- Home

- »

- Automotive & Transportation

- »

-

Pharmaceutical Logistics Market Size & Share Report, 2030GVR Report cover

![Pharmaceutical Logistics Market Size, Share & Trends Report]()

Pharmaceutical Logistics Market Size, Share & Trends Analysis Report By Type (Cold Chain Logistics, Non-cold Chain Logistics), By Component (Storage, Transportation, Monitoring Components), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-829-9

- Number of Report Pages: 115

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Pharmaceutical Logistics Market Trends

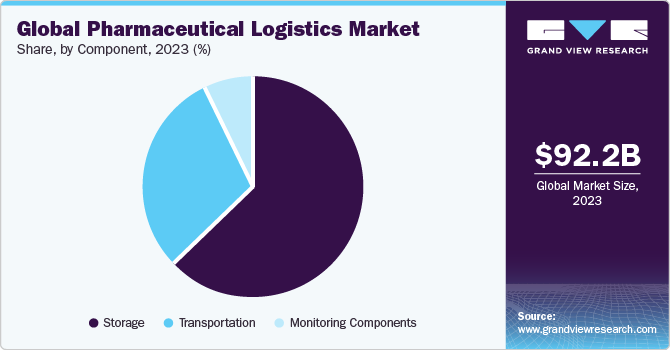

The global pharmaceutical logistics market size was valued at USD 92.18 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.3% from 2024 to 2030. The short-term impact of the COVID-19 pandemic on the market is a crucial factor for the fast-paced growth of pharmaceutical logistics. Amid the pandemic, governments around the world are emphasizing healthcare facilities and ample medicinal supply for the patients. As such, the trade of conventional medicines is increasing from country-to-country. Additionally, the U.S. Food and Drug Administration (FDA) has approved Emergency Use Authorization for hydroxychloroquine, which is to be used by licensed healthcare providers to treat teens and adults hospitalized with COVID-19 who weigh more than 50 kg. As such, the trade of hydroxychloroquine is increasing in countries, including the U.S. and India.

The emergence of the COVID-19 virus has enabled several key pharmaceutical players or vaccine producers to invest massively in research and trials for launching effective vaccines for the virus. More than 60 companies were doing clinical trials of COVID-19 vaccines across the globe, wherein few of the vaccines such as Sputnik V, Covishield, Covaxin, and mRNA have been approved for emergency use in key countries such as India, Russia, the U.K., and the U.S.

With the approval of the aforementioned vaccines for usage, key vaccine producers are actively looking to distribute these vaccines around the globe. It would need a resilient supply chain to make vaccines available across the globe for urgent usage. Therefore, it is estimated to drive the growth of the market at a significant pace during the forecast period. Along with this, the demand for medicines used for curing the novel coronavirus disease is also expected to boost the market growth.

The growth of the market is also attributed to the increasing demand for Over-the-Counter (OTC) medicines such as Vitamins, Minerals, and Supplements (VMS), common cough and cold drugs, gastrointestinal drugs, and dermatology products. The rising importance of fast-track assistance in the healthcare sector is also driving the market for pharmaceutical logistics. Moreover, decreasing the distribution cost by creating a single source distribution channel further increases the demand for pharmaceutical logistics.

Many companies are entering into mergers and acquisitions to expand their geographical presence and proprietary knowledge. They are also focusing on reducing the overall packaging costs of their products. The biocomponent and pharmaceutical supply chains are particularly prone to the risks associated with product adulteration during transport as well as non-compliance with federal regulations, standards, and guidelines. As a result, the players are actively investing in state-of-the-art technologies such as telematics and remote monitoring to provide safety and convenience during transportation operations, which is, in turn, propelling the market growth.

Pharmaceutical manufacturing companies are increasingly outsourcing packaging and labeling activities from third-party providers. Many pharmaceutical companies are expanding their operations in untapped regions, including Sub-Saharan Africa and South America. The preference for local logistics providers with high expertise in pharmaceuticals is of great importance to drug manufacturers. However, deteriorating service levels and loss of control are significant threats that are faced in outsourcing operations.

