- Home

- »

- Plastics, Polymers & Resins

- »

-

Phenolic Resins Market Size & Share, Industry Report, 2033GVR Report cover

![Phenolic Resins Market Size, Share & Trends Report]()

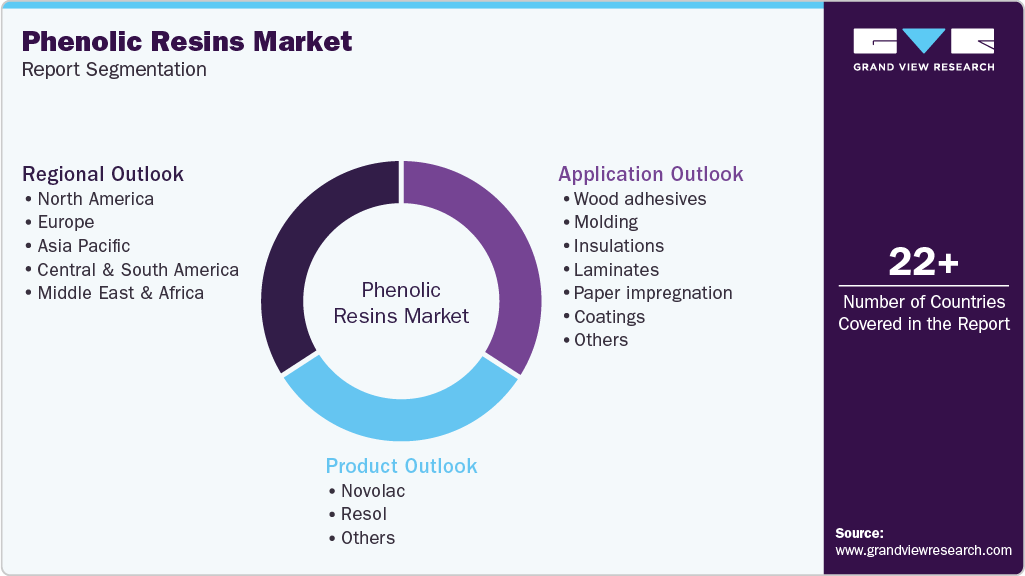

Phenolic Resins Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Novolac, Resol, Others), By Application (Wood Adhesives, Molding, Insulations, Laminates, Paper Impregnation), By Region, and Segment Forecasts

- Report ID: 978-1-68038-271-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Phenolic Resins Market Summary

