- Home

- »

- Renewable Chemicals

- »

-

Pharmaceutical Fine Chemicals Market Size Report, 2030GVR Report cover

![Pharmaceutical Fine Chemicals Market Size, Share & Trends Report]()

Pharmaceutical Fine Chemicals Market Size, Share & Trends Analysis Report By Type (Proprietary, Non Proprietary), By Product, By Chemical, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-978-4

- Number of Report Pages: 122

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

Market Size & Trends

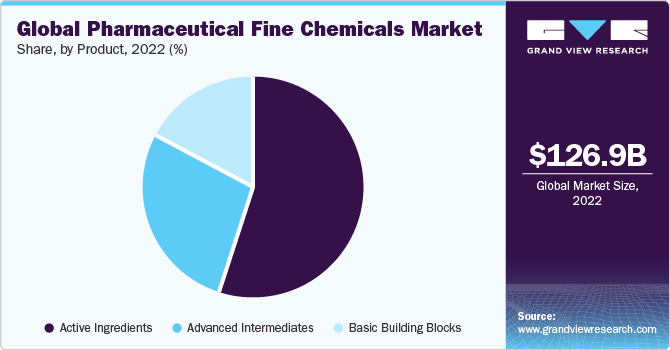

The global pharmaceutical fine chemicals market size was valued at USD 126.9 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. The increasing elderly population in conjunction with a growing awareness of health among consumers is projected to drive an increase in demand over the predicted timeframe. Pharmaceutical fine chemicals, often referred to as fine chemicals, differ from generic commodity chemicals because they are pure substances. They possess a low volume and a higher price structure. These pure chemicals are combined with foundational chemicals to transform into intricate compounds that find diverse uses across sectors like agriculture, pharmaceuticals, and nutraceuticals.

The production of pharmaceutical fine chemicals relies on raw products that are regulated by the U.S. FDA. This agency has established quality benchmarks for both the raw products and the goods produced using pharmaceutical fine chemicals. The U.S. EPA has provided directives that promote the establishment of environmentally conscious industrial plants for these chemicals, which are also economically viable.

In the worldwide market, prominent players in the industry are dedicating their efforts to research and development endeavors. To take advantage of emerging prospects in areas like the Asia Pacific and Central & South America, corporations are establishing production sites to expand their presence in these regions.

Product Insights

The active ingredients segment accounted for the largest revenue share of 54.9% in 2022. Companies are maintaining global active pharmaceutical ingredients (API) manufacturing facilities to facilitate efficient service to their customers. The molecules are manufactured under stringent quality checks, as customers demand high purity, quality, strength, and identity.

The basic building blocks segment is expected to register a CAGR of 7.5% over the forecast period. Basic building blocks is a virtual molecular fragment possessing a reactive functional group. Building blocks include acids, acid chlorides, esters, brominated derivatives, ketones, nitrile derivatives, and heterocyclic compounds among others.These compounds are employed in the production of a wide array of medications aimed at addressing a diverse range of illnesses, including cardiovascular, musculoskeletal, and neurological conditions. Companies engaged in the production of these foundational components are intensifying their efforts towards enhancing quality. The extensive versatility of these compounds, along with the tactics embraced by the building block manufacturers, is projected to be a driving force behind the growth of this segment.

Companies are outsourcing their intermediate manufacturing requirements to offset the economic pressure as well as the regulatory barriers. The companies’ manufacturing advanced intermediates work in collaboration with the large as well as small pharmaceutical companies for sourcing lower cost, and high-quality pharmaceutical intermediates.

Type Insights

The proprietary segment accounted for the largest revenue share of 81.6% in 2022. Proprietary drugs are drugs that are protected by patents and have a trading name. Companies strive to develop proprietary drugs for achieving maximum profit share. The industry participants are using technologies to manufacture drugs, which are cost-competitive as well as effective. Most of the pharmaceutical fine chemicals are used as building blocks for proprietary products.

