophisticated technologies in the region, along with increasing spending on pet healthcare, is anticipated to drive the regional pet wearable industry growth. For example, according to the America Pet Product Association, the spending on the pet industry in the U.S. is projected to surpass USD 100 billion by 2022. The improving regulations standards and the presence of key companies in the region have also played a crucial role in the North America pet wearable market.

Europe Pet Wearable Market

The pet wearable market in Europe held a market share of 27.7% in 2022. The growth of the pet wearable market in Europe can be attributed to factors such as increased demand for pet monitoring and technical improvements, increased acceptance of IoT, and increased acceptance of pets’ physical and mental wellness.

U.K. Pet Wearable Market

The U.K. pet wearable market held a market share nearly of 15% in the European pet wearable market in 2022. The growth of the pet wearable market in the U.K. can be attributed to factors that include the capability to track pets using GPS technology, check the health aspects of pets, and monitor, track, and receive information and alerts on pets.

Germany Pet Wearable Market

The pet wearable market in Germany held a market share of 24.0% in 2022 in the European pet wearable market. The growth of the pet wearable market in Germany can be attributed to factors such as the country being a major player in the sensor market. Moreover, the humanization trend among pet owners for demanding advanced and top-class pet wearable products has also been fueling the growth of the region market.

France Pet Wearable Market

The pet wearable market in France held a market share nearly of 19% in 2022 in the European pet wearable market. The growth of the pet wearable market in France can be attributed to factors such as advancement in wireless area network, adoption of digital maps, development of mobile application among others.

Asia Pacific Pet Wearable Market

The Asia Pacific pet wearable market held a market share nearly of 20% in the global pet wearable market. The growth of the pet wearable market in the Asia Pacific region can be attributed to the rising incidence of chronic diseases in pets, growing expenditure on pets owing to high disposal income, and increasing wearable technology penetration.

China Pet Wearable Market

The China pet wearable market was estimated to be USD 0.19 billion in 2022. The growth of the pet wearable market in China can be attributed to increased investment in R&D activities, increased concern for pet health and wellbeing, and growing expenditure on pets.

India Pet Wearable Market

The pet wearable market in India is expected to register a growth rate of 18% over 2023 to 2030. The growth of the pet wearable market in India can be attributed to increasing investment in pet technologies, increasing awareness about animal health, and integration of AI and ML algorithms, among others.

Japan Pet Wearable Market

The pet wearable market in Japan is estimated to be USD 0.07 million in 2022. The growth of the Japanese pet wearable market can be attributed to companies based in the country who have been coming up with pet wearable solution that offers advanced capabilities. For instance, in April 2022, Unicharm Corp. announced its partnership with Rabo Inc. aimed at pushing the digital transformation of the pet care sector forward. Rabo Inc. has launched a wearable device that enables owners to track their cat's movements in real-time and also gives insights into pet's emotions and health, among others.

Middle East & Africa Pet Wearable Market

The Middle East & Africa pet wearable market is expected to occupy a market share nearly of 6% in 2022. The driving factors of the pet wearable market in the Middle East & Africa include growing demand for pet monitoring, technological advancement, and growing expenditure on pets, among others.

Saudi Arabia Pet Wearable Market

The pet wearable market in Saudi Arabia is witnessing a high growth rate in 2023 to 2030, which can be attributed to increasing pet adoption, technological advancement, an increasing number of veterinary clinics, and expanding IoT adoption, among others.

Key Companies & Market Share Insights

Some of the key players operating in the pet wearable market include Datamars, FitBark Service, and Garmin Ltd., among others.

-

Datamars is a Swiss technology company that specializes in identification, tracking, and monitoring solutions for a variety of industries, including the pet industry. They offer a variety of products and services for pets, including ID tags, GPS trackers, and activity monitors. Datamars also offers a variety of software solutions for the pet industry, including pet tracking software and pet management software. The presence of such major companies in the European region has been crucial in driving the growth of the Europe pet wearable market.

-

FitBark is a company that makes pet wearables, including the FitBark 2 and the FitBark GPS. The FitBark 2 is an accelerometer that is used to measure physical activity in dogs. The FitBark GPS is a tracker that can be used to track the location of a dog. Both the FitBark 2 and the FitBark GPS are designed to be low-cost and have a long battery life. The FitBark 2 has a battery life of about six months, while the FitBark GPS has a battery life of about three days. The FitBark 2 is a small, lightweight device that is attached to the collar of a dog. It uses a 3-axis accelerometer to measure the amount of activity that the dog is doing. The data from the accelerometer is then sent to the FitBark app, which can be used to track the dog's activity levels over time.

PETFON, Link my Pet, and LATSEN are some of the emerging market participants in the pet wearable market.

-

PETFON is a pet GPS tracker that uses a combination of GPS, WiFi, Bluetooth, and long-distance wireless technologies to track your pet's activity and pinpoint its location in real time. It is designed for outdoor use, such as camping or hiking. The tracking distance varies from 0.1-3.5 miles depending on the user's environment. PETFON consists of two modules, Controller and Tracker. The owner carries the Controller, and the Tracker is attached to the dog. To use PETFON, you need to download the PETFON app and follow the instructions. With the app, you can view your pet's activities and pinpoint their location at any time. The presence of such companies in the North American region has played a pivotal role in the growth of the North America pet wearable market.

