- Home

- »

- Pharmaceuticals

- »

-

Pharmaceutical Manufacturing Market Size Report, 2030GVR Report cover

![Pharmaceutical Manufacturing Market Size, Share & Trends Report]()

Pharmaceutical Manufacturing Market (2023 - 2030) Size, Share & Trends Analysis Report By Route of Administration, By Molecule Type, By Drug Development Type, By Sales Channel, By Age Group, By Formulation, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-014-2

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

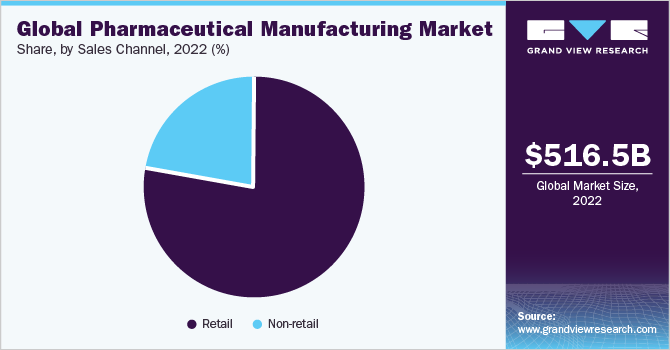

The global pharmaceutical manufacturing market size was estimated at USD 516.48 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.63% from 2023 to 2030. The pharmaceutical industry has experienced a significant shift due to advancements in technology, cost-effective manufacturing methods, and increased investment. These factors have had a positive impact on market growth. The implementation of robotic technology and Artificial Intelligence (AI) has led to a reduction in manufacturing floor downtime and product waste. These technologies have improved efficiency and productivity in pharmaceutical manufacturing processes.

Moreover, the adoption of single-use disposable solutions has gained traction, replacing traditional open-transfer manufacturing methods. This shift has resulted in more streamlined operations and reduced contamination risks. Furthermore, there has been a transition toward integrated, smart, and data-rich paperless operations. This shift has led to error-free and precise production processes, ensuring high-quality pharmaceutical products. These ongoing developments in the industry have significantly contributed to advancements in drug manufacturing. Advancements in personalized medicine have revolutionized the healthcare industry, offering new avenues to target various health conditions and paving the way for patient-centric models.

As a result, there has been a shift from large-scale production to smaller batches to cater to the development of complex medicines and personalized treatments tailored to individual patients. This transformation has prompted pharmaceutical manufacturers to restructure their supply chains to align with the patient-centric healthcare system. The increasing number of drug approvals by regulatory bodies is expected to drive growth in drug manufacturing processes. In 2022, the FDA approved 37 novel drugs, indicating a positive trend.

In addition, the extensive number of ongoing clinical trials presents numerous opportunities for market expansion and innovation. Moreover, the pharmaceutical industry has witnessed a surge in mergers and acquisitions (M&As) in recent years. Established companies are engaging in consolidation strategies to strengthen their market position in the highly competitive environment. Simultaneously, small- to mid-sized pharmaceutical companies with innovative capabilities are being acquired by larger players. Furthermore, the implementation of stringent regulations to control pharmaceutical prices has further incentivized M&A activities within the industry.

Molecule Type Insights

In 2022, the conventional drugs (small molecules) segment generated the highest revenue share of over 54.9% and is estimated to grow rapidly over the forecast period. According to a November 2022 NCBI study, small-molecule drugs represent up to 90% of total global drug sales in terms of units. These figures highlight a significant dominance of small molecules in the global pharmaceutical market. Recent drug approvals by regulatory bodies worldwide further support this trend. Out of the 37 new drugs approved by the U.S. FDA in 2022, 19 were small molecule drugs, indicating their prominent position in the market.

Small molecule drugs hold a majority share of over 50% compared to large molecule drugs. Moreover, various factors, such as molecule potency, complexity of drug products, industry composition, and manufacturing trends, have contributed to the continued dominance of small molecule drugs in the pharmaceutical industry. Over the past few years, biologics are increasingly gaining traction with promising efficacy for the treatment of autoimmune diseases and cancer. Owing to the substantial investments and innovative approaches, biologics are gaining significant attention. In early 2020, seven of the top 10 best-selling drugs were biologics. This shows the emergence of biologics in the global market.