The non proprietary segment is expected to grow at the fastest CAGR of 8.2% during the forecast period. The utilization of pharmaceutical fine chemicals in the production of non-proprietary drugs is anticipated to experience substantial growth throughout the projected period. Non-proprietary drugs, also known as generic drugs, are those whose patents have expired. They are typically sold at a lower cost compared to their proprietary equivalents. Increasing awareness about generic drugs, coupled with the expiration of patents for proprietary drugs, is projected to contribute to the market demand for this sector over the forecast period.

Regional Insights

North America dominated the global pharmaceutical fine chemicals market and accounted for the largest revenue share of 37.3% in 2022. North America region is characterized by the presence of strict laws and regulations about manufacturing as well as consumption. The claims made by the drug producers regarding the efficacy of their product need to be validated by the proper regulatory agencies before the product launch. The region is also characterized by people having a strong inclination towards preventive healthcare. Also, a wide awareness of drug use is also a key regional characteristic.

Asia Pacific is expected to grow at the fastest CAGR of 8.4% during the forecast period. High population growth in countries such as China and India coupled with the rising disposable income as well the increasing standard of living is catering to market growth in the region. Rising government healthcare expenditure in the region is also expected to benefit the market demand over the forecast period.

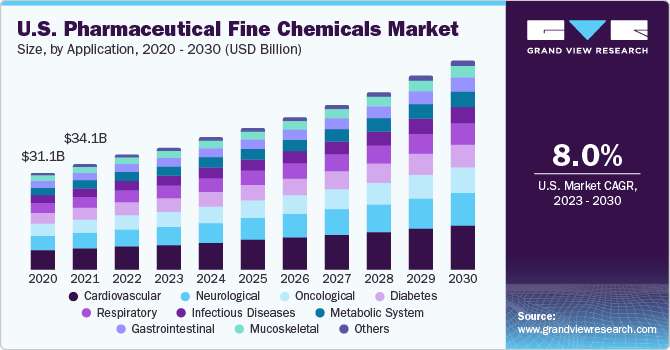

Application Insights

The cardiovascular segment held the largest revenue share of 21.1% in 2022. The chemicals are utilized to manufacture medicines & drugs for the treatment of heart and blood vessels diseases. This application segment is expected to have high market penetration and high growth over the forecast period.

Diabetes is one of the most common diseases in the world today. To treat this, individuals living with diabetes are often subjected to a particular diet. This diet often includes products and medicines, which are highly expensive. On account of these factors, the diabetes segment is expected to witness a high growth rate over the forecast period.

The neurological segment is expected to grow at a CAGR of 8.1% over the forecast period. There is a high prevalence of neurological disorders due to factors such as genetic disorders, lifestyle, infections, and malnutrition and brain injury. Pharmaceutical companies have developed products that target the nerve imbalance in the body and try to restore normal neurological function. There are various innovative platforms for drug mechanisms developed recently such as glutamate modulators, which have the capability to treat neurological disorders. Such trends have benefited the segment and are expected to do so over the forecast period.

Chemical Insights

The big molecules segment held the largest revenue share of 89.4% in 2022. These molecules are used in applications such as dipeptides, which are used to treat occurrences of cardiovascular diseases. The application of big molecules in vaccination is also driving the segment demand. Big molecule products have entered the market in the recent past in large numbers as compared to small molecules. Companies have developed small molecules for usage in drug metabolites, drug intermediates, pharmaceutical intermediates, and ingredients.

The small molecules segment is expected to grow at the fastest CAGR of 8.4% over the forecast period.Companies provide various services such as synthesis development, and assistance in setting up commercial production processes for small molecule manufacturing. Industry participants also cater to customers who demand small molecules in small quantities. The small molecules segment dominates in the approval for new molecular entity approvals. Such trends are expected to benefit the market demand over the forecast period. The emergence of contract and manufacturing organizations (CMO) with integrated processes for manufacturing small molecule intermediates, advanced formulations, and concept–to–commercial manufacturing is also favoring market growth.

