- Home

- »

- Healthcare IT

- »

-

Pharmacy Inventory Management Software Solutions And Cabinets Market 2033GVR Report cover

![Pharmacy Inventory Management Software Solutions And Cabinets Market Share & Trends Report]()

Pharmacy Inventory Management Software Solutions And Cabinets Market (2025 - 2033) Share & Trends Analysis Report By Type (Cabinets/Systems), By Mode Of Operations, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-420-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmacy Inventory Management Software Solutions and Cabinets Market Summary

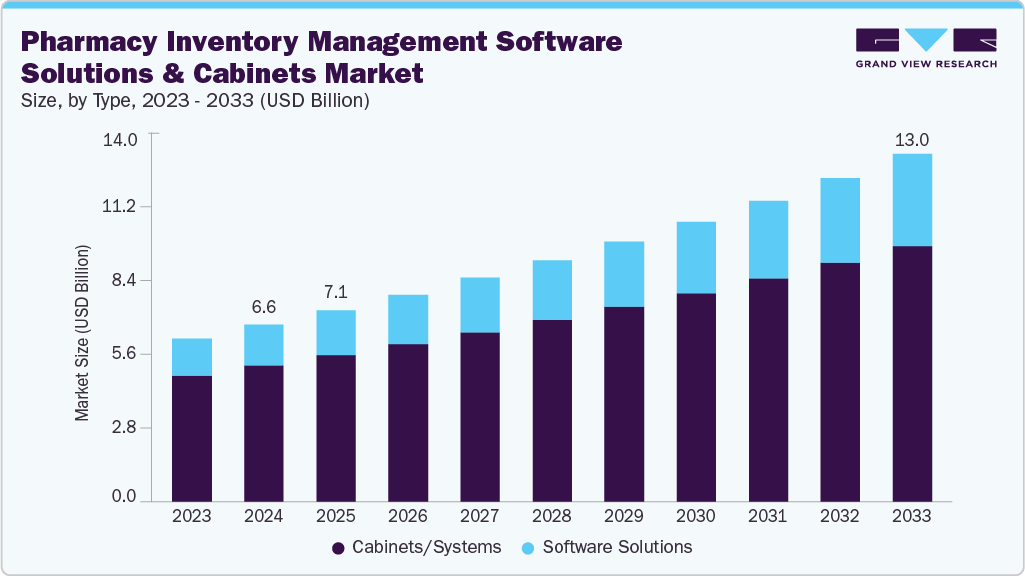

The global pharmacy inventory management software solutions and cabinets market size was estimated at USD 6.62 billion in 2024 and is projected to reach USD 13.03 billion by 2033, growing at a CAGR of 7.77% from 2025 to 2033. The market growth is attributed to the increased adoption of automation solutions including dispensing cabinets with barcode and RFID technology.

Key Market Trends & Insights

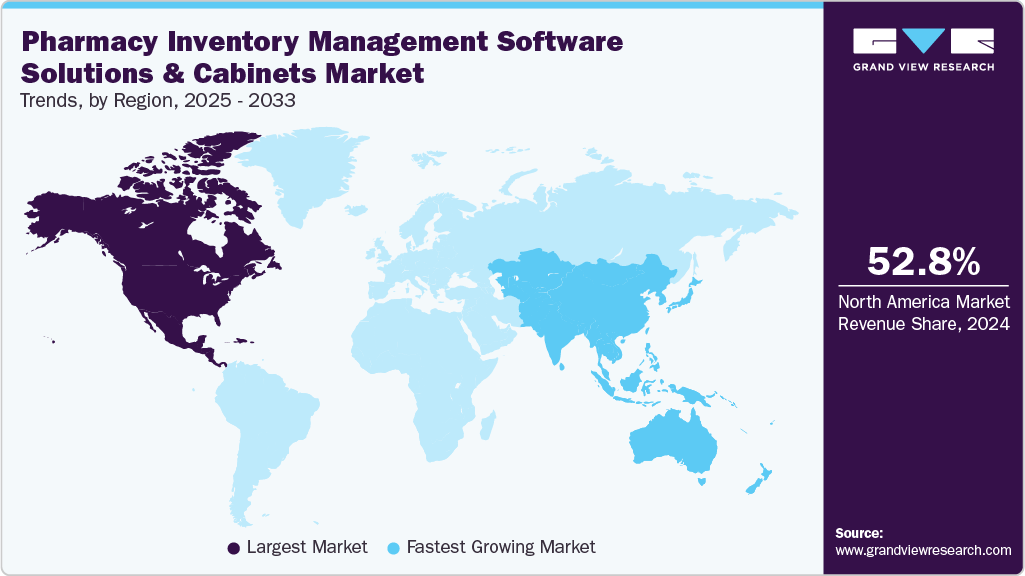

- North America pharmacy inventory management software solutions and cabinets market dominated with a share of 52.83% in 2024

