- Home

- »

- Organic Chemicals

- »

-

PFAS Treatment Market Size & Share, Industry Report, 2033GVR Report cover

![PFAS Treatment Market Size, Share & Trends Report]()

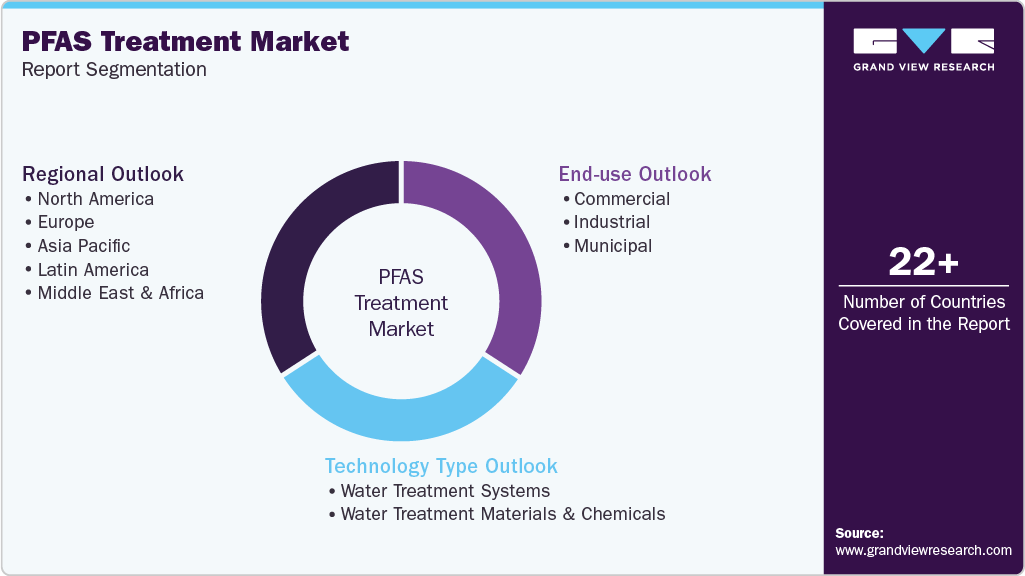

PFAS Treatment Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology Type (Water Treatment Systems, Water Treatment Materials & Chemicals), By End-use Industry (Commercial, Industrial, Municipal), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-789-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

PFAS Treatment Market Summary

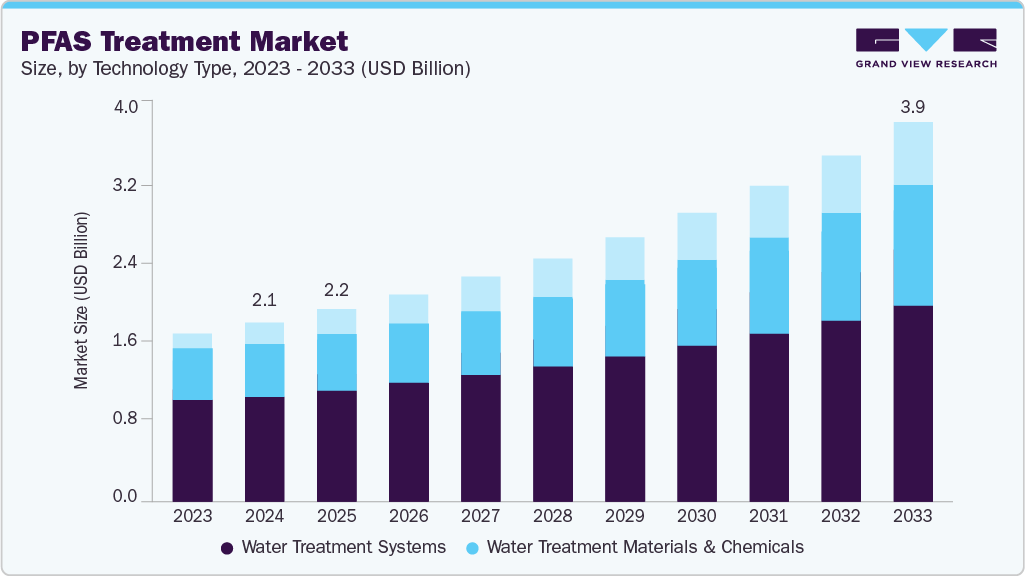

The global PFAS treatment market size was estimated at USD 2,081.9 million in 2024 and is projected to reach USD 3,859.4 million by 2033, growing at a CAGR of 7.2% from 2025 to 2033. The market is primarily driven by increasingly stringent environmental regulations, rising public awareness of PFAS-related health risks, and the growing need for sustainable water and soil remediation solutions.

