- Home

- »

- Medical Devices

- »

-

Pharmaceutical Robots Market Size, Industry Report, 2033GVR Report cover

![Pharmaceutical Robots Market Size, Share & Trends Report]()

Pharmaceutical Robots Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Traditional Robots, Collaborative Robots), By Application (Picking & Packaging, Laboratory Applications), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-515-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Robots Market Summary

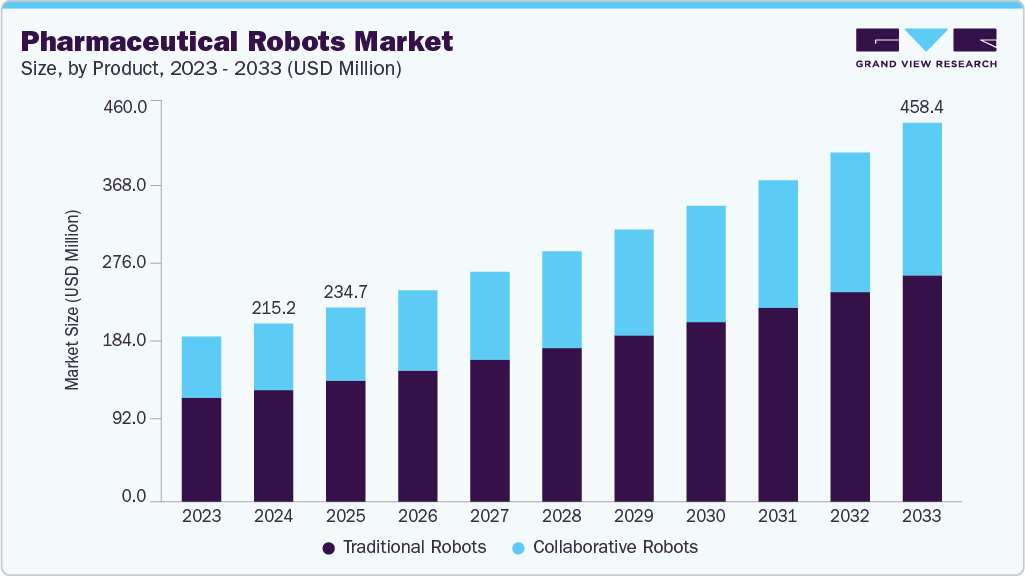

The global pharmaceutical robots market size was estimated at USD 215.26 million in 2024 and is projected to reach USD 458.36 million by 2033, growing at a CAGR of 8.73% from 2025 to 2033. The high costs of new drug discovery and the rising need for automation in manufacturing units significantly increase the demand for robotics in drug discovery, clinical trials, and laboratories for automating procedures.

