- Home

- »

- Animal Health

- »

-

Pet Wheelchair Market Size & Share, Industry Report, 2030GVR Report cover

![Pet Wheelchair Market Size, Share & Trends Report]()

Pet Wheelchair Market (2025 - 2030) Size, Share & Trends Analysis Report By Pet (Dogs, Cats), By End-use (Pet Owners, Veterinary Clinics), By Product, By Material, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-522-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Wheelchair Market Size & Trends

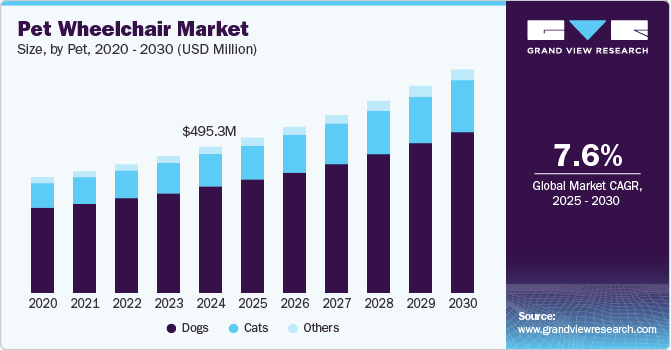

The global pet wheelchair market size was estimated at USD 495.32 million in 2024 and is projected to grow at a CAGR of 7.59% from 2025 to 2030. The growing pet population, increasing pet health awareness, and technological improvements have all contributed to the market’s strong growth. In addition, the increasing need for personalized mobility aids and the effort of major players, such as regional development, are drivers fueling industry growth. For example, Walkin' Wheels dog wheelchairs are available in India through Oliver Pet Care Solutions Pvt. Ltd., a distributor of Walkin Pets.

Furthermore, the market is expanding due to the rising demand for customized and adjustable wheelchairs and carts for dogs and cats with different types of infirmities and the increased use of innovative methods like 3D printing and carbon fiber materials in their production. Wheelchairs and other mobility aids are also covered by pet insurance plans, which encourages owners to think about these options without having to worry about the cost. For example, compared to 2022, the total number of insured pets in the United States increased by 17.1% in 2023. In addition, since 2020, the number of pets insured has risen by an average of 22.6% per year. Increased hospital visits are the reason for this rise in insurance enrollment since it provides owners with financial convenience.

One major driver propelling the pet wheelchair industry is the rising incidence of arthritis in dogs and cats. Pets are increasingly vulnerable to joint-related diseases like osteoarthritis as they get older, which can make it difficult for them to move around. For example, an article from the Morris Animal Foundation in July 2024 states that osteoarthritis affects around 14 million adult dogs in the US, making it a major health problem for owners. Although the precise percentages for cats are yet unknown, 90% of cats older than 12 show signs of osteoarthritis on X-rays. Pet owners are now more aware of mobility devices, such as wheelchairs made to accommodate animals with restricted movement, due to this rising prevalence.

Advancements in veterinary care and pet rehabilitation have increased the adoption of assistive devices, further propelling market growth. With pet humanization trends on the rise, owners are more willing to invest in solutions that enhance their pets’ quality of life, making pet wheelchairs an increasingly popular choice.

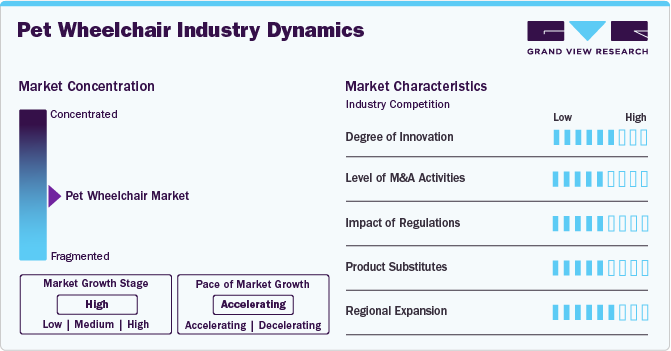

Industry Concentration

In terms of the growth stage, the market is positioned at a moderate level, characterized by significant growth. The expansion of pet insurance coverage beyond veterinary costs, including pet mobility aids, significantly boosts market growth. Pet insurance helps cover costs for mobility aids like pet wheelchairs, making them more accessible to pet owners. Policies covering rehabilitation and assistive devices encourage pet owners to invest in mobility solutions for injured or disabled pets. As pet insurance providers include coverage for assistive devices, awareness about pet mobility solutions, including wheelchairs, increases. More pet owners become aware of these options for their aging, injured, or disabled pets.