- The U.S. pharmacy inventory management software solutions and cabinets market held the largest revenue share in the North American region

- Based on type, the cabinets/systems segment dominated the market with a 76.92% share in 2024.

- Based on mode of operations, the decentralized segment held the largest market share of 64.97% in 2024.

- Based on end use insights, the independent pharmacies segment dominated the market with 37.90% of the market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.62 Billion

- 2033 Projected Market Size: USD 13.03 Billion

- CAGR (2025-2033): 7.77%

- North America: Largest market in 2024

As the healthcare sector expands rapidly, it faces a significant rise in the volume of prescriptions. Healthcare providers have increasingly sought automated pharmacy inventory management systems to reduce medication errors. For instance, Texas Children’s Hospital implements an advanced RFID drug inventory management system each year, focusing on high-value and specialty medications. The new process reduces manual data entry by associating RFID tags with medications and their storage locations, enabling real-time tracking, reducing waste, preventing drug diversion, and improving inventory accuracy.

In addition, pharmacies have increasingly adopted advanced medication management systems to ensure updated inventory and monitor slow-moving inventory and the expiry of medicines. The implementation of analytical tools advanced with artificial intelligence (AI), the Internet of Things (IoT), and blockchain have significantly enhanced the functionality of the pharmacy management system, leading to substantial inventory acquisition and usage tracking. The pharmacy inventory management system assists in handling the intricacies of overseeing drug inventory, point-of-sale transactions, and dispensing medication. Moreover, healthcare professionals have faced mounting pressure to reduce costs. Inventory management software and cabinets help manage medication inventory efficiently, minimizing excess stock and lowering expenses. For instance, Intermountain Healthcare reported that 60%-70% of its pharmacy budget was allocated to inventory management. Similarly, hospitals are investing in establishing smart rooms for inventory management. For instance, in February 2023, Galilee Medical Center in northern Israel launched the first smart room for managing operating room inventory. Developed by Autonomi ltd. and Sarel, this system automates inventory management, reducing errors and waste.

Furthermore, incorporating e-commerce and digitalization through pharmacy management systems has helped pharmaceutical vendors offer patients an effective way to find and buy their needed medications. In a business-to-customer (B2C) setting, patients can purchase and receive their prescription medications without leaving their homes. In the (business-to-business) B2B setting, thorough pharmaceutical e-commerce platforms have let providers analyze various fluctuating factors in drug purchasing, such as availability and prices of other drugs, for informed spending. These factors have further augmented the pharmacy inventory management software solutions & cabinets market.

Market Concentration & Characteristics

The industry is witnessing increased innovation with the launch of digital healthcare solutions and innovative dispensing systems to enhance patient experience. For instance, in August 2024, Omnicell introduced its Central Med Automation Service, a subscription-based solution designed to enhance medication management in healthcare settings. This service aims to streamline pharmacy operations, improve medication safety, and optimize inventory management.

“As the health system enterprise grows, we find that traditional methods of medication management can lead to multi-vendor environments that may complicate workflows, often creating unnecessary redundancy and increasing chances for error. Pharmacy leaders recognize the potential value of centralizing pharmacy services, but often lack the capital budgets, resources, and expertise necessary to transform their infrastructure and scale it over time. Omnicell’s Central Med Automation Service is designed to help health systems develop and execute a central fill strategy while providing the expert support necessary to help ensure this environment meets current and future medication management needs.”

-Randall Lipps, chairman, president, chief executive officer, and founder of Omnicell

The industry witnesses a moderate level of partnership and collaboration activities. Companies are collaborating to bolster product offerings, expand global reach, diversify portfolios, integrate technologies, and enhance their standing in the industry. For instance, in August 2024, TraceLink and Tecsys announced a strategic collaboration to improve supply chain management within healthcare systems. This partnership combines TraceLink's expertise in serialization and compliance with Tecsys' advanced warehouse management solutions to create a more efficient and secure supply chain for healthcare systems.