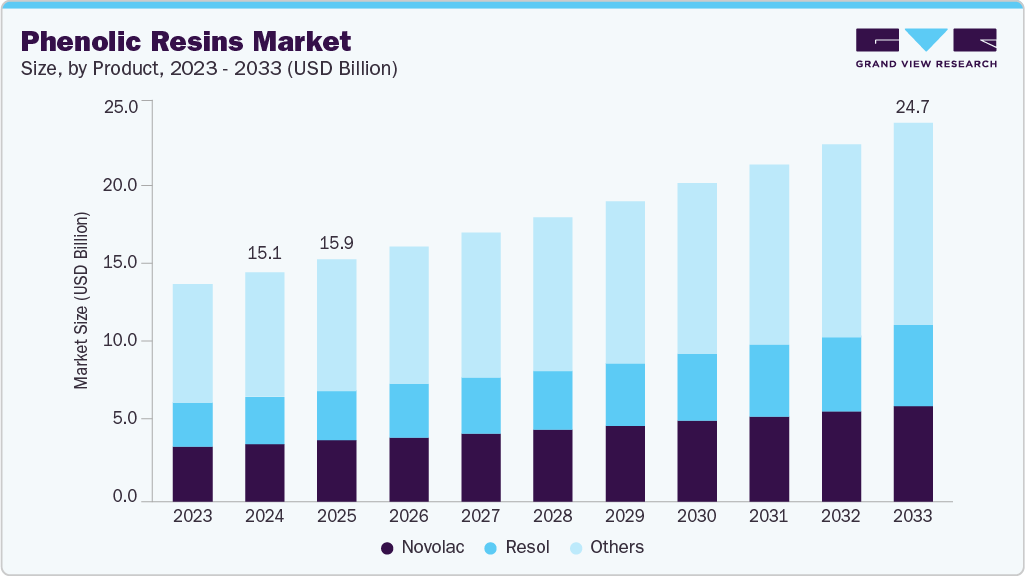

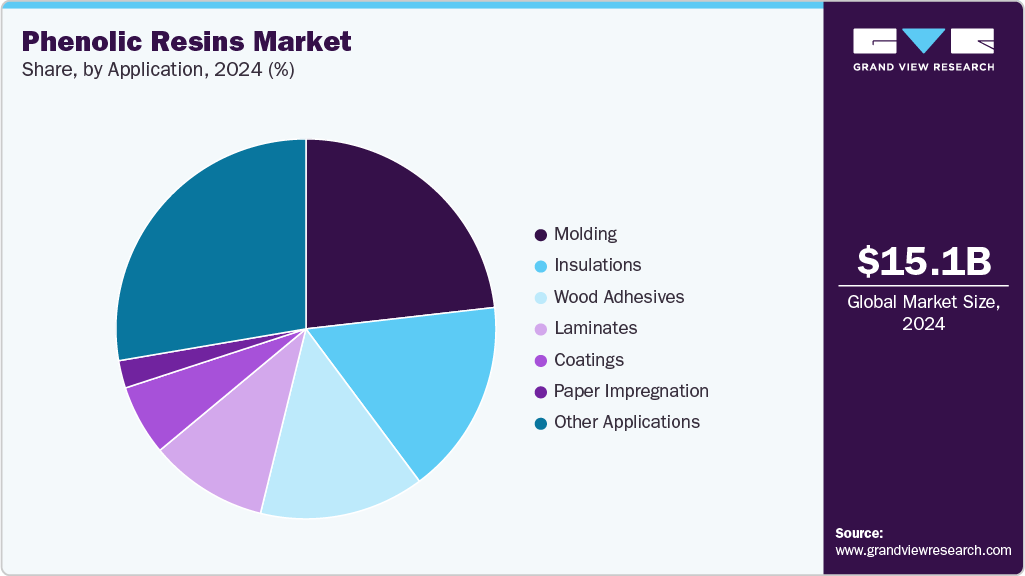

The global phenolic resins market size was estimated to be USD 15.07 billion in 2024 and is projected to reach USD 24.71 billion by 2033, growing at a CAGR of 5.7% from 2025 to 2033. Phenolic resins are commonly used across applications, including wood adhesives, molding, insulations, laminates, paper impregnation, coatings, and other applications such as abrasives, composites, carbon binders, friction materials, sound-roof bonding felt, and tires & rubbers.

Key Market Trends & Insights

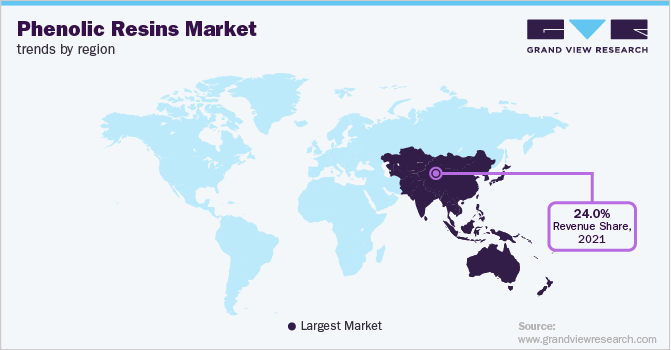

- Asia Pacific dominated the phenolic resins market with the largest revenue share of 30.92% in 2024.

- The phenolic resins market in China is expected to grow at a substantial CAGR of 6.5% from 2025 to 2033.

- By application, the molding segment is expected to grow at the fastest CAGR of 6.5% from 2025 to 2033 in terms of revenue.