Key Market Trends & Insights

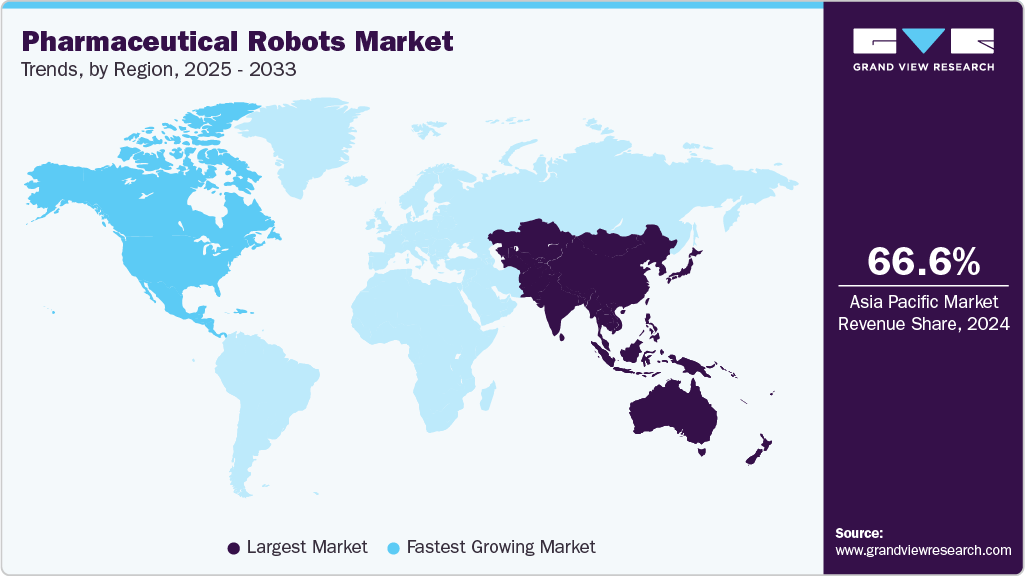

- North America pharmaceutical robots market dominated global market in 2024 and accounted for the largest revenue share of 66.57%.

- The pharmaceutical robots market in the U.S. is anticipated to register the significant CAGR during the forecast period.

- In terms of product, the traditional robots segment held the largest revenue share in 2024.

- In terms of application, the picking and packaging segment held the largest revenue share in 2024.

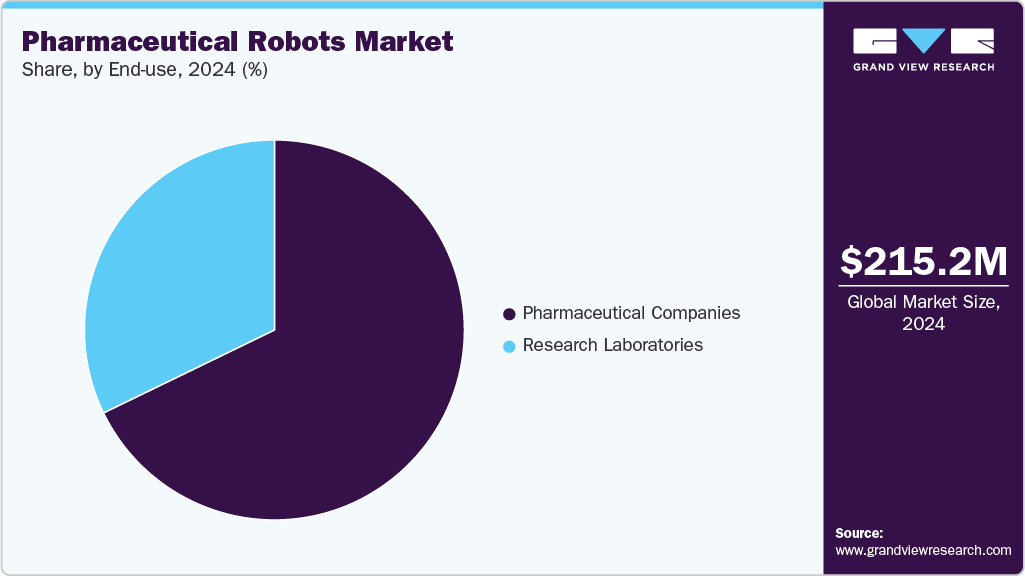

- In terms of end use, the pharmaceutical companies segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 215.26 Million

- 2033 Projected Market Size: USD 458.36 Million

- CAGR (2025-2033): 8.73%

- North America: Fastest growing market

- Asia Pacific: Largest market in 2024

In addition, key companies are introducing technologically advanced robotic machines, further leading to tremendous market growth. For instance, in March 2021, Sepro Group, a manufacturer of Cartesian robots, launched the MED series, a new range of robots for the medical and pharmaceutical industries. It offers the MED series for three, five, or six-axis robots. With growing demands for accuracy, efficiency, and faster turnaround times, adopting automation and robotics has become more prevalent.Employing robotic automation has become a popular solution to tackle monotonous tasks, allowing employees to concentrate on more important responsibilities. In addition, automation ensures that quality control standards and strict regulations are met as it can ensure accurate and consistent processing, which minimizes the risk of human error & contamination. By automating repetitive tasks such as assembling medical devices, packaging medication, and handling samples, productivity & efficiency can be enhanced, allowing employees to focus on critical areas, including research & development, increasing production volume and overall efficiency. For instance, Medtronic, AMGEN, and others are utilizing collaborative robots (COBOTS) for different processes in manufacturing facilities.