Key Companies & Market Share Insights

Pharmaceutical fine chemical manufacturers have been adopting various strategies such as new product development, joint ventures, and collaborations. These strategies have been adopted to increase market penetration and cater to changing technological requirements for different end-use applications in their specific regions.

Companies operating in the Asia Pacific region suffered a severe setback due to the strict regulatory checks imposed by the western regulatory agencies. The formidable advantage that the enterprises in the region possess about the lower labor costs and environmental costs are rapidly being offset as both these costs are escalating in the region. The region is characterized by the presence of a large number of small players having in line manufacturing capabilities as compared to their western counterparts. Wide distribution channels along with growing competition among players are expected to open new avenues over the forecast period.

Key Pharmaceutical Fine Chemicals Companies:

- Denisco

- Albemarle Corporation

- Kenko Corporation

- GRACE

- CHEMADA

- JMP Statistical Discovery LLC.

- Pfizer Inc.

- GSK plc

Recent Developments

-

In September 2022, IOL, a company headquartered in Ludhiana and known for manufacturing isobutyl benzene, a crucial component for pharmaceutical production, unveiled its strategic intentions to diversify into the domains of specialty chemicals and active pharmaceutical ingredients (APIs). This expansion plan entails a significant investment in the establishment of a production facility located in western India. In order to gain authorization for the sale of APIs in regulated markets like Europe and the U.S., IOL aims to submit 4-5 drug master files (DMFs). The forthcoming production facility is poised to play a pivotal role in facilitating this authorization process and further bolstering the company's presence in the industry.

-

In June 2023, Univar Solutions Inc., a prominent global supplier of specialized chemicals and ingredients, announced a partnership with W.R. Grace & Co. This strategic collaboration involves the distribution of W.R. Grace & Co.'s renowned product, SYLOID FP silica. This specific product plays a pivotal role as a versatile ingredient in the formulation of prescription drugs, over-the-counter pharmaceutical solutions, and dietary supplements. The primary focus of this agreement is to facilitate the distribution of this ingredient across various European markets. As a result, Univar Solutions stands to benefit from valuable technical support and a complementary array of products.

Pharmaceutical Fine Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 136.2 billion

Revenue forecast in 2030

USD 233.5 billion

Growth Rate

CAGR of 7.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, chemical, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America,; and MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Denisco; Albemarle Corporation; Kenko Corporation; GRACE; CHEMADA; JMP Statistical Discovery LLC.; Pfizer Inc.; GSK plc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Fine Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global pharmaceutical fine chemicals market report on the basis of type, product, chemical, application, and region:

-

Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Proprietary

-

Non Proprietary

-

-

Product Outlook (Revenue in USD Million, 2018 - 2030)

-

Basic Building Blocks

-

Advanced Intermediates

-

Active Ingredients

-

-

Chemical Outlook (Revenue in USD Million, 2018 - 2030)

-

Small Molecules

-

Big Molecules

-

-

Application Outlook (Revenue in USD Million, 2018 - 2030)

-

Cardiovascular

-

Neurological

-

Oncological

-

Infectious Diseases

-

Metabolic System

-

Diabetes

-

Respiratory

-

Gastrointestinal

-

Mucoskeletal

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical fine chemicals market size was estimated at USD 126.9 billion in 2022 and is expected to reach USD 136.2 billion in 2023.

b. The global pharmaceutical fine chemicals market is expected to grow at a compound annual growth rate of 7.9% from 2023 to 2030 to reach USD 233.5 billion by 2030.

b. Cardiovascular dominated the pharmaceutical fine chemicals market with a share of 21.1% in 2022. This is attributable to their application to manufacture medicines & drugs for the treatment of heart and blood vessel diseases.

b. Some key players operating in the pharmaceutical fine chemicals market include Denisco Chemicals, Albemarle Corporation, Kenko Corporation, W. R. Grace & Co., Chemada Fine Chemicals, Syntor Fine Chemicals, Johnson Matthey Fine Chemicals, Pfizer Inc, GlaxoSmithKline plc, and others

b. Key factors that are driving the market growth include the rising geriatric population along with rising health consciousness among consumers across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."