Drug Development Insights

The outsourcing segment dominated the pharmaceutical manufacturing market and accounted for a revenue share of over 53.5% in 2022. This segment is poised for lucrative growth in the future due to several associated benefits. Outsourcing operations offer numerous advantages, such as reduced investments, lower drug development and overall costs, increased manufacturing efficiency, and easier compliance with regulatory norms. In addition, the integration of Robotic Process Automation (RPA) by contract manufacturers has greatly accelerated drug development processes.

Moreover, many large-scale drug manufacturers prefer in-house production to maintain control over confidential information related to novel molecules, the expansion of in-house manufacturing facilities by key firms is also contributing to the growth of the in-house segment. For instance, in February 2021, WuXi STA, a subsidiary of WuXiAppTec, announced the acquisition of a manufacturing facility in Switzerland from Bristol Myers Squibb. Consequently, in-house manufacturing is expected to witness rapid growth in the coming years.

Formulation Insights

The tablet segment dominated the market and accounted for a revenue share of more than 26.08% in 2022. This growth can be attributed to the widespread availability of tablet-based products in various formulations, including film-coated, enteric-coated, orally disintegrating, and effervescent tablets. In addition, the introduction of 3D-printed tablets tailored to meet personalized needs has significantly contributed to the expansion of this segment. The sprays segment is expected to grow at the fastest CAGR during the forecast period, followed by the injectable segment.

The growth of the sprays segment can be attributed to the increasing number of approvals for auto-injectors and prefilled syringes. Moreover, in recent years, subcutaneous injections have gained considerable popularity among device manufacturers, drug developers, and patients. These injections offer various benefits, and ease of use, including self-administration, reliability, precision, fixed doses in prefilled syringes, compliance, compact design, and high patient comfort. The emergence of subcutaneous injections is anticipated to further fuel the injectable segment growth.

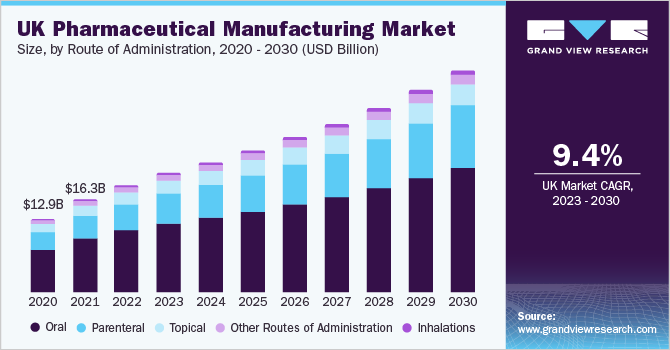

Route of Administration Insights

The oral route of administration segment dominated the market and accounted for a revenue share of 58.0% in 2022. Oral dosage forms are preferred due to their affordability, ease of manufacturing, and patient-friendly administration. Furthermore, advancements in drug delivery technologies such as targeted drug delivery and sustained release formulations have enhanced the availability of orally administered drugs in the market. The parenteral segment is expected to register the fastest CAGR over the forecast years.

The growth is driven by the increased implementation of barrier systems and automated systems. In addition, the introduction of a wide range of packaging styles, including cartridges, ready-to-fill syringes, and vials, has significantly transformed the parenteral manufacturing segment. The growing demand for novel drug-delivery systems, which cater to the mobile lifestyle of patients has led to a surge in the adoption of auto-injectors and pens, fueling the growth of this segment. In addition, the outsourcing of fill-finish manufacturing services by drug developers has contributed to the revenue growth of the segment.

Therapy Area Insights

The other diseases segment comprises immunological diseases, infectious diseases, musculoskeletal conditions, women’s health, and eye disorders, as well as other therapeutic areas. The segment captured a revenue share of over 63.44% in 2022 and is expected to maintain its leading position throughout the forecast period. The COVID-19 pandemic has played a significant role in driving R&D expenditure in this segment. Furthermore, increasing awareness about women's health has prompted operating players to focus on developing therapies to address key conditions in women, such as menstrual irregularities.