Pet Wheelchair Industry Characteristics

The market demonstrates a moderate degree of innovation, characterized by ongoing advancements and customization in products. For instance, some models have incorporated 3D printing technology, enabling precise tailoring to a dog's specific measurements, which enhances support and mobility. Additionally, the integration of smart technologies, such as sensors and mobile applications, allows pet owners to monitor their dog's movement and health metrics in real-time, facilitating timely interventions and adjustments.

Within the market, there exists a moderate level of mergers and acquisitions activity. For instance, in August 2024, Paw Prosper, a pet health and wellness platform, acquired Walkin' Pets, a leading provider of pet wheelchairs and mobility support products. This strategic move aimed to enhance Paw Prosper's offerings for mobility-challenged pets, leveraging Walkin' Pets' extensive product portfolio and established reputation.

Regulations have a moderate impact on the market. Many countries enforce veterinary medical device regulations that require pet wheelchairs to meet specific durability, material safety, and ergonomic standards. ISO certifications or similar regulatory approvals enhance consumer trust and drive compliance with safety norms. Some regions classify pet wheelchairs as assistive veterinary devices, requiring veterinary supervision for prescription and use. FDA (U.S.) and EMA (Europe) regulations may impact the approval and commercialization process.

It is anticipated that substitution risk will remain moderate, depending on the pet's condition and the owner's preferences. Pet slings & harnesses, pet strollers, and splints are some of the substitutes preferred by pet owners. A pet stroller is a popular alternative for small and medium-sized pets that can't walk but don't need leg movement support. While substitutes exist, pet wheelchairs are still the most effective solution for long-term mobility in pets with paralysis or severe limb weakness.

Regional expansion significantly impacts the pet wheelchair market by increasing accessibility, enhancing product awareness, and driving market growth. For instance, Walkin' Pets expanded its global reach, making its adjustable dog wheelchairs available in over 22 countries, including India. Their wheelchairs are designed to support pets with mobility issues such as degenerative myelopathy, arthritis, paralysis, and neurological disorders. The adjustable design ensures a customizable fit for pets of various sizes, aiding in their mobility and overall well-being.

Pet Insights

The dog segment dominated the market with the largest revenue share of over 72.0% in 2024, driven by the large number of dogs kept as pets worldwide, their popularity as companions, and their sizeable share in the veterinary healthcare industry. The need for pet healthcare and mobility solutions is growing as more people adopt dogs into their homes. Wheelchairs are helpful for elderly dogs, injured dogs, and dogs with mobility problems brought on by diseases such as arthritis, hip dysplasia, or paralysis. The American Pet Products Association reports that, in 2024, there were more than 58.0 million pet dogs in the US alone, demonstrating how common dogs are as companion animals.

The cat segment is expected to grow at a CAGR of 8.04% from 2025 to 2030. This growth is attributed to the increasing prevalence of diabetes in cats. For instance, according to a December 2024 article by Chewy, one of the most prevalent conditions in cats is diabetes. In fact, one in every 100 cats is predicted to get diabetes at some point in their lives. Cats weighing more than nine pounds are also far more likely to have diabetes. A cat's quality of life may be affected by hind limb weakness brought on by feline diabetes, which frequently results in neuropathy. Pet wheelchair demand is increasing as more pet owners look for ways to improve the mobility of their diabetic cats. In addition, new, lightweight, and adaptable wheelchairs are facilitating the recovery of mobility for diabetic cats, driving the segment growth.

Product Insights

Adjustable wheelchairs held the largest revenue share, over 75%, in 2024. Due to their versatility and adaptability for pets of various sizes and mobility conditions, this segment is also anticipated to grow at the fastest CAGR over the forecast period. These wheelchairs provide customizable support for pets suffering from mobility issues caused by injuries, arthritis, degenerative diseases, or congenital disabilities.