Key Market Trends & Insights

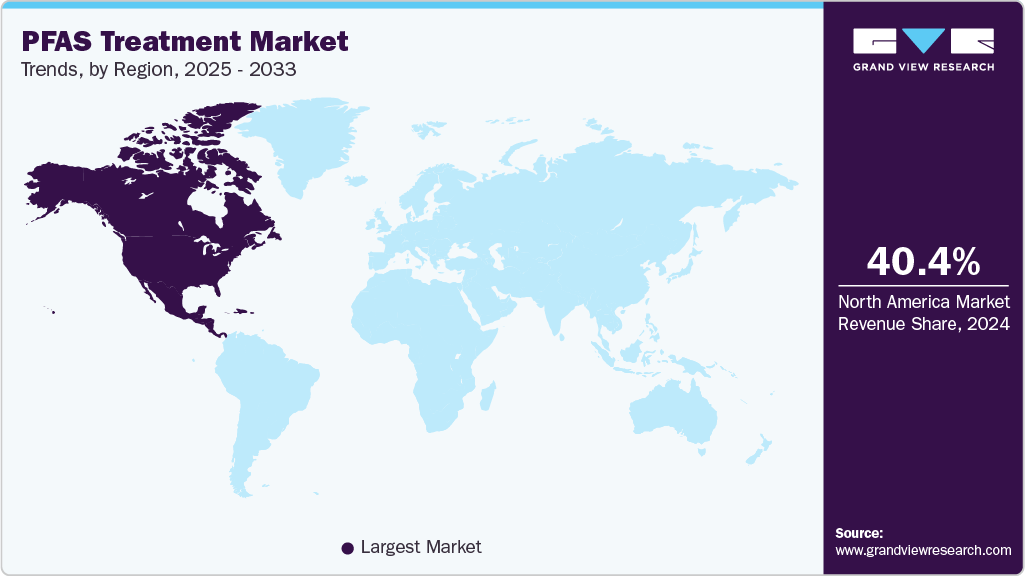

- North America dominated the per- and polyfluoroalkyl substances (PFAS) treatment market with the largest revenue share of 40.4% in 2024.

- The United States, accounting for 74.7% of North America’s PFAS treatment market in 2024.

- By technology type, the water treatment systems segment held the largest revenue share of 66.6% in 2024 in terms of value.

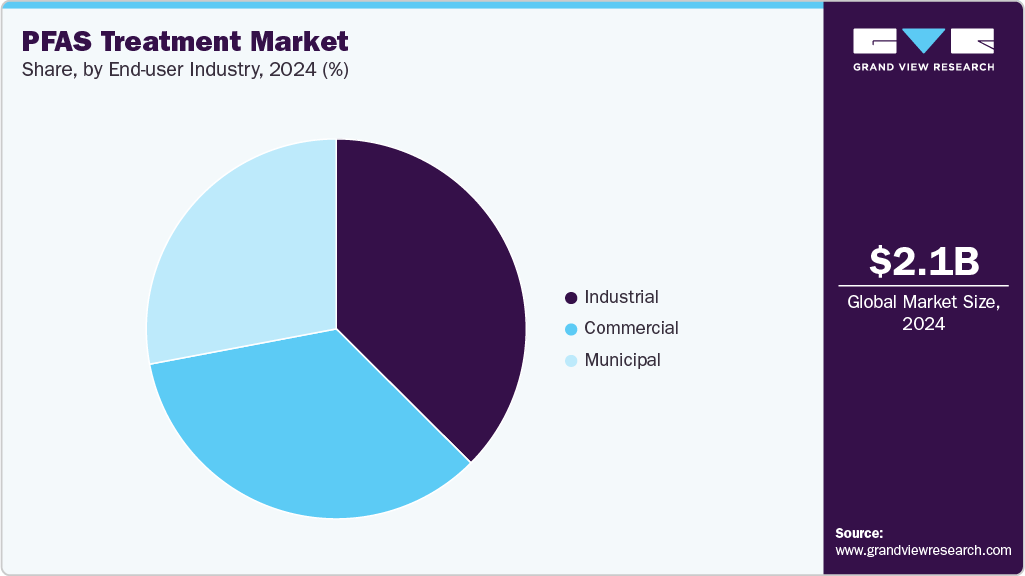

- By end-use industry, the industrial segment held the largest revenue share of 37.5% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 2,081.9 Million