Robotics play a significant role in the pharmaceutical industry, serving in several activities, such as packaging medical devices and implants. Moreover, collaborative robotic arms are employed in mixing, counting, dispensing, and inspecting to ensure reliable results for essential business products. The manufacturing sector has seen a boost in efficiency due to automation. Large and small enterprises leverage technological advancements to address workforce shortages, quality assurance, and consistency. Using robotics and Autonomous Mobile Robots (AMRs) enables facilities to maintain a competitive edge and flexibility. Many emerging technologies and startups are working on solutions for the pharmaceutical sector. For instance, Addverb Technologies Limited (Warehouse Management), Strateos (Robotic Cloud Lab), Maalex (End Of Arm Tooling Solution), AiRO Digital Labs (Pharmacovigilance Automation), and SensoVision (Automated Quality Inspection) are engaged in developing robotic solutions for pharmaceuticals.

Furthermore, pharmaceutical companies have found using traditional industrial robots challenging due to their high cost, intricate programming, and bulky size. As a solution, collaborative robots or cobots have been developed as viable options. The increasing preference for automation and the launch of new robots has resulted in adopting robots over traditional robots, a major contributor to market growth. For instance, in May 2021, Universal Robots introduced an upgraded UR10e with an increased payload capacity of 12.5kg, opening up new opportunities for applications including palletizing, machine tending, and packaging.

Pharmaceutical companies prioritize more than just innovation to boost their patent portfolios. They are still strategically investing in robotics to secure lucrative partnerships and position themselves at the forefront of industry advancements. Recent deals highlight the significance of robotics in shaping the future landscape of the pharmaceutical sector. Despite a slight decline in the number of robotics-related deals in the pharmaceutical industry in Q3 2023 compared to the same period in 2022, there was a noteworthy 80% increase in the number of deals every quarter in Q3 2023 compared to the preceding quarter.

Announced Date

Deal Headline

Deal Type

Deal Value (USD Million)

Announced Date

September 2023

CMR Surgical Secures USD 165 Million in Venture Funding

Venture Financing

165

September 20, 2023

August 2023

Shanghai Ruilong Nuofu Medical Technology Raises Approximately USD 27.47 Million in Series Pre-B+ Financing

Venture Financing

27.47

August 30, 2023

Case Study: Swiss Company Uses Cobots for Sterile Vial Filling

Lonza, a Swiss-based Contract Manufacturing Organization (CMO) with expertise in producing small and mid-sized batches for the pharmaceutical & biotech industries, announced plans to build a new filling line at its Stein site. The filling line will be used for commercial-scale filling of Antibody-Drug Conjugates (ADCs) for a major biopharmaceutical partner. To ensure aseptic vial filling, Lonza has deployed cobots instead of manual labor, which are more efficient and reliable for this delicate process.

- Lonza's Stein site is getting a new cGMP filling line

-

This new line will be used to handle and fill bioconjugates for commercial supply

-

The expansion of filling capacity will improve Lonza's integrated offering for manufacturing ADCs drug substances and drug products

-

This expansion is expected to create around 115 new jobs at Lonza Stein (CH)

-

The operations using the new filling line will begin in 2027

Cobots benefit SMEs in the pharmaceutical industry by offering a cost-effective, flexible, easy-to-use automation solution. With the constant development of cobot technology, more SMEs are expected to adopt this technology in the future, leading to significant changes in the pharmaceutical manufacturing landscape.

Moreover, employing robotic automation has become a popular solution to tackle monotonous tasks, allowing employees to focus on more important responsibilities. Moreover, automation ensures that strict regulations and quality control standards are met as it can provide consistent and accurate processing, which minimizes the risk of human error & contamination. By automating repetitive tasks such as packaging medication, assembling medical devices, and handling samples, productivity & efficiency are enhanced, allowing employees to concentrate on critical areas, including research & development, increasing production volume and overall efficiency. Thus, such factors boost the market growth.

