Market Size & Trends

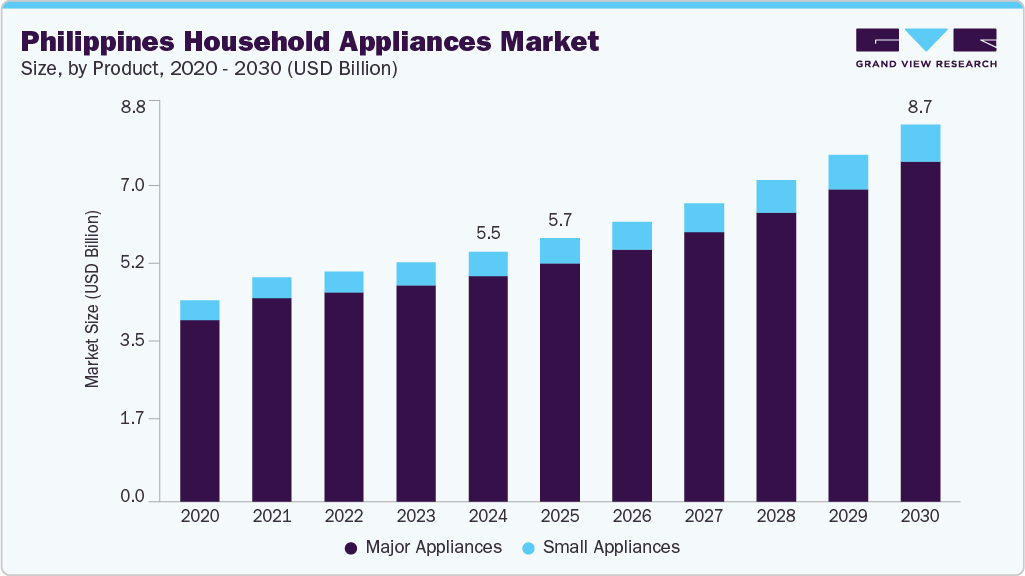

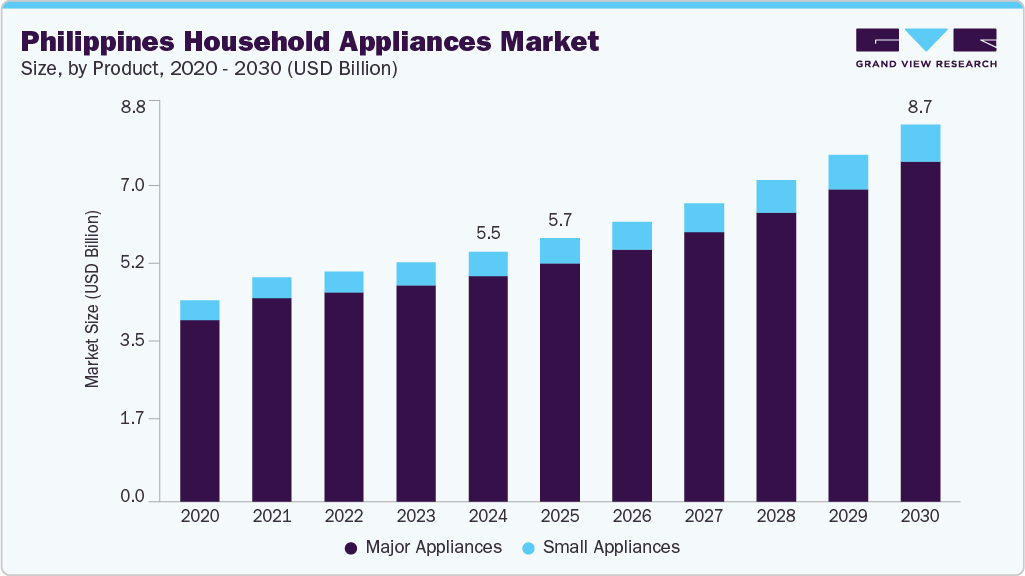

The Philippines household appliances market size was estimated at USD 5.74 billion in 2024 and is projected to grow at a CAGR of 7.4% from 2025 to 2030. The growth is attributed to urbanization and housing development. Growing demand for residential properties, especially in urban areas, is leading to increased sales of essential appliances like refrigerators, air conditioners, and washing machines. Compact living spaces in condominiums and apartments create a need for space-efficient and multifunctional products. Developers often include appliance packages in new housing projects, further boosting sales. Changing home environments and modern lifestyle expectations also push consumers to upgrade to advanced and stylish appliances, contributing to sustained market growth nationwide.