- 2033 Projected Market Size: USD 3,859.4 Million

- CAGR (2025-2033): 7.2%

- North America: Largest market in 2024

Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) are enforcing stricter limits on PFAS concentrations in drinking water, prompting municipalities and industries to adopt advanced treatment technologies. The expanding investments in wastewater infrastructure, coupled with technological advancements in adsorption, membrane filtration, and destruction processes, are accelerating market adoption across industrial, commercial, and municipal sectors.The market presents significant growth opportunities driven by increasing investments in advanced remediation technologies and the emergence of sustainable treatment materials. The rising focus on green chemistry and circular economy principles is fostering the development of eco-friendly adsorbents, regenerable resins, and PFAS destruction methods such as plasma and electrochemical oxidation. The expansion of public-private partnerships for large-scale contamination cleanup, coupled with growing demand for decentralized and mobile treatment systems, is opening new avenues for solution providers. The integration of digital monitoring tools and AI-driven analytics for real-time PFAS detection further enhances the operational efficiency and scalability of treatment solutions.

Despite its growth potential, the per- and polyfluoroalkyl substances (PFAS) treatment market faces key challenges such as high operational costs, limited full-scale technology validation, and the complexity of complete PFAS destruction. Many conventional treatment technologies, including granular activated carbon and ion exchange resins, are effective only for short-chain PFAS removal, leading to secondary waste management concerns. The absence of globally harmonized regulatory standards and variations in permissible PFAS limits across regions create uncertainty for industry participants. Technical limitations in achieving cost-effective, long-term remediation at large, contaminated sites continue to hinder widespread adoption, particularly in developing economies with constrained budgets for environmental management.

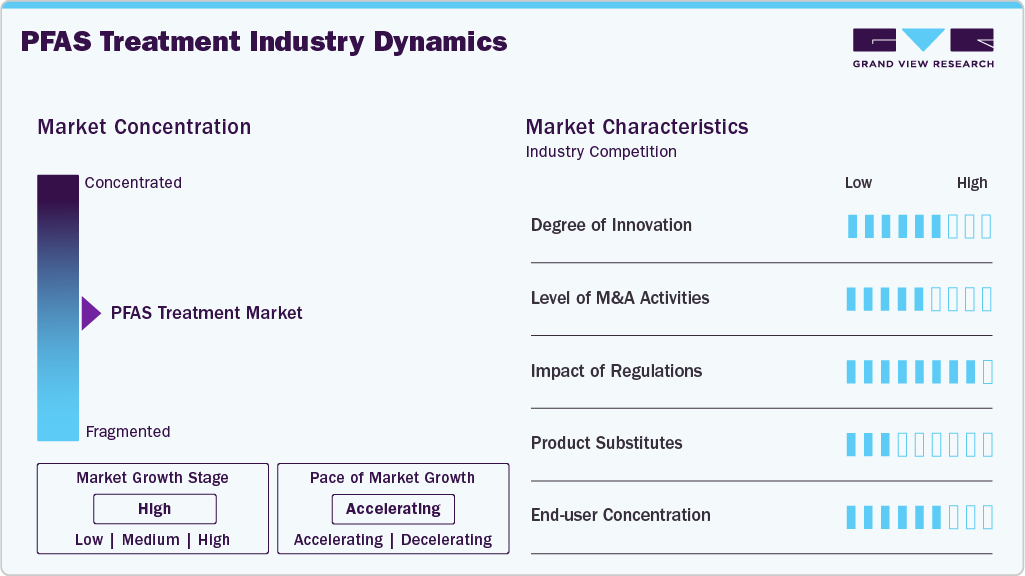

Market Concentration & Characteristics

The competitive landscape of the global per- and polyfluoroalkyl substances (PFAS) treatment market is characterized by the presence of both established environmental engineering firms and specialized technology providers focusing on advanced water treatment solutions. Leading players such as Veolia, AECOM, Xylem, Pentair, WSP, Jacobs, and CDM Smith, Inc. dominate the market through extensive project portfolios, strong regulatory expertise, and end-to-end service offerings covering design, installation, and maintenance of PFAS remediation systems. These companies are leveraging advanced treatment technologies, including granular activated carbon (GAC), ion exchange, and high-pressure membrane systems, to deliver scalable solutions for industrial, municipal, and commercial applications. Strategic collaborations, government contracts, and long-term service agreements with municipalities and industrial clients are key competitive strategies enhancing their market positioning.