"Partnering with Tecsys allows TraceLink to offer health systems the ability to source real-time supply chain information from 100% of their suppliers directly into their inventory management system, thereby eliminating time-consuming effort that busy pharmacy staff have to expend on a variety of challenges,"

-Shabbir Dahod, President and CEO of TraceLink.

"This partnership underscores TraceLink's commitment to delivering innovative multi-enterprise data and solutions that improve patient outcomes and streamline supply chain operations, without the need for expensive or time-consuming enterprise system changes or upgrades."

Regulatory measures significantly influence the pharmacy inventory management software solutions and cabinets market. In the U.S., regulatory oversight is managed by the U.S. Food and Drug Administration (FDA). Pharmacy management software must be validated to ensure it performs accurately and reliably in managing drug inventories.

North America and Europe held a prominent share in the pharmacy inventory management software solutions and cabinets market, and the Asia-Pacific region is witnessing rapid growth due to expanding healthcare infrastructure and the rising adoption of advanced technology in healthcare. Moreover, increasing online and retail pharmacies in developing countries like India demand sophisticated inventory management solutions to streamline workflows, aiding market growth.

Case Study: Bartle’s Pharmacy Enhances Patient Medication Adherence and Financial Performance through Technology Integration

Bartle’s Pharmacy, a community pharmacy in Oxford, New York, faced significant challenges adapting to an evolving healthcare environment marked by declining reimbursements and increasing emphasis on medication adherence as a quality metric. To improve patient compliance and operational efficiency, Bartle’s integrated McKesson’s Adherence Performance Solution (APS) into their workflow to transform pharmacy care delivery and business performance.

Challenges:

-

The pharmacy struggled with low medication adherence rates, impacting their star ratings and reimbursement levels through increased direct and indirect remuneration (DIR) fees. Limited real-time data on patient compliance hindered proactive interventions, and the growing economic pressure necessitated new revenue streams and service improvements. In addition, maintaining high-quality personalized care was challenged by increasing patient volumes and administrative burdens.

Solution:

-

Bartle’s Pharmacy deployed the APS platform, which provided an accessible, real-time dashboard highlighting patients’ adherence status across multiple categories. Pharmacy staff could promptly identify non-adherent patients, initiate outreach through calls, and engage patients during prescription pick-up consultations. APS streamlined adherence monitoring without requiring staff to log into separate systems, fostering timely, data-driven patient engagement and enabling the pharmacy team to focus on meaningful clinical interactions.

Results/Outcomes:

-

Post-implementation, Bartle’s achieved over a 10% increase in average proportion of days covered (PDC) within six months, with prescription refills per patient nearly tripling from 3.6 to 10 annually. Enhanced adherence contributed to improved revenue streams and reduced DIR fees.

-

The technology facilitated better inventory management by enabling just-in-time ordering of high-cost drugs and strengthened pharmacist-patient relationships through proactive care.

-

Bartle’s gained Top 20 status in the CMS Five-Star Quality Ratings within the first year, underpinning sustained financial and clinical improvements. The Pharmacy continues to leverage APS to pursue further adherence goals, provider outreach, and high-risk medication management.

Type Insights

The cabinets/systems segment dominated the market with a 76.92% share in 2024, owing to the increased use of automated dispensing cabinets (ADCs) that help streamline medication dispensing by automating the process. They reduce manual errors, improve workflow, and enhance overall efficiency in hospitals and clinics. These cabinets incorporate barcode scanning and RFID technology. For instance, McKesson Corporation’s ExpressRx Track ensures accurate medication administration, optimizes inventory levels and minimizes waste. Furthermore, pharmacists have increasingly adopted compact robotic dispensers to manage high prescription volumes efficiently. These systems often work seamlessly with inventory management software, providing real-time data and analytics.

The software solutions segment is expected to register the fastest CAGR during the forecast period owing to technological advancements, including AI, which is used for predictive analytics, demand forecasting, and inventory optimization. The increasing number of prescriptions worldwide has driven the need for efficient inventory management software solutions. Factors including efficient inventory management, expiry date tracking, automated reordering, and improvement in the functioning of the pharmacy staff have contributed to the market growth.