-

Link My Pet is a health and wellness platform for pets that uses algorithms to develop solutions. The Link Smart Pet Wearable is a lightweight, waterproof collar attachment that connects pet parents to their pet's health, safety, and well-being. The app's algorithm offers customized activity targets by size, breed, size, and behavior aimed at making sure the pet gets enough exercise. The app can also be used to monitor the ambient temperature of the pet's location and get alerts if the temperature gets too hot or cold.

Key Pet Wearable Companies:

- Avid Identification Systems, Inc.

- Barking Labs

- Datamars

- Felcana

- FitBark Service

- Garmin Ltd.

- GoPro Inc.

- LATSEN

- Link My Pet

- Loc8tor Ltd.

- Mars, Incorporated

- PETFON

- PetPace

- PetTech.co.uk.Ltd.

- Tractive

Recent Developments

-

In November 2023, PetPace announced a partnership with Veterinary Health Research Centers (VHRC) to research Canine Alzheimer's Disease. The initiative has been named Dogs Overcoming Geriatric Memory and Aging (DOGMA). For carrying out this study, the biometric collars of PetPace would be used to monitor and analyze the health and behavior of aging dogs to identify similarities between Alzheimer's disease in humans and canines.

-

In October 2023, PetPace announced the launch of its next-generation Health 2.0 smart dog collar, which offers features such as early symptom detection, location tracking, disease management, and continuous health monitoring. PetPace's AI-powered life-saving technology enables pet owners of sick, at-risk, or old pets with medical insights that often go overlooked. The company's Health 2.0 measures all major vital signs and health-related biometrics, including heart rate variability (HRV), activity, posture, sleep quality, pulse, behavior, respiratory rate, and internal temperature, in addition to features such as wellness index, health profile, pain indicator, and workout intensity assessment.

-

In May 2023, Datamars announced the acquisition of Kippy S.r.l. of a successful acquisition. The transaction is coordinated by growth capital. With this partnership, Datamars is strengthening its market-leading identification and matching solution, which has identified more than 50 million pets and connected thousands of lost animals with their owners. Equipped with GPS, the Kippy collar monitors the activity and location of animals and communicates with pets via a smartphone application. In addition to being able to locate their pet in real-time, owners can easily understand if their pet is getting enough physical activity. The solution offered by Kippy combines GPS/activity tracking with engagement and communication features such as personal messaging and in-app social networking.

Pet Wearable Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.70 billion

Revenue forecast in 2030

USD 6.89 billion

Growth rate

CAGR of 14.3% from 2023 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, trends

Segments covered

Technology; Product; Animal Type; Component; Application; Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Germany, U.K., France, Spain, China, Japan, India, South Korea, Australia, Brazil, Mexico, Saudi Arabia, UAE, South Africa

Key companies profiled

Avid Identification Systems, Inc., Barking Labs, Datamars, Felcana, FitBark Service, Garmin Ltd., GoPro Inc., LATSEN, Link My Pet, Loc8tor Ltd., Mars, Incorporated, PETFON, PetPace, PetTech.co.uk.Ltd., and Tractive

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Wearable Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet wearable market report based on technology, product, component, animal type, application, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

RFID

-

GPS

-

Sensors

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smart Collar

-

Smart Camera

-

Smart Harness and Vest

-

Others

-

-

Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dogs

-

Cats

-

Other Animals

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

GPS Chips

-

RFID Chips

-

Connectivity Integrated Circuit

-

Bluetooth Chips

-

Wi-Fi Chips

-

Cellular Chips

-

-

Sensors

-

Processors

-

Memory

-

Displays

-

Batteries

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Identification & Tracking

-

Behavior Monitoring & Control

-

Facilitation, Safety & Security

-

Fitness Monitoring

-

Medical Diagnosis & Treatment

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pet wearable market size was estimated at USD 2365.1 million in 2022 and is expected to reach USD 2,702.0 million in 2023.

b. The global pet wearable market is expected to grow at a compound annual growth rate of 14.3% from 2023 to 2030 to reach USD 6,888.1 million by 2030.

b. North America dominated the pet wearable market with a share of 38.33% in 2022. Factors such as high penetration of activity and fitness monitoring devices for pets and rising awareness of pet health drives the regional market growth.

b. Some key players operating in the pet wearable market include Allflex USA Inc.; Avid Identification Systems, Inc.; Datamars; Fitbark; Garmin Ltd.; Intervet Inc.; Invisible Fence; Konectera Inc.; Nuzzle; PetPace LLC; Tractive; Trovan Ltd.; Whistle Labs, Inc.; and Voyce.

b. Key factors that are driving the pet wearable market growth include increasing pet expenditure owing to rising disposable income in emerging countries, and increasing awareness concerning animal health across the world.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Pet Wearable Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.3.3. Market Opportunity Analysis

3.4. Pet Wearable Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Pet Wearable Market: Technology Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Pet Wearable Market: Technology Movement Analysis, USD Billion, 2023 & 2030