Emerging and mid-sized players such as Cyclopure, Inc., Mineral Technologies, Inc., and TRC Companies, Inc. are strengthening their foothold through innovation in material science and cost-effective treatment solutions. Cyclopure’s development of cyclodextrin-based adsorbents and Mineral Technologies’ mineral-derived filtration materials represent a shift toward sustainable and high-efficiency PFAS capture technologies. Companies are increasingly investing in R&D and pilot-scale demonstrations to validate destruction technologies such as plasma treatment and electrochemical oxidation, which are gaining traction for complete PFAS degradation. The market is thus witnessing growing competition centered on technological differentiation, performance efficiency, and lifecycle cost optimization, with players aiming to secure a competitive edge in the evolving regulatory and sustainability landscape.

Technology Type Insights

The water treatment systems segment dominated the global PFAS treatment market with the largest revenue share of 66.6% in 2024, primarily driven by its widespread adoption across municipal and industrial applications for large-scale water purification and remediation projects. The growing enforcement of stringent regulatory standards for PFAS levels in drinking and wastewater has driven municipalities and industries to invest in proven, full-scale treatment systems such as granular activated carbon (GAC), ion exchange resins, and reverse osmosis (RO) units. These systems offer high removal efficiency, scalability, and reliability, making them the preferred choice for both temporary and permanent installations. Technological advancements such as integrated monitoring systems, modular configurations, and hybrid treatment units have enhanced operational flexibility and performance efficiency, further reinforcing the dominance of this segment in 2024.

The water treatment materials and chemicals segment is witnessing steady growth, supported by increasing innovation in adsorbent materials and advanced filtration media designed for PFAS capture and degradation. Companies are focusing on developing sustainable and regenerable materials, such as cyclodextrin-based polymers, zeolites, and mineral-based adsorbents, to reduce secondary waste and overall treatment costs. These advanced materials are gaining traction among industrial end users seeking cost-effective and environmentally responsible solutions. Moreover, the continuous R&D investments by emerging players such as Cyclopure, Inc., and Mineral Technologies, Inc. are driving the transition from traditional sorbents to next-generation functionalized materials with higher affinity and faster kinetics for PFAS removal. As regulatory frameworks tighten globally, the demand for high-performance treatment chemicals and materials is expected to grow, complementing system-based solutions and expanding the market’s overall technological landscape.

End-use Industry Insights

The industrial segment dominated the global PFAS treatment market with the largest revenue share of 37.5% in 2024, primarily attributed to the widespread use of PFAS compounds across manufacturing sectors such as chemicals, textiles, electronics, and metal plating. These industries are under increasing regulatory and environmental pressure to mitigate PFAS discharge from production processes and wastewater streams. The growing emphasis on corporate sustainability, coupled with rising compliance requirements under frameworks such as the U.S. EPA’s PFAS Strategic Roadmap and the EU REACH regulations, has accelerated the adoption of advanced on-site treatment systems. Industrial players are increasingly investing in technologies such as ion exchange, membrane filtration, and high-efficiency adsorbents to ensure regulatory compliance and minimize environmental liabilities. Furthermore, the integration of PFAS treatment systems into existing industrial water management infrastructure has contributed to strong market penetration within this segment.

The commercial and municipal segments also represent significant growth areas in the PFAS treatment market. The commercial sector, including airports, firefighting training facilities, and industrial parks, is witnessing rising demand for remediation of legacy PFAS contamination and preventive treatment of runoff and effluents. Meanwhile, the municipal segment continues to expand, driven by growing public concern over PFAS-contaminated drinking water and the enforcement of stringent water quality standards. Municipal utilities are deploying large-scale treatment systems based on granular activated carbon (GAC), ion exchange, and reverse osmosis technologies to ensure compliance with national and regional guidelines. Supported by government funding and infrastructure modernization initiatives, both commercial and municipal end users are expected to increasingly adopt PFAS treatment solutions, reinforcing the market’s long-term growth trajectory.