- By product, the Resol segment is expected to grow in revenue at the fastest CAGR of 6.1% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 15.07 Billion

- 2033 Projected Market Size: USD 24.71 Billion

- CAGR (2025-2033): 5.7%

- Asia Pacific: Largest market in 2024

The growth in domestic manufacturing of wood-based cabinets, furniture, wall panels, and associated construction materials, along with increasing residential housing utilizing similar engineered wood products, is likely to present lucrative opportunities for phenolic resins during the forecast period.Phenolic resins are gaining renewed traction as industries demand materials that balance durability, thermal stability, and sustainability. In automotive and aerospace, the shift toward lightweighting and fire-safe components is reinforcing phenolic adoption in composites, brake linings, and insulation systems. Electronics manufacturers are also leveraging phenolic-based laminates and adhesives to ensure dimensional stability and flame resistance in high-performance circuit boards.

Meanwhile, the construction sector is turning to phenolic foams for energy-efficient insulation solutions with low smoke and toxicity profiles. These dynamics are prompting producers to refine product lines with advanced, low-emission, and bio-based phenolic grades that align with tightening environmental regulations and next-generation performance needs.

Drivers, Opportunities & Restraints

The demand for phenolic resins continues to be driven by system-level requirements in automotive lightweighting, aerospace safety, and advanced construction. When subjected to stress, these sectors require materials that provide inherent flame resistance, thermal stability, and mechanical strength. Phenolics meet these criteria and are increasingly utilized in brake linings, friction materials, insulating foams, laminates, and structural composites that must perform reliably in challenging environments. As original equipment manufacturers (OEMs) emphasize safety, regulatory compliance, and performance efficiency, phenolic resins are evolving from a cost-effective option to a standard design choice in essential applications.

The commercial potential exists in the downstream integration of phenolics into specialized solutions such as aerospace interior panels, lightweight auto components, electronic laminates, and insulation systems designed for energy-efficient buildings. Developments in modified and bio-based grades broaden their application in areas that prioritize low emissions, sustainability, and safety. Further value can be realized through tailored resin formulations, collaborative development with end users to achieve specific performance criteria, and localized production strategies that minimize supply chains and enhance cost-effectiveness.

The adoption of phenolic resins encounters obstacles due to processing demands and regulatory constraints. These resins necessitate specific curing processes, extended processing durations, and careful handling of formaldehyde-based materials. Fluctuating feedstock prices and stricter regulations regarding formaldehyde emissions increase costs and drive innovation towards low-emission and quicker-curing solutions. Until these newer variants achieve larger-scale production, some manufacturers might opt for epoxies, polyesters, or hybrid resins where acceptable performance trade-offs exist, thereby restricting the wider use of phenolic resins.