4.3. RFID

4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4. GPS

4.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.5. Sensors

4.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Pet Wearable Market: Product Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Pet Wearable Market: Product Movement Analysis, USD Billion, 2023 & 2030

5.3. Smart Collar

5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4. Smart Camera

5.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.5. Smart Harness and Vest

5.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.6. Others

5.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Pet Wearable Market: Animal Type Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Pet Wearable Market: Animal Type Movement Analysis, USD Billion, 2023 & 2030

6.3. Dogs

6.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.4. Cats

6.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.5. Other Animals

6.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. Pet Wearable Market: Component Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Pet Wearable Market: Component Movement Analysis, USD Billion, 2023 & 2030

7.3. GPS Chips

7.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4. RFID Chips

7.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5. Connectivity Integrated Circuit

7.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5.2. Bluetooth Chips

7.5.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5.3. Wi-Fi Chips

7.5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5.4. Cellular Chips

7.5.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.6. Sensors

7.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.7. Processors

7.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8. Memory

7.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.9. Displays

7.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.10. Batteries

7.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.11. Others

7.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 8. Pet Wearable Market: Application Estimates & Trend Analysis

8.1. Segment Dashboard

8.2. Pet Wearable Market: Application Movement Analysis, USD Billion, 2023 & 2030

8.3. Identification & Tracking

8.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4. Behaviour Monitoring & Control

8.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.5. Facilitation, Safety & Security

8.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6. Fitness Monitoring

8.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.7. Medical Diagnosis & Treatment

8.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 9. Pet Wearable Market: Regional Estimates & Trend Analysis

9.1. Pet Wearable Market Share by Region, 2023 & 2030 (USD Billion)

9.2. North America

9.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.2.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.2.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.2.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.2.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.2.7. U.S.

9.2.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.7.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.2.7.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.2.7.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.2.7.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.2.7.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.2.8. Canada

9.2.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.8.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.2.8.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.2.8.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.2.8.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.2.8.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3. Europe

9.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.3.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.3.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.3.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.3.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.7. U.K.

9.3.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.7.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.3.7.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.3.7.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.3.7.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.3.7.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.8. Germany

9.3.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.8.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.3.8.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.3.8.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.3.8.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.3.8.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.9. France

9.3.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.9.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.3.9.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.3.9.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.3.9.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.3.9.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.10. Spain

9.3.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.10.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.3.10.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.3.10.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.3.10.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.3.10.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4. Asia Pacific

9.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.4.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.4.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.4.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.4.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.7. China

9.4.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.7.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.4.7.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.4.7.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.4.7.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.4.7.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.8. India

9.4.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.8.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.4.8.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.4.8.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.4.8.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.4.8.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.9. Japan

9.4.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.9.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.4.9.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.4.9.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.4.9.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.4.9.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.10. Australia

9.4.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.10.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.4.10.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.4.10.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.4.10.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.4.10.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.11. South Korea

9.4.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.11.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.4.11.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.4.11.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.4.11.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.4.11.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.5. Latin America

9.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.5.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.5.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.5.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.5.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.5.7. Brazil

9.5.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.7.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.5.7.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.5.7.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.5.7.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.5.7.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.5.8. Mexico

9.5.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.8.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.5.8.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.5.8.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.5.8.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.5.8.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.6. Middle East & Africa

9.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.6.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.6.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.6.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.6.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.6.7. UAE

9.6.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.7.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.6.7.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.6.7.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.6.7.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.6.7.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.6.8. Saudi Arabia

9.6.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.8.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.6.8.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.6.8.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.6.8.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.6.8.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.6.9. South Africa

9.6.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.9.2. Market Size Estimates and Forecasts by Technology, 2018 - 2030 (USD Billion)

9.6.9.3. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.6.9.4. Market Size Estimates and Forecasts by Animal Type, 2018 - 2030 (USD Billion)

9.6.9.5. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.6.9.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