Regional Insights

North America PFAS treatment market dominated the respective global market with a 40.4% market share in 2024, driven by stringent regulatory frameworks, advanced water treatment infrastructure, and strong government commitment to addressing PFAS contamination. The region’s leadership is reinforced by the U.S. Environmental Protection Agency’s (EPA) PFAS Strategic Roadmap and state-level mandates enforcing maximum contaminant levels (MCLs) in drinking water. Significant federal and state funding for site remediation and wastewater treatment modernization has accelerated technology adoption across industrial, municipal, and commercial sectors. Moreover, the strong presence of leading market participants such as Veolia, AECOM, and Xylem, coupled with ongoing technological innovation, continues to position North America as the global hub for PFAS treatment solutions.

U.S. PFAS Treatment Market Trends

The United States, accounting for 74.7% of North America’s PFAS treatment market in 2024, remains the focal point of regulatory action and technology deployment. Growing public concern over groundwater contamination and heightened scrutiny from the EPA and state agencies have prompted rapid adoption of advanced treatment technologies, particularly in the municipal and industrial sectors. Federal infrastructure programs and remediation grants under the Bipartisan Infrastructure Law are providing significant financial backing for large-scale PFAS removal projects. Furthermore, collaboration between government agencies, technology developers, and consulting firms such as Jacobs and CDM Smith, Inc. is fostering innovation in PFAS destruction methods, including plasma and electrochemical oxidation, driving continued market expansion in the U.S.

Europe PFAS Treatment Market Trends

Europe captured a 28.6% market share in 2024, supported by the region’s comprehensive regulatory environment and proactive measures to phase out PFAS-containing products. The European Union’s REACH regulation, coupled with the Drinking Water Directive, has set strict limits on PFAS levels, driving significant investment in treatment infrastructure and remediation projects. Countries such as Germany, the Netherlands, and Sweden are leading the implementation of PFAS monitoring and removal technologies. The presence of major engineering and environmental consulting firms such as WSP and Veolia has further strengthened Europe’s competitive landscape. Continuous R&D in adsorption and advanced oxidation processes reflects the region’s focus on sustainable and energy-efficient treatment solutions.

PFAS treatment market in Germany holds a prominent position within the European PFAS treatment market due to its stringent environmental policies, well-developed water management infrastructure, and strong emphasis on sustainability. The country’s regulatory alignment with the EU Drinking Water Directive and national guidelines has accelerated the implementation of PFAS monitoring and remediation programs across municipal and industrial sectors. German utilities and engineering companies are actively deploying granular activated carbon (GAC) and membrane-based treatment technologies to meet compliance standards. Furthermore, ongoing government-supported pilot projects and research initiatives on PFAS destruction and recovery technologies underscore Germany’s leadership in advancing clean water innovation and regulatory-driven market growth.

Asia Pacific PFAS Treatment Market Trends

The Asia Pacificregion accounted for a 22.1% market share in 2024, driven by rising industrialization, growing environmental awareness, and evolving regulatory frameworks targeting PFAS contamination. Countries such as China, Japan, South Korea, and Australia are increasing investments in wastewater treatment infrastructure and implementing stricter discharge norms. The rapid growth of manufacturing industries, particularly electronics and textiles, has intensified the need for effective PFAS remediation solutions. The region’s market growth is also supported by the introduction of advanced treatment systems and locally tailored technologies developed by both international and regional players. Moreover, the increasing adoption of public-private partnerships for environmental restoration projects is enhancing market expansion across Asia Pacific.

PFAS treatment market in China dominated the Asia Pacific PFAS treatment market with a revenue share of 55.9% in 2024, driven by extensive industrial activity, heightened environmental concerns, and expanding regulatory oversight. The government’s focus on sustainable industrial development and stricter enforcement of wastewater discharge standards have spurred significant demand for PFAS removal technologies. Investments in municipal water treatment, modernization and industrial effluent management are further fueling market growth. In addition, domestic companies are increasingly collaborating with international technology providers to deploy advanced adsorption and membrane filtration systems. The emphasis on green manufacturing practices and environmental accountability continues to position China as a major growth center for PFAS treatment solutions in the region.