Market Concentration & Characteristics

The market for pharmaceutical robots has recently seen significant advancements in robot technology, personalized medicine, industrial advancements in autonomous driving, and air mobility for next-gen AI robots. Recently, the European Union has launched Horizon Europe, a research and innovation program with a budget of USD 100.7 billion from 2021 to 2027. Its main objective is to boost scientific and technological advancements within the EU, increase innovation capacity, create job opportunities, and address citizens' priorities while preserving socio-economic models & values.

The pharmaceutical robots market is characterized by a high level of merger and acquisition (M&A) activity by the leading players. Strategic initiatives adopted by key players, such as partnerships, collaborations, mergers, and acquisitions, are expected to drive the demand for pharmaceutical robots in the market enabling companies to accelerate product development, improve operational efficiency, and capture a larger share of the market. For instance, in February 2023, NYC Health + Hospitals acquired Parata Max 2 High-Speed, Vial Filling Robot. This new machine enhances pharmacy workflow and fills more than 266,000 prescriptions annually.

Regulations play a major role in ensuring manufacturers' manufacturing capabilities, quality control standards, and pre-market approval. Robotic automation often undergoes various regulatory guidelines. Automation ensures that strict regulations and quality control standards are met as it can ensure consistent and accurate processing, which minimizes the risk of human error & contamination. The Industrial Robot Safety Standard, a uniform regulation developed by the U.S. and Canada, showcases safety guidelines for collaborative robots in pharmaceuticals.

Manufacturers are involved in continuous product expansion and improvements in robotics and artificial intelligence technology enabling the development of more sophisticated pharmaceutical robots. For instance, in September 2023, ABB announced an investment of USD 280 million to expand its manufacturing facility in Europe and establish a new ABB Robotics European Campus in Vasteras, Sweden. This campus is expected to act as the focal point for the company's European offerings, encompassing artificial intelligence-enabled industrial & collaborative robots.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising product launches create more opportunities for market players to enter new regions.For instance, in February 2024, OMRON Automation expanded its robotics portfolio in India by introducing the TM S series cobots. It features expanded safety and faster joints, making it an ideal solution for enhancing efficiency.

Product Insights

By product, the traditional robots segment dominated the market and accounted for the largest share of 62.72% in 2024. Benefits associated with adopting these products in various industrial automation applications include loading & unloading, pick & place material handling, palletizing & depalletizing, packaging, & storing. Manufacturers are involved in new product launches in the segment. For instance, in June 2022, FANUC launched three new variants of SCARA robots, such as the SR-3iA/U ceiling mount, the SR-3iA/C, and the SR-6iA/C. These new variants have enhanced assembly, pick & place, inspection, and packaging capabilities. Further, traditional robots are involved in retrieving, product placement, stacking, cutting, scribing, sorting, process-to-process transferring, and precision spot welding, which positively contribute to segment growth.

The collaborative robot segment is anticipated to witness the fastest growth during the forecast period. These machines are cheaper and easier to handle and maintain than traditional solutions. They are also lightweight and require minimum skills to handle, which is revolutionizing manufacturing units. They work alongside humans, unlike traditional robots that are used to substitute for them. Furthermore, market players are undertaking various strategies, such as launching new collaborative robots. (cobots). For instance, in February 2023, ABB launched its new SWIFTI CRB 1300 collaborative robot, which features advanced features such as pick-and-place and palletizing. The robot's load-handling capacity has also been increased to up to 11 kg, which is a significant improvement on its predecessor.

Application Insights

By application, the picking and packaging segment dominated the market and accounted for the largest share of 55.01% in 2024 and is expected to grow at fastest CAGR over the forecast period. Robots facilitate high precision & efficiency and help manage material handling challenges. Pick-and-place allows the conservation of floor space due to the need for a limited work envelope, leading to optimum workspace utilization. For instance, Epson RS4, manufactured by Seiko Epson Corporation, is used for picking and packaging in the pharmaceutical industry. In addition, the RightPick robotic piece-picking system consistently picks products quickly and accurately. Moreover, cobots are widely used for picking and packaging in the pharmaceutical industry owing to the growing need for these applications and the lack of skilled labor in the market.