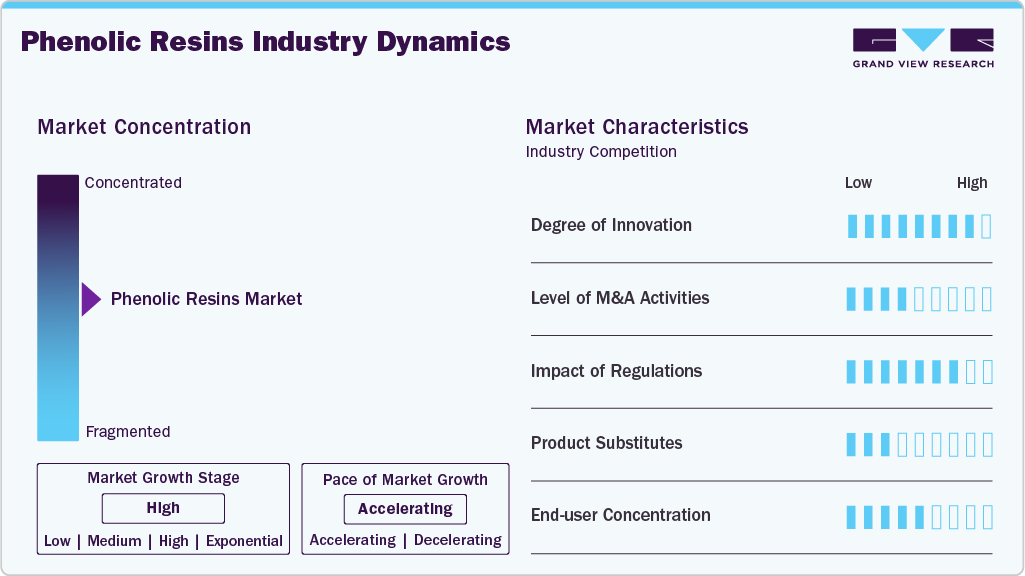

Market Concentration & Characteristics

The market growth stage of the phenolic resins market is high, and the pace is accelerating. The market exhibits slight consolidation, with key players dominating the industry landscape. Major companies such as DIC CORPORATION, Kolon Industries, Inc., Sumitomo Bakelite Co. Ltd., Hexcel Corporation, Georgia-Pacific Chemicals, KRATON CORPORATION, Hexion, Bostik, Inc., SI Group, Inc., and others play a significant role in shaping the market dynamics. These leading players often drive innovation in the market by introducing new products, technologies, and applications to meet evolving industry demands.

The phenolic resins market is evolving from traditional binder formulations to advanced engineered systems that incorporate material science, processing techniques, and sustainability considerations. Manufacturers are introducing low-free formaldehyde and bio-based options that maintain thermal stability, flame resistance, and mechanical strength while reducing emissions and overall environmental impact. Innovations in nanofilled phenolics, lightweight composite frameworks, and specialized molding compounds are creating opportunities in electronics casings, automotive parts, and high-temperature insulation. Investment in customized resin formulations and increased collaboration with converters are accelerating qualification processes and enabling suppliers to offer complete solution packages such as prepregs, composites, and engineered adhesives instead of just bulk resins. These advancements are transforming phenolics from a traditional thermoset material into a platform for high-performance and sustainable system designs.

Regulatory changes are also transforming commercial strategies across the phenolic resin supply chain. Stricter formaldehyde emission regulations in North America, Europe, and Asia are encouraging the shift to ultra-low-emission resins and alternative chemistries, while REACH and the EU Chemicals Strategy require greater transparency, circularity, and safer formulations. At the same time, policies focused on indoor air quality, green building standards, and extended producer responsibility are shaping procurement choices and creating strategic incentives for local production, certified renewable raw materials, and advanced recycling methods. Companies that integrate regulatory compliance and sustainability standards into their resin design not only reduce compliance risks but also improve their prospects for quick adoption in construction, transportation, and electronics markets.

Product Insights

Novolac resin segment dominated the phenolic resin market with a revenue share of 25.12% in terms of revenue in 2024. Novolac resin, a type of phenolic resin offers excellent impact resistance, high strength, fire resistance, thermal resistance, chemical resistance, thermal stability, flexibility, surface hardness, electrical insulating properties, and lightweight, making it ideal to produce automotive components such as suspension, seats, bottom plates, tires, brake pistons, brake block & pads, brake linings, and clutch facing.

On a contrary, resol phenolic resin can be processed using thermoplastic processing methods including alkaline catalysts and formaldehyde. In addition, these resins are self-curing due to the presence of reactive side groups, hence it is suitable for applications including coatings, molding compounds, wood-working adhesives, insulation, and others owing to its high impact resistance and serviceability.

Liquid resol phenolic resins are highly resistant to dust and other airborne particles, making them suitable for the manufacture of friction mixes, which are further used for the manufacture of disc brake pads and drum linings. Furthermore, their non-reactivity makes them ideal for manufacturing internal protective coatings for canned food, tanks, and drums. In contrast, solid resol phenolic resins are compatible with most of the available solvents, offering a versatile solution for various types of inner coatings.