Middle East & Africa PFAS Treatment Market Trends

The Middle East & Africa per- and polyfluoroalkyl substances (PFAS) treatment market remains in the early stages of development but is gaining momentum as governments increase their focus on sustainable water management and environmental protection. The region’s growth is primarily driven by infrastructure modernization initiatives, particularly in the Gulf Cooperation Council (GCC) countries, where water scarcity concerns are encouraging the use of advanced treatment systems. Industrial sectors such as oil and gas, chemicals, and manufacturing are beginning to adopt PFAS remediation solutions to comply with emerging environmental standards. Collaboration with international technology providers and consulting firms is expected to accelerate the deployment of efficient and scalable PFAS treatment systems across both urban and industrial applications in the coming years.

Latin America PFAS Treatment Market Trends

In Latin America, the PFAS treatment market is in a nascent but steadily growing phase, driven by increasing awareness of water contamination issues and gradual regulatory development. Countries such as Brazil, Mexico, and Chile are investing in improving their water treatment infrastructure and initiating PFAS monitoring programs. The market is primarily supported by industrial users in sectors such as mining, petrochemicals, and manufacturing, where PFAS discharge control is becoming a growing concern. International partnerships and technical collaborations with established players from North America and Europe are enabling the adoption of cost-effective PFAS removal technologies, laying the foundation for long-term market expansion across the region.

Key PFAS Treatment Company Insights

Key players, such as Veolia, AECOM, Xylem, Pentair, WSP, and Jacobs are dominating the market.

-

Veolia is a global leader in environmental services, specializing in water, waste, and energy management solutions with a strong presence in the PFAS treatment market. The company offers a comprehensive portfolio of advanced technologies, including granular activated carbon (GAC), ion exchange, and membrane filtration systems, tailored for both industrial and municipal applications. Leveraging its extensive experience in large-scale water treatment infrastructure, Veolia provides end-to-end PFAS management solutions—from site assessment and pilot testing to full-scale implementation and ongoing system optimization. The company’s commitment to sustainability and innovation is reflected in its continuous R&D investments aimed at enhancing PFAS capture efficiency and developing emerging destruction methods, such as electrochemical oxidation. Through strategic collaborations with government bodies and industrial clients, Veolia continues to strengthen its market leadership by delivering reliable, compliant, and sustainable solutions for PFAS remediation worldwide.

Key PFAS Treatment Companies:

The following are the leading companies in the PFAS treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Veolia

- AECOM

- Xylem

- Pentair

- WSP

- Jacobs

- TRC Companies, Inc.

- Cyclopure, Inc.

- Mineral Technologies, Inc.

- CDM Smith, Inc.

PFAS Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,213.1 million

Revenue forecast in 2033

USD 3,859.4 million

Growth rate

CAGR of 7.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology type, end-use industry, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Veolia; AECOM; Xylem; Pentair; WSP; Jacobs; TRC Companies, Inc.; Cyclopure, Inc.; Mineral Technologies, Inc.; CDM Smith, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global PFAS Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global PFAS treatment market report based on technology type, end-use industry, and region:

-

Technology Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Water Treatment Systems

-

Water Treatment Materials & Chemicals

-

-

End-use Industry Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Commercial

-

Industrial

-

Municipal

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global per- and polyfluoroalkyl substances (PFAS) treatment market size was estimated at USD 2,081.9 million in 2024 and is expected to reach USD 2,213.1 million in 2025.

b. The per- and polyfluoroalkyl substances (PFAS) treatment market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2033 to reach USD 3,859.4 million by 2033.

b. The industrial segment dominated the PFAS treatment market with a 37.5% revenue share in 2024 due to the extensive use of PFAS compounds across manufacturing industries such as chemicals, textiles, and electronics, which generate high volumes of PFAS-contaminated wastewater. Growing regulatory scrutiny and stringent discharge standards have driven industries to adopt advanced on-site treatment technologies to ensure compliance and mitigate environmental risks. The increasing corporate sustainability commitments and investments in wastewater management infrastructure have further reinforced the segment’s leading position.

b. Some of the key players operating in the PFAS treatment market include Veolia, AECOM, Xylem, Pentair, WSP, Jacobs, TRC Companies, Inc., Cyclopure, Inc., Mineral Technologies, Inc., and CDM Smith, Inc.

b. The growth of the PFAS treatment market is driven by increasingly stringent environmental regulations, heightened public awareness of PFAS-related health risks, and the growing need for sustainable remediation solutions. Regulatory initiatives such as the U.S. EPA’s PFAS Strategic Roadmap and the EU’s REACH restrictions are compelling industries and municipalities to adopt advanced treatment technologies. The rising investments in water and wastewater infrastructure modernization are further propelling market expansion globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.