The laboratory application segment is expected to grow significantly over the forecast period, owing to the rise in drug discovery and diagnostic testing has led to the high growth of laboratory applications in the pharmaceutical robots market. In addition, laboratory automation through robotic machines minimizes the potential for human contamination. For instance, MYS850L, developed by YASKAWA Europe GmbH, facilitates laboratory automation. Other laboratory applications include vial handling. Robots can handle ten vials at a time. Thus, pharmaceutical robots used in laboratories help improve the efficiency and quality of the products with high throughput analysis. Thus, this segment is expected to witness considerable growth over the forecast period. For instance, in December 2022, Insilico Medicine (Insilico), an AI-driven drug discovery company, introduced Life Star, a 6th generation Intelligent Robotics Drug Discovery Laboratory in Suzhou BioBAY Industrial Park. It performs compound screening, target discovery, translational research, and precision medicine development.

End-use Insights

By end use, the pharmaceutical companies segment accounted for the largest market share of 67.81% in 2024 and is anticipated to grow at fastest CAGR over the forecast period. The rising application of robotics in pharmaceutical manufacturing aids reproducibility and repeatability while reducing human errors. For instance, Takeda Pharmaceutical Company Limited automated its order pickup line by collaborating with SKDK automation and FANUC CR-15iA. Making the packaging and picking line workload comfortable for workers. Further the rise in the demand for new drugs has resulted in increased productivity by facilitating the adoption of automated equipment by pharmaceutical companies.

The research laboratories segment is expected to grow significantly over the forecast period. Pharmaceutical robot adoption is increasing among research laboratories owing to the increasing usage of robots in these facilities. Laboratory automation has facilitated rapid test analysis and revolutionized the R&D sector. In addition, robots offer benefits in laboratory applications, such as better record-keeping, higher consistency, traceability, and product integrity. The initiatives undertaken by public and private players to promote automation, growing investment and the rising demand for efficient workflow management in research laboratories are among the key factors promoting the adoption of pharmaceutical robot solutions and aiding market growth. For instance, in June 2022, Insilico Medicine, an AI-driven drug discovery company, received USD 60 million in funding from a syndicate of global investors to launch an AI-powered drug discovery robotics laboratory and enhance the pipeline products.

Regional Insights

The North America pharmaceutical robots industry is expected to register the fastest growth rate over the forecast period, owing to the well-established healthcare infrastructure contributing to the increasing demand for collaborative robots in the pharmaceutical industry. Moreover, North America is among the first regions to adopt pharmaceutical collaborative robot solutions. Further the robots are increasingly used in various applications in the pharmaceutical industry due to advancements in robotics technology and increased flexibility. For instance, in May 2023, Elite Robots launched the C S620 cobot at the EASTEC trade show in West Springfield, Massachusetts. The cobot is a part of the company's CS series, built on an advanced software infrastructure featuring a modular graphical user interface supporting the Python scripting language. In addition, the CS series is rated for ISO Class 5 cleanrooms, making it ideal for industries that require a high level of hygiene, such as pharmaceuticals and electronics. For instance, in May 2023, Elite Robots launched the C S620 cobot at the EASTEC trade show in West Springfield, Massachusetts. The cobot is a part of the company's CS series, built on an advanced software infrastructure featuring a modular graphical user interface supporting the Python scripting language. In addition, the CS series is rated for ISO Class 5 cleanrooms, making it ideal for industries that require a high level of hygiene, such as pharmaceuticals and electronics.

U.S. Pharmaceutical Robots Market Trends

The U.S. dominated the pharmaceutical robots market in North America region in 2024. The growth is attributed to the well-established healthcare infrastructure, growing government initiatives and healthcare spending on healthcare technology thus bolstering the market growth over the forecast period. Increased funding and rising awareness regarding the benefits of robots in healthcare is expected to positively impact the market. For instance, in July 2023, a San Francisco-based startup, Collaborative Robotics, secured USD 30 million in Series A funding. The company was aiming to utilize the funds raised to scale early field deployments and manufacture its innovative collaborative robots (cobots). This funding was expected to fuel the startup's growth in the collaborative robotic market, rapidly gaining prominence due to its ability to work near humans.