Younger consumers prioritize design, innovation, and efficiency, leading to a surge in demand for technologically advanced products. These lifestyle shifts are influencing frequent upgrades and broader product adoption across households, accelerating the overall growth trajectory of the market. In July 2024, Samsung introduced its latest Bespoke AI appliances, including a side-by-side refrigerator, washing machine, and all-in-one smart oven. These smart home solutions are tailored to meet the changing needs of Filipino households.

Energy efficiency and the rapid growth of e-commerce are reshaping the Philippines household appliances industry. High electricity costs push consumers toward energy-saving models, especially those with inverter technology and eco-label certifications. E-commerce platforms make appliances more accessible across regions, offering convenience, price comparisons, and home delivery. Promotions, digital payment options, and online-exclusive models further encourage purchases. Consumer trust in online shopping is rising, making it a vital channel for purchasing major and small appliances. In May 2024, Haier introduced its latest Smart Home Solutions, designed to transform and elevate everyday living in Filipino households through advanced, innovative appliance technology.

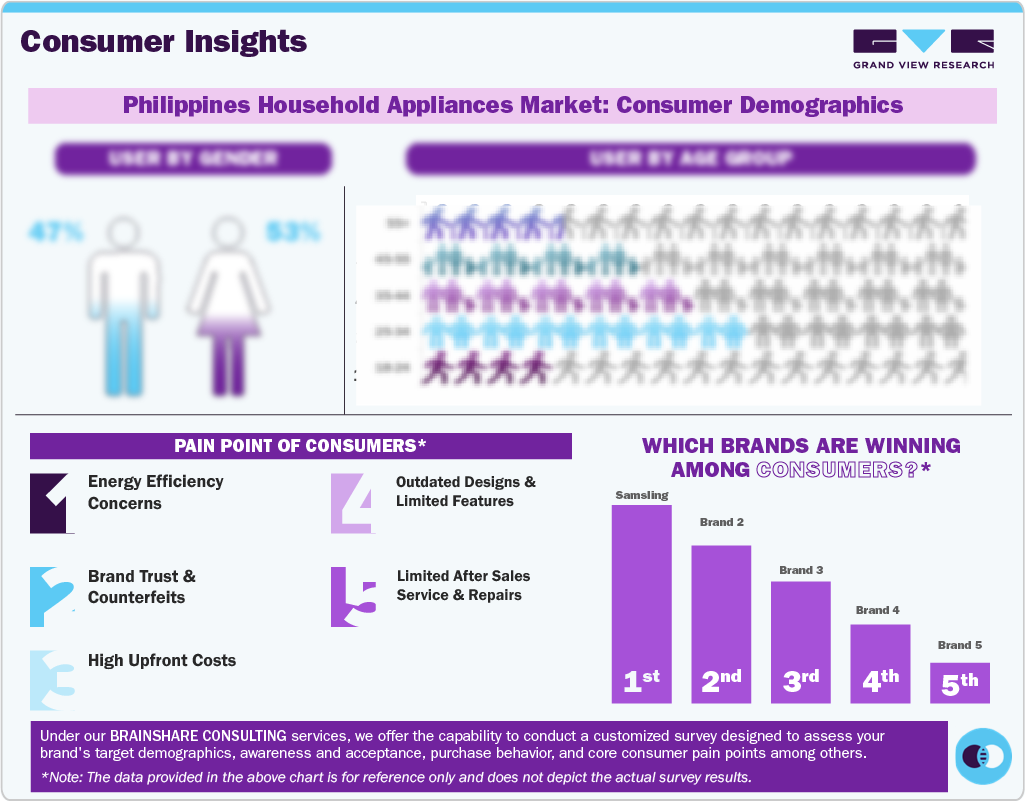

Consumer Insights

Consumers in the Philippines prioritize affordability, durability, and energy efficiency when purchasing household appliances, reflecting growing awareness of electricity costs and budget constraints. Urban buyers often seek compact, multifunctional products that fit smaller living spaces, while rural consumers emphasize reliability and ease of maintenance.