Chapter 10. Competitive Landscape

10.1. Recent Developments & Impact Analysis by Key Market Participants

10.2. Company Categorization

10.3. Company Market Share Analysis

10.4. Company Heat Map Analysis

10.5. Strategy Mapping

10.5.1. Expansion

10.5.2. Mergers & Acquisition

10.5.3. Partnerships & Collaborations

10.5.4. New Product Launches

10.5.5. Research And Development

10.6. Company Profiles

10.6.1. Avid Identification Systems, Inc.

10.6.1.1. Participant’s Overview

10.6.1.2. Financial Performance

10.6.1.3. Product Benchmarking

10.6.1.4. Recent Developments

10.6.2. Barking Labs

10.6.2.1. Participant’s Overview

10.6.2.2. Financial Performance

10.6.2.3. Product Benchmarking

10.6.2.4. Recent Developments

10.6.3. Datamars

10.6.3.1. Participant’s Overview

10.6.3.2. Financial Performance

10.6.3.3. Product Benchmarking

10.6.3.4. Recent Developments

10.6.4. Felcana

10.6.4.1. Participant’s Overview

10.6.4.2. Financial Performance

10.6.4.3. Product Benchmarking

10.6.4.4. Recent Developments

10.6.5. FitBark Service

10.6.5.1. Participant’s Overview

10.6.5.2. Financial Performance

10.6.5.3. Product Benchmarking

10.6.5.4. Recent Developments

10.6.6. Garmin Ltd.

10.6.6.1. Participant’s Overview

10.6.6.2. Financial Performance

10.6.6.3. Product Benchmarking

10.6.6.4. Recent Developments

10.6.7. GoPro Inc.

10.6.7.1. Participant’s Overview

10.6.7.2. Financial Performance

10.6.7.3. Product Benchmarking

10.6.7.4. Recent Developments

10.6.8. LATSEN

10.6.8.1. Participant’s Overview

10.6.8.2. Financial Performance

10.6.8.3. Product Benchmarking

10.6.8.4. Recent Developments

10.6.9. Link My Pet

10.6.9.1. Participant’s Overview

10.6.9.2. Financial Performance

10.6.9.3. Product Benchmarking

10.6.9.4. Recent Developments

10.6.10. Loc8tor Ltd.

10.6.10.1. Participant’s Overview

10.6.10.2. Financial Performance

10.6.10.3. Product Benchmarking

10.6.10.4. Recent Developments

10.6.11. Tesco Mobile Ltd

10.6.11.1. Participant’s Overview

10.6.11.2. Financial Performance

10.6.11.3. Product Benchmarking

10.6.11.4. Recent Developments

10.6.12. Mars, Incorporated

10.6.12.1. Participant’s Overview

10.6.12.2. Financial Performance

10.6.12.3. Product Benchmarking

10.6.12.4. Recent Developments

10.6.13. PETFON

10.6.13.1. Participant’s Overview

10.6.13.2. Financial Performance

10.6.13.3. Product Benchmarking

10.6.13.4. Recent Developments

10.6.14. PetPace

10.6.14.1. Participant’s Overview

10.6.14.2. Financial Performance

10.6.14.3. Product Benchmarking

10.6.14.4. Recent Developments

10.6.15. PetTech.co.uk.Ltd.

10.6.15.1. Participant’s Overview

10.6.15.2. Financial Performance

10.6.15.3. Product Benchmarking

10.6.15.4. Recent Developments

10.6.16. Tractive

10.6.16.1. Participant’s Overview

10.6.16.2. Financial Performance

10.6.16.3. Product Benchmarking

10.6.16.4. Recent Developments

List of Tables

Table 1 Pet wearable market 2018 - 2030 (USD Billion)

Table 2 Pet wearable market estimates and forecasts by region 2018 - 2030 (USD Billion)

Table 3 Pet wearable market estimates and forecasts by technology 2018 - 2030 (USD Billion)

Table 4 Pet wearable market estimates and forecasts by product 2018 - 2030 (USD Billion)

Table 5 Pet wearable market estimates and forecasts by animal type 2018 - 2030 (USD Billion)

Table 6 Pet wearable market estimates and forecasts by component 2018 - 2030 (USD Billion)

Table 7 Pet wearable market estimates and forecasts by application 2018 - 2030 (USD Billion)

Table 8 RFID market by region, 2018 - 2030 (USD Billion)

Table 9 GPS market by region, 2018 - 2030 (USD Billion)

Table 10 Sensors market by region, 2018 - 2030 (USD Billion)

Table 11 Smart collar market by region, 2018 - 2030 (USD Billion)

Table 12 Smart camera market by region, 2018 - 2030 (USD Billion)

Table 13 Smart harness and vest market by region, 2018 - 2030 (USD Billion)

Table 14 Others market by region, 2018 - 2030 (USD Billion)

Table 15 Dogs market by region, 2018 - 2030 (USD Billion)

Table 16 Cats market by region, 2018 - 2030 (USD Billion)

Table 17 Other animals market by region, 2018 - 2030 (USD Billion)

Table 18 GPS chips market by region, 2018 - 2030 (USD Billion)

Table 19 RFID chips market by region, 2018 - 2030 (USD Billion)

Table 20 Connectivity integrated circuit market by region, 2018 - 2030 (USD Billion)

Table 21 Bluetooth chips market by region, 2018 - 2030 (USD Billion)

Table 22 Wi-Fi chips market by region, 2018 - 2030 (USD Billion)

Table 23 Cellular chips market by region, 2018 - 2030 (USD Billion)

Table 24 Sensors market by region, 2018 - 2030 (USD Billion)

Table 25 Processors market by region, 2018 - 2030 (USD Billion)

Table 26 Memory market by region, 2018 - 2030 (USD Billion)

Table 27 Display chips market by region, 2018 - 2030 (USD Billion)

Table 28 Batteries chips market by region, 2018 - 2030 (USD Billion)

Table 29 Others chips market by region, 2018 - 2030 (USD Billion)

Table 30 Identification & tracking market by region, 2018 - 2030 (USD Billion)

Table 31 Behaviour monitoring & control market by region, 2018 - 2030 (USD Billion)

Table 32 Facilitation, safety & security market by region, 2018 - 2030 (USD Billion)

Table 33 Fitness monitoring market by region, 2018 - 2030 (USD Billion)

Table 34 Medical diagnosis & treatment market by region, 2018 - 2030 (USD Billion)