On the other hand, the respiratory diseases therapy segment is projected to register the fastest CAGR over the forecast period. This growth is attributed to the development of innovative drugs that are improving treatment options for respiratory diseases. Inhalation devices, such as dry powder inhalers and nebulizers, are making it easier for patients to administer medication, leading to improved patient outcomes. In addition, the COVID-19 pandemic has underscored the importance of respiratory health, resulting in increased investments in respiratory research and development.

Prescription Insights

The prescription medicines segment dominated the marketwith a revenue share of 83.76% in 2022 and is projected to expand at a significant CAGR over the forecast period. This growth can be attributed to the increasing expenditures on prescription drugs worldwide. The American Journal of Health-System Pharmacy reports that prescription drug spending in the U.S. has risen 4-6% over the past decade. The Over-The-Counter (OTC) medicines segment has witnessed significant transformation due to factors, such as the demand for cost-effective treatment options and self-medication.

OTC medicines offer cost and time efficiency compared to prescription medicines. Regulatory bodies have recently moved a substantial number of medicines from prescription to the OTC segment. According to a Consumer Healthcare Products Association study, this shift is projected to save approximately USD 20.0 billion in healthcare spending annually. The Rx-to-OTC switch follows a scientifically rigorous, data-driven, and highly regulated process that allows consumers to access a wide range of medicines. The cost-saving benefits and high public demand for OTC medicines will drive the segment's growth at the fastest rate during the forecast period.

Age Group Insights

The geriatric segment dominated the market and accounted for a revenue share of approximately 49.83% in 2022. According to the World Population Prospects, one in 11 individuals was aged 65 years or older in 2021. This proportion is expected to increase to one in six individuals by 2050, highlighting the significant growth potential of the geriatric segment. In addition, pediatric medicine has experienced notable advancements through the development of specialty drugs under the Orphan Drug Act. Initiatives, such as the Pediatric Research Equity Act (PREA) and the Best Practices for Children Act (BPCA), have played a crucial role in promoting the development of pediatric medicines. PREA serves as a checkpoint during FDA drug approval, ensuring the focus on pediatric medicine.

Thus, the children & adolescents segment is projected to exhibit the fastest CAGR over the forecast period. Furthermore, the increasing number of approvals for pediatric medicines is driving the growth of this segment. For example, in March 2020, Eli Lilly and Company received FDA approval for the supplemental Biologics License Application of its Taltz injection, specifically designed for the treatment of plaque psoriasis in children. Similarly, in January 2020, Neurelis, Inc. obtained FDA approval for its VALTOCO nasal spray, intended for the treatment of epilepsy in children aged 6 years and above. These approvals signify the expanding portfolio of pediatric medicines and contribute to the segment growth.

Sales Channel Insights

The retail segment dominated the market and accounted for a revenue share of 77.51% in 2022. With the rise in medical costs and health insurance premiums, more individuals are opting for self-medication to address minor health issues. The convenience and cost-effectiveness of OTC medicines have contributed to their popularity among consumers. As a result, there has been a significant increase in the adoption of drugs from retail stores, driving the growth of this segment. Specialty pharmacy has witnessed significant growth in recent years, leading to the availability of a wide range of specialty drugs in retail pharmacies. This expansion of offerings further contributes to the growth of the retail segment.

In addition, retail pharmacies are increasingly engaging in partnerships and collaboration models with healthcare professionals and facilities to enhance clinical outcomes and maintain competitiveness in the industry. The introduction of electronic information transfer has the potential to create numerous opportunities in primary care. It can address issues related to poor communication between primary and secondary care providers. Furthermore, diagnostic support systems enable the automated implementation of tailored clinical pathways, personalized by clinicians according to individual patient needs. These advancements are expected to drive the sales of drugs in the non-retail segment, exhibiting the fastest compound annual growth rate (CAGR) over the forecast period.