Moreover, adjustable wheelchairs can accommodate pets of various sizes, breeds, and mobility needs. They can be modified for different limb disabilities accordingly for support required for the front or rear limb. In addition, as pets grow or their mobility conditions change, adjustable wheelchairs can be adapted, reducing the need for multiple purchases. Furthermore, their adaptability, cost-effectiveness, and ability to improve pet mobility make it a preferred choice for both pet owners and veterinary professionals.

Material Insights

Aluminum wheelchairs dominated the market in 2024 due to their lightweight, durability, and resistance to rust. Pet owners prefer aluminum wheelchairs because they balance strength and comfort well, ensuring easy mobility for pets with disabilities or injuries. In addition, the rising demand for personalized and adjustable pet wheelchairs further supports the dominance of aluminum-based designs.

Others is expected to grow at the fastest CAGR over the forecast period. High-quality plastics, such as reinforced polymer composites, make pet wheelchairs easy to maneuver, especially for smaller pets. Plastic components reduce manufacturing costs, making pet wheelchairs more affordable and accessible. Moreover, increasing demand for customizable solutions further fuels the segment growth. The combination of plastic and stainless steel allows manufacturers to create adjustable and foldable designs tailored to different pet sizes and needs.

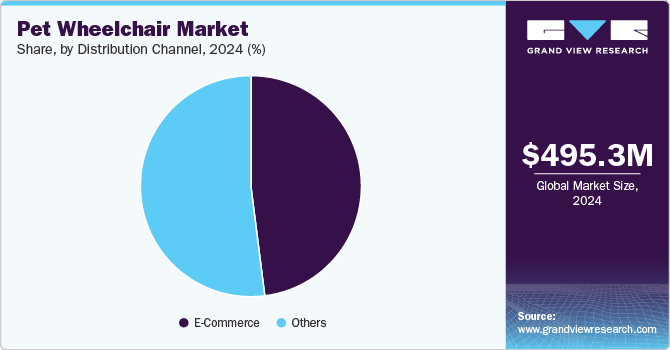

Distribution Channel Insights

The others segment dominated the market in 2024, driven by consumers’ preference for in-store purchases that allow them to physically evaluate the products before buying. Pet specialty stores or departmental stores offer a broad range of pet wheelchairs tailored to different pet sizes, breeds, and mobility needs, making them a go-to choice for pet owners. Customers often prefer to purchase from well-known specialty and department stores with trusted brands, ensuring product quality and reliability. Furthermore, most pet specialty stores provide fitting and customization services, allowing pet owners to ensure a proper fit before purchasing.

The e-commerce segment is expected to grow at the fastest CAGR during the forecast period, driven by increased e-commerce platform adoption and the convenience of online purchasing. Platforms like Chewy, Amazon, and specialty pet care websites draw customers due to their extensive product selection, affordable prices, and ease of comparing features and ratings. Furthermore, because of the integration of advanced delivery methods and the growing trust in secure payment gateways, online shopping is becoming increasingly popular, especially among tech-savvy and urban consumers.

End-use Insights

The pet owners dominated the market and held the largest revenue share in 2024, owing to the growing awareness about their pet health. Many pet owners consider animals to be family members and are prepared to spend money on assistive technology, such as wheelchairs, to enhance their quality of life. In addition, rising pet expenses fuel the segment's growth. For example, APPA estimated that around USD 12.6 billion was spent on pet services in 2024. Pet wheelchairs are a developing market as pet owners spend more money on healthcare and assistive items.

Veterinary clinics is anticipated to grow at the fastest CAGR over the forecast period. Veterinary clinics diagnose conditions such as arthritis, hip dysplasia, degenerative myelopathy, and spinal injuries, leading to a higher demand for pet wheelchairs. Many clinics prescribe wheelchairs as part of post-surgery recovery plans, especially after orthopedic or neurological procedures. As veterinary care advances, the integration of assistive devices like wheelchairs is becoming more widespread, fueling the segment growth.