Table 35 North America pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 36 North America pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 37 North America pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 38 North America pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 39 North America pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 40 U.S. pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 41 U.S. pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 42 U.S. pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 43 U.S. pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 44 U.S. pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 45 Canada pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 46 Canada pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 47 Canada pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 48 Canada pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 49 Canada pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 50 Europe pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 51 Europe pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 52 Europe pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 53 Europe pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 54 Europe pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 55 U.K. pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 56 U.K. pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 57 U.K. pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 58 U.K. pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 59 U.K. pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 60 Germany pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 61 Germany pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 62 Germany pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 63 Germany pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 64 Germany pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 65 France pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 66 France pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 67 France pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 68 France pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 69 France pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 70 Spain pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 71 Spain pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 72 Spain pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 73 Spain pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 74 Spain pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 75 Asia Pacific pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 76 Asia Pacific pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 77 Asia Pacific pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 78 Asia Pacific pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 79 Asia Pacific pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 80 China pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 81 China pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 82 China pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 83 China pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 84 China pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 85 India pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 86 India pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 87 India pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 88 India pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 89 India pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 90 Japan pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 91 Japan pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 92 Japan pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 93 Japan pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 94 Japan pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 95 Australia pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 96 Australia pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 97 Australia pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 98 Australia pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 99 Australia pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 100 South Korea pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 101 South Korea pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 102 South Korea pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 103 South Korea pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 104 South Korea pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 105 Latin America pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 106 Latin America pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 107 Latin America pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 108 Latin America pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 109 Latin America pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 110 Brazil pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 111 Brazil pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 112 Brazil pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 113 Brazil pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 114 Brazil pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 115 Mexico pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 116 Mexico pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 117 Mexico pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 118 Mexico pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 119 Mexico pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 120 Middle East & Africa pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 121 Middle East & Africa pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 122 Middle East & Africa pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 123 Middle East & Africa pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 124 Middle East & Africa pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 125 UAE pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 126 UAE pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 127 UAE pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 128 UAE pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 129 UAE pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 130 South Africa pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 131 South Africa pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 132 South Africa pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 133 South Africa pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 134 South Africa pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 135 Saudi Arabia pet wearable market, by technology, 2018 - 2030 (Revenue, USD Billion)

Table 136 Saudi Arabia pet wearable market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 137 Saudi Arabia pet wearable market, by animal type, 2018 - 2030 (Revenue, USD Billion)

Table 138 Saudi Arabia pet wearable market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 139 Saudi Arabia pet wearable market, by application, 2018 - 2030 (Revenue, USD Billion)

List of Figures

Fig. 1 Pet Wearable Market Segmentation

Fig. 2 Market landscape

Fig. 3 Information Procurement

Fig. 4 Data Analysis Models

Fig. 5 Market Formulation and Validation

Fig. 6 Data Validating & Publishing

Fig. 7 Market Snapshot

Fig. 8 Segment Snapshot (1/2)

Fig. 9 Segment Snapshot (2/2)

Fig. 10 Competitive Landscape Snapshot

Fig. 11 Pet Wearable Market: Industry Value Chain Analysis

Fig. 12 Pet Wearable Market: Market Dynamics

Fig. 13 Pet Wearable Market: PORTER’s Analysis

Fig. 14 Pet Wearable Market: PESTEL Analysis

Fig. 15 Pet Wearable Market Share by Technology, 2023 & 2030 (USD Billion)

Fig. 16 Pet Wearable Market, by Technology: Market Share, 2023 & 2030

Fig. 17 RFID Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 18 GPS Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 19 Sensors Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 20 Pet Wearable Market Share by Product, 2023 & 2030 (USD Billion)

Fig. 21 Pet Wearable Market, by Product: Market Share, 2023 & 2030

Fig. 22 Smart Collar Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 23 Smart Camera Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 24 Smart Harness and Vest Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 25 Others Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 26 Pet Wearable Market Share by Animal Type, 2023 & 2030 (USD Billion)

Fig. 27 Pet Wearable Market, by Animal Type: Market Share, 2023 & 2030

Fig. 28 Dogs Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 29 Cats Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 30 Other Animals Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 31 Pet Wearable Market Share by Component, 2023 & 2030 (USD Billion)

Fig. 32 Pet Wearable Market, by Component: Market Share, 2023 & 2030

Fig. 33 GPS Chips Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 34 RFID Chips Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 35 Connecivity Integrated Circuit Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 36 Bluetooth Chips Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 37 Wi-Fi ChipsMarket Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 38 Cellular ChipsMarket Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 39 Sensors Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 40 Processors Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 41 Memory Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 42 Display Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 43 Batteries Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 44 Others Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 45 Pet Wearable Market Share by Application, 2023 & 2030 (USD Billion)

Fig. 46 Pet Wearable Market, by Application: Market Share, 2023 & 2030

Fig. 47 Identification & Tracking Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 48 Behaviour Monitoring & Control Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 49 Facilitation, Safety & Security Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 50 Fitness Monitoring Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 51 Medical Diganosis & TreatmentMarket Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 52 Regional Marketplace: Key Takeaways