Mode of Operations Insights

The decentralized segment held the largest market share of 64.97% in 2024, owing to the growing demand for point-of-use dispensing of medications. In addition, this segment is anticipated to grow at the fastest CAGR during the forecast period. Pharmacies have increasingly adopted automation solutions, including decentralization software to optimize medication dispensing, faster prescription processing, and increased savings on inventory costs. Decentralized dispensing systems, with features including barcode scanning and RFID technology, ensure accurate medication administration, minimizing adverse events. Furthermore, the trend of using decentralized software in long-term care centers is rising. These systems provide point-of-care convenience, improving accessibility and reducing patient wait times.

The centralized operations segment is anticipated to register growth at a significant CAGR over the forecast period as these encourage collaboration among pharmacy units within a healthcare system. This model helps pharmacies share inventory data and optimize stock levels collectively, improving efficiency and reducing costs. They also facilitate bulk purchasing and negotiating with suppliers, saving costs. In addition, centralized operations benefit from automation and robotics with optimized inventory handling, reduced manual effort, and ensured timely restocking. Furthermore, centralized inventory models allow better resource utilization, minimize waste, and promote eco-friendly practices that align with an increased focus on sustainability.

End Use Insights

The independent pharmacies segment dominated the market with 37.90% of the market share in 2024, owing to the rise in the pharmacy industry and the implementation of automation software to reduce operational costs and improve overall functioning. Independent or retail pharmacies catering to local communities have faced growing prescription volumes, which encouraged them to seek inventory management solutions to streamline their processes. Furthermore, alarming government regulations for storing and dispensing controlled substances have increased the demand for automated dispensing cabinets.

The long-term care (LTC) segment is expected to grow at the fastest CAGR during the forecast period. The growing geriatric population has increased the demand for specialized medication management, including LTC pharmacies. These pharmacies handle various medications, including chronic disease treatments, pain management, and palliative care. Inventory management systems allow proper monitoring of stocks and timely delivery of medicines to the patients. These systems applied in LTC allow optimized medicine distribution and time management, further boosting segment growth.

Regional Insights

North America pharmacy inventory management software solutions and cabinets market dominated with a share of 52.83% in 2024. The market has primarily benefited from a substantial number of market players, leading to increased availability of pharmacy inventory management systems and solutions. Healthcare providers have increasingly adopted these systems to optimize the workflow of pharmacies with ongoing advancements in healthcare IT infrastructure.

U.S. Pharmacy Inventory Management Software Solutions and Cabinets Market Trends

The U.S. pharmacy inventory management software solutions and cabinets market held the largest revenue share in the North American region, owing to the increasing government focus on cost containment in healthcare. Pharmacy inventory management systems contribute to waste reduction and lower inventory costs, leading to an anticipated rise in demand.

Europe Pharmacy Inventory Management Software Solutions and Cabinets Market Trends

Europe pharmacy inventory management software solutions and cabinets market experienced lucrative growth in 2024. This growth is attributed to the growing adoption of advanced technology, including automated dispensing cabinets (ADCs) and RFID tracking, which enhances efficiency and accuracy in inventory management. Moreover, the rise in retail, mail-order, and long-term care pharmacies has necessitated effective inventory management solutions, boosting market growth.

Germany pharmacy inventory management software solutions and cabinets market held a significant market share in the European region in 2024. This is attributed to the strong healthcare infrastructure, advancements in technology, and robust presence of pharmacies across the country. Moreover, the rising shift towards digital health solutions significantly influences the country’s market. With increasing emphasis on telehealth services and digital prescriptions, pharmacies are required to adapt their operations to accommodate these changes effectively. Such factors are expected to propel market growth.

The UK pharmacy inventory management software solutions and cabinets market experiences growth over the forecast period. The growing emphasis on improving operational efficiency within pharmacies, rapid technological advancements, and stringent regulatory requirements are factors contributing to market growth. The stringent regulatory compliance requirements imposed by health authorities such as the Medicines and Healthcare Products Regulatory Agency (MHRA) and the General Pharmaceutical Council (GPhC) mandate pharmacies to maintain accurate records of medication stock levels, expiry dates, and controlled substances. Hence, pharmacies are increasingly adopting sophisticated inventory management systems to ensure compliance with these regulations.