Canada pharmaceutical robots market is anticipated to register the fastest growth rate during the forecast period. Rising healthcare expenditure and the presence of key market players in the country aid in driving the market growth. For instance, as per the data published by Canada Institute of Health Information in November 2023, total healthcare spending in Canada by 2023 is anticipated to reach USD 344 billion or USD 8,740 per Canadian citizen. Further presence of favorable government initiatives and the increasing funding for robots in the pharmaceutical industry is helping the market grow. For instance, in November 2022, the government of Canada (Minister of Innovation, Science and Industry) invested USD 30 million in Sanctuary Cognitive Systems Corporation, a Vancouver-based AI and robotics company, to develop human-like intelligence in robots to complete physical tasks in the healthcare industry. The aforementioned factors are anticipated to fuel the market over the forecast period.

Europe Pharmaceutical Robots Market Trends

The Europe pharmaceutical robots market is anticipated to grow significantly during the forecast period, due to the presence of skilled professionals and well-established healthcare infrastructure. Recent data from the International Federation of Robotics IFR 2024 revealed that Germany is one of the leading countries in the world regarding the number of robots per employee. The country had approximately 415 robot units for every 10,000 employees in 2023. This has led to a significant rise in the demand for pharmaceutical robots in various parts of Europe.

Germany pharmaceutical robots industry is anticipated to register a considerable growth rate during the forecast period. The growing emphasis on laboratory automation drives the growth rate. Fueling the adoption of pharmaceutical robots in the country as they provide work efficiency & accuracy and eliminate human errors more effectively than traditional machinery. For instance, in August 2020, Gizelis Robotics expanded its network in Germany, which indicates Yaskawa Electric Corporation’s confidence in the company’s ability to support high-demand robotics applications in Europe. The expansion is expected further to boost the adoption of pharmaceutical robots in the region.

The UK pharmaceutical robots industry is anticipated to grow considerably during the forecast period. The growth is attributable to the pharmaceutical industry witnessing an increase in the adoption of robots due to their precision, cleanroom-grade operating capabilities, and ability to work around the clock. Moreover, Western manufacturing faces a significant setback due to a severe labor shortage. The UK is experiencing its most substantial labor shortage in 3 decades, caused by multiple factors such as Brexit, the impact of COVID-19, low wages, aging populations, and a lack of technological skills.Manufacturers are increasingly investing in developing and expanding innovative technologies to overcome these challenges. For instance, in November 2022, Shadow Robot, a UK-based company, designed and developed the Haptic Telerobot to conduct intricate tasks in the sterile manufacturing of drugs and vaccines.

Asia Pacific Pharmaceutical Robots Market Trends

Asia Pacific dominated the pharmaceutical robots market with a revenue share of 66.57% in 2024. This is attributed to the presence of a large number of local pharmaceutical companies in countries, such as Japan, India, with various emerging robotics startups are expected to fuel this growth by developing innovative medical technologies that optimize patient care, enhance healthcare delivery, and reduce costs. Furthermore, the increasing interest in new technologies, including pharmaceutical collaborative robot systems, is anticipated to contribute to the market growth.

The China pharmaceutical robots market is anticipated to hold a considerable market share rate during the forecast period, owing to the growing modernization of domestic production facilities and favorable government initiatives are contributing to the demand for pharmaceutical collaborative robots. For instance, in August 2023, the Beijing Municipal Bureau of Economy and Information Technology announced the investment of a USD 1.4 billion robotics fund to promote the development of robotics technology in the city. This fund aims to position Beijing as the international industrial hub. It will provide financial assistance to local companies within the industry, including incubation of the latest innovations, development of commercial breakthroughs, as well as financing mergers-&-acquisition activities.