Fig. 53 North America Pet Wearable Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 54 U.S. Pet Wearable Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 55 Canada Pet Wearable Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 56 Europe Pet Wearable Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 57 U.K. Pet Wearable Market Estimates and Forecasts, 2018 - 2030,) (USD Billion)

Fig. 58 Germany Pet Wearable Market Estimates and Forecasts (2018 - 2030,) (USD Billion)

Fig. 59 France Pet Wearable Market Estimates and Forecasts (2018 - 2030,) (USD Billion)

Fig. 60 Spain Pet Wearable Market Estimates and Forecasts (2018 - 2030,) (USD Billion)

Fig. 61 Asia Pacific Pet Wearable Market Estimates and Forecast, 2018 - 2030 (USD Billion)

Fig. 62 China Pet Wearable Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 63 Japan Pet Wearable Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 64 India Pet Wearable Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 65 South Korea Pet Wearable Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 66 Australia Pet Wearable Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 67 Latin America Pet Wearable Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 68 Brazil Pet Wearable Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 69 Mexico Pet Wearable Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 70 MEA Pet Wearable Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 71 Saudi Arabia Pet Wearable Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 72 UAE Pet Wearable Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 73 South Africa Pet Wearable Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 74 Key Company Categorization

Fig. 75 Company Market Positioning

Fig. 76 Key Company Market Share Analysis, 2023

Fig. 77 Strategic FrameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Pet Wearable Technology Outlook (Revenue, USD Million, 2018 - 2030)

- RFID

- GPS

- Sensors

- Pet Wearable Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Collar

- Smart Camera

- Smart Harness and Vest

- Others

- Pet Wearable Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Dogs

- Cats

- Other Animals

- Pet Wearable Component Outlook (Revenue, USD Billion, 2018 - 2030)

- GPS Chips

- RFID Chips

- Connectivity Integrated Circuit

- Bluetooth Chips

- Wi-Fi Chips

- Cellular Chips

- Sensors

- Processors

- Memory

- Displays

- Batteries

- Others

- Pet Wearable Application Outlook (Revenue, USD Million, 2018 - 2030)

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation, Safety & Security

- Medical Diagnosis & Treatment

- Pet Wearable Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Pet Wearable Market, By Technology

- RFID

- GPS

- Sensors

- North America Pet Wearable Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Collar

- Smart Camera

- Smart Harness and Vest

- Others

- North America Pet Wearable Market Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Dogs

- Cats

- Other Animals

- North America Pet Wearable Market Component Outlook (Revenue, USD Billion, 2018 - 2030)

- GPS Chips

- RFID Chips

- Connectivity Integrated Circuit

- Bluetooth Chips

- Wi-Fi Chips

- Cellular Chips

- Sensors

- Processors

- Memory

- Displays

- Batteries

- Others

- North America Pet Wearable Market, By Application

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation, Safety & Security

- Fitness Monitoring

- Medical Diagnosis & Treatment

- U.S.

- U.S. Pet Wearable Market, By Technology

- RFID

- GPS

- Sensors

- U.S. Pet Wearable Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Collar

- Smart Camera

- Smart Harness and Vest

- Others

- U.S. Pet Wearable Market Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Dogs

- Cats

- Other Animals

- U.S. Pet Wearable Market Component Outlook (Revenue, USD Billion, 2018 - 2030)

- GPS Chips

- RFID Chips

- Connectivity Integrated Circuit

- Bluetooth Chips

- Wi-Fi Chips

- Cellular Chips

- Sensors

- Processors

- Memory

- Displays

- Batteries

- Others

- U.S. Pet Wearable Market, By Application

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation, Safety & Security

- Fitness Monitoring

- Medical Diagnosis & Treatment

- U.S. Pet Wearable Market, By Technology

- Canada

- Canada Pet Wearable Market, By Technology

- RFID

- GPS

- Sensors

- Canada Pet Wearable Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Collar

- Smart Camera

- Smart Harness and Vest

- Others

- Canada Pet Wearable Market Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Dogs

- Cats

- Other Animals

- Canada Pet Wearable Market Component Outlook (Revenue, USD Billion, 2018 - 2030)

- GPS Chips

- RFID Chips

- Connectivity Integrated Circuit

- Bluetooth Chips

- Wi-Fi Chips

- Cellular Chips

- Sensors

- Processors

- Memory

- Displays

- Batteries

- Others

- Canada Pet Wearable Market, By Application

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation, Safety & Security

- Fitness Monitoring

- Medical Diagnosis & Treatment

- Canada Pet Wearable Market, By Technology

- North America Pet Wearable Market, By Technology

- Europe

- Europe Pet Wearable Market, By Technology

- RFID

- GPS

- Sensors

- Europe Pet Wearable Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Collar

- Smart Camera

- Smart Harness and Vest

- Others

- Europe Pet Wearable Market Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Dogs

- Cats

- Other Animals

- Europe Pet Wearable Market Component Outlook (Revenue, USD Billion, 2018 - 2030)

- GPS Chips

- RFID Chips

- Connectivity Integrated Circuit

- Bluetooth Chips

- Wi-Fi Chips

- Cellular Chips

- Sensors

- Processors

- Memory

- Displays

- Batteries

- Others

- Europe Pet Wearable Market, By Application

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation, Safety & Security

- Fitness Monitoring

- Medical Diagnosis & Treatment

- U.K.