Regional Insights

North America dominated the marketand accounted for a significant revenue share of 42.38% in 2022. This can be attributed to the numerous strategic partnerships formed among established and early-stage pharmaceutical companies in the region. The U.S., in particular, held a prominent position in terms of per capita prescription drug spending on a global scale. Additionally, the U.S. accounted for the largest number of drug efficacy studies and clinical trials conducted worldwide. The Asia Pacific region is expected to witness the highest growth rate during the forecast period.

This can be attributed to several factors, including a large customer base, increased healthcare expenditure, rising disease incidence, and the presence of supportive regulatory systems. Moreover, the region has recently embraced new technologies and transformed digitally to ensure sustainable patient care. Various national-level policies in Asian countries have promoted the application of big data and AI in healthcare. For instance, the State Council of China has issued guidelines to encourage the development of healthcare big data and AI, specifically emphasizing their application in the healthcare sector. Furthermore, several Western companies are establishing new facilities in the region to leverage the cost benefits offered.

Key Companies & Market Share Insights

Leading companies in the industry have implemented strategic initiatives to enhance their market presence and gain a competitive advantage. These key players are actively involved in various activities, such as product development, collaboration & partnership models, agreements, business expansion, and mergers & acquisitions. These initiatives aim to strengthen their product portfolio and meet the growing demand for pharmaceutical products.

For instance, in June 2023, Pfizer, Inc. and Samsung Biologics entered into a strategic partnership for the long-term manufacturing of biosimilars. Under the agreement, Pfizer will be provided with additional manufacturing capacity by Samsung Biologics for a biosimilar portfolio comprising immunology, oncology, and inflammation. Both companies partnered initially in March 2023 for a manufacturing agreement for Pfizer’s product. Some prominent players in the global pharmaceutical manufacturing market include:

-

F. Hoffmann-La Roche Ltd.

-

Novartis AG

-

GlaxoSmithKline plc

-

Pfizer, Inc.

-

Merck & Co., Inc.

-

AstraZeneca

-

Johnson & Johnson

-

Sanofi SA

-

Eli Lilly and Company

-

AbbVie, Inc.

-

Thermo Fisher Scientific, Inc.

-

Wuxi Apptec

-

Samsung Biologics

-

FUJIFILM Diosynth Biotechnologies U.S.A., Inc.

-

Lonza

-

Catalent Pharma Solutions

-

Jubilant Pharmova Limited

Pharmaceutical Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 566.3 billion

Revenue forecast in 2030

USD 929.9 billion

Growth rate

CAGR of 7.63% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Molecule type, drug development type, formulation, routes of administration, therapy area, prescription, age group, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

F. Hoffmann-La Roche Ltd.; Novartis AG; GlaxoSmithKline plc; Pfizer, Inc.; Merck & Co., Inc.; AstraZeneca; Johnson & Johnson; Sanofi SA; Eli Lilly and Company; AbbVie, Inc.; Thermo Fisher Scientific, Inc.; Wuxi Apptec; Samsung Biologics; FUJIFILM Diosynth Biotechnologies U.S.A., Inc.; Lonza; Catalent Pharma Solutions; Jubilant Pharmova Limited

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the pharmaceutical manufacturing market report based on molecule type, drug development type, formulation, route of administration, therapy area, prescription, age group, sales channel, and region:

-

Molecule Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biologics & Biosimilars (Large Molecules)

-

Monoclonal Antibodies

-

Vaccines

-

Cell & Gene Therapy

-

Others

-

-

Conventional Drugs (Small Molecules)

-

-

Drug Development Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

In-house

-

Outsource

-

-

Formulation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tablets

-

Capsules

-

Injectable

-

Sprays

-

Suspensions

-

Powders

-

Other Formulations

-

-

Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oral

-

Topical

-

Parenteral

-

Inhalations

-

Other Routes of Administration

-

-

Therapy Area Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cardiovascular Diseases (CVDs)

-

Pain

-

Diabetes

-

Cancer

-

Respiratory Diseases

-

Other Diseases

-

-

Prescription Outlook (Revenue, USD Billion, 2018 - 2030)

-

Prescription Medicines

-

Over-the-counter (OTC) Medicines

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

Children & Adolescents

-

Adults

-

Geriatric

-

-

Sales Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail

-

Non-retail

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.