Indian pharmaceutical robots market accounted for significant market share, owing to the increasing deployment of collaborative robots in the pharmaceutical sector and launches of new products. According to the Draft National Strategy on Robotics, India experienced a notable 54% surge in robotics installations, reaching a total of 4,945 units in 2021. This positioned India as the 10th highest in annual industrial robot installations globally. Furthermore, growing support from the government and private investors in the form of funding is anticipated to fuel the market growth over the forecast period.

Latin America Pharmaceutical Robots Market Trends

The Latin America pharmaceutical robots market is anticipated for the second fastest CAGR growth over the forecast period, this is attributable to the technological advancements and research breakthroughs in emerging nations, such as Brazil and Mexico. These countries present lucrative opportunities due to their evolving healthcare landscapes and expanding pharmaceutical industries.

The Brazil pharmaceutical robots market accounted for significant market share. As the pharmaceutical manufacturing in Brazil has been witnessing a significant shift toward automation. Collaborative robots are gaining traction in this industry due to their ability to work alongside human operators, boosting productivity and improving worker safety. The benefits of collaborative robots, such as accuracy, high speed, and error-free operation, are expected to drive the adoption of these machines in the pharmaceutical industry.

Middle East & Africa Pharmaceutical Robots Market Trends

The MEA pharmaceutical robots market holds a significant market share due to growing awareness & adoption and developing healthcare infrastructure. However, the lack of skilled professionals in this region are expected to boost the need for robotic-assisted surgeries. Furthermore, the development of new products in the healthcare robots market, the growing number of FDA approvals, and rising partnerships among international players for product refinements are expected to boost the market over the forecast period.

The UAE pharmaceutical robots market holds a significant market share due to the growing need for increased productivity and operational agility. With the rising demand for pharmaceutical products fueled by population growth and healthcare advancements, manufacturers are under pressure to ramp up production while maintaining high standards of quality & safety. Cobots enable companies to achieve this balance by automating repetitive and labor-intensive tasks. Thus, the adoption of such robots boosts the market in the country.

Key Pharmaceutical Robots Company Insights

Key participants in the pharmaceutical robots market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Pharmaceutical Robots Companies:

The following are the leading companies in the pharmaceutical robots market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Universal Robots A/S

- Kawasaki Heavy Industries Ltd.

- Yaskawa Electric Corporation

- FANUC America Corporation

- Marchesini Group S.p.A

- Seiko Epson Corporation

- Denso Wave, Inc.

- Shibuya Corporation

- Mitsubishi Electric Corporation

- Kuka AG

Recent Developments

-

In March 2024, Olis Robotics entered into a new partnership with Kawasaki Robotics Inc. This partnership is expected to enable customers to expedite production restarts, significantly reduce troubleshooting and downtime expenses by up to 90%, and swiftly access expert support. Olis users can directly connect to their robots through an on-premises device via a secure connection.

-

In December 2023, Mitsubishi Electric India launched an advanced Factory Automation Systems facility in India. This is expected to expand the company’s global presence and meet the evolving needs of Indian and international markets. The facility aims to optimize delivery efficiency and supply chain capabilities, ensure cost-effectiveness, and empower customers and the wider manufacturing sector with enhanced efficiency & precision.

-

In December 2023, ABB Robotics and XtalPi have formed a strategic partnership to manufacture automated laboratory workstations in China. These automated labs are expected to enhance R&D productivity in biopharmaceuticals, chemistry, chemical engineering, and new energy materials. XtalPi Intelligent Automation utilizes the GoFa cobots to create preparation, filtration, dilution, reaction, along with Automated Guided Vehicles (AGV), streamlining lab research and development for improved efficiency

-

In July 2023, YASKAWA India launched its advanced Robotic Experience Centre in India. This cutting-edge facility highlights the latest advancements in industrial automation, featuring six robotic cells that include Articulated and collaborative robots, along with drives and motion control products.

-

In March 2023, ABB announced an expansion of its North American robotics headquarters and manufacturing facility in Michigan. This USD 20 million investment is expected to generate 72 skilled jobs. The initiative marks a significant advancement in ABB Robotics' global dominance in pioneering and manufacturing state-of-the-art robotic solutions in the U.S.