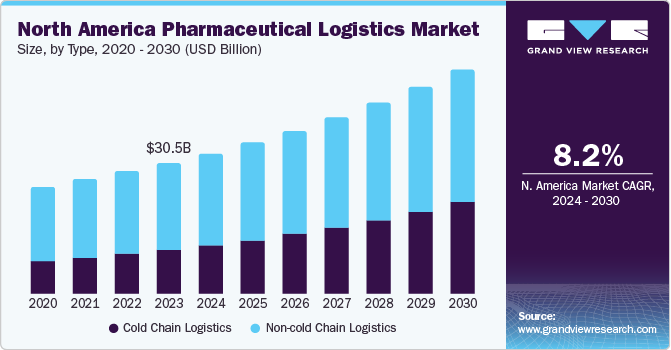

The demand for pharmaceutical logistics is growing in the U.S. due to increasing sales of generic drugs, as well as reforms in the healthcare sector favoring generics. The market for pharmaceutical logistics in North America is significantly fragmented, owing to several regional and international companies. The industry is highly competitive due to the presence of many local and global companies.

Major companies strive to offer cloud-based supply chain solutions and secured supply chain functions as it helps manufacturers ensure the authenticity of the drugs. These solutions prevent the production of counterfeit drugs and medical devices. The increasing demand for sea and air freight pharmaceutical logistics is anticipated to propel industry growth during the forecast period. The transportation of pharma products by sea reduces the transportation cost by up to 80.0% and decreases the staffing requirements.

Additionally, it conserves the packaging and storage needs while reducing the carbon footprint of logistics operations. The increasing use of air freight logistics for long-distance and intercontinental distribution of valuable vaccines and medicines is expected to fuel the market growth further.

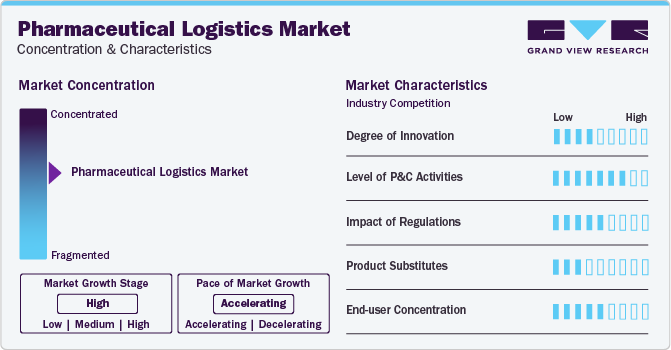

Market Concentration & Characteristics

The market growth stage in the pharmaceutical logistics market is high, and the pace of the market growth is accelerating. The pharmaceutical logistics market is marked by a robust culture of innovation, driven by the rising demand for over-the-counter (OTC) medicines and the high emphasis of the government on the development of healthcare supply chain infrastructure.

The pharmaceutical logistics market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain a high market share and the need to consolidate in a rapidly growing market.

The pharmaceutical logistics market is governed by stringent regulations and the logistics providers have to follow the new guidelines for logistics operations. For instance, the wholesale distributor must assign a responsible person, and that person should meet the qualification & several other norms set by the legislation. Moreover, under the new GDP regulation, the storage of medicines for more than 24 hours will require a relevant GDP license. The drugs that are destined for non-European countries will require a separate physical warehouse for medicine storage.

Pharmaceutical logistics currently lacks a direct substitute. Pharmaceutical logistics faces several obstacles concerning on-time delivery, compliance, real-time-based monitoring, and others. The temperature-sensitive drugs require real-time-based temperature monitoring during shipping through sea freight, air freight, or roadways. These aspects that are creating challenges for the market are expected to generate new opportunities for players.

The concentration of services within the pharmaceutical industry ensures specialized and compliant handling of sensitive and time-critical medical products. The end-use concentration allows logistics providers to tailor their services to the unique requirements and regulatory standards of the pharmaceutical sector, ensuring the safe and efficient delivery of healthcare products to end-users.

Type Insights

In terms of value, the cold chain logistics segment is anticipated to hold a considerable market share by 2030 and is expected to grow at a significant growth rate from 2024 to 2030. The growth is attributable to the rising demand for temperature-controlled products, such as the ongoing distribution of COVID-19 vaccines that require accurate temperature-control logistics services to maintain the products’ efficacy.

Furthermore, the stringent government regulations regarding maintaining accurate temperature for highly temperature-sensitive pharmaceutical products are expected to boost the segment growth during the forecast period. The growing adoption of telematics in cold chain pharmaceutical logistics is helping companies to enhance the efficiency, connectivity, and safety of transport cargoes.