Other phenolic resins include modified resins, spray-dried resins, cyanate ester resins, and benzoxazine resins. Spray drying produces resins in particulate form. Owing to their high caustic content, these particles are hygroscopic but sinter-resistant when kept dry. The principal application of these types of products is wood binding, especially in wafer board applications.

Application Insights

The molding application segment dominated the phenolic resin market with a revenue share of 23.20% in terms of revenue in 2024. Phenolic resins are versatile polymers used across a variety of industrial and consumer applications such as wood binders, paper, abrasives, and friction materials. Wood adhesives are utilized in plywood, particleboard, wafer board (WB), high-density fiberboard (HDF), oriented strand board (OSB), and medium-density fiberboard (MDF) owing to their excellent bonding properties.

In addition, phenolic resins exhibit superior water dilutibility, low free monomers, and excellent moisture resistance, which make them suitable for various applications such as containers, concrete forms, kitchen & bathroom cabinets, and interior parts in transportation & foundry patterns.

Phenolic molding compounds are used in applications such as oil pump housing, intake manifolds, valve blocks, and other automotive components, including air conditioning systems and turbochargers. These applications utilize phenolic resins due to their high heat resistance, chemical resistance, and overall enhanced dimensional accuracy and stability.

Phenolic insulation is produced by mixing phenolic resin and high solids with surface-acting agents. Its insulating properties are highly effective compared to those of other insulation materials. Phenolic insulation products are lightweight and easy to transport, handle, and install.

Phenolic laminates are produced by saturating one or more layers of base materials, including paper, carbon, or fiberglass, with phenolic resins and further laminating the resin-saturated base material under pressure and heat. They are extremely versatile on account of their unusual combination of properties, such as lightweight, structural strength, and moisture resistance. In addition, their high dielectric strength makes them easy to punch and shear for various electrical applications.

Regional Insights

Asia Pacific phenolic resins market dominated the global market in 2024 with a revenue share of 30.92% and is expected to witness a significant growth over the forecast period. The growth is attributed to its strong economic development coupled with substantial investment in various industries, including automotive, building and construction, electrical and electronics, and others.

China Phenolic Resins Market Trends

The phenolic resins market in China is growing consistently, fueled by robust demand in the construction, automotive, and electronics industries. The rapid pace of urban development and infrastructure projects is increasing the use of phenolic-based laminates, insulation materials, and adhesives in residential and commercial ventures. In the automotive sector, phenolic molding compounds are becoming popular for creating lightweight parts, brake pads, and heat-resistant components that enhance vehicle safety and longevity. Concurrently, the market is experiencing a transition towards environmentally friendly products, with manufacturers prioritizing low-emission and bio-based resin technologies in reaction to stricter national regulations governing formaldehyde emissions and sustainability efforts. These developments position China as a significant consumer of phenolic resins, as well as an innovative leader in resin solutions.

North America Phenolic Resins Market Trends

The phenolic resins market in North America is experiencing a gradual shift toward sustainable and high-performance options, influenced by regulatory demands, construction growth, and advancements in the automotive sector. Heightened formaldehyde emission regulations set by the EPA are driving the need for low-emission and bio-based phenolic products, especially in applications such as wood adhesives, insulation, and engineered panels for green building initiatives. Companies in the automotive and aerospace industries are increasingly utilizing lightweight phenolic composites and molding compounds for under-the-hood and structural purposes, given their durability and heat resistance. Increasing investments in advanced materials, along with enhanced collaboration between resin manufacturers and end users, are promoting innovations such as nanofilled phenolics, hybrid systems, and pre-impregnated composites. These developments are transforming phenolic resins in North America from conventional binders to engineered materials that align with performance, compliance, and sustainability objectives.

The U.S. phenolic resins market is evolving as end users seek materials that balance performance, cost efficiency, and regulatory compliance. Growth is supported by strong demand in construction, where phenolic resins are used in laminates, insulation, and engineered wood products aligned with green building certifications. Automotive and electrical industries are also driving adoption of molding compounds and composites that offer heat resistance, dimensional stability, and durability under harsh conditions. At the same time, regulatory frameworks such as EPA formaldehyde emission standards are prompting a shift toward low-emission and bio-based phenolic formulations. Ongoing investments in R&D are resulting in innovations like nanofilled phenolics, hybrid resins, andlightweight composites, positioning the U.S. as a hub for advanced applications that leverage phenolic chemistry in both traditional and next-generation industries.