Consumer Demographic Insights

Filipino households are increasingly drawn to smart and connected appliances that offer convenience and modern features, reflecting a shift toward tech-savvy living. Consumers value products that save time and simplify daily chores, such as automated washing machines and AI-powered refrigerators.

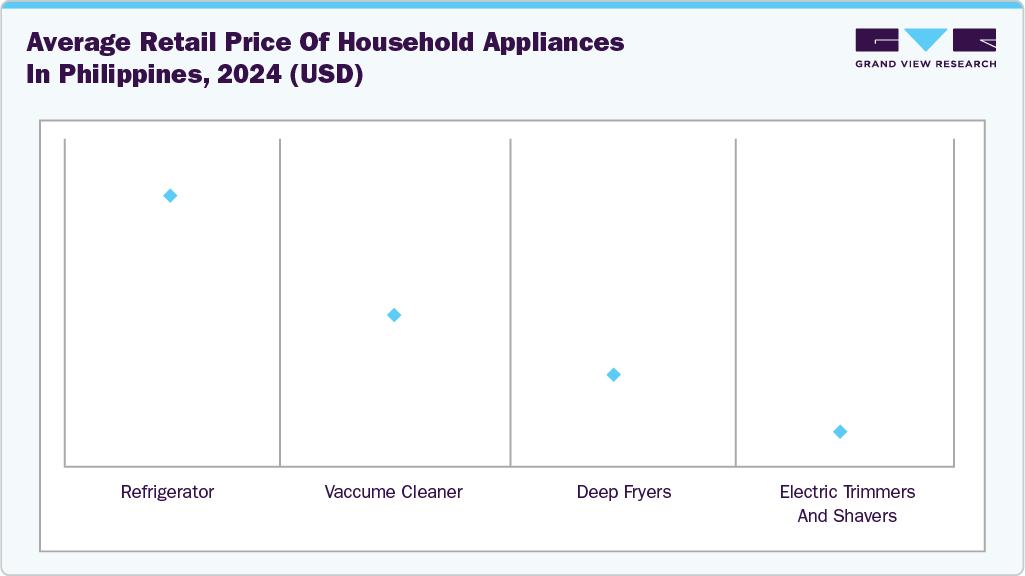

Pricing Analysis

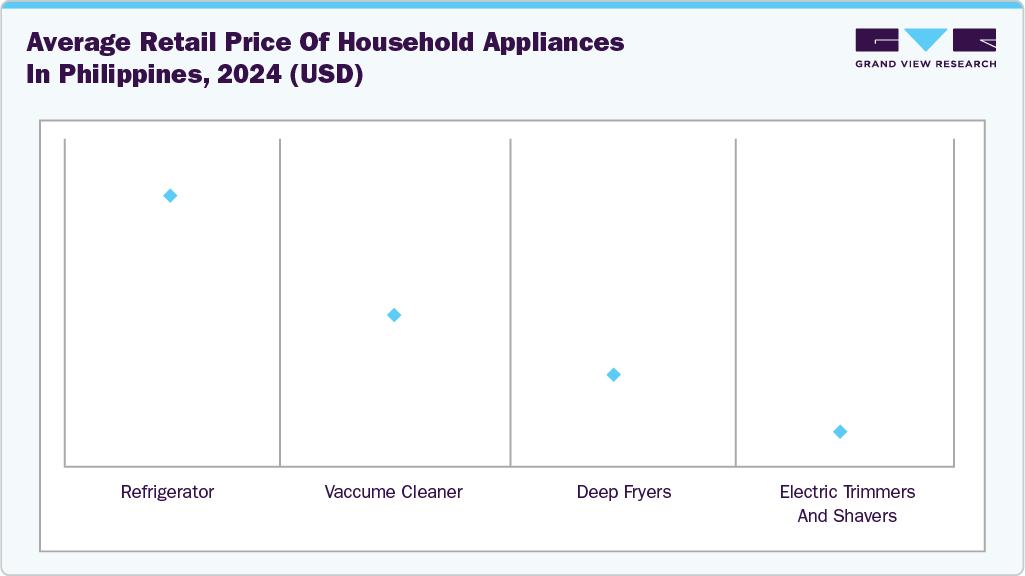

Pricing in the Philippines household appliances market reflects a diverse consumer base, with products ranging from affordable budget options to premium models. Competitive pricing is crucial, as many Filipino consumers are price-sensitive, often relying on promotions, seasonal discounts, and flexible installment plans to make purchases more manageable.