- U.K. Pet Wearable Market, By Technology

- RFID

- GPS

- Sensors

- U.K. Pet Wearable Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Collar

- Smart Camera

- Smart Harness and Vest

- Others

- U.K. Pet Wearable Market Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Dogs

- Cats

- Other Animals

- U.K. Pet Wearable Market Component Outlook (Revenue, USD Billion, 2018 - 2030)

- GPS Chips

- RFID Chips

- Connectivity Integrated Circuit

- Bluetooth Chips

- Wi-Fi Chips

- Cellular Chips

- Sensors

- Processors

- Memory

- Displays

- Batteries

- Others

- U.K. Pet Wearable Market, By Application

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation, Safety & Security

- Fitness Monitoring

- Medical Diagnosis & Treatment

- U.K. Pet Wearable Market, By Technology

- Germany

- Germany Pet Wearable Market, By Technology

- RFID

- GPS

- Sensors

- Germany Pet Wearable Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Collar

- Smart Camera

- Smart Harness and Vest

- Others

- Germany Pet Wearable Market Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Dogs

- Cats

- Other Animals

- Germany Pet Wearable Market Component Outlook (Revenue, USD Billion, 2018 - 2030)

- GPS Chips

- RFID Chips

- Connectivity Integrated Circuit

- Bluetooth Chips

- Wi-Fi Chips

- Cellular Chips

- Sensors

- Processors

- Memory

- Displays

- Batteries

- Others

- Germany Pet Wearable Market, By Application

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation, Safety & Security

- Fitness Monitoring

- Medical Diagnosis & Treatment

- Germany Pet Wearable Market, By Technology

- France

- France Pet Wearable Market, By Technology

- RFID

- GPS

- Sensors

- France Pet Wearable Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Collar

- Smart Camera

- Smart Harness and Vest

- Others

- France Pet Wearable Market Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Dogs

- Cats

- Other Animals

- France Pet Wearable Market Component Outlook (Revenue, USD Billion, 2018 - 2030)

- GPS Chips

- RFID Chips

- Connectivity Integrated Circuit

- Bluetooth Chips

- Wi-Fi Chips

- Cellular Chips

- Sensors

- Processors

- Memory

- Displays

- Batteries

- Others

- France Pet Wearable Market, By Application

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation, Safety & Security

- Fitness Monitoring

- Medical Diagnosis & Treatment

- France Pet Wearable Market, By Technology

- Spain

- Spain Pet Wearable Market, By Technology

- RFID

- GPS

- Sensors

- Spain Pet Wearable Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Collar

- Smart Camera

- Smart Harness and Vest

- Others

- Spain Pet Wearable Market Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Dogs

- Cats

- Other Animals

- Spain Pet Wearable Market Component Outlook (Revenue, USD Billion, 2018 - 2030)

- GPS Chips

- RFID Chips

- Connectivity Integrated Circuit

- Bluetooth Chips

- Wi-Fi Chips

- Cellular Chips

- Sensors

- Processors

- Memory

- Displays

- Batteries

- Others

- Spain Pet Wearable Market, By Application

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation, Safety & Security

- Fitness Monitoring

- Medical Diagnosis & Treatment

- Spain Pet Wearable Market, By Technology

- Rest of Europe

- Rest of Europe Pet Wearable Market, By Technology

- RFID

- GPS

- Sensors

- Rest of Europe Pet Wearable Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Collar

- Smart Camera

- Smart Harness and Vest

- Others

- Rest of Europe Pet Wearable Market Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Dogs

- Cats

- Other Animals

- Rest of Europe Pet Wearable Market Component Outlook (Revenue, USD Billion, 2018 - 2030)

- GPS Chips

- RFID Chips

- Connectivity Integrated Circuit

- Bluetooth Chips

- Wi-Fi Chips

- Cellular Chips

- Sensors

- Processors

- Memory

- Displays

- Batteries

- Others

- Rest of Europe Pet Wearable Market, By Application

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation, Safety & Security

- Fitness Monitoring

- Medical Diagnosis & Treatment

- Rest of Europe Pet Wearable Market, By Technology

- Europe Pet Wearable Market, By Technology

- Asia Pacific

- Asia Pacific Pet Wearable Market, By Technology

- RFID

- GPS

- Sensors

- Asia Pacific Pet Wearable Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Collar

- Smart Camera

- Smart Harness and Vest

- Others

- Asia Pacific Pet Wearable Market Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Dogs

- Cats

- Other Animals

- Asia Pacific Pet Wearable Market Component Outlook (Revenue, USD Billion, 2018 - 2030)

- GPS Chips

- RFID Chips

- Connectivity Integrated Circuit

- Bluetooth Chips

- Wi-Fi Chips

- Cellular Chips

- Sensors

- Processors

- Memory

- Displays

- Batteries

- Others

- Asia Pacific Pet Wearable Market, By Application

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation, Safety & Security

- Fitness Monitoring

- Medical Diagnosis & Treatment

- China

- China Pet Wearable Market, By Technology

- RFID

- GPS

- Sensors

- China Pet Wearable Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Collar

- Smart Camera

- Smart Harness and Vest

- Others

- China Pet Wearable Market Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Dogs