Europe Phenolic Resins Market Trends

The European market for phenolic resins is influenced by sustainability, compliance with regulations, and the needs of advanced manufacturing industries. Strict EU regulations regarding formaldehyde emissions and chemical safety are driving the transition to low-free formaldehyde and bio-based phenolic resins, especially in uses such as wood adhesives, laminates, and insulation panels. The rise in energy-efficient construction is also promoting the utilization of phenolic foams and composites due to their excellent thermal performance.

The phenolic resins market in Germany is propelled by the nation’s robust industrial foundation, regulatory advancements, and a focus on high-performance engineered materials. There is a growing demand in the automotive sector, where phenolic molding compounds and composites are utilized for lightweight, durable, and heat-resistant components, aligning with Germany’s goals regarding electric mobility and fuel efficiency. The construction sector is increasingly using phenolic foams and insulation boards to comply with rigorous energy efficiency and fire safety regulations established by the EU Green Deal.

Latin America Phenolic Resins Market Trends

The market for phenolic resins in Latin America is growing alongside the expansion of infrastructure, industrial development, and the increased need for long-lasting materials in the automotive, construction, and electrical sectors. Brazil and Argentina are the region's leading consumers, exhibiting significant use of wood adhesives, laminates, and coatings in construction and furniture production.

Middle East & Africa Phenolic Resins Market Trends

The phenolic resins market in the Middle East and Africa is experiencing consistent growth, driven by the construction, automotive, and industrial industries. In the Gulf regions, large-scale infrastructure initiatives and urban expansion are boosting the demand for phenolic-based laminates, wood adhesives, and insulation foams known for their durability and fire resistance. In South Africa, the automotive sector is particularly contributing to the use of phenolic molding compounds for brake linings, clutch facings, and heat-resistant components.

Key Phenolic Resins Company Insights

Key players operating in the global phenolic resin market include DIC CORPORATION, Kolon Industries, Inc., Sumitomo Bakelite Co., Ltd., Hexcel Corporation, Georgia-Pacific Chemicals, KRATON CORPORATION, Hexion, Bostik, Inc., and SI Group, Inc. The market is additionally influenced by the presence of a few medium and small regional players. Global players compete intensely with each other, and regional players have strong distribution networks and good knowledge about phenolic resin suppliers and related regulations.

Key Phenolic Resins Companies:

The following are the leading companies in the phenolic resins market. These companies collectively hold the largest market share and dictate industry trends.

- DIC CORPORATION

- Kolon Industries, Inc.

- Sumitomo Bakelite Co., Ltd.

- Hexcel Corporation

- Georgia-Pacific Chemicals

- KRATON CORPORATION

- Hexion

- Bostik, Inc.

- SI Group, Inc.

Phenolic Resins Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.88 billion

Revenue forecast in 2033

USD 24.71 billion

Growth rate

CAGR of 5.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France, Italy; China; India; Japan; Brazil; Argentina; GCC Countries; South Africa

Key companies profiled

DIC CORPORATION; Kolon Industries, Inc.; Sumitomo Bakelite Co. Ltd.; Hexcel Corporation; Georgia-Pacific Chemicals; KRATON CORPORATION; Hexion; Bostik, Inc.; SI Group, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Phenolic Resins Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2025 to 2033. For this study, Grand View Research has segmented the phenolic resins market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Novolac

-

Resol

-

Liquid Resol Resin

-

Solid Resol Resin

-

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Wood adhesives

-

Molding

-

Molding Compounds

-

Shell Molding

-

Coated Foundry Sand

-

-

-

Insulations

-

Laminates

-

Paper impregnation

-

Coatings

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.