Household appliances in the Philippines, including refrigerators and dishwashers, are available across a broad price spectrum to accommodate diverse consumer preferences. Budget-friendly options such as compact refrigerators from Haier and LG start around USD 251.15 (PHP 13,998), offering essential features for cost-conscious buyers. Premium models like Bosch dishwashers, with stainless steel tubs, water softeners, and app connectivity, are priced around USD 1,600 (PHP 90,000), targeting consumers seeking advanced technology.

Compact kitchen appliances, particularly coffee makers, toasters, juicers, blenders, and food processors, have seen significant sales growth in the Philippines household appliances industry. This surge is driven by changing consumer lifestyles, where convenience and time-saving products are highly valued.

Product Insights

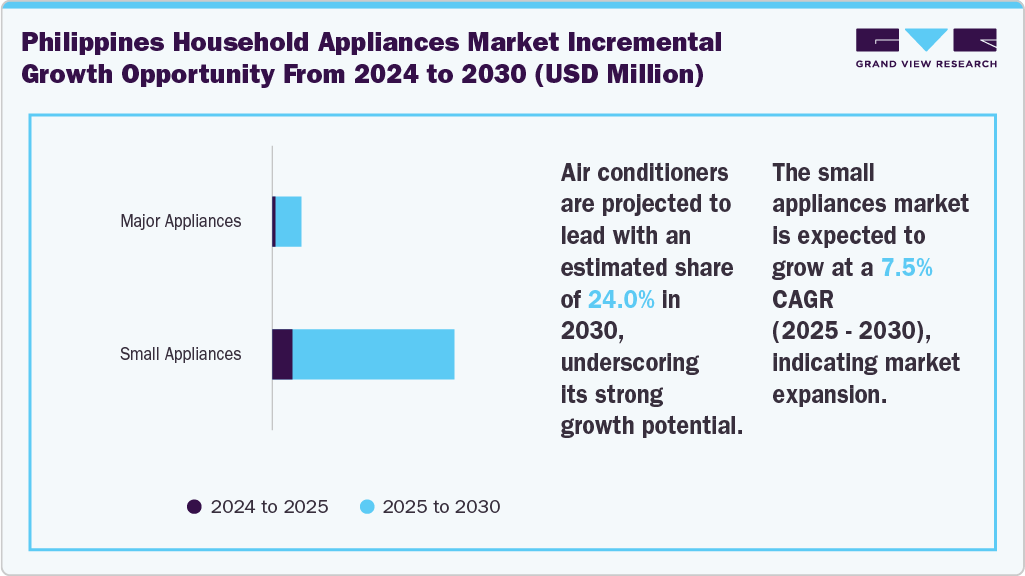

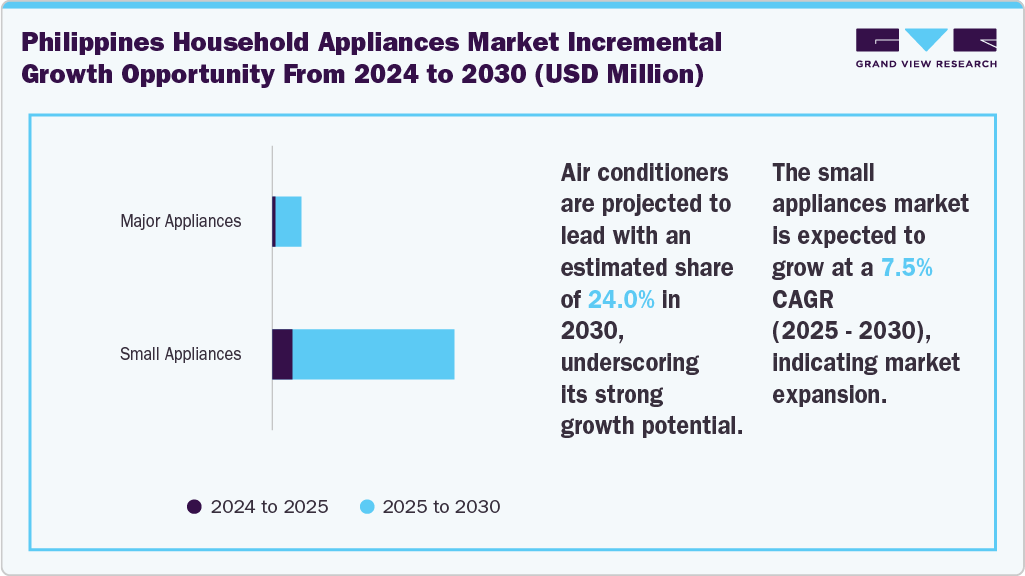

Major appliances accounted for the largest market share of 90.3% in 2024, attributed to rising demand for essential products such as refrigerators, washing machines, and air conditioners. These items are considered long-term investments by Filipino households, especially among middle-income groups. Urbanization, increasing disposable income, and improved access to financing options have also contributed to higher sales. Consumers prioritize durability and energy efficiency, prompting greater adoption of branded appliances. The expanding residential sector and modernization of homes are further expected to fuel the segment’s dominance in the overall market.

The small appliances segment is expected to grow at the fastest CAGR of 7.5% during the forecast period. Increasing demand for convenient, time-saving, and multifunctional products, including air fryers, rice cookers, and electric kettles, favors market growth. Urban lifestyles, rising disposable incomes, and smaller living spaces encourage consumers to invest in compact and efficient appliances.