Asia Pacific Pharmacy Inventory Management Software Solutions and Cabinets Market Trends

Asia Pacific pharmacy inventory management software solutions and cabinets market held a significant market share in 2024 and is expected to grow at the fastest CAGR during the forecast period. The increasing number of retail pharmacies and prescriptions and the ongoing enhancements in healthcare infrastructure have collectively driven market growth in the region. In addition, rising healthcare expenditure and the growing burden of diseases in recent years are expected to fuel demand for pharmacy inventory management solutions.

Japan pharmacy inventory management software solutions and cabinets market is expected to grow over the forecast period. This growth is attributed to rapid technological advancements such as the integration of artificial intelligence (AI) and machine learning into inventory management systems and the stringent regulatory environment governing pharmaceutical practices. Furthermore, the adoption of cloud-based solutions facilitates remote access to inventory data, enhancing operational efficiency and enabling better collaboration among pharmacy staff. Thus, as these technological innovations continue to evolve, they are likely to drive increased investment in sophisticated inventory management systems across the country’s pharmacy sector.

China pharmacy inventory management software solutions and cabinets market is poised to grow during the forecast period. Increasing healthcare expenditure and technological advancements are factors contributing to market growth. Moreover, hospitals in the country are optimizing their pharmacies by integrating smart technologies into inventory management and drug dispensing systems. For instance, the Tongzhou branch of Anzhen Hospital utilizes a robotic closed-loop operational method to deliver drugs to patients. This is a fully automated system designed to ensure precise drug dispensation, storage, and distribution.

Latin America Pharmacy Inventory Management Software Solutions and Cabinets Market Trends

The Latin America pharmacy inventory management software solutions and cabinets market is expected to grow during the forecast period. Rising healthcare expenditure and increasing technology integration in healthcare are factors propelling market growth. In addition, the growing emphasis on enhancing operational efficiency while reducing costs is another crucial driver boosting market growth.

Middle East and Africa Pharmacy Inventory Management Software Solutions and Cabinets Market Trends

The Middle East and Africa pharmacy inventory management software solutions and cabinets market is poised to grow significantly from 2025 to 2033. One significant factor driving market growth is the region's rapid expansion of the healthcare sector. As the number and complexity of healthcare facilities, such as hospitals and pharmacies, continue to increase, there is a growing demand for effective inventory management systems. In addition, the increasing trend of digital transformation in healthcare significantly influences the regional market.

Key Pharmacy Inventory Management Software Solutions and Cabinets Company Insights

Key players operating in the pharmacy inventory management software solutions and cabinets market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Pharmacy Inventory Management Software Solutions and Cabinets Companies:

The following are the leading companies in the pharmacy inventory management software solutions and cabinets market. These companies collectively hold the largest market share and dictate industry trends.

- ARxIUM

- BD

- Clanwilliam IRL

- Datascan

- DCS INFOWAY

- Epicor Software Corporation

- GlobeMed Ltd.

- Health Business Systems Inc.

- JVM Co., Ltd.

- LIBERTY SOFTWARE

- Logic ERP Solutions Pvt Ltd.

- McKesson Corporation

- Omnicell Inc.

- Oracle

- Supplylogix LLC

- Swisslog Healthcare

- OSP

- Tecsys

- Cardinal Health

Recent Developments

-

In June 2025, Tecsys launched ESL+, an interactive electronic shelf labeling solution designed specifically for hospital inventory management. ESL+ combines tactile control with visual and digital connectivity, featuring programmable buttons and LED indicators.

-

In March 2025, Roche, a prominent biotechnology company, adopted Tecsys’ cloud-based Elite platform for inventory management across its global laboratory network spanning 50+ countries. The solution integrates with Roche’s SAP backend, automating the full inventory lifecycle for laboratory reagents and consumables. It delivers real-time inventory visibility, usage tracking, and automated replenishment workflows.

-

In October 2024, Alto Pharmacy introduced a new technology platform to optimize hub and dispensing solutions for its industry partners. This innovative platform aims to streamline pharmacy operations, improve patient care, and optimize the overall medication management process.

-

In July 2024, Intelliguard launched the Mira Ecosystem, an enhanced suite of medication management and data intelligence solutions. This suite includes Mira Intelligence, Mira Prep, Mira Care, and Mira Supply, offering a smart medication and inventory management approach.