Regional Insights

The North America pet wheelchairs industry held the largest revenue share of 54.90% in 2024. Increased pet ownership, increased owners’ awareness, improvements in veterinary treatment, the rise in bone health problems, the acceptance of pet insurance, and the presence of top manufacturers are the main drivers of the growth. The market growth is further supported by the region's robust presence of businesses offering a variety of goods. Important companies, including Doggon Wheels, Eddie's Wheels for Pets, and K9 Carts, are actively involved in a number of strategic activities to fortify their positions and bolster their market share in North America.

U.S. Pet Wheelchair Market Trends

The pet wheelchair industry in the U.S. is driven by the increasing uptake of pet insurance and rising pet ownership. Pet insurance plans that cover rehabilitation and mobility aids make it more affordable for pet owners to purchase wheelchairs for their animals. The significant rise in pet insurance's yearly gross written premium suggests that pet owners are increasingly purchasing pet insurance globally. The State of the Industry (SOI) 2024 report from the North American Pet Health Insurance Association (NAPHIA) states that the GWP has grown significantly between 2019 and 2023, rising by almost 35%. By 2023, the GWP had grown from its 2019 valuation of over USD 1.5 billion to over USD 3.9 billion.

Europe Pet Wheelchair Market Trends

The Europe pet wheelchair industry is driven by increasing pet humanization and increasing prevalence of mobility issues in pets. For instance, the data published by FEDIAF and GlobalPETS in October 2024 showed that over 352 million pets of different kinds, primarily dogs and cats, reside in Europe. There are around 129 million cats and 106 million dogs. These figures show how important pets are to many families in Europe. With the expansion in the population, there is also an increase in the need for items that simplify their life, such as wheelchairs and carts.

The pet wheelchair industry in the UK is expected to grow significantly over the forecast period, owing to the rising prevalence of arthritis in pets in the country. According to an article published by Canine Arthritis Management, osteoarthritis is the most frequent cause of persistent discomfort in dogs in the UK. Up to 35% of dogs of all ages are likely to be impacted, and 80% of canines older than 8 years develop arthritis. In companion animals like dogs, it is regarded as a welfare issue, particularly if treatment is not received. The need for mobility devices like pet wheelchairs is rising as more pets, particularly elderly dogs and cats, develop arthritis, severely impairing their mobility.

Asia Pacific Pet Wheelchair Market Trends

The Asia Pacific Pet wheelchair industry is anticipated to grow at the fastest CAGR during the forecast period. The increasing popularity of pet ownership is driving wheelchair demand, increasing disposable incomes, and changing lifestyles in nations such as China, Japan, and India. The region's adoption of these items is being driven by a focus on enhancing care and a growing awareness of health issues. Furthermore, improving pets' quality of life, including resolving mobility issues, is becoming increasingly important.

The pet wheelchair industry in India is significantly fueled by the existence of sanctuaries and the actions these groups have taken across the country, where pet owners are increasingly treating their animals like members of the family. Numerous sanctuaries rescue and rehabilitate animals with immobility issues because of wounds, congenital deformities, or age-related illnesses. These groups frequently look for ways to improve the quality of life for pets with disabilities, including pet wheelchairs, which raise demand. For example, the Stray Animal Foundation of India aims to provide all of the sanctuary's disabled canines with wheelchairs. They have about 20-30 paralyzed animals at a time. In addition, the sanctuary intends to employ a certified veterinary technician to assemble the wheelchairs every day.

Latin America Pet Wheelchair Market Trends

The pet wheelchair industry in Latin America is experiencing growth driven by the increasing pet population and pet humanization. For example, Argentina has around 10.0 million dogs as of 2024. The need for mobility assistance is greatly influenced by these variables, especially as pet healthcare becomes more well-recognized. Wheelchairs are among the products that benefit from the aging and disabled pet population. Pet owners are further encouraged to invest in solutions that enhance their pets' quality of life by growing urbanization and pet humanization tendencies.

The pet wheelchair industry in Brazil is experiencing growth due to aging and special needs pets and growing awareness of pet healthcare. There is a rising awareness among Brazilian pet owners regarding the health and well-being of their animals. This awareness drives the adoption of mobility aids to assist pets with disabilities or mobility challenges, ensuring they maintain an active and comfortable lifestyle. As pets age, they become more susceptible to mobility issues such as arthritis, hip dysplasia, and other degenerative conditions. The increasing number of aging pets in Brazil leads to a higher demand for mobility solutions like wheelchairs, prosthetics, and slings to enhance their quality of life.