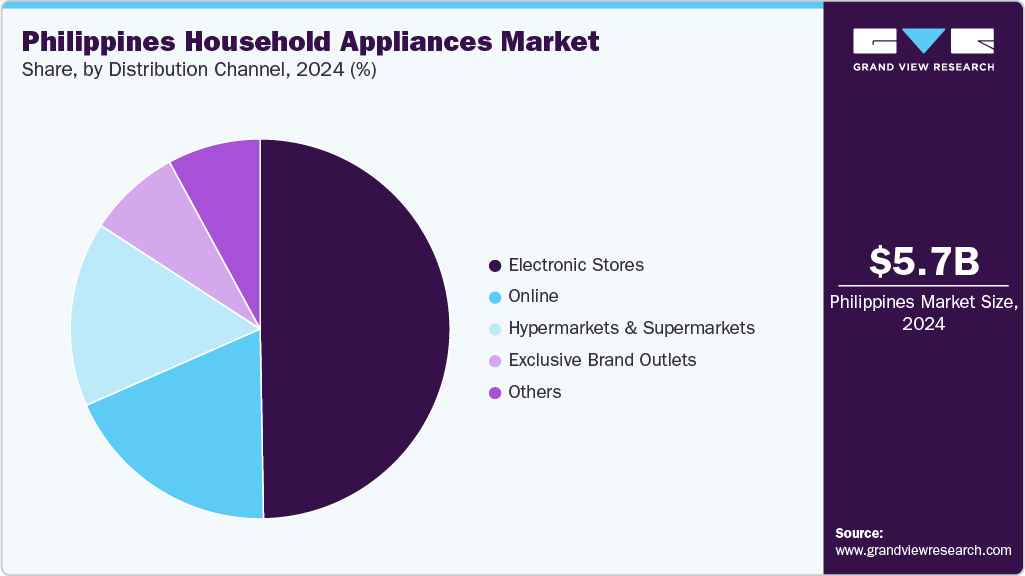

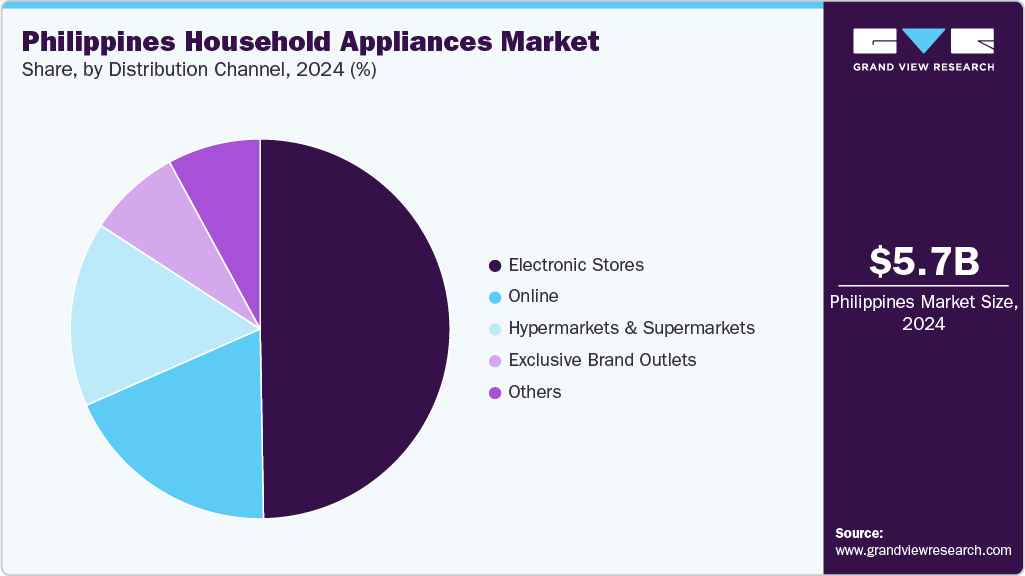

Distribution Channel Insights

Electronic stores held the largest revenue share of 47.3% in 2024, propelled by strong consumer preference for in-person product evaluation and guidance. Filipinos often rely on physical retail outlets to compare features, avail promotional offers, and ensure product authenticity. These stores provide better post-sale services, installment payment options, and personalized recommendations, enhancing customer trust and satisfaction. The widespread presence of well-known chains across urban and provincial areas has strengthened their market hold, making them a primary channel for major and small appliance purchases nationwide.

Online distribution channels are anticipated to witness the fastest CAGR of 8.4% from 2025 to 2030, driven by changing shopping habits and digital adoption. Consumers are turning to e-commerce for better deals, wider selections, and the convenience of home delivery. Increased trust in online payment systems, improved logistics, and engaging virtual promotions contribute to rising sales.