Most biological and medical products require a temperature-controlled environment during the stage of manufacturing and distribution, which helps in maintaining the effectiveness and quality of the medicines. Thus, pharma companies are using temperature-controlled transportation and cold storage systems. The non-cold chain segment is expected to have a considerable share in the next seven years, owing to the increasing demand for non-cold chain pharma medicines and other products.

Component Insights

The storage segment attained the largest market share of more than 63.51% in 2023. The rapidly rising demand for generic and branded pharma products' has surged the significant need for storage facilities to preserve and procure these products’ efficacy after production and their further distribution through multiple channels to the distributors and retailers.

Further, the ongoing pandemic of COVID-19 has generated the demand for temperature-sensitive storage facilities to store the vaccines at their requisite temperature during logistics. As a result, this is expected to bolster the segment growth over the coming years. Factors such as the changing lifestyles of consumers and dietary patterns are driving the demand for temperature-sensitive protein and nutritional supplements, which are expected to boost the demand for the storage segment during the forecast period.

The monitoring components segment is expected to witness the highest CAGR from 2024 to 2030, owing to the increasing need to ensure the efficiency, integrity, and safety of cold chain products. The monitoring components segment is divided into hardware and software components. The transportation segment is likely to reach a considerable growth pace over the forecast period.

The transportation segment is further divided into sea freight logistics, air freight logistics, and overland logistics. The increasing adoption of sea-based pharmaceutical logistics is driving the growth of the market for pharmaceutical logistics as sea freight logistics services can handle sensitive large molecule biologics and personalized medicines.

Regional Insights

Europe accounted for a market share of over 36.65% in 2023 and is estimated to expand at a significant growth rate from 2024 to 2030. The high market share is due to the substantial growth in pharmaceutical product trades across key European countries. These countries mainly include Germany, the U.K., France, Nordics, and others. Additionally, growing production and demand for several categories of pharma products such as OTC medicines in the domestic region has further helped the market to gain a huge market share.

The Asia Pacific region is projected to be the fastest-growing region, owing to the rapid economic growth in emerging countries, such as China and India. High demand for OTC medicines among a huge population is expected to increase the market for pharmaceutical logistics in Asia Pacific. Moreover, the pharmaceutical industry is undergoing a geographic shift in production and sales locations. The market players are finding lucrative opportunities in the developing economies in Asia and South America, which is, in turn, expected to boost the market growth in these regions.

U.S. Pharmaceutical Logistics Market

The pharmaceutical logistics market in the U.S. accounted for a revenue share of 86.8% in the North America market. Pressure to bring down the cost of drugs is an additional element—resulting in the need to reexamine the supply chain is expected to support the growth of the pharmaceutical logistics market.

U.K. Pharmaceutical Logistics Market

The U.K. accounted for a significant revenue share in the Europe market. Manufacturers' approach towards addressing the complex multilayer networks and material movement problems that not only affect inventory levels but also increase overall supply chain costs are factors expected to support the growth of the market.

Germany Pharmaceutical Logistics Market

The pharmaceutical logistics market in India accounted for a significant revenue share in the target market. The growth is attributed to stringent government regulations pertaining to the transportation of medical devices and medicines.

France Pharmaceutical Logistics Market

The pharmaceutical logistics market in France accounted for a noticeable revenue share in the Europe pharmaceutical logistics market. The growth is attributed to pharma manufacturers' approach towards the adoption of transportation services that provide product storage facilities at the required conditions throughout its transition.

China Pharmaceutical Logistics Market

The pharmaceutical logistics market in China accounted for a revenue share of major revenue share the Asia Pacific market. Companies have fearlessly embarked on a growth trajectory aspiring to become a hub for low-cost manufacturing and R&D, and yet they are also facing a unique set of local and global challenges that are creating significant pressure to tighten the end-to-end operations

India Pharmaceutical Logistics Market

The pharmaceutical logistics market in India accounted for a revenue share of 18.4% in the Asia Pacific market. Indian pharmaceutical manufacturing companies are focused on integrating enterprise software and automating the supply chain process in order to enhance the logistic aspects.

Saudi Arabia/KSA Pharmaceutical Logistics Market

The pharmaceutical logistics market in Saudi Arabia is expected to witness faster growth in the coming years. The growth is attributed to increasing government spending on the development of transportation infrastructure and pharmaceutical manufacturers' approach toward the adoption of services that provide them visibility and control over products in transit.