MEA Pet Wheelchair Market Trends

The pet wheelchair industry in the Middle East and Africa region is being driven by the increasing cases of pet injuries and disabilities and the expansion of e-commerce and pet retail channels. Traffic accidents, genetic disorders, and joint-related ailments like arthritis in pets are fueling the demand for mobility solutions. The rise of online pet stores and veterinary e-commerce platforms makes pet wheelchairs more accessible across the MEA region.

The pet wheelchair industry in Saudi Arabia is being fueled by advancements in veterinary care, the availability of customized solutions, and the rising trend of pet humanization. Improvements in veterinary medicine have increased the survival rates of pets with mobility impairments, thereby creating a need for supportive devices like wheelchairs to aid in their rehabilitation and daily activities. Moreover, pet owners are becoming more attuned to their pets' health and mobility challenges due to age, injury, or congenital conditions. This heightened awareness drives the demand for solutions such as pet wheelchairs to enhance pets' quality of life.

Key Pet Wheelchair Company Insights

The market is fairly competitive due to the presence of multiple small- and large-scale companies. Moreover, companies are increasingly adopting various strategies, such as mergers and acquisitions, geographic expansion, and product launches, to expand their market shares. This industry is witnessing moderate-to-high innovation due to constant research initiatives.

Key Pet Wheelchair Companies:

The following are the leading companies in the pet wheelchair market. These companies collectively hold the largest market share and dictate industry trends.

- Doggon Wheels

- Eddie's Wheels for Pets

- K9 Carts

- Pfaff Tierorthopädie

- Best friend Mobility

- Walkin' Pets

- Mintbowl Inc.

- LaraCart Dog Wheelchairs

- Orthopets

- Animal Ortho Care

Recent Developments

-

In November 2024, Paw Prosper acquired K9 Mobility to strengthen its presence in Europe through a dedicated E-commerce platform. This acquisition will help consumers with easy access, leading to increased adoption of pet mobility aids.

-

In July 2024, K9 Carts, the company that created the first pet wheelchair, launched a new logo and website that better represents its goal of assisting animals in maintaining their mobility so they can lead the best possible lives.

Pet Wheelchair Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 527.34 million

Revenue forecast in 2030

USD 760.38 million

Growth Rate

CAGR of 7.59% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet, product, material type, distribution channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa and Kuwait

Key companies profiled

Doggon Wheels; Eddie's Wheels for Pets; K9 Carts; Pfaff Tierorthopädie; Best friend Mobility; Walkin' Pets; Mintbowl Inc.; LaraCart Dog Wheelchairs; Orthopets; Animal Ortho Care

Customization scope

Free report customization (equivalent upto 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Wheelchair Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet wheelchair market report based on pet, product, material, distribution channel, end-use, and region:

-

Pet Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Adjustable Wheelchairs

-

Non-Adjustable Wheelchairs

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Aluminum

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Others

-

E-Commerce

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Clinics

-

Pet Rehabilitation Centers

-

Pet Owners

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LATAM

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global pet wheelchair market size was estimated at USD 495.32 million in 2024 and is expected to reach USD 527.34 million in 2025.

b. The global pet wheelchair market is expected to grow at a compound annual growth rate of 7.59% from 2025 to 2030 to reach USD 760.38 million by 2030.

b. North America dominated the pet wheelchair market with a share of 54.90% in 2024. This is attributable to increased pet ownership, increased owners’ awareness, improvements in veterinary treatment, the rise in bone health problems, the acceptance of pet insurance, and the presence of top manufacturers

b. Some key players operating in the pet wheelchair market include Doggon Wheels, Eddie's Wheels for Pets, K9 Carts, Pfaff Tierorthopädie, Best friend Mobility, Walkin' Pets, Mintbowl Inc., LaraCart Dog Wheelchairs, Orthopets, Animal Ortho Care

b. Key factors that are driving the market growth include growing pet population, increasing pet health awareness, the growing need for personalized mobility aids, and technological improvements

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.