Pharmaceutical Robots Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 234.69 million

Revenue forecast in 2033

USD 458.36 million

Growth rate

CAGR of 8.73% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ABB Ltd.; Kawasaki Heavy Industries Ltd.; Universal Robots A/S; FANUC America Corporation; Yaskawa Electric Corporation; Marchesini Group S.p.A; Seiko Epson Corporation; Denso Wave, Inc.; Kuka AG, Mitsubishi Electric Corporation; Shibuya Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Robots Market Report Segmentation

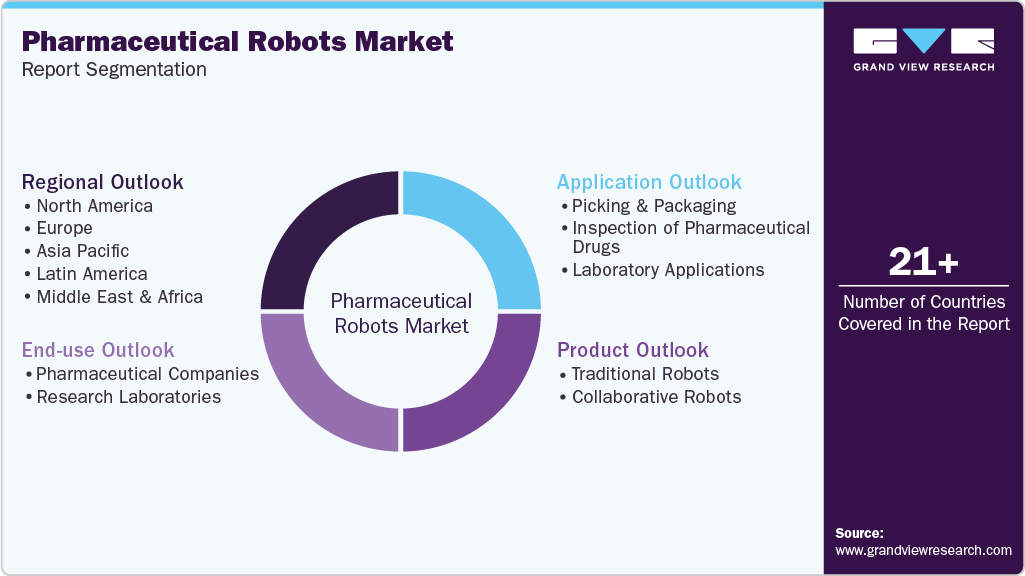

This report forecasts revenue growth at the global, regional, and country-level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the global pharmaceutical robots market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Traditional Robots

-

Articulated Robots

-

SCARA Robots

-

Delta/Parallel Robots

-

Cartesian Robots

-

Dual-arm Robots

-

-

Collaborative Robots

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Picking and Packaging

-

Inspection of Pharmaceutical Drugs

-

Laboratory Applications

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical Companies

-

Research Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical robots market size was estimated at USD 215.26 million in 2024 and is expected to reach USD 234.69 million in 2025.

b. The global pharmaceutical robots market is expected to grow at a compound annual growth rate of 8.73% from 2025 to 2033 to reach USD 458.36 million by 2033.

b. Traditional Robots dominated the pharmaceutical robots market with a share of 62.72% in 2024. This is attributable to increased awareness about these machines and rising usage for different applications.

b. Some key players operating in the pharmaceutical robots market include ABB Ltd., Universal Robots A/S, Kawasaki Heavy Industries Ltd., Yaskawa Electric Corporation, FANUC America Corporation, Marchesini Group S.p.A, Seiko Epson Corporation, Denso Wave, Inc., Shibuya Corporation, Mitsubishi Electric Corporation, and Kuka AG.

b. The high costs of new drug discovery and the rising need for automation in manufacturing units significantly increase the demand for robotics in drug discovery, clinical trials, and laboratories for automating procedures. In addition, key companies are introducing technologically advanced robotic machines, further leading to tremendous market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.