Key Pharmaceutical Logistics Companies Insights

To maintain their position in the market, pharma companies continuously undertake strategic initiatives, such as mergers and acquisitions. Furthermore, the companies in the market are investing in technologies such as telematics, remote sensing and monitoring, and GPS and GIS integration in transporting cargo, thereby providing customers with safe and convenient pharmaceutical logistics services.

Some prominent players in the market include Agility; Air Canada; CEVA Logistics; DB Schenker; Deutsche Post AG; FedEx; LifeConEx; Marken; United Parcel Service of America, Inc.; VersaCold Logistics Services, among others.

-

Agility is engaged in the construction, management, and renting of different types of warehouses. It also provides various types of transportation, handling, distribution, and customs clearance of goods. The company conducts and reports its business activities in two segments, namely logistics & related services and infrastructure.

-

Air Canada is a scheduled passenger service provider catering to the Canadian market, the Canada-U.S. transborder market, as well as the international market that includes to and from Canada.Air Canada, through its business division Air Canada Cargo, provides air cargo services. The primary customers of the company include large freight forwarding companies as well as businesses having time-sensitive cargo shipping requirements. The company provides customized shipping solutions that are tailored for specific commodities and time constraints.

Key Pharmaceutical Logistics Companies:

The following are the leading companies in the pharmaceutical logistics market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these pharmaceutical logistics companies are analyzed to map the supply network.

- Agility

- Air Canada

- CEVA Logistics

- DB Schenker

- Deutsche Post AG

- FedEx

- LifeConEx

- Marken

- United Parcel Service of America, Inc.

- VersaCold Logistics Services

Recent Developments

-

In February 2021, Agility launched an express road freight network that connects consumers and businesses across the GCC region. The new service aims to provide full truckload (FTL) and less-than-truckload (LTL) options to its customers.

-

In December 2020, Agility announced that Maersk has chosen its 5,000 SQM warehouse project in Abidjan as a storage, deconsolidation and distribution facility. It aims to meet the requirements of Maersk customers across various industries.

-

In May 2020, United Parcel Service of America, Inc. announced the expansion of the company’s healthcare capabilities with the launch of the new UPS Premier. UPS Premier aims to improve service reliability and improved visibility of healthcare packages by leveraging next-generation sensor technology and monitoring.

-

In January 2019, FedEx announced the acquisition of International Express Business from Flying Cargo Group in Israel. The acquisition is aimed at strengthening FedEx’s portfolio and regional presence, providing customers with the benefits of the company’s global network.

-

In October 2018, FedEx acquired Manton Air-Sea Pty Ltd., a logistics service provider company. The acquisition helped FedEx to fortify its geographical footprints across the Asia Pacific region.

Pharmaceutical Logistics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 92.18 billion

Revenue forecast in 2030

USD 170.17 billion

Growth rate

CAGR of 9.3% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, region

Regional scope

North America, Europe, Asia Pacific, South America, MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; Brazil

Key companies profiled

Agility; Air Canada; CEVA Logistics; DB Schenker; Deutsche Post AG; FedEx; LifeConEx; Marken; United Parcel Service of America, Inc.; VersaCold Logistics Services

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented global pharmaceutical logistics market report based on type, component, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cold Chain Logistics

-

Non-cold Chain Logistics

-

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Storage

-

Warehouse

-

Refrigerated Container

-

-

Transportation

-

Sea Freight Logistics

-

Airfreight Logistics

-

Overland Logistics

-

-

Monitoring Components

-

Hardware

-

Sensors

-

RFID Devices

-

Telematics

-

Networking Devices

-

-

Software

-

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global pharmaceutical logistics market size was estimated at USD 85.24 billion in 2022 and is expected to reach USD 92.18 billion in 2023.

b. The global pharmaceutical logistics market is expected to grow at a compound annual growth rate of 9.2% from 2023 to 2030 to reach USD 170.17 billion by 2030.

b. The non-cold chain segment dominated the pharmaceutical logistics market for pharmaceutical logistics and accounted for the largest revenue share of 70.92% in 2022. The segment is expected to have a considerable share in the next seven years owing to the increasing demand for non-cold chain pharma medicines and other products.

b. The storage segment dominated the pharmaceutical logistics market and accounted for the largest revenue share of approximately 63.89% in 2022.

b. Europe accounted for the largest revenue share of more than 36.5% in 2022 in the pharmaceutical logistics market and is estimated to witness a significant growth rate from 2023 to 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."