- Cats

- Other Animals

- China Pet Wearable Market Component Outlook (Revenue, USD Billion, 2018 - 2030)

- GPS Chips

- RFID Chips

- Connectivity Integrated Circuit

- Bluetooth Chips

- Wi-Fi Chips

- Cellular Chips

- Sensors

- Processors

- Memory

- Displays

- Batteries

- Others

- China Pet Wearable Market, By Application

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation, Safety & Security

- Fitness Monitoring

- Medical Diagnosis & Treatment

- China Pet Wearable Market, By Technology

- India

- India Pet Wearable Market, By Technology

- RFID

- GPS

- Sensors

- India Pet Wearable Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Collar

- Smart Camera

- Smart Harness and Vest

- Others

- India Pet Wearable Market Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Dogs

- Cats

- Other Animals

- India Pet Wearable Market Component Outlook (Revenue, USD Billion, 2018 - 2030)

- GPS Chips

- RFID Chips

- Connectivity Integrated Circuit

- Bluetooth Chips

- Wi-Fi Chips

- Cellular Chips

- Sensors

- Processors

- Memory

- Displays

- Batteries

- Others

- India Pet Wearable Market, By Application

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation, Safety & Security

- Fitness Monitoring

- Medical Diagnosis & Treatment

- India Pet Wearable Market, By Technology

- Japan

- Japan Pet Wearable Market, By Technology

- RFID

- GPS

- Sensors

- Japan Pet Wearable Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Collar

- Smart Camera

- Smart Harness and Vest

- Others

- Japan Pet Wearable Market Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Dogs

- Cats

- Other Animals

- Japan Pet Wearable Market Component Outlook (Revenue, USD Billion, 2018 - 2030)

- GPS Chips

- RFID Chips

- Connectivity Integrated Circuit

- Bluetooth Chips

- Wi-Fi Chips

- Cellular Chips

- Sensors

- Processors

- Memory

- Displays

- Batteries

- Others

- Japan Pet Wearable Market, By Application

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation, Safety & Security

- Fitness Monitoring

- Medical Diagnosis & Treatment

- Japan Pet Wearable Market, By Technology

- Rest of Asia Pacific

- Rest of Asia Pacific Pet Wearable Market, By Technology

- RFID

- GPS

- Sensors

- Rest of Asia Pacific Pet Wearable Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Collar

- Smart Camera

- Smart Harness and Vest

- Others

- Rest of Asia Pacific Pet Wearable Market Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Dogs

- Cats

- Other Animals

- Rest of Asia Pacific Pet Wearable Market Component Outlook (Revenue, USD Billion, 2018 - 2030)

- GPS Chips

- RFID Chips

- Connectivity Integrated Circuit

- Bluetooth Chips

- Wi-Fi Chips

- Cellular Chips

- Sensors

- Processors

- Memory

- Displays

- Batteries

- Others

- Rest of Asia Pacific Pet Wearable Market, By Application

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation, Safety & Security

- Fitness Monitoring

- Medical Diagnosis & Treatment

- Rest of Asia Pacific Pet Wearable Market, By Technology

- Asia Pacific Pet Wearable Market, By Technology

- Latin America

- Latin America Pet Wearable Market, By Technology

- RFID

- GPS

- Sensors

- Latin America Pet Wearable Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Collar

- Smart Camera

- Smart Harness and Vest

- Others

- Latin America Pet Wearable Market Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Dogs

- Cats

- Other Animals

- Latin America Pet Wearable Market Component Outlook (Revenue, USD Billion, 2018 - 2030)

- GPS Chips

- RFID Chips

- Connectivity Integrated Circuit

- Bluetooth Chips

- Wi-Fi Chips

- Cellular Chips

- Sensors

- Processors

- Memory

- Displays

- Batteries

- Others

- Latin America Pet Wearable Market, By Application

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation, Safety & Security

- Fitness Monitoring

- Medical Diagnosis & Treatment

- Brazil

- Brazil Pet Wearable Market, By Technology

- RFID

- GPS

- Sensors

- Brazil Pet Wearable Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Collar

- Smart Camera

- Smart Harness and Vest

- Others

- Brazil Pet Wearable Market Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Dogs

- Cats

- Other Animals

- Brazil Pet Wearable Market Component Outlook (Revenue, USD Billion, 2018 - 2030)

- GPS Chips

- RFID Chips

- Connectivity Integrated Circuit

- Bluetooth Chips

- Wi-Fi Chips

- Cellular Chips

- Sensors

- Processors

- Memory

- Displays

- Batteries

- Others

- Brazil Pet Wearable Market, By Application

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation, Safety & Security

- Fitness Monitoring

- Medical Diagnosis & Treatment

- Brazil Pet Wearable Market, By Technology

- Mexico

- Mexico Pet Wearable Market, By Technology

- RFID

- GPS

- Sensors

- Mexico Pet Wearable Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Collar

- Smart Camera

- Smart Harness and Vest

- Others

- Mexico Pet Wearable Market Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Dogs

- Cats

- Other Animals