-

In March 2024, Truepill, a digitally enabled pharmacy solutions company, selected Tecsys's Elite Warehouse Management System (WMS) to modernize its nationwide mail-order pharmacy operations.

-

In November 2023, Tecsys Inc. introduced the Elite Warehouse Management System (WMS) designed for healthcare distribution, ensuring compliance with the U.S. Drug Supply Chain Security Act (DSCSA).

-

In November 2023, Baptist Health has partnered with Omnicell to implement the Central Pharmacy Dispensing Service to improve pharmacy care and medication supply chain management.

“We selected Omnicell’s robotics and services for our Central Pharmacy Services Center in an effort to help alleviate staffing challenges while focusing on improving quality, patient safety, and efficiency,”

-said Nilesh Desai, Chief Pharmacy Officer at Baptist Health.

“We’re excited about the opportunity to advance further toward our vision of a fully integrated and highly automated pharmacy solution.”

-

In March 2022, Omnicell launched the IVX Station, a robotic compounding solution to enhance pharmacy care by automating workflows and improving patient safety. This technology addresses challenges in sterile compounding, offering three times the throughput speed of existing IV robotics.

-

In August 2021, iA (Intelligent Automation) launched a new suite of solutions designed to enhance pharmacy services. This initiative aims to leverage operational efficiency, manage inventory, and streamline pharmacy workflows.

Pharmacy Inventory Management Software Solutions and Cabinets Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.16 billion

Revenue forecast in 2033

USD 13.03 billion

Growth rate

CAGR of 7.77% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, mode of operations, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ARxIUM; BD; Clanwilliam IRL; Datascan, DCS INFOWAY; Epicor Software Corporation; GlobeMed Ltd.; Health Business Systems Inc.; JVM Co., Ltd.; LIBERTY SOFTWARE; Logic ERP Solutions Pvt Ltd.; McKesson Corporation; Omnicell Inc.; Oracle; Supplylogix LLC; Swisslog Healthcare; OSP; Tecsys; Cardinal Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmacy Inventory Management Software Solutions And Cabinets Market Report Segmentation

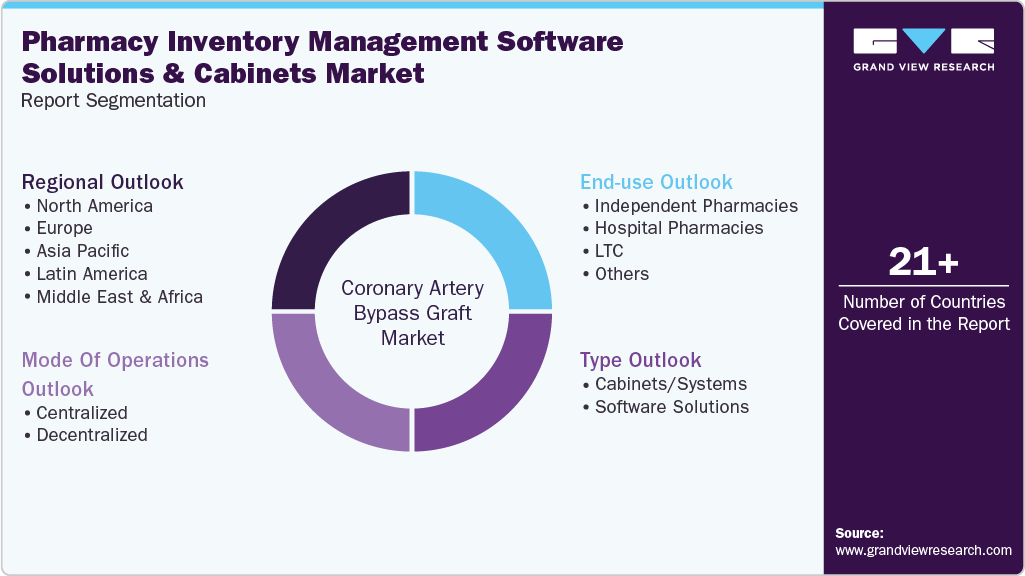

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global pharmacy inventory management software solutions and cabinets market report based on type, mode of operations, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Cabinets/Systems

-

Software Solutions

-

-

Mode of Operations Outlook (Revenue, USD Million, 2021 - 2033)

-

Centralized

-

Decentralized

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Independent Pharmacies

-

Hospital Pharmacies

-

LTC

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.