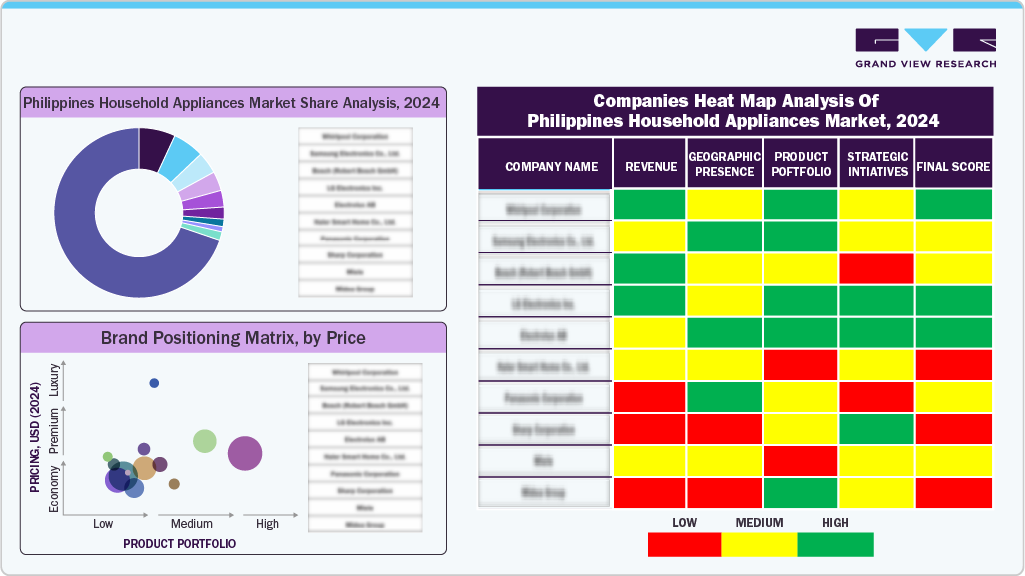

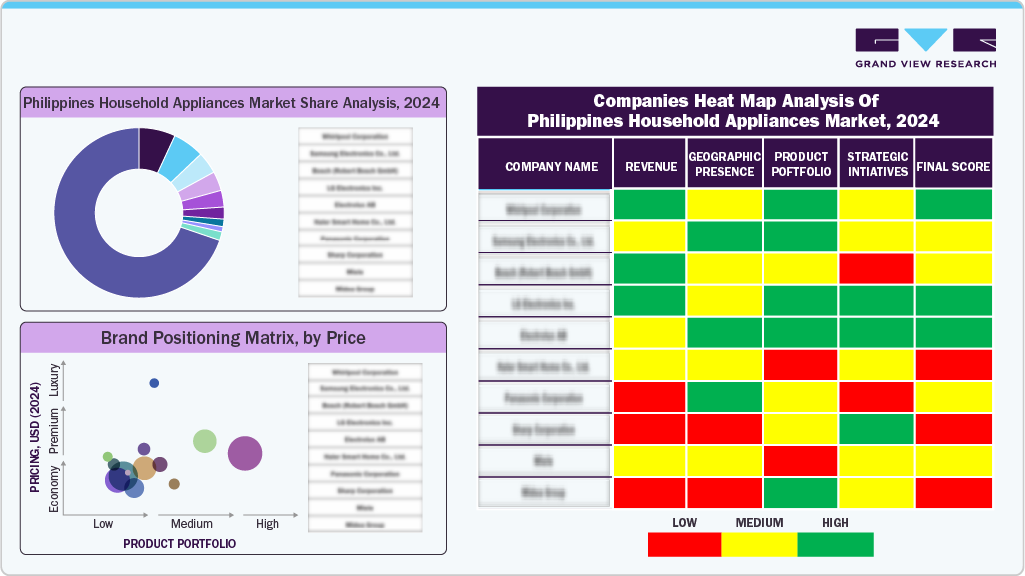

Key Philippines Household Appliances Company Insights

Some of the key companies operating in the market include Samsung, Panasonic Philippines, Whirlpool Corporation, Haier Inc., and Robert Bosch Inc.

-

Samsung offers electronics, home appliances, smartphones, TVs, semiconductors, and display panels, blending cutting-edge technology with sleek design. It leads in mobile innovation, smart home integration, and AI-powered solutions for everyday consumer and industrial needs.

-

Haier Inc. specializes in innovative home appliances and consumer electronics, including refrigerators, washing machines, air conditioners, and smart home solutions. The company focuses on customization, energy efficiency, and IoT integration to meet diverse global consumer needs and enhance lifestyles.

Key Philippines Household Appliances Companies:

- Samsung

- Panasonic Philippines

- Whirlpool Corporation

- Haier Inc.

- Robert Bosch Inc.

- Midea

- SHARP

Recent Developments

-

In August 2024, at the Robinsons Appliances Kitchen Revolution event in Cebu, Toshiba Lifestyle Philippines showcased its Lava Series Gas Range, including 60 cm and 90 cm models.

-

In May 2024, SharkNinja, a leading American home appliance brand known for its innovative and high-quality products, debuted in the Philippines as a part of its ongoing expansion into Asia Pacific.

Philippines Household Appliances Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2030

|

USD 8.67 billion

|

|

Growth rate

|

CAGR of 7.4% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Product, distribution channel

|

|

Country scope

|

Philippines

|

|

Key companies profiled

|

Samsung; Panasonic Philippines; Whirlpool Corporation; Haier Inc.; Robert Bosch Inc.; Midea; and SHARP

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Philippines Household Appliances Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Philippines household appliances market report based on product and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Major Appliances

-

Water Heater

-

Dishwasher

-

Refrigerator

-

Cooktop, Cooking Range, Microwave, and Oven

-

Vacuum Cleaner

-

Washing Machine and Dryers

-

Air Conditioner

-

Small Appliances

-

Coffee Makers

-

Toasters

-

Juicers, Blenders and Food Processors

-

Hair Dryers

-

Irons

-

Deep Fryers

-

Space Heaters

-

Electric Trimmers and Shavers

-

Air Purifiers

-

Humidifiers & Dehumidifiers

-

Rice Cookers & Steamers

-

